Italy's Largest Bank to Close Russian Representative Office

August 02 2023 - 8:25AM

Dow Jones News

By Mauro Orru

Intesa Sanpaolo, Italy's largest bank by assets, is closing its

representative office in Moscow, a spokesman said Wednesday,

building on efforts to reduce the group's exposure to Russia after

its invasion of Ukraine.

Intesa's presence in Russia dates back 48 years. The group's

Moscow-based corporate bank has been operating 27 branches with 907

staff as part of a regional branch network stretching from the

Russian exclave of Kaliningrad in Eastern Europe to Vladivostok in

the Far East, according to the bank's 2022 report.

Since the war broke out, Intesa has been working to gradually

reduce its exposure to Russia, bringing it down to 700 million

euros ($768.8 million), or 0.2% of the group's total customer loans

at the end of June, from EUR3.2 billion in June 2022. However,

Intesa still has a very small local subsidiary in Russia, the

spokesman said.

Numerous Western companies have left Russia since the invasion

of Ukraine, though some remain. Austria's Raiffeisen Bank

International--one of the European banks with the largest exposure

to Russia, with more than 9,500 employees there at the end of

2022--has been looking at ways to dispose of its Russian

operations. It reduced loans to customers and ring-fenced

Raiffeisenbank Russia's capital, but it never left the country.

Recent developments in Russia are making it harder for Western

companies to leave. Last month, Russia appointed Chechnya's

agriculture minister as the new head of Danone's business in the

country and tapped a Russian businessman to run Carlsberg's

operations there, cementing control of the Western multinationals'

Russian assets days after they were seized.

The moves highlight the risks to Western companies that still

operate in Russia, or are looking to leave, as well as the shifts

in corporate power in the country more than a year after the

invasion of Ukraine.

Russia issued a decree in April that allows the state to take

temporary control of assets of companies or individuals from what

the Kremlin calls "unfriendly" states.

Last year, the Kremlin adopted rules requiring the Russian

government to conduct an assessment of the market value of any

asset for sale by a foreign company. The seller is then required to

sell the asset at a 50% discount of that value. Additionally,

Moscow is levying an exit tax of 10% of the transaction price.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

August 02, 2023 09:10 ET (13:10 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

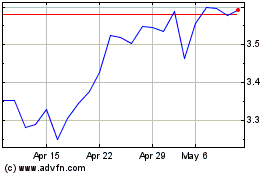

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Oct 2024 to Nov 2024

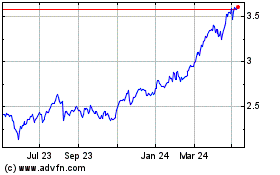

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Nov 2023 to Nov 2024