false000170652400017065242024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 12, 2024

URBAN-GRO, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39933 | | 46-5158469 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

1751 Panorama Point, Unit G Lafayette, Colorado | | 80026 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (720) 390-3880

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.001 per share | | UGRO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

The information included in Item 7.01 below is incorporated herein by reference.

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review

As reported on the Current Report on Form 8-K filed on May 6, 2024 by urban-gro, Inc. (the “Company”), the Company dismissed its previous independent registered public accounting firm, BF Borgers CPA PC ("BF Borgers"). On May 3, 2024, the Securities and Exchange Commission instituted public administrative and cease-and-desist proceedings against BF Borgers. In the Current Report on Form 8-K filed on May 29, 2024, the Company announced that it had appointed Sadler, Gibb & Associates, LLC ("Sadler Gibb") as its new independent public accounting firm. Sadler Gibb has substantially conducted a re-audit of the Company's previously issued financial statements for the year ended December 31, 2023. In connection with the re-audit of the 2023 financial statements as conducted to date, Sadler Gibb identified accounting errors related to deferred tax liabilities associated with historical share-purchase acquisitions made by the Company. Accounting for the initial deferred tax liabilities associated with the acquisitions was determined to be proper, but due to losses incurred by the Company following the acquisitions, the majority of the deferred tax liabilities that were recorded in connection with the share-purchase acquisition of each acquired company should have been recorded as income tax benefits to the statement of operations shortly after each acquisition. The Company had amortized these deferred tax liabilities to the statement of operations corresponding to the amortization of the intangible assets with which they were associated.

Effective August 12, 2024, the Audit Committee (the “Audit Committee”) of the Company’s Board of Directors, in consultation with the Company’s management and with Sadler Gibb, determined that the Company’s previously issued audited consolidated financial statements as of and for the years ended December 31, 2022 and December 31, 2023 (the “Year-End Financial Statements”), the Company’s previously issued unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2022, the three and six months ended June 30, 2022, and the three and nine months ended September 30, 2022 (the “2022 Interim Financial Statements”), the three months ended March 31, 2023, the three and six months ended June 30, 2023, and the three and nine months ended September 30, 2023 (the “2023 Interim Financial Statements”), and the three months ended March 31, 2024 (the “Q1 2024 Interim Financial Statements” and, together with the 2022 Interim Financial Statements and the 2023 Interim Financial Statements, the “Interim Financial Statements”) should no longer be relied upon and should be restated due to the foregoing accounting errors. Similarly, any previously issued or filed reports, press releases, earnings releases, investor presentations or other communications of the Company describing the Company’s financial results or other financial information relating to the periods covered by the Year-End Financial Statements or the Interim Financial Statements should no longer be relied upon.

As a result of the accounting errors, the Company intends to (a) restate the Year-End Financial Statements, the 2022 Interim Financial Statements, the 2023 Interim Financial Statements, and the respective notes thereto in a comprehensive amendment to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 with expanded financial information and other disclosures in lieu of filing separate amended annual and quarterly reports for the affected periods (the “Amended 10-K”), (b) restate the Q1 2024 Interim Financial Statements and the notes thereto in an amendment to the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024 (the “Amended 10-Q”), and (c) amend, among other related disclosures, its Management’s Discussion and Analysis of Financial Condition and Results of Operations for the applicable periods in the Amended 10-K and the Amended 10-Q. The adjustments to such financial statement items will be set forth through expanded disclosure in the financial statements included in the Amended 10-K and the Amended 10-Q, including further describing the restatements and their impact on previously reported amounts.

Although the Company cannot at this time estimate when it will file its restated financial statements, the Amended 10-K or the Amended 10-Q, it is diligently pursuing completion of the restatements and intends to make such filings as soon as reasonably practicable following the completion of Sadler Gibb’s re-audit.

The Company’s management also is assessing the effect of the matters identified to date and the restatements on the Company’s internal control over financial reporting and its disclosure controls and procedures. Although the assessment is not yet complete, the Company does not anticipate that the review will result in one or more material weaknesses in the Company’s internal control over financial reporting during the applicable periods.

The description of the restatements and accounting errors above is preliminary, unaudited and subject to further change in connection with the ongoing review, re-audit and the completion of the restatements. Accordingly, there can be no assurance as to the actual effects of the restatements or that the Company will not determine to restate any financial statements other than the Year-End Financial Statements and the Interim Financial Statements or with respect to any additional accounting errors.

The Company’s management and the Audit Committee have discussed the matters disclosed in this Item 4.02 with the Company’s independent registered public accounting firm, Sadler Gibb.

