Q1

2024

--12-31

false

0001621672

false

false

false

false

2

1

3

1

3

0

1

50

50

10

00016216722024-01-012024-03-31

thunderdome:item

iso4217:USD

0001621672slgg:CertainClaimsArisingFromAnInterpretationOfCertainRightsOfSPAMember2024-01-012024-03-31

0001621672slgg:CertainClaimsArisingFromAnInterpretationOfCertainRightsOfSPAMember2024-03-192024-03-19

iso4217:USDxbrli:shares

0001621672slgg:CertainClaimsArisingFromAnInterpretationOfCertainRightsOfSPAMember2024-03-19

xbrli:shares

0001621672slgg:CertainClaimsArisingFromAnInterpretationOfCertainRightsOfSPAMember2023-01-012023-12-31

0001621672slgg:CertainClaimsArisingFromAnInterpretationOfCertainRightsOfSPAMember2024-03-122024-03-12

00016216722024-01-31

0001621672slgg:SeriesA5PreferredStockMember2024-01-012024-03-31

xbrli:pure

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2024-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2024-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-12-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2023-12-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMember2023-12-22

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-05-26

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2023-05-26

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-22

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-05-26

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputPriceVolatilityMember2024-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-22

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMemberus-gaap:MeasurementInputPriceVolatilityMember2023-05-26

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMember2023-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMember2024-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMember2023-01-012023-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMember2024-01-012024-03-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMember2022-12-31

0001621672slgg:WarrantsIssuedWithPlacementAgentAgreementMember2023-12-31

0001621672slgg:SeriesAPreferredOfferingsMemberslgg:PlacementAgencyAgreementMember2024-01-012024-03-31

0001621672slgg:SeriesAPreferredOfferingsMemberslgg:SubscriptionAgreementsMember2024-03-31

0001621672slgg:SeriesAPreferredOfferingsMember2024-03-31

0001621672slgg:SeriesAPreferredOfferingsMember2024-01-012024-03-31

0001621672slgg:SeriesAPreferredOfferingsMember2023-12-31

0001621672slgg:SeriesAPreferredOfferingsMember2023-01-012023-12-31

0001621672slgg:SeriesA5PreferredStockMember2024-03-31

0001621672slgg:SeriesA5PreferredStockMember2023-12-31

0001621672slgg:SeriesA5PreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesA4PreferredStockMember2024-03-31

0001621672slgg:SeriesA4PreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesA4PreferredStockMember2023-12-31

0001621672slgg:SeriesA4PreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesA3PreferredStockMember2024-03-31

0001621672slgg:SeriesA3PreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesA3PreferredStockMember2023-12-31

0001621672slgg:SeriesA3PreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesA2PreferredStockMember2024-03-31

0001621672slgg:SeriesA2PreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesA2PreferredStockMember2023-12-31

0001621672slgg:SeriesA2PreferredStockMember2023-01-012023-12-31

0001621672us-gaap:SeriesAPreferredStockMember2024-03-31

0001621672us-gaap:SeriesAPreferredStockMember2024-01-012024-03-31

0001621672us-gaap:SeriesAPreferredStockMember2023-12-31

0001621672us-gaap:SeriesAPreferredStockMember2023-01-012023-12-31

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:SubscriptionAgreementsMember2024-01-012024-03-31

0001621672slgg:SeriesAPreferredOfferingsMember2022-11-222023-01-31

0001621672slgg:SeriesAPreferredOfferingsMember2023-01-31

0001621672slgg:SeriesA5PreferredStockMember2023-01-312023-01-31

0001621672slgg:SeriesA5PreferredStockMember2023-01-31

0001621672slgg:SeriesA4PreferredStockMember2022-12-222022-12-22

0001621672slgg:SeriesA4PreferredStockMember2022-12-22

0001621672slgg:SeriesA3PreferredStockMember2022-11-302022-11-30

0001621672slgg:SeriesA3PreferredStockMember2022-11-30

0001621672slgg:SeriesA2PreferredStockMember2022-11-282022-11-28

0001621672slgg:SeriesA2PreferredStockMember2022-11-28

0001621672us-gaap:SeriesAPreferredStockMember2022-11-222022-11-22

0001621672us-gaap:SeriesAPreferredStockMember2022-11-22

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMemberslgg:SubscriptionAgreementsMember2023-01-31

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMemberslgg:SubscriptionAgreementsMember2022-11-222023-01-31

0001621672slgg:SeriesAAPreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesAAPreferredStockMemberslgg:SubscriptionAgreementsMember2024-03-31

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAAConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAAConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAAConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2023-08-23

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2023-08-23

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2023-08-23

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2023-08-23

0001621672slgg:SeriesAAPreferredStockMember2023-11-30

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2024-03-312024-03-31

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2023-12-312023-12-31

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2024-03-312024-03-31

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2023-12-312023-12-31

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2024-03-312024-03-31

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2023-12-312023-12-31

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2024-03-312024-03-31

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2023-12-312023-12-31

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2024-03-312024-03-31

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2023-12-312023-12-31

0001621672slgg:SeriesAAConvertiblePreferredStockMember2024-03-312024-03-31

0001621672slgg:SeriesAAConvertiblePreferredStockMember2023-12-312023-12-31

0001621672slgg:SeriesAAPreferredStockMember2023-08-23

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2023-04-192023-05-26

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMember2023-05-26

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2023-05-262023-05-26

0001621672slgg:SeriesAA5ConvertiblePreferredStockMember2023-05-26

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2023-05-052023-05-05

0001621672slgg:SeriesAA4ConvertiblePreferredStockMember2023-05-05

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2023-04-282023-04-28

0001621672slgg:SeriesAA3ConvertiblePreferredStockMember2023-04-28

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2023-04-202023-04-20

0001621672slgg:SeriesAA2ConvertiblePreferredStockMember2023-04-20

0001621672slgg:SeriesAAPreferredStockMember2023-04-192023-04-19

0001621672slgg:SeriesAAPreferredStockMember2023-04-19

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMemberslgg:SubscriptionAgreementsMember2024-03-31

0001621672slgg:SeriesAAAA2AA3AndAA4ConvertiblePreferredStockMemberslgg:SubscriptionAgreementsMember2023-04-192023-05-26

0001621672slgg:SeriesPreferredAAAMember2024-03-31

0001621672slgg:SeriesPreferredAAAMember2024-01-012024-03-31

0001621672slgg:SeriesPreferredAAAMember2023-12-31

0001621672slgg:SeriesPreferredAAAMember2023-01-012023-12-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMember2024-03-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMember2024-01-012024-03-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMember2023-12-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMember2023-01-012023-12-31

