TIDMZIN

RNS Number : 8872A

Zinc Media Group PLC

28 September 2022

28 September 2022

Zinc Media Group plc

("Zinc Media", the "Group" or the "Company")

Interim results for the six months ended 30 June 2022

Zinc Media Group plc, the award-winning television, brand,

content and audio production group, is pleased to announce its

unaudited interim results for the six months to 30 June 2022 ("H1

2022").

Headlines

The Group is pleased to report excellent progress in H1 2022 and

continues to trade in line with market expectations for the current

financial year. The first half of 2022 includes the following

highlights:

-- Revenue of GBP10.8m (H1 2021: GBP7.0m), an increase of 54% year-on-year.

-- Adjusted EBITDA[1] loss of GBP0.65m (H1 2021: loss of

GBP1.1m), an improvement of GBP0.45m over the prior year

period.

-- Gross margins in the period were 33% (H1 2021: 34%), which

remain significantly up on 2019 and 2020 when they were 25% and 30%

respectively.

-- The acquisition of The Edge Picture Company ("The Edge") post

period-end, announced in August, will add scale to the existing

Group, supporting long-term profitability. The Edge is one of the

largest brand and corporate film making production companies in the

UK. It closely aligns with the Group's other film-based production

businesses and is a fantastic fit for Zinc Media.

-- The Group completed a fundraise of GBP5m (before expenses)

alongside the acquisition of The Edge. This was supported by

several new and existing institutional shareholders. The proceeds

of the placing were used to finance the acquisition and will also

provide additional growth capital for the Group.

-- As at 26 September 2022 the enlarged group has booked GBP27m

of revenue which has or is expected to be delivered in 2022,

representing an increase of GBP10m since the last trading update in

May 2022 and an improvement of GBP10m compared to the same point in

2021 in relation to that financial year.

-- The Group has a strong pipeline of potential new business for

2022 and 2023 and is confident of trading in line with market

expectations.

Operational Highlights

-- There were a number of significant programme successes in the

first half of the year, which included:

o Being awarded the weekly BBC ONE series Sunday Morning Live

for an initial two year term in a competitive tender process;

o The recommission of the Group's largest ever series with

Channel 5;

o The recommission from the Warner Bros. Discovery Group of

Spooked Scotland;

o A landmark programme for BBC ONE titled Tom Daley: Illegal to

be me;

o Afghanistan: Getting Out , a major production for the BBC;

and

o Nominations for prestigious industry awards including a BAFTA,

an RTS award and two Emmys in recognition of the Group's quality

and impactful content.

Outlook

-- The outlook for the Group is positive, with the recent period

of new business conversion underpinning the Board's confidence in

meeting market expectations for the financial year, including being

profitable in the second half of the year.

-- The Edge are performing very well: they are having their best

ever year and expect to post record revenues in 2022.

-- The acquisition of The Edge will further strengthen and

provide significant scale to the Group, resulting in annualised

proforma Group revenues for FY22 of over GBP35m.

Mark Browning, Chief Executive, commented: "We are delighted

with the current performance of the Group which has seen a

considerable increase in turnover whilst maintaining an attractive

margin, with good visibility of sustainable profitability. The

organic growth, coupled with the acquisition of The Edge, provides

initial scale and the Board is optimistic about the Group's outlook

and views the future with confidence."

A copy of the interim results will be made available on the

Company's website , zincmedia.com.

For further information, please contact:

Zinc Media Group plc +44 (0) 20 7878 2311

Mark Browning, CEO / Will Sawyer, CFO

www.zincmedia.com

Singer Capital Markets (NOMAD and Broker to Zinc Media Group plc) +44 (0) 20 7496 3000

Mark Taylor / George Tzimas

IFC Advisory Ltd (Financial PR) +44 (0) 20 3934 6630

Graham Herring / Zach Cohen

CHAIRMAN'S STATEMENT

The first six months of 2022 demonstrate the Group has largely

recovered from the Covid pandemic with revenues up over 50%

compared to the same period last year and is trading in line with

market expectations for the full year. With the acquisition of The

Edge, which was completed in August, and the scale this brings, we

look forward to sustained profitability in 2023.

The Edge is synergistic with our current portfolio and was

priced at a sensible valuation multiple. The level of support from

new and existing shareholders for this acquisition has been

overwhelming, and we thank all investors for their ongoing support.

