Huazhu Group Limited (Nasdaq: HTHT), a leading and fast-growing

multi-brand hotel group in China with international coverage (the

“Company”), today announced the pricing of the global offering (the

“Global Offering”) of 20,422,150 new ordinary shares (the “Offer

Shares”), which comprises an international offering (the

“International Offering”) and a Hong Kong public offering (the

“Hong Kong Public Offering”). The final offer price for both the

International Offering and the Hong Kong Public Offering (the

“Offer Price”) has been set at HK$297 per Offer Share. Based on the

ratio of one ordinary share per Nasdaq-listed American depositary

share (“ADS”), the Offer Price translates to approximately

US$38.321 per ADS. Subject to approval from The Stock Exchange of

Hong Kong Limited (the “SEHK”), the Offer Shares are expected to

begin trading on the Main Board of the SEHK on September 22, 2020

under the stock code “1179.HK.” The Global Offering is expected to

close on the same day, subject to customary closing conditions.

The gross proceeds to the Company from the Global Offering,

before deducting underwriting fees and the offering expenses, are

expected to be approximately HK$6,065.4 million. In addition, the

Company has granted the international underwriters an option to

purchase additional ordinary shares, exercisable from September 16,

2020 until 30 days thereafter, to require the Company to issue up

to an additional 3,063,300 new ordinary shares at the Offer

Price.

The Company plans to use the net proceeds to fund the capital

expenditures and expenses to strengthen the Company’s hotel

network, including opening of new hotels and the upgrade and

on-going maintenance of existing hotels; to repay part of the

Company’s US$500 million revolving credit facility drawn down in

December 2019; to enhance the Company’s technology platform,

including our H Rewards loyalty program; and for general corporate

purposes.

Goldman Sachs (Asia) L.L.C. and CMB International Capital

Limited are the joint sponsors, joint global coordinators and joint

bookrunners for the proposed Offering. CLSA Limited, J.P. Morgan

(Asia Pacific) Limited and Morgan Stanley Asia Limited (in

alphabetical order) are also acting as the joint global

coordinators and joint bookrunners.

The International Offering is being made only by means of a

preliminary prospectus supplement dated September 9, 2020 and the

accompanying prospectus included in an automatic shelf registration

statement on Form F-3 filed with the U.S. Securities and Exchange

Commission (the “SEC”) on October 26, 2017, which automatically

became effective upon filing. The registration statement on Form

F-3 and the preliminary prospectus supplement are available at the

SEC website at: http://www.sec.gov. The final prospectus supplement

will be filed with the SEC and will be available on the SEC’s

website at: http://www.sec.gov. When available, copies of the final

prospectus supplement and the accompanying prospectus relating to

the offering may also be obtained from Goldman Sachs & Co.

L.L.C., 200 West Street, New York, NY 10282-2198, Attention:

Prospectus Department, or E-mail: Prospectus-NY@gs.com; CMB

International Capital Limited, 45/F, Champion Tower, 3 Garden Road,

Central, Hong Kong, Attention: Ethan Hu, E-mail: ecms@cmbi.com.hk;

CLSA Limited, 18/F, One Pacific Place, 88 Queensway, Hong Kong,

Attention: ECM Team, or E-mail: ib.ecm@clsa.com; J.P. Morgan (Asia

Pacific) Limited, 28/F, Chater House, 8 Connaught Road Central,

Hong Kong, E-mail: prospectus-eq_fi@jpmchase.com; or Morgan Stanley

& Co. LLC, 180 Varick Street, 2nd Floor, New York,

NY 10014, Attention: Prospectus Department, or E-mail:

prospectus@morganstanley.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer or an invitation to buy any securities of

the Company, nor shall there be any offer or sale of these

securities in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction. This press release does not constitute a prospectus

(including as defined under the laws of Hong Kong) and potential

investors should read the prospectus of the Company for detailed

information about the Company and the proposed offering, before

deciding whether or not to invest in the Company. This press

release has not been reviewed or approved by the SEHK or the

Securities and Futures Commission of Hong Kong.

