| | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities EXCHANGE ACT OF 1934 (AMENDMENT NO. ) |

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ☒ | Definitive Proxy Statement |

| | | | | |

| ☐ | Definitive Additional Materials |

| | | | | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

First Business Financial Services, Inc.

(Name of Registrant as Specified In Its Charter)

____________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | | | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

FIRST BUSINESS FINANCIAL SERVICES, INC.

401 Charmany Drive

Madison, WI 53719

March 8, 2024

Dear Fellow Shareholder:

We are pleased to invite you to attend the 2024 Annual Meeting of Shareholders ("Annual Meeting") of First Business Financial Services, Inc. (the "Company"), to be held in a virtual meeting format only on Friday, April 26, 2024 at 10:00 a.m. CDT. Shareholders will be provided an opportunity to ask questions, to consider matters described in the proxy statement, and to receive an update on the Company's activities and performance.

In connection with the Annual Meeting, we want to share with you some of the recent highlights of the work of the Board of Directors and Company.

2023 marked the culmination of our five-year strategic plan in which the Company committed to growing loans, deposits, and revenues at a 10% annual pace. We surpassed our own expectations by achieving a 17% increase in loans, a 19% increase in in-market deposits, and a 13% increase in operating revenue during the year. We outperformed our peers and delivered significant value to our shareholders by growing pre-tax, pre-provision adjusted earnings by 17% over 2022, while tangible book value per share – arguably the most meaningful measure of our success – rose 13%. Our team executed our plan with consistency and efficiency, producing outstanding results even as our industry confronted the persistent headwinds of a challenging interest rate environment.

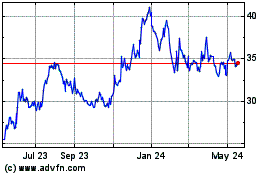

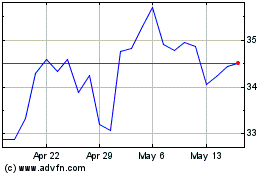

We introduced our five-year plan in 2019 with the view that long-term success would mean achieving our primary end goal of shareholder returns that consistently outperform peers. Over the five-year period ended December 31, 2023, the Company generated cumulative total shareholder returns ("TSR") exceeding 135%. Over the same period, our peer group(1) delivered a median TSR measuring 32%. The Russell 2000 – a benchmark group including small-cap companies across all industries – returned 60%. Even the large cap S&P 500 Bank index returned only 47% over this time period. We are delighted to share this success with our shareholders.

Comprehensive planning has been underway to develop our strategies and establish our goals for the next five-year period. The new strategic plan will be rolled out Company-wide in 2024. We expect our team to prioritize quality balance sheet and revenue growth while optimizing technology for the benefit of our clients and shareholders, evolving with our industry in a manner that stays true to the Company's deep-rooted culture.

On behalf of the Board of Directors and Management team, we thank you for your continued support. Your vote is important, no matter how large or small your holdings may be. We hope you join us in supporting the proposals presented at the Annual Meeting. Whether or not you attend, it is very important that your shares are represented at the meeting. Accordingly, please vote your shares by following the instructions on the Notice of Annual Meeting of Shareholders.

Sincerely,

| | | | | |

| |

Jerry Kilcoyne | Corey Chambas |

Board Chair | Chief Executive Officer |

| | |

(1) Peer group consists of publicly traded banks with assets between $1.5 billion and $5.5 billion. |

| | | | | |

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Shareholders ("Annual Meeting") will be held at 10:00 a.m., Central Daylight Saving Time ("CDT") on Friday, April 26, 2024. There is no physical location for this meeting, but shareholders may participate in the virtual meeting by logging in to www.meetnow.global/MUGGH7C. Additional instructions on how to attend the Annual Meeting follow this notice. Shareholders as of the record date can participate online, vote shares electronically, and submit questions prior to and during the meeting. | |

|

Matters to be Voted on |

1.To elect the three Class II director nominees named in the proxy statement, each to hold office until the 2027 Annual Meeting of Shareholders and until their successors are duly elected and qualified. 2.To approve in a non-binding shareholder advisory vote the compensation of the named executive officers. 3.To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. 4.To consider and act upon such other business as may properly come before the

meeting or any adjournment or postponement thereof. |

Record Date

If you were a shareholder at the close of business on February 28, 2024, you are eligible to vote at the Annual Meeting.

Your vote is important, no matter how large or small your holdings may be.

To assure your representation at the meeting, please vote by following the instructions on the Notice of Internet Availability of Proxy Materials.

You may vote your shares by following the instructions included in the proxy statement and on the Notice of Internet Availability of Proxy Materials, including by voting online during the Annual Meeting. You may revoke your proxy and vote your shares online or by using any of the voting options in accordance with the instructions provided. Please review the Notice of Internet Availability of Proxy Materials and follow the directions carefully in exercising your vote.

By Order of the Board of Directors

Lynn Ann Arians

Director of Corporate Governance & Corporate Secretary

March 8, 2024

| | | | | |

Voting Your Shares | |

Registered Shareholders If you are a Registered Shareholder, meaning that you hold your shares directly through our transfer agent, Computershare (not through a bank, broker, or other nominee), you may vote before the meeting by submitting your proxy online, by phone or mail. |

Beneficial Shareholders If you are a Beneficial Shareholder, meaning that you hold shares through an intermediary, such as a bank or broker (commonly referred to as holding shares in "street name"), you should have received these proxy materials from your bank or broker by mail or email with information on how to submit your voting instructions. |

Registering to Attend the Annual Meeting |

Registered Shareholders (if your shares are held directly through our transfer agent, Computershare): As a registered shareholder, you do not need to pre-register to attend the Annual Meeting virtually on the Internet. To attend the Annual Meeting, please visit www.meetnow.global/MUGGH7C or follow the instructions on the Notice or proxy card that you received. Beneficial Shareholders (if your shares are held through an intermediary, such as a bank or broker): Beneficial Shareholders have two options to register online to attend, ask questions and vote: |

OPTION 1

An industry solution has been agreed upon to allow Beneficial Shareholders to register online at the Annual Meeting to attend, ask questions and vote. We expect that the vast majority of Beneficial Shareholders will be able to fully participate using the control number received with their voting instruction form. Please note, however, that this option is intended to be provided as a convenience to Beneficial Shareholders only, and there is no guarantee this option will be available for every type of Beneficial Shareholder voting control number. The inability to provide this option to any or all Beneficial Shareholders shall in no way impact the validity of the Annual Meeting. Beneficial Shareholders may choose to register in advance of the Annual Meeting via Option 2 described below, if they prefer to use the traditional, paper-based option. Beneficial Shareholders can access and participate in the meeting by visiting www.meetnow.global/MUGGH7C for more information on the available options and registration instructions. |

OPTION 2

Pre-meeting registration must be received no later than 4:00 p.m. CDT on Monday, April 22, 2024. If you hold shares through an intermediary, such as a bank or broker, and want to attend the Annual Meeting online with the ability to ask questions and/or vote, you have two options to submit proof of your proxy power ("Legal Proxy") from your broker or bank reflecting your First Business Financial Services, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as "Legal Proxy" and be received no later than 4:00 p.m. CDT on Monday, April 22, 2024.

Requests for registration should be directed to Computershare at the following:

By email

By email Forward the email from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to: legalproxy@computershare.com

By mail (must be received no later than 4:00 p.m. CDT on Monday, April 22, 2024):

By mail (must be received no later than 4:00 p.m. CDT on Monday, April 22, 2024):Computershare: First Business Financial Services, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

You will receive a confirmation of your registration by email after Computershare receives your registration materials. You can access and participate in the meeting by visiting www.meetnow.global/MUGGH7C using the information you receive from Computershare.