Together with our employees and clients, we are building a premium

content creation Group with the ambition and financial backing to

operate at significant scale.

The Group continues to deliver outstanding programmes and

content across all divisions. The award of the BBC ONE series

Sunday Morning Live demonstrates that the Group is ambitious to

enter new markets; the renewal of the Group's largest ever series

commission, Bargain Loving Brits in the Sun for Channel 5,

demonstrates sustained creative and commercial firepower; and the

brilliant Tom Daley: Illegal to be me for BBC ONE shows the Group

continues to produce some of the most talked about factual

television in the UK. With Zinc Communicate also growing by almost

80% in the period, this is a Group that is attracting the right

kind of attention.

September 2022 concludes the Group's initial three year

strategic plan which was announced in 2019, with all aspects

successfully delivered, including the Group's latest acquisition.

This is a phenomenal achievement given the significant headwinds

encountered due to the Covid pandemic and current global economic

conditions.

Notwithstanding inflationary pressures and the impending

economic downturn, the future of Zinc Media is looking very

positive. Current strong trading and the acquisition of The Edge

post period end allows for the return of market forecasts. The

Group is on course for a period of steady organic growth and

sustainable profitability, with the Board focussed on providing

returns and value to shareholders.

The Board would like to thank the management team, employees and

freelancers for their professional and dedicated work, and our

shareholders for their continued support.

Christopher Satterthwaite

Chairman

CEO'S REPORT

CURRENT TRADING, STRATEGY AND MARKET OUTLOOK

Trading in the first six months of the year has been strong with

organic growth seeing revenues increase 54% to GBP10.8m (H1: 2021

GBP7.0m) with an adjusted EBITDA loss of GBP0.65m, an improvement

of GBP0.45m over the same period in the prior year.

Following the acquisition of The Edge in August, market

estimates were reinstated, and the Group is trading in line with

market expectations and expecting to be profitable at EBITDA level

in H2 2022.

As at 26 September 2022 the enlarged group has booked GBP27m of

revenue which has or is expected to be delivered in 2022,

representing an increase of GBP10m since the last trading update in

May 2022, and an improvement of GBP10m on the same point in 2021 in

relation to that financial year. The Edge's financial performance

will be consolidated in the Group's results from 23 August 2022

(the date of acquisition).

The strategy for 2023 and beyond is to deliver organic growth at

both the revenue and EBITDA level while maintaining healthy cash

reserves and continuing to strengthen the balance sheet. As the

Group delivers these objectives, it will also seek further growth

through selective acquisitions. These may accelerate growth in

existing business areas, further diversify Group revenues in new

content genres in either television or Zinc Communicate or further

build the Group's non-UK business. It remains our ambition to be a

listed content producing Group operating at substantial scale.

The first six months of 2022 have seen a number of editorial

highlights and new business launches in the Group.

The television labels continue to produce some of the UK's most

watched television. H1 2022 saw Red Sauce win the Group's largest

ever volume series, a recommission of the now highly successful

Bargain Loving Brits in the Sun for Channel 5. This label was

launched in 2020. This was recommissioned for 54 episodes and is

now running in a daytime slot as well as a peak time slot and

delivering excellent ratings for the channel. It has the added

benefit to the buyer in that it can also run on some of the other

channels owned by Viacom, making it a strong commercial

proposition. Brook Lapping continues to produce highly reputable

television. This includes the excellent Afghanistan: Getting Out

which explored the chaotic withdrawal of western forces from

Afghanistan, a prime-time BBC ONE documentary titled Tom Daley:

Illegal to be me, which was broadcast to coincide with the

Commonwealth Games and shone a light on the plight of many LGBTQ+

athletes from countries where it is illegal to be gay. The first

half of the year also saw the launch of the Group's latest

television production label, Rex, which aims to diversify

television revenues into the large market for factual

entertainment, which can deliver long running series and

commercially valuable IP and formats.

Tern TV's Belfast based division delivered another successful

series of the daytime series Critical Incident for BBC ONE. Tern TV

Glasgow delivered their first series for Really (part of Warner

Bros. Discovery) with a programme titled Spooked Scotland,

exploring the paranormal activity north of the border. H1 2022 saw

the launch of the Group's new weekly BBC ONE series Sunday Morning

Live, which is produced in partnership with Green Inc who are based

in Northern Ireland and have live television expertise. Tern TV

also delivered one of the BBC's masthead Easter programmes, Jill

Halfpenny's Easter Walks, for BBC ONE. Tern continues to be a

trusted supplier to BBC Scotland, producing many programmes for the

channel including Addicted which is presented by Darren

McGarvey.

