Nichols PLC Purchase of Own Shares (3648X)

January 04 2022 - 5:03AM

UK Regulatory

TIDMNICL

RNS Number : 3648X

Nichols PLC

04 January 2022

Nichols plc

(the "Company" or "Group')

Purchase of Own Shares

Further to the confirmation of its intention to implement a

share buyback programme, as set out in its announcement on 13

December 2021, the Company announces that it has purchased 6,000 of

its ordinary shares at a price of 1,515 pence per share. The

ordinary shares purchased will be held in treasury.

Aggregated information

Date of purchase 4 January 2022

Number of ordinary shares purchased 6,000

---------------

Highest price paid per share 1515p

---------------

Lowest price paid per share 1515p

---------------

Volume weighted average price

paid 1515p

---------------

Transaction details

In accordance with Article 5(1)(b) of Regulation (EU) No

596/2014 (the Market Abuse Regulation) (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018) , a detailed breakdown of individual trades is available

below:

Number of ordinary Transaction price Time of transaction Trading venue

shares purchased (GBp)

6,000 1515p 08:08:13 AIMX

------------------ -------------------- --------------

Total voting rights

Following the purchase, the Company's total issued share capital

will consist of 36,968,772 ordinary shares of 10p each ("Ordinary

Shares") with one voting right per share, of which 113,664 Ordinary

Shares will be held in treasury. Therefore, the total number of

Ordinary shares carrying voting rights will be 36,855,108.

The above figure of 36,855,108 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Contacts:

Andrew Milne, Group Chief Executive Officer

David Rattigan, Group Chief Financial Officer

Nichols plc

Telephone: 0192 522 2222

Website: www.nicholsplc.co.uk

Alex Brennan / Elfie Steve Pearce / Rachel

Kent Hayes

Hudson Sandler Singer Capital Markets

(Nominated Adviser and

Broker)

Telephone: 0207 796 4133 Telephone: 0207 496 3000

Email: nichols@hudsonsandler.com Website: www.singercm.com

Notes to Editors:

Nichols plc is an international soft drinks business

with sales in over 73 countries, selling products in

both the Still and Carbonate categories. The Group is

home to the iconic Vimto brand which is popular in the

UK and around the world, particularly in the Middle

East and Africa. Other brands in its portfolio include

SLUSH PUPPiE, Feel Good, Starslush, ICEE, Levi Roots

and Sunkist.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSSSFFFLEESESF

(END) Dow Jones Newswires

January 04, 2022 06:03 ET (11:03 GMT)

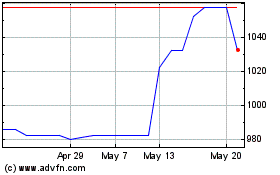

Nichols (AQSE:NICL.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

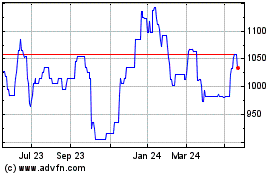

Nichols (AQSE:NICL.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024