0001621672slgg:SeriesAAA2PreferredStockExchangesMember2024-03-31

0001621672slgg:SeriesAAA2PreferredStockExchangesMember2024-01-012024-03-31

0001621672slgg:SeriesAAA2PreferredStockExchangesMember2023-12-31

0001621672slgg:SeriesAAA2PreferredStockExchangesMember2023-01-012023-12-31

0001621672slgg:SeriesAAAPreferredStockExchangesMember2024-03-31

0001621672slgg:SeriesAAAPreferredStockExchangesMember2024-01-012024-03-31

0001621672slgg:SeriesAAAPreferredStockExchangesMember2023-12-31

0001621672slgg:SeriesAAAPreferredStockExchangesMember2023-01-012023-12-31

0001621672slgg:SeriesAAAAndAAA2ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAAAAndAAA2ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAAA2ConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAAA2ConvertiblePreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesAAA2ConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAAA2ConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:SeriesAAAConvertiblePreferredStockMember2024-03-31

0001621672slgg:SeriesAAAConvertiblePreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesAAAConvertiblePreferredStockMember2023-12-31

0001621672slgg:SeriesAAAConvertiblePreferredStockMember2023-01-012023-12-31

0001621672slgg:PlacementAgentWarrantsWithSeriesA2PreferredStockMember2024-03-31

0001621672slgg:PlacementAgentWarrantsWithSeriesA2PreferredStockMember2024-01-012024-03-31

0001621672slgg:PlacementAgentWarrantsWithSeriesA2PreferredStockMembersrt:MaximumMember2024-01-012024-03-31

0001621672slgg:PlacementAgentWarrantsWithSeriesA2PreferredStockMembersrt:MinimumMember2024-01-012024-03-31

0001621672slgg:SeriesAAIntoSeriesAAAPreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesAAAAndAAA2ConvertiblePreferredStockMember2023-11-302023-12-22

0001621672slgg:SeriesAAAAndAAA2ConvertiblePreferredStockMember2023-12-22

0001621672slgg:SeriesAAA2ConvertiblePreferredStockMember2023-12-222023-12-22

0001621672slgg:SeriesAAA2ConvertiblePreferredStockMember2023-12-22

0001621672slgg:SeriesAAAConvertiblePreferredStockMember2023-11-302023-11-30

0001621672slgg:SeriesAAAConvertiblePreferredStockMember2023-11-30

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMemberslgg:SubscriptionAgreementsMember2024-03-31

0001621672slgg:SeriesAAAAndAAA2ConvertiblePreferredStockMemberslgg:SubscriptionAgreementsMember2024-03-31

0001621672slgg:SeriesAAAAndAAA2ConvertiblePreferredStockMemberslgg:SubscriptionAgreementsMember2024-01-012024-03-31

00016216722023-05-30

00016216722023-05-29

00016216722024-03-31

0001621672slgg:ReverseStockSplitMember2023-09-072023-09-07

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2023-03-31

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2022-01-012022-12-31

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2023-01-012023-03-31

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2024-01-012024-03-31

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2022-12-31

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2022-05-16

0001621672slgg:SecuritiesPurchaseAgreementMemberslgg:NoteHoldersMember2022-05-162022-05-16

utr:M

0001621672slgg:SLRAgreementMember2024-01-012024-03-31

0001621672slgg:SLRAgreementMember2024-03-31

0001621672slgg:SLRAgreementMemberslgg:FacilityRateMember2023-12-172023-12-17

0001621672slgg:SLRAgreementMember2023-12-17

0001621672slgg:SLRAgreementMemberus-gaap:PrimeRateMember2023-12-172023-12-17

0001621672slgg:SLRAgreementMember2023-12-172023-12-17

0001621672slgg:MelonAcquisitionMemberus-gaap:MeasurementInputSharePriceMember2024-03-31

0001621672slgg:MelonAcquisitionMember2024-01-012024-03-31

0001621672slgg:SuperbizAcquisitionMember2023-03-31

0001621672slgg:SuperbizAcquisitionMember2024-03-31

0001621672slgg:SuperbizAcquisitionMember2023-01-012023-03-31

0001621672slgg:SuperbizAcquisitionMember2024-01-012024-03-31

0001621672slgg:SuperbizAcquisitionMember2022-12-31

0001621672slgg:SuperbizAcquisitionMember2023-12-31

0001621672slgg:MelonAcquisitionMemberus-gaap:MeasurementInputDiscountRateMember2024-03-31

0001621672slgg:MelonAcquisitionMemberus-gaap:MeasurementInputPriceVolatilityMembersrt:MinimumMember2024-03-31

0001621672slgg:MelonAcquisitionMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-31

0001621672slgg:MelonAcquisitionMemberslgg:SecondEarnoutPeriodStockPaymentsMember2023-05-04

0001621672slgg:MelonAcquisitionMemberslgg:SecondEarnoutPeriodCashPaymentsMember2023-05-04

0001621672slgg:MelonAcquisitionMemberslgg:SecondEarnoutPeriodMember2023-05-04

0001621672slgg:MelonAcquisitionMemberslgg:FirstEarnoutPeriodMember2023-05-04

0001621672slgg:MelonAcquisitionMember2023-05-04

0001621672slgg:SuperbizMember2023-04-012023-04-30

0001621672slgg:SuperbizMemberslgg:FirstEarnoutPeriodMember2023-04-012023-04-30

0001621672slgg:SuperbizMember2023-03-31

0001621672slgg:SuperbizMember2023-01-012023-03-31

0001621672slgg:SuperbizMember2024-03-31

0001621672slgg:SuperbizMember2024-01-012024-03-31

0001621672slgg:SuperbizMember2022-12-31

0001621672slgg:SuperbizMember2023-12-31

0001621672slgg:SuperbizMember2021-10-04

0001621672slgg:MinehutMember2024-02-29

0001621672slgg:MinehutMember2024-02-292024-02-29

0001621672us-gaap:OtherNoncurrentAssetsMemberslgg:MinehutMember2024-02-29

0001621672us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberslgg:MinehutMember2024-02-29

