The past few months haven’t exactly been kind to banking stocks.

Though an improved asset market and sound balance sheet helped the

sector regain the ground it lost five years back in recession, it

has again found itself under pressure this year.

Lackluster activities both at household and corporate levels, high

frequency trading concerns, increased regulatory scrutiny and

sluggish mortgage as well as capital market business held the

sector back.

Banking stocks were expected to benefit from a rising rate scenario

this year after the Fed initiated QE taper in a steady and phased

manner. A widely accepted view is that rising rates are followed by

lenders’ rate hikes on loans faster than what is paid on

deposits.

But, against popular belief, interest rates have fallen this year

thanks to the risk-off trade sentiment prevailing in the market.

Geo-political tension in Russia, measly growth in the U.S. economy

in Q1 and a choppy housing market once again spurred the appeal for

defensive plays. Consequently, investors dumped financial stocks

along with some other growth stocks as of late.

Reasons Behind the Slump

Marine Cole from the Fiscal Times said “as mortgage loan

application and origination volumes continue to fall, large banks

are paying the price of the slowdown”. A KBW analyst also pointed

out that mortgage volume has been low on a sequential basis due to

lower refinance volumes.

According to the author, lowest temperatures in a decade

intensified the regular seasonal slowdown and resulted in purchase

volumes that lagged expectations in the first quarter.

Following this, banks in the U.S. eased loan policies to businesses

including real estate companies during the first quarter. For

household as well, banks formulated easier credit standards.

However, with the passage of severe winter which restrained

consumer confidence, the sector should see some tailwinds.

Consumers’ transaction with banks might pick up in Q2. In fact,

earnings growth for the financial sector should resume from

Q3.

For 2014, the sector is expected to expand 3.8% on bottom line

which is definitely not an outstanding growth rate, but the year

next should see a 12.4% upswing on the bottom line, as per the

Zacks Industry Trend (read: 3 Financial ETFs to Play the Bank

Stress Tests).

While sluggish mortgage activities brought about modest losses for

a number of companies in the space, pushing industry share prices

down several percentage points in recent sessions, risk tolerant

investors can smartly use this slump as an entry point to the

sector and relish the long-term potential.

If you go by Fed Chair Janet Yellen’s recent comment that “mortgage

rates went up quite a lot over the spring and summer, but they are

still quite low by historical standards, so in that sense housing

remains affordable, and I expect housing to pick up”, you may also

see rays of hope.

While investing in a single stock will be risky in this uncertain

environment, a basket approach should serve investors better.

Below, we have highlighted some top-ranked financial ETFs which

could be in focus in the coming days (read: Banking Sector Earnings

Put These Financial ETFs in Focus):

Financial Select Sector SPDR

(XLF)

The fund tracks the S&P Financial Select Sector Index, giving

investors exposure to the U.S. financial space. The fund holds a

basket of 85 stocks with the top three holdings – Wells Fargo &

Company, Berkshire Hathaway Inc. Class B and JPMorgan Chase &

Co. – each receiving about 8% of the portfolio.

The fund also includes some well-known banks such as Bank of

America Corporation, Citigroup Inc. and Goldman Sachs Group Inc. in

its top 10 holdings. Sector-wise, banks occupy around 37% of fund

assets, followed by insurance (about 18%) and REITs (14.2%) (see

all Financial ETFs here).

The fund returned 19.5% in the past one year and has added 1.1% so

far this year. Also with an expense ratio of 16 basis points, XLF

is one of the cheapest in the space. The ETF currently carries a

Zacks ETF Rank #1 or ‘Strong Buy’; however, it does have a high

risk outlook.

First Trust Financials AlphaDEX

Fund (FXO)

FXO tracks the Strata Quant Financial AlphaDEX Index, which is a

modified equal-dollar weighted index. The benchmark is designed to

objectively identify and select stocks from the Russell 1000 Index

in the financial services sector that may generate positive alpha

relative to traditional passive-style indices through the use of

the AlphaDEX selection methodology.

The fund invests about $953.2 million in assets in 171 holdings.

The fund is well spread across individual holdings as it does not

put more than 10% in its top 10. FXO does well in eliminating

concentration risk as it does not allot too much in any single

constituent. Expense ratio is bit higher at 70 bps a year.

FXO gained 16.3% in the last one year but has lost 1.5% this year.

FXO currently has a Zacks ETF Rank of 1 with a medium outlook

(read: Top Ranked Financial ETF in Focus: FXO).

RevenueShares Financial Sector Fund

(RWW)

For a slightly different approach to the financial sector,

investors may want to consider this revenue-weighted ETF. The

product tracks the RevenueShares Financial Sector Index, a

benchmark that gives exposure to about 86 stocks that are weighted

by revenues instead of market cap. RWW has amassed about $31.5

million in assets. However, the fund charges 49 bps in fees.

RWW was up 17.1% in the last one year but has lost 2.2% so far this

year. RWW has a Zacks ETF Rank of 1 with a high risk outlook.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

FT-FINL ALPHA (FXO): ETF Research Reports

REVENU-FINL SEC (RWW): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

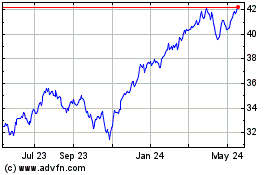

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Nov 2023 to Nov 2024