Attending the Annual Meeting

To participate in the Annual Meeting, you will need the voter control number that is printed in the shaded bar on your Notice of Annual Meeting of Shareholders or on your proxy card. Beneficial Shareholders and Registered Shareholders will be able to attend the Annual Meeting online by visiting www.meetnow.global/MUGGH7C, vote their shares, and submit questions during the Annual Meeting.

The online meeting will begin promptly at 10:00 a.m. CDT on Friday, April 26, 2024.

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most up-to-date version of applicable software and plugins. Note: Internet Explorer is not a supported browser. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. We encourage you to access the Annual Meeting prior to the start time. If you need further assistance with the virtual meeting platform on the day of the Annual Meeting, you may call 1-888-724-2416 (local) or 1-781-575-2748 (international).

Submitting Questions Prior to and During the Annual Meeting

Registered Shareholders (if your shares are held directly through our transfer agent, Computershare): Beginning on March 8, 2024, Registered Shareholders may submit questions by going to the virtual meeting site at www.meetnow.global/MUGGH7C, and entering your voter control number. Once logged in, click on the "Q&A" icon at the top of the screen to type in your question, then click the "send" button on the right to submit.

Beneficial Shareholders (if your shares are held through an intermediary, such as a bank or broker): Beginning at 12:01 a.m. CDT on Friday, April 26, 2024, Beneficial Shareholders may submit questions by going to the virtual meeting site at www.meetnow.global/MUGGH7C, and entering your voter control number. Once logged in, click on the "Q&A" icon at the top of the screen to type in your question, then click the "send" button on the right to submit.

Only questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions should be directly related to the business of First Business Financial Services, Inc. and the matters properly brought before the meeting. Unrelated questions will not be answered. Any questions pertinent to the meeting matters that cannot be answered during the meeting due to time constraints will be answered and posted online at https://ir.firstbusiness.bank/news-presentations/investor-presentations-reports/default.aspx. The questions and answers will be available as soon as practical after the meeting and will remain available for one week after posting.

Proxy Statement For Annual Meeting Of Shareholders To Be Held April 26, 2024

This proxy statement is being furnished to shareholders by the Board of Directors (the "Board") of First Business Financial Services, Inc. (the "Company", "we", "our", "us") beginning on or about March 8, 2024 in connection with the solicitation of proxies by the Board for use at the Annual Meeting of Shareholders to be held on Friday, April 26, 2024, at 10:00 a.m., CDT, via a virtual online meeting format, and all adjournments or postponements thereof (the "Annual Meeting") for the purposes set forth in the Notice of Annual Meeting of Shareholders. In accordance with rules and regulations of the Securities and Exchange Commission (the "SEC"), we furnish proxy materials, which include this proxy statement, the Notice of Annual Meeting and our Annual Report on Form 10-K for fiscal year ended December 31, 2023, to our shareholders by making such materials available on the Internet unless otherwise instructed by the shareholder. The Notice of Internet Availability of Proxy Materials (the "Notice") that we mail to shareholders is not a proxy card and cannot be used to vote your shares. To vote your shares, you should follow the instructions included on the Notice. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice, which is first being mailed to shareholders on or about March 8, 2024.

Voting your shares in advance of the Annual Meeting will not affect your right to attend and cast your vote online during the Annual Meeting. However, when you vote pursuant to the proxy card or one of the methods set forth in the Notice, you appoint the proxy holder as your representative at the Annual Meeting. The proxy holder will vote your shares as you instruct, thereby ensuring that your shares will be voted whether or not you attend the Annual Meeting. Attendance at the Annual Meeting by a shareholder who has appointed a proxy does not in itself revoke a proxy. Any shareholder appointing a proxy may revoke that appointment at any time before it is exercised by: (i) giving notice thereof to the Company in writing or during the Annual Meeting; (ii) signing another proxy, if you voted by mailing in a proxy card, with a later date and returning it to the Company; (iii) timely submitting another proxy via the telephone or Internet, if that is the method you used to submit your original proxy; or (iv) voting online during the Annual Meeting. Even if you plan to attend the Annual Meeting online, we ask that you instruct the proxies how to vote your shares in advance of the Annual Meeting in case your plans change.

If you appointed the proxies to vote your shares and an issue comes up for a vote at the Annual Meeting that is not identified in the proxy materials, the proxy holder will vote your shares, pursuant to your proxy, in accordance with their judgment.

If you sign and return a proxy card or vote over the Internet or by telephone without giving specific voting instructions, the shares represented by your proxy will be voted "FOR" the three persons nominated for election as directors referred to in this proxy statement, "FOR" the approval of the non-binding, advisory proposal on the compensation of Named Executive Officers ("NEOs"), which is referred to as a "say-on-pay" proposal, "FOR" the ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, and on such other business matters which may properly come before the Annual Meeting in accordance with the judgment of the persons named as proxies. Other than the above proposals, the Board has no knowledge of any matters to be presented for action by the shareholders at the Annual Meeting.

Only holders of record of the Company’s Common Stock, par value $0.01 per share (the "Common Stock"), at the close of business on February 28, 2024 are entitled to vote at the Annual Meeting. On that date, the Company had outstanding 8,306,543 shares of Common Stock, each of which is entitled to one vote.

First Business Financial Services, Inc. 2024 Proxy Statement | 1

| | | | | |

First Business Bank ("FBB" or the "Bank") is a wholly owned subsidiary of First Business Financial Services, Inc. (Nasdaq: FBIZ) headquartered in Madison, Wisconsin. All of the Company's operations are conducted through the Bank and subsidiaries of the Bank. |  All data as of 12/31/2023 All data as of 12/31/2023

(1) Consists of all on-balance sheet assets for First Business Financial Services, Inc. on a consolidated basis |

The Bank's full-service banking locations operate in Wisconsin, Kansas, and Missouri while its niche commercial lending products and bank consulting services are offered nationwide. First Business Bank specializes in business banking, including commercial lending and treasury management, private wealth management solutions, and bank consulting services. |

The Bank’s operating model is predicated on deep client relationships and financial expertise. This model is built on guiding principles including an entrepreneurial spirit and a disciplined sales process, as core differentiators balanced with a conservative credit culture and efficiency associated with centralized administrative functions. The Company’s business banking focus does not rely on an extensive branch network to attract retail clients but instead draws on its strong client relationships and broad range of deposit products and services to grow deposits at a rate commensurate with loan growth. The Bank's focused model allows our experienced team to provide a level of financial expertise needed to develop and maintain long-term relationships with our clients. |

The Bank focuses on delivering a full line of commercial banking products and services tailored to meet the specific needs of small and medium sized businesses, business owners, executives, professionals, and high net worth individuals. |

|

First Business Financial Services, Inc. 2024 Proxy Statement | 2

2023 Performance Highlights

Our 2023 performance highlights, including certain financial performance metrics, are shown below. This performance information is qualified by reference to our Annual Report on Form 10-K for the year ended December 31, 2023 (our "2023 Annual Report"). For more complete information regarding our 2023 performance, please review our 2023 Annual Report.

| | | | | |

| Strong performance driven by robust deposit growth, sustained loan growth, and positive operating leverage |

Net Income

$37.0 MM | Solid bottom line profitability reflects success of efforts to grow deposits and loans at a double-digit pace, bolstering revenue growth and bringing relative stability to net interest margin in a volatile environment |

In-Market Deposits

+19% | Continued Deposit Growth • In-market deposits grew 19.0% from the fourth quarter of 2022 |

