UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

ADC Therapeutics

SA

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11 |

ADC Therapeutics

SA

Biopôle, Route de la Corniche 3B

1066 Epalinges

Switzerland

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Date and Time: November 11, 2024 at 10:00 AM

EST / 4:00 PM CET

Location: Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland

Dear Shareholders:

We are pleased to invite you to an extraordinary general meeting of

shareholders (the “Special Meeting”) of ADC Therapeutics SA (the “Company”) to be held on November 11, 2024 at

10:00 AM EST / 4:00 PM CET at the Company’s headquarters located at Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland.

At the Special Meeting, shareholders will be asked to consider and

vote upon the following matters, which are discussed in greater detail in the accompanying proxy statement:

| 1. | Approving amendments to Article 4a of the articles of association to increase the Company’s capital range. |

| 2. | Approving amendments to Article 4c of the articles of association to increase the Company’s conditional share capital for financing,

acquisitions and other purposes. |

We will also consider and act upon any other matters that properly

come before the Special Meeting or any adjournment or postponement thereof.

Only shareholders of record at the close of business on September 20,

2024 are entitled to notice of and vote at the Special Meeting or any postponement(s) or adjournment(s) of the Special Meeting.

Under U.S. Securities and Exchange Commission (“SEC”)

rules that allow companies to furnish proxy materials to shareholders over the Internet, we have elected to make our proxy materials available

to all of our shareholders over the Internet. We will be able to provide shareholders with the information they need, while at the same

time conserving natural resources and lowering the cost of delivery. On or about September 23,

2024, we will commence sending to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing

instructions on how to access our proxy statement for the Special Meeting. The Notice also provides instructions on how to vote online

or vote by phone and includes instructions on how to receive a paper copy of the proxy materials by mail.

Whether or not you plan to attend the Special Meeting, it is important

that you cast your vote. You may vote over the Internet, by telephone or by mail. You are urged to vote in accordance with the instructions

set forth in the accompanying proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at

the Special Meeting, whether or not you can attend.

Thank you for your ongoing support of and interest in ADC Therapeutics

SA.

By order of the board of directors,

/s/ Ron Squarer

Chair of the board of directors |

/s/ Peter J. Graham

Secretary |

TABLE OF CONTENTS

| INFORMATION ABOUT THE SPECIAL MEETING |

2 |

| PROPOSAL NO. 1: APPROVING AMENDMENTS TO ARTICLE 4A OF THE ARTICLES OF ASSOCIATION TO INCREASE THE COMPANY’S

CAPITAL RANGE |

7 |

| PROPOSAL NO. 2: APPROVING AMENDMENTS TO ARTICLE 4C OF THE ARTICLES OF ASSOCIATION TO INCREASE THE COMPANY’S

CONDITIONAL SHARE CAPITAL FOR FINANCING, ACQUISITIONS AND OTHER PURPOSES |

10 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

13 |

| OTHER MATTERS |

15 |

ADC Therapeutics

SA

Biopôle, Route de la Corniche 3B

1066 Epalinges

Switzerland

PROXY STATEMENT

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Date and Time: November 11, 2024 at 10:00 AM

EST / 4:00 PM CET

Location: Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland

This proxy statement (this “Proxy Statement”) and Notice

of Extraordinary General Meeting of Shareholders are being provided to you in connection with the solicitation of proxies by our board

of directors for use at our extraordinary general meeting of shareholders (the “Special Meeting”) to be held on November 11,

2024 at 10:00 AM EST / 4:00 PM CET at the Company’s headquarters located at Biopôle, Route de la Corniche 3B, 1066 Epalinges,

Switzerland.

Shareholders of record at the close of business on September 20, 2024

are invited to attend the Special Meeting and are entitled to vote on the proposals described in this Proxy Statement.

On or about September 23,

2024, we made available this Proxy Statement and the attached Notice of Extraordinary General Meeting of Shareholders to all shareholders

entitled to vote at the Special Meeting and we began sending the Notice Regarding the Availability of Proxy Materials to all shareholders

entitled to vote at the Special Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS

FOR THE EXTRAORDINARY MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 11, 2024

This Proxy Statement is not a form for voting and presents only an

overview of the proxy materials, which contain important information. You are encouraged to access and view the complete proxy materials

before voting. This Proxy Statement and the proxy materials are available for viewing, printing and downloading at ir.adctherapeutics.com/sec-filings/annual-reports-and-proxies/default.aspx.

Additionally, you can find a copy of this Proxy Statement on the website of the U.S. Securities and Exchange Commission (the “SEC”)

at sec.gov. You may also obtain a printed copy of this Proxy Statement and the proxy materials, at no cost, upon written or oral

request to us at the following address: Investor Relations, ADC Therapeutics SA, c/o ADC Therapeutics America, Inc., 430 Mountain Avenue,

4th Floor, Murray Hill, NJ 07974; (908) 731-5556.

INFORMATION ABOUT THE SPECIAL MEETING

Why am I receiving this Proxy Statement?

ADC Therapeutics SA (the “Company”) is soliciting proxies

for the Special Meeting. You are receiving this Proxy Statement because you owned common shares of the Company at the close of business

on September 20, 2024, the record date for the Special Meeting, which entitles you to vote at the Special Meeting unless you dispose of

your shares or otherwise cease to have voting rights in relation to your shares before the Special Meeting. By use of a proxy, you can

vote whether or not you attend the Special Meeting. This Proxy Statement describes the matters on which we would like you to vote and

provides information on such matters so that you can make an informed decision.

When and where is the Special Meeting?

The Special Meeting is scheduled to be held on November 11, 2024 at

10:00 AM EST / 4:00 PM CET at the Company’s headquarters located at Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland.

What is the purpose of the Special Meeting?

