UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of report: September 14, 2023

Commission File Number: 001-39084

Innate Pharma SA

(Translation of registrant's name into English)

Innate Pharma SA

117 Avenue de Luminy—BP 30191

13009 Marseille, France

+ 33 (0) 4 30 30 30

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

INCORPORATION BY REFERENCE

This Report on Form 6-K and Exhibit 99.1 and 99.2 to this Report on Form 6-K shall be deemed to be incorporated by reference into the registration statement on Form F-3 (File No. 333-252074) and registration statement on Form S-8 (File No. 333-257834) of Innate Pharma S.A. (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

Exhibit

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

INNATE PHARMA S.A.

Date: September 14, 2023 By: /s/ Mondher Mahjoubi Name: Mondher Mahjoubi

Title: Chief Executive Officer

INNATE PHARMA REPORTS FIRST HALF 2023 FINANCIAL RESULTS AND BUSINESS UPDATE

•Phase 1/2 dose escalation safety and preliminary efficacy of ANKET® NK cell engager, SAR'579/IPH6101, developed by Sanofi, showed it was well tolerated with observed clinical benefit in patients with R/R AML (ASCO 2023 annual meeting), FDA Fast Track Designation awarded

•Exclusive worldwide rights granted to Takeda to research and develop antibody drug conjugates (ADC) using a panel of selected Innate antibodies; $5m upfront payment to Innate and up to $410m in future milestones plus royalties

•Proprietary ANKET® IPH65 IND approved, progressing to Phase 1

•Proprietary IPH45 ADC target, nectin-4 disclosed

•Innate announces new Chief Medical Officer, Sonia Quaratino

•Cash position of €124.7 million1 as of June 30, 2023, anticipated cash runway into H2 2025

•Conference call to be held today at 2:00 p.m. CEST / 8:00 a.m. EDT

| | |

| Marseille, France, September 14, 2023, 7:00 AM CEST |

Innate Pharma SA (Euronext Paris: IPH; Nasdaq: IPHA) (“Innate” or the “Company”) today reported its consolidated financial results for the six months ended June 30, 2023. The consolidated financial statements are attached to this press release.

“Based on our strong financial position, we continue momentum with our clinical pipeline and were encouraged by the clinical data from our first ANKET® NK cell engager, SAR'579/IPH6101 - in partnership with Sanofi presented at the ASCO 2023 annual meeting. We look forward to further data readouts in the future from this and other exciting pipeline projects including on our ADC pipeline, where we signed a partnership earlier this year with Takeda. Importantly, already in the second half of this year, we expect to report final results from our Phase 2 TELLOMAK trial with lacutamab,” said Mondher Mahjoubi, Chief Executive Officer of Innate Pharma. ”We have also continued to strengthen the team at Innate and it is with great pleasure that we welcome Dr Sonia Quarantino as Chief Medical Officer. She has outstanding international industry experience in clinical development, including in senior roles at leading global pharmaceutical companies. I would like to thank outgoing Joyson Karakunnel for his great work in building/shaping the pipeline and the R&D team during the past years at Innate and wish him well in his future endeavors.”

| | |

Webcast and conference call will be held today at 2:00 p.m. CEST (8:00 a.m. ET) Access to live webcast: https://events.q4inc.com/attendee/859850812

Participants may also join via telephone by registering in advance of the event at https://registrations.events/direct/Q4E60903.

This information can also be found on the Investors section of the Innate Pharma website, www.innate-pharma.com. A replay of the webcast will be available on the Company website for 90 days following the event. |

1 Including short term investments (€17.5 million) and non-current financial instruments (€35.8 million)

Innate Pharma |HY 2023 Financial results | 1

Pipeline highlights:

Lacutamab (anti-KIR3DL2 antibody):

•Innate continues to see progress for lacutamab with final data from the TELLOMAK Phase 2 trial for both mycosis fungoides and Sézary syndrome expected in H2 2023.

•In June 2023, interim efficacy results from the TELLOMAK Phase 2 study in advanced mycosis fungoides (MF) according to updated lymph node classification were presented at the 17th International Conference on Malignant Lymphoma, in Lugano, Switzerland. Results confirm clinical activity and favorable safety profile of lacutamab. Results showed that lacutamab produced an increased global objective response rate (ORR) of 42.9% (95% confidence interval [CI], 24.5-63.5) in patients with KIR3DL2 ≥ 1% MF (cohort 2, n=21), including 2 complete responses and 7 partial responses.

•Initial PTCL data are expected in H2 2023. Two parallel clinical trials to study lacutamab in patients with KIR3DL2-expressing, relapsed/refractory peripheral T-cell lymphoma (PTCL) are ongoing.

ANKET® (Antibody-based NK cell Engager Therapeutics):

ANKET® is Innate’s proprietary platform for developing next-generation, multi-specific NK cell engagers to treat certain types of cancer. Innate’s pipeline includes four public drug candidates born from the ANKET® platform: SAR’579 / IPH6101 (CD123-targeted), SAR’514 / IPH6401 (BCMA-targeted), IPH62 (B7-H3-targeted) and tetra-specific IPH65 (CD20-targeted). Several other undisclosed proprietary preclinical targets are being explored.

SAR’579 / IPH6101, SAR’514 / IPH6401 and IPH62 (partnered with Sanofi)

SAR’579 / IPH6101

•The Phase 1/2 clinical trial by Sanofi is progressing well, evaluating SAR’579 / IPH6101, a trifunctional anti-CD123 NKp46×CD16 NK cell engager and ANKET® platform lead asset, in patients with relapsed or refractory acute myeloid leukemia (AML), B-cell acute lymphoblastic leukemia (B-ALL) or high-risk myelodysplastic syndrome (HR-MDS).

◦Phase 1/2 dose escalation safety and preliminary efficacy of SAR'579 / IPH6101 in R/R AML, B-ALL and HR-MDS were presented during an oral presentation at the ASCO (American Society for Clinical Oncology) 2023 Annual Meeting in June. Preliminary data showed SAR’579 / IPH6101 was well tolerated and induced 3 complete responses in the 8 patients at 1 mg/kg as highest dose.