Loans

+ 17% | Robust Expansion Across Loan Products and Geographies • Loans grew 16.7% from the fourth quarter of 2022 |

NIM

3.78% | Diversified Balance Sheet Growth Drives Net Interest Income Expansion • Net interest income grew 7.6% from the fourth quarter of 2022 • GAAP net interest margin ("NIM") of 3.78% declined 4 basis points from the prior year |

PTPP ROA(1) 1.75% | Strong Pre-tax, Pre-Provision ("PTPP") Income • PTPP income grew 17.8% from the fourth quarter of 2022 • PTPP adjusted return on average assets rose to 1.75% for 2023, increasing from 1.74% for the prior year and remaining well above peers |

TBV per Share(2) +13% | Strong earnings generation produced a 12.9% increase in tangible book value ("TBV") per share from the fourth quarter of 2022 |

Note: Percentages represent growth from the fourth quarter of 2022 to the fourth quarter of 2023. |

(1) Pre-tax, pre-provision adjusted return on average assets ("PTPP ROA") is defined as operating revenue less operating expense divided by average total assets. In the judgment of the Company’s management, the adjustments made to non-interest expense and non-interest income allow investors and analysts to better assess the Company’s operating expenses in relation to its core operating revenue by removing the volatility that is associated with certain one-time items and other discrete items.

(2) Tangible book value per share is a non-GAAP measure representing tangible common equity divided by total common shares outstanding. Tangible common equity itself is a non-GAAP measure representing common stockholders’ equity reduced by intangible assets, if any. The Company’s management believes that this measure is important to many investors in the marketplace who are interested in period-to-period changes in book value per common share exclusive of changes in intangible assets.

In 2023, we completed the final year of our five-year strategic plan launched in 2019 which was focused on four key priority areas that are critical for our value-creation strategy.

During 2023, the management team engaged in extensive planning to develop our strategies and set goals for the next five-year period. The management team expects to prioritize quality balance sheet and revenue growth while optimizing technology for the benefit of our clients and stakeholders, evolving with our industry in a manner that stays true to the Company's deep-rooted culture.

First Business Financial Services, Inc. 2024 Proxy Statement | 3

Executive Compensation Highlights

The primary goal of our executive compensation program is to drive continued growth and successful execution of our business objectives, thereby creating value for our shareholders. Our compensation programs are designed to pay for performance and foster a high-performance culture, aligning the interests of our executive team with those of our shareholders.

Our compensation philosophy supports our commitment to motivating and rewarding employees in ways that drive our Company’s success and reflect our culture and values. Key principles include:

•Pay-for-Performance Culture: We foster a culture where compensation is linked to performance.

•Attracting and Retaining Talent: Our compensation programs are designed to attract and retain the highest caliber of employees.

•Fair and Equitable Pay: We are dedicated to fair and equitable compensation practices.

•Consideration of Company, Team, and Individual Success: We consider the success of the Company, teams and individuals in making executive compensation decisions.

•Motivation for Goal Achievement: We use compensation as a tool to motivate employees to achieve business goals.

Our executive compensation program supports long-term value creation. Approximately 49% of our Chief Executive Officer’s ("CEO") total direct compensation and 40% of the compensation for the other Named Executive Officers ("NEOs") is variable and at risk, tied to the achievement of rigorous performance metrics that are aligned to our strategic priorities and important to our shareholders.

The Annual Bonus Plan ("Bonus Plan") for fiscal 2023 paid out at 113% of target. The payout reflects our strong performance across the key performance metrics (top line revenue, Return on Average Assets ("ROAA"), efficiency ratio) which drive shareholder value and the Company’s business strategy.

The Performance Restricted Stock Units ("PRSUs") grant for 2020-2022 vested at 200% of target. The vesting of these performance-based awards, which was determined in April 2023, reflects our superior performance relative to a peer group of over 100 banks our size. The Company performed at the 94th percentile for relative Total Shareholder Return ("TSR") and the 82nd percentile for relative Return on Average Equity ("ROAE") over the three-year measurement period. Both of these metrics surpassed the superior performance level established in the plan.

First Business Financial Services, Inc. 2024 Proxy Statement | 4

The Company's Commitment to ESG and Human Capital Management

The Company’s environmental, social and governance ("ESG") practices are integrated into our core business strategy and are an essential component of our corporate culture. In 2021, the Company defined its ESG framework, including the responsibilities of management, the Board, and the committees. While the Board maintains primary responsibility for ESG, to ensure alignment with the Company's ESG principles, responsibility for certain ESG risks and opportunities in the Company's defined ESG framework are delegated to the Board committees via their charters. As part of its Board-delegated responsibility for monitoring key ESG risks, the Corporate Governance and Nominating Committee reviews information related to ESG initiatives, deliverables, and areas of focus at each quarterly meeting and provides regular updates to the Board. The Company is committed to all stakeholders including our employees, clients, shareholders and the communities in which we live and work. We believe that all communities we serve will prosper when everyone has equal access to basic social, education, health and economic opportunities and through a commitment to environmental sustainability. In 2023, the Company demonstrated this continued commitment in the following ways, among others:

| | | | | |

Environmental •Branch-lite model with only one location in each of the four primary banking markets. •Minimal technology eco-footprint through the use of state-of-the-art technology to minimize power consumption. •Recycled 3,645 pounds of Company and employee e-waste in accordance with e-Stewards Standard for Responsible Recycling. •Sound loan administration and underwriting practices, including consideration of environmental risk to promote sustainable growth. •Employee 401(k) plan options include two ESG-focused investment alternatives. | Social •Employees spent 4,038 hours volunteering in their communities and impacted 151 non-profits/not-for-profits, educational institutions, and other charitable organizations. •Donations, contributions and sponsorships totaled $963,220 (an increase of $53,795 over 2022). •Invested $33.3 million in Low Income Housing Tax Credits to support the construction and renovation of low-income rental housing to bring affordable housing, financial stability and economic opportunity to those who need it most. •Ranked among the Top 100 Small Business Administration Lenders, fostering an inclusive economy and supporting the diverse spectrum of entrepreneurs. •Investment in the communities we serve via Community Reinvestment Act lending activities.

|

Governance •Director Independence – All directors except the Company’s CEO are independent, independent Board chair, and Board committees are comprised entirely of independent directors. •Committed to Board Diversity – 30% of the Board members are female, 10% are racially or ethnically diverse, and 50% of Board committees are chaired by female directors; advisory board member diversity in the four primary banking markets exceeds 40%. •Selected as one of only 31 small-cap banks in the country named to the Piper Sandler Sm-All Star Class of 2023, placing the Company among the top 10% of the industry related to growth, profitability, credit quality and strength of capital. •Ranked by Bank Director magazine as #2 among 30 publicly traded banks with $1 billion-$5 billion in total assets and #5 among top 300 publicly traded banks based on TSR, profitability, capital adequacy, and asset quality. •See pages 14 through 20 for additional information about the Company's corporate governance practices. |

|

|

(1) Moses & Associates, 2023

(2) J.D. Power, 2022

(3) Qualtrics XM Institute, 2022

(4) Statista, 2023

Note: Net Promoter Score assesses likelihood to recommend on an 11-point scale, where detractors (scores 0-6) are subtracted from promoters (scores 9-10), while passive scores (scores 7-8) are not considered. The NPS score ranges from -100 to +100.

First Business Financial Services, Inc. 2024 Proxy Statement | 5

Human Capital Management

The Company believes achieving strong financial results begins with its employees. In 2023, our workforce grew to 349 employees. While the majority of our employees are located in the primary banking markets, the Company has employees working onsite, hybrid, and remote in over 20 states. This geographic expansion allows the Company to continue to diversify the workforce, compete in an increasingly challenging talent landscape, and add producers and specialists as business lines and needs grow.

