UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-39301

LION

GROUP HOLDING LTD.

Not Applicable

(Translation of registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

3 Phillip Street, #15-04 Royal Group Building

Singapore 048693

(Address of principal executive office)

Registrant’s phone number, including area

code

+65 8877 3871

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

As previously disclosed, Lion Group Holding Ltd.,

a Cayman Islands exempt company (the “Company”), entered into that certain Securities Purchase Agreement, dated as

of February 15, 2021 (the “February SPA”), and that certain Securities Purchase Agreement, dated as of December 13,

2021 (the “December SPA,” and, collectively with the February SPA, the “Agreements”) with an accredited

investor (the “Investor”). Pursuant to the Agreements, the Company issued certain Series D American Deposit Shares

(“ADSs”) Purchase Warrants (the “Series D Warrants”), certain Series E ADSs Purchase Warrants (the

“Series E Warrants”), certain Series F ADSs Purchase Warrants (the “Series F Warrants,” and, collectively

with the Series D and Series E Warrants, the “February Warrants”) and certain Series G ADSs Purchase Warrants (the

“Series G Warrants,” and, collectively with the February Warrants, the “Warrants”).

On September 26, 2023, the Company entered into

a waiver agreement (the “Waiver Agreement”) with the Investor. Pursuant to the Waiver Agreement, the parties agreed

to, among other things, waive the Event Market Price (as defined in the Warrants) adjustments requirements set forth under Section 3(a)(ii)

of the Warrants, effective as of the issuance dates of the Warrants. The parties further agreed that the Company would use its reasonable best efforts to obtain shareholder approval to increase

the number of authorized shares. If, despite the Company’s reasonable best efforts, shareholder approval is not obtained, the Company

shall convene an additional shareholder meeting semi-annually until such approval is obtained. The Warrants shall not be exercisable by

the Investor until the earlier of (x) the approval to increase authorized shares is obtained and (y) October 6, 2023.

The foregoing description of the Waiver Agreement

is qualified in its entirety by reference to the full text of the form thereof, which is attached as Exhibit 10.1 hereto and incorporated

by reference herein.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 27, 2023

| |

LION GROUP HOLDING LTD. |

| |

|

|

| |

By: |

/s/ Chunning

Wang |

| |

Name: |

Chunning Wang |

| |

Title: |

Chief Executive Officer and Director |

Exhibit 10.1

WAIVER

This Waiver (this “Waiver”)

is dated as of September 26, 2023, by and between Lion Group Holding Ltd., a Cayman Islands exempt company (the “Company”),

and the undersigned holder of securities in the Company (the “Holder”). Unless otherwise specified herein, capitalized

terms used and not otherwise defined herein shall have the meanings assigned to such terms in the February SPA (as defined below).

A. The

Company and the Holder are parties to (i) that certain Securities Purchase Agreement, dated as of February 15, 2021 (as in effect as

of the date hereof, the “February SPA”), pursuant to which such Holder purchased from the Company, among other

securities, (x) certain Series D American Deposit Shares (“ADSs”) Purchase Warrants (the “Series D

Warrants”), (y) certain Series E ADSs Purchase Warrants (the “Series E Warrants”) and (z) certain

Series F ADSs Purchase Warrants (the “Series F Warrants,” and, collectively with the Series D and Series E

Warrants, the “February Warrants”), and (ii) that certain Securities Purchase Agreement, dated as of December 13,

2021 (as in effect as of the date hereof, the “December SPA,” and together with the February SPA, each a

“SPA”), pursuant to which such Holder purchased from the Company, among other securities, certain Series G ADSs

Purchase Warrants (the “Series G Warrants,” and, collectively with the February Warrants, the

“Warrants”).

B. The

issuance of (i) the February Warrants occurred at a closing on February 18, 2021 (the “February Issuance Date”)

and (ii) the Series G Warrants occurred at a closing on December 13, 2021 (the “December Issuance Date,” and

together with the February Closing Date, each an “Issuance Date”).

C. Effective

as of (x) the February Issuance Date with respect to the February Warrants any (y) the December Issuance Date with respect to the Series

G Warrants (as applicable, the “Effective Time”), the Company desires that the Holder waive the Event Market Price

(as defined in the Warrants) adjustment requirement under Section 3(a)(ii) of the Warrants (the “Event Market Price Adjustment

Requirements”), with respect to any adjustment pursuant to Section 3(a)(ii) that would otherwise have occurred prior to the

date hereof (collectively, the “Adjustment Waivers”).

