This release includes business updates and unaudited interim

financial results for the three ("Q2", "Q2 2023" or the "Quarter")

and six months ("1H 2023") ended June 30, 2023 of Cool Company Ltd.

("CoolCo" or the "Company") (NYSE:CLCO / CLCO.OL).

Q2 Highlights and Subsequent Events

- Generated total operating revenues of $90.3 million in Q2,

compared to $98.6 million for the first quarter of 2023 ("Q1" or

"Q1 2023"), the reduction mainly related to the sale of Golar Seal

in late March 2023.

- Net income of $44.6 million in Q2, compared to $70.1 million

for Q1;

- Achieved average Time Charter Equivalent Earnings ("TCE")1 of

$81,100 per day for Q2, compared to $83,700, per day for Q1, mainly

attributable to a lower variable rate charter that is linked to the

spot-market;

- Adjusted EBITDA1 of $59.9 million for Q2, compared to $67.8

million for Q1;

- The Company announced that it has exercised its option to

acquire two newbuild 2-stroke LNG carriers from affiliates of EPS

Ventures Ltd (“EPS”). The state-of-the-art MEGA LNG carriers (the

“Newbuilds”) are scheduled to be delivered from Hyundai Samho Heavy

Industries (“HHI”) in Korea in September and December of 2024;

- On June 28, 2023, bank approval was granted for a $70 million

increase under the senior secured sustainability linked amortizing

term loan (the “$570 million bank facility"), in addition to a

reduction in the interest rate margin under the $570 million bank

facility from 275 basis points to 225 basis points;

- Declared a dividend for Q2 of $0.41 per share, to be paid to

shareholders of record on September 11, 2023.

Richard Tyrrell, CEO, commented:

“During the second quarter, we achieved full utilization across

the CoolCo fleet and secured well-timed growth through the exercise

of our option on two state-of-the-art newbuild MEGA LNG carriers

with deliveries in late 2024, newbuild pricing materially below

current levels and committed financing in place subject to

documentation. By exercising our option to acquire these vessels

with scheduled delivery years well in advance of comparable

newbuild orders, we are one of the few independent owners with

availability in an early period of rapid expected growth in LNG

supply. In conjunction with our three existing vessels that come

into the charter market in 2023 and 2024, of which two are

currently at rates well below prevailing levels, we have a clear

path towards the realization of significant incremental value,

cashflow, and continued dividend-paying capacity.

“With the approach of winter in the Northern Hemisphere, which

is typically accompanied by a surge in LNG carrier demand related

to both increased gas consumption and additional utilization for

floating storage, trading arbitrage involving lengthy voyages to

the Far East, and weather-related delays that soak up shipping

capacity, the market seems tightly coiled. Moreover, the recent

extreme volatility in gas pricing demonstrates a continued emphasis

on energy security, as importers continue to put a premium on the

commodity and the shipping capacity required to ensure security of

supply.

“It remains to be seen how the coming winter will ultimately

play out, but similar tightness of both cargoes and shipping

capacity has historically presaged dramatic inflections in the spot

charter market and provided firm support for both rates and charter

durations in the more stable time charter market. As owners of

modern LNG carriers that will be available for time charter

employment through the medium term, we believe that our strategy of

combining the certainty of long-term charter coverage with a

measured amount of charter market exposure has the potential to

shine in the quarters ahead.”

1 Refer to 'Appendix A' - Non-GAAP financial measures and

definitions, for definitions of these measures and a reconciliation

to the nearest GAAP measure.

Financial Highlights

The table below sets forth certain key financial information for

Q2 2023, Q1 2023, 1H 2023 and 1H 2022, split between Successor and

Predecessor periods, as defined below.

Q2 2023

Q1 2023

1H 2023

1H 2022

(in thousands of $, except TCE)

Successor

Successor

Successor

Successor

Predecessor

Total

Time and voyage charter revenues

82,071

91,168

173,239

49,822

37,289

87,111

Total operating revenues

90,316

98,649

188,965

56,892

43,456

100,348

Operating income

45,484

52,022

97,506

25,631

27,728

53,359

Net income

44,646

70,132

114,778

17,659

23,244

40,903

Adjusted EBITDA1

59,894

67,814

127,708

33,527

33,473

67,000

Average daily TCE1

(to the closest $100)

81,100

83,700

82,500

60,500

57,100

59,100

Note: As noted previously, the

commencement of operations and funding of CoolCo and the

acquisition of its initial tri-fuel diesel electric ("TFDE") LNG

carriers, The Cool Pool Limited and the shipping and FSRU

management organization from Golar LNG Limited ("Golar") were

completed in a phased process. It commenced with the funding of

CoolCo on January 27, 2022 and concluded with the acquisition of

the LNG carrier and FSRU management organization on June 30, 2022,

with vessel acquisitions taking place on different dates over that

period. Results for the six months that commenced January 1, 2022

and ended June 30, 2022 have therefore been split between the

period prior to the funding of CoolCo and various phased

acquisitions of vessel and management entities (the "Predecessor"

period) and the period subsequent to the various phased

acquisitions (the "Successor" period). The combined results are not

in accordance with U.S. GAAP and consist of the aggregate of

selected financial data of the Successor and Predecessor periods.