Zinc Communicate continues to grow rapidly with revenues up 78%

on the same period last year. It has diversified its digital

publishing revenues off the back of new products focusing on

sustainable energy and producing content for the home renovation

market championing green initiatives. The video marketing business,

which sells and produces corporate films, secured an enviable list

of new partners in the reporting period including The London

Institute of Banking and Finance, Sustainable Travel International

and the Association for UK Interactive Entertainment, and films are

being made for blue chip companies including Shell, American

Express and Easyjet. Revenues in this division are on course to

double in 2022. The branded entertainment and audio division grew

audio revenues with new business from the BBC, and brand

partnerships with the likes of Universal Music, The Independent and

The Evening Standard.

Post period end, and off the back of outstanding technical

innovation in the market of post-production, the Group has launched

a new UK wide business called Bumblebee Post Production. Bumblebee

is led by Olly Strous, the Group's CTO, who joined Zinc Media in

the summer of 2021. It offers the television and branded content

market a highly automated, fully remote technical solution for

uploading content and post producing programmes and aims to be

carbon neutral. It will make use of Zinc Media's existing technical

hubs in London, Manchester, Glasgow and Belfast, and has already

secured clients including Avalon Television and the BBC.

The Group continues to be recognised within its industries for

producing market leading, high-quality content, with nominations

for prestigious awards including a BAFTA award, an RTS award, two

Emmy's and a Broadcast Digital Award.

The market for premium factual television along with content for

brands and media owners remains strong. Broadcasters, platforms,

media owners and brands continue to see content as a differentiator

with their consumers. Zinc Media Group now produces for all these

markets and, while growing, still maintains a relatively small

market share. While there will now be some recessionary headwinds,

particularly in the UK, which may well impact speed of growth, the

Group remains confident of delivering further organic growth and

profitability in the years ahead.

Mark Browning

Chief Executive Officer

CFO'S REPORT

INCOME STATEMENT

Group revenues in the reporting period were up by over 50%

year-on-year to GBP10.8m (H1 2021: GBP7.0m). All divisions

increased revenues year-on-year in the period, with London TV up

62%, Tern TV up 37% and Zinc Communicate up 78%.

Gross margins in the period were 33% (H1: 2021 34%), which

remain significantly up on 2019 and 2020 when they were 25% and 30%

respectively.

Gross margins were lower in the period than the full year 2021,

when they reached 38%, as a result of the Group deciding to invest

in winning certain lower margin contracts in order to gain a

foothold in new television markets, including live TV, that can

provide the Group with high volume commissions in more diverse

areas. This includes multi-million pound contracts for the BBC and

Channel 5.

The Group has continued to invest in anticipation of further

growth in H2. It has invested in new business winning talent in

television, including launching a new television label called Rex

in March, in sales and production teams in Zinc Communicate, and in

technology, which has led to the launch of the post-production

business, Bumblebee.

These initiatives suppressed the full impact of the healthy

uplift in revenue during the period, resulting in an Adjusted

EBITDA loss of GBP0.65m. This is a GBP0.45m improvement

year-on-year, and improved profitability is anticipated in H2 2022

in line with market expectations.

Dividend

No dividend is proposed. The Board considers the Group's

investment plans, financial position and business performance in

determining when to pay a dividend.

STATEMENT OF FINANCIAL POSITION

Asset s

Cash at the end of June 2022 was GBP2.6m, having decreased by

GBP3.0m during the period as a result of working capital required

to service the increase in activity and due to the unwinding of

working capital held at December 2021 where broadcasters had funded

some large productions up front. Conversely trade and other

receivables have increased by GBP3.0m since December 2021 as a

result of the volume of commissions increasing markedly.

As at the end of August 2022 the Group's cash position had risen

to GBP5.4m, driven by the proceeds from the capital fundraise in

August.

Equity and Liabilities

The GBP0.8m reduction in equity and liabilities results from the

loss for the period and a GBP1.0m increase in trade and other

payables as a result of the increased working capital requirement

in the period.