D. The Holder has exercised

certain Series E Warrants for 400,000 ADSs representing 20,000,000 Class A ordinary shares of the Company, par value $0.0001 per share

(the “Ordinary Shares”) as of the date of this Agreement.

E. The Company is authorized

to issue 300,000,000 Ordinary Shares, with 179,250,754 Ordinary Shares issued and outstanding.

NOW, THEREFORE, in consideration

of the premises and the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, the Company and the Holder hereby agrees as follows:

1.

Waiver. Effective as of the Effective Time, the Holder hereby grants the Adjustment Waivers.

2.

Disclosure. On or before 8:30 a.m., New York City time, on September 27, 2023, the Company shall file a Current Report on

Form 6-K describing any material non-public information the Company may have provided to the Holder in relation to this Waiver or otherwise

in the form required by the 1934 Act and attaching this Waiver as exhibits to such filing (the “6-K Filing”). From

and after the filing of the 6-K Filing with the SEC, the Holder shall not be in possession of any material, nonpublic information received

from the Company, any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agents. In addition,

the Company acknowledges and agrees that any and all confidentiality or similar obligations under any agreement, whether written or oral,

between the Company, any of its Subsidiaries or any of their respective officers, directors, affiliates, employees or agents on the one

hand, and the Holder or any of its affiliates on the other hand, has terminated as of the date hereof and is of no further force or effect.

The Company shall not, and shall cause each of its Subsidiaries and its and each of their respective officers, directors, affiliates,

employees and agents, not to, provide any Holder with any material, non-public information regarding the Company or any of its Subsidiaries

from and after the date hereof without the express prior written consent of the Holder. To the extent that the Company, any of its Subsidiaries

or any of their respective officers, directors, affiliates employees or agents delivers any material, non-public information to any Holder

without the Holder’s consent, the Company hereby covenants and agrees that the Holder shall not have any duty of confidentiality

to the Company, any of its Subsidiaries or any of their respective officers, directors, affiliates, employees or agents with respect to,

or a duty to the Company, any of its Subsidiaries or any of their respective officers, directors, affiliates, employees or agents not

to trade on the basis of, such material, non-public information. The Company understands and confirms that the Holder will rely on the

foregoing representations in effecting transactions in securities of the Company.

3.

No Third Party Beneficiaries. This Waiver is intended for the benefit of the parties hereto and their respective permitted

successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

4.

Shareholder Approval. The Company shall provide each shareholder entitled to vote at the annual meeting of stockholders

of the Company (the “Shareholder Meeting”), which shall be promptly called and held not later than October 6, 2023

(the “Shareholder Meeting Deadline”), a proxy statement, soliciting each such shareholder’s affirmative vote

at the Shareholder Meeting for approval of resolutions (“Shareholder Resolutions”) providing for the approval of the

increase of the authorized Ordinary Shares from 300,000,000 to 40,000,000,000 (the “Shareholder Approval,” and the

date the Shareholder Approval is obtained, the “Shareholder Approval Date”), and the Company shall use its reasonable

best efforts to solicit its shareholders’ approval of such resolutions and to cause the Board of Directors of the Company to recommend

to the shareholders that they approve such resolutions. The Company shall be obligated to seek to obtain the Shareholder Approval by the

Shareholder Meeting Deadline. If, despite the Company’s reasonable best efforts the Shareholder Approval is not obtained on or prior

to the Shareholder Meeting Deadline, the Company shall cause an additional Shareholder Meeting to be held on or prior to January 31, 2023.

If, despite the Company’s reasonable best efforts the Shareholder Approval is not obtained after such subsequent shareholder meetings,

the Company shall cause an additional Shareholder Meeting to be held semi-annually thereafter until such Shareholder Approval is obtained.

5.

Limitations on Exercises prior to Exercise Limitation Deadline. Notwithstanding anything in the Warrants to the contrary,

if at any time on or prior to the earlier to occur of (x) the Shareholder Approval Date and (y) the Shareholder Meeting Deadline (as applicable,

the “Exercise Limitation Deadline”), the Company has an insufficient number of authorized and unreserved Ordinary Shares

or ADSs necessary to satisfy its obligation to issue Ordinary Shares or ADSs upon the exercise of any Warrant, then any such Warrant shall

not be exercisable by the Holder on or prior to such Exercise Limitation Deadline. For the avoidance of doubt, nothing herein shall prohibit

the Holder’s exercise of any Warrants, in whole or in part, after the Exercise Limitation Deadline.