Item 7.01. Regulation FD Disclosure.

On August 14, 2024, the Company issued a press release announcing the intention to restate the Year-End Financial Statements and the Interim Financial Statements, as well as the related delay in the filing of the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2024 and the Company’s preliminary estimated revenue for the quarter ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, unless specifically identified as being incorporated therein by reference.

Cautionary Note Regarding Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995, including statements regarding the expected impacts of the restatements of the Year-End Financial Statements and the Interim Financial Statements and the Company’s plans to file the Amended 10-K and the Amended 10-Q. These statements reflect the beliefs and assumptions of the Company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The Company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward-looking statements. Factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings. In addition, these risks and uncertainties include, but are not limited to, the discovery of additional information relevant to the periods covered by the Year-End Financial Statements, the Interim Financial Statements or other periods, changes in the effects of the restatements on the Company’s financial statements or financial results and delay in the filing of the Company’s periodic reports with the SEC, including the Amended 10-K and the Amended 10-Q, due to the Company’s efforts to complete the restatements. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements for any reason.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| URBAN-GRO, INC. |

| | |

| Date: August 14, 2024 | By: | /s/ Bradley Nattrass |

| | Bradley Nattrass |

| | Chairperson of the Board of Directors and Chief Executive Officer |

urban-gro, Inc. Announces Delayed 10-Q Filing and Restatement of Previously Issued Financial Statements Tied to Incorrect Accounting of Deferred Tax Liabilities Associated with Historical Acquisitions

No Expected Material Impact on Revenue, Adjusted EBITDA, or Cash Flows

Expects Q2 2024 Revenue of $17.5 Million, a Sequential 13% Increase

LAFAYETTE, Colo., August 14, 2024 – urban-gro, Inc. (NASDAQ: UGRO) ("urban-gro" or the "Company"), an integrated professional services and Design-Build firm offering solutions to the Controlled Environment Agriculture (“CEA”) and other commercial sectors, today announced its decision to restate its previously issued financial statements for the years ended December 31, 2022 and 2023, as well as the first quarter of 2024. As a result of the restatement process, the Company will not be able to file its Quarterly Report on Form 10-Q for the second fiscal quarter of 2024 within the filing deadline established by the Securities and Exchange Commission (the "SEC").

As reported on the Company's Current Report on Form 8-K filed on May 6, 2024, the Company dismissed its previous independent registered public accounting firm, BF Borgers CPA PC ("BF Borgers"). On May 3, 2024, the SEC instituted public administrative and cease-and-desist proceedings against BF Borgers. In the Current Report on Form 8-K filed on May 29, 2024, the Company announced that it had appointed Sadler, Gibb & Associates, LLC ("Sadler Gibb") as its new independent public accounting firm. Sadler Gibb has substantially conducted a re-audit of the Company's previously issued financial statements for the year ended December 31, 2023. In connection with the re-audit of the 2023 financial statements as conducted to date, Sadler Gibb has not identified any material misstatements in the Company's revenue, Adjusted EBITDA, or cash flows.

Sadler Gibb identified incorrect accounting of the deferred tax liabilities associated with historical share-purchase acquisitions made by the Company. Accounting for the initial deferred tax liabilities associated with the acquisitions was determined to be proper, however, the majority of the deferred tax liabilities that were recorded in connection with the share-purchase acquisition of each acquired company should have been recorded as income tax benefits to the statement of operations shortly after each acquisition. The Company had been amortizing these deferred tax liabilities to the statement of operations over a period corresponding to the amortization of the intangible assets with which they were associated. Adjusting for this incorrect accounting is expected to result in a reduction in cumulative net losses for fiscal years 2022 and 2023.

As a result of the audit findings to date, the Company will now engage Sadler Gibb to re-audit the Company's fiscal year 2022 financial statements in order for the Company to file amended 10-K and 10-Q filings for the fiscal years ended December 31, 2023 and 2022 and the fiscal quarters ended March 31, 2022 through March 31, 2024. As part of the 2023 re-audit, Sadler Gibb has identified other immaterial adjustments which will also be adjusted in connection with the amended filings. Based on the information currently available, which is limited to Sadler Gibb's re-audit of the 2023 financial statements, the Company does not expect a material impact to previously reported revenues, Adjusted EBITDA, or cash flows.

As a result, the Company has not yet filed its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and will be unable to file the report by the prescribed due date. Although the Company cannot at this time estimate when it will file its restated financial statements and the Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, it is diligently pursuing completion of the restatements and intends to make such filings as soon as reasonably practicable following the completion of Sadler Gibb's re-audit of the 2022 financial statements.