◦In June, SAR’579 / IPH6101 received U.S. Food and Drug Administration (FDA) Fast Track Designation for the treatment of hematological malignancies.

◦Preclinical data showing the control of AML cells by a trifunctional NKp46-CD16a-NK cell engager targeting CD123 were published in Nature Biotechnology in January 2023.

SAR’514 / IPH6401

•In July 2023, partner Sanofi advanced SAR’514 / IPH6401, a trifunctional anti-BCMA Nkp46xCD16 NK cell engager, to first-in-human clinical trial in Relapsed/Refractory Multiple Myeloma (RRMM) and Relapsed/Refractory Light-chain Amyloidosis (RRLCA)

◦Our partner presented preclinical data showing SAR’514 / IPH6401 has potent in-vitro, in-vivo and ex-vivo anti-myeloma effect through dual NK cell

Innate Pharma |HY 2023 Financial results | 2

engagement in a poster at the American Association for Cancer Research (AACR) 2023 in April.

IPH62

•As announced on December 19, 2022, Sanofi licensed IPH62, a NK cell engager program targeting B7-H3 from Innate’s ANKET® platform, and the company has the option to add up to two additional ANKET® targets. Upon candidate selection, Sanofi will be responsible for all development, manufacturing and commercialization. Under the terms of the agreement, Innate received a €25m upfront payment and is eligible for up to €1.35bn total in preclinical, clinical, regulatory and commercial milestones plus royalties on potential net sales.

IPH65 (proprietary)

•Following approval of the IND-filing by the FDA in July 2023, IPH65, Innate’s proprietary CD20 targeted tetra-specific ANKET® continues toward a Phase 1 clinical trial in 2023.

◦Updated preclinical data on IPH65 were presented at the European Hematology Association (EHA) 2023 congress in June.

Monalizumab (anti-NKG2A antibody), partnered with AstraZeneca:

•Innate continues to see progress for monalizumab in the early non-small cell lung cancer (NSCLC) setting, with the ongoing Phase 3 PACIFIC-9 study run by AstraZeneca. The study is evaluating durvalumab (anti-PD-L1) in combination with monalizumab or AstraZeneca’s oleclumab (anti-CD73) in patients with unresectable, Stage III NSCLC who have not progressed following definitive platinum-based concurrent chemoradiation therapy (CRT).

◦Monalizumab was highlighted in two “Trial in progress” posters at the ASCO 2023 Annual Meeting in June:

▪Phase 3 study of durvalumab combined with oleclumab or monalizumab in patients with unresectable stage III NSCLC (PACIFIC-9).

▪NeoCOAST-2: A Phase 2 study of neoadjuvant durvalumab plus novel immunotherapies (IO) and chemotherapy (CT) or MEDI5752 (volrustomig) plus CT, followed by surgery and adjuvant durvalumab plus novel IO or volrustomig alone in patients with resectable non-small-cell lung cancer (NSCLC).

IPH5201 (anti-CD39), partnered with AstraZeneca:

•In June 2023, the first patient was dosed in the MATISSE Phase 2 clinical trial conducted by Innate in neoadjuvant lung cancer for IPH5201, an anti-CD39 blocking monoclonal antibody developed in collaboration with AstraZeneca.

IPH5301 (anti-CD73):

•The investigator-sponsored CHANCES Phase 1 trial of IPH5301 with Institut Paoli-Calmettes is ongoing.

Antibody Drug Conjugates:

•Fueling its R&D engine, the Company continues to develop different approaches for the treatment of cancer utilizing its antibody engineering capabilities to deliver novel assets, with its innovative ANKET® platform and continuing to explore Antibody Drug Conjugates (ADC) formats.

Innate Pharma |HY 2023 Financial results | 3

Takeda license agreement:

•In April 2023, Innate announced that it has entered into an exclusive license agreement with Takeda under which Innate grants Takeda exclusive worldwide rights to research and develop antibody drug conjugates (ADC) using a panel of selected Innate antibodies against an undisclosed target, with a primary focus in Celiac disease. Under the terms of the license agreement, Innate received a $5m upfront payment and is eligible to receive up to $410m in future development, regulatory and commercial milestones if all milestones are achieved during the term of the agreement, plus royalties on potential net sales of any commercial product resulting from the license.

IPH45 (nectin-4 ADC):

◦Innate’s proprietary nectin-4 targeted antibody drug conjugate, IPH45 continues toward a Phase 1 clinical trial.

Corporate Update:

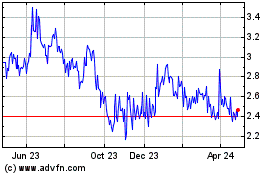

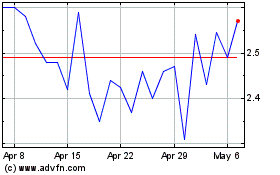

•On April 26, Innate announced the establishment of a new At-The-Market (ATM) program, pursuant to which it may, from time to time, offer and sell to eligible investors a total gross amount of up to $75 million American Depositary Shares (“ADS”). Each ADS representing one ordinary share of Innate.

•Dr. Sonia Quaratino, MD, PhD, will join Innate Pharma as Executive Vice President and Chief Medical Officer, effective October 2023. Dr. Sonia Quaratino succeeds to Dr. Karakunnel who is leaving the Company to pursue other challenges. Dr. Quaratino brings over 25 years of experience in basic research, clinical development, and translational medicine, having worked in academia, global large pharmaceuticals, and biotechs. Recently, Dr. Quaratino was Chief Medical Officer at Georgiamune INC.(USA) and prior to that she was Chief Medical Officer at Kymab (UK), a clinical-stage biopharmaceutical company with a focus on immune-mediated diseases and immuno-oncology, acquired by Sanofi in 2021. Previously, she held roles at Novartis (Switzerland) and Merck Serono (Germany), and was Professor of Immunology in UK at the University of Southampton. Her research has been published in high impact scientific journals.