No other adjustments have been made to the combined presentation.

We cannot adequately benchmark the operating results for the six

month period ended June 30, 2023 against the previous period

reported in our comparative unaudited condensed consolidated and

combined carve-out financial statements without combining the

applicable Successor and Predecessor periods and do not believe

that reviewing the results of the periods in isolation would be

useful in identifying trends in or reaching conclusions regarding

our overall operating performance.

LNG Market Review

The average Japan/Korea Marker gas price ("JKM") for the Quarter

was $11.06/MMBtu compared to $17.05/MMBtu for Q1 2023. The Quarter

commenced with Dutch Title Transfer Facility gas price ("TTF") at

$14.31/MMBtu and quoted TFDE headline spot rates of $58,500 per

day. The Quarter concluded with TTF at $10.91/MMBtu and quoted TFDE

headline spot rates of $69,250 per day.

The LNG market experienced typical seasonal weakness and

relatively lower prices during the quarter, reaching price parity

with oil for the first time since before the invasion of Ukraine.

Shorter haul voyages to southern hemisphere markets increased, as

is customary for the time of year. LNG volumes into Europe remained

elevated by historic standards, as LNG replaces Russian pipeline

gas and filled onshore storage. European inventory levels reached

78% by the end of the quarter and ~90% today. While the impact of

these factors on the LNG carrier spot market was pronounced, the

spot market continued to be populated almost entirely by sublets

and this only affected CoolCo because of a single remaining

variable rate charter. Owner-controlled vessels, of which very few

are coming into the charter market in the short-term, have remained

focused on time charters of 12 months or longer, where terms have

remained largely stable at rates well above those prevailing in

recent years, as charterers look to ensure access to carriers

through the critical winter season in the northern hemisphere.

With the winter approaching, the supply of LNG carriers

available for term employment remains minimal. The recent extreme

volatility in LNG commodity pricing is indicative of a very tight

supply/demand balance and the relative fragility of global supply

chains still adapting to the sudden removal of large volumes of

Russian pipeline gas that previously provided a significant

proportion of the EU’s energy needs. Whether as a result of

geopolitical developments, labor action, industrial issues, or the

weather or congestion-related issues that the industry experiences

with some regularity, it is clear that the fast-growing LNG market

remains highly dynamic. In this environment, importers are

prioritizing certainty of access to both the LNG molecules and the

transportation capacity, rather than managing towards maximal

efficiency and risking being short gas at a critical juncture. We

continue to expect that term rates will remain strong and with the

potential of sharp seasonal upswing in the spot market, we expect

to fix our vessel coming available in September 2023 on attractive

terms.

Operational Review

CoolCo's fleet continued to perform well with no technical

off-hire during the Quarter, resulting in a Q2 fleet utilization of

100%, unchanged from Q1. There are no drydocks planned for 2023,

with the next drydock expected during the second quarter of

2024.

Business Development

In June 2023, CoolCo signed contracts with HD Hyundai Global

Service, a ship service subsidiary of HD Hyundai Group, to retrofit

five LNG carriers with sub-coolers for LNG boil-off reliquefaction

units. The contract value is approximately $10.0 million per

vessel.

On June 28, 2023, the Company announced that it had exercised

its option to acquire two newbuild 2-stroke LNG carriers from

affiliates of EPS. The Newbuilds are scheduled to be delivered from

HHI in Korea in September and December of 2024. Each of the two

Newbuilds is being acquired for an amount of approximately $234

million. The initial option exercise price was $56.9 million per

vessel, resulting in a total of $113.8 million paid to EPS on July,

3 2023. The Newbuilds, named Kool Tiger and Kool Panther, are

expected to be funded with a combination of cash on hand, including

cash that was recently released from the sale of the Golar Seal,

and committed debt financing.

CoolCo is in discussions with multiple potential charterers

seeking work for the Newbuilds.

Financing and Liquidity

In June 2023, the Company announced that the syndicate of

existing lenders in the $570 million bank facility approved an

increase in the debt amount of $70.0 million and a reduction of the

interest rate margin from 275 basis points to 225 basis points. The

$570 million bank facility's underlying, secured overnight

financing rate ("SOFR") exposure is fully hedged and the scheduled

amortization has been adjusted proportionally for the increased

size. The additional debt funding under this $570 million bank

facility will fund the LNGe conversion of five vessels, including

retrofits with sub-coolers for LNG boil-off reliquefaction under

the recently announced contract with HD Hyundai Global Service.

