false

0001867066

0001867066

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 12, 2024

Journey Medical Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware | |

001-41063 | |

47-1879539 |

(State or Other Jurisdiction

of Incorporation) | |

(Commission File Number) | |

(I.R.S.

Employer

Identification No.) |

9237 E Via de Ventura Blvd., Suite 105

Scottsdale, AZ 8525

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (480) 434-6670

Check the appropriate box below if the Form

8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered

pursuant to Section 12(b) of the Act: |

| |

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange

on which registered |

| Common Stock |

DERM |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02. | Results of Operations and Financial Condition. |

On August 12, 2024, Journey

Medical Corporation issued a press release to provide a corporate update and to announce its financial results for the three months ended

June 30, 2024. A copy of such press release is being furnished as Exhibit 99.1 to this report.

The information, including

Exhibit 99.1, in this Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not

be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall otherwise be expressly set

forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Journey Medical Corporation |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Claude Maraoui |

| |

|

Claude Maraoui |

| |

|

Chief Executive Officer, President and Director |

Date: August 12, 2024

Exhibit 99.1

Journey Medical Corporation Reports Second

Quarter 2024 Financial Results and Recent Corporate Highlights

New Drug Application for DFD-29 to treat rosacea

under FDA review; PDUFA goal date of November 4, 2024

Total

revenues for the second quarter ended June 30, 2024 were $14.9 million, a 14% increase from the $13.0 million reported

in the first quarter of 2024

Company to hold conference

call today at 4:30 p.m. ET to discuss the financial results and provide a business update

Scottsdale,

AZ – August 12, 2024 – Journey Medical Corporation (Nasdaq: DERM) (“Journey Medical” or “the

Company”), a commercial-stage pharmaceutical company that primarily focuses on the selling and marketing of U.S. Food and Drug

Administration (“FDA”)-approved prescription pharmaceutical products for the treatment of dermatological conditions, today

announced financial results and recent corporate highlights for the second quarter ended June 30, 2024.

Claude

Maraoui, Journey Medical’s Co-Founder, President and Chief Executive Officer, said, “We continued to execute on our business

plan in the second quarter, delivering $14.9 million in total net product revenue and positive Adjusted EBITDA. We are pleased with these

results, particularly given our strategic decision to reduce the Company’s expense base in 2023. We believe that the business is

now sufficiently right-sized to support our core dermatology franchise and effectively launch DFD-29. We’re looking forward to

the DFD-29 PDUFA date and anticipate a productive second half of 2024 with additional business progress and continued financial performance.

Importantly, we grew revenue 14% sequentially from the first quarter of this year as we remain on track to deliver on our 2024

financial guidance. We also strengthened our corporate team with the appointment of Joseph M. Benesch as our permanent Chief Financial

Officer and the appointment of Michael C. Pearce to our Board of Directors.”

Financial Results:

| · | Total

net product revenues were $14.9 million for the second quarter of 2024, a 12% decrease compared

to the second quarter of 2023. The decrease from the prior-year period was primarily due

to the timing of customer orders for Qbrexza®, continued generic competition for Targadox®,

and our decision to discontinue Ximino® at the end of the third quarter of 2023. Net

product revenues in the second quarter of 2024 increased by 14% sequentially from the first

quarter of 2024. |

| · | Research

and development costs were $0.9 million in the second quarter of 2024, compared to $1.8 million

in the second quarter of 2023. The decrease is due to lower clinical trial expenses to develop

DFD-29, as the clinical phase of the project has concluded. |

| · | Selling,

general and administrative expenses were $10.3 million for the second quarter 2024, a $1.8

million decrease from the $12.1 million reported in the second quarter of 2023. The decrease

is due to the Company’s expense reduction efforts initiated in 2023. |

| · | The

Company significantly reduced its net loss by $5.0 million, from a net loss of $8.4 million

or $(0.46) per share basic and diluted, for the second quarter of 2023, to a net loss of

$3.4 million or $(0.17) per share basic and diluted, for the second quarter of 2024. |

| · | The

Company’s non-GAAP results in the table below reflect positive Adjusted EBITDA of $0.3

million, or $0.02 per share basic and $0.01 per share diluted, for the second quarter of