0001621672slgg:MinehutMember2024-02-29

00016216722022-01-012022-09-30

00016216722022-07-012022-09-30

00016216722023-01-012023-09-30

00016216722023-07-012023-09-30

00016216722023-12-31

utr:Y

0001621672us-gaap:CopyrightsMember2024-03-31

0001621672us-gaap:CopyrightsMember2023-12-31

0001621672us-gaap:InternetDomainNamesMember2024-03-31

0001621672us-gaap:InternetDomainNamesMember2023-12-31

0001621672us-gaap:TradeNamesMember2024-03-31

0001621672us-gaap:TradeNamesMember2023-12-31

0001621672slgg:InfluencersContentCreatorsMember2024-03-31

0001621672slgg:InfluencersContentCreatorsMember2023-12-31

0001621672us-gaap:DevelopedTechnologyRightsMember2024-03-31

0001621672us-gaap:DevelopedTechnologyRightsMember2023-12-31

0001621672slgg:AnimeBattlegroundsXMember2024-03-31

0001621672slgg:AnimeBattlegroundsXMember2023-12-31

0001621672slgg:CapitalizedSoftwareDevelopmentCostsMember2024-03-31

0001621672slgg:CapitalizedSoftwareDevelopmentCostsMember2023-12-31

0001621672us-gaap:CustomerRelationshipsMember2024-03-31

0001621672us-gaap:CustomerRelationshipsMember2023-12-31

00016216722023-01-012023-03-31

0001621672us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-03-31

0001621672us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-03-31

0001621672slgg:CommonStockUnderlyingAllOutstandingStockOptionRestrictedStockUnitsAndWarrantsMember2023-01-012023-03-31

0001621672slgg:CommonStockUnderlyingAllOutstandingStockOptionRestrictedStockUnitsAndWarrantsMember2024-01-012024-03-31

0001621672us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMemberslgg:TwoVendorsMember2023-01-012023-12-31

0001621672us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMember2023-12-31

0001621672us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMemberslgg:OneVendorMember2024-01-012024-03-31

0001621672us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMember2024-03-31

0001621672us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberslgg:ThreeVendorsMember2023-01-012023-12-31

0001621672us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-12-31

0001621672us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberslgg:ThreeVendorsMember2024-01-012024-03-31

0001621672us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberslgg:PublishingAndContentStudioMember2023-01-012023-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberslgg:PublishingAndContentStudioMember2024-01-012024-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberslgg:AdvertisingAndSponsorshipsMember2023-01-012023-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberslgg:AdvertisingAndSponsorshipsMember2024-01-012024-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberslgg:ThreeCustomersMember2023-01-012023-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberslgg:TwoCustomersMember2024-01-012024-03-31

0001621672us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-31

0001621672us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-31

0001621672us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-31

0001621672us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-31

0001621672us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-31

0001621672us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-31

0001621672us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-31

0001621672us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-03-19

0001621672us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-03-192024-03-19

0001621672us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-03-192024-03-19

0001621672us-gaap:RestrictedStockUnitsRSUMember2024-03-19

0001621672us-gaap:EmployeeStockOptionMember2024-03-19

00016216722024-03-19

0001621672srt:MaximumMember2024-03-31

0001621672srt:MinimumMember2024-03-31

00016216722022-12-31

0001621672us-gaap:TransferredOverTimeMember2023-01-012023-03-31

0001621672us-gaap:TransferredAtPointInTimeMember2023-01-012023-03-31

0001621672us-gaap:TransferredOverTimeMember2024-01-012024-03-31

0001621672us-gaap:TransferredAtPointInTimeMember2024-01-012024-03-31

0001621672slgg:DirectToConsumerMember2023-01-012023-03-31

0001621672slgg:DirectToConsumerMember2024-01-012024-03-31

0001621672slgg:ContentSalesMember2023-01-012023-03-31

0001621672slgg:ContentSalesMember2024-01-012024-03-31

0001621672slgg:AdvertisingAndSponsorshipsMember2023-01-012023-03-31

0001621672slgg:AdvertisingAndSponsorshipsMember2024-01-012024-03-31

0001621672slgg:MinehutMember2024-03-31

0001621672slgg:MelonAcquisitionMember2023-01-012023-03-31

00016216722023-03-31

0001621672us-gaap:PreferredStockMember2023-01-012023-03-31

0001621672us-gaap:PreferredStockMember2024-01-012024-03-31

0001621672us-gaap:RetainedEarningsMember2023-03-31

0001621672us-gaap:RetainedEarningsMember2024-03-31

0001621672us-gaap:RetainedEarningsMember2023-01-012023-03-31

0001621672us-gaap:RetainedEarningsMember2024-01-012024-03-31

0001621672us-gaap:RetainedEarningsMember2022-12-31

0001621672us-gaap:RetainedEarningsMember2023-12-31

0001621672us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001621672us-gaap:AdditionalPaidInCapitalMember2024-03-31

0001621672us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001621672us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0001621672us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001621672us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001621672us-gaap:CommonStockMember2023-03-31

0001621672us-gaap:CommonStockMember2024-03-31

0001621672us-gaap:CommonStockMember2023-01-012023-03-31

0001621672us-gaap:CommonStockMember2024-01-012024-03-31

0001621672us-gaap:CommonStockMember2022-12-31

0001621672us-gaap:CommonStockMember2023-12-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMemberus-gaap:CommonStockMember2024-01-012024-03-31

0001621672slgg:SeriesAAPreferredStockMemberus-gaap:CommonStockMember2023-01-012023-03-31

0001621672slgg:SeriesAAPreferredStockMemberus-gaap:CommonStockMember2024-01-012024-03-31

0001621672slgg:SeriesAPreferredOfferingsMemberus-gaap:CommonStockMember2023-01-012023-03-31

0001621672slgg:SeriesAPreferredOfferingsMemberus-gaap:CommonStockMember2024-01-012024-03-31

0001621672us-gaap:PreferredStockMember2023-03-31

0001621672us-gaap:PreferredStockMember2024-03-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMemberus-gaap:PreferredStockMember2023-01-012023-03-31

0001621672slgg:SeriesAAAAndAAA2PreferredStockExchangesMemberus-gaap:PreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesAAPreferredStockMemberus-gaap:PreferredStockMember2023-01-012023-03-31

0001621672slgg:SeriesAAPreferredStockMemberus-gaap:PreferredStockMember2024-01-012024-03-31

0001621672slgg:SeriesAPreferredOfferingsMemberus-gaap:PreferredStockMember2023-01-012023-03-31

0001621672slgg:SeriesAPreferredOfferingsMemberus-gaap:PreferredStockMember2024-01-012024-03-31

0001621672us-gaap:PreferredStockMember2022-12-31

0001621672us-gaap:PreferredStockMember2023-12-31

00016216722024-05-13

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

From the transition period from to

Commission File Number 001-38819

|

SUPER LEAGUE ENTERPRISE, INC.

|

|

(Exact name of small business issuer as specified in its charter)

|

|

Delaware

|

|

47-1990734

|

|

(State or other jurisdiction of incorporation or

organization)

|

|

(IRS Employer Identification No.)

|

2912 Colorado Ave., Suite #203

Santa Monica, California 90404

(Address of principal executive offices)

Company: (213) 421-1920; Investor Relations: 203-741-8811

(Issuer’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically on its corporate web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Sec.232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

| |

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| |

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

| |

Common Stock, par value $0.001 per share

|

|

SLE

|

|

NASDAQ Capital Market

|

|

As of May 13, 2024, there were 6,632,707 shares of the registrant’s common stock, $0.001 par value, issued and outstanding.