As of June 30, 2023 CoolCo had cash and cash equivalents of

$309.4 million and total short and long-term debt, net of deferred

finance charges, amounted to $1,063.9 million. Total Contractual

Debt1 stood at $1,179.4 million, which comprised of $504.4 million

in respect of the $570 million bank facility maturing in March

2027, $481.3 million in respect of the four-vessel bank financing

facility maturing in May 2029 (the “$520 million term loan

facility”), and $193.8 million in respect of the two sale and

leaseback facilities maturing in the first quarter of 2025 (Kool

Ice and Kool Kelvin).

During Q2, we entered into further floating interest rate (SOFR)

swap agreements for a notional amount of $40.0 million in respect

of the $520 million term loan facility. Overall, the Company’s

interest rate on its debt is fixed or hedged for approximately 90%

of the notional debt, adjusting for existing cash on hand, but

excluding cash that was earmarked for the option exercise of the

Newbuilds.

Corporate and Other Matters

As of June 30, 2023, CoolCo had 53,688,462 shares issued and

outstanding. Of these, 31,254,390 shares (58.2%) were owned by EPS

Ventures Ltd ("EPS") and 22,434,072 (41.8%) were publicly

owned.

In line with the Company’s variable dividend policy, the Board

has declared a Q2 dividend of $0.41 per ordinary share. The record

date is September 11, 2023 and the dividend will be distributed to

DTC-registered shareholders on or around September 18, 2023, while

due to the implementation of Central Securities Depositories

Regulation in Norway, the dividend will be distributed to Euronext

VPS-registered shareholders on or about September 22, 2023.

Outlook

Since the end of the Quarter, TTF has increased to $12/MMBtu and

TFDE spot rates have increased to $120,000 per day.

In the coming years, the global supply of LNG is set to increase

by more than 50% on the basis of projects that have already reached

FID, of which at least 40 mtpa of capacity has reached FID in 2023

alone, equal to approximately 10% of total 2022 LNG production. In

understanding the current 51% order book-to-fleet ratio (by

volume), it is critical to understand that the order book has

overwhelmingly been built on the basis of long-term contracts to

service new liquefaction facilities, with the timing and quantity

of their deliveries intended to match the commencement of new

production. Furthermore, to the extent that project development

delays result in vessels delivering to their charterers before

their intended startup time, we would expect to see a dynamic

similar to that which has recently prevailed, in which the market

is sharply bifurcated between charterers seeking to fill interim

periods in the spot market and owners such as CoolCo who are in a

position to offer multi-year time charters. A number of additional

liquefaction projects remain under development across North America

and the Middle East in particular, but also in a wide variety of

other geographies as there remains a strong and widespread desire

to decarbonize by substituting LNG for the vast amounts of coal

still being consumed, particularly in emerging markets.

Among LNG carriers currently on the water, the older, less

efficient vessels in the charter market are expected to face

growing competitive pressure over time, particularly among the

steam turbine vessels that continue to make up over 30% of the

global fleet by volume. The imposition of the IMO’s carbon

intensity indicator (“CII”) rules from the beginning of this year,

as well as forthcoming European carbon pricing set to come into

effect next year, are set to increase the relative advantage of

modern, efficient TFDE and 2-stroke tonnage such as those in the

CoolCo fleet.

The limited supply of modern vessels available for time charter

employment through the medium term is concentrated among a small

number of owners, including CoolCo. Given the improved bargaining

position afforded by a combination of scarcity and concentration,

such owners have remained focused primarily on longer-term charters

that would bridge the period from now until the next wave of LNG

volumes arrives in 2026-2027. A newbuild vessel ordered today would

be subject to an approximately 4-year lead time and a purchase

price exceeding $260 million, limiting the likelihood of unforeseen

newbuild tonnage during that period while further supporting the

benchmark against which the overall fleet is priced.

FORWARD LOOKING STATEMENTS

This press release and any other written or oral statements made

by us in connection with this press release include forward-looking

statements. All statements, other than statements of historical

facts, that address activities and events that will, should, could

or may occur in the future are forward-looking statements. These

forward-looking statements are made under the "safe harbor"

provisions of the U.S. Private Securities Litigation Reform Act of

1995. You can identify these forward-looking statements by words or

phrases such as “believe,” “anticipate,” “intend,” “estimate,”

“forecast,” “project,” “plan,” “potential,” “will,” “may,”

“should,” “expect,” “could,” “would,” “predict,” “propose,”

“continue,” or the negative of these terms and similar expressions

are intended to identify such forward-looking statements. These

forward-looking statements include statements relating to our

ability and expectations to charter available vessels and

chartering strategy, outlook, expected results and performance,

expected drydockings, delivery dates of newbuilds, intended uses of

our financing facilities, dividends and dividend policy, expected

growth in LNG supply, expected industry and business trends

including expected trends in LNG demand and market trends, expected

trends in LNG shipping capacity, LNG vessel supply and demand,

trends of the spot market and the term market, and factors

impacting supply and demand of vessels such as CII and European

carbon pricing backlog, expected trends in charter and spot rates,

expectations on rates for future charters, contracting, utilization

(including expected revenue backlog), LNG vessel newbuild

order-book, expected winter demand, commodity volatility statements

under “LNG Market Review” and “Outlook” and other non-historical

matters.