Innate Pharma |HY 2023 Financial results | 4

Financial highlights for the first half of 2023:

The key elements of Innate’s financial position and financial results as of and for the six-month period ended June 30, 2023 are as follows:

•Cash, cash equivalents, short-term investments and financial assets amounting to €124.7 million (€m) as of June 30, 2023 (€136.6m as of December 31, 2022).

•Revenue and other income from continuing operations amounted to €40.2m in the first half of 2023 (€45.6m in the first half of 2022) and mainly comprise of:

◦Revenue from collaboration and licensing agreements, which mainly resulted from the partial or entire recognition of the proceeds received pursuant to the agreements with AstraZeneca, Sanofi and Takeda. They results from the partial or entire recognition of the proceeds received pursuant to the agreements with AstraZeneca, Sanofi and Takeda. They are recognized when the entity's performance obligation is met. Their accounting is made at a point in time or spread over time according to the percentage of completion of the work that the Company is committed to carry out under these agreements:

▪(i) Revenue from collaboration and licensing agreements for monalizumab decreased by €6.9m to €9.5m in the first half of 2023 (€16.4m in the first half of 2022). This change mainly results from the transaction price increase of €13.4 million ($14.0 million) in the first half of 2022, triggered by the launch of the “PACIFIC-9” Phase 3 trial on April 28, 2022. As a reminder, this increase in the transaction price led to the recognition of an additional revenue of €12.5 million for the first half of 2022. However, this decrease is partially offset by an increase in monalizumab-related revenues for the first half of 2023, in line with the progress of Phase 1/2 trials over the period.

▪(ii) Revenue related to the license and collaboration agreement signed with Sanofi in 2016 decreased by €1.0m, to €2.0m for the six months ended June 30, 2023, as compared to €3.0m for the six months ended June 30, 2022. The Company announced that, in June 2023, the first patient was dosed in a Sanofi-sponsored Phase 1/2 clinical trial evaluating SAR'514/IPH6401 in relapsed or refractory Multiple Myeloma. As provided by the licensing agreement signed in 2016, Sanofi made a milestone payment of €2.0 million, fully recognized in revenue as of June 30, 2023. This amount was received by the Company on July 21, 2023. As a reminder, the revenue recognized in the first half of 2022 resulted from Sanofi's decision to advance SAR'514/IPH6401 into investigational new drug (IND)-enabling studies. As such, Sanofi had selected a second multispecific antibody engaging NK cells as a drug candidate. This selection triggered a €3.0 million milestone payment from Sanofi to the Company, fully recognized in revenue as of June 30, 2022.

▪(iii) Revenue of €18.7 million related to the research collaboration and licensing agreement signed with Sanofi in 2022. On January 25, 2023, the Company announced the expiration of the waiting period under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976 and the effectiveness of the licensing agreement as of January 24, 2023. Consequently, the Company received an upfront payment of €25.0 million in March 2023, including €18.5 million for the

Innate Pharma |HY 2023 Financial results | 5

exclusive license, €1.5 million for the research work and €5.0 million for the two additional targets options. The €18.5 million upfront payment relating to the exclusive license has been fully recognized in revenue as of June 30, 2023. The €1.5 million upfront payment will be recognized on a straight-line basis over the duration of the research work that the Company has agreed to carry out. The €5.0 million initial payment relating to the options is recognized in deferred revenue—non-current portion as of June 30, 2023. The Company will recognize the related revenues either at the reporting date or three years after the effective date.

▪(iv) Revenue of €4.6m related to the licensing agreement signed with Takeda in 2023. On April 3, 2023, the Company announced that it has entered into an exclusive license agreement with Takeda under which Innate grants Takeda exclusive worldwide rights to research and develop antibody drug conjugates (ADC) using a panel of selected Innate antibodies against an undisclosed target, with a primary focus in Celiac disease. Takeda will be responsible for the future development, manufacture and commercialization of any potential products developed using the licensed antibodies. As such, the Company considers that the license granted is a right to use the intellectual property, which is granted fully and perpetually to Takeda. The agreement does not stipulate that Innate's activities will significantly affect the intellectual property granted during the life of the agreement. Consequently, the $5.0 million (or €4.6 million) initial payment, received by the Company in May 2023, was fully recognized in revenue as of June 30, 2023.

◦Government funding for research expenditures of €4.9m in the first half of 2023 (€4.3m in the first half of 2022).

•Operating expenses from continuing operations are €40.6m in the first half of 2023 (€37.1m in the first half of 2022), of which 77.5% (€31.5m) are related to R&D.

◦R&D expenses from continuing operations increased by €6.5m to €31.5m in the first half of 2023 (€25.0m in the first half of 2022). This change mainly results from (i) a €4.9m increase in direct R&D expenses relating to €4.8m non-clinical program in the Antibody Drug Conjugates (ADC) field and a slight increase of clinical programs of €0.1m; (ii) Personnel expenses and other R&D expenses increased by €1.6m (12.9%) to reach €14.2m in the first half 2023 compared to €12.6m in the first half 2022. This increase is mainly explained by €2.0m amortization for the rights relating to IPH5201 following the first patient dosed in the Phase 2 MATISSE clinical trial. The amortization of rights related to the monalizumab decreased by €0.3m.

◦General and administrative (G&A) expenses from continuing operations decreased by €3.0m to €9.1m in the first half of 2023 (€12.1m in the first half of 2022) mainly resulting from ((i) a €1.4m decrease of personnel expenses mainly due to a reduction of administrative workforce, (ii) a €0.6m decrease on non-scientific advisory and consulting fees (limited use of recruitment agencies and strategic consulting), and finally (iii) a decrease on other expenses for €1.0m mainly related to a decrease on leasing and maintenance for €0.5m to the benefit of research and development enabling a more consistent allocation of support expenses to the company's research laboratory as well as a reduction of 0.2 million following more limited use of external communication and investor relations service providers.