The Company’s culture is critical to our success and is rooted in a set of founding beliefs and guided by a core cultural competency framework. The clarity of the Company’s core values creates a special and committed team atmosphere, which increases productivity, reduces turnover, attracts motivated employees, and cultivates a culture of belonging. The Company is in a people-differentiated business and attracting and retaining the best talent possible is critical to our success and financial performance. The strength of our culture and core values is demonstrated in a number of ways.

| | | | | |

| Our Culture | |

•Conducted a culture check-in with all employees to encourage open discussion and feedback between managers and employees. •Provided ongoing diversity, equity, and inclusion ("DEI") education opportunities to all employees. Workplace culture discussions were held with over 60% of our employees who identify as racially/ethnically diverse. •As part of the Top Workplaces survey, awarded the 2023 Top Workplaces Culture Excellence recognition across nine categories. •Employee turnover was 9.33%; well below the employee turnover average of 17.7% in the banking industry, as reported in a survey conducted by Aon in 2023. |

| Investing in our Employees |

•The Career Path Ratio (progression into different or more advanced roles) for employees was 14%, above our 10% goal, recognizing strong employee performance and career progression. •A Leadership Challenge Team, comprised of emerging leaders and key employees, was formed to provide development opportunities and exposure to the strategic planning process to prepare the employees to participate and lead future planning cycles. •Launched a Rising Professionals Development Series, providing employee opportunities to grow, connect, and share ideas with peers and leadership within the organization. |

(1) The 2023 Survey Results are compiled from the annual Employee Engagement Survey.

(2) Employee Engagement is a key driver for organizational success. An engaged employee is a person who is fully involved in, and enthusiastic about, their work. Engaged employees work harder, are more loyal and are more likely to go the "extra mile" for the organization.

(3) Manager Effectiveness - managers contribute significantly to the perceived quality of the work environment, as well as to the engagement of their employees.

(4) The Performance Enablement index focuses on client service and quality, involvement, training and teamwork.

(5) The Belonging index measures a feeling of security and support and a sense of acceptance and inclusion as a member of the team and employee of the Company.

The Results of Our Commitment

From the Company’s inception, the commitment to and investment in our employees and the communities we serve has been the foundation of the Company’s long-term success for the benefit of our shareholders. The Company’s commitment to corporate responsibility and sustainability is best expressed in the words of our Belief Statement: At First Business Bank, we believe visionary, determined entrepreneurs and investors create a thriving economy and, in turn, social and economic advancement for their employees, investors, families and communities. Built by driven entrepreneurs, First Business Bank has the experience to create both wealth, and a wealth of good in the world.

First Business Financial Services, Inc. 2024 Proxy Statement | 6

The Company’s Amended and Restated By-Laws provide that the directors shall be divided into three classes, with staggered terms of three years each. At the Annual Meeting, the shareholders will elect three directors to hold office until the 2027 Annual Meeting of Shareholders and until their successors are duly elected and qualified. Unless shareholders otherwise specify, the shares represented by the proxies received will be voted in favor of the election as directors of the three persons named as nominees by the Board herein. The Board has no reason to believe that the listed nominees will be unable or unwilling to serve as directors if elected. In the event that any nominee should be unable or unwilling to serve, the shares represented by proxies received will be voted for another nominee selected by the Board. Each director will be elected by a plurality of the votes cast at the Annual Meeting (assuming a quorum is present). Consequently, any shares not voted at the Annual Meeting, whether due to abstentions, broker non-votes or otherwise, will have no impact on the election of the directors. Any nominee for election as a director who receives a greater number of votes "withheld" from their election than votes "for" their election will tender their resignation to the Board in accordance with the Company's Director Resignation Policy as outlined in the Corporate Governance Guidelines on the Company’s website located at https://ir.firstbusiness.bank/corporate-overview/corporate-governance/default.aspx. Votes will be tabulated by an inspector of elections appointed by the Board.

As previously disclosed, Mark D. Bugher will retire from the Company’s Board following the conclusion of the Annual Shareholders Meeting on April 26, 2024. The Board of Directors wishes to express its gratitude to Mr. Bugher for his dedicated service to the Board and shareholders.

The following sets forth certain information about the Board’s nominees for election at the Annual Meeting and each director of the Company whose term will continue after the Annual Meeting.

First Business Financial Services, Inc. 2024 Proxy Statement | 7

Nominees for Election at the Annual Meeting

Terms expiring at the 2027 Annual Meeting

| | | | | |

Laurie S. Benson

Executive Director

Nurses on Boards Coalition

Age: 70 Independent Director since 2018

COMMITTEES •Compensation •Corporate Governance and Nominating, Chair | Experience •Executive Director, Nurses on Boards Coalition (since 2016) •CEO, LSB Unlimited, LLC (since 2009) •Co-Founder and CEO, Inacom Information Services (1984-2009) Qualifications •Technology/Information Security expertise as the co-founder and CEO of an IT systems integrator, from inception until its sale to CORE BTS in 2009 •Governance and Human Resources/Compensation and Strategic Planning expertise acquired through her extensive experience as a CEO and C-Suite advisor on complex issues including board governance, strategy, business growth, innovation, high performance teams, human resources and succession planning; supporting the mission to improve health in communities through the service of nurses on boards, commissions and appointments; and through service on public and private boards •Strategic Planning expertise and Entrepreneurial focus as the co-founder of Inacom Information Services, growing the company from start-up to over 150 employees and three office locations and as the founder of LSB Unlimited, LLC Education •BS, Nursing, University of Wisconsin-Madison Other Boards and Organizations •Director, FBB Board of Directors (since 2009) •Member, FBB Northeast Wisconsin Advisory Board (2012-2021) •Member of the boards of other private organizations |

Corey A. Chambas

Chief Executive Officer First Business Financial Services, Inc.

Age: 61 Director since 2002

COMMITTEES •None | Experience •Chief Executive Officer (since 2006), President (2005-2023), Chief Operating Officer (2005-2006), Executive Vice President (2002-2005), First Business Financial Services, Inc. •Chief Executive Officer (1999-2006), President (1999-2005), First Business Bank Qualifications •Financial Services Industry and Financial Reporting, Accounting and Financial Controls expertise acquired over more than 35 years in the financial services industry, with a specific focus in the commercial banking sector and leadership roles with responsibility for oversight of all aspects of financial management •Enterprise Risk Management and Strategic Planning expertise developed while serving as CEO of both the Company and FBB with responsibility for enterprise-wide risk, development and execution of the strategic planning process and oversight for six distinct financial services businesses •Human Resources/Compensation expertise through his experience as CEO with responsibility for senior management recruitment and succession planning, oversight of human resources leadership, and Company culture Education •BBA, Finance, Investment & Banking, Wisconsin School of Business, University of Wisconsin-Madison Other Boards and Organizations •Director, FBB Board of Directors (since 2018, 2009-2011, 1999-2006) •Advisory board member and advisor to the board of other private organizations