At the Special Meeting, shareholders will be asked to consider and

vote upon the following matters:

| 1. | Approving amendments to Article 4a of the articles of association to increase the Company’s capital range. |

| 2. | Approving amendments to Article 4c of the articles of association to increase the Company’s conditional share capital for financing,

acquisitions and other purposes. |

We will also consider and act upon any other matters that properly

come before the Special Meeting or any adjournment or postponement thereof. If any other matter properly comes before the shareholders

for a vote at the Special Meeting, unless the shareholder elected otherwise in its instructions to the Independent Proxy, the Independent

Proxy will have authority to vote the proxy on such matters in accordance with the recommendation of the board of directors.

Why did I receive a notice in the mail regarding the Internet

availability of proxy materials instead of a full set of proxy materials?

In accordance with SEC rules, we are permitted to furnish proxy materials

to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. If you received a Notice

of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive a printed copy of the proxy materials.

Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed

to our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also

instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper copy of the proxy materials, you

should follow the instructions for requesting such materials in the Notice.

When is the record date for the Special Meeting?

The record date for the meeting is September 20, 2024. Only shareholders

of record at the close of business on that date are entitled to vote at the meeting (unless they dispose of their shares before the Special

Meeting). No shareholders will be registered in the share register, and will thus become shareholders of record, between the record date

and the date of the Special Meeting.

Will I be able to vote if I sell my shares after the record date?

Only shareholders of record at the close of business on the record

date are entitled to vote at the Special Meeting. Shareholders who sell their shares prior to the Special Meeting will not be able to

vote even if they are in possession of the proxy materials.

How many shares were outstanding as of the record date?

At the close of business on the record date, there were 96,687,709

common shares outstanding. The number of common shares that will be entitled to vote at the Special Meeting will vary depending on

how many common shares are deregistered between the record date and the date of the Special Meeting.

To how many votes am I entitled?

Each common share is entitled to one vote per share on all matters

presented for a vote. However, our articles of association provide that, if an individual or legal entity acquires shares and, as a result,

directly or indirectly, has (alone or in concert with other parties) voting rights with respect to more than 15% of the share capital

recorded in the Commercial Register, the shares exceeding the 15% limit shall be entered in the share register as shares without voting

rights. If shares are being held by a nominee for third-party beneficiaries that control (alone or together with third parties) voting

rights with respect to more than 15% of the share capital, the board of directors may cancel the registration of the shares with voting

rights held by such nominee in excess of the 15% limit.

What is the difference between being a shareholder of record and

a beneficial owner?

Many of our shareholders hold their shares through brokers, banks or

other nominees, rather than directly in their own names. As summarized below, there are some differences between being a shareholder of

record and a beneficial owner.

Shareholder of Record: If your shares are registered directly

in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are the shareholder of record,

and these proxy materials are being sent directly to you. As the shareholder of record, you have the right to grant your voting proxy

directly to the individuals named on the proxy card and to attend and vote at the Special Meeting.

Beneficial Owner: If your shares are held in a stock brokerage

account or by a bank or other nominee, you are the beneficial owner of shares held in “street name,” and these proxy materials

are being forwarded to you by your broker, bank or other nominee, who is considered to be the shareholder of record. As the beneficial

owner, you have the right to tell your nominee how to vote, and you are also invited to attend the Special Meeting. However, since you

are not the shareholder of record, you may not vote your shares at the Special Meeting unless you obtain a legal proxy from your broker,

bank or nominee authorizing you to do so. Your nominee has sent you instructions on how to direct the nominee’s vote in advance

of the meeting through the voting instruction card. You may vote by following those instructions.

I share an address with another shareholder. What do I do if we

received only one paper copy of the proxy materials and want additional copies, or we received multiple copies and want only one?

SEC rules permit companies and intermediaries, such as brokers and

banks, to satisfy proxy statement delivery requirements for two or more shareholders sharing an address by delivering one proxy statement

to those shareholders. This procedure, known as “householding,” reduces the amount of duplicate information that shareholders

receive and lowers our printing and mailing costs. Shareholders who participate in householding will continue to be able to access and

receive separate proxy cards. Upon written or oral request, we will promptly deliver a separate copy of the Notice and, if applicable,

the proxy materials to any shareholder of record at a shared address to which we delivered a single copy of any of these materials. To

receive a separate copy, such shareholder of record may contact Investor Relations, ADC Therapeutics SA, c/o ADC Therapeutics America,

Inc. 430 Mountain Avenue, 4th Floor, Murray Hill, NJ 07974 or by calling (908) 731-5556. Beneficial holders may contact their bank, brokerage

firm, or other nominee to request information about householding.

Conversely, if shareholders of record living at the same address received

multiple copies of the Notice and, if applicable, the proxy materials, you may request delivery of a single copy by contacting us as set

forth above. Beneficial holders may contact their bank, brokerage firm, or other nominee to request a single copy of the Notice and, if

applicable, the proxy materials.

How is a quorum reached?

There is no quorum requirement for the Special Meeting. Under Swiss

law, corporations do not have specific quorum requirements for shareholder meetings, and our articles of association do not otherwise

provide for a quorum requirement.

Who is the independent voting representative for the Special Meeting

and how do I get in touch?

Swiss law requires public companies to appoint an independent voting

representative (the “Independent Proxy”), to whom shareholders of record and nominees can give a proxy to vote on their behalf

as well as voting instructions. The Company’s Independent Proxy is PHC Notaires, in Lausanne, Switzerland. You may contact the Independent

Proxy at PHC Notaires, Pl. Benjamin-Constant 2, Case postale 1269, 1001 Lausanne, Switzerland.

Will representatives of the Company’s independent registered

public accounting firm be present at the Special Meeting?

Representatives of PricewaterhouseCoopers SA are expected to be present

at the Special Meeting, will have the opportunity to make a statement if they desire to do so and are expected to be available to respond

to appropriate questions from shareholders at the Special Meeting.

How can I vote my shares in advance of the Special Meeting?