Innate Pharma |HY 2023 Financial results | 6

•Net income from discontinued operations related to Lumoxiti are nil compared to a net loss of €0.1 million for the first half of 2022 corresponding to residual costs associated with the transfer of activities to AstraZeneca. This transfer has now been completed.

•A net financial gain of €2.1m in the first half of 2023 (net financial loss of €2.1m in the first half of 2022), principally as a result of the increase in fair value of certain of our financial instruments and net foreign exchange gain over the period.

•A net income of €1.7m for the first half of 2023 (net income of €6.3m for the first half of 2022).

The table below summarizes the IFRS consolidated financial statements as of and for the six months ended June 30, 2023, including 2022 comparative information.

| | | | | | | | |

| In thousands of euros, except for data per share | June 30, 2023 | June 30, 2022 |

| Revenue and other income | 40,198 | 45,589 |

| Research and development expenses | (31,453) | (24,956) |

| General and administrative expenses | (9,144) | (12,140) |

| Operating expenses | (40,597) | (37,096) |

| | |

| Operating income (loss) | (398) | 8,494 |

| Net financial income (loss) | 2,116 | (2,118) |

| Income tax expense | — | — |

| Net income (loss) from continuing operations | 1,718 | 6,376 |

| Net income (loss) from discontinued operations | — | (73) |

| Net income (loss) | 1,718 | 6,303 |

| Weighted average number of shares ( in thousands) : | 80,320 | 79,754 |

| - Basic income (loss) per share | 0.02 | 0.08 |

| - Diluted income (loss) per share | 0.02 | 0.08 |

| -Basic income (loss) per share from continuing operations | 0.02 | 0.08 |

| - Diluted income (loss) per share from continuing operations | 0.02 | 0.08 |

| -Basic income (loss) per share from discontinued operations | — | — |

| - Diluted income (loss) per share from discontinued operations | — | — |

| | | | | | | | |

| June 30, 2023 | December 31, 2022 |

| Cash, cash equivalents and financial assets | 124,679 | 136,604 |

| Total assets | 199,049 | 207,863 |

| Total shareholders’ equity | 57,863 | 54,151 |

| Total financial debt | 40,658 | 42,251 |

Innate Pharma |HY 2023 Financial results | 7

About Innate Pharma:

Innate Pharma S.A. is a global, clinical-stage biotechnology company developing immunotherapies for cancer patients. Its innovative approach aims to harness the innate immune system through therapeutic antibodies and its ANKET® (Antibody-based NK cell Engager Therapeutics) proprietary platform.

Innate’s portfolio includes lead proprietary program lacutamab, developed in advanced form of cutaneous T cell lymphomas and peripheral T cell lymphomas, monalizumab developed with AstraZeneca in non-small cell lung cancer, as well as ANKET® multi-specific NK cell engagers to address multiple tumor types.

Innate Pharma is a trusted partner to biopharmaceutical companies such as Sanofi and AstraZeneca, as well as leading research institutions, to accelerate innovation, research and development for the benefit of patients.

Headquartered in Marseille, France with a US office in Rockville, MD, Innate Pharma is listed on Euronext Paris and Nasdaq in the US.

Learn more about Innate Pharma at www.innate-pharma.com

Information about Innate Pharma shares:

| | | | | |

ISIN code Ticker code LEI | FR0010331421 Euronext: IPH Nasdaq: IPHA 9695002Y8420ZB8HJE29 |

Innate Pharma |HY 2023 Financial results | 8

Disclaimer on forward-looking information and risk factors:

This press release contains certain forward-looking statements, including those within the meaning of the Private Securities Litigation Reform Act of 1995. The use of certain words, including “believe,” “potential,” “expect” and “will” and similar expressions, is intended to identify forward-looking statements. Although the company believes its expectations are based on reasonable assumptions, these forward-looking statements are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks and uncertainties include, among other things, the uncertainties inherent in research and development, including related to safety, progression of and results from its ongoing and planned clinical trials and preclinical studies, review and approvals by regulatory authorities of its product candidates, the Company’s commercialization efforts, the Company’s continued ability to raise capital to fund its development. For an additional discussion of risks and uncertainties which could cause the company's actual results, financial condition, performance or achievements to differ from those contained in the forward-looking statements, please refer to the Risk Factors (“Facteurs de Risque") section of the Universal Registration Document filed with the French Financial Markets Authority (“AMF”), which is available on the AMF website http://www.amf-france.org or on Innate Pharma’s website, and public filings and reports filed with the U.S. Securities and Exchange Commission (“SEC”), including the Company’s Annual Report on Form 20-F for the year ended December 31, 2022, and subsequent filings and reports filed with the AMF or SEC, or otherwise made public, by the Company.

This press release and the information contained herein do not constitute an offer to sell or a solicitation of an offer to buy or subscribe to shares in Innate Pharma in any country.

| | | | | |

| For additional information, please contact: |

| |

| Investors | Media Relations |

| Innate Pharma | NewCap |

| Henry Wheeler | Arthur Rouille |

| Tel.: +33 (0)4 84 90 32 88 | Tel. : +33 (0)1 44 71 00 15 |

Henry.Wheeler@innate-pharma.fr | innate@newcap.eu |

Innate Pharma |HY 2023 Financial results | 9

Summary of Interim Condensed Consolidated Financial Statements and Notes as of JUNE 30, 2023

