Bitcoin Potential For Monetary Policy Sparks Growing Interest Among Central Banks

October 28 2024 - 8:30PM

NEWSBTC

Bitcoin, the world’s top cryptocurrency, is designed to act as a

money or payment option outside anyone’s control. Using the crypto,

which is decentralized and peer-to-peer, removes the involvement of

third parties, like central banks. This Bitcoin promise has

redefined the financial landscape, helped the unbanked, and

empowered those who want independence. However, the ecosystem has

its share of critics, including central banks. Related Reading:

Floki Inu Warning: Analyst Says ‘Prepare For The Crash’ – Details

Central banks’ role shrinks as the Bitcoin ecosystem grows and its

use cases expand. This prevailing belief is validated by a growing

amount of research from financial institutions and central banks

that assess Bitcoin’s disruptive nature. The ever-increasing

narrative focuses on Bitcoin’s role in promoting inequality and its

potential to disrupt central banks’ policies. The Role Of Bitcoin

In Distributing Wealth One subject of central banks’ studies

highlights Bitcoin’s role in wealth distribution. To help us

understand Bitcoin’s role, we look at two papers published by the

European Central Bank. The first paper, published after the FTX

fiasco in 2022, is titled “Bitcoin’s Last Stand,” which sees the

top crypto as a failed monetary project nearing its end. But in

2024, when Bitcoin hit an all-time high, the same researchers filed

another study, painting Bitcoin positively. The paper argued that

crypto can impact wealth distribution, but only the early holders

get richer. Since Bitcoin or crypto use doesn’t produce a product

or service, the increased wealth of early adopters comes from the

reduced consumption of all other members of society. Does BTC

Disrupt Monetary Policies? Other finance-related researches look at

Bitcoin’s impact on monetary policies. For example, the Minneapolis

Federal Reserve argues that when people can hold and use Bitcoin,

it is difficult for the state to run budget deficits regularly.

Traditionally, the government can just offer bonds in case there’s

a deficit in revenue collection. But governments may only spend

what they usually collect if there’s Bitcoin. The study suggests

two options: one, to ban Bitcoin’s adoption, and two, to tax this

asset. In addition to the Minneapolis paper, an IMF policy paper in

2023 highlighted Bitcoin’s effect on monetary policy. The paper

argues that Bitcoin impacts a state’s policy, and emerging markets

are most vulnerable. As a solution, the researchers recommend

strengthening their monetary policies first before banning Bitcoin.

Related Reading: MicroStrategy Stock Hits All-Time High As Bitcoin

Blazes Past $67,000 Central Banks, Financial Institutions Now Take

Bitcoin Seriously Recent studies and research from central banks

indicate that Bitcoin is redefining finance. While these papers

don’t mirror the ideas and thinking of policymakers at these

institutions, they give us insight into how the industry sees

Bitcoin. Some recent policies, including the IMF 2022 Argentina

bailout recommendations, include a few anti-cryptocurrency

provisions. Bitcoin’s continued popularity is now becoming an

obstacle for many central banks in their efforts to create monetary

policies. One of the main aims of Bitcoin’s supporters is to offer

the public an alternative financing landscape free from the

direction, if not, clutches of banks. Featured image from Dall-E,

chart from TradingView

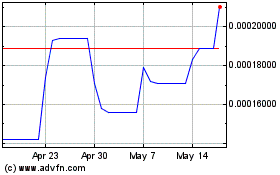

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025