6.

Counterparts. This Waiver may be executed in any number of counterparts and by different parties hereto in separate counterparts,

each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute but one

and the same instrument. In the event that any signature is delivered by facsimile transmission or by an e-mail which contains a portable

document format (.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party

executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

7.

No Strict Construction. The language used in this Waiver will be deemed to be the language chosen by the parties to express

their mutual intent, and no rules of strict construction will be applied against any party.

8.

Headings. The headings of this Waiver are for convenience of reference and shall not form part of, or affect the interpretation

of, this Waiver.

9.

Severability. If any provision of this Waiver is prohibited by law or otherwise determined to be invalid or unenforceable

by a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended

to apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall

not affect the validity of the remaining provisions of this Waiver so long as this Waiver as so modified continues to express, without

material change, the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability

of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or

the practical realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith

negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as

close as possible to that of the prohibited, invalid or unenforceable provision(s).

10.

Fees and Expenses. Except for a non-accountable amount of $[5,000], which shall be paid by the Company to Kelley Drye &

Warren LLP on behalf of the lead investor, each party shall pay the fees and expenses of its advisers, counsel, accountants and other

experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance

of this Waiver.

11.

Amendments. No provision of this Waiver may be amended other than by an instrument in writing signed by the Company and

the Holder.

12.

Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things,

and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request

in order to carry out the intent and accomplish the purposes of this Waiver and the consummation of the transactions contemplated hereby.

13.

Notice. Whenever notice is required to be given under this Waiver, unless otherwise provided herein, such notice shall be

given in accordance with Section 5.4 of the SPA.

14.

Successors and Assigns. This Waiver shall be binding upon and inure to the benefit of the parties and their respective successors

and assigns.

15.

Governing Law; Jurisdiction; Jury Trial. All questions concerning the construction, validity, enforcement and interpretation

of this Waiver shall be governed by the internal laws of the State of New York, without giving effect to any choice of law or conflict

of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of

any jurisdictions other than the State of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and

federal courts sitting in The City of New York, Borough of Manhattan, for the adjudication of any dispute hereunder or in connection herewith

or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit,

action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding

is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives

personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such

party at the address for such notices to it under this Waiver and agrees that such service shall constitute good and sufficient service

of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted

by law. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF

ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS WAIVER OR ANY TRANSACTION CONTEMPLATED HEREBY.

16.

Ratification. Except as otherwise expressly provided herein, the Transaction Documents, are, and shall continue to be, in

full force and effect and are hereby ratified and confirmed in all respects.

17.

Miscellaneous. Article V of the SPA (as amended hereby) is hereby incorporated by reference herein, mutatis mutandis.

[Signature Pages Follow]

IN WITNESS WHEREOF,

the undersigned and the Company have caused their respective signature page to this Waiver to be duly executed as of the date first written

above.

| |

COMPANY: |

| |

|

| |

LION GROUP HOLDING LTD. |

| |

|

|

| |

By: |

/s/ Chunning Wang |

| |

Name: |

Chunning Wang |

| |

Title: |

Chief Executive Officer and Director |

[Signature Page to Waiver – September

2023]

IN WITNESS WHEREOF,

the undersigned and the Company have caused their respective signature page to this Waiver to be duly executed as of the date first written

above.

| |

HOLDER: |

| |

|

|

| |

ATW OPPORTUNITIES MASTER FUND, L.P. |

| |

|

|

| |

By: |

/s/ Antonio Ruiz-Gimenez |

| |

Name: |

Antonio Ruiz-Gimenez |

| |

Title:

| Managing Partner |

[Signature Page to Waiver – September

2023]

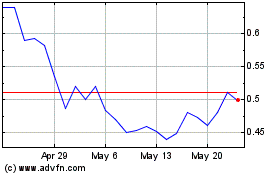

Lion (NASDAQ:LGHL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lion (NASDAQ:LGHL)

Historical Stock Chart

From Nov 2023 to Nov 2024