The forward-looking statements in this document are based upon

management’s current expectations, estimates and projections. These

statements involve significant risks, uncertainties, contingencies

and factors that are difficult or impossible to predict and are

beyond our control, and that may cause our actual results,

performance or achievements to be materially different from those

expressed or implied by the forward-looking statements. Numerous

factors could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements including:

- our limited operating history under the CoolCo name;

- changes in demand in the LNG shipping industry, including the

market for modern TFDE vessels and modern 2-stroke vessels;

- general LNG market conditions, including fluctuations in

charter hire rates and vessel values;

- our ability to successfully employ our vessels;

- changes in the supply of LNG vessels;

- our ability to procure or have access to financing and

refinancing, including financing for the Newbuild Vessels;

- our continued borrowing availability under our credit

facilities and compliance with the financial covenants

therein;

- potential conflicts of interest involving our significant

shareholders;

- our ability to pay dividends;

- general economic, political and business conditions, including

sanctions and other measures;

- changes in our operating expenses due to inflationary pressure

and volatility of supply and maintenance including fuel or cooling

down prices and lay-up costs when vessels are not on charter,

drydocking and insurance costs;

- fluctuations in foreign currency exchange and interest

rates;

- vessel breakdowns and instances of loss of hire;

- vessel underperformance and related warranty claims;

- potential disruption of shipping routes and demand due to

accidents, piracy or political events;

- compliance with, and our liabilities under, governmental, tax

environmental and safety laws and regulations;

- information system failures, cyber incidents or breaches in

security;

- changes in governmental regulation, tax and trade matters and

actions taken by regulatory authorities; and

- other risks indicated in the risk factors included in CoolCo’s

Annual Report on Form 20-F for the year ended December 31, 2022 and

other filings with the U.S. Securities and Exchange

Commission.

The foregoing factors that could cause our actual results to

differ materially from those contemplated in any forward-looking

statement included in this report should not be construed as

exhaustive. Moreover, we operate in a very competitive and rapidly

changing environment. New risks and uncertainties emerge from time

to time, and it is not possible for us to predict all risks and

uncertainties that could have an impact on the forward-looking

statements contained in this press release. The results, events and

circumstances reflected in the forward-looking statements may not

be achieved or occur, and actual results, events or circumstances

could differ materially from those described in the forward-looking

statements.

As a result, you are cautioned not to place undue reliance on

any forward-looking statements which speak only as of the date of

this press release. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise unless

required by law.

Responsibility Statement

We confirm that, to the best of our knowledge, the interim

unaudited condensed consolidated financial statements for the three

and six months ended June 30, 2023, which have been prepared in

accordance with accounting principles generally accepted in the

United States (US GAAP) give a true and fair view of the Company’s

consolidated assets, liabilities, financial position and results of

operations. To the best of our knowledge, the financial report for

the three and six months ended June 30, 2023 includes a fair review

of important events that have occurred during the period and their

impact on the interim unaudited condensed consolidated financial

statements, the principal risks and uncertainties, and major

related party transactions.

August 31, 2023 Cool Company Ltd. Hamilton, Bermuda

Questions should be directed to: c/o Cool Company Ltd - +44 207

659 1111

Richard Tyrrell - Chief Executive

Officer

Cyril Ducau (Chairman of the

Board)

John Boots - Chief Financial

Officer

Antoine Bonnier (Director)

Mi Hong Yoon (Director)

Neil Glass (Director)

Peter Anker (Director)

COOL COMPANY LTD

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

For the three months

ended

For the six months

ended

Apr-Jun 2023

Jan-Mar 2023

Apr-Jun 2022

Jan-Jun 2023

Jan-Jun 2022

(in thousands of $)

Successor

(Consolidated)

Successor

(Consolidated)

Successor

(Consolidated)1

Predecessor (Combined

Carve-out)2

Successor

(Consolidated)

Successor

(Consolidated)1

Predecessor (Combined

Carve-out)2

Time and voyage charter revenues

82,071

91,168

45,537

747

173,239

49,822

37,289

Vessel and other management fee

revenues

3,757

3,376

—

2,933

7,133

—

6,167

Amortization of intangible assets and

liabilities - charter agreements, net

4,488

4,105

7,070

—

8,593

7,070

—

Total operating revenues

90,316

98,649

52,607

3,680

188,965

56,892

43,456

Vessel operating expenses

(18,835

)

(18,588

)

(11,652

)

440

(37,423

)

(13,302

)

(7,706

)

Voyage, charter hire and commission

expenses, net

(877

)

(1,499

)