The Group had an outstanding balance on long-term debt of

GBP3.5m as at 30 June 2022 which has remained almost unchanged

(2021: GBP3.4m), held by two of the Company's shareholders and with

no financial covenants relating to the debt. During the period the

long-term debt holders agreed to extend the term of the debt by two

years, such that the repayment of the debt is now due on 31

December 2024.

Post balance sheet events

The Company announced in August 2022 that it had acquired The

Edge Picture Co Limited, one of the largest brand and corporate

film making production companies in the UK, for an initial

consideration of GBP1.56 million in cash and GBP0.54 million

satisfied by the issue of 540,000 new ordinary shares in the Group,

and deferred consideration of up to a further GBP3.875 million to

be satisfied by a combination of cash and ordinary shares in the

Company.

The Company also announced in August 2022 that it had raised

GBP5.0 million (before expenses) by way of a placing of 5,037,059

ordinary shares.

The proceeds of the placing were used to finance the initial

cash consideration due in respect of the acquisition and will also

provide additional growth capital for the enlarged business.

Will Sawyer

Chief Financial Officer

Zinc Media Group plc consolidated income statement

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Half Year Half Year

to to Year to

30 June 30 June 31 December

2022 2021 2021

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ------------ ---------- ------------

Revenue 3 10,775 6,975 17,491

Cost of sales (7,263) (4,628) (10,759)

------------------------------ ----- ------------ ---------- ------------

Gross Profit 3,512 2,347 6,732

Operating expenses (5,118) (4,295) (9,097)

Operating loss (1,606) (1,948) (2,365)

------------------------------ ----- ------------ ---------- ------------

Depreciation & amortisation 737 727 1,486

Share based payment charge 92 40 122

(Profit)/loss on disposal

of tangible assets - (1) 4

Exceptional items 4 132 85 141

Adjusted EBITDA (645) (1,097) (612)

----- ------------ ----------

Finance costs (154) (121) (241)

Finance income - - -

------------------------------ ----- ------------ ---------- ------------

Loss before tax (1,760) (2,069) (2,606)

Taxation credit 63 61 86

Loss for the period (1,697) (2,008) (2,520)

Attributable to:

Equity holders (1,701) (2,016) (2,544)

Non-controlling interest 4 8 24

Retained loss for the period (1,697) (2,008) (2,520)

------------------------------ ----- ------------ ---------- ------------

Earnings per share

Basic Loss per Share 5 (10.48)p (12.61)p (15.80)p

Diluted Loss per Share 5 (10.48)p (12.61)p (15.80)p

------------------------------ ----- ------------ ---------- ------------

Zinc Media Group plc consolidated statement of financial position

As at 30 June 2022

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

Note GBP'000 GBP'000 GBP'000

------------------------ ----- ----------- ---------- ----------------

Assets

Non-current

Goodwill and intangible

assets 6 3,464 4,153 3,800

Property, plant and

equipment 7 850 842 904

Right-of-use assets 9 943 1,269 1,159

5,257 6,264 5,863

------------------------ ----- ----------- ---------- ----------------------

Current assets

Inventories 63 154 226

Trade and other

receivables 8 6,327 3,505 3,887

Cash and cash

equivalents 2,596 5,460 5,608

8,986 9,119 9,721

------------------------ ----- ----------- ---------- ----------------

Total assets 14,243 15,383 15,584

------------------------ ----- ----------- ---------- ----------------

Equity and liabilities

Shareholders' equity

Called up share capital 11 20 20 20

Share premium account 4,785 4,785 4,785

Merger reserve 27 27 27

Share Based payment

reserve 369 195 277

Retained earnings (3,087) (858) (1,386)

------------------------ ----- ----------- ---------- ----------------

Total equity

attributable

to equity holders of

the

parent 2,114 4,169 3,723

Non-controlling

interests 28 18 24

------------------------ ----- ----------- ---------- ----------------

Total Equity 2,142 4,187 3,747

Liabilities

Non-current

Borrowings 3,471 3,433 -

Deferred tax 128 218 190

Provisions 250 101 250

Lease liabilities 9 530 931 735

4,379 4,683 1,175

------------------------ ----- ----------- ---------- ----------------

Current

Trade and other

payables 10 7,300 5,987 6,799

Current tax liabilities 4 10 4

Lease liabilities 9 418 516 431

Borrowings - - 3,428

7,722 6,513 10,662

------------------------ ----- ----------- ---------- ----------------

Total equity and

liabilities 14,243 15,383 15,584

------------------------ ----- ----------- ---------- ----------------

Zinc Media Group plc consolidated statement of cash flows

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Half year to Half year to Year to