|

First Business Financial Services, Inc. 2024 Proxy Statement | 8

| | | | | |

John J. Harris

Retired Managing Director Stifel Nicolaus Weisel

Age: 71 Independent Director since 2012

COMMITTEES •Audit •Operational Risk | Experience •Managing Director, Investment Banking Financial Institutions Group, Stifel Nicolaus Weisel (2007-2010) and Piper Jaffray & Co. (2005-2007) •Principal, Investment Banking Financial Institutions Group, William Blair & Co., LLC (2000-2005) •Investment Banking Professional, various banking financial institutions (1982-2000) Qualifications •Financial Services Industry experience and Financial Reporting, Accounting and Financial Controls expertise acquired in his over 25 years providing financial advisory services to senior management and boards of publicly traded and privately held companies •Strategic Planning, Legal/Regulatory, and Mergers and Acquisitions expertise acquired over his substantial career serving as an investment banking professional advising clients on mergers and acquisitions, capital formation and execution of public and private capital raises Education •BSSE, Systems Engineering, US Naval Academy •MBA, University of Chicago Other Boards and Organizations •Director, FBB Board of Directors (since 2018)

|

First Business Financial Services, Inc. 2024 Proxy Statement | 9

Directors Continuing in Office

Terms expiring at the 2025 Annual Meeting

| | | | | |

W. Kent Lorenz

Owner and Managing Director Lakeside Consulting, LLC

Age: 61 Independent Director since 2018

COMMITTEES •Audit •Operational Risk | Experience •Owner and Managing Director, Lakeside Consulting, LLC (since 2017) •Chairman and CEO, Acieta LLC (2014-2017) •President, Midwest Region, Ellison Technologies (2006-2014) and President, Ellison Machinery & Robotics of Wisconsin (1998-2006) Qualifications •Financial Reporting, Accounting and Financial Controls, Strategic Planning and Mergers and Acquisitions expertise developed through acquisitions with Ellison Technologies and the merger to form Acieta, LLC and as Chairman and CEO of Acieta, LLC with responsibility for the company's business strategy development and implementation and oversight of financial management •Technology/Information Security expertise developed through integration of new technologies and robotic automation systems to North American manufacturers and their global affiliates •Entrepreneurial focus as Owner and Managing Director of Lakeside Consulting, LLC and his previous affiliation as a partner in a commercial real estate investment company Education •BS, Engineering Mechanics, University of Wisconsin-Madison Other Boards and Organizations •Director, FBB Board of Directors (since 2017) •Member, FBB Southeast Wisconsin Advisory Board (2017-2021) •Director, FBB-Milwaukee Board of Directors (2010-2017) •Member of the boards and advisory boards of other private organizations |

Carol P. Sanders

President Carol P. Sanders Consulting, LLC

Age: 57 Independent Director since 2016

COMMITTEES •Audit, Chair •Compensation | Experience •President, Carol P. Sanders Consulting LLC (since 2015) •EVP, Chief Financial Officer and Treasurer, Sentry Insurance (2013-2015) •EVP and Chief Operating Officer (2012-2013) and other executive positions (2004-2012), Jewelers Mutual Insurance Company Qualifications •Financial Services Industry, Financial Reporting, Accounting and Financial Controls, Enterprise Risk Management, and Strategic Planning expertise acquired in over 25 years in the insurance industry primarily in executive vice president ("EVP"), chief financial officer, chief operating officer and treasurer roles with responsibility for strategic financial planning, oversight of the firm’s internal audits, enterprise risk management, and actuarial services and through her experience as a designated financial expert and audit committee chair for publicly traded companies •Governance experience acquired through service on other public company boards, including serving as lead independent director and chair of audit, compensation, and nominating and governance committees Education •BBA, Accounting and Economics, University of Wisconsin-Oshkosh Other Public Company Boards •Lead independent Director, Alliant Energy Corporation, a Wisconsin-based public utility holding company (since 2005) •Director, RenaissanceRe Holdings Ltd., a global provider of reinsurance and insurance (since 2016) Other Boards and Organizations •Director, FBB Board of Directors (since 2018) •Member of the board of a private organization |

First Business Financial Services, Inc. 2024 Proxy Statement | 10

Terms expiring at the 2026 Annual Meeting

| | | | | |

Carla C. Chavarria

Senior Vice President and Chief Human Resources Officer AMC Entertainment, Inc.

Age: 58 Independent Director since 2017

COMMITTEES •Compensation, Chair Elect •Corporate Governance and Nominating | Experience •Senior Vice President and Chief Human Resources Officer (since 2014) and various human resources roles (1994-2014), AMC Entertainment Inc., a publicly traded company Qualifications •Human Capital/Compensation and Strategic Planning expertise developed as a member of the executive committee of a publicly traded company and over 30 years serving as a human resources executive with responsibility for strategic development and implementation of total rewards, associate engagement, talent acquisition and development, and community relations •Legal/Regulatory and Enterprise Risk Management expertise acquired over 30 years as a human resources executive with responsibility for managing workforce-related risks, labor relations oversight, ensuring compliance with relevant laws and maintaining fair and ethical workplace practices •Mergers and Acquisitions experience through AMC Entertainment, Inc.’s acquisition of multiple companies during her tenure as Senior Vice President and Chief Human Resources Officer Education •BS, Business Administration, Pennsylvania State University Other Boards and Organizations •Director, FBB Board of Directors (since 2018) |

Ralph R. Kauten

Owner Air-Lec Industries

Age: 72 Independent Director since 2018

COMMITTEES •Audit •Operational Risk | Experience •Owner, Air-Lec Industries (since 2013) •Co-Owner, Mirus Bio (since 1996) •Biotechnology company executive: Chair and CEO of Lucigen Corporation (2006-2018); Chair and CEO of Quintessence Biosciences, Inc. (2002-2016); Co-Founder, President and CEO of PanVera Corporation (1992-2001); and Vice President, Finance and Treasurer of Promega Corporation (1979-1992) •Faculty Member, University of Wisconsin-Whitewater; Plant Controller, Heublein, Inc.; and Senior Auditor, Grant Thornton, CPAs Qualifications •Enterprise Risk Management and Strategic Planning expertise gained over 40 years in the biotechnology industry, building start-up companies and driving company growth through strategy development and implementation •Financial Reporting, Accounting and Financial Controls expertise acquired in executive roles with responsibility for oversight of all financial matters including private equity and debt financing, experience as a treasurer, controller and senior auditor and as the audit committee chair of a privately held organization •Entrepreneurial focus gained through co-founding and owning multiple businesses and Mergers and Acquisitions experience gained through mergers, joint ventures and sale of biotechnology companies Education •BBA, Accounting, University of Iowa •MBA, Accounting, University of Wisconsin-Madison Other Boards and Organizations •Director, FBB Board of Directors (since 2004); Chair (June 2018-November 2018) •Member of boards of other private organizations |

First Business Financial Services, Inc. 2024 Proxy Statement | 11

| | | | | |

Jerry L. Kilcoyne

Managing Partner Pinnacle Enterprises, LLC

Age: 64 Independent Director since 2011 Board Chair since 2018

COMMITTEES •None | Experience •Managing Partner, Pinnacle Enterprises, LLC (since 1997) •President, Northbrook Rail Corporation (1989-1996) Qualifications •Financial Services Industry experience, Financial Reporting, Accounting and Financial Controls, and Strategic Planning expertise acquired in more than 35 years of executive experience with responsibility for all aspects of financial management and strategy implementation and service on the board, committees and as chair of a publicly traded financial institution and its subsidiaries •Mergers and Acquisitions expertise developed through his management role with mergers and acquisitions operations of Northbrook Corporation and the private equity ownership and sale of businesses in the transportation, manufacturing, distribution and other industries throughout his career •Entrepreneurial focus through the acquisition and management of multiple companies Education •AA, Accounting, Madison Area Technical College Other Boards and Organizations •Chair, FBB Board of Directors (since November 2018, May 2010-June 2018) •Director, FBB Board of Directors (since November 2018 and 2005-June 2018) •Director, First Business Equipment Finance, LLC (2006-2017), and Director, First Business Capital Corp. (2006-2013), both FBB entities were merged into First Business Specialty Finance, LLC, a wholly-owned subsidiary of FBB in 2021 •Director, Alterra Bank (2016-2017) until its charter consolidation with FBB in 2017 |

