0001716583FALSE00017165832024-01-172024-01-170001716583us-gaap:CommonStockMember2024-01-172024-01-170001716583us-gaap:WarrantMember2024-01-172024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2024

___________________________________

Hyzon Motors Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-3962 | 82-2726724 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

475 Quaker Meeting House Road Honeoye Falls, NY | | 14472 |

| (Address of principal executive offices) | | (Zip Code) |

(585)-484-9337 |

(Registrant's telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | HYZN | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | HYZNW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 16, 2024, the Company issued a press release announcing that it will be attending the 26th Annual Needham Growth Conference on Wednesday, January 17, 2024, at 4:30 pm ET. Hyzon Chief Executive Officer Parker Meeks and Chief Financial Officer Steve Weiland will make a presentation on Hyzon’s business highlights for the year ended December 31, 2023. The press release and conference presentation are attached hereto as Exhibits 99.1 and 99.2, and are incorporated in this Item 7.01 by reference.

The information set forth in Item 7.01 (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

The following exhibit relating to Item 9.01 shall be deemed to be furnished, and not filed:

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

| | |

| | |

| | |

| | |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HYZON MOTORS INC. |

| | |

| Date: January 17, 2024 | By: | /s/ Parker Meeks |

| Name: | Parker Meeks |

| Title: | Chief Executive Officer |

| | | | | | | | | | | |

| | | |

| | |

News release | | January 16, 2024 |

| | | |

HYZON TO PRESENT AT THE 26TH ANNUAL

NEEDHAM GROWTH CONFERENCE

ROCHESTER, N.Y., January 16, 2024 - Hyzon Motors Inc. (NASDAQ: HYZN) (Hyzon or the company), a high-power hydrogen fuel cell technology manufacturer and global supplier of zero-emission heavy-duty fuel cell electric vehicles (FCEVs), today announced that Chief Executive Officer Parker Meeks and Chief Financial Officer Stephen Weiland will present at the 26th Annual Needham Growth Conference on Wednesday, January 17, 2024 at 4:30 p.m. ET. The company also will host investor meetings on the same day.

The presentation will be webcast live and will also be available for replay on Hyzon’s investor relations website at https://investors.hyzonmotors.com/. Investors interested in a 1x1 meeting with the company should contact their Needham sales representative.

# # #

About Hyzon

Hyzon Motors is a global supplier of high-power fuel cell technology focused on integrating the technology into zero-emission heavy-duty hydrogen fuel cell electric vehicles. Hyzon’s clean hydrogen infrastructure approach synchronizes supply with demand, accelerating the deployment of zero emission trucks. Utilizing its proven and proprietary hydrogen fuel cell technology, Hyzon aims to supply zero-emission heavy duty trucks to customers in North America, Europe, Australia, and New Zealand to mitigate emissions from diesel transportation - one of the single largest sources of global carbon emissions. Hyzon is contributing to the adoption of fuel cell electric vehicles through its demonstrated technology advantage, fuel cell performance, and history of rapid innovation. Visit www.hyzonmotors.com.

| | | | | | | | |

| | |

| Accelerating the | | |

| Energy Transition | | hyzonmotors.com |

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, are forward-looking statements. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyzon disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Hyzon cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyzon, including risks and uncertainties described in the

“Risk Factors” section of Hyzon’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 31, 2023, its Form 10-Q for the quarter ended September 30, 2023 filed on November 14, 2023, and other documents filed by Hyzon from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Hyzon gives no assurance that Hyzon will achieve its expectations.

For media inquiries:

Hyzon@Kivvit.com

For investors:

ir@hyzonmotors.com

| | | | | | | | |

| | |

| Accelerating the | | |

| Energy Transition | | hyzonmotors.com |

1 Needham Growth Conference 2024 January 17th, 2024

2 Forward Looking Statements This presentation includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this presentation, are forward-looking statements. When used herein, the words "aim", "could," "should," "will," "may," "believe," "anticipate," "intend," "estimate," "expect," "project," "outlook," "guidance," the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements are based on management's current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyzon disclaims any duty to update any forward-looking statements, all of which are expressly qualified by events or circumstances after the date of this presentation. Hyzon cautions you that forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyzon, including, but not limited to, the following: our ability to commercialize our products and strategic plans, including our ability to establish facilities to produce our fuel cells, assemble our vehicles or secure hydrogen supply in appropriate volumes, at competitive costs or with competitive emissions profiles; our ability to effectively compete in the heavy-duty transportation sector, and withstand intense competition and competitive pressures from other companies worldwide in the industries in which we operate; our ability to convert non-binding memoranda of understanding into binding orders or sales (including because of the current or prospective resources of our counterparties) and the ability of our counterparties to make payments on orders; our ability to invest in hydrogen production, distribution, and refueling operations to supply our customers with hydrogen at competitive costs to operate their fuel cell electric vehicles; disruptions to the global supply chain, including as a result of geopolitical events, and shortages of raw materials, and the related impacts on our third party suppliers and assemblers; our ability to maintain the listing of our common stock on the Nasdaq Capital Market; our ability to raise financing in the future; our ability to retain or recruit, or changes required in, our officers, key employees or directors; our ability to protect, defend, or enforce our intellectual property on which we depend; and the impacts of legal proceedings, regulatory disputes, and governmental inquiries Additional information on potential factors that could affect the financial results of Hyzon and its forward-looking statements is included in the "Risk Factors" section of Hyzon's Annual Report on Form 10-K for the year ended December 31, 2022, Hyzon's Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 and other documents filed by Hyzon from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Hyzon gives no assurances that Hyzon will achieve its expectations as may be described herein

3 Hyzon’s Technology-Led Value Proposition is Strengthening 5 4 3 2 1 Significant technology option value in several fuel cell advantaged future market applications Fuel cell technology leadership with capital-light, U.S. manufacturing nearing Start of Production Asset-light business model with cash-positive contribution margin fuel cell trucks expected this year Accelerating hydrogen fuel cell truck market powered by customer and government tailwinds A proven and driven leadership team that continues to strengthen

Hyzon at a Glance Note: Company logos are trademarked images of the respective firms. 1.Patent counts are totals of exclusively and jointly owned, both granted and filed / pending. 4 Fuel Cell Technology Leader, Driving “Early Mover” Commercialization of Heavy-Duty FCEV Trucks 160 Total patents granted and filed/pending1 4.5 kW/L Current generation power-density of PEM fuel cell stacks 200 kW Net fuel cell single stack system in on-road testing U.S. Headquarters & fuel cell production Proprietary fuel cell technology and 200 kW FCS Repowered fuel cell trucks Hydrogen relationships and investments

Hyzon’s Leading Fuel Cell Technology Deployed In Heavy Duty Trucks, Innovating to Drive Performance and Economics 1. Range estimates are based on Hyzon customer trial data, Hyzon and customer simulations and other projections. Range varies widely based on customer use case, total freight weight, distance, terrain, and many other factors. Range estimates listed are based on typical Hyzon customer use cases and may vary 2. Per Hyzon internal estimates 5 Overview of Hyzon’s Class 8 Heavy Duty FCET Components and Planned FCET Portfolio PLANNED ELECTRIFIED COMPONENTS PLANNED HYDROGEN STORAGE VEHICLE CONTROL & POWER MANAGEMENT SYSTEM FUEL CELL Components such as e-axle, e-motor, controllers etc. Effective software to manage power / charging of the hybrid (fuel cell/battery) powertrain Total single-stack power of fuel cell driving overall fuel efficiency Total storage available in compressed or liquified H2 Short-Range 100kW FCET: FCS: 110 kW Fuel: 350bar gaseous 50kgs Powertrain & Software: Original Range est.1: 300-350 miles Medium-Range 200kW FCET2: FCS: 200 kW Fuel: 350bar gaseous 50kgs Powertrain & Software: Hyzon battery (2024), e-axle (2025) + Software upgrades Range est.1: 400-450 miles Long-Range 200kW LH2 FCET2: FCS: 200kW Fuel: 120kg Liquid Hydrogen Range est. 1: 800+ miles Medium and Long-Range Class 8 planned to include e-axle, Hyzon C3/C5 battery and component upgrades, improving fuel efficiency Software optimization building on 100kW FCET learnings to improve fuel efficiency in 200kW FCET’s Liquid Hydrogen truck planned to expand usable H2 onboard from 50kg to ~120kg in commercialized sleeper cab LH2 truck2 200kW FCS showing fuel efficiency gains in alpha 200kW FCET testing vs. 110kW FCS US Class 8 FCET Portfolio

