Rezolve, a leader in mobile commerce and engagement, announced

today that it has entered into a definitive business combination

agreement with Armada Acquisition Corp. I (NASDAQ: AACI)

(“Armada”), a publicly traded special purpose acquisition company.

Upon closing of the transaction, the combined company’s shares are

expected to trade on the NASDAQ under the ticker symbol “ZONE”.

“Rezolve sits at the intersection of eCommerce

enablement, digital payments and eMarketing technology. They have

developed proprietary technology with a powerful partner driven

business model that could lead to rapid growth in the still nascent

but potentially massive mobile commerce market,” commented Betsy

Cohen, a highly regarded SPAC investor that has agreed to invest in

the combined company.

“Douglas Lurio and I set out to find a company

that had carved out a unique position in the FinTech sector, with a

recurring revenue model at an inflection point where our additional

capital and expertise could drive rapid accelerating growth. We

believe that we have found that with Rezolve. We believe that

Rezolve is a potential market leader and that our valuation of

Rezolve is priced at a significant discount to our selected

publicly traded peers.” said Armada Chairman and CEO Stephen

Herbert.

“I believe that Rezolve has the potential to

eventually become one of the most successful ecommerce companies in

the world and that’s why I have been investing in Rezolve from the

early rounds and why I am stepping up my investment in Rezolve in

this transaction now. I deeply believe that this is just the

beginning of something very big,” said Christian Angermayer, the

founder of investment firm Apeiron Investment Group.

Rezolve is positioned to become the engine of

mobile engagement that enables the transformation of interactions

between consumers and merchants on mobile devices. Rezolve is an

enterprise SaaS platform designed from the ground up specifically

for mobile commerce and engagement. The platform allows merchants

and brands to convert media into an interactive experience on a

mobile device, which can drive a meaningful increase in consumer

engagement and purchase activity. Rezolve currently has

go-to-market partner agreements with leading global players that

have a combined global reach of over 20 million merchants and over

1 billion consumers across China, Asia and Europe. Rezolve’s

platform already serves over 150,000 of those merchants today.

Rezolve founder and CEO Dan Wagner has been

building eCommerce businesses for over 35 years and will continue

to lead the combined company following the close of the

transaction. “We are doing for mobile commerce what Shopify and

BigCommerce Holdings have done for web commerce,” said Mr. Wagner.

“We believe mobile commerce is the future and our proprietary

technology enables physical merchants to tap into this potentially

massive opportunity. I have been working on this problem since 2007

and founded Rezolve in 2016 to solve it. We now have the technology

platform solution and go to market partnerships that strongly

positions Rezolve to take advantage of what we see as a near $500

billion global market opportunity over time. We expect the proceeds

from this transaction will allow us to significantly accelerate

adoption and market growth going forward.”

Transaction OverviewThe

transaction has been unanimously approved by the Board of Directors

of Armada, as well as the Board of Directors of Rezolve, and is

subject to the satisfaction of customary closing conditions,

including the approval of the stockholders of Armada and receipt of

certain regulatory approvals.

The combined entity will receive approximately $150 million from

Armada’s trust account, assuming no redemptions by Armada’s public

stockholders, together with approximately $40m in additional

investment proceeds. The proposed business combination values the

enlarged Rezolve group at a pro forma enterprise value of

approximately $1.8 billion and a pro forma market capitalization of

approximately $2 billion. The parties may seek additional debt or

equity capital between today’s announcement and the consummation of

the business combination.

Additional information about the proposed transaction, including

a copy of the business combination agreement will be provided in a

Current Report on Form 8-K and in Armada’s registration statement

on Form F-4, which will include a document that serves as a

prospectus and proxy statement of Armada, referred to as a proxy

statement/prospectus, each of which will be filed by Armada with

the Securities and Exchange Commission (“SEC”) and available at

www.sec.gov.

Conference Call InformationThe investor video

and presentation discussing the proposed business combination can

be accessed by visiting www.rezolve.com/investors. A transcript of

the call and copy of the investor presentation will also be filed

by Armada Acquisition Corp with the SEC in a Current Report on Form

8-K and in Armada’s registration statement on Form F-4, which will

include a document that serves as a prospectus and proxy statement

of Armada, referred to as a proxy statement/prospectus.

AdvisorsBarclays and Cantor

Fitzgerald & Co. are serving as financial advisors to

Rezolve. Cohen & Company Capital Markets, a

division of J.V.B Financial Group, LLC is serving as the financial

advisor to Armada. KPMG is acting as a financial and diligence

advisor to Armada and as an accounting advisor to Rezolve. Taylor

Wessing and Wilson Sonsini are representing Rezolve and DLA Piper

LLP (US) and DLA Piper UK LLP are representing Armada Acquisition

Corp. I as legal counsel for the transaction. Cantor Fitzgerald

& Co. and Cohen & Company Capital Markets are acting as

placement agents in connection with the PIPE offering. King &

Spalding LLP is acting as legal counsel to the placement

agents.