PART I

FINANCIAL INFORMATION

|

ITEM 1.

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

SUPER LEAGUE ENTERPRISE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Rounded to the nearest thousands, except share and per share data)

| |

|

March 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

3,311,000 |

|

|

$ |

7,609,000 |

|

|

Accounts receivable

|

|

|

6,240,000 |

|

|

|

8,287,000 |

|

|

Prepaid expense and other current assets

|

|

|

1,134,000 |

|

|

|

862,000 |

|

|

Total current assets

|

|

|

10,685,000 |

|

|

|

16,758,000 |

|

|

Property and equipment, net

|

|

|

53,000 |

|

|

|

70,000 |

|

|

Intangible assets, net

|

|

|

5,603,000 |

|

|

|

6,636,000 |

|

| Goodwill |

|

|

1,864,000 |

|

|

|

1,864,000 |

|

|

Other receivable – noncurrent

|

|

|

395,000 |

|

|

|

- |

|

|

Total assets

|

|

$ |

18,600,000 |

|

|

$ |

25,328,000 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

7,110,000 |

|

|

$ |

10,420,000 |

|

|

Accrued contingent consideration

|

|

|

2,017,000 |

|

|

|

1,812,000 |

|

|

Contract liabilities

|

|

|

334,000 |

|

|

|

339,000 |

|

|

Secured loan – SLR Facility

|

|

|

370,000 |

|

|

|

800,000 |

|

|

Total current liabilities

|

|

|

9,831,000 |

|

|

|

13,371,000 |

|

|

Accrued contingent consideration – noncurrent

|

|

|

449,000 |

|

|

|

396,000 |

|

|

Warrant liability

|

|

|

2,332,000 |

|

|

|

1,571,000 |

|

|

Total liabilities

|

|

|

12,612,000 |

|

|

|

15,338,000 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.001 per share; 10,000,000 shares authorized; 22,078 and 23,656 and shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively.

|

|

|

- |

|

|

|

- |

|

|

Common stock, par value $0.001 per share; 400,000,000 shares authorized; 5,982,912 and 4,774,116 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively.

|

|

|

83,000 |

|

|

|

81,000 |

|

|

Additional paid-in capital

|

|

|

260,183,000 |

|

|

|

258,923,000 |

|

|

Accumulated deficit

|

|

|

(254,278,000 |

)

|

|

|

(249,014,000 |

)

|

|

Total stockholders’ equity

|

|

|

5,988,000 |

|

|

|

9,990,000 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

18,600,000 |

|

|

$ |

25,328,000 |

|

See accompanying notes to condensed consolidated financial statements

SUPER LEAGUE ENTERPRISE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Rounded to the nearest thousands, except share and per share data)

(Unaudited)

| |

|

Three Months

Ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

REVENUE

|

|

$ |

4,209,000 |

|

|

$ |

3,322,000 |

|

| |

|

|

|

|

|

|

|

|

|

COST OF REVENUE

|

|

|

2,477,000 |

|

|

|

1,948,000 |

|

| |

|

|

|

|

|

|

|

|

|

GROSS PROFIT

|

|

|

1,732,000 |

|

|

|

1,374,000 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING EXPENSE

|

|

|

|

|

|

|

|

|

|

Selling, marketing and advertising

|

|

|

2,277,000 |

|

|

|

2,650,000 |

|

|

Engineering, technology and development

|

|

|

1,699,000 |

|

|

|

2,956,000 |

|

|

General and administrative

|

|

|

2,102,000 |

|

|

|

2,520,000 |

|

|

Contingent consideration

|

|

|

259,000 |

|

|

|

468,000 |

|

|

Total operating expense

|

|

|

6,337,000 |

|

|

|

8,594,000 |

|

| |

|

|

|

|

|

|

|

|

|

NET OPERATING LOSS

|

|

|

(4,605,000 |

)

|

|

|

(7,220,000 |

)

|

| |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

| Gain on sale of intangible assets |

|

|

144,000 |

|

|

|

- |

|

|

Change in fair value of warrant liability

|

|

|

(761,000 |

) |

|

|

- |

|

|

Interest expense

|

|

|

(18,000 |

) |

|

|

(40,000 |

) |

|

Other

|

|

|

(20,000 |

) |

|

|

24,000 |

|

|

Total other income (expense)

|

|

|

(655,000 |

) |

|

|

(16,000 |

) |

| |

|

|

|

|

|

|

|

|

|

Loss before provision for income taxes

|

|

|

(5,260,000 |

)

|

|

|

(7,236,000 |

)

|

| |

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$ |

(5,260,000 |

)

|

|

$ |

(7,236,000 |

)

|

| |

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders - basic and diluted

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share

|

|

$ |

(1.00 |

)

|

|

$ |

(3.84 |

)

|

|

Weighted-average number of shares outstanding, basic and diluted

|

|

|

5,240,755 |

|

|

|

1,885,797 |

|

See accompanying notes to condensed consolidated financial statements

SUPER LEAGUE ENTERPRISE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Rounded to the nearest thousands, except share and per share data)

(Unaudited)

| |

|

Three Months

|

|

| |

|

Ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Preferred stock (Shares):

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period

|

|

|

23,656 |

|

|

|

10,323 |

|

|

Issuance of Series A-5 preferred stock at $1,000 per share

|

|

|

- |

|

|

|

2,299 |

|

|

Conversions of Series A Preferred stock to common stock

|

|

|

(475 |

) |

|

|

- |

|

|

Conversions of Series AA Preferred stock to common stock

|

|

|

(263 |

) |

|

|

- |

|

|

Conversions of Series AAA Preferred stock to common stock

|

|

|

(840 |

) |

|

|

- |

|

|

Balance, end of period

|

|

|

22,078 |

|

|

|

12,622 |

|

| |

|

|

|

|

|

|

|

|

|

Preferred stock (Amount, at Par Value):

