Turkish Lira Climbs To 11-day High Against U.S. Dollar

June 21 2016 - 3:07AM

RTTF2

The Turkish Lira drifted higher against the U.S. dollar in

European trading on Tuesday, as the latter weakened across the

board, while emerging market assets saw demand on bets that the

U.K. is likely to remain in the EU at the referendum on

Thursday.

In economic news, Turkey's central bank reduced its key lending

rate further, although it maintained the repo and borrowing

rates.

The Monetary Policy Committee of the Turkish central bank

trimmed the Marginal Funding Rate by 50 basis points to 9.00

percent from 9.50 percent. This was the fourth consecutive

reduction in rate.

The bank had reduced the funding rate by 25 basis points in

March and 50 basis points in April and May.

The Turkish Lira firmed to 2.8933 against the greenback, its

highest since June 10. On the upside, 2.7 is likely seen as the

next resistance level for the Lira. The pair finished yesterday's

trading at 2.9051.

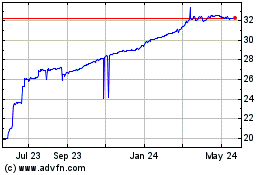

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Apr 2024 to May 2024

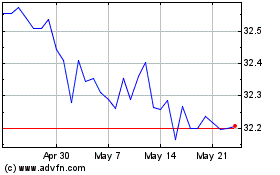

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From May 2023 to May 2024