About RezolveRezolve is taking

retailing into a new era of customer engagement with a proprietary

mobile engagement platform. The Rezolve Platform is a powerful set

of mobile commerce and engagement capabilities that provide mobile

application vendors with a range of valuable commercial

opportunities that can be realized without having to develop code,

host operations or manage security. The Rezolve Inside SDK allows

mobile application vendors to quickly deliver innovation for their

consumers into existing or new mobile apps. Rezolve was founded in

2016, is headquartered in London, UK and has offices in China,

India, Taiwan, Germany, Spain and Mexico. (www.rezolve.com).

About Armada Acquisition Corp. IArmada

Acquisition Corp. I is a blank check company whose business purpose

is to effect a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with

one or more businesses. Armada was founded on November 5, 2020 and

is headquartered in Philadelphia, PA.

Cohen & CompanyCohen &

Company Inc. (NYSE American: COHN) is a financial services company

specializing in fixed income markets and, more recently, in SPAC

markets. It was founded in 1999 as an investment firm focused on

small-cap banking institutions but has grown to provide an

expanding range of capital markets and asset management services.

An investment vehicle managed by its indirect subsidiary, Cohen

& Company Financial Management, LLC has a passive membership

interest in Armada.

About Christian

AngermayerChristian Angermayer is a serial entrepreneur,

investor, and founder of his private investment firm, Apeiron

Investment Group (www.apeiron-investments.com). With more than $3.5

billion in assets under management and 60 FTEs across five

international locations, Apeiron focuses on Life Sciences, FinTech

& Crypto, and FutureTech (e.g. SpaceTech, FoodTech, AI).

Apeiron has a global approach and deploys its capital across the

entire company lifecycle. Apeiron’s investments include atai Life

Sciences (NASDAQ: ATAI), which was founded by Christian in 2018 and

works to unlock innovative treatments to improve the status quo for

the one billion plus people worldwide suffering from mental health

issues.

Important Information About the Proposed Transaction and

Where to Find ItThis communication relates to a proposed

business combination transaction among Armada, Rezolve, Rezolve

Group Limited, a Cayman Islands exempted company (“Newco”), and

Cayman Merger Sub, Inc. A full description of the terms of the

transaction will be provided in a registration statement on Form

F-4 that Armada intends to file with the SEC that will include a

prospectus of Newco with respect to the securities to be issued in

connection with the proposed business combination and a proxy

statement of Armada with respect to the solicitation proxies for

the special meeting of stockholders of Armada to vote on the

proposed business combination. Armada

urges its investors, stockholders and other interested

persons to read, when available, the preliminary proxy statement/

prospectus as well as other documents filed with the SEC because

these documents will contain important information about Armada,

Rezolve, Newco and the transaction. After the registration

statement is declared effective, the definitive proxy

statement/prospectus to be included in the registration statement

will be mailed to shareholders of Armada as of a record date to be

established for voting on the proposed business combination. Once

available, shareholders will also be able to obtain a copy of the

Registration Statement on Form F-4, including the proxy

statement/prospectus included therein, and other documents filed

with the SEC without charge, by directing a request to: Armada

Acquisition Corp. I, 2005 Market Street, Suite 3120, Philadelphia,

PA 19103 USA; (215) 543-6886. The preliminary and definitive proxy

statement/prospectus to be included in the registration statement,

once available, can also be obtained, without charge, at the SEC’s

website (www.sec.gov). This communication does not

contain all the information that should be considered concerning

the proposed business combination and is not intended to form the

basis of any investment decision or any other decision in respect

of the business combination. Before making any voting or

investment decision, investors and security holders are urged to

read the registration statement, the proxy statement/prospectus and

all other relevant documents filed or that will be filed with the

SEC in connection with the proposed business combination as they

become available because they will contain important information

about the proposed transaction.

Forward-Looking StatementsThis press release

contains forward-looking statements that are based on beliefs and

assumptions and on information currently available. In some cases,

you can identify forward-looking statements by the following words:

“may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “ongoing” or the negative of these terms