2024. This compares to negative Adjusted EBITDA of $(0.6 million), or $(0.04) per share basic

and diluted, for the second quarter of 2023. Adjusted EBITDA, Adjusted EBITDA per share basic

and Adjusted EBITDA per share diluted are non-GAAP financial measures, each of which is

reconciled to the most directly comparable financial measures calculated in accordance with

GAAP below under “Use of Non-GAAP Measures.” |

| · | At

June 30, 2024, the Company had $23.9 million in cash and cash equivalents, as compared to

$24.1 million at March 31, 2024, and $27.4 million at December 31, 2023. |

Recent Corporate Highlights:

| · | In

March 2024, the FDA accepted the Company’s NDA filing for DFD-29 and set a PDUFA goal

date of November 4, 2024. If approved, DFD-29 has the potential to be the only oral,

systemic therapy to address both inflammatory lesions and erythema (redness) from rosacea,

differentiating it as a potential best-in-class solution for the millions of patients suffering

from rosacea. Journey Medical submitted its NDA to the FDA seeking approval for DFD-29 in

January 2024. |

| · | In

April 2024, Journey Medical appointed Joseph M. Benesch as its Chief Financial Officer. Mr.

Benesch served as Journey Medical’s Interim Chief Financial Officer since January 2023

and previously, he was Corporate Controller at the Company since November 2021. |

| · | In

July 2024, Journey Medical appointed Michael C. Pearce to its Board of Directors. Mr. Pearce

is an accomplished executive, with substantial strategic, business and financial experience

across many industries, including healthcare. |

Conference Call and Webcast Information

Journey Medical management will conduct a conference

call and audio webcast on August 12, 2024, at 4:30 p.m. ET.

To

listen to the conference call, interested parties within the U.S. should dial 1-866-777-2509 (domestic) or 1-412-317-5413 (international).

All callers should dial in approximately 10 minutes prior to the scheduled start time and ask to be joined into the Journey Medical conference

call. Participants can register for the conference here: https://dpregister.com/sreg/10190841/fd0fed9bae. Please

note that registered participants will receive their dial-in number upon registration.

A

live audio webcast can be accessed on the News and Events page of the Investors section of Journey Medical’s website, www.journeymedicalcorp.com,

and will remain available for replay for approximately 30 days after the meeting.

About Journey Medical Corporation

Journey

Medical Corporation (Nasdaq: DERM) (“Journey Medical”) is a commercial-stage pharmaceutical company that primarily focuses

on the selling and marketing of FDA-approved prescription pharmaceutical products for the treatment of dermatological conditions through

its efficient sales and marketing model. The Company currently markets seven branded and two generic products that help treat and heal

common skin conditions. The Journey Medical team comprises industry experts with extensive experience in developing and commercializing

some of dermatology’s most successful prescription brands. Journey Medical is located in Scottsdale, Arizona and was founded by

Fortress Biotech, Inc. (Nasdaq: FBIO). Journey Medical’s common stock is registered under the Securities Exchange Act of 1934,

as amended, and it files periodic reports with the U.S. Securities and Exchange Commission (“SEC”). For additional information

about Journey Medical, visit www.journeymedicalcorp.com.

Forward-Looking Statements

This press release may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. As used below and throughout this press release, the words “the Company”, “we”, “us”

and “our” may refer to Journey Medical. Such statements include, but are not limited to, any statements relating to our growth

strategy and product development programs and any other statements that are not historical facts. The words “anticipate,”

“believe,” “estimate,” “may,” “expect,” “will,” “could,” “project,”

“intend,” “potential” and similar expressions are generally intended to identify forward-looking statements.

