Akerna Announces Special Meeting Date to Vote on Merger with Gryphon Digital Mining, Inc.; Effectiveness of Registration Statement on Form S-4 in Connection with Merger

January 10 2024 - 7:01AM

Akerna Corp. (Nasdaq: KERN) (“Akerna”) announced

that its special meeting of stockholders will be held on Monday,

January 29, 2024, at 9:00 a.m., Mountain Time for consideration and

voting on the proposed merger (the “Transaction”) between Akerna

and Gryphon Digital Mining, Inc. (“Gryphon”), as well as certain

other matters relating thereto ("Akerna Special Meeting"). The

record date for the determination of stockholders entitled to

receive notice of and to vote at the Akerna Special Meeting is the

close of business on December 21, 2023.

Akerna’s registration statement on Form S-4

(File No. 333-271857, the “Form S-4”), filed with the U.S.

Securities and Exchange Commission (the “SEC”) by Akerna was

declared effective by the SEC on January 9, 2024. The Form S-4 was

filed in connection with the previously announced Transaction. The

Form S-4 serves as both a proxy statement of Akerna (to solicit

proxies for the Akerna Special Meeting) and as a prospectus

(relating to the Akerna shares to be issued to Gryphon stockholders

under the Transaction). Stockholders of both Akerna and Gryphon are

encouraged to read the proxy statement/prospectus which contains

important information regarding the Transaction. A copy of the Form

S-4 is accessible on the SEC's website at www.sec.gov.

“The declaration of effectiveness by the SEC

represents a significant step forward towards the closing of our

merger with Akerna,” said Rob Chang, Gryphon’s CEO. “With

approximately 41% of outstanding Akerna shareholders and about 72%

of Gryphon stockholders subject to merger support agreements, we

look forward to completing final approvals towards creating an

ESG-committed, carbon-neutral bitcoin miner that already has an

over two-year track record of top-tier bitcoin efficiency.”

Upon the closing of the Transaction, the common

stock of the new “Gryphon Digital Mining, Inc.” is expected to be

listed on the Nasdaq under the proposed ticker symbol “GRYP.”

Akerna stockholders who need assistance in

completing the proxy card, need additional copies of the proxy

materials or have questions regarding the upcoming special meeting

may contact Akerna's proxy solicitor, Advantage Proxy, Inc. by

calling toll-free at (877) 870-8565 or by email at

ksmith@advantageproxy.com.

The closing of the Transaction remains subject

to approval by both Akerna and Gryphon stockholders, final approval

by the Nasdaq and customary closing conditions. Akerna and Gryphon

are targeting to close the Transaction on January 31, 2024

About Gryphon Digital

Mining

Gryphon Digital Mining, Inc. is an innovative venture in the

bitcoin space dedicated to helping bring digital assets onto the

clean energy grid. With a talented leadership team coming from

globally recognized brands, Gryphon is assembling thought leaders

to improve digital asset network infrastructure. Its Bitcoin mining

operation has a net carbon-negative strategy.

About Akerna

Akerna (Nasdaq: KERN) is an emerging technology firm focused on

innovative technology.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material

with respect to the proposed transactions between Akerna and

Gryphon and between Akerna and MJ Acquisition Co. In connection

with the proposed transactions, Akerna has filed relevant materials

with the United States Securities and Exchange Commission, or the

SEC, including a registration statement on Form S-4 that contains a

prospectus and a proxy statement. Akerna mailed the proxy

statement/prospectus to the Akerna stockholders on January 9, 2024.

Investors and securityholders of Akerna and Gryphon are urged to

read these materials because they contain important information

about Akerna, Gryphon and the proposed transactions. This

communication is not a substitute for the Form S-4, definitive

proxy statement/prospectus included in the Form S-4 or any other

documents that Akerna may file with the SEC or send to

securityholders in connection with the proposed transactions.