Whether you hold shares directly as the shareholder of record or beneficially

in street name, you may direct how your shares are voted without attending the Special Meeting.

If you are a shareholder of record, you may vote by giving voting instructions

and authorization to the Independent Proxy electronically through the Computershare portal with the individual shareholder number (QR

Code). To do so, shareholders of record should follow the instructions given in the Notice. Shareholders of record may also give voting

instructions and authorization to the Independent Proxy through Computershare by mail, using a proxy card.

If you are a beneficial owner, you may vote by giving voting instructions

and authorization to the Independent Proxy electronically pursuant to the instructions of your broker or nominee and should use the portal

designated by your broker or nominee. Beneficial owners should observe the deadlines to submit voting instructions and authorizations

that are set in the instructions of their broker or nominee.

Can I attend the Special Meeting in person?

If you are a shareholder of record, or if you are a beneficial owner

and have obtained a legal proxy from your broker, bank or nominee authorizing you to vote at the Special Meeting, you may attend the Special

Meeting in person or arrange to be represented by another person with the right to vote. We recommend that you give voting instructions

and authorization to the Independent Proxy even if you plan to attend the Special Meeting in person.

Shareholders who plan to attend the Special Meeting in person need

to present their proxy card, a valid government-issued proof of identity and evidence of share ownership, such as the most recent account

statement, at the Special Meeting venue. Such shareholders are urged to arrive at the Special Meeting venue no later than 10:00 AM EST

/ 4:00 PM CET on November 11, 2024.

To enable us to determine attendance correctly, shareholders leaving

the Special Meeting early or temporarily will be requested to present their proxy card upon exit.

Can I revoke my proxy and change my vote?

You may revoke your proxy by notifying the Independent Proxy in writing,

by returning a signed proxy with a later date, by transmitting a subsequent vote over the Internet or by telephone, or by attending the

meeting and voting in person. If you choose to revoke your proxy by notifying the Independent Proxy or by returning a signed proxy with

a later date, you must ensure that such action is taken and any notices or documents are received no later than November 4, 2024, 11:59

PM EST / November 5, 2024 at 5:59 AM CET. If you choose to revoke your proxy by transmitting a subsequent vote over the Internet or by

telephone, you must do so prior to the close of the Internet

voting facility or the telephone voting facility at November 6, 2024,

11:59 PM EST / November 7, 2024 at 5:59 AM CET. If your shares are held in street name, you must contact your broker or nominee for instructions

as to how to change your vote.

What if I do not vote my shares?

If you are a shareholder of record, if you do not vote or give instructions

to the Independent Proxy to vote, your shares will not be counted for or against the proposals.

If you are a beneficial owner, if you do not vote or give instructions

to the Independent Proxy to vote via your broker or nominee, then under applicable rules, your broker or nominee will still be able to

vote your shares with respect to certain “routine” items. Proposal #1 (approving amendments to Article 4a of the articles

of association to increase the Company’s capital range) and Proposal #2 (approving amendments to Article 4c of the articles of association

to increase the Company’s conditional share capital for financing, acquisitions and other purposes) are considered routine items.

Accordingly, your broker may vote your shares in its discretion with respect to these proposals even if you do not give voting instructions.

We encourage you to give your broker or nominee voting instructions with respect to all proposals.

How does the board of directors recommend I vote on the proposals?

The board of directors recommends that you vote “FOR” Proposal

#1 (approving amendments to Article 4a of the articles of association to increase the Company’s capital range) and “FOR”

Proposal #2 (approving amendments to Article 4c of the articles of association to increase the Company’s conditional share capital

for financing, acquisitions and other purposes).

What is the vote required to approve the proposals and how are

votes counted?

The affirmative vote of two-thirds of votes represented and the majority

of the par value of the shares represented at the Special Meeting is required for Proposal #1 (approving amendments to Article 4a of the

articles of association to increase the Company’s capital range) and for Proposal #2 (approving amendments to Article 4c of the

articles of association to increase the Company’s conditional share capital for financing, acquisitions and other purposes). Abstentions

will have the same effect as votes “AGAINST” these proposals. We do not expect any broker non-votes for these proposals. Please

refer to “What if I do not vote my shares?” regarding brokers’ ability to vote your shares with respect to routine items.

Are there other matters to be voted on at the Special Meeting?

We do not know of any matters that may come before the Special Meeting

other than the proposals set forth in this Proxy Statement. If any other matters are properly presented at the Special Meeting, unless

the shareholder elected otherwise in its instructions to the Independent Proxy, the Independent Proxy will have authority to vote the

proxy on such matters in accordance with the recommendation of the board of directors.

How are proxies solicited for the Special Meeting and who is paying

for such solicitation?

The board of directors is soliciting proxies for use at the Special

Meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing,

mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers,

banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The

original solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors,

officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such

individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We have retained Alliance Advisors, LLC

as proxy solicitor to assist in the solicitation of proxies for $16,000.

If you choose to access the proxy materials and/or vote over the Internet,

you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges

you may incur.

How can I find out the results of the voting at the Special Meeting?

Final voting results will be contained in a Current Report on Form

8-K that will be filed within four business days after the Special Meeting.

Who should I call if I have any additional questions?

If you are a shareholder of record, you may contact Investor Relations,

ADC Therapeutics SA, c/o ADC Therapeutics America, Inc. 430 Mountain Avenue, 4th Floor, Murray Hill, NJ 07974 or by calling (908) 731-5556.

If you are a beneficial owner, please contact the telephone number provided on your voting instruction form or contact your broker or

nominee holder directly.

What is the mailing address of the Company’s principal executive

office?

The mailing address of our principal executive office is Biopôle,

Route de la Corniche 3B, 1066 Epalinges, Switzerland.

