Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

February 27 2024 - 1:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

The Walt Disney Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

On February 27, 2024, The Walt Disney Company ("Disney") updated its website www.VoteDisney.com, which contains information relating to Disney’s 2024 Annual

Meeting of Shareholders. A copy of the updated website content (other than that previously filed) can be found below:

LEGAL NOTICES The truth matters. Shareholders rightfully expect directors to base their statements on facts, The activists and their nominees have not

lived up to this expectation. Below are some Important facts that we’re highlighting because we know you share our passion for continuing Disney’s remarkable 100-year legacy.

X FALSE CLAIM In his letter to shareholders, Nelson Peltz claims he has media expertise. “By the way, they said I have no media experience. I

don’t claim to have any” Nelson Peltz, January 18.2024 01

X FALSE CLAIM Trian claims Jay Rasulo’s media experience and business acumen will be additive to the Disney Board. Mr. Rasula left Disney in 2016, and eight years later,

hi; perspective on the media industry is stale. Since he joined the iHeartMedia Board in May 2019 as Lead Independent Director, the stock has declined by nearly 90%. IHEARTMEDIA (IHRT) HAS DECLINED 87% WITH JAY RASULO ON THE BOARD sw $M

518.03 $W w I 02 May ‘19 May ‘20 May ‘21 May ’22 May ’23 Source Factset as of 02/22/24 IHRT share price data first available on 05 as listing on the OTC ink after Rasul was appointed to Board on 05/2019 02

X FALSE CLAIM Mr. Peltz claims Trian Partners has a stake of >$3 billion (~33 million shares) in Disney and to speak for all shareholders. . THE TRUTH According to Trim’s

own filings, Mr. Peltz and Trian Fund Management own 6.8 million Disney shares, fewer than the 9.4 million shares Trian owned a year ago. Shareholders should ask Trian, if it speaks for them, why it continues to sell down its stake, including

selling over 500,000 shares between September 30, 2023, and December 31,2023. Isaac Perlmutter, a former Disney executive who has a fraught history with CIO Bob Iger, owns 25.6 million shares, which make up the lion’s share of Trian’s position.

TRIAN GROUP: DIS OWNERSHIP 03 Mr. Peltz and Trian sold over 500,000 shares in the last quarter 6.8mm 25.6mm Ike Perlmutter Nelson Peltz 03

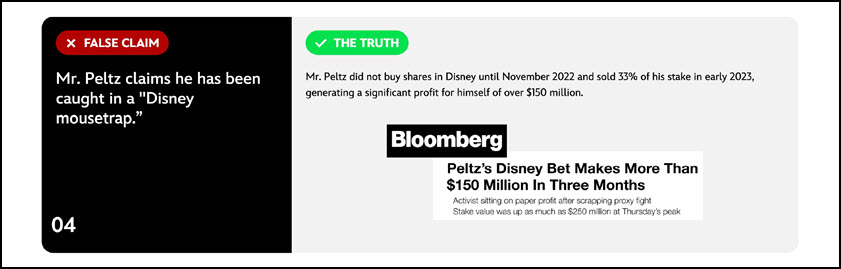

X FALSE CLAIM Mr. Peltz claims he has been caught in a “Disney mousetrap,” 04 Mr. Peltz did not buy shares in Disney until November 2022 and sold 33% of his stake

in early 2023. generating a significant profit for himself of over $150 million. Peltz’s Disney Bet Makes More Than $150 Million In Three Months Activist sitting on paper profit after scrapping proxy fight stake value was up as as much as $250

million at Thursday’s peak

X FALSE CLAIM Mr, Peltz claims the Boards on which he has sat have, on average, outperformed the S&P by 900bps annually. 05 The Truth PeltzTrian involvement on

board; resulted in TSR unde [performance versus the S&P 500 in -68% of cases. NELSON PELTZ AS BOARD MEMBER ¦ OTHER TRIAN REP AS BOARD MEMBER 05

X FALSE CLAIM Trian claims Disney has refused to engage with Mr. Peltz. 06 Sines Mr. Peltz ended! his proxy contest in February 2023. the Board Slid management

have maintained art open dialogue with him and the Trian Group, having no Less than 20 meaningful interactions. Mr. Peltz was offered the opportunity to meet with both the Disney Board and Disney’s segment leaders to present his thesis and views in

late 2023 and declined each invitation. Select interactions with Disney since February 2023: 2X May 2023 1X Jul 2023 6X Nov 2023 3X Dec 2023 06

X FALSE CLAIM Trian claims Disney’s Board is closed to new ideas and refuses to heed input from shareholders. p THE TRUTH Over the past 18 months. Mr. Peltt has

resurfaced old ideas which have been considered and dismissed, suggested actions that already were in motion, or proposed ideas that demonstrate a complete lack of understanding of the media ecosystem (e.g., a Board committee to review content, or

licensing ESPN* to NFLX). He and Trian’s other nominee Mr. Rasulo offer no additive relevant experience to our Independent, highly qualified Board. Disney is always open to constructive advice and engagement with shareholders, as evidenced by our

recent information sharing arrangements with ValueAct Capital and our support agreement with Third Point. I 07 FORTUNE A consumer and industrial goods and finance maven miscasting himself as Disney’s savior