Hyzon’s Expanding IP Portfolio Foundational to 200kW Single Stack Fuel Cell System’s Economic Advantages 1. Includes patents awarded and patents pending. 2. 2 2 ; Estimated based on early 200 kW truck testing at test track in similar simulated routes on flat road vs. similar use case performance with single 120 kW FCS.200 vs. 1 0kW at 1 0kW Standard industry approach combines two ~110kW fuel cell systems to reach 200kW power output Hyzon’s single stack 200 kW FCS shows significant benefits vs. traditional approach of two ~110 kW fuel cells -30% Lower volume +20% Improved miles per kg H2 vs. 120 kW FC truck2 -25% Lower total FCS cost in truck BOM (200 kW vs. 2x~110 kW) -30% Less total FCS weight vs. 2 systems 6 Hyzon has applied for 82 patents since 2021, with 10 granted 160 total patents1 Patented areas include MEA, bipolar plates, unit cell, FC stack, hydrogen storage and fuel cell system

7 2H 2023: Business Highlights Government Subsidies Strengthening Beyond California • Department of Energy announced $7 Bn to launch seven Regional Clean hydrogen Hubs; Hyzon supported several winning hubs • Inflation Reduction Act Zero Emission Port Equipment fund ($2.6 Bn) anticipating December 2024 grant awards • Nearly $400 million available in California’s CARB HVIP Zero Emission Truck subsidy pool Commercial Pipeline Conversion + Deliveries Advancing • As of December 31, 2023, deployed 19 vehicles under commercial agreements, meeting annual guidance of 15-20 vehicles. • Delivered first FCEV truck sale in North America to drayage fleet customer to be deployed at the Port of Long Beach, CA • Continued to expand North American trial program with 20 customer trials in 2023 • Deployed first hydrogen waste collection truck in commercial trial with Remondis in Australia in October • Revised commercial agreement with TR Group, for up to 20 FCEVs upfit with Hyzon’s 200kW fuel cell system • Successfully completed first customer demo of liquid hydrogen FCEV with Performance Food Group in North America in August Fuel Cell Commercialization and IP Portfolio • Achieved targeted production of 25 200kW FC B-Samples, advancing development to C-Sample stage, on-track for 2H24 Start of Production • IP Amendment expands addressable markets with added rights to stationary power in North America and pathway for efficient development of 300kW single stack fuel cell system (option) • Total patent count expanded to 160 (applied + granted), including 82 (applied + granted) by Hyzon since 2021 Strengthened Board & Leadership • Appointed Dr. Christian Mohrdieck, most recently Chief Commercial Officer of Cellcentric, as Chief Technology Officer, effective January 1, 2024 • Appointed Matthew Foulston, accomplished finance executive, to Hyzon Board of Directors, effective July 12, 2023 • Named Erik Anderson as Chairman of the Board of Directors and Andrea Farace named as Vice Chairman, effective August 24, 2023 • Appointed Stephen Weiland, a veteran in leading financial teams at Caterpillar and early-stage technology-led companies, as Chief Financial Officer, effective November 1, 2023 01 02 03 04

8 Bolingbrook, IL facility on track for 2024 Start of Production (SoP) Membrane Electrode Assembly (MEA) production line commissioned and in production 200kW fuel cell system SoP <$5M capex remaining and projected 700+ FCS initial annual capacity1 Capital-Efficient, U.S. Fuel Cell Manufacturing 1. Assumes three shifts.

