Energy Resources Of Australia Fiscal Year Net Profit Up 23%

January 28 2010 - 5:29PM

Dow Jones News

Energy Resources of Australia Ltd. (ERA.AU) on Friday met

analysts' forecasts with a 23% rise in annual profit, boosted by

higher uranium contract prices.

It forecast 2010 production, sales and average realized sale

prices to be "broadly similar" to 2009.

The Darwin-based uranium miner, 68%-owned by Rio Tinto Ltd.

(RIO.AU), booked a net profit for the year to Dec. 31 of A$272.6

million. The average forecast of five analysts polled by Dow Jones

Newswires was for a profit of A$270.9 million.

ERA owns the Ranger mine in Australia's Northern Territory,

which in 2008 was the second largest producing uranium mine in the

world, according to the World Nuclear Association.

The company declared a final dividend of 25 cents per share, up

from 20 cents in 2008.

Earlier this month, ERA said annual 2009 production fell 2% on

year to 5,240 tons but sales rose 4% to 5,497 tons as the company

drew on stockpiled ore.

Revenue totaled A$780.6 million in 2009, up 13% from A$691.8

million in 2008.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

ross.kelly@dowjones.com

Order free Annual Report for Rio Tinto PLC

Visit http://djnweurope.ar.wilink.com/?ticker=GB0007188757 or

call +44 (0)208 391 6028

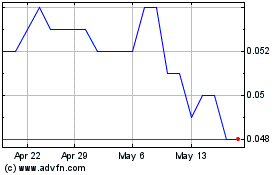

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jul 2023 to Jul 2024