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------- ------------- ------------- ------------

Cash flows from operating activities

Loss for the period before tax (1,760) (2,069) (2,606)

Adjustments for:

Depreciation 385 375 782

Amortisation and impairment of intangibles 352 352 704

Finance costs 154 121 241

Share based payment charge 92 40 122

(Gain)/Loss on disposal of assets - (1) 4

Consideration paid in shares - 131 131

-------------------------------------------------------------------- ------------- ------------- ------------

(777) (1,051) (623)

Decrease/(increase) in inventories 164 30 (42)

(Increase)/decrease in trade and other receivables (2,440) 774 392

Increase/(decrease) in trade and other payables 501 (784) 28

-------------------------------------------------------------------- ------------- ------------- ------------

Cash (used in)/generated from operations (2,552) (1,031) (245)

Interest on leases - (33) -

Net cash flows (used in)/generated from operating activities (2,552) (1,064) (245)

-------------------------------------------------------------------- ------------- ------------- ------------

Investing activities

Purchase of property, plant and equipment (115) (42) (273)

Purchase of intangible assets (16) - -

Net cash flows used in investing activities (131) (42) (273)

-------------------------------------------------------------------- ------------- ------------- ------------

Financing activities

Interest paid (111) (83) (241)

Principal elements of lease payments (218) (160) (432)

Net cash flows generated used in financing activities (329) (243) (673)

-------------------------------------------------------------------- ------------- ------------- ------------

Net decrease in cash and cash equivalents (3,012) (1,349) (1,191)

Translation differences - 4 (6)

Cash and cash equivalents at beginning of period 5,608 6,805 6,805

Cash and cash equivalents at end of period 2,596 5,460 5,608

-------------------------------------------------------------------- ------------- ------------- ------------

Total equity

Share attributable

based to equity

Share Share payment Merger Retained holders of Non-controlling Total

capital premium reserve reserve earnings the parent interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 20 4,654 155 27 1,158 6,014 12 6,026

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Total

comprehensive

income for the

year - - - - (2,544) (2,544) 24 (2,520)

Equity-settled

share-based

payments - - 122 - - 122 - 122

Consideration

paid in shares - 131 - - - 131 - 131

Dividends paid - - - - - - (12) (12)

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Total

transactions

with owners of

the Company - 131 122 - (2,544) (2,291) 12 (2,279)

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Balance at 31

December 2021 20 4,785 277 27 (1,386) 3,723 24 3,747

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Balance at 1

January 2021 20 4,654 155 27 1,158 6,014 12 6,026

Total

comprehensive

income for the

year - - - - (2,016) (2,016) 8 (2,008)

Equity-settled

share-based

payments - - 40 - - 40 - 40

Consideration

paid in shares 0 131 - - - 131 - 131

Dividends paid - - - - - - (2) (2)

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Total

transactions

with owners of

the Company 0 131 40 - (2,016) (1,845) 6 (1,839)

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Balance at 30

June 2021 20 4,785 195 27 (858) 4,169 18 4,187

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Balance at 1

January 2022 20 4,785 277 27 (1,386) 3,723 24 3,747

Total

comprehensive

income for the

year - - - - (1,701) (1,701) 4 (1,697)

Equity-settled

share-based

payments - - 92 - - 92 - 92

Total

transactions

with owners of

the Company - - 92 - (1,701) (1,609) 4 (1,605)

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Balance at 30

June 2022 20 4,785 369 27 (3,087) 2,114 28 2,142

---------------- --------- --------- ---------- --------- ---------- ------------- ---------------- --------

Notes to the consolidated financial statements

1) GENERAL INFORMATION

The Company is a public limited company incorporated in the

United Kingdom. The address of its registered office is 4th Floor,

Saltire Court, 20 Castle Terrace, Edinburgh EH1 2EN. Its shares are

traded on the AIM Market of the London Stock Exchange plc

(LSE:ZIN).

2) BASIS OF PREPARATION

The interim results for the six months ended 30 June 2022 have

been prepared on the basis of the accounting policies expected to

be used in the 2022 Zinc Media Group plc Annual Report and Accounts

and in accordance with the recognition and measurement requirements

of UK adopted International Accounting Standards (IAS) but does not

include all the disclosures that would be required under IAS and

should be read in conjunction with the accounts for the period

ended 31 December 2021.