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could

negatively affect our business, operating results, financial condition and stock price. Factors that could cause actual results to differ

materially from those currently anticipated include: the fact that our products and product candidates are subject to time and cost intensive

regulation and clinical testing and as a result, may never be successfully developed or commercialized; a substantial portion of our

sales derive from products that may become subject to third-party generic competition, the introduction of new competitor products, or

an increase in market share of existing competitor products, any of which could have a significant adverse impact on our operating income;

we operate in a heavily regulated industry, and we cannot predict the impact that any future legislation or administrative or executive

action may have on our operations; our revenue is dependent mainly upon sales of our dermatology products and any setback relating to

the sale of such products could impair our operating results; competition could limit our products’ commercial opportunity and

profitability, including competition from manufacturers of generic versions of our products; the risk that our products do not achieve

broad market acceptance, including by government and third-party payors; our reliance third parties for several aspects of our operations;

our dependence on our ability to identify, develop, and acquire or in-license products and integrate them into our operations, at which

we may be unsuccessful; the dependence of the success of our business, including our ability to finance our company and generate additional

revenue, on the successful development and regulatory approval of the DFD-29 product candidate and any future product candidates that

we may develop, in-license or acquire; clinical drug development is very expensive, time consuming, and uncertain and our clinical trials

may fail to adequately demonstrate the safety and efficacy of our current or any future product candidates; our competitors could develop

and commercialize products similar or identical to ours; risks related to the protection of our intellectual property and our potential

inability to maintain sufficient patent protection for our technology and products; our business and operations would suffer in the event

of computer system failures, cyber-attacks, or deficiencies in our or our third parties’ cybersecurity; the substantial doubt about

our ability to continue as a going concern; the effects of major public health issues, epidemics or pandemics on our product revenues

and any future clinical trials; our potential need to raise additional capital; Fortress controls a voting majority of our common stock,

which could be detrimental to our other shareholders; as well as other risks described in Part I, Item 1A, “Risk Factors,”

in our Annual Report on Form 10-K for the year ended December 31, 2023, subsequent Reports on Form 10-Q, and our other filings we make

with the SEC. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which

any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

Company Contact:

Jaclyn Jaffe

(781) 652-4500

ir@jmcderm.com

Media Relations Contact:

Tony Plohoros

6 Degrees

(908) 591-2839

tplohoros@6degreespr.com

JOURNEY MEDICAL

CORPORATION

Unaudited Consolidated

Balance Sheets

($ in thousands except

for share and per share amounts)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 23,912 | | |

$ | 27,439 | |

| Accounts receivable, net of reserves | |

| 10,465 | | |

| 15,222 | |

| Inventory | |

| 9,687 | | |

| 10,206 | |

| Prepaid expenses and other current assets | |

| 2,406 | | |

| 3,588 | |

| Total current assets | |

| 46,470 | | |

| 56,455 | |

| Intangible assets, net | |

| 18,658 | | |

| 20,287 | |

| Operating lease right-of-use asset, net | |

| 55 | | |

| 101 | |

| Other assets | |

| 6 | | |

| 6 | |

| Total assets | |

$ | 65,189 | | |

$ | 76,849 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 14,604 | | |

$ | 18,149 | |

| Due to related party | |

| 260 | | |

| 195 | |

| Accrued expenses | |

| 15,972 | | |

| 20,350 | |

| Accrued interest | |

| 251 | | |

| 22 | |

| Income taxes payable | |

| - | | |

| 53 | |

| Installment payments – licenses, short-term | |

| 3,000 | | |

| 3,000 | |

| Operating lease liability, short-term | |

| 59 | | |

| 99 | |

| Total current liabilities | |

| 34,146 | | |

| 41,868 | |

| Term loan, long-term, net of debt discount | |

| 19,748 | | |

| 14,622 | |

| Operating lease liability, long-term | |

| - | | |

| 9 | |

| Total liabilities | |

| 53,894 | | |

| 56,499 | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Common stock, $.0001 par value, 50,000,000 shares authorized, 14,018,146 and

13,323,952 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 1 | | |

| 1 | |

| Common stock - Class A, $.0001 par value, 50,000,000 shares authorized,

6,000,000 shares issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 97,451 | | |

| 92,703 | |

| Accumulated deficit | |

| (86,158 | ) | |

| (72,355 | ) |

| Total stockholders' equity | |

| 11,295 | | |

| 20,350 | |

| Total liabilities and stockholders' equity | |

$ | 65,189 | | |

$ | 76,849 | |

JOURNEY

MEDICAL CORPORATION

Unaudited

Consolidated Statements of Operations

($

in thousands except for share and per share amounts)

| | |

Three-Month Periods Ended | | |

Six-Month Periods Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product revenue, net | |