PROPOSAL NO. 1: APPROVING AMENDMENTS TO ARTICLE

4A OF THE ARTICLES OF ASSOCIATION TO INCREASE THE COMPANY’S CAPITAL RANGE

Explanation

Background and Reasons for the Proposal

Shareholders of a Swiss corporation cannot give the board of directors

blanket authorization to issue new shares. However, under Swiss law, companies may have a so-called capital range, under which the board

of directors is authorized to increase and/or decrease the share capital by up to 50% each during a period of up to 5 years.

At our annual general meeting of shareholders held on June 14, 2023,

our shareholders adopted such a capital range, ranging from CHF 7,123,355.68 (lower limit) to CHF 10,685,033.52 (upper limit), in article

4a of our articles of association. Under that capital range, the board of directors is authorized within the capital range to increase

or reduce the share capital once or several times and in any amounts or to acquire or dispose of shares directly or indirectly, until

June 14, 2028 or until an earlier expiry of the capital range. The capital increase or reduction may be effected by issuing up to 44,520,973

fully paid-in registered shares with a par value of CHF 0.08 each and cancelling up to 44,520,973 registered shares with a par value of

CHF 0.08 each, as applicable, or by increasing or reducing the par value of the existing shares within the limits of the capital range

or by simultaneous reduction and re-increase of the share capital.

On the date of our annual general meeting of shareholders held on June

14, 2023, we had 89,041,946 common shares in issue. At that time, the upper limit of our capital range was at the maximum allowed by Swiss

law, namely 150% of our share capital at that time. Since then, we issued 10,411,912 shares out of the capital range in an underwritten

offering in May 2024. Accordingly, the board of directors proposes to amend article 4a para. 1 of the articles of association to increase

the upper and lower limit of the capital range to one ranging from CHF 7,956,308.64 (lower limit) to CHF 11,934,462.96 (upper limit).

The proposed lower limit is equal to our current share capital, which means that our board of directors would not be authorized to reduce

the Company’s share capital to a level below our current share capital. The proposed upper limit corresponds to 150% of our current

share capital, which is the maximum allowed by Swiss law.

In addition, the board of directors proposes to strike the number of

shares that may be issued or canceled within the capital range, as this information is no longer required to be included in our articles

of association according to Swiss legal practice. The number of shares that the board of directors may issue or cancel continues to be

determined by the upper and the lower limit of the capital range as compared to the number of shares in issue at any point in time.

As is the case under the current capital range, the board of directors

has the right to restrict or withdraw shareholders’ pre-emptive rights in the event of an issue of shares within the capital range.

The reasons for the restriction or withdrawal of pre-emptive rights remain the same as under the current capital range.

We have incurred substantial net losses since our inception, expect

to continue to incur losses for the foreseeable future. Accordingly, we may need to raise additional capital to fund our operations and

execute our business plan. The proposed amendments to the articles of association would allow us to raise additional capital through the

sale of our securities to fund our operations and execute our business plan. In addition to financing activities, we would benefit from

deploying our share capital as we pursue strategic licensing transactions, collaborations and acquisitions.

If this proposal is approved, except as required under NYSE listing

standards, no further authorization from shareholders will be necessary or solicited prior to an issuance of common shares within the

capital range.

Approval of this proposal does not mean that the maximum number of

shares authorized to be issued under the capital range will, in fact, be issued. Rather, approval of this proposal gives the board of

directors, in its discretion, the ability to raise additional funds to fund our operations and execute our business plan.

We have no current plans, agreements, arrangements or understandings

relating to the issuance of the additional common shares from the capital range that will become available as a result of the proposed

amendments to the articles of association.

Text of the Proposed Amendments

If this proposal is approved, article 4a, para. 1 of the articles of

association will be amended to reflect the foregoing as follows (red strikethrough text represents deletions and blue underlined text

represents additions):

| English version |

French version |

| Capital Range |

1 The Company has a capital range ranging from CHF 7,123,355.68 7,956,308.64 (lower limit) to CHF 10,685,033.52 11,934,462.96 (upper limit). The Board of Directors shall be authorized within the capital range to increase or reduce the share capital once or several times and in any amounts or to acquire or dispose of shares directly or indirectly, until June 14, 2028 November 11, 2029 or until an earlier expiry of the capital range. The capital increase or reduction may be effected by issuing up to 44,520,973 fully paid-in registered shares with a par value of CHF 0.08 each and cancelling up to 44,520,973 registered shares with a par value of CHF 0.08 each, as applicable, or by increasing or reducing the par value of the existing shares within the limits of the capital range or by simultaneous reduction and re-increase of the share capital. |

Marge de fluctuation du capital |

1 La Société dispose d'une marge de fluctuation du capital allant de CHF 7'123'355.68 7'956'308.64 (limite inférieure) à CHF 10'685'033.52 11'934'462.96 (limite supérieure). Le Conseil d'administration peut, dans les limites définies de la marge de fluctuation, et ce jusqu'au 14 juin 2028 11 Novembre 2029 ou jusqu'à l'expiration anticipée de la marge de fluctuation, augmenter ou réduire le capital-actions en une ou plusieurs fois, de quelque montant que ce soit, ou acquérir ou aliéner des actions directement ou indirectement. L'augmentation ou la réduction du capital peut se faire par l'émission de jusqu'à 44'520'973 d’actions nominatives d'une valeur nominale de CHF 0.08 chacune, qui doivent être intégralement libérées, respectivement l'annulation de jusqu'à 44'520'973 d’actions nominatives d'une valeur nominale de CHF 0.08 chacune, ou par une augmentation ou une réduction, dans les limites de la marge de fluctuation, de la valeur nominale des actions nominatives existantes ou encore par une réduction et une nouvelle augmentation simultanées. |

| |

|

|

|

Anti-Takeover Effects of the Proposal

Release No. 34-15230 of the SEC Staff requires disclosure and discussion

of the effects of any action that may be used as an anti-takeover mechanism. Because the proposed amendments to the articles of association