Cash Positive Contribution Margin at Truck Level in 2023 9 Drivers of Hyzon’s positive cash contribution margin for Class 8 large fleet fuel cell trucks in the U.S. Illustrative breakdown of expected U.S. Class 8 large fleet 200kW FC truck economics at low volume Base vehicle cost carried by large fleet customer in U.S. (working capital reduction) Reduced cost, asset-light, 3rd party assembly less than 10% of direct truck-level cost structure Single 200kW fuel cell system w/ in-house U.S.-based manufacturing Cost-efficient powertrain design (e.g., 350 bar tanks vs. 700 bar tanks) 1 2 3 4Class 8 200kW FC Truck Cash Contribution Margin Direct Production Costs Fuel Cell Cab/Chassis Third Party Truck Assembly Fee Powertrain/Aux/Other Direct Production Cost Breakdown Estimates

10 Government Subsidy Tailwinds Creating Strong Market Scaling Support Source: California Air Resources Board, New York State Truck Voucher Incentive Program, Rocky Mountain Institute, U.S. EPA, U.S. Senate Energy and Natural Resources Committee, U.S. Senate Initiatives, press releases. Appalachian Hydrogen Hub Gulf Coast Hydrogen Hub California Hydrogen Hub Pacific Northwest Hydrogen Hub Heartland Hydrogen Hub Midwest Hydrogen Hub DOE Hydrogen Hubs Award Recipients Mid-Atlantic Hydrogen Hub Major Ports Three major U.S. subsidy programs with potential to support thousands of fuel cell trucks by 2030 California (CARB) HVIP • Nearly $400M available today • Up to $288k subsidy per truck • Hyzon large fleet + Port focus today Inflation Reduction Act (IRA) ZE Port Equipment • $2.6 Bn to include drayage trucks • Coastal + inland ports eligible • Dec. 2024: Grant awards expected US DoE Hydrogen Hub Program • $7 Bn awarded to 7 hydrogen hubs • Hyzon supported several awardees • FC Trucks + Infrastructure

Large Fleet Focus with Three-Step Ramp-up, Enabling Scalability and an Active and Progressing Pipeline in Each Region Note: Company logos are trademarked images of the respective firms. 1. Based on 40kgs of hydrogen consumption per day per FCEV Class 8 truck. 2. Collaborative first-year commercial structures vary between direct sales, sales with buyback provisions, sales conditional on successful trials, unpaid trials, paid trials, and others. 3. As of January 15, 2024 1 Hyzon partners with customers through the FCEV ramp-up, starting with trials attached to confirmed pilots and milestone orders2 2 Post-trial fleet ramp-up to 100 trucks per year over 3 - 4-year period 3 10 customers per region leads to 1,000 trucks per year over multiple phases 4 Active trial and customer pipeline with anchor customers under agreements in U.S., Europe and Australia / New Zealand Implementation Milestone Ramp-upPilot Example Large Fleet Customer Order Intention Ramp-Up Schedule w/ Hydrogen Fuel Requirements Number of Class 8 FCEV trucks 5-10 15-20 30-50 75-100 Cumulative Class 8 FCEV trucks in fleet 5-10 20-30 50-80 125-175 Cumulative hydrogen consumption (tons/day)1 ~0.2-0.4 ~0.8-1.2 ~2.0-3.2 ~5.0-7.0 Hydrogen Fueling Solutions Mobile refueler or existing public access Public access or behind the fence based on interest and operational needs Number of fleets active at each Pipeline Stage Globally3 1 Deployed 19 FCEVs under commercial agreements (5 US, 3 EU, 11 AU) and collected $3.8 million in cash in 2023 2 Completed 20 vehicle trials in North America since inception in March 2022 3 First US deliveries in 2023 with five FCEV trucks deployed to both drayage and large fleet customers Early Engagement Trial Planning / Contract Negotiations Contracted Fleets 60 23 12 Select Contracted Fleets 11

Truck Commercial Agreements Expanding Global commercial progress summary and example commercial agreements in place Commercial Updates U.S. Commercial Agreements EU Commercial Agreements ANZ Commercial Agreements • Nineteen vehicles deployed under commercial agreements in 2023, meeting annual deployment guidance of 15-20 units: • Five deployed in the U.S. to both drayage and large fleet customers, including the industry’s first publicly announced sale & delivery of a heavy- duty fuel cell truck in the U.S. • Three deployed in Europe • Eleven deployed in Australia Note: Company logos are trademarked images of the respective firms . 12