Innate Pharma |HY 2023 Financial results | 10

Interim Condensed Consolidated Statements of Financial Position

(in thousand euros)

| | | | | | | | |

| | June 30, 2023 | December 31, 2022 |

| Assets | | |

| | |

| Current assets | | |

| Cash and cash equivalents | 71,414 | 84,225 |

| Short-term investments | 17,475 | 17,260 |

| Trade receivables and others | 55,566 | 38,346 |

| Total current assets | 144,455 | 139,831 |

| | |

| Non-current assets | | |

| Intangible assets | 903 | 1,556 |

| Property and equipment | 7,262 | 8,542 |

| Non-current financial assets | 35,790 | 35,119 |

| Other non-current assets | 86 | 149 |

| Trade receivables and others - non-current | 880 | 14,099 |

| Deferred tax asset | 9,674 | 8,568 |

| Total non-current assets | 54,594 | 68,033 |

| | |

| Total assets | 199,049 | 207,863 |

| Liabilities | | |

| | |

| Current liabilities | | |

| Trade payables and others | 18,991 | 20,911 |

| Collaboration liabilities – current portion | 6,538 | 10,223 |

| Financial liabilities – current portion | 5,335 | 2,102 |

| Deferred revenue – current portion | 5,050 | 6,560 |

| Provisions - current portion | 1,753 | 1,542 |

| Total current liabilities | 37,667 | 41,338 |

| | |

| Non-current liabilities | | |

| Collaboration liabilities – non-current portion | 49,520 | 52,988 |

| Financial liabilities – non-current portion | 35,323 | 40,149 |

| Defined benefit obligations | 2,532 | 2,550 |

| Deferred revenue – non-current portion | 5,974 | 7,921 |

| Provisions - non-current portion | 494 | 198 |

| Deferred tax liabilities | 9,674 | 8,568 |

| Total non-current liabilities | 103,518 | 112,374 |

| | |

| Shareholders’ equity | | |

| Share capital | 4,027 | 4,011 |

| Share premium | 381,371 | 379,637 |

| Retained earnings | (330,315) | (272,213) |

| Other reserves | 1,064 | 819 |

| Net income (loss) | 1,718 | (58,103) |

| Total shareholders’ equity | 57,863 | 54,151 |

| | |

| Total liabilities and shareholders’ equity | 199,049 | 207,863 |

Innate Pharma |HY 2023 Financial results | 11

Interim Condensed Consolidated Statements of Income (loss) (in thousand euros)

| | | | | | | | |

| June 30, 2023 | June 30, 2022 |

| | | |

| Revenue from collaboration and licensing agreements | 35,344 | 41,271 |

| Government financing for research expenditures | 4,854 | 4,319 |

| | |

| | |

| Revenue and other income | 40,198 | 45,589 |

| | |

| Research and development expenses | (31,453) | (24,956) |

| General and administrative expenses | (9,144) | (12,140) |

| | |

| Operating expenses | (40,597) | (37,096) |

| | |

| | |

| | |

| Operating income (loss) | (398) | 8,494 |

| | |

| Financial income | 3,083 | 4,048 |

| Financial expenses | (966) | (6,166) |

| | |

| Net financial income (loss) | 2,116 | (2,118) |

| | |

| Net income (loss) before tax | 1,718 | 6,376 |

| | |

| Income tax expense | — | — |

| | |

| Net income (loss) from continuing operations | 1,718 | 6,376 |

| | |

| Net income (loss) from discontinued operations | — | (73) |

| | |

| Net income (loss) | 1,718 | 6,303 |

| | |

| Weighted average number of shares : (in thousands) | 80,320 | 79,754 |

| - Basic income (loss) per share | 0.02 | 0.08 |

| - Diluted income (loss) per share | 0.02 | 0.08 |

| -Basic income (loss) per share from continuing operations | 0.02 | 0.08 |

| - Diluted income (loss) per share from continuing operations | 0.02 | 0.08 |

| -Basic income (loss) per share from discontinued operations | — | — |

| - Diluted income (loss) per share from discontinued operations | — | — |

Innate Pharma |HY 2023 Financial results | 12

Interim Condensed Consolidated Statements of Cash Flow

(in thousand euros)

| | | | | | | | |

| June 30, 2023 | June 30, 2022 |

| Net income (loss) | 1,718 | 6,303 |

| Depreciation and amortization, net | 3,645 | 2,030 |

| Employee benefits costs | 83 | 192 |

| Change in provision for charges | 507 | 134 |

| Share-based compensation expense | 1,401 | 2,596 |

| Change in valuation allowance on financial assets | (1,044) | 2,255 |

| Gains (losses) on financial assets | 288 | (1,333) |

| Change in valuation allowance on financial instruments | (130) | (100) |

| Gains on assets and other financial assets | — | (25) |

| Interest paid | — | 194 |

| Disposal of property and equipment (scrapping) | 591 | — |

| Other profit or loss items with no cash effect | 6 | (52) |

| Operating cash flow before change in working capital | 7,065 | 12,194 |

| Change in working capital | (18,530) | (10,976) |

| Net cash generated from / (used in) operating activities: | (11,465) | 1,218 |

| | |

| Acquisition of property and equipment, net | (309) | (420) |

| | |

| | |

| | |

| | |

| Disposal of other assets | 66 | — |

| Purchase of other assets | (3) | (1) |

| | |

| | |

| Interest received on financial assets | — | 25 |

| Net cash generated from / (used in) investing activities: | (246) | (395) |

| Proceeds from the exercise / subscription of equity instruments | 348 | 192 |

| | |

| | |

| Repayment of borrowings | (1,594) | (958) |

| Net interest paid | — | (194) |

| Net cash generated / (used in) from financing activities: | (1,246) | (960) |

| Effect of the exchange rate changes | 145 | (670) |

| Net increase / (decrease) in cash and cash equivalents: | (12,811) | (807) |

| Cash and cash equivalents at the beginning of the year: | 84,225 | 103,756 |

| Cash and cash equivalents at the end of the six-months period: | 71,414 | 102,949 |

Innate Pharma |HY 2023 Financial results | 13

Revenue and other income

The following table summarizes operating revenue for the periods under review:

| | | | | | | | |

| In thousands of euros | June 30, 2023 | June 30, 2022 |

| Revenue from collaboration and licensing agreements | 35,344 | 41,271 |

| Government funding for research expenditures | 4,854 | 4,319 |

| | |

| Revenue and other income | 40,198 | 45,589 |

Revenue from collaboration and licensing agreements

Revenue from collaboration and licensing agreements decreased by €5.9 million, to €35.3 million for the six months ended June 30, 2023, as compared to revenues from collaboration and licensing agreements of €41.3 million for the six months ended June 30, 2022. These revenues mainly result from the partial or entire recognition of the proceeds received pursuant to the agreements with AstraZeneca, Sanofi and Takeda. They are recognized when the entity's performance obligation is met. Their accounting is made at a point in time or spread over time according to the percentage of completion of the work that the Company is committed to carry out under these agreements.

