Despite the difficult market environment, Sartorius posted

slight gains in growth for both Group divisions and robust

earnings. �Given the unexpectedly adverse economic conditions, we

performed well. Amid this situation, we could not reach our

ambitious financial targets for 2008. Yet we still achieved the

third best profitability result in our company�s history,"

commented CEO Dr. Joachim Kreuzburg on the yearly results for 2008

at the annual press conference in Goettingen, Germany. Referring to

the exceptional uncertainty that still surrounds the economic

climate, Dr. Kreuzburg did not provide any specific forecast of the

financial results for 2009. �It is already foreseeable that the

global economic crisis will have a significantly negative impact on

our Mechatronics business in the current year, so we have to expect

that sales revenue and earnings for this sector will decline," said

Dr. Kreuzburg. By contrast, the Biotechnology Division as a

supplier to the biopharmaceutical industry is comparably less

affected by general cyclical trends. �We are targeting sales and

profitability growth for the Biotechnology Division.� The mid- and

long-term business prospects for both divisions continue to remain

excellent, as Kreuzburg further stated. In addition to focusing on

systematic cost management, in 2009 we will be launching a large

number of innovative products that truly add value for our

customers."

Key data on fiscal 2008

The Group slightly increased its sales revenue in 2008 by a

currency-adjusted 0.9% to 611.6 million euros (current exchange

rates: -1.8%). Order intake on a currency-adjusted basis was up

1.6% to 609.8 million euros and is thus slightly above the previous

year�s level (current exchange rates: -1.1%). Consolidated earnings

declined due to the overall weak market environment and the effects

of unfavorable exchange rates compared with a year ago, but

continued to remain at a solid level: twelve-month operating

earnings (EBITA = earnings before interest, taxes and amortization)

stood at 56.8 million euros (2007: 71.1 million euros); the

corresponding EBITA margin was 9.3% (2007: 11.4%). Net profit was

impacted, among other things, by extraordinary expenses for foreign

currency hedging transactions. Excluding both non-cash items of

amortization and interest expense for share price warrants, net

profit was at 18.2