Based on the preliminary findings by and in consultation with Sadler Gibb, the Company's Audit Committee has determined that the Company's previously issued financial statements for the years ended December 31, 2023 and 2022 and the quarterly periods ended during those fiscal years, as well as the quarter ended March 31, 2024, should no longer be relied upon. Similarly, any previously

issued or filed reports, press releases, earnings releases, investor presentations or other communications of the Company describing the Company's financial results or other financial information relating to those periods should no longer be relied upon.

urban-gro’s Chairman and CEO, Brad Nattrass, commented “while it is disappointing that we need to restate our financials due to this technical accounting situation, we do not expect that it will materially affect our revenues, Adjusted EBITDA, or cash flows. Revenues in the second quarter are expected to exceed $17.5 million, representing a sequential increase of 13%, and our third quarter-to-date performance has accelerated further, giving us confidence that we will generate stronger results in the second half of the year. While we navigate this process with our auditor, we aim to keep our investors updated on our overall progress and expect to announce contracts as they are closed.”

Additional information relating to the restatement is available in the Company's Current Report on Form 8-K filed today.

About urban-gro, Inc.

urban-gro, Inc.® (Nasdaq: UGRO) is an integrated professional services and Design-Build firm. We offer value-added architectural, engineering, and construction management solutions to the Controlled Environment Agriculture ("CEA"), industrial, healthcare, and other commercial sectors. Innovation, collaboration, and creativity drive our team to provide exceptional customer experiences. With offices across North America and in Europe, we deliver Your Vision - Built. Learn more by visiting www.urban-gro.com

Safe Harbor Statement

This press release contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this release, terms such as “believes,” “will,” “expects,” “anticipates,” “may,” “projects” and similar expressions and variations as they relate to the Company or its management are intended to identify forward-looking statements. The forward-looking statements in this press release include, without limitation, the expected impacts of the material misstatements identified in this press release on the Company's net loss, whether any additional misstatements will be identified as part of the re-audit of the Company's 2022, 2023 and first quarter 2024 financial statements, and the expected timing of filing restated periodic reports and the Form 10-Q for the Company's second fiscal quarter of 2024.. These and other forward-looking statements are based on the current expectations, forecasts, beliefs and assumptions of the Company's management and are subject to risks and uncertainties that could cause actual outcomes and results to differ materially from those anticipated or expected, including, among others, our ability to successfully manage and integrate acquisitions, our ability to accurately forecast revenues and costs, competition for projects in our markets, our ability to predict and respond to new laws and governmental regulatory actions, including any potential rescheduling of cannabis and passage of the SAFER Banking Act, our ability to successfully develop new and/or enhancements to our product offerings and develop a product mix to meet demand, risks related to weather conditions that are adverse to our business operations, supply chain issues for the Company or third party suppliers, rising interest rates, economic downturn or other factors that could cause delays or the cancellation of projects in our backlog or our ability to secure future projects, our ability to maintain favorable relationships with suppliers, risks associated with reliance on key customers and suppliers, our ability to attract and retain key personnel, results of litigation and other claims and insurance coverage issues, risks related to our information technology systems and infrastructure, our ability to maintain effective internal controls, our ability to execute on our strategic plans, our ability to achieve and maintain cost savings, the sufficiency of our liquidity and capital resources, and our ability to achieve our key initiatives for 2024, particularly our growth initiatives. A more detailed description of these and certain other factors that could affect actual results is included in the Company’s filings with the Securities and Exchange Commission. Copies of these filings are available online at www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as may be required by law.

Investor Contacts:

Jeff Sonnek - ICR, Inc.

(720) 730-8160

investors@urban-gro.com

Media Contact:

Barbara Graham – urban-gro, Inc.

(720) 903-1139

media@urban-gro.com

v3.24.2.u1

Cover

|

May 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity Registrant Name |

URBAN-GRO, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39933

|

| Entity Tax Identification Number |

46-5158469

|

| Entity Address, Address Line One |

1751 Panorama Point

|

| Entity Address, Address Line Two |

Unit G

|

| Entity Address, City or Town |

Lafayette

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80026

|

| City Area Code |

(720)

|

| Local Phone Number |

390-3880

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

UGRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001706524

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

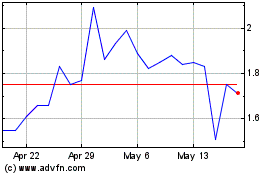

Urban Gro (NASDAQ:UGRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Urban Gro (NASDAQ:UGRO)

Historical Stock Chart

From Nov 2023 to Nov 2024