The evolution for the first half of 2023 is mainly due to:

•A €6.9 million decrease in revenue related to monalizumab, to €9.5 million for the six months ended June 30, 2023, as compared to €16.4 million for the six months ended June 30, 2022. This change mainly results from the transaction price increase of €13.4 million ($14.0 million) in the first half of 2022, triggered by the launch of the “PACIFIC-9” Phase 3 trial on April 28, 2022. As a reminder, this increase in the transaction price led to the recognition of an additional revenue of €12.5 million for the first half of 2022. However, this decrease is partially offset by an increase in monalizumab-related revenues for the first half of 2023, in line with the progress of Phase 1/2 trials over the period. As of June 30, 2023, the deferred revenue related to monalizumab is €4.7 million entirely classified as “Deferred revenue—Current portion” in connection with the maturity of Phase 1/2 trials.

•A €4.8 million decrease in revenue related to IPH5201 which are nil for the six months ended June 30, 2023 . The revenue for the first half of 2022 resulted from the entire recognition in revenue of the $5.0 million milestone payment received from AstraZeneca following the signature on June 1, 2022 of an amendment to the initial contract signed in October 2018. As a reminder, this amendment sets the terms of the collaboration following AstraZeneca’s decision to advance IPH5201 to a Phase 2 study. The Company conducts the study. Both parties share the external cost related to the study and incurred by the Company and AstraZeneca provides products necessary to conduct the clinical trial.

•As a reminder, during the first half of 2022, AstraZeneca informed the Company that it will not exercise its option to license the four preclinical programs covered in the "Future Programs Option Agreement". This option agreement was part of the 2018 multi-term agreement between AstraZeneca and the Company under which the Company received an upfront payment of $20.0 million (€17.4 million). Innate has regained full rights to further develop the four preclinical molecules. Consequently, the entire initial payment of $20.0 million, or €17.4 million was recognized as revenue as of June 30, 2022.

Innate Pharma |HY 2023 Financial results | 14

•The recognition of €18.7 million in revenue as of June 30, 2023, relating to the research collaboration and licensing agreement signed with Sanofi in 2022. On January 25, 2023, the Company announced the expiration of the waiting period under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976 and the effectiveness of the licensing agreement as of January 24, 2023. Consequently, the Company received an upfront payment of €25.0 million in March 2023, including €18.5 million for the exclusive license, €1.5 million for the research work and €5.0 million for the two additional targets options. The Company considers that the license to the B7-H3 technology is a right to use the intellectual property granted exclusively to Sanofi from the effective date of the agreement. As such, the €18.5 million upfront payment relating to the exclusive license has been fully recognized in revenue as of June 30, 2023. The Company will provide collaborative research services to Sanofi for a three years period from the effective date of the collaboration, i.e. January 24, 2023. Consequently, the corresponding upfront payment of €1.5 million will be recognized on a straight-line basis over the duration of the research work that the Company has agreed to carry out. As a result, a €0.2 million has been recognized in revenue as of June 30, 2023, and amounts not recognized in revenue are classified as deferred revenue—current portion for €0.4 million and deferred revenue—non-current portion for €0.9 million. Under the terms of this agreement, the Company has also granted two exclusive options, exercisable no later than three years after the effective date, for exclusive licenses to Innate's intellectual property for the research, development, manufacture and commercialization of NKCEs specifically targeting two preclinical molecules. The Company considers that the option to acquire an exclusive license provide a material right to Sanofi that it would not receive without entering into this agreement. The Company will recognize the related revenues either at the reporting date or three years after the effective date. Consequently, the €5.0 million initial payment relating to these options is recognized in deferred revenue—non-current portion as of June 30, 2023.

•The recognition of €4.6 million in revenue from licensing agreement signed with Takeda in 2023. On April 3, 2023, the Company announced that it has entered into an exclusive license agreement with Takeda under which Innate grants Takeda exclusive worldwide rights to research and develop antibody drug conjugates (ADC) using a panel of selected Innate antibodies against an undisclosed target, with a primary focus in Celiac disease. Takeda will be responsible for the future development, manufacture and commercialization of any potential products developed using the licensed antibodies. As such, the Company considers that the license granted is a right to use the intellectual property, which is granted fully and perpetually to Takeda. The agreement does not stipulate that Innate's activities will significantly affect the intellectual property granted during the life of the agreement. Consequently, the $5.0 million (or €4.6 million) initial payment, received by the Company in May 2023, was fully recognized in revenue as of June 30, 2023.

•A €1.0 million decrease in revenue from collaboration and research license agreement signed with Sanofi in 2016, to €2.0 million for the six months ended June 30, 2023, as compared to €3.0 million for the six months ended June 30, 2022. The Company announced that, in June 2023, the first patient was dosed in a Sanofi-sponsored Phase 1/2 clinical trial evaluating SAR'514/IPH6401 in relapsed or refractory Multiple Myeloma. As provided by the licensing agreement signed in 2016, Sanofi made a milestone payment of €2.0 million, fully recognized in revenue as of

Innate Pharma |HY 2023 Financial results | 15

June 30, 2023. This amount was received by the Company on July 21, 2023. As a reminder, the revenue recognized in the first half of 2022 resulted from Sanofi's decision to advance SAR'514/IPH6401 into investigational new drug (IND)-enabling studies. As such, Sanofi had selected a second multispecific antibody engaging NK cells as a drug candidate. This selection triggered a €3.0 million milestone payment from Sanofi to the Company, fully recognized in revenue as of June 30, 2022. This amount was received by the Company on September 9, 2022.