$ | 14,855 | | |

$ | 16,961 | | |

$ | 27,885 | | |

$ | 29,126 | |

| Other revenue | |

| - | | |

| 211 | | |

| - | | |

| 259 | |

| Total revenue | |

| 14,855 | | |

| 17,172 | | |

| 27,885 | | |

| 29,385 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold – product revenue | |

| 6,541 | | |

| 7,767 | | |

| 13,357 | | |

| 14,216 | |

| Research and development | |

| 913 | | |

| 1,774 | | |

| 8,797 | | |

| 3,807 | |

| Selling, general and administrative | |

| 10,328 | | |

| 12,141 | | |

| 18,748 | | |

| 25,433 | |

| Loss on impairment of intangible assets | |

| - | | |

| 3,143 | | |

| - | | |

| 3,143 | |

| Total operating expenses | |

| 17,782 | | |

| 24,825 | | |

| 40,902 | | |

| 46,599 | |

| Loss from operations | |

| (2,927 | ) | |

| (7,653 | ) | |

| (13,017 | ) | |

| (17,214 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense (income) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| (161 | ) | |

| (79 | ) | |

| (378 | ) | |

| (201 | ) |

| Interest expense | |

| 563 | | |

| 756 | | |

| 1,111 | | |

| 1,406 | |

| Foreign exchange transaction losses | |

| 32 | | |

| 33 | | |

| 53 | | |

| 80 | |

| Total other expense (income) | |

| 434 | | |

| 710 | | |

| 786 | | |

| 1,285 | |

| Loss before income taxes | |

| (3,361 | ) | |

| (8,363 | ) | |

| (13,803 | ) | |

| (18,499 | ) |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

$ | (3,361 | ) | |

$ | (8,363 | ) | |

$ | (13,803 | ) | |

$ | (18,499 | ) |

| Net loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.17 | ) | |

$ | (0.46 | ) | |

$ | (0.69 | ) | |

$ | (1.03 | ) |

| Weighted average number of common shares: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 19,993,858 | | |

| 18,005,055 | | |

| 19,875,653 | | |

| 17,906,671 | |

Use of Non-GAAP Measures:

In addition to the GAAP financial measures as

presented in our Form 10-Q that will be filed with the Securities and Exchange Commission (“SEC”), the Company has, in this

press release, included certain non-GAAP measurements, including Adjusted EBITDA, Adjusted EBITDA per share basic and Adjusted EBITDA

per share diluted. We define Adjusted EBITDA as net income (loss) excluding interest, taxes and depreciation, less certain other non-cash

and infrequent items not considered to be normal, recurring operating expenses, including, share-based compensation expense, amortization

and impairments of acquired intangible assets, severance, short-term research and development expense and foreign exchange transaction

losses. In particular, we exclude the following matters for the reasons more fully described below:

| · | Share-Based

Compensation Expense: We exclude share-based compensation from our adjusted financial

results because share-based compensation expense, which is non-cash, fluctuates from period

to period based on factors that are not within our control, such as our stock price on the

dates share-based grants are issued. |

| · | Non-core

and Short-term Research and Development Expense: We exclude research and development

costs incurred in connection with our DFD-29 product candidate, including the filing fee

payment made to the FDA and contractual milestone payments, which is the only product in

our portfolio not currently approved for marketing and sale, because we do not consider such

costs to be normal, recurring operating expenses that are core to our long-term strategy.

Instead, our long-term strategy is focused on the marketing and sale of our core FDA-approved

dermatological products and the out licensing our intellectual property and related technologies. |

| · | Amortization

and impairments of Acquired Intangible assets: We exclude the impact of certain

amounts recorded in connection with the acquisitions of intangible assets that are either

non-cash or not normal, recurring operating expenses due to their nature, variability of

amounts, and lack of predictability as to occurrence and/or timing. These amounts may include

non-cash items such as the amortization impairments of acquired intangible assets. |

Adjusted EBITDA per share basic and Adjusted

EBITDA per share diluted are determined by dividing the resulting Adjusted EBITDA by the number of shares outstanding on an actual and

fully diluted basis.