13 Significant Global Market Opportunity in HD Trucking Alone, with Multiple Layers of Upside Optionality 1. Statista HD Truck Projections (2019). 2030 and 2050 TAM based on extrapolation of 2019 – 2026 CAGR of 2.57%. 2. Mordor Intelligence MD and HD Commercial Vehicles Market Research Report (2022). 2030 and 2050 TAM based on extrapolation of 2018 – 2028 CAGR of 8%. 3. Heavy Duty Mobility Applications consists of Locomotive, Agricultural Machinery, Construction Machinery, ATV markets. 4. Airport: The Business Research Company Commercial Aircraft Market Research Report (2023). 2030 and 2050 TAM based on extrapolation of 2023 – 2027 CAGR of 7.9%. Port: Skyquest Tech Consulting Marine Vessel Market Research Report (2022). 2030 and 2050 TAM based on extrapolation of 2022 – 2028 CAGR of 1.61%. 5. Markets and Markets Hybrid Power Solutions Market Research Report (2015). 2030 and 2050 TAM based on extrapolation of 2016 – 2021 CAGR of 8.13%.` Scale = $100Bn Hydrogen Fuel Supply (via partner project investment rights) Core Focus Today: Heavy Duty Trucking1 3 core platforms in 3 core regions (US, EU and ANZ) Medium Duty2 Remote & Off-Grid Power5 Airport/Port & Other Ecosystems4 Rail/Off-road and other HD3 Option Value End-Markets & Example Entry FC Applications Class 6 Regional Delivery; Vocational Trucks Construction & Mining Equipment w/ 200kW FCS Ground Support Equipment (e.g. aircraft tug) 500kW to 1 MW+ power

2023-2024 Milestone Execution is on Track 14 2023 priority milestones complete, while 2024 milestones are on track for planned completion timing Category Timing Priority Milestones (Subset) Status 2H 2022 Restructure Hyzon Europe & China Ops 2H 2022 Rigid Platform ISO Certification & Launch 1H 2023 Europe Cabover Gen 1 4x2 Customer Launch with Anchor Customers 1H 2023 First 9 200kW B-sample fuel cell systems produced and tested 1H 2023 First U.S. customer order contracted 1H 2023 First 200kW FCEV truck in testing 2H 2023 Deliver first commercial Class 8 Hyzon FCEV to U.S. customer 2H 2023 200kW fuel cell C-sample stage advancement declaration 2H 2023 25 200kW fuel cell prototypes produced / validated 1H 2024 200kW FCEV Truck Commercial Launch 2H 2024 200kW production facility SOP declared Organization Fuel cell Vehicle

15 Hyzon’s Technology-Led Value Proposition is Strengthening 5 4 3 2 1 Significant technology option value in several fuel cell advantaged future market applications Fuel cell technology leadership with capital-light, U.S. manufacturing nearing Start of Production Asset-light business model with cash-positive contribution margin fuel cell trucks expected this year Accelerating hydrogen fuel cell truck market powered by customer and government tailwinds A proven and driven leadership team that continues to strengthen

16 Appendix

Q3 2023 GAAP Financial Summary 17 (in thousands, except per share and headcount amounts) Q4 2022 Q1 2023 Q2 2023 Q3 2023 Revenue 787 - - - Cost of revenue 13,094 838 2,410 3,286 Research and development 12,472 9,340 12,597 10,857 Selling, general, and administrative 38,153 30,857 49,098 21,044 Restructuring and asset impairment - - - 4,885 Loss from operations (62,932) (41,035) (64,105) (40,072) Net loss attributable to Hyzon (42,867) (30,248) (60,248) (44,054) EPS (Basic) (0.17) (0.12) (0.25) (0.18) EPS (Diluted) (0.17) (0.12) (0.25) (0.18) Unrestricted cash, cash equivalents, and short- term investments 255,329 209,015 172,415 137,807 Cash burn (54,921) (46,314) (36,600) (34,608) Total headcount (rounded) 330 330 380 370 Weighted average common shares Basic 248,040 244,541 244,628 244,885 Diluted 248,040 244,541 244,628 244,885 Three consecutive quarters of declining cash burn

Q3 2023 EBITDA and Adjusted EBITDA 18 The following table reconciles net income (loss) to EBITDA and adjusted EBITDA (In thousands) Q4 2022 Q1 2023 Q2 2023 Q3 2023 Net income (loss) $(48,833) $(30,258) $(60,255) $(44,055) Interest income, net (107) (135) (304) (419) Depreciation and amortization 1,259 1,082 1,111 967 EBITDA $(47,681) $(29,311) $(59,448) $(43,507) Adjusted for: Change in fair value of private placement warrant liability (721) (641) (160) 240 Change in fair value of earnout liability (5,463) (6,420) (916) 1,307 Stock-based compensation 1,217 1,359 1,628 2,156 Executive transition charges 85 - - - Regulatory and legal matters 16,454 7,742 25,894 2,576 Acquisition-related expenses (40) - - - Restructuring and asset impairment - - - 4,885 Adjusted EBITDA $(36,149) $(27,271) $(33,002) $(32,342)

19 Q3 2023 – Continued Execution and Financial Discipline Key Financial Highlights Financial Summary and Guidance • Lowest quarterly cash burn over the previous eight quarters in Q3, including third consecutive quarter of declining cash burn, with continued impact from: o Financial discipline and prioritization o Reducing legal, consulting and accounting fees o Managing headcount • Monthly cash burn in October 2023 fell below $10 million • Loss per share improved to $(0.18) in Q3 2023 from $(0.25) in Q2 2023 • First payment of the SEC Settlement was not paid in Q4. Will provide 2024 guidance update with year-end financial release Q3 2023 Financial Highlights In $MM, except per share amounts Loss from Operations $(40.1) Net Loss Attributable to Hyzon $(44.1) Loss Per Share (Basic & Diluted) $(0.18) Cash & Equivalents + ST Investments (9/30/23) $137.8 Cash & Equivalents + ST Investments (10/31/23)1 $129 Guidance from Q3 2023 In $MM 2H 2023 Cash Burn2 Guidance $65-$73 FY2024 Cash Burn3 Guidance $110-$120 1. Approximately as of October 31, 2023. 2. Includes impact of first payment of the SEC settlement. 3. Includes impact of second payment of the SEC settlement.

20 Hyzon Ownership Post Hymas/Horizon Restructuring Hymas Restructuring Details (MM shares) Hymas Horizon Certain Horizon Security Holders Pre-restructuring ownership 151.9 Hymas internal sale to Horizon (88.2) 88.2 Hymas sales to certain Horizon security holders (23.7) 23.7 Exercised Horizon call option grants to certain Horizon security holders1 (29.1) 29.1 Post-Restructuring Equity Stake in HYZN 40.0 59.1 52.8 Hyzon Ownership Pre Hymas / Horizon Restructuring • As a result of the restructuring transactions by Hymas Pte. Ltd. (“Hymas”), a subsidiary of Horizon, and Horizon, as described in schedule 13D/A, Hyzon is no longer a controlled company under applicable NASDAQ rules • Hymas executed a restructuring transaction including the internal sale of Hyzon shares to Horizon (its parent) and the sale of Hyzon shares to certain Horizon security holders • Prior to the restructuring, Hymas controlled ~62% of outstanding Hyzon shares • Post restructuring, the Hymas/Horizon ownership has dropped to ~40% of outstanding Hyzon shares Source: Horizon Amended 13D, filed January 8, 2024. 1 - 53.3m granted, 29.1m immediately exercised. Note: Above table only reflects the immediate impact of the restructuring actions. Does not reflect any potential impact from Hymas call options, remaining unexercised Horizon call options, and Horizon tracking stock. 62% 38% Hymas Public 16% 24% 22% 38% Hymas Horizon Certain Horizon security holders Public Hyzon Ownership Post Hymas / Horizon Restructuring

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

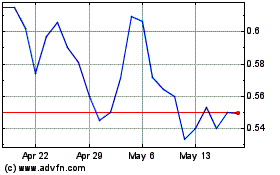

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Sep 2024 to Oct 2024

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Oct 2023 to Oct 2024