will result in an increase in the capital range, this proposal could, under certain circumstances, have an anti-takeover effect, although

this is not the purpose or intent of the board of directors. An increase in the capital range could enable the board of directors to render

more difficult or discourage an attempt by a party attempting to obtain control of us by tender offer or other means. The use of the capital

range to issue common shares or securities convertible into or exercisable for common shares in a public or private sale, merger or similar

transaction would increase the number of outstanding shares entitled to vote, increase the number of votes required to approve a change

of control of us and dilute the interest of a party attempting to obtain control of us. Any such issuance could deprive shareholders of

benefits that could result from an attempt to obtain control of the Company, such as the realization of a premium over the market price

that such an attempt could cause. Moreover, the issuance of common shares or securities convertible into or exercisable for common shares

to persons friendly to the board of directors could make it more

difficult to remove incumbent officers and directors from office even

if such change were favorable to shareholders generally.

As stated above, we have no present intent to use the increase in the

capital range for anti-takeover purposes, and the proposed amendments to the articles of association are not part of a plan by the board

of directors to adopt a series of anti-takeover provisions; however, if this proposal is approved by the shareholders, then a greater

amount of common shares or other securities would be available for such purpose than is currently available. This proposal is not the

result of any attempt to obtain control of us and the board of directors has no present intent to authorize the issuance of additional

common shares or other securities to discourage any such efforts if they were to arise.

Dissenters’ Right of Appraisal

Under Swiss law, shareholders are not entitled to dissenters’

right of appraisal or similar right with respect to this proposal. We will not independently provide shareholders with any such right

or similar right.

Interests of Certain Persons in the Proposal

Certain of our directors and executive officers have an interest in

this proposal as a result of their ownership of our common shares, as set under “Security Ownership of Certain Beneficial Owners

and Management.” However, we do not believe that our directors or executive officers have interests in this proposal that are different

from or greater than those of any of our other shareholders.

Proposal

The board of directors proposes that the amendments to article 4a of

the articles of association to increase the Company’s capital range be approved.

Voting Requirement

The affirmative vote of two-thirds of the votes represented and the

majority of the par value of the shares represented at the Special Meeting is required for this proposal. Abstentions will have the same

effect as votes “AGAINST” this proposal. This is a “routine” item and thus we do not expect any broker non-votes.

Recommendation

The board of directors recommends that you vote “FOR”

this proposal.

PROPOSAL NO. 2: APPROVING AMENDMENTS TO ARTICLE

4C OF THE ARTICLES OF ASSOCIATION TO INCREASE THE COMPANY’S CONDITIONAL SHARE CAPITAL FOR FINANCING, ACQUISITIONS AND OTHER PURPOSES

Explanation

Background and Reasons for the Proposal

Swiss companies may have a so-called conditional share capital, under

which new shares in the amount of up to 50% of the share capital can be issued through the exercise or mandatory exercise of equity-linked

instruments issued by the board of directors. Our articles of association provide for (i) a conditional share capital for employee participation

and (ii) a conditional share capital for financing, acquisitions and other purposes, both of which set forth the maximum number of new

common shares that the board of directors is authorized to use as underlying such equity-linked instruments. Our conditional share capital

for financing, acquisitions and other purposes (article 4c of our articles of association) authorizes our board of directors to issue

a certain number of common shares through the exercise or mandatory exercise of conversion, exchange, option, warrant or similar rights

or obligations for the subscription of common shares granted to shareholders or third parties on a stand-alone basis or in connection

with bonds, notes, options, warrants or other securities or contractual obligations of the Company or any of its group companies, including,

without limitation, convertible debentures (collectively, the “Financial Instruments”).

At the time of our initial public offering in May 2020, our articles

of association provided for a conditional share capital for financing, acquisitions and other purposes that authorized the board of directors

to issue up to 20,300,000 common shares pursuant to article 4c of our articles of association. As of the date of our annual general meeting

of shareholders held on June 13, 2024, we had reserved 13,103,400 common shares out of the remaining 17,909,703 common shares still available

under this conditional share capital. Given the limited number of common shares still available under this conditional share capital,

the board of directors proposes to amend article 4c para. 1 of the articles of association to increase the number of common shares issuable

under this conditional share capital to the maximum number permissible under Swiss law, being 50% of our share capital, minus the number

of common shares issuable under our conditional share capital for employee participation.

As is the case under the current conditional share capital for financing,

acquisitions and other purposes, the board of directors has the right to restrict or withdraw shareholders’ pre-emptive rights in

the event of an issue of Financial Instruments using this conditional share capital. The reasons for the restriction or withdrawal of

pre-emptive rights remain the same as under the current conditional share capital for financing, acquisitions and other purposes.

We have incurred substantial net losses since our inception, expect

to continue to incur losses for the foreseeable future. Accordingly, we may need to raise additional capital to fund our operations and

execute our business plan. The proposed amendments to the articles of association would allow us to raise additional capital through the

sale of securities convertible into or exercisable for our common shares or similar Financial Instruments to fund our operations and execute

our business plan. In addition to financing activities, we would benefit from deploying our conditional share capital for financing, acquisitions

and other purposes such as optimizing our capital structure, as we pursue strategic licensing transactions, collaborations, acquisitions

and other strategic transactions.

If this proposal is approved, except as required under NYSE listing

standards, no further authorization from shareholders will be necessary or solicited prior to an issuance of Financial Instruments or

common shares upon the conversion or exercise of Financial Instruments under the conditional share capital for financing, acquisitions

and other purposes. The terms of any such Financial Instruments, including dividend or interest rates, conversion prices, voting rights,

redemption prices, maturity dates and similar matters, will be determined by our board of directors.

Approval of this proposal does not mean that the maximum number of

shares authorized to be issued under the conditional share capital for financing, acquisitions and other purposes provision will, in fact,

be issued. Rather, approval of this proposal gives the board of directors, in its discretion, the ability to raise additional funds to

fund our operations and execute our business plan.