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period

|

|

$ |

- |

|

|

$ |

- |

|

|

Issuance of Series A-5 preferred stock, $0.001 par value, at $1,000 per share

|

|

|

- |

|

|

|

- |

|

|

Conversions of Series A Preferred stock

|

|

|

- |

|

|

|

- |

|

|

Conversions of Series AA Preferred stock

|

|

|

- |

|

|

|

- |

|

|

Conversions of Series AAA Preferred stock

|

|

|

- |

|

|

|

- |

|

|

Balance, end of period

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

Common stock (Shares):

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period

|

|

|

4,774,116 |

|

|

|

1,880,298 |

|

|

Conversion of Series A preferred stock

|

|

|

45,587 |

|

|

|

- |

|

|

Conversion of Series AA preferred stock

|

|

|

139,452 |

|

|

|

- |

|

|

Conversion of Series AAA preferred stock

|

|

|

501,803 |

|

|

|

- |

|

|

Stock-based compensation

|

|

|

19,788 |

|

|

|

9,455 |

|

|

Issuance of common stock in settlement of legal matter

|

|

|

500,000 |

|

|

|

- |

|

|

Preferred stock dividends paid – common stock

|

|

|

2,166 |

|

|

|

- |

|

|

Balance, end of period

|

|

|

5,982,912 |

|

|

|

1,889,753 |

|

| |

|

|

|

|

|

|

|

|

|

Common stock (Amount):

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period

|

|

$ |

81,000 |

|

|

$ |

47,000 |

|

|

Conversion of Series A, AA and AAA preferred stock

|

|

|

1,000 |

|

|

|

- |

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

Issuance of common stock in settlement of legal matter

|

|

|

1,000 |

|

|

|

- |

|

|

Preferred stock dividends paid – common stock

|

|

|

- |

|

|

|

- |

|

|

Balance, end of period

|

|

$ |

83,000 |

|

|

$ |

47,000 |

|

| |

|

|

|

|

|

|

|

|

|

Additional paid-in-capital:

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period

|

|

$ |

258,923,000 |

|

|

$ |

229,900,000 |

|

|

Issuance of Series A-5 preferred stock at $1,000 per share, net of issuance costs

|

|

|

- |

|

|

|

1,919,000 |

|

|

Stock-based compensation

|

|

|

332,000 |

|

|

|

720,000 |

|

|

Issuance of common stock in settlement of legal matter

|

|

|

924,000 |

|

|

|

- |

|

|

Preferred stock dividends paid – common stock

|

|

|

4,000 |

|

|

|

- |

|

|

Balance, end of period

|

|

$ |

260,183,000 |

|

|

$ |

232,539,000 |

|

| |

|

|

|

|

|

|

|

|

|

Accumulated Deficit:

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period

|

|

$ |

(249,014,000 |

) |

|

$ |

(210,743,000 |

) |

|

Preferred stock dividends paid – common stock

|

|

|

(4,000 |

) |

|

|

- |

|

|

Net Loss

|

|

|

(5,260,000 |

) |

|

|

(7,236,000 |

) |

|

Balance, end of period

|

|

$ |

(254,278,000 |

) |

|

$ |

(217,979,000 |

) |

|

Total stockholders’ equity

|

|

$ |

5,988,000 |

|

|

$ |

14,607,000 |

|

See accompanying notes to condensed consolidated financial statements

SUPER LEAGUE ENTERPRISE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Rounded to the nearest thousands)

(Unaudited)

| |

|

Three Months

Ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(5,260,000 |

)

|

|

$ |

(7,236,000 |

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

700,000 |

|

|

|

1,337,000 |

|

|

Stock-based compensation

|

|

|

332,000 |

|

|

|

783,000 |

|

|

Change in fair value of warrant liability

|

|

|

761,000 |

|

|

|

- |

|

|

Change in fair value of contingent consideration

|

|

|

116,000 |

|

|

|

- |

|

|

Amortization of convertible notes discount

|

|

|

- |

|

|

|

40,000 |

|

|

Gain on sale of intangible assets

|

|

|

(144,000 |

) |

|

|

- |

|

| Change in fair value of noncash legal settlement |

|

|

164,000 |

|

|

|

- |

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

2,048,000 |

|

|

|

2,671,000 |

|

|

Prepaid expense and other current assets

|

|

|

(48,000 |

)

|

|

|

140,000 |

|

|

Accounts payable and accrued expense

|

|

|

(2,548,000 |

) |

|

|

(919,000 |

) |

|

Accrued contingent consideration

|

|

|

142,000 |

|

|

|

468,000 |

|

|

Contract liabilities

|

|

|

(6,000 |

) |

|

|

(82,000 |

) |

|

Accrued interest on note payable

|

|

|

- |

|

|

|

(180,000 |

) |

|

Net cash used in operating activities

|

|

|

(3,743,000 |

)

|

|

|

(2,978,000 |

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

- |

|

|

|

(6,000 |

) |

|

Capitalization of software development costs

|

|

|

(125,000 |

) |

|

|

(281,000 |

) |

|

Acquisition of other intangible assets

|

|

|

- |

|

|

|

(7,000 |

) |

|

Net cash used in investing activities

|

|

|

(125,000 |

) |

|

|

(294,000 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of preferred stock, net of issuance costs

|

|

|

- |

|

|

|

1,919,000 |

|

|

Payments on convertible notes

|

|

|

- |

|

|

|

(539,000 |

) |

|

Accounts receivable facility advances

|

|

|

371,000 |

|

|

|

- |

|

|

Payments on accounts receivable facility

|

|

|

(801,000 |

)

|

|

|

- |

|

|

Net cash (used in) provided by financing activities

|

|

|

(430,000 |

) |

|

|

1,380,000 |

|

| |

|

|

|

|

|

|

|

|

|

DECREASE IN CASH

|

|

|

(4,298,000 |

)

|

|

|

(1,892,000 |

)

|

|

Cash and Cash Equivalents – beginning of period

|

|

|

7,609,000 |

|

|

|

2,482,000 |

|

|

Cash and Cash Equivalents – end of period

|

|

$ |

3,311,000 |

|

|

$ |

590,000 |

|

| |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL NONCASH INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Issuance of common stock in connection with legal settlement

|

|

$ |

924,000 |

|

|

|

- |

|

See accompanying notes to condensed consolidated financial statements

SUPER LEAGUE ENTERPRISE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

1.