(1,034

)

(229

)

(2,376

)

(357

)

(1,229

)

Administrative expenses

(6,222

)

(6,643

)

(1,282

)

(2,192

)

(12,865

)

(2,636

)

(5,422

)

Depreciation and amortization

(18,898

)

(19,897

)

(13,974

)

(6

)

(38,795

)

(14,966

)

(5,745

)

Total operating expenses

(44,832

)

(46,627

)

(27,942

)

(1,987

)

(91,459

)

(31,261

)

(20,102

)

Other operating income

—

—

—

4,374

—

—

4,374

Operating income

45,484

52,022

24,665

6,067

97,506

25,631

27,728

Other non-operating income

21

42,528

—

—

42,549

—

—

Financial income/(expense):

Interest income

2,791

1,517

59

4

4,308

59

4

Interest expense

(19,863

)

(19,485

)

(5,798

)

(47

)

(39,348

)

(6,672

)

(4,725

)

Gains/(Losses) on derivative

instruments

16,705

(6,001

)

—

—

10,704

—

—

Other financial items, net

(414

)

(393

)

(301

)

1,267

(807

)

(1,359

)

622

Financial expenses, net

(781

)

(24,362

)

(6,040

)

1,224

(25,143

)

(7,972

)

(4,099

)

Income before income taxes and

non-controlling interests

44,724

70,188

18,625

7,291

114,912

17,659

23,629

Income taxes, net

(78

)

(56

)

—

(71

)

(134

)

—

(385

)

Net income

44,646

70,132

18,625

7,220

114,778

17,659

23,244

Net income/(loss) attributable to

non-controlling interests

344

(1,287

)

(811

)

279

(943

)

(811

)

(8,206

)

Net income attributable to the Owners

of Cool Company Ltd

44,990

68,845

17,814

7,499

113,835

16,848

15,038

Net income/(loss) attributable

to:

Owners of Cool Company Ltd

44,990

68,845

17,814

7,499

113,835

16,848

15,038

Non-controlling interests

(344

)

1,287

811

(279

)

943

811

8,206

Net income

44,646

70,132

18,625

7,220

114,778

17,659

23,244

(1)

The commencement of operations and funding

of CoolCo and the acquisition of its initial TFDE LNG carriers, The

Cool Pool Limited and the shipping and FSRU management organization

from Golar LNG Limited ("Golar") was completed in a phased process.

On January 26, 2022, CoolCo entered into various agreements (the

"Vessel SPA") with Golar, as amended on February 25, 2022, pursuant

to which CoolCo acquired all of the outstanding shares of nine of

Golar’s wholly-owned subsidiaries on various dates in March and

April 2022. Eight of these entities were each the registered or

disponent owner or lessee of the following modern LNG carriers:

Crystal, Ice, Bear, Frost, Glacier, Snow, Kelvin and Seal (disposed

subsequently). The Cool Pool Limited was the entity responsible for

the marketing of these LNG carriers. For CoolCo, for three and six

month periods ended June 30, 2022, the successor period reflects

the period beginning from January 27, 2022 with the closing of

CoolCo’s Norwegian equity raise and the date CoolCo operations

substantially commenced and were considered meaningful. Vessel SPA

acquisition dates were staggered reflecting results, as the

successor, from the date CoolCo obtained control of the respective

vessel entities.

(2)

Predecessor period includes results

derived from the carve-out of historical operations from Golar

entities acquired by CoolCo as part of the Vessel SPA and ManCo SPA

until the day before the staggered acquisition date per legal

entity during the period beginning from January 1, 2022 to June 30,

2022.

COOL COMPANY LTD

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

At June 30,

At December 31,

(in thousands of $)

2023

2022

(Audited)

ASSETS

Current assets

Cash and cash equivalents

309,419

129,135

Restricted cash and short-term

deposits

3,554

3,435

Intangible assets, net

2,570

5,552

Trade receivable and other current

assets

10,379

6,225

Inventories

604

991

Total current assets

326,526

145,338

Non-current assets

Restricted cash

474

507

Intangible assets, net

8,571

8,315

Newbuildings

113,787

—

Vessels and equipment, net

1,733,799

1,893,407

Other non-current assets

20,024

10,494

Total assets

2,203,181

2,058,061

LIABILITIES AND EQUITY

Current liabilities

Current portion of long-term debt and

short-term debt

159,739

180,065

Trade payables and other current

liabilities

252,610

98,524

Total current liabilities

412,349

278,589

Non-current liabilities

Long-term debt

904,162

958,237

Other non-current liabilities

98,669

105,722

Total liabilities

1,415,180

1,342,548

Equity

Owners' equity includes 53,688,462 common

shares of $1.00 each, issued and outstanding

718,102

646,557

Non-controlling interests

69,899

68,956

Total equity

788,001

715,513

Total liabilities and equity

2,203,181

2,058,061

COOL COMPANY LTD

UNAUDITED CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS

For the six months

ended

Jan-Jun 2023

Jan-Jun 2022

(in thousands of $)

