Euro Falls As Italian Govt. Reportedly Plans To Reach Out To ECB For QE

August 29 2018 - 3:16AM

RTTF2

The euro weakened against its major counterparts in the European

session on Wednesday, after a media report showed that Italian

government is considering a plan for a new bond buying program from

the European Central Bank to avert a ratings downgrade.

Italian government may reach out to the ECB to begin a new

quantitative easing programme to ward off speculative attacks on

its financial markets, Italian daily La Stampa reported.

Italian bond yields fell, with the yield on 2-year note falling

0.04 points to 1.23 percent. Yields move inversely to bond

prices.

Investors look forward to see progress in talks between the U.S.

and Canada to salvage the North American trade pact.

Meanwhile, Italian Finance Minister Giovanni Tria said that

Italy isn't planning to breach the European Union's budget deficit

limit.

Survey from the market research group GfK showed that Germany's

consumer confidence is set to drop marginally in September.

The forward-looking consumer sentiment index dropped to 10.5 in

September from 10.6 in August. The score was forecast to remain

unchanged at 10.6.

The currency has been trading in a negative territory against

its major rivals in the Asian session.

The euro declined to a 2-day low of 1.1652 against the

greenback, from a high of 1.1698 hit at 10:15 pm ET. Next key

support for the euro is seen around the 1.15 mark.

The common currency slipped to 2-day lows of 129.58 against the

yen and 0.9042 against the pound, coming off from its early highs

of 130.21 and 0.9092, respectively. On the downside, 128.00 and

0.89 are likely seen as the next support levels for the euro

against the yen and the pound, respectively.

Having advanced to 1.1424 against the franc at 10:15 pm ET, the

euro reversed direction and hit a 5-day low of 1.1388. The euro is

likely to challenge support around the 1.12 level.

Survey data from the investment bank Credit Suisse and the CFA

Society Switzerland showed that optimism among Swiss financial

analysts deteriorated sharply in August.

The investor confidence index declined by 10.3 points to -14.3

in August. The indicator remained negative for the second straight

month.

The single currency declined to a 2-day low of 1.7384 against

the kiwi and a 6-day low of 1.5079 against the loonie, reversing

from its early highs of 1.7443 and 1.5126, respectively. The euro

is poised to find support around 1.72 against the kiwi and 1.49

against the loonie.

On the flip side, the euro held steady against the aussie, after

rising to near a 4-month high of 1.5991 at 2:30 am ET. At

yesterday's close, the pair was worth 1.5935.

Looking ahead, U.S. GDP data for the second quarter and pending

home sales for July are scheduled for release in the New York

session.

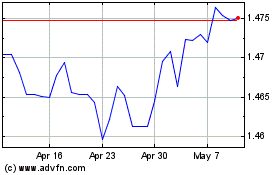

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024