We have no current plans, agreements, arrangements or understandings

relating to the issuance of additional Financial Instruments convertible into or exercisable for the additional common shares that would

be available under

the conditional share capital for financing, acquisitions and other

purposes if our shareholders approve the proposed amendments to the articles of association, which would result in an increase in the

aggregate number of outstanding common shares and common shares issuable upon the conversion or exercise of Financial Instruments.

Text of the Proposed Amendments

If this proposal is approved, article 4c, para. 1 of the articles of

association will be amended to reflect the foregoing as follows (red strikethrough text represents deletions and blue underlined text

represents additions):

| English version |

French version |

| Conditional Share Capital for Financing, Acquisitions and other Purposes |

1 The share capital may be increased including in connection with an intended takeover in an amount not to exceed CHF 1,432,776.24 3,042,154.32 through the issuance of up to 17,909,703 38,026,929 fully paid in registered shares with a par value of CHF 0.08 per share through the exercise or mandatory exercise of conversion, exchange, option, warrant or similar rights or obligations for the subscription of shares granted to shareholders or third parties on a stand-alone basis or in connection with bonds, notes, options, warrants or other securities or contractual obligations of the Company or any of its group companies, including without limitation a convertible debenture to be entered into by the Company, as may be amended or novated from time to time (hereinafter collectively, the Financial Instruments). |

Capital-actions conditionnel aux fins de financement, acquisitions ou d'autres buts |

1 Le capital-actions peut être augmenté, y compris en lien avec une future offre publique d'acquisition, d'un montant maximum de CHF 1'432'776.24 3'042'154.32 par l'émission de 17'909'703 38'026'929 actions nominatives au plus, d'une valeur nominale de CHF 0.08 chacune, qui doivent être intégralement libérées par l'exercice ou l'exercice obligatoire de droits de conversion, d'échange, d'option, de warrant ou d'autres droits ou obligations similaires pour la souscription d'actions octroyés aux actionnaires ou à des tiers de manière autonome ou en rapport avec des obligations, effets, options, warrants ou autres instruments financiers ou obligations contractuelles de la Société ou de l'une des sociétés du groupe, y compris, mais sans s'y limiter, une débenture convertible de la société, laquelle peut être amenée à être modifiée ou actualisée (ci-après désignés collectivement les Instruments Financiers). |

| |

|

|

|

Anti-Takeover Effects of the Proposal

Release No. 34-15230 of the SEC Staff requires disclosure and discussion

of the effects of any action that may be used as an anti-takeover mechanism. Because the proposed amendments to the articles of association

will result in an increase in conditional share capital for financing, acquisitions and other purposes, this proposal could, under certain

circumstances, have an anti-takeover effect, although this is not the purpose or intent of the board of directors. An increase in conditional

share capital for financing, acquisitions and other purposes could enable the board of directors to render more difficult or discourage

an attempt by a party attempting to obtain control of us by tender offer or other means. The use of conditional share capital for financing,

acquisitions and other purposes to issue securities convertible into or exercisable for the additional common shares in a public or private

sale, merger or similar transaction would increase the number of outstanding shares entitled to vote, increase the number of votes required

to approve a change of control of us and dilute the interest of a party attempting to obtain control of us. Any such issuance could deprive

shareholders of benefits that could result from an attempt to obtain control of the Company, such as the realization of a premium over

the market price that such an attempt could cause. Moreover, the issuance of securities convertible into or exercisable for common shares

to persons friendly to the board of directors could make it more difficult to remove incumbent officers and directors from office even

if such change were favorable to shareholders generally.

As stated above, we have no present intent to use the increase in the

conditional share capital for financing, acquisitions and other purposes for anti-takeover purposes, and the proposed amendments to the

articles of association are not part of a plan by the board of directors to adopt a series of anti-takeover provisions; however, if this

proposal is approved by the shareholders, then a greater amount of common shares or other securities would be available for such purpose

than is currently available. This proposal is not the result of any attempt to obtain control of us and the board of directors has no

present intent to authorize the issuance of securities convertible into or exercisable for the additional common shares to discourage

any such efforts if they were to arise.

Dissenters’ Right of Appraisal

Under Swiss law, shareholders are not entitled to dissenters’

right of appraisal or similar right with respect to this proposal. We will not independently provide shareholders with any such right

or similar right.

Interests of Certain Persons in the Proposal

Certain of our directors and executive officers have an interest in

this proposal as a result of their ownership of our common shares, as set under “Security Ownership of Certain Beneficial Owners

and Management.” However, we do not believe that our directors or executive officers have interests in this proposal that are different

from or greater than those of any of our other shareholders.

Proposal

The board of directors proposes that the amendments to article 4c of

the articles of association to increase the Company’s conditional share capital for financing, acquisitions and other purposes be

approved.

Voting Requirement

The affirmative vote of two-thirds of the votes represented and the

majority of the par value of the shares represented at the Special Meeting is required for this proposal. Abstentions will have the same

effect as votes “AGAINST” this proposal. This is a “routine” item and thus we do not expect any broker non-votes.

Recommendation

The board of directors recommends that you vote “FOR”

this proposal.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table presents information relating to the beneficial

ownership of our common shares as of September 1, 2024:

| · | each person, or group of affiliated persons, known by us to own beneficially 5% or more of our outstanding common shares; |

| · | each of our executive officers and directors; and |

| · | all executive officers and directors as a group. |

The number of common shares beneficially owned by each entity, person,

executive officer or director is determined in accordance with the rules of the SEC, and the information is not necessarily indicative

of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any common shares over which the individual

has sole or shared voting power or investment power as well as any common shares that the individual has the right to acquire within 60

days from September 1, 2024 through the exercise of any option or other right. Except as otherwise indicated, and subject to applicable

community property laws, we believe that the persons named in the table have sole voting and investment power.