Successor

(Consolidated)

Successor

(Consolidated)

Predecessor (Combined

Carve-out)

Operating activities

Net income

114,778

17,659

23,244

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expenses

38,795

14,966

5,745

Amortization of intangible assets and

liabilities arising from charter agreements, net

(8,593

)

(7,070

)

—

Amortization of deferred charges and fair

value adjustments

2,319

441

1,588

Gain on sale of Golar Seal vessel

(42,549

)

—

—

Drydocking expenditure

(4,284

)

—

—

Compensation cost related to share-based

payment

1,197

—

238

Change in fair value of derivative

instruments

(6,446

)

—

—

Changes in assets and liabilities:

Trade accounts receivable

(3,885

)

(2,285

)

(117

)

Inventories

387

(1,298

)

—

Other current and other non-current

assets

(4,892

)

5,158

(7,226

)

Amounts (due to) /from related parties

(1,270

)

3,067

1,252

Trade accounts payable

26,966

991

(400

)

Accrued expenses

(7,178

)

3,261

(180

)

Other current and non-current

liabilities

12,236

(598

)

2,957

Net cash provided by operating

activities

117,581

34,292

27,101

Investing activities

Additions to vessels and equipment

(872

)

—

—

Proceeds on sale of vessel

184,300

—

—

Additions to intangible assets

(432

)

—

—

Consideration for acquisition of vessels

and management entities

—

(218,276

)

—

Net cash provided by / (used in)

investing activities

182,996

(218,276

)

—

Financing activities

Proceeds from short-term and long-term

debt

70,000

570,000

—

Repayments of short-term and long-term

debt

(144,828

)

(24,862

)

(498,832

)

Repayments of Parent's funding

—

(136,351

)

Financing arrangement fees and other

costs

(1,892

)

(6,128

)

—

(Repayments to) / contributions from

CoolCo in connection with acquisition, net of equity proceeds

(581,072

)

581,072

Net proceeds from equity raise

267,056

—

Cash dividends paid

(43,487

)

—

—

Net cash used in / (provided by)

financing activities

(120,207

)

224,994

(54,111

)

Net increase / (decrease) in cash, cash

equivalents and restricted cash

180,370

41,010

(27,010

)

Cash, cash equivalents and restricted

cash at beginning of period

133,077

50,892

77,902

Cash, cash equivalents and restricted

cash at end of period

313,447

91,902

50,892

COOL COMPANY LTD

UNAUDITED CONDENSED CONSOLIDATED

STATEMENT OF CHANGES IN EQUITY

For the six months ended June

30, 2023

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated successor balance at

December 31, 2022 (Audited)

53,688,462

53,688

507,127

85,742

646,557

68,956

715,513

Net income

—

—

—

113,835

113,835

943

114,778

Share based payments contribution

—

—

1,197

—

1,197

—

1,197

Dividends

—

—

—

(43,487

(43,487

)

—

(43,487

)

Consolidated successor balance at June

30, 2023

53,688,462

53,688

508,324

156,090

718,102

69,899

788,001

(1)

Additional paid-in capital refers to the

amounts of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

For the six months ended June

30, 2022

(in thousands of $, except number of

shares)

Number of common

shares

Parent’s / Owners’ Share

Capital

Contributed/ Additional

Paid-in Capital (1)

Retained (Deficit) /

Earnings

Total Parent's / Owners'

Equity

Non- controlling

Interest

Total Equity

Combined carve-out predecessor balance

at December 31, 2021 (Audited)

1,010,000

1,010

779,852

(212,305

)

568,557

174,498

743,055

Net income

—

—

—

15,038

15,038

8,206

23,244

Share based payments contribution

—

—

238

—

238

—

238

Deconsolidation of lessor

VIEs

—

—

—

—

—

(115,412

)

(115,412

)

Combined carve-out predecessor balance

upon disposal

1,010,000

1,010

780,090

(197,267

)

583,833

67,292

651,125

Cancellation of Parent's equity

(1,000,000

)

(1,000

)

(780,090

)

197,267

(583,823

)

—

(583,823

)

Combined carve-out equity

balance prior to acquisition

10,000

10

—

—

10

67,292

67,302

Consolidated successor balance upon

acquisition

10,000

10

—

—

10

—

10

Issuance of shares from private

placement

27,500,000

27,500

239,393

—

266,893

—

266,893

Issuance of shares to Golar

12,500,000

12,500

114,703

—

127,203

—

127,203

Recognition of non-controlling

interest upon acquisition

—

—

—

—

—

67,292

67,292

Fair value adjustment in relation to

acquisition

—

—

—

—

—

(95

)

(95

)

Net income

—

—

—

16,848

16,848

811

17,659

Consolidated successor balance at June

30, 2022

40,010,000

40,010

354,096

16,848

410,954

68,008

478,962

(1)

