BHP CEO Says China Commodity Demand Robust Despite Economic Struggles -- Update

November 01 2023 - 1:11AM

Dow Jones News

By Rhiannon Hoyle

ADELAIDE, Australia--China's demand for commodities including

iron ore and copper remains robust, the chief executive of mining

giant BHP Group said, even as the country's economic recovery

disappoints and its property sector struggles.

Mike Henry said China's appetite for copper--used widely in

manufacturing and construction--is even stronger than the world's

largest miner by market value was anticipating six to 12 months ago

and that economic headwinds haven't translated into reduced

commodity demand more broadly.

Authorities have recently stepped up stimulus aimed at

re-energizing consumer spending and shoring up China's troubled

property market--measures cited by Citi analysts this week as a

tailwind for iron-ore prices as they upgraded their own short-term

forecast for the steel ingredient.

Still, Henry cautioned that China's economic outlook continues

to be murky as the latest data stokes concerns about the fragility

of its recovery. China is the world's top buyer of iron ore, copper

and a number of other metals.

A private gauge of China's factory activity fell into

contraction in October, according to data released Wednesday by

Caixin Media Co. and S&P Global, weighing on prices of metals

including copper. A day earlier, official data showed that factory

orders shrank and construction activity slowed, reigniting growth

concerns.

"There have been some green shoots over the past couple of

months, but also some things that clearly aren't progressing as

quickly as some would hope for," Henry told reporters after an

annual shareholder meeting in Adelaide. "So the jury is still out a

little bit in terms of how quickly things recover."

He also said the escalating conflict in Gaza between Israel and

Hamas would cast a shadow over the global economy.

"It does bring greater concerns around stability," Henry

said.

BHP doesn't have any businesses in or sales to the region, so it

isn't directly affected by the war, he said.

"But, of course, it's something that we keep an eye on in terms

of what signals it's sending, and what ripples it's sending into

the broader global economy," he said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

November 01, 2023 01:56 ET (05:56 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

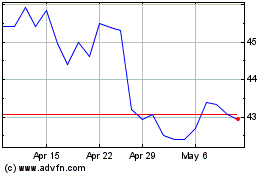

BHP (ASX:BHP)

Historical Stock Chart

From Oct 2024 to Nov 2024

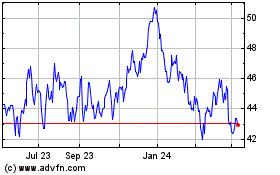

BHP (ASX:BHP)

Historical Stock Chart

From Nov 2023 to Nov 2024