The same accounting policies, presentation and methods of

computation are followed in these interim condensed set of

financial statements as have been applied in the Group's latest

annual audited financial statements.

The interim results, which were approved by the Directors on 26

September 2022, are unaudited. The interim results do not

constitute statutory financial statements within the meaning of

section 434 of the Companies Act 2006.

Comparative figures for the 12 months ended 31 December 2021

have been extracted from the statutory accounts for the Group for

that period, which carried an unqualified audit report, did not

include a reference to any matters to which the auditor drew

attention by way of emphasis of matter, did not contain a statement

under section 498(2) or (3) of the Companies Act 2006 and have been

delivered to the Registrar of Companies.

3) SEGMENTAL INFORMATION

The operations of the group are managed in two principal

business divisions that generate revenue: Zinc TV and Zinc

Communicate. These divisions are the basis upon which the

management reports its primary segmental information. The

activities undertaken by the TV segment include the production of

television. The Zinc Communicate unit includes content production

for brands and businesses, publishing and audio production.

Unaudited Unaudited Audited

Half Year to Half Year to Year to

30 Jun 2022 30 Jun 2021 31 Dec 2021

Revenues by Business Division (continuing operations) GBP'000's GBP'000's GBP'000's

------------------------------------------------------- ------------- ------------- ------------

Zinc TV 9,135 6,054 14,565

Zinc Communicate 1,640 921 2,926

Total 10,775 6,975 17,491

------------------------------------------------------- ------------- ------------- ------------

4) EXCEPTIONAL ITEMS

Exceptional items are presented separately as, due to their

nature or the infrequency of the events giving rise to them, this

allows shareholders to understand better the elements of financial

performance for the period, to facilitate comparison with prior

periods and to assess better the trends of financial

performance.

Unaudited Unaudited Audited

Half Year to Half Year to Year to

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP'000's GBP'000's GBP'000's

---------------------------------------- ------------- ------------- ------------

Reorganisation and restructuring costs (52) (85) (81)

Other exceptional items (80) - (60)

Total (132) (85) (141)

---------------------------------------- ------------- ------------- ------------

5) EARNINGS PER SHARE

Basic loss per share (EPS) for the period equals the loss after

tax from continuing operations attributable to the Company's

ordinary shareholders divided by the weighted average number of

issued ordinary shares.

When the Group makes a profit from continuing operations,

diluted EPS equals the profit attributable to the Company's

ordinary shareholders divided by the diluted weighted average

number of issued ordinary shares. When the Group makes a loss from

continuing operations, diluted EPS equals the loss attributable to

the Company's ordinary shareholders divided by the basic

(undiluted) weighted average number of issued ordinary shares. This

ensures that EPS on losses is shown in full and not diluted by

unexercised share options or awards.

Unaudited Unaudited Audited

Half Year to Half Year to Year to

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP'000 GBP'000 GBP'000

------------------------------------------------------ ------------- ------------- ------------

Weighted average number of shares used

in basic and diluted earnings per share calculation 16,200,919 15,989,252 16,095,991

Potentially dilutive effect of share options 1,467,502 788,342 1,117,890

------------------------------------------------------ ------------- ------------- ------------

Basic Loss per Share (10.48)p (12.61)p (15.80)p

Diluted Loss per Share (10.48)p (12.61)p (15.80)p

------------------------ --------- --------- ---------

6) GOODWILL AND INTANGIBLE ASSETS

Customer Distribution

Goodwill Brands Relationships Software Catalogue Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- ------------ ---------- ----------------- --------- --------------- ---------

Net Book Value

At 30 June 2022 3,055 64 279 37 29 3,464

------------------------ ------- ---------- ----------------- -------- ---------------- ---------

At 30 June 2021 3,055 161 743 77 117 4,153

At 31 December 2021 3,055 111 511 50 73 3,800

------------------------ ------- ---------- ----------------- -------- ---------------- ---------

7) PROPERTY, PLANT AND EQUIPMENT

Land and buildings Office and computer equipment Total

GBP000's GBP000's GBP000's

------------------------ ------------------- ------------------------------ ---------

Net book value

------------------------ ------------------- ------------------------------ ---------