Additional paid-in capital refers to the

amounts of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

APPENDIX A - NON-GAAP FINANCIAL MEASURES AND DEFINITIONS

Non-GAAP Financial Metrics Arising from How Management Monitors

the Business

In addition to disclosing financial results in accordance with

U.S. generally accepted accounting principles (US GAAP), this

earnings release and the associated investor presentation and

discussion contain references to the non-GAAP financial measures

which are included in the table below. We believe these non-GAAP

financial measures provide investors with useful supplemental

information about the financial performance of our business, enable

comparison of financial results between periods where certain items

may vary independent of business performance, and allow for greater

transparency with respect to key metrics used by management in

operating our business and measuring our performance. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with US GAAP, and the financial results calculated in accordance

with US GAAP. Non-GAAP measures are not uniformly defined by all

companies, and may not be comparable with similar titles, measures

and disclosures used by other companies. The reconciliations from

these results should be carefully evaluated.

Non-GAAP measure

Closest equivalent US GAAP

measure

Adjustments to reconcile to

primary financial statements prepared under US GAAP

Rationale for

adjustments

Performance

Measures

Adjusted EBITDA

Net income

+/- Other non-operating income

+/- Net financial expense, representing:

Interest income, Interest expense, Losses on derivative instruments

and Other financial items, net

+/- Income taxes

+ Depreciation and amortization

- Amortization of intangible assets and

liabilities - charter agreements, net

Increases the comparability of total

business performance from period to period and against the

performance of other companies by removing the impact of other

non-operating income, depreciation, amortization of intangible

assets and liabilities -charter agreements, net, financing and tax

items.

Average daily TCE

Time and voyage charter revenues

- Voyage, charter hire and commission

expenses, net

The above total is then divided by

calendar days less scheduled off-hire days.

- Measure of the average daily net revenue

performance of a vessel.

- Standard shipping industry performance

measure used primarily to compare period-to-period changes in the

vessel’s net revenue performance despite changes in the mix of

charter types (i.e. spot charters, time charters and bareboat

charters) under which the vessel may be employed between the

periods.

- Assists management in making decisions

regarding the deployment and utilization of its fleet and in

evaluating financial performance.

Liquidity

measures

Total Contractual Debt

Total debt (current and non-current), net

of deferred finance charges

+ VIE Consolidation and fair value

adjustments upon acquisition

+ Deferred Finance Charges

We consolidate two lessor VIEs for our

sale and leaseback facilities (for the vessels Ice and Kelvin).

This means that on consolidation, our contractual debt is

eliminated and replaced with the Lessor VIEs’ debt.

Contractual debt represents our actual

debt obligations under our various financing arrangements before

consolidating the Lessor VIEs.

The measure enables investors and users of

our financial statements to assess our liquidity and the split of

our debt (current and non-current) based on our underlying

contractual obligations.

Total Company Cash

CoolCo cash based on GAAP measures:

+ Cash and cash equivalents

+ Restricted cash and short-term deposits

(current and non-current)

- VIE restricted cash and short-term

deposits (current and non-current)

We consolidate lessor VIEs for our sale

and leaseback facilities. This means that on consolidation, we

include restricted cash held by the lessor VIEs.

Total Company Cash represents our cash and

cash equivalents and restricted cash and short-term deposits

(current and non-current) before consolidating the lessor VIEs.

Management believes that this measure

enables investors and users of our financial statements to assess

our liquidity and aids comparability with our competitors.

Reconciliations - Performance

Measures

Adjusted EBITDA

For the three months

ended

Apr-Jun 2023

Jan-Mar 2023

Apr-Jun 2022

(in thousands of $)

Successor

(Consolidated)

Successor

(Consolidated)

Successor

(Consolidated)1

Predecessor (Combined

Carve-out)2

Net income

44,646

70,132

18,625

7,220

Other non-operating income

(21

)

(42,528

)

—

—

Interest income

(2,791

)

(1,517

)

(59

)

(4

)

Interest expense

19,863

19,485

5,798

47

Gains / (Losses) on derivative

instruments

(16,705

)

6,001

—

—

Other financial items, net

414

393

301

(1,267

)

Income taxes

78

56

—

71

Depreciation and amortization

18,898

19,897

13,974

6

Amortization of intangible - charter

agreements, net

(4,488

)

(4,105

)

(7,070

)

—

Adjusted EBITDA

59,894

67,814

31,569

6,073

For the six months

ended

Jan-June 2023

Jan-Jun 2022

(in thousands of $)

Successor

(Consolidated)

Successor

(Consolidated)1

Predecessor (Combined

Carve-out)2

Net income

114,778

17,659

23,244

Other non-operating income

(42,549

)

—

—

Interest income

(4,308

)

(59

)

(4

)

Interest expense

39,348

6,672

4,725

Gains on derivative instruments

(10,704

)