The price of the Offer Shares of the Company may be stabilized

in accordance with the Securities and Futures (Price Stabilization)

Rules. The details of the intended stabilization and how it will be

regulated under the Securities and Futures Ordinance (Chapter 571

of the laws of Hong Kong) have been contained in the prospectus of

the Company dated September 11, 2020.

About Huazhu Group Limited

Originated in China, Huazhu Group Limited is a world-leading

hotel group. As of June 30, 2020, Huazhu operated 6,187 hotels with

599,235 rooms in operation in 16 countries. Huazhu’s brands include

Hi Inn, Elan Hotel, HanTing Hotel, JI Hotel, Starway Hotel, Orange

Hotel, Crystal Orange Hotel, Manxin Hotel, Madison Hotel, Joya

Hotel, Blossom House, and Ni Hao Hotel. Upon the completion of

Deutsche Hospitality acquisition on January 2, 2020, Huazhu added

five brands to its portfolio, including Steigenberger Hotels &

Resorts, Maxx by Steigenberger, Jaz in the City, IntercityHotel and

Zleep Hotel. In addition, Huazhu also has the rights as master

franchisee for Mercure, Ibis and Ibis Styles, and co-development

rights for Grand Mercure and Novotel, in the pan-China region.

Safe Harbor Statement Under the U.S. Private Securities

Litigation Reform Act of 1995

The information in this release contains forward-looking

statements which involve risks and uncertainties, including

statements regarding the Company’s capital raising plan, business

strategy and expectations. Any statements contained herein that are

not statements of historical fact may be deemed to be

forward-looking statements, which may be identified by terminology

such as “may,” “should,” “will,” “expect,” “plan,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“forecast,” “project,” or “continue,” the negative of such terms or

other comparable terminology. Readers should not rely on

forward-looking statements as predictions of future events or

results. Any or all of the Company’s forward-looking statements may

turn out to be incorrect. They can be affected by inaccurate

assumptions, risks and uncertainties and other factors which could

cause actual events or results to be materially different from

those expressed or implied in the forward-looking statements. In

evaluating these statements, readers should consider various

factors, including the anticipated growth strategies of the

Company, the future results of operations and financial condition

of the Company, the economic conditions of China and Europe, the

regulatory environment in China and Europe, the Company’s ability

to attract customers and leverage its brands, trends and

competition in the lodging industry, the expected growth of the

lodging market in China and Europe, the spread and impact of

COVID-19, and other factors and risks outlined in the Company’s

filings with the Securities and Exchange Commission, including its

annual report on Form 20-F and other filings. These factors may

cause the Company’s actual results to differ materially from any

forward-looking statement. In addition, new factors emerge from

time to time and it is not possible for the Company to predict all

factors that may cause actual results to differ materially from

those contained in any forward-looking statements. Any projections

in this release are based on limited information currently

available to the Company, which is subject to change. This release

also contains statements or projections that are based upon

information available to the public, as well as other information

from sources which the Company believes to be reliable, but it is

not guaranteed by the Company to be accurate, nor does the Company

purport it to be complete. The Company disclaims any obligation to

publicly update any forward-looking statements to reflect events or

circumstances after the date of this document, except as required

by applicable law.

Contact Information Huazhu Investor Relations Tel: +86 (21) 6195

9561 Email: ir@huazhu.com http://ir.huazhu.com

1 The translation from Hong Kong dollar amount to U.S. dollar

amount was made at the exchange rate of HK$7.7502 to US$1.00, which

is the exchange rate set forth in the H.10 statistical release of

The Board of Governors of the Federal Reserve System on September

11, 2020.

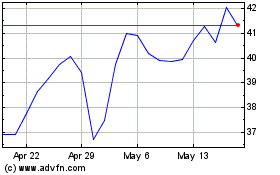

H World (NASDAQ:HTHT)

Historical Stock Chart

From Sep 2024 to Oct 2024

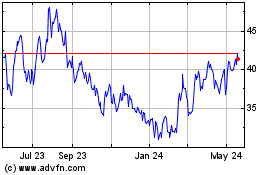

H World (NASDAQ:HTHT)

Historical Stock Chart

From Oct 2023 to Oct 2024