BlackRock CEO Larry Fink Earns $25 Million in 2019

April 09 2020 - 4:13PM

Dow Jones News

By Dawn Lim

BlackRock Inc. Chief Executive Laurence Fink earned $25.25

million last year, a 5% boost for an increasingly influential

figure behind the U.S. government's response to the coronavirus

crisis.

Mr. Fink's pay for his work in 2019 included a $7.75 million

cash award, $16 million in stock and other incentives, as well as a

base salary of $1.5 million.

By another measure that calculates executive payouts in line

with Securities and Exchange Commission guidelines, Mr. Fink made

$24.3 million, a decrease of 8.4% in 2019. But that figure captured

earnings from 2018 and isn't as reliable of a proxy for one

year.

The pay boost reflects a year where the world's largest money

manager took in record investor money and hit a $7.43 trillion

record for assets under management. Even so, the firm continued to

face significant competition and wrestled with a raging price

war.

BlackRock's bonus pool for 2019 was largely flat compared with

2018, said people familiar with the matter.

Mr. Fink, 67, has emerged as one of the most visible finance

executives in the world in recent weeks, as countries have wrestled

with the toll of coronavirus. He has spoken with President Trump as

well as other world leaders, like Mexican President Andrés Manuel

López Obrador, during this critical period for governments.

His firm, BlackRock, was tapped by the Federal Reserve to steer

as much as hundreds of billions in corporate bond purchases, an

unprecedented measure by the central bank to shore up the economy.

It turned BlackRock into the envy of the investment world -- and a

target for rivals and critics of the Fed's swift and extraordinary

interventions.

BlackRock took in roughly $429 billion in new money last year,

more than three times the net flows it attracted in 2018. The firm

also reported higher profit and revenue, though operating margins

were roughly flat.

Mr. Fink has pushed BlackRock to become a bigger presence in

alternatives to stock and bond investments and a larger provider of

software for Wall Street and other financial institutions. He has

also pressed the firm to keep expanding its fast-growing

exchange-traded funds business.

Among Mr. Fink's top lieutenants, President Rob Kapito earned

$19.95 million for his work in 2019 and Chief Operating Officer

Robert Goldstein earned $9.85 million in 2019.

Across the industry, asset management professionals' bonuses

fell 3% in 2019, compared with 2018, according to compensation

consulting firm Johnson Associates. It projects that asset

management professionals will end 2020 with even more severe

decreases in bonus packages at the end of this year.

Intense stress in markets is taking its toll on asset managers

this year, as they prepare to report quarterly earnings in coming

weeks. Many are facing intense pressure to avoid layoffs, the

typical way they have cut costs. BlackRock told employees this week

that it wouldn't lay off any staffers because of the impact of the

new coronavirus.

Shares of BlackRock declined roughly 6% in the year to date on a

total return basis, a sharp reversal from the roughly 32% total

return they delivered in 2019. Total returns include price gains

and dividends. The firm's stock price is outperforming many asset

management rivals.

Write to Dawn Lim at dawn.lim@wsj.com

(END) Dow Jones Newswires

April 09, 2020 16:58 ET (20:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

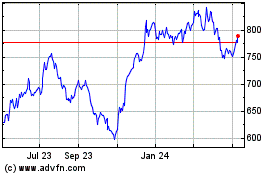

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

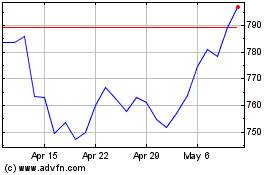

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024