Makara Announces C$1.6 Million Private Placement

March 16 2022 - 8:29AM

InvestorsHub NewsWire

Makara Announces

C$1.6 Million Private Placement

Vancouver,

BC – March 16th, 2022 –

InvestorsHub NewsWire -- Makara Mining Corp. (CSE: MAKA) (the "Company")

that it will proceed with a private

placement of up to 21,333,333 units of the Company (collectively,

the "Units") at a price of C$0.075 per Unit for aggregate

gross proceeds of up to C$1,600,000 (the "Offering"). There is no minimum number of Units or minimum

aggregate proceeds required to close the Offering and the Company

may, at its discretion, elect to close the Offering in one or more

tranches.

Each Unit will

consist of one

common share of

the Company (each,

a "Common Share") and

one common share purchase warrant (each whole

warrant, a "Warrant"). Each Warrant will

entitle the holder thereof to acquire, on payment of C$0.09 to the

Company, one common share of the Company (each, a

"Warrant

Share"), subject to adjustment in certain

circumstances, for a period of 24 months from the closing date

(the "Closing Date"). Up

to one quarter

of the Units

may be sold as

flow through shares

within the meaning of subsection

66(15) of the Income Tax Act (Canada).

The Offering will be conducted pursuant to exemptions from

the requirement to deliver a prospectus pursuant to applicable

securities laws. The Company has determined that it will make a

portion of the Offering available to existing shareholders.

Accordingly, the Company may rely on BC Instrument

45-534

– Prospectus Exemption

for Distributions to

Existing Security Holders

and the corresponding

blanket orders and rules implementing CSA 45-313

in the participating jurisdictions in respect thereof

(collectively, the "Existing Security Holder

Exemption"). As at the date hereof, the Existing

Security Holder Exemption is available in each of the provinces and

territories of Canada, with the exception of Newfoundland and

Labrador. Subject to applicable securities laws, the Company will

permit each person or company who, as of March 11, 2022 (being the

record date set by the Company pursuant), holds common shares as of

that date to subscribe for the Units that will be distributed

pursuant to the Offering, provided that the Existing Security

Holder Exemption is available to such person or company.

Subscriptions will first be allocated to subscribers who are not

relying on the Existing Security Holder Exemption. In the event

that aggregate subscriptions for

Units under the

Offering exceed the

maximum number of

securities to be

distributed, then Units sold pursuant to the

Existing Security Holder Exemption will be allocated to qualifying

existing shareholders on a pro rata basis based on the number of

Units subscribed for. Insiders may participate in the Offering.

Qualifying shareholders who wish to participate in the Offering

should contact Cole Lesueur or Grant Hendrickson at the

numbers below:

The Offering is not subject to any minimum subscription

level. The proceeds of the Offering will be allocated: (i) first,

to the costs of the Offering (not expected to exceed $30,000), (ii)

second, on general corporate activities including permitting, legal

costs, audit fees and listing fees required to maintain the Company

in good standing for the next six months, in the minimum amount of

$50,000 and to a maximum of ten

percent of the

net proceeds of

the Offering; and

(iii) finally, the

balance of the

net proceeds, equal to

up to ninety percent

of the net

proceeds, will be

used on exploration

work on the

Yukon properties, including

geochemistry, geophysics and drilling. All of the proceeds of the

sale of the Units sold on a flow through basis used to incur

expenditures that qualify as Canadian exploration

expenses.

In addition to the Existing Security Holder Exemption, will

also be conducted pursuant to other available prospectus

exemptions. A portion of the Offering may be completed pursuant to

exemptions adopted pursuant to CSA Notice 45-318 – Prospectus

Exemption for Certain Distributions through an Investment Dealer

("CSA

45-318") and the corresponding blanket orders and

rule implementing CSA 45- 318 in the

- 2 -

participating jurisdictions in respect thereof (collectively

the "Investment Dealer

Exemption"). As at the date hereof, the Investment

Dealer Exemption is available in each of Alberta, British Columbia,

Saskatchewan, Manitoba and New Brunswick. Each subscriber relying

on the Investment Dealer Exemption must obtain advice regarding the

suitability of the investment from a registered investment

dealer.

There is no material fact or material change of the Company

that has not been disclosed.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any

sale of any of

the securities in

any jurisdiction in

which such offer,

solicitation or sale

would be unlawful, including

any of the

securities in the

United States of

America. The securities

have not been

and will not be

registered under the United States Securities Act of 1933, as

amended (the "1933 Act") or any state securities

laws and may

not be offered

or sold within

the United States

or to, or for

account or benefit

of,

U.S. Persons (as defined in Regulation S under the 1933 Act)

unless registered under the 1933 Act and applicable state

securities laws, or an exemption from such registration

requirements is available.

About Makara Mining Corp.

Makara

Mining Corp. is a mineral exploration company focused on the

acquisition, exploration and development of gold properties. The

Company is based in Vancouver, B.C. and holds options over the Rude

Creek Property and Idaho Creek Property located in the Yukon.

Additional information about the Company is available at

www.makaramining.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Grant Hendrickson

Director and Chief Executive Officer Telephone:

250-208-4364

Email: grant@makaramining.com

The

Canadian Securities Exchange has not reviewed and does not accept

responsibility for the adequacy of accuracy of this news

release.

FORWARD-LOOKING STATEMENTS

This news release

includes certain forward-looking statements concerning the use of

proceeds of the Offering, the future performance of our business, its operations and its financial performance and condition, as well as

management's objectives, strategies, beliefs and intentions.

Forward-looking statements are frequently identified by such words

as "may", "will", "plan", "expect", "anticipate", "estimate",

"intend" and similar words referring to future events and results.

Forward-looking statements are based on the current opinions and

expectations of management. All forward-looking information is

inherently uncertain and subject to a variety of assumptions, risks

and uncertainties, including the speculative nature of mineral

exploration and development, fluctuating commodity prices, the

future tax treatment of the Units issued as flow through shares,

competitive risks and the availability of financing, as described

in more detail in our recent securities filings available at

www.sedar.com.

Actual events or

results may differ materially from those projected in the

forward-looking statements and we caution against placing undue

reliance thereon. We assume no obligation to revise or update these

forward-looking statements except as required by applicable

law.

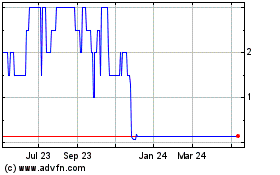

Makara Mining (CSE:MAKA)

Historical Stock Chart

From Nov 2024 to Dec 2024

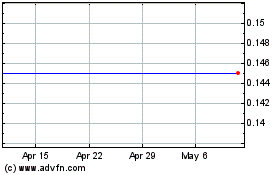

Makara Mining (CSE:MAKA)

Historical Stock Chart

From Dec 2023 to Dec 2024