or other comparable terminology, although not all forward-looking

statements contain these words. These statements involve risks,

uncertainties and other factors that may cause actual results,

levels of activity, performance or achievements to be materially

different from the information expressed or implied by these

forward-looking statements. We caution you that these statements

are based on a combination of facts and factors currently known by

us and our projections of the future, which are subject to a number

of risks. Forward-looking statements in this press release include,

but are not limited to, statements regarding the proposed business

combination, including the timing and structure of the transaction,

the listing of the Combined Company’s shares, including the timing

thereof, the amount and use of the proceeds of the transaction, our

future growth and innovations, the initial pro forma market

capitalization of the combined company, the pro forma amount of

funds available in the trust account, our assumptions regarding

stockholder redemptions, and the benefits of the transaction. These

forward looking statements are subject to a number of risks and

uncertainties, including, among others, (1) the occurrence of any

event, change or other circumstances that could give rise to the

termination of the proposed business combination; (2) the outcome

of any legal proceedings that may be instituted against Armada,

Rezolve, Newco or others following the announcement of the proposed

business combination and any definitive agreements with respect

thereto; (3) the inability to complete the proposed business

combination due to the failure to obtain approval of the

stockholders of Armada, to receive regulatory approvals or to

satisfy other conditions to closing; (4) the ability to meet stock

exchange listing standards following the consummation of proposed

business combination; (5) the risk that the proposed business

combination disrupts current plans and operations of Armada or

Rezolve as a result of the announcement and consummation of the

proposed business combination; (6) the ability to recognize the

anticipated benefits of the proposed business combination, which

may be affected by, among other things, competition, the ability of

the combined company to grow and manage growth profitably, and

retain its management and key employees; (7) costs related to the

proposed business combination; (8) changes in applicable laws or

regulations and delays in obtaining, adverse conditions contained

in, or the inability to obtain regulatory approvals required to

complete the proposed business combination; (9) the possibility

that Armada, Rezolve or the combined company may be adversely

affected by other economic, business, and/or competitive factors;

(10) the impact of COVID-19 on Rezolve’s business and/or the

ability of the parties to complete the proposed business

combination; (11) the ability of existing investors to redeem and

the level of redemptions, the ability to complete the business

combination due to the failure to obtain approval from Armada’s

stockholders, , including those to be included under the header

“Risk Factors” in the registration statement on Form F-4 to be

filed by Newco with the SEC and those included under the header

“Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” in the final prospectus of Armada related to its

initial public offering. Furthermore, if the forward-looking

statements prove to be inaccurate, the inaccuracy may be material.

In addition, you are cautioned that past performance may not be

indicative of future results. In light of the significant

uncertainties in these forward-looking statements, you should not

rely on these statements in making an investment decision or regard

these statements as a representation or warranty by us or any other

person that we will achieve our objectives and plans in any

specified time frame, or at all. The forward-looking statements in

this press release represent our views as of the date of this press

release. We anticipate that subsequent events and developments will

cause our views to change. However, while we may elect to update

these forward-looking statements at some point in the future, we

have no current intention of doing so except to the extent required

by applicable law. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

No Offer or SolicitationThis communication is

for informational purposes only and does not constitute an offer or

for a solicitation of an offer to buy or sell securities, assets or

the business described herein or a commitment to the Company or

Rezolve, nor is it a solicitation of any vote, consent or approval

in any jurisdiction pursuant to or in connection with the proposed

business combination or otherwise, nor shall there be any offer,

sale, issuance or transfer of securities in any jurisdiction in

contravention of applicable law.

Participants in SolicitationArmada, Newco and

Rezolve, and their respective directors and executive officers, may

be deemed participants in the solicitation of proxies of Armada’s

stockholders in respect of the proposed business combination.

Information about the directors and executive officers of Armada is

set forth in Armada’s final prospectus relating to its initial

public offering, dated August 12, 2021, which was filed with the

SEC on August 16, 2021 and is available free of charge at the SEC’s

web site at www.sec.gov. Information about the directors and

executive officers of Newco and Rezolve and more detailed

information regarding the identity of all potential participants,

and their direct and indirect interests by security holdings or

otherwise, will be set forth in the definitive proxy

statement/prospectus for the proposed business combination when

available. Additional information regarding the identity of all

potential participants in the solicitation of proxies to Armada’s

stockholders in connection with the proposed business combination

and other matters to be voted upon at the special meeting, and

their direct and indirect interests, by security holdings or

otherwise, will be included in the definitive proxy

statement/prospectus, when it becomes available.

ContactsFor Rezolve:

Investor Contact:Kevin Hunt RezolveIR@icrinc.com

Media Contact:Urmee Khanurmeekhan@rezolve.com44-7576-094-040

For Armada Acquisition Corp. I:Stephen P.

Herbertsherbert@armadaacq.com

Douglas M. Luriodlurio@armadaacq.com

Media Contact:Edmond LococoICR Inc.RezolvePR@icrinc.com

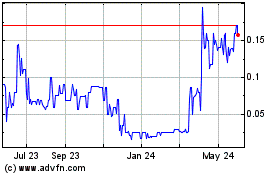

Armada Acquisition Corpo... (NASDAQ:AACIW)

Historical Stock Chart

From Dec 2024 to Jan 2025

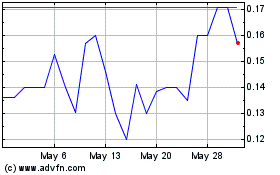

Armada Acquisition Corpo... (NASDAQ:AACIW)

Historical Stock Chart

From Jan 2024 to Jan 2025