Glassnode: 8/8 Bitcoin On-Chain Indicators Confirm Recovery From Bear

April 18 2023 - 3:00PM

NEWSBTC

8 of 8 Glassnode indicators tracking the recovery progress from the

Bitcoin bear market are now displaying green signals. Bitcoin

On-Chain Indicators May Suggest The Bear Market Is Behind Us The

on-chain analytics firm Glassnode released a “recovering from a

Bitcoin bear” dashboard that combines different on-chain indicators

to know whether the market is making a healthy and robust recovery

from the bear market. “Generally speaking, the behavior of Bitcoin

investors has been remarkably consistent over cycles, which allows

us to develop tools that find confluence,” explains the firm. Eight

metrics are being used here, covering four areas of the BTC market.

The first of these areas involves the spot price’s alignment

relative to two key pricing models: the 200-day simple moving

average (SMA) and realized price. The realized price is an on-chain

pricing model that measures the average market investor’s cost

basis. Whenever the cryptocurrency breaks above these two pricing

models, it’s generally a sign that the market is recovering from a

bearish trend. The second area of interest is the state of network

utilization. The relevant indicators are the number of new

addresses and miners’ fee revenue. When these metrics rise, it

means the blockchain is observing more activity, and hence, there

is currently higher demand for the coin. Related Reading: Bitcoin

Bearish Signal: Exchange Whale Ratio Spikes Profitability-related

indicators are the third batch being combined in this dashboard, as

they are useful for checking whether the selling pressure has

exhausted and whether the market can absorb any sell-side. Finally,

there is the topic of long-term holders (LTHs). Bear market bottoms

form when these investors get the maximum share of the supply,

while recovery happens as the LTHs start spending and new demand

flows in to absorb this selling. Now, here is a chart that shows

what these indicators are signaling regarding the current state of

the Bitcoin sector: Looks like the indicators have lit up in recent

days | Source: Glassnode's The Week Onchain - Week 16, 2023 As you

can see above, the graph has turned dark recently, suggesting that

eight Bitcoin indicators signal recovery from the bear market.

Related Reading: Bitcoin Supply Structure Very Similar To Early

2019, Bull Run Ahead? In the chart, it’s also visible that this

signal has held during past cycles as well, as the cryptocurrency’s

price has generally gone on to rally after the formation of this

pattern. The April 2019 rally, a run that’s quite reminiscent of

the current one as it was also a recovery rally out of the bear

market lows, saw the formation of this pattern midway through it as

well. Based on all these indicators recently entering into the

cryptocurrency’s positive territory again, Glassnode believes “the

Bitcoin bear could very well be behind us.” BTC Price At the time

of writing, Bitcoin is trading around $30,200, up 1% in the last

week. The price of BTC seems to have recovered above $30,000 over

the past day | Source: BTCUSD on TradingView Featured image from

Michael Förtsch on Unsplash.com, charts from TradingView.com,

Glassnode.com

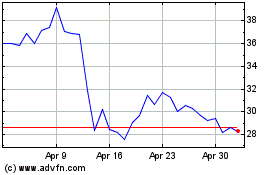

Dash (COIN:DASHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dash (COIN:DASHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024