Investors and security holders may obtain free copies of the

documents filed with the SEC on Akerna’s website at www.akerna.com,

on the SEC’s website at www.sec.gov or by directing a request to

Akerna’s Investor Relations at (516) 419-9915.

This communication is not a proxy statement or a solicitation of

a proxy, consent or authorization with respect to any securities or

in respect of the proposed transactions, and shall not constitute

an offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

Participants in the Solicitation

Each of Akerna, Gryphon, MJ Acquisition Co. and their respective

directors and executive officers may be deemed to be participants

in the solicitation of proxies from the stockholders of Akerna in

connection with the proposed transactions. Information about the

executive officers and directors of Akerna is set forth in the

proxy statement/prospectus included in the Form S-4, as last filed

with the SEC on January 8, 2024. Other information regarding the

interests of such individuals, who may be deemed to be participants

in the solicitation of proxies for the stockholders of Akerna, is

also set forth in the proxy statement/prospectus included in the

Form S-4. You may obtain free copies of these documents as

described above.

Cautionary Statements Regarding Forward-Looking

Statements

This press release contains forward-looking statements based

upon the current expectations of Gryphon and Akerna. Actual results

and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these

risks and uncertainties, which include, without limitation: (i) the

risk that the conditions to the closing of the proposed

transactions are not satisfied, including the failure to timely

obtain stockholder approval for the transactions, if at all; (ii)

uncertainties as to the timing of the consummation of the proposed

transactions and the ability of each of Akerna, Gryphon and MJ

Acquisition Co. to consummate the proposed merger or asset sale, as

applicable; (iii) risks related to Akerna’s ability to manage its

operating expenses and its expenses associated with the proposed

transactions pending closing; (iv) risks related to the failure or

delay in obtaining required approvals from any governmental or

quasi-governmental entity necessary to consummate the proposed

transactions; (v) the risk that as a result of adjustments to the

exchange ratio, Akerna stockholders and Gryphon stockholders could

own more or less of the combined company than is currently

anticipated; (vi) risks related to the market price of Akerna’s

common stock relative to the exchange ratio of outstanding

securities of Akerna at closing; (vii) unexpected costs, charges or

expenses resulting from either or both of the proposed

transactions; (viii) potential adverse reactions or changes to

business relationships resulting from the announcement or

completion of the proposed transactions; (ix) risks related to the

inability of the combined company to obtain sufficient additional

capital to continue to advance its business plan; and (x) risks

associated with the possible failure to realize certain anticipated

benefits of the proposed transactions, including with respect to

future financial and operating results. Actual results and the

timing of events could differ materially from those anticipated in

such forward-looking statements as a result of these risks and

uncertainties. These and other risks and uncertainties are more

fully described under the heading “Risk Factors” in the proxy

statement/prospectus included in the Form S-4 and the periodic

filings with the SEC, including the factors described in the

section titled “Risk Factors” in Akerna’s Annual Report on Form

10-K for the year ended December 31, 2022 and Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, each filed with

the SEC, and in other filings that Akerna makes and will make with

the SEC in connection with the proposed transactions. You should

not place undue reliance on these forward-looking statements, which

are made only as of the date hereof or as of the dates indicated in

the forward-looking statements. Except as required by law, Akerna

and Gryphon expressly disclaim any obligation or undertaking to

update or revise any forward-looking statements contained herein to

reflect any change in its expectations with regard thereto or any

change in events, conditions, or circumstances on which any such

statements are based.

INVESTOR CONTACT:

Name: Rob Chang

Company: Gryphon Digital Mining

Phone Number: (877) MINE-ESG (877) 646-3374

Email: invest@gryphonmining.com

Akerna (NASDAQ:KERNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

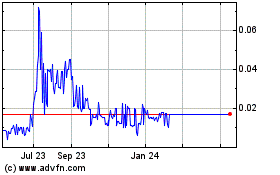

Akerna (NASDAQ:KERNW)

Historical Stock Chart

From Apr 2023 to Apr 2024