|

DESCRIPTION OF BUSINESS

|

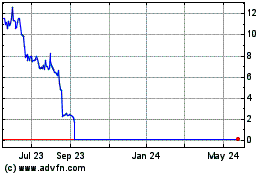

Super League Enterprise, Inc. (Nasdaq: SLE), (“Super League,” the “Company,” “we,” “us” or “our”) is a leading creator and publisher of content experiences and media solutions across the world’s largest immersive platforms. From open gaming powerhouses such as Roblox, Minecraft and Fortnite Creative, to bespoke worlds built using the most advanced 3D creation tools, Super League’s innovative solutions provide incomparable access to massive audiences who gather in immersive digital spaces to socialize, play, explore, collaborate, shop, learn and create. As a true end-to-end activation partner for dozens of global brands, Super League offers a complete range of development, distribution, monetization and optimization capabilities designed to engage users through dynamic, energized programs. As an originator of new experiences fueled by a network of top developers, a comprehensive set of proprietary creator tools and a future-forward team of creative professionals, Super League accelerates intellectual property (“IP”) and audience success within the fastest growing sector of the media industry.

Super League was incorporated on October 1, 2014 as Nth Games, Inc. under the laws of the State of Delaware and changed its name to Super League Gaming, Inc. on June 15, 2015, and to Super League Enterprise, Inc. on September 11, 2023. We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012, as amended.

On September 7, 2023, the Company filed a Certificate of Amendment (the “2023 Second Amendment”) to the Charter, which Second Amendment became effective as of September 11, 2023, to change the name of the Company from Super League Gaming, Inc. to Super League Enterprise, Inc. (the “Name Change”) and to effect a reverse stock split of the Company’s issued and outstanding shares of common stock at a ratio of 1-for-20 (the “Reverse Split”). The Name Change and the Reverse Split were approved by the Company’s Board on July 5, 2023, and approved by the stockholders of the Company on September 7, 2023. Refer to Note 7 below for additional information regarding the Reverse Split. In connection with the Name Change, the Company also changed its Nasdaq ticker symbol to “SLE” from “SLGG.”

All references to common stock, warrants to purchase common stock, options to purchase common stock, restricted stock, share data, per share data and related information contained in the condensed consolidated financial statements (hereinafter, “consolidated financial statements”) have been retroactively adjusted to reflect the effect of the Reverse Split for all periods presented.

All references to “Note,” followed by a number reference from one to seven herein, refer to the applicable corresponding numbered footnotes to these consolidated financial statements.

Sale of Minehut

On February 29, 2024, the Company sold its Minehut related assets (“Minehut Assets”) to GamerSafer, Inc. (“GamerSafer”), in a transaction approved by the Board of Directors of the Company. Pursuant to the Asset Purchase Agreement entered into by and between GamerSafer and the Company on February 26, 2024 (the “GS Agreement”), the Company will receive $1.0 million of purchase consideration (“Purchase Consideration”) for the Minehut Assets, which amount will be paid by GamerSafer in revenue and royalty sharing over a multiple year period, as described in the GS Agreement (the “Minehut Sale”). Other than with respect to the GS Agreement, there is no relationship between the Company or its affiliates with GamerSafer or its affiliates.

The transaction allows Super League to streamline its position in partnering with major brands to build, market, and operate 3D experiences across multiple immersive platforms, including open gaming powerhouses like Minecraft, and aligns with the Company’s cost improvement initiatives. Super League and GamerSafer will maintain a commercial relationship which ensures that Minehut can remain an ongoing destination available to Super League’s partners.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, certain information and footnotes required by U.S. GAAP in annual financial statements have been omitted or condensed in accordance with quarterly reporting requirements of the Securities and Exchange Commission (“SEC”). These interim condensed consolidated financial statements should be read in conjunction with our audited financial statements for the year ended December 31, 2023 included in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 15, 2023.

The December 31, 2023 condensed consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by U.S. GAAP. The condensed consolidated interim financial statements of Super League include all adjustments of a normal recurring nature which, in the opinion of management, are necessary for a fair statement of Super League’s financial position as of March 31, 2024, and results of its operations and its cash flows for the interim periods presented. The results of operations for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the entire fiscal year, or any future period.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Reclassifications

Certain reclassifications to operating expense line items have been made to prior year amounts for consistency and comparability with the current year’s consolidated financial statement presentation. These reclassifications had no effect on the reported total revenue, operating expense, total assets, total liabilities, total stockholder’s equity, or net loss for the prior period presented.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expense during the reporting period. Actual results could differ from these estimates. The Company believes that, of the significant accounting policies described herein, the accounting policies associated with revenue recognition, impairment of intangibles, stock-based compensation expense, capitalized internal-use-software costs, accounting for business combinations and related contingent consideration, derecognition of assets, accounting for convertible debt, including estimates and assumptions used to calculate the fair value of debt instruments, accounting for convertible preferred stock, including modifications and exchanges of equity and equity-linked instruments, accounting for warrant liabilities and accounting for income taxes and valuation allowances against net deferred tax assets, require its most difficult, subjective, or complex judgments.

Going Concern

The accompanying condensed consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company incurred net losses of $5.3 million and $7.2 million for the three months ended March 31, 2024 and 2023, respectively, and had an accumulated deficit of $254.3 million as of March 31, 2024. For the three months ended March 31, 2024 and 2023, net cash used in operating activities totaled $3.7 million and $3.0 million, respectively.

The Company had cash and cash equivalents of $3.3 million and $7.6 million as of March 31, 2024 and December 31, 2023, respectively. To date, our principal sources of capital used to fund our operations and growth have been the net proceeds received from equity and debt financings. We have and will continue to use significant capital for the growth and development of our business, and, as such, we expect to seek additional capital either from operations, or that may be available from future issuance(s) of common stock, preferred stock and / or debt financings, to fund our planned operations. Accordingly, our results of operations and the implementation of our long-term business strategies have been and could continue to be adversely affected by general conditions in the global economy, including conditions that are outside of our control. The most recent global financial crisis caused by severe geopolitical conditions, including conflicts abroad, and the threat of other outbreaks or pandemics, have resulted in extreme volatility, disruptions and downward pressure on stock prices and trading volumes across the capital and credit markets in which we traditionally operate. A severe or prolonged economic downturn could result in a variety of risks to our business and could have a material adverse effect on us, including limiting our ability to obtain additional funding from the capital and credit markets. In management’s judgement, these conditions raise substantial doubt about the ability of the Company to continue as a going concern as contemplated by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), Topic 205-40, “Going Concern,” (“ASC 205”).