Daniel P. Olszewski

Director Weinert Center for Entrepreneurship

Age: 59 Independent Director since 2018

COMMITTEES •Operational Risk, Chair •Corporate Governance and Nominating | Experience •Director, Weinert Center for Entrepreneurship, Wisconsin School of Business, University of Wisconsin-Madison (since 2006) •Chair/President, PNA Holdings, LLC, owner of Parts Now! and Katun Corporation (1999-2002, 2003-2005); CEO, Katun Corporation (2003-2005); CEO/President (1999-2003) and COO (1997-1999), Parts Now! •Consultant, McKinsey & Company (1988-1990, 1992-1997) Qualifications •Entrepreneurial expertise as the instructor for the capstone Weinert Applied Ventures in Entrepreneurship graduate course and co-founder of the Morgridge Entrepreneurial Bootcamp program for graduate students in STEM programs •Mergers and Acquisitions expertise serving as an instructor of graduate student mergers and acquisitions courses and through the acquisition of Katun Corporation with the assistance of private equity sponsors •Strategic Planning, Enterprise Risk Management and Financial Services Industry expertise obtained in his role as a strategy and finance consultant at McKinsey, through his CEO and board chair roles, and as an instructor of graduate courses on corporate finance, capital budgeting and structure, valuation methods and entrepreneurial finance Education •BA, Economics and Computer Science, University of Wisconsin-Madison •MBA, Harvard Business School Other Boards and Organizations •Director, FBB Board of Directors (since 2010) •Director, First Business Capital Corp. (2011-2018), FBB entity merged into First Business Specialty Finance, LLC, a wholly-owned subsidiary of FBB in 2021 •Member of the board of a private organization |

First Business Financial Services, Inc. 2024 Proxy Statement | 12

Director Disclosures

None of the directors, executive officers or nominees is related to one another and there are no arrangements or understandings between any of the directors, executive officers or any other person pursuant to which any of the Company’s directors or executive officers have been selected for their respective positions. None of the above-named directors or director nominees was a party to any SEC enforcement actions or any legal proceedings that are material to an evaluation of their ability or integrity in the past ten years.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires the Company’s directors, executive officers and holders of 10% or more of the outstanding Common Stock to file reports concerning their ownership of Company equity securities with the SEC. Based solely upon a review of such reports, other than one late Form 4 filing related to the purchase of shares by Carol P. Sanders, Company Director, the Company believes that during the fiscal year ended December 31, 2023, all of its directors and executive officers complied with the Section 16(a) filing requirements.

First Business Financial Services, Inc. 2024 Proxy Statement | 13

CORPORATE GOVERNANCE

The Company is committed to good corporate governance, which promotes the long-term interests of the shareholders and provides a strong foundation for business operations. All Company directors serve as directors of both the Company and its wholly-owned subsidiary, First Business Bank, which eliminates redundancies, simplifies and streamlines governance processes, and enhances the Board’s oversight of the Company’s strategic initiatives.

Director Selection, Qualifications and Nominations

In making recommendations to the Company’s Board with respect to nominees to serve as directors, the Corporate Governance and Nominating Committee will examine each director nominee on a case-by-case basis, regardless of who recommended the nominee, and take into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen and industry knowledge. In evaluating director nominees, the Board, with the assistance of the Corporate Governance and Nominating Committee, considers diversity of viewpoint, backgrounds, technical skills, industry knowledge and experience as well as diversity such as race, gender, age, sexual orientation, ethnicity, disability, geographic representation, and other personal dimensions of diversity and identities as outlined in the Board Diversity, Equity, and Inclusion Policy to ensure a balanced, diverse Board, with each director contributing talents, skills and experiences needed for the Board as a whole. The Corporate Governance and Nominating Committee assesses the implementation of the practices outlined in the Board Diversity, Equity and Inclusion Policy, which was adopted in 2021, on an annual basis.

The Director Resignation Policy requires that any director receiving a greater number of votes "withheld" from their election than votes "for" will tender their resignation to the Board Chair. The Board, in its discretion, may accept or reject the tendered resignation in accordance with the Director Resignation Policy, as outlined in the Corporate Governance Guidelines on the Company’s website located at https://ir.firstbusiness.bank/corporate-overview/corporate-governance/default.aspx.

The Board also believes the following minimum qualifications must be met by a director nominee to be recommended by the Corporate Governance and Nominating Committee:

•Strong personal and professional ethics, integrity and values.

•The ability to exercise sound business judgment.

•Accomplished in their respective field as an active or former executive officer of a public or private organization, with broad experience at the administrative and/or policy-making level in business, government, education, technology or public interest.

•Relevant expertise and experience and the ability to offer advice and guidance based on that expertise and experience.

•Independence from any particular constituency, the ability to represent all shareholders of the Company and a commitment to enhancing long-term shareholder value.

•Sufficient time available to devote to activities of the Board and to enhance their knowledge of the Company’s business.

Using a defined director succession planning process as a component of Board succession planning, the Corporate Governance and Nominating Committee works with the Board to evaluate:

•Board composition and assess whether directors should be added in view of director departures,

•The number of directors needed to fulfill the Board’s responsibilities under the Company’s Corporate Governance Guidelines and committee charters, and

•The skills and capabilities that are relevant to the Board’s work and the Company’s strategy.

In making recommendations to the Board, the Corporate Governance and Nominating Committee considers the mix of different tenures of directors, taking into account the benefits of directors with longer tenures including greater Board stability, continuity of organizational knowledge and the critical importance of expertise and understanding of the commercial banking industry as well as the benefits of directors with shorter tenures who help to foster new ideas and examination of the status quo. As part of its on-going responsibility to identify prospective directors to provide an appropriate balance of knowledge, experience, background and capability on the Board, the Corporate Governance and Nominating Committee periodically evaluates director candidates to recommend for the Board’s consideration and possible appointment to the Board.

First Business Financial Services, Inc. 2024 Proxy Statement | 14

The following tables summarize key qualifications, skills and attributes relevant to the decision to nominate candidates to serve on the Board and possessed by current directors. A mark indicates this particular qualification, skill or attribute was identified as one of the director’s top five strongest qualifications, skills or attributes, but the absence of a mark does not mean the director does not possess that qualification, skill or attribute.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Director Skills, Attributes, and Qualifications |

| Benson | Bugher | Chambas | Chavarria | Harris | Kauten | Kilcoyne | Lorenz | Olszewski | Sanders |

Governance/ Other Public Company Board Service | ● | ● | | | | | | | | ● |

| Financial Services Industry | | ● | ● | | ● | | ● | | ● | ● |

Financial Reporting, Accounting and Financial Controls | | | ● | | ● | ● | ● | ● | | ● |

