Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

August 02 2023 - 3:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

AMREP CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with

preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

August 2, 2023

To Our Owners:

During 2023, we

delivered strong results in our two core businesses of land development and homebuilding, recognized a substantial income tax benefit

and significantly reduced our pension liabilities with lump sum payments and an annuity purchase. Our headline financial results included

$48.7 million in revenues, $6.4 million in net cash provided by operating activities and $21.8 million

in net income. Highlights of the year included:

| · | Core Businesses: We generated developed residential land sale revenues of $25.7 million in 2023

versus $22.0 million in 2022 and our homebuilding segment closed on the sale of 32 homes in 2023 with $16.7 million in revenues as compared

to 41 homes in 2022 with $13.6 million in revenues. This excellent performance took place in an operating environment with significant

inflation, rapidly rising interest rates and continued material and labor shortages and price increases. During 2023, we reduced the number

and scope of our active land development projects and delayed proceeding with certain new land development projects due to market headwinds

and uncertainty. |

| · | Commercial Property: We generated developed commercial land sale revenues of $4.8 million with

sales of 3.8 acres of developed commercial land in New Mexico. |

| · | Other Assets: We generated other income of $1.8 million by selling our minerals

and mineral rights in Brighton, Colorado. |

| · | Pension: We recognized a non-cash pre-tax pension settlement expense of $7.6 million due to our

defined benefit pension plan paying certain lump sum payouts of pension benefits to former employees and the transfer of nearly all remaining

pension benefit liabilities to an insurance company through an annuity purchase. We did not provide any additional funds to the pension

plan for these activities. As of April 30, 2023, we had $283,000 of liabilities in our pension plan and a significantly reduced administrative

burden and cost related thereto. |

| · | Taxes: We recognized a non-cash income tax benefit of $14.1 million primarily due to a worthless

stock deduction related to our former fulfillment services business. This benefit should reduce future income taxes that are payable. |

| · | Inventory and Investment Assets: We increased our real estate inventory and investment assets by

$3.1 million in connection with the production of finished residential lots and homes and limited acquisitions of land at opportunistic

pricing. |

| · | Cash Position: Our cash position as of April 30, 2023 was $20.0 million, which compares favorably

to our historical fiscal year-end cash balances. We were able to limit our debt financing needs by relying on cash flow from operations

and available cash. |

We encourage you to read our annual report on

Form 10-K to understand the details of these results.

AMREP

CORPORATION

850 West Chester Pike, Suite 205 ● Havertown, Pennsylvania

19083

As you know, we are a small company compared to

most other public companies – whether measured in terms of market capitalization, share trading volume, revenues, income, employees

or board members. We have been a small company for many years and likely will continue to be one in the years to come. We have optimized

our cost structure to reflect this fact and believe our size provides competitive advantages in seizing opportunities and minimizing operational

risks.

One of the quirks of being a small company is

that shareholders have difficulty readily acquiring and selling significant amounts of AMREP shares. For example, the average daily trading

volume of our shares on the New York Stock Exchange during fiscal 2023 was approximately 7,700 shares per day – an amount too small

to allow for easy entry or exit from a large investment. This inability to quickly monetize a large share position in AMREP may sometimes

surprise investors, especially those that do not regularly invest in small public companies.

So, then, how do we address this structural issue

over which we have no direct control but which can create a lot of noise around our stock and easily distract our management? For us,

the answer is simple and clear: we are firmly committed to managing AMREP with a disciplined focus on delivering sustainable and growing

profitability that will benefit long-term holders of our common stock. In so doing, we seek to avoid being sidetracked by short-term concerns

that would take our eyes off the ball.

With this in mind, AMREP enters fiscal 2024 expecting

continued growth in our homebuilding business and some uncertainty in our residential land development business which is dependent on

the activity level of our major homebuilder customers, punctuated by opportunistic land dispositions and acquisitions. We continue to

operate with the goal and strategy of being a leading New Mexico real estate company focused on sustainable long-term success and profitability

through careful advance planning and meticulous project execution. Our strategy will continue to leverage our talented and highly dedicated

team of employees to expand our operations through homebuilding, land development and other value-added related real estate capabilities.

Our goal, strategy and operations are intended to generate strong future returns on capital and maximize per share equity value on a long-term

basis.

We appreciate your continued support.

Sincerely,

|

Christopher V. Vitale

President and Chief Executive Officer |

Edward B. Cloues, II

Chairman of the Board |

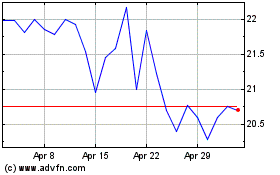

AMREP (NYSE:AXR)

Historical Stock Chart

From Apr 2024 to May 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From May 2023 to May 2024