Management’s Plans

The Company experienced growth during the periods presented through organic and inorganic growth activities, including the expansion of our premium advertising inventory and quarter over quarter increases in recognized revenue across our primary revenue streams. During the prior fiscal year and the quarter ended March 31, 2024, we continued our focus on the expansion of our service offerings and revenue growth opportunities through internal development, collaborations, and through opportunistic strategic acquisitions, as well as management and reduction of operating costs. Management continues to explore alternatives for raising capital to facilitate our growth and execute our business strategy, including strategic partnerships and or other forms of equity or debt financings.

The Company considers historical operating results, costs, capital resources and financial position, in combination with current projections and estimates, as part of its plan to fund operations over a reasonable period. Management’s considerations assume, among other things, that the Company will continue to be successful implementing its business strategy, that there will be no material adverse developments in the business, liquidity or capital requirements, and the Company will be able to raise additional equity and / or debt financing on acceptable terms. If one or more of these factors do not occur as expected, it could cause a reduction or delay of the Company’s business activities, sales of material assets, default on its obligations, or forced insolvency. The accompanying consolidated financial statements do not contain any adjustments which might be necessary if the Company were unable to continue as a going concern. No assurance can be given that any future financing will be available or, if available, that it will be on terms that are satisfactory to the Company.

We may continue to evaluate potential strategic acquisitions. To finance such strategic acquisitions, we may find it necessary to raise additional equity capital, incur debt, or both. Any efforts to seek additional funding could be made through issuances of equity or debt, or other external financing. However, additional funding may not be available on favorable terms, or at all. The capital and credit markets have experienced extreme volatility and disruption periodically and such volatility and disruption may occur in the future. If we fail to obtain additional financing when needed, we may not be able to execute our business plans which, in turn, would have a material adverse impact on our financial condition, our ability to meet our obligations, and our ability to pursue our business strategies.

Revenue Recognition

Revenue is recognized when the Company transfers promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods and services and when the customer obtains control of the good or service. In this regard, revenue is recognized when: (i) the parties to the contract have approved the contract (in writing, orally, or in accordance with other customary business practices) and are committed to perform their respective obligations; (ii) the entity can identify each party’s rights regarding the goods or services to be transferred; (iii) the entity can identify the payment terms for the goods or services to be transferred; (iv) the contract has commercial substance (that is, the risk, timing, or amount of the entity’s future cash flows is expected to change as a result of the contract); and (v) it is probable that the entity will collect substantially all of the consideration to which it will be entitled in exchange for the goods or services that will be transferred to the customer.

Transaction prices are based on the amount of consideration to which we expect to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties, if any. We consider the explicit terms of the revenue contract, which are typically written and executed by the parties, our customary business practices, the nature, timing, and the amount of consideration promised by a customer in connection with determining the transaction price for our revenue arrangements. Refunds and sales returns historically have not been material.

The Company generates revenue from (i) innovative advertising including immersive game world and experience publishing and in-game media products, (ii) content and technology through the production and distribution of our own, advertiser and third-party content, and (iii) direct to consumer offers, including in-game items, e-commerce and digital collectibles.

The Company reports revenue on a gross or net basis based on management’s assessment of whether the Company acts as a principal or agent in the transaction and is evaluated on a transaction-by-transaction basis. To the extent the Company acts as the principal, revenue is reported on a gross basis net of any sales tax from customers, when applicable. The determination of whether the Company acts as a principal or an agent in a transaction is based on an evaluation of whether the Company controls the goods or services prior to transfer to the customer. Where applicable, the Company has determined that it acts as the principal in all of its media and advertising, publishing and content studio and direct to consumer revenue streams, except in situations where we utilize a reseller partner with respect to media and advertising sales arrangements.

In the event a customer pays us consideration, or we have a right to an amount of consideration that is unconditional, prior to our transfer of a good or service to the customer, we reflect the contract as a contract liability when the payment is made or the payment is due, whichever is earlier. In the event we perform by transferring goods or services to a customer before the customer pays consideration or before payment is due, we reflect the contract as a contract asset, excluding any amounts reflected as a receivable.

Media and Advertising

Media and advertising revenue primarily consists of direct and reseller sales of our on-platform media and analytics products, and influencer marketing campaign sales to third-party brands and agencies (hereinafter, “Brands”).

On Platform Media

On platform media revenue is generated from third party Brands advertising in-game on Roblox or other digital platforms, and prior to the Minehut Sale, on our Minehut Minecraft platform. Media assets include static billboards, video billboards, portals, 3D characters, Pop Ups and other media products. We work with Brands to determine the specific campaign media to deploy, target ad units and target demographics. We customize the media advertising campaign and media products with applicable branding, images and design and place the media on the various digital platforms. Media is delivered via our Super Biz Roblox platform, the Roblox Immersive Ads platform, other platforms, and prior to the Minehut Sale, on our owned and operated Minehut platform. Media placement can be based on a cost per thousand, other cost per measure, or a flat fee. Media and advertising arrangements typically include contract terms for time periods ranging from one week to two or three months in length.

For on-platform media campaigns, we typically insert media products on-platform (in-game) to deliver to the Brand a predetermined number of impressions identified in the underlying contract. The benefit accrues to the Brand at the time that we deliver the impression on the platform, and the media product is viewed or interacted with by the on-platform user. The performance obligation for on-platform media campaigns is each impression that is guaranteed or required to be delivered per the underlying contract.

Each impression is considered a good or service that is distinct under the revenue standard, and the performance obligation under our on-platform media contracts is the delivery of a series of impressions. Each impression required to be delivered in the series that we promise to transfer to the Brand meets the criteria to be a performance obligation satisfied over time, due to the fact that (1) our performance does not create an asset with an alternative use to the Company, and (2) we have an enforceable right to payment for performance completed to date per the terms of the contract. Further, the same method is used to measure our progress toward complete satisfaction of the performance obligation to transfer each distinct impression, as in the transfer of the series of impressions to the customer, which is based on actual delivery of impressions. As such, we account for the specified series of impressions as a single performance obligation.

The delivery of the impression on platform represents the change in control of the good or service, and therefore, the Company satisfies its performance obligations and recognizes revenue based on the delivery of impressions under the contract.

Influencer Marketing

Influencer marketing revenue is generated in connection with the development, management and execution of influencer marketing campaigns on behalf of Brands, primarily on You Tube, Instagram and Tik Tok. Influencer marketing campaigns are collaborations between Super League, popular social-media influencers, and Brands, to promote a Brands’ products or services. Influencers are paid a flat rate per post to feature a Brand’s product or service on their respective social media outlets.