Human Resources/Compensation | ● | ● | ● | ● | | | | | | |

| Enterprise Risk Management | | | ● | ● | | ● | | | ● | ● |

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

Legal/Regulatory | | | | ● | ● | | | | | |

| Mergers and Acquisitions | | | | ● | ● | ● | ● | ● | ● | |

| Entrepreneurial | ● | ● | | | | ● | ● | ● | ● | |

Technology/Information Security | ● | | | | | | | ● | | |

| Years | 5 | 18 | 21 | 6 | 12 | 5 | 12 | 5 | 5 | 7 |

| | | | | | | | | | | | | | |

Board Diversity Matrix |

Total Number of Directors: 10 | | | | |

| Female | Male | Non-Binary | Did not Disclose Gender |

| Gender Identity | 3 | 7 | — | — |

| Demographic Background: | | | | |

| African American or Black | 1 | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 7 | — | — |

| Two or More Races or Ethnicities | — | — | — | — |

| LGBTQ+ | — | — | — | — |

| Did not Disclose Demographic Background | — | — | — | — |

The Corporate Governance and Nominating Committee will consider persons recommended by shareholders to become nominees for election as directors. Recommendations for consideration by the Corporate Governance and Nominating Committee should be sent to the Corporate Secretary of the Company in writing together with appropriate biographical information concerning each proposed nominee. The Company’s Amended and Restated By-Laws also set forth certain requirements for shareholders wishing to nominate director candidates directly for consideration by the shareholders. With respect to an election of directors to be held at an

First Business Financial Services, Inc. 2024 Proxy Statement | 15

annual meeting, a shareholder must, among other things, give notice of an intent to make such a nomination to the Corporate Secretary of the Company not less than 60 days or more than 90 days prior to the date of the previous year’s annual meeting (subject to certain exceptions if the annual meeting is advanced or delayed a certain number of days). Under the Amended and Restated By-Laws, if the Company does not receive notice of an intent to make such a nomination on or after January 26, 2025 and on or prior to February 25, 2025, then the notice will be considered untimely and the Company will not be required to present such nomination at the 2025 annual meeting.

Director Evaluation Process, Development and Education

The Board recognizes that a constructive evaluation process is an essential component of governance best practices and annually conducts a robust peer and self-evaluation in conjunction with its annual Board and committee evaluation. The Corporate Governance and Nominating Committee oversees the evaluation process and reviews the format of the evaluation to ensure that actionable feedback is solicited related to the operation of the Board, its committees and director performance. In addition to evaluating the Board and committees, the peer and self-evaluation process serves as a mechanism to measure clear performance standards, both objective and subjective, and the Board Chair meets annually with each director to review their evaluation results. The chart below outlines the evaluation process.

The Board is committed to continuing director education and development and solicits director feedback on education topics. The feedback was utilized to develop Board education sessions presented at each quarterly Board meeting in 2023. The Board education sessions included internally developed presentations as well as programs presented by third parties on the following topics: Current Expected Credit Loss accounting standards, treasury management, asset/liability management, Bank Secrecy Act/Anti-Money Laundering, Office of Foreign Assets Control and regulatory compliance, and derivatives and hedging. The Company provides financial support for director education and at each quarterly meeting the Corporate Governance and Nominating Committee reviews the Director Education Report. All directors are in compliance with the Board’s director education guidelines.

First Business Financial Services, Inc. 2024 Proxy Statement | 16

Independent Directors and Meeting Attendance

Of the nine directors who will be serving on the Board at the conclusion of the Annual Meeting, the Board has determined that all except for Mr. Chambas, the Company’s CEO, are "independent directors" for purposes of applicable Nasdaq rules.

Directors are expected to attend the Company’s annual meeting of shareholders each year. All ten directors attended the Company’s 2023 annual meeting.

The Board held seven meetings in 2023. Each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board during 2023 while they were a director and (ii) the total number of meetings held by all committees of the Board on which such director served during 2023 while they were a member of such committees.

Board Leadership Structure

The roles of Board Chair and CEO are held separately. Mr. Kilcoyne serves as Board Chair and Mr. Chambas serves as CEO. The Board believes that at this time, separation of these roles is in the best interests of the Company and its shareholders because separation:

•allows for additional talents, perspectives and skills on the Board;

•preserves the distinction between the CEO’s leadership of management and the Board Chair’s leadership of the Board;

•promotes a balance of power and an avoidance of conflict of interest;

•provides an effective channel for the Board to express its views on management; and

•allows the CEO to focus on leading the Company and the Board Chair to focus on leading the Board, monitoring corporate governance and shareholder issues.

Committees

The Board conducts its business through meetings of the Board and the following standing Board committees: Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee, and Operational Risk Committee. Each of these committees has the responsibilities set forth in a formal written charter approved by the Board. The Board has also adopted guidelines on significant corporate governance matters that, together with the Company’s Code of Business Conduct and Ethics and other policies, create the Board’s corporate governance standards. Copies of the charters, the Corporate Governance Guidelines, and the Code of Business Conduct and Ethics are available on the Company’s website located at https://ir.firstbusiness.bank/corporate-overview/corporate-governance/default.aspx. The Company intends to disclose amendments to, or waivers of, the Code of Business Conduct and Ethics, if any, to the website above. The following table reflects the current membership of each Board committee:

| | | | | | | | | | | | | | |

Name(1) | Audit | Compensation | Corporate Governance And Nominating | Operational Risk |

| Laurie S. Benson | | ● | Chair | |

Mark D. Bugher | | Chair | ● | |

| Carla C. Chavarria | | ● | ● | |

| John J. Harris | ● | | | ● |

| Ralph R. Kauten | ● | | | ● |

| W. Kent Lorenz | ● | | | ● |

| Daniel P. Olszewski | | | ● | Chair |

Carol P. Sanders(2) | Chair | ● | | |

| Number of Meetings in 2023 | 5 | 5 | 4 | 4 |

● Member

(1) Mr. Chambas and Mr. Kilcoyne are not members of a standing committee

(2) Ms. Sanders qualifies as an "audit committee financial expert"

First Business Financial Services, Inc. 2024 Proxy Statement | 17

Audit Committee

The Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by overseeing the Company’s accounting and financial reporting processes and the audits of the financial statements of the Company. The Audit Committee evaluates, monitors and advises the Board on all matters relating to maintaining the right "tone at the top" which serves the best interest of the Company, its employees and shareholders. The Audit Committee presently consists of Carol P. Sanders (Chair), John J. Harris, Ralph R. Kauten, and W. Kent Lorenz, each of whom meets the requirements set forth in Nasdaq Listing Rule 5605(c)(2)(A) and the independence standards set forth in Rule 10A-3(b)(1) promulgated by the SEC under the Exchange Act. The Board has thus determined that each of the Audit Committee’s current members is qualified to serve in such capacity. The Board has determined that Carol P. Sanders qualifies as an "audit committee financial expert" for purposes of applicable SEC regulations, and has the financial sophistication required by applicable Nasdaq rules because she has the requisite attributes through, among other things, her education and experience as a certified public accountant (inactive) and financial executive in the insurance industry, and her service on the audit committee of other public companies.

Compensation Committee

The Compensation Committee's primary functions are to review and recommend to the Board the compensation structure for the Company’s directors and executive officers, including salary rates, participation in incentive compensation and benefit plans, fringe benefits, non-cash perquisites and other forms of compensation, and administer the Company’s long-term incentive plan and employee stock purchase plan. Mark D. Bugher (Chair), Laurie S. Benson, Carla C. Chavarria (Chair Elect), and Carol P. Sanders are the current members of the Compensation Committee, each of whom is considered to be "independent" and meets the requirements set forth in applicable Nasdaq rules and the independence standards set forth in Rule 10C-1(b)(1) promulgated by the SEC under the Exchange Act. The Board has determined that none of the aforementioned directors has a relationship to the Company which is material to their ability to be independent from management in connection with the duties of a Compensation Committee member and has further determined that each of the Compensation Committee’s current members is qualified to serve in such capacity.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee’s primary functions are to recommend persons to be selected by the Board as nominees for election as directors; recommend persons to be elected to fill any vacancies on the Board; lead the Board in its annual review of Board performance; Board and committee structure and director independence; review and recommend to the Board corporate governance principles, policies and procedures and oversee execution of the Company’s succession planning program and advise the Board on the effectiveness of the program. While the Board continues to maintain primary responsibility for ESG, it has delegated assessment and monitoring of the Company's ESG and Board DEI practices to the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee presently consists of Laurie S. Benson (Chair), Mark D. Bugher, Carla C. Chavarria, and Daniel P. Olszewski. The Board has determined that each of the Corporate Governance and Nominating Committee members is considered to be "independent" according to applicable Nasdaq rules and has further determined that each current member is qualified to serve in such capacity.