—

—

Other financial items, net

807

1,359

(622

)

Income taxes

134

—

385

Depreciation and amortization

38,795

14,966

5,745

Amortization of intangible - charter

agreements, net

(8,593

)

(7,070

)

—

Adjusted EBITDA

127,708

33,527

33,473

Average daily TCE

For the three months

ended

Apr-Jun 2023

Jan-Mar 2023

Apr-Jun 2022

(in thousands of $, except number of days

and average daily TCE)

Successor

(Consolidated)

Successor

(Consolidated)

Successor

(Consolidated)1

Predecessor (Combined

Carve-out)2

Time and voyage charter revenues

82,071

91,168

45,537

747

Voyage, charter hire and commission

expenses

(877

)

(1,499

)

(1,034

)

(229

)

81,194

89,669

44,503

518

Calendar days less scheduled off-hire

days

1,001

1,071

718

10

Average daily TCE (to the closest

$100)

$

81,100

$

83,700

$

62,000

$

51,800

For the six months

ended

Jan-Jun 2023

Jan-Jun 2022

(in thousands of $, except number of days

and average daily TCE)

Successor

(Consolidated)

Successor

(Consolidated)1

Predecessor (Combined

Carve-out)2

Time and voyage charter revenues

173,239

49,822

37,289

Voyage, charter hire and commission

expenses

(2,376

)

(357

)

(1,229

)

170,863

49,465

36,060

Calendar days less scheduled off-hire

days

2,072

817

631

Average daily TCE (to the closest

$100)

$

82,500

$

60,500

$

57,100

(1)

The commencement of operations and funding

of CoolCo and the acquisition of its initial TFDE LNG carriers, The

Cool Pool Limited and the shipping and FSRU management organization

from Golar LNG Limited ("Golar") was completed in a phased process.

On January 26, 2022, CoolCo entered into various agreements (the

"Vessel SPA") with Golar, as amended on February 25, 2022, pursuant

to which CoolCo acquired all of the outstanding shares of nine of

Golar’s wholly-owned subsidiaries on various dates in March and

April 2022. Eight of these entities are each the registered or

disponent owner or lessee of the following modern LNG carriers:

Crystal, Ice, Bear, Frost, Glacier, Snow, Kelvin and Seal (disposed

subsequently). The Cool Pool Limited was the entity responsible for

the marketing of these LNG carriers. For CoolCo, for three and six

month periods ended June 30, 2022, the successor period reflects

the period beginning from January 27, 2022 with the closing of

CoolCo’s Norwegian equity raise and the date CoolCo operations

substantially commenced and were considered meaningful. Vessel SPA

acquisition dates were staggered reflecting results, as the

successor, from the date CoolCo obtained control of the respective

vessel entities.

(2)

Predecessor period includes results

derived from the carve-out of historical operations from Golar

entities acquired by CoolCo as part of the Vessel SPA and ManCo SPA

until the day before the staggered acquisition date per legal

entity during the period beginning from January 1, 2022 to June 30,

2022.

Reconciliations - Liquidity

measures

Total Contractual Debt

(in thousands of $)

At June 30, 2023

At December 31, 2022

Total debt (current and non-current) net

of deferred finance charges

1,063,901

1,138,302

Add: VIE consolidation and fair value

adjustments

108,923

106,829

Add: Deferred finance charges

6,557

6,186

Total Contractual Debt

1,179,381

1,251,317

Total Company Cash

(in thousands of $)

At June 30, 2023

At December 31,

2022

Cash and cash equivalents

309,419

129,135

Restricted cash and short-term

deposits

4,028

3,942

Less: VIE restricted cash

(3,554

)

(3,435

)

Total Company Cash

309,893

129,642

Other definitions

Revenue Backlog

Revenue backlog is defined as the contracted daily charter rate

for each vessel multiplied by the number of scheduled hire days for

the remaining contract term. Revenue backlog is not intended to

represent adjusted EBITDA or future cashflows that will be

generated from these contracts. This measure should be seen as a

supplement to and not a substitute for our US GAAP measures of

performance.

This information is subject to the disclosure requirements in

Regulation EU 596/2014 (MAR) article 19 number 3 and section 5-12

of the Norwegian Securities Trading Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230830205366/en/

+44 207 659 1111 / ir@coolcoltd.com

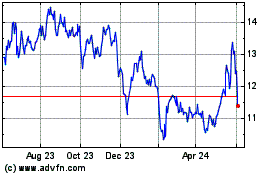

Cool (NYSE:CLCO)

Historical Stock Chart

From Oct 2024 to Oct 2024

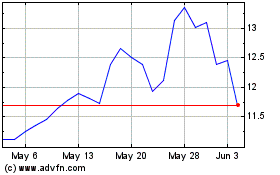

Cool (NYSE:CLCO)

Historical Stock Chart

From Oct 2023 to Oct 2024