For influencer marketing campaigns that include multiple influencers, the customer can benefit from the influencer posts either on its own or together with other resources that are readily available to the customer. Our influencer marketing campaigns for Brands (1) incorporate a significant service of integrating the goods or services with other goods or services promised in the contract (typically additional influencer posts) into a bundle of goods or services that represent the combined output that the customer has contracted for, and (2) the goods or services are interdependent in that each of the goods or services is affected by one or more of the other goods or services in the contract which combined, create an influencer marketing campaign to satisfy the Brand’s specific campaign objectives. The interdependency of the performance obligations is supported by an understanding of what a customer expects to receive as a final product with respect to an influencer marketing campaign, which is an integrated influencer marketing advertising campaign that the influencer posts create when they are combined into an overall integrated campaign.

Our customers receive and consume the benefits of each influencer’s post as the content is posted on the influencers respective social media outlet. In addition, the influencer marketing campaigns and videos created by influencers are highly customized advertising engagements, where Brand specific assets and collateral are created for the customer based on specific and customized specifications, and therefore, does not create an asset with an alternative use. Further, based on contract terms, we typically have an enforceable right to payment for performance to date during the term of the arrangement.

We recognize revenues for influencer marketing campaigns based on input methods which recognize revenue on the basis of the entity’s efforts or inputs to the satisfaction of a performance obligation relative to the total expected inputs to the satisfaction of that performance obligation. As such, revenues are recognized over the term of the campaign, as the influencer videos are posted, based on costs incurred to date relative to total costs for the influencer marketing campaign.

Publishing and Content Studio

Publishing and content studio revenue consists of revenue generated from immersive game development and custom game experiences within our owned and affiliate game worlds, and revenue generated in connection with our production, curation and distribution of entertainment content for our own network of digital channels and media and entertainment partner channels.

Publishing

Custom builds are highly customized branded game experiences created and built by Super League for customers on existing digital platforms such as Roblox, Fortnite, Decentraland and others. Custom builds often include the creation of highly customized and branded gaming experiences and other campaign specific media or products to create an overall customized immersive world campaign.

Custom integrations are highly customized advertising campaigns that are integrated into and run on existing affiliate Roblox gaming experiences. Custom integrations will often include the creation of highly customized and branded game integration elements to be integrated into the existing Roblox gaming experience to the customers specifications and other campaign specific media or products. Prior to the Minehut Sale, we also created custom integrations on the digital property “Minehut” for Brands.

Our custom builds and custom integration (hereinafter, “Custom Programs”) campaign revenue arrangements typically include multiple promises and performance obligations, including requirements to design, create and launch a platform game, customize and enhance an existing game, deploy media products, and related performance measurement. Custom Programs offer a strategically integrated advertising campaign with multiple integrated components, and we provide a significant service of integrating the goods or services with other goods or services promised in the contract into a bundle of goods or services that represent the combined output or outputs that the customer has contracted for. As such, Custom Program revenue arrangements are combined into a single performance unit, as our performance does not create an asset with an alternative use to the entity and we typically have an enforceable right to payment for performance to date during the term of the arrangement.

We recognize revenues for Custom Programs based on input methods, that recognize revenue based upon estimates of progress toward complete satisfaction of the contract performance obligations, utilizing primarily costs or direct labor hours incurred to date to estimate progress towards completion.

Content Production

Content production revenue is generated in connection with our production, curation and distribution of entertainment content for our own network of digital channels and media and entertainment partner channels. We distribute three primary types of content for syndication and licensing, including: (1) our own original programming content, (2) user generated content (“UGC”), including online gameplay and gameplay highlights, and (3) the creation of content for third parties utilizing our remote production and broadcast technology.

Content production arrangements typically involve promises to provide a distinct set of videos, creative, content creation and or other live or remote production services. These services can be one-off in nature (relatively short services periods of one day to one week) or can be specified as monthly services over a multi-month period.

One-off and monthly content production services are distinct in that the customer can benefit from the service either on its own or together with other resources that are readily available to the customer. Further, promises to provide one-off or monthly content production services are typically separately identifiable as the nature of the promises, within the context of the contract, is to transfer each of those goods or services individually. Each month’s content production services are separate and not integrated with a prior month’s or subsequent months services and do not represent a combined output; each months content production services do not modify any other prior period content production services, and the monthly services are not interdependent or highly interrelated.

As a result, each one-off or monthly promise to provide content production services is a distinct good or service that we promise to transfer and are therefore performance obligations. In general, content production contracts do not meet the criteria for recognition of revenues over time as the customer typically does not simultaneously receive and consume the benefits provided by our performance as we perform, our performance does not typically create or enhance an asset that the customer controls, and while our performance does not create an asset with an alternative use, we typically have a right to payment upon completion of each distinct performance obligation.

A performance obligation is satisfied at a point in time if none of the criteria for satisfying a performance obligation over time are met. For content production arrangements, we have a right to payment and the customer has control of the good or service at the time of completion and delivery of the one-off or monthly content production services in accordance with the terms of the underlying contract. As such, revenue is recognized at the time of completion of the one-off or monthly content production services.

Direct to Consumer

Direct to consumer revenue primarily consists of monthly digital subscription fees, and sales of in-game digital goods. Subscription revenue is recognized in the period the services are rendered. Payments are typically due from customers at the point of sale.

InPvP Platform Generated Sales Transactions

Through a relationship with Microsoft, the owner of Minecraft, we operate a Minecraft server world for players playing the game on consoles and tablets. We are one of seven partner servers with Microsoft that, while “free to play,” monetize the players through in-game micro transactions. We generate in-game platform sales revenue from the sale of digital goods, including cosmetic items, durable goods, player ranks and game modes, leveraging the flexibility of the Microsoft Minecraft Bedrock platform, and powered by the InPvP cloud architecture technology platform. Revenue is generated when transactions are facilitated between Microsoft and the end user, either via in-game currency or cash.

InPvP revenues are generated from single transactions for various distinct digital goods sold to users in-game. Microsoft processes sales transactions and remits the applicable revenue share to us pursuant to the terms of the Microsoft agreement.

Revenue for digital goods sold on the platform is recognized when Microsoft (our partner) collects the revenue and facilitates the transaction, including delivery of digital goods, on the platform. Revenue for such arrangements includes all revenue generated, make goods, and refunds of all transactions managed via the platform by Microsoft. Payments are made to the Company monthly based on the sales revenue generated on the platform.

Revenue was comprised of the following for the three months ended March 31:

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited) |

|

|

|

|

|

|

Media and advertising

|