Management believes the use of these non-GAAP

measures provide meaningful supplemental information regarding the Company’s performance because (i) it allows for greater transparency

with respect to key measures used by management in its financial and operational decision-making, (ii) it excludes the impact of non-cash

or, when specified, non-recurring items that are not directly attributable to the Company’s core operating performance and that

may obscure trends in the Company’s core operating performance and (iii) it is used by institutional investors and the analyst

community to help analyze the Company's results. However, Adjusted EBITDA, Adjusted EBITDA per share basic, Adjusted EBITDA per share

diluted and any other non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to,

the corresponding measures calculated in accordance with GAAP. Further, non-GAAP financial measures used by the Company and the manner

in which they are calculated may differ from the non-GAAP financial measures or the calculations of the same non-GAAP financial measures

used by other companies, including the Company’s competitors.

The table below provides a reconciliation from

GAAP to non-GAAP measures:

JOURNEY MEDICAL

CORPORATION

Reconciliation of

GAAP to Non-GAAP Adjusted EBITDA

(Dollars in thousands except for share and per

share amounts)

| | |

Three-Month Periods Ended | | |

Six-Month Periods Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| GAAP Net Loss | |

$ | (3,361 | ) | |

$ | (8,363 | ) | |

$ | (13,803 | ) | |

$ | (18,499 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Interest | |

| 402 | | |

| 677 | | |

| 733 | | |

| 1,205 | |

| Taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| Amortization of acquired intangible assets | |

| 814 | | |

| 1,069 | | |

| 1,629 | | |

| 2,138 | |

| EBITDA | |

| (2,145 | ) | |

| (6,617 | ) | |

| (11,441 | ) | |

| (15,156 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP Adjusted EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Non-Cash Components: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 1,674 | | |

| 873 | | |

| 3,080 | | |

| 1,519 | |

| Loss on impairment of intangible assets | |

| - | | |

| 3,143 | | |

| - | | |

| 3,143 | |

| Non-core & Infrequent Components: | |

| | | |

| | | |

| | | |

| | |

| Short-term R&D (includes one-time DFD-29 license and milestone payments) | |

| 742 | | |

| 1,744 | | |

| 8,482 | | |

| 3,743 | |

| Foreign exchange transaction losses | |

| 32 | | |

| 33 | | |

| 53 | | |

| 80 | |

| Severance | |

| 6 | | |

| 185 | | |

| 147 | | |

| 711 | |

| Non-GAAP Adjusted EBITDA | |

$ | 309 | | |

$ | (639 | ) | |

$ | 321 | | |

$ | (5,960 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) & Non-GAAP Adjusted EBITDA per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| | | |

| | | |

| | | |

| | |

| GAAP Net Loss | |

$ | (0.17 | ) | |

$ | (0.46 | ) | |

$ | (0.69 | ) | |

$ | (1.03 | ) |

| Non-GAAP Adjusted EBITDA | |

$ | 0.02 | | |

$ | (0.04 | ) | |

$ | 0.02 | | |

$ | (0.33 | ) |

| Diluted | |

| | | |

| | | |

| | | |

| | |

| GAAP Net Loss | |

$ | (0.17 | ) | |

$ | (0.46 | ) | |

$ | (0.69 | ) | |

$ | (1.03 | ) |

| Non-GAAP Adjusted EBITDA | |

$ | 0.01 | | |

$ | (0.04 | ) | |

$ | 0.01 | | |

$ | (0.33 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares: | |

| | | |

| | | |

| | | |

| | |

| GAAP - Basic and Diluted | |

| 19,993,858 | | |

| 18,005,055 | | |

| 19,875,653 | | |

| 17,906,671 | |

| Non-GAAP - Basic | |

| 19,993,858 | | |

| 18,005,055 | | |

| 19,875,653 | | |

| 17,906,671 | |

| Non-GAAP - Diluted | |

| 24,298,007 | | |

| 18,005,055 | | |

| 24,203,162 | | |

| 17,906,671 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

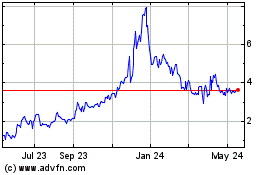

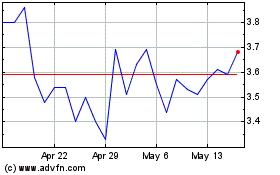

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Aug 2023 to Aug 2024