X FALSE CLAIM Mr. Peltz claims that Disney+ is an emerging streaming business that has been poorly managed. THE TRUTH Disney has built the second largest global

streaming platform with more than 180 million subscriptions across Disney*, Hulu and ESPN*. We are competitively differentiated by our IP, global scale and #1 sports media brand, ESPN. We expect to achieve profitability by the of end of FY24, within

five years of launching Disney* (same timeframe as Netflix) in a significantly more competitive streaming landscape. STREAMING BUSINESS IS ON THE PATH TO SUSTAINED GROWTH AND PROFITABILITY Entertainment Direct-to-consumer Quarterly Results (in

Billions Q1‘23 Q2‘23 Q3‘23 Q4’23 Q1‘24 ($0.1) ($1.0) (0.4) ($0.5) ($0.6) Operating Losses

Your vote matters. Remember to use the WHITE proxy card. Terms of use of Privacy Policy Your US State Privacy Rights Do not sell or share my personal information

My Personal Children’s online privacy policy Internet based ads Lega notices contacts expert analysis company news our board how to vote

Shareholder Materials Downloads February 26, 2024 Letter to Shareholders Disney highlights progress made and promises kept February

14, 2024 Shareholder Brochure See how Disney is delivering on its strategy: Learn how to vote February 12, 2024 Letter to Shareholders Learn more about Disney’s exciting announcements and strong financial results February 7, 2024 Q1 FY24 Earnings

Presentation February 1, 2024 Letter to Shareholders Read why Disney’s board nominees are best-qualified to sustain shareholder value 2024 Proxy Statement

Forward-Looking Statements

Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s

expectations; beliefs; plans; strategies; business or financial prospects or outlook; future shareholder value; expected growth and value creation; profitability; investments; capital allocation, including dividends and share repurchases; earnings

expectations; expected drivers and guidance, including free cash flow and funding sources; expected benefits of new initiatives; cost reductions and efficiencies; content offerings; priorities or performance; and other statements that are not

historical in nature. These statements are made on the basis of the Company’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. The Company does not undertake any obligation to

update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements.

Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or strategic initiatives (including capital

investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations), our execution of our business plans (including the content we create and intellectual property we invest in, our pricing decisions,

our cost structure and our management and other personnel decisions), our ability to quickly execute on cost rationalization while preserving revenue, the discovery of additional information or other business decisions, as well as from developments

beyond the Company’s control, including: the occurrence of subsequent events; deterioration in domestic or global economic conditions or failure of conditions to improve as anticipated, including heightened inflation, capital market volatility,

interest rate and currency rate fluctuations and economic slowdown or recession; deterioration in or pressures from competitive conditions, including competition to create or acquire content, competition for talent and competition for advertising

revenue, consumer preferences and acceptance of our content and offerings, pricing model and price increases, and corresponding subscriber additions and churn, and the market for advertising and sales on our direct-to-consumer services and linear

networks; health concerns and their impact on our businesses and productions; international, political or military developments; regulatory or legal developments; technological developments; labor markets and activities, including work stoppages;

adverse weather conditions or natural disasters; and availability of content. Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): our

operations, business plans or profitability, including direct-to-consumer profitability; our expected benefits of the composition of the Board; demand for our products and services; the performance of the Company’s content; our ability to create or

obtain desirable content at or under the value we assign the content; the advertising market for programming; income tax expense; and performance of some or all Company businesses either directly or through their impact on those who distribute our

products.

Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023, including under the captions “Risk Factors”, “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and “Business”, and subsequent filings with the Securities and Exchange Commission (the “SEC”), including, among others, quarterly reports on Form 10-Q.

Additional Information and Where to Find it

Disney has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Disney’s 2024 Annual Meeting of

Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY DISNEY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Disney free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Disney are also available free of charge by accessing Disney’s website at http://www.disney.com/investors.

Participants

Disney, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Disney. Information about

Disney’s executive officers and directors is available in Disney’s definitive proxy statement for its 2024 Annual Meeting, which was filed with the SEC on February 1, 2024. To the extent holdings by our directors and executive officers of Disney

securities reported in the proxy statement for the 2024 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free

of charge at the SEC’s website at www.sec.gov.

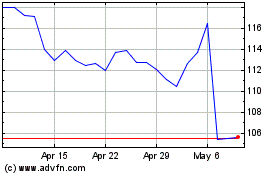

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

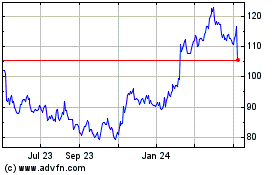

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Jul 2023 to Jul 2024