The percentage of outstanding common shares beneficially owned is computed

based on 96,666,748 common shares outstanding as of September 1, 2024. Common shares that a person has the right to acquire within 60

days are deemed outstanding for purposes of computing the percentage ownership of the person holding such rights, but are not deemed outstanding

for purposes of computing the percentage ownership of any other person, except with respect to the percentage ownership of all executive

officers and directors as a group. Unless otherwise indicated below, the business address for each beneficial owner is ADC Therapeutics

SA, Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland.

| Principal Shareholders |

|

Number of Common Shares Beneficially Owned |

|

Percentage of Common Shares Beneficially Owned |

| 5% Shareholders |

|

|

|

|

| Redmile Group LLC (1) |

|

15,269,217 |

|

15.8% |

| Dr. Hans-Peter Wild and entities affiliated with Dr. Hans-Peter Wild (2) |

|

9,788,944 |

|

10.1% |

| Prosight Management L.P. (3) |

|

9,570,000 |

|

9.9% |

| Executive Officers and Directors |

|

|

|

|

| Robert Azelby |

|

23,338 |

|

* |

| Jean-Pierre Bizzari |

|

56,904 |

|

* |

| Jose “Pepe” Carmona |

|

210,833 |

|

* |

| Peter Hug |

|

142,644 |

|

* |

| Ameet Mallik |

|

991,845 |

|

1.0% |

| Viviane Monges |

|

94,783 |

|

* |

| Thomas Pfisterer(4) |

|

625,756 |

|

* |

| Tyrell J. Rivers (5) |

|

— |

|

* |

| Victor Sandor |

|

71,998 |

|

* |

| Ron Squarer (6) |

|

1,545,007 |

|

1.6% |

| Mohamed Zaki |

|

233,333 |

|

* |

| All executive officers and directors as a group (11 persons) |

|

3,996,441 |

|

4.1% |

* Less than 1% of our total

outstanding common shares.

| (1) | This information is based on a Schedule 13F filed with the SEC on August 14, 2024 by Redmile Group, LLC. The common shares are owned

by certain private investment vehicles and/or separately managed accounts managed by Redmile Group, LLC. The reported securities may be

deemed beneficially owned by Redmile Group, LLC as investment manager of such private investment vehicles and/or |

separately managed accounts, as well

as by Jeremy C. Green as the principal of Redmile Group, LLC. Redmile Group, LLC and Mr. Green each disclaim beneficial ownership of these

shares, except to the extent of its or his pecuniary interest in such shares, if any. The business address of each of Redmile Group, LLC

and Mr. Green is One Letterman Drive, Building D, Suite D3-300, The Presidio of San Francisco, San Francisco, California 94129.

The number of common shares beneficially owned by Redmile

Group, LLC excludes 8,163,265 common shares issuable upon the exercise of pre-funded warrants, as such warrants include a provision that

a holder is prohibited from exercising such warrants to the extent that, upon such exercise, the number of common shares then beneficially

owned by the exercising holder and its affiliates and any other person or entity with whom the exercising holder’s beneficial ownership

would be aggregated for purposes of Section 13(d) under the Exchange Act, would exceed 9.99% of the total number of common shares outstanding

immediately after giving effect to such exercise.

| (2) | Dr. Hans-Peter Wild holds a portion of the shares directly and the other portion indirectly via HP WILD Holding AG (“HPW Holding”)

and HPWH TH AG (“HPWH”). The principal business of HPWH is holding investment rights in, directly or indirectly, ADC Therapeutics.

HPW Holding is an intermediary holding company. Dr. Hans-Peter Wild is the chairman of HPWH and HPW Holding. |

| (3) | This information is based on a Schedule 13F filed with the SEC on August 14, 2024 by Prosight Management, LP. The business address

of each of the foregoing persons and entities is c/o Prosight Management, LP, 5956 Sherry Lane, Suite 1365, Dallas, Texas 75225. |

| (4) | Thomas Pfisterer holds a portion of the shares directly and the other portion indirectly via HPWH TH AG (“HPWH”) and HPWH

MH AG (“MH”). The principal business of HPWH is holding investment rights in, directly or indirectly, ADC Therapeutics. HP

WILD Holding AG (“HPW Holding”) is an intermediary holding company. Thomas Pfisterer is a board member of HPWH. By reason

of a stockholders’ agreement by and among Mr. Pfisterer and HPW Holding and their joint indirect minority equity interest in HPWH

via their joint ownership of MH, which owns a 12.5% interest in HPWH, Mr. Pfisterer may be deemed to have shared voting and investment

power with respect to such shares held of record by HPWH. However, Mr. Pfisterer disclaims beneficial ownership of all common shares held

of record by HPWH other than the shares indirectly represented by his 41.7% interest in MH. |

| (5) | Mr. Rivers, an executive director within AstraZeneca’s corporate development group, disclaims beneficial ownership with respect

to common shares held of record by AstraZeneca. |

| (6) | Includes 159,026 shares held by a trust in which Mr. Squarer serves as a settlor and trustee. |

OTHER MATTERS

Other Business at the Special Meeting

As of the date of this Proxy Statement, we know of no other business

that will be conducted at the Special Meeting other than as described in this Proxy Statement. If any other matter or matters are properly

brought before the Special Meeting or any adjournment or postponement of the Special Meeting, unless the shareholder elected otherwise

in its instructions to the Independent Proxy, the Independent Proxy will have authority to vote the proxy on such matters in accordance

with the recommendation of the board of directors.

Availability of Proxy Materials

This Proxy Statement is posted on the Investors section of our website

adctherapeutics.com and is available from the SEC at its website at sec.gov. You may also obtain a printed copy of this

Proxy Statement and the proxy materials, at no cost, upon written or oral request to us at the following address:

Investor Relations

ADC Therapeutics SA

c/o ADC Therapeutics America, Inc.