As at 30 June 2022 222 628 850

------------------------ ------------------- ------------------------------ ---------

As at 30 June 2021 274 568 842

As at 31 December 2021 237 667 904

------------------------ ------------------- ------------------------------ ---------

8) TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP'000 GBP'000 GBP'000

------------------------------- ------------ ------------ ------------

Current

Trade receivables 4,380 2,507 2,609

Less provision for impairment (467) (487) (549)

------------------------------- ------------ ------------ ------------

Net trade receivables 3,913 2,020 2,060

Prepayments 526 497 325

Contract assets 1,888 988 1,502

Total 6,327 3,505 3,887

------------------------------- ------------ ------------ ------------

The carrying amount of trade and other receivables approximates

to their fair value. The creation and release of provision for

impaired receivables have been included in administration expenses

in the income statement.

The maximum exposure to credit risk at the reporting date is the

carrying value of each class of asset above. The Group does not

hold any collateral as security for trade receivables. The Group is

not subject to any significant concentrations of credit risk.

9) LEASES AND RIGHT OF USE ASSETS

Right-of-use assets

Short leasehold land and buildings Office and computer equipment Total

GBP'000 GBP'000 GBP'000

Balance as at 30 June 2021 1,111 158 1,269

Additions 188 - 188

Depreciation (260) (36) (296)

-------------------------------- ----------------------------------- ------------------------------ --------

Balance as at 31 December 2021 1,039 122 1,161

Depreciation (172) (46) (218)

-------------------------------- ----------------------------------- ------------------------------ --------

Balance as at 30 June 2022 867 76 943

Lease liabilities

Lease liabilities are presented in the statement of financial

position as follows:

Unaudited Unaudited Audited

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP000's GBP000's GBP'000

------------- ------------ ------------ ------------

Current 418 516 431

Non-current 530 931 735

948 1,447 1,166

------------- ------------ ------------ ------------

10) TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ ------------

Current

Trade payables 1,297 945 764

Other payables 67 657 133

Other taxes and social security 770 296 1,348

Accruals 3,296 2,989 3,486

Contract liabilities 1,870 1,100 1,068

Total 7,300 5,987 6,799

--------------------------------- ------------ ------------ ------------

The Directors consider that the carrying amount of trade and

other payables approximates to their fair value. The Group's

payables are unsecured.

11) SHARE CAPITAL

Unaudited Half Year Unaudited Half Year Audited Year

to 30 Jun 22 to 30 Jun 21 To 31 Dec 2021

Share Share Share

Number of Capital Number of Capital Number of Capital

Shares GBP'000 Shares GBP'000 Shares GBP'000

Ordinary Shares

At start of period 16,200,919 20 15,963,039 20 15,963,039 20

Shares issued - - 237,880 0.3 237,880 0.3

At end of period 16,200,919 20 16,200,919 20 16,200,919 20

----------------------------------- ------------ ------------- ------------ ------------- ----------- --------

Total called up share capital 16,200,919 20 16,200,919 20 16,200,919 20

----------------------------------- ------------ ------------- ------------ ------------- ----------- --------

12) POST BALANCE SHEET EVENTS

Acquisition of The Edge Picture Company and capital

fundraise

The Company announced in August 2022 that it had acquired The

Edge Picture Co Limited, one of the largest brand and corporate

film making production companies in the UK, for an initial

consideration of GBP1.56 million in cash and GBP0.54 million

satisfied by the issue of 540,000 new ordinary shares in the Group,

and deferred consideration of up to a further GBP3.875 million to

be satisfied by a combination of cash and ordinary shares in the

Company.

The Company also announced in August 2022 that it had raised

GBP5.0 million (before expenses) by way of a placing of 5,037,059

ordinary shares.

The proceeds of the placing were used to finance the initial

cash consideration due in respect of the acquisition and will also

provide additional growth capital for the enlarged business.

[1] Adjusted EBITDA defined as EBITDA before share based payment

charge, profit/loss on disposal of fixed assets and exceptional

items.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LRMATMTMTBLT

(END) Dow Jones Newswires

September 28, 2022 02:00 ET (06:00 GMT)

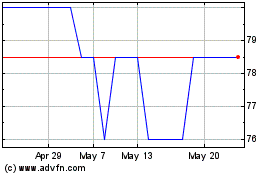

Zinc Media (AQSE:ZIN.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Zinc Media (AQSE:ZIN.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024