Operational Risk Committee

The Operational Risk Committee's primary function is to assess and manage certain of the Company's risks. While the Board continues to maintain primary responsibility and oversight for enterprise risk management ("ERM"), the Operational Risk Committee oversees execution of the Company’s ERM Program and evaluates the Company’s strategic risk based on an assessment of the Company’s strategies in the context of the Company’s overall risk tolerance, related opportunities and capacity to manage the resulting risk. The Board has additionally delegated assessment and management of credit, compliance, operational, cybersecurity/information security, investment, liquidity and market, and reputation risks to the Operational Risk Committee. The Operational Risk Committee presently consists of Daniel P. Olszewski (Chair), John J. Harris, Ralph R. Kauten, and W. Kent Lorenz.

First Business Financial Services, Inc. 2024 Proxy Statement | 18

Board Role in Risk Oversight

| | |

Oversight of Risk |

•The Board has an active and ongoing role in the management of the risks of the Company. It is responsible for general oversight of enterprise-wide risk management. •The Board, acting as a whole and through its Corporate Governance and Nominating Committee, is responsible for oversight of the Company's ESG framework. To ensure alignment with the Company's ESG principles, responsibility for Board delegated ESG risks and opportunities are defined in the committee charters. •The Operational Risk Committee was established in 2018 to evaluate and monitor the Company’s strategic risk and its key operational risks, including overseeing management's execution of the ERM Program and periodically evaluating the Board’s risk management structure and processes to ensure appropriate Board-level risk reporting. The Board, acting as a whole and through its delegation to the Operational Risk Committee, is responsible for general oversight of the Company's cybersecurity and information security program. •The Chief Risk Officer, along with Company management, is responsible for assessing and managing risk through robust internal processes and effective internal controls and for providing appropriate reporting to the Board and its committees. |

The Company believes open and transparent communication between management and the Board is essential for effective risk management and oversight. The Board, acting as a whole and through its committees, is responsible for oversight of the Company’s enterprise-wide risk management including, but not limited to, strategic, financial, credit, liquidity, compensation, information security including cybersecurity, regulatory, reputation, and operational risks. Given the critical link between strategy and risk, the Board is also responsible for developing strategies based on an assessment of the Company’s overall risk tolerance, the related opportunities and the capacity to manage the resulting risk. As part of its ongoing planning, the Board discusses with executive management the strategies, key challenges, risks and opportunities facing the Company.

Executive management is responsible for the day-to-day management of the Company’s key risks and operates through a Senior Management Risk Committee ("SMRC"). The SMRC monitors key risks, develops and executes mitigation or remediation plans as appropriate, identifies emerging risks, evaluates the effectiveness of the Company’s risk management processes and reports such to the Board or its committees on a regular basis. The SMRC is responsible for the annual review of each key risk indicator ("KRI") included in the Risk Tolerance Dashboard and presents its recommendations to the Operational Risk Committee. The Operational Risk Committee reviews the SMRC's recommendations regarding any potential changes to KRIs and tolerance levels to ensure the Company’s most significant risks along with related metrics/key KRIs have been identified, and risk tolerance thresholds have been established.

ERM is a standing agenda item for each of the Board’s regular quarterly meetings. At these meetings the Board reviews the Risk Tolerance Dashboard, the status of each KRI relative to the designated tolerance threshold, and the related remediation plans. The Board has delegated oversight of each of the key risks to either the Audit, Compensation, Corporate Governance and Nominating or Operational Risk Committee in accordance with the committee charters. These charters are reviewed annually to reflect the changing risk environment. Each committee monitors the assigned specific key risks, ensures that appropriate risk mitigation plans are in place, identifies emerging risks, reports back to the Board with recommendations and updates and apprises the Board of any areas of concern. The following table summarizes each committee’s role in the risk oversight function.

First Business Financial Services, Inc. 2024 Proxy Statement | 19

| | | | | |

Committee | Risk Oversight Focus |

| Audit Committee | •Monitors the integrity of the financial statements, effectiveness of internal control over financial reporting, compliance with applicable legal and regulatory requirements, the qualifications and independence of the Company’s independent registered public accounting firm, the performance of the third-party, outsourced internal auditor, and the systems of disclosure controls and procedures. •Evaluates, monitors and advises the Board on all matters relating to maintaining the right "tone at the top." |

| Compensation Committee | •Oversees the compensation of the executive officers and directors, monitors the Company's overall practices and plans to assess whether the compensation structure establishes appropriate incentives for the executive officers and aligns with the corporate goals and objectives, evaluates risks presented by all compensation programs and confirms that the programs do not encourage risk-taking to a degree that is likely to have a materially adverse impact on the Company, do not encourage the management team to take unnecessary and excessive risks that threaten the value of the Company, and do not encourage the manipulation of reported earnings of the Company. •Evaluates risks and opportunities related to human capital management. |

| Corporate Governance and Nominating Committee | •Monitors risks relating to the Company's corporate governance structure, director independence, succession, and ESG. •Evaluates and makes recommendations related to Board DEI practices as outlined in the Board Diversity, Equity and Inclusion Policy. |

| Operational Risk Committee | •Assures the ERM Program is operating effectively. •Monitors strategic risk based on an assessment of the Company’s strategies in the context of the Company’s overall risk tolerance, related opportunities and capacity to manage the resulting risk. •Evaluates, monitors and assesses key risks via quarterly updates from senior management related to credit risk; regulatory and compliance risk; operational risk; investment, liquidity and market risk; and reputation risk. •Receives quarterly updates from the Company's Chief Information Officer on the Company's cybersecurity and information security program and reviews information security and cybersecurity risk reports and actions taken by management to assess and mitigate such risks. |

CEO and Executive Officer Succession Planning

Succession planning and leadership development are top priorities for the Board and management. Because of the significance of the CEO’s leadership, the Board retains primary responsibility for oversight of CEO succession planning as well as overall executive leadership development and succession planning practices and strategies. The Board has delegated certain responsibility for the ongoing development and monitoring of CEO and executive officer succession planning to the Corporate Governance and Nominating Committee, and at least annually, that committee reviews the policies and principles of selecting a successor to the CEO. The Board participates in the annual review of the CEO succession plan, which includes an assessment of potential CEO candidates, contingency plans in the event of a sudden termination (including death or disability), development plans that are being utilized to strengthen the skills and qualifications of candidates and the Company CEO’s recommendations for contingency and longer term succession planning for the CEO. The Corporate Governance and Nominating Committee in accordance with its charter also reviews succession plans for the other executive officers.

Communications with the Board of Directors

Shareholders may communicate with the Board by writing to First Business Financial Services, Inc., Board of Directors (or, at the shareholder’s option, to a specific director), c/o Lynn Ann Arians, Corporate Secretary, 401 Charmany Drive, Madison, Wisconsin 53719. The Corporate Secretary will ensure that all appropriate communications are delivered to the Board or the specified director, as the case may be.

First Business Financial Services, Inc. 2024 Proxy Statement | 20

DIRECTOR COMPENSATION