430 Mountain Avenue, 4th Floor

Murray Hill, NJ 07974

(908) 731-5556

Corporate Website

We maintain a website at adctherapeutics.com. Information contained

on, or that can be accessed through, our website is not incorporated by reference into this Proxy Statement, and references to our website

address in this Proxy Statement are inactive textual references only.

2025 Annual General Meeting of Shareholders

Shareholders wishing to present a proposal for inclusion in our proxy

materials for the 2025 annual general meeting of shareholders pursuant to Rule 14a-8 of the Exchange Act must timely submit their proposals

so that they are received by our Secretary at the address below no later than December 27, 2024 (120 calendar days prior to the anniversary

of our mailing of the proxy statement for our 2024 annual general meeting of shareholders). The submission of a shareholder proposal does

not guarantee that it will be included in our proxy statement and any such proposal must comply with the requirements of Rule 14a-8 in

order to be considered for inclusion in our proxy materials for the 2025 annual general meeting of shareholders. Any communication to

be made to our Secretary should be sent to ADC Therapeutics SA, c/o ADC Therapeutics America, Inc., 430 Mountain Avenue, 4th Floor, Murray

Hill, NJ 07974, Attention: Secretary.

Shareholders who, alone or together, represent at least 0.5% of the

share capital or voting rights may request that an item be included on the agenda of a meeting of shareholders or that a proposal with

respect to an existing agenda item be included in the proxy statement for the 2025 annual general meeting of shareholders. Assuming the

2025 annual general meeting of shareholders is held in accordance with Swiss law on June 13, 2025, shareholders wishing to include an

item on the agenda or a proposal with respect to an agenda item (including the nomination of a candidate for election to the board of

directors) in the proxy statement for the 2025 annual general meeting of shareholders, other than pursuant to Rule 14a-8 of the Exchange

Act, must submit a written notice so that it is received by our Secretary no later than March 17, 2025 (90 calendar days prior to the

assumed date of the 2025 annual meeting of shareholders).

Any shareholder proposal or director nominations, including proposals

pursuant to Rule 14a-8 of the Exchange Act, must comply with Swiss law and our articles of association.

To solicit proxies in support of director nominees other than the Company’s

nominees, a shareholder must give timely notice that complies with the requirements of Rule 14a-19 and which must be received no later

than April 14, 2025 (60 days prior to the anniversary of the 2024 annual general meeting of shareholders).

Electronic

Voting Instructions Available 24 hours a day, 7 days a week! Instead of mailing your proxy, you may choose the voting method outlined

below to vote your proxy. VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. Electronic voting instructions must be received by Computershare

no later than November 6, at 11:59 p.m. EST / November 7 at 5:59 a.m. CET Proxy cards by mail must be received by Computershare no later

than November 4, at 11:59 p.m. EST / November 5 at 5:59 a.m. CET Vote by Internet www.envisionreports.com/ADCT Using a black ink pen,

mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Extraordinary

General Meeting Proxy Card

A

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE

Proposals

— The Board of Directors recommend a vote FOR all the nominees listed,

Approving

amendments to Article 4a of the articles of association to increase the Company’s capital range The Board of Directors proposes

that the amendments to Article 4a of the articles of association to increase the Company’s capital range be approved. The Board

of Directors recommends that you vote “FOR” this proposal.

Approving

amendments to Article 4c of the articles of association to increase the Company’s conditional share capital for financing, acquisitions

and other purposes The Board of Directors proposes that the amendments to Article 4c of the articles of association to increase the Company’s

conditional share capital for financing, acquisitions and other purposes be approved. The Board of Directors recommends that you vote

“FOR” this proposal.

If

a new proposal is made under a new or existing agenda item, I instruct the independent proxy to:

vote

in accordance with the recommendation of the Board of Directors vote against the proposal abstain

Extraordinary General Meeting

Admission Ticket Extraordinary General Meeting of ADC Therapeutics SA Shareholders Monday, November 11, 2024, at 10:00 a.m. EST / 4:00

p.m. CET Headquarters of ADC Therapeutics SA Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland Upon arrival, please

present this admission ticket, photo identification and evidence of share ownership at the registration desk.

IF VOTING BY MAIL, SIGN,

DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE

Proxy — ADC Therapeutics

SA

Notice of 2024 Extraordinary

General Meeting of Shareholders Proxy Solicited by Board of Directors for Extraordinary General Meeting Date and Time: November 11, 2024

at 10:00 AM EST / 4:00 PM CET Location: Biopôle, Route de la Corniche 3B, 1066 Epalinges, Switzerland Notary firm PHC Notaires,

in Lausanne, Switzerland, with the power of substitution, independent proxy, is hereby authorized to represent and vote the shares of

the undersigned, with all the powers which the undersigned would possess if personally present, at the Extraordinary General Meeting

of Shareholders of ADC Therapeutics SA to be held on November 11, 2024, or at any postponement or adjournment thereof. Shares represented

by this proxy will be voted as directed by the independent proxy. If no such directions are indicated, the independent proxy will have

authority to vote FOR items 1 and 2 and in accordance with the recommendation of the Board of Directors in the event of a new proposal

under a new or existing agenda item. (Items to be voted appear on reverse side)

B Authorized Signatures

— This section must be completed for your vote to be counted. — Date and Sign Below

NOTE: Please sign as name

appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full

title as such. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature

2 — Please keep signature within the box.

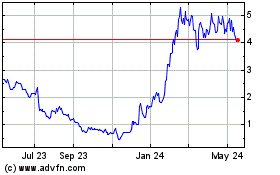

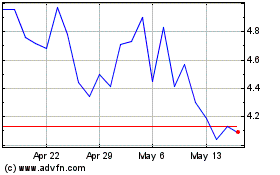

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

From Nov 2024 to Dec 2024

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

From Dec 2023 to Dec 2024