•A €0.6 million increase in revenue from invoicing of research and development costs. The change between the two periods is mainly explained by the increase in research and development costs incurred by the Company under these agreements during the first half of 2023 in line with the clinical trial progress.

Government funding for research expenditures

Government financing for research expenditures increased by €0.5 million, or 12.4%, to €4.9 million for the six months ended June 30, 2023 as compared to €4.3 million the six months ended June 30, 2022. This change is primarily a result of a increase in the research tax credit of €0.6 million, which is mainly due to (i) the increase in depreciation on IPH5201 rights following the full amortization of the additional payment of €2.0 million due to Orega Biotech following the dosing of the first patient in the Phase 2 MATISSE clinical trial, and (ii) the absence of grants recognized during the first half of 2023 as compared to the remaining Force financing of €0,7 million received in the first half of 2022 from BPI following the technical and commercial failure of the project based on the results of the Phase 2 "Force" trial evaluating avdoralimab in COVID-19. However, these decreases are partially offset by a decrease in public and private R&D subcontracting expenses eligible due to the maturity of clinical trials and the non-inclusion, as a precautionary measure, of subcontracting expenses with a supplier whose agreement is in the process of being renewed as of June 30, 2023. In addition, this decrease is also explained by the decrease in amortization of the monalizumab intangible asset due to the extension of the amortization period, as well as for certain tangible assets which had reached the end of their amortization period, and also by lower R&D personnel costs

The Company met again the SME status under European Union criteria since December 31, 2020. As such, it was eligible for the early repayment by the French treasury of the 2021 Research Tax Credit for an amount of €10.3 million in 2022 and also the 2022 Research Tax Credit for an amount of €9.2 million. These amounts was received by the Company on November 16,2022 and July 21, 2023, respectively.

Operating expenses

The table below presents our operating expenses from continuing operations for the six months periods ended June 30, 2023 and 2022:

| | | | | | | | |

| In thousands of euros | June 30, 2023 | June 30, 2022 |

| Research and development expenses | (31,453) | (24,956) |

| General and administrative expenses | (9,144) | (12,140) |

| Operating expenses | (40,597) | (37,096) |

Innate Pharma |HY 2023 Financial results | 16

Research and development expenses

Research and development (“R&D”) expenses from continuing operations increased by €6.5 million, or 26.0%, to €31.5 million for the six months ended June 30, 2023, as compared to €25.0 million for the six months ended June 30, 2022, representing a total of 77.5% and 67.3% of the total operating expenses, respectively. R&D expenses include direct R&D expenses (subcontracting costs and consumables), depreciation and amortization, and personnel expenses.

Direct R&D expenses increased by €4.9 million, or 39.4%, to €17.3 million for the six months ended June 30, 2023, as compared to €12.4 million for the six months ended June 30, 2022. This increase is mainly explained by €4.8 million non-clinical program in the Antibody Drug Conjugates – ADC field and a slight increase of clinical programs of €0.1 million. The increase of €0.9 million on IPH5201 is linked to startup costs of Phase 2 MATISSE clinical trial and is partly offset by the decrease expenses related to lacutamab program for €0.2 million as well as avdoralimab and monalizumab programs for respectively 0.2 million euros and 0.2 million euros. These decreases follow the decision taken by the Company at the end of the first half of 2020 to stop recruitment in trials evaluating avdoralimab in oncology and the maturity of Phase 1/2 clinical trials entering the scope of the collaboration with AstraZeneca regarding monalizumab.

Also, as of June 30, 2023, the collaboration liabilities relating to monalizumab and the agreements signed with AstraZeneca in April 2015, October 2018 and September 2020 amounted to €56.1 million, as compared to collaborations liabilities to €63.2 million as of December 31, 2022. This decrease of €7.2 million mainly results from (i) the net reimbursement of €6.4 million made in the first half 2023 to AstraZeneca relating to the co-financing of the monalizumab program, mainly including the Phase 3 INTERLINK-1 trial launched in October 2020 and (ii) the decrease in the collaboration commitment for the amount of €1.1 million in connection with the observed exchange rate fluctuations over the period for the euro-dollar parity.

Personnel and other expenses allocated to R&D increased by €1.6 million, or 12.9%, to €14.2 million for the six months ended June 30, 2023, as compared to an amount of €12.6 million for the six months ended June 30, 2022. This increase is mainly due to €2.0 million amortization for the rights relating to IPH5201 following the first patient dosed in the Phase 2 MATISSE clinical trial. The amortization of rights related to the monalizumab is decreasing by €0.3 million.

General and administrative expenses

General and administrative expenses from continuing activities decreased by €3.0 million, or 24.7%, to €9.1 million for the six months ended June 30, 2023, as compared to general and administrative expenses of €12.1 million for the six months ended June 30, 2022. General and administrative expenses represented a total of 22.5% and 32.7% of the total operating expenses for the six months ended June 30, 2023 and 2022, respectively.

Personnel expense includes the compensation paid to our employees, and decreased by €1.4 million, to €4.4 million for the six months ended June 30, 2023, as compared to €5.8 million for six months ended June 30, 2022. This decrease of €1.4 million is mainly due to a reduction of administrative workforce.

Non-scientific advisory and consulting expenses mostly consist of auditing, accounting, taxation and legal fees as well as consulting fees in relation to business strategy and operations and hiring services. Non-scientific advisory and consulting expenses

Innate Pharma |HY 2023 Financial results | 17

decreased by €0.6 million, or 25.9%, to €1.7 million for the six months ended June 30, 2023 as compared to €2.2 million for the six months ended June 30, 2022. This decrease is mainly due to the decrease in fees in connection with a limited use of recruitment agencies and strategic consulting in first half 2023 compared to first half 2022.

The fall in other expenses of €1.0 million mainly results from a decrease on leasing and maintenance for €0.5 million for the benefit of research and development enabling a more consistent allocation of support expenses to the company's research laboratory as well as a decrease of €0.2 million on external communication and investor relations service providers.

Financial income (loss), net

We recognized a net financial income of €2.1 million in the six months ended June 30, 2023 as compared to a net financial loss of €2.1 million in the six months ended June 30, 2022. This variance mainly results from the variance in fair value of our financial instruments (net gain of €1.0 million for the six months ended June 30, 2023 as compared to a net loss of €2.3 million for the six months ended June 30, 2022) and a net foreign exchange gain of €0.4 million for the first half of 2023 as compared to a net foreign exchange gain of €0.1 million for the first half of 2022.

Net loss from discontinued operations

As a reminder, a Termination and Transition Agreement was negotiated and executed, effective as of June 30, 2021 further to the Company's decision to return the rights of Lumoxiti back to AstraZeneca. Consecutively, activities related to Lumoxiti are presented as discontinued operations since October 1, 2021.

Thus, the net income from discontinued operations related to Lumoxiti are nil compared to a net loss of €0.1 million for the first half of 2022 corresponding to residual costs associated with the transfer of activities to AstraZeneca. This transfer has now been completed.

Balance sheet items

Cash, cash equivalents, short-term investments and non-current financial assets amounted to €124.7 million as of June 30, 2023, as compared to €136.6 million as of December 31, 2022. Net cash as of June 30, 2023 amounted to €83.6 million (€99.4 million as of December 31, 2022). Net cash is equal to cash, cash equivalents and short-term investments less current financial liabilities.

The Company also has bank borrowings of €39.6m, including €28.7m of State Guaranteed Loans (“Prêts Garantis par l’Etat”) as of June 30, 2023, and €1.1m of lease liabilities.

The other key balance sheet items as of June 30, 2023 are:

•Deferred revenue of €11.0 million (including €6.0 million booked as ‘Deferred revenue – non-current portion’) and collaboration liabilities of €56.1 million (including €49.5 million booked as ‘Collaboration liabilities - non-current portion’) relating to the remainder of the initial payment received from AstraZeneca not yet recognized as revenue or used as part of the co-financing of the monalizumab program with AstraZeneca;

Innate Pharma |HY 2023 Financial results | 18

•Receivables from the French government amounting to €43.9 million in relation to the research tax credit for 2019, 2020, 2022 and the six-month period ended June 30, 2023;

•Shareholders’ equity of €57.9 million, including the net income of the period of €1.7 million.

Cash-flow items

As of June 30, 2023, cash and cash equivalents amounted to €71.4 million, compared to €84.2 million as of December 31, 2022, corresponding in a decrease of €12.8 million.

The net cash flow used during the period under review mainly results from the following:

•Net cash flow used by operations of €11.5 million for the six months ended June 30, 2023 as compared to net cash flows generated by operations of €1.2 million for the six months ended June 30, 2022. The net cash flow used in operating activities includes (i) the €25.0 million upfront payment received from Sanofi in March 2023 following the effectiveness of the research collaboration and licensing agreement signed in December 2022 under which the Company granted Sanofi an exclusive license to Innate Pharma's B7-H3 ANKET® program and options on two additional targets, but also (ii) the €4.6 million ($5.0 million) upfront payment received from Takeda following the signing of an exclusive licensing agreement which the Company grants Takeda exclusive worldwide rights for the research and development of antibody drug conjugates (ADCs). As a reminder, net cash flow from operating activities for the first half of 2022 included the collection of €47.7 million, in June 2022, following the treatment of the first patient in the second Phase 3 clinical trial evaluating monalizumab, “PACIFIC-9”, partially offset by the €5.9 million payment to AstraZeneca on April 20, 2022 pursuant to the Lumoxiti termination and transition agreement. Restated for these transactions, net cash flow used in operating activities for the first half of 2023 increased by €0.5 million as compared to the first half of 2022. This change mainly results from the occurrence of exceptional cash flows in the first half of 2022, notably in connection with personnel costs and the BPI repayable advance. Net outflows in connection with the monalizumab and IPH5201 collaboration agreement were stable over the period. Net cash flow consumed by operating activities in connection with the Lumoxiti discontinued operation are nil for the first half of 2023, as compared to €5.5 million for the first half of 2022. The amount consumed for the first half of 2022 mainly relates to the payment of €5.9 million ($6.2 million) made to AstraZeneca in April 2022 in accordance with the Lumoxiti termination and transition agreement effective as of June 30, 2021.

•Net cash flow used in investing activities of €0.2 million, as compared to €0.4 million for the first half of 2022. The Company has not made any other investments in tangible, intangible or significant financial assets during the first half of 2023 and 2022. Net cash flows consumed by investing activities in connection with the Lumoxiti discontinued operation were nil for the first half of 2023 and 2022.

•Net cash flows used in financing activities for the six months ended June 30, 2023 were €1.2 million as compared to net cash flow used in financing activities of €1.0 million the six months ended June 30, 2022. These consumptions are mainly related

Innate Pharma |HY 2023 Financial results | 19

to repayments of financial liabilities. Net cash flows consumed by financing activities in connection with the Lumoxiti discontinued operation were nil for the first half of 2023 and 2022.

Post period events

None.

Nota

The interim consolidated financial statements for the six-month period ended June 30, 2023 have been subject to a limited review by our Statutory Auditors and were approved by the Executive Board of the Company on September 13, 2023. They were reviewed by the Supervisory Board of the Company on September 13, 2023. They will not be submitted for approval to the general meeting of shareholders.

Risk factors

Risk factors identified by the Company are presented in section 3 of the universal registration document (“Document d’Enregistrement Universel”) submitted to the French stock-market regulator, the “Autorité des Marchés Financiers”, on April 6, 2023 (AMF number D.23-0246). The main risks and uncertainties the Company may face in the six remaining months of the year are the same as the ones presented in the universal registration document available on the internet website of the Company.

Of note, the risks that are likely to arise during the remaining six months of the current financial year could also occur during subsequent years.

Related party transactions:

Transactions with related parties during the periods under review are disclosed in Note 19 to the interim condensed consolidated financial statements for the period ended June 30, 2023 prepared in accordance with IAS 34.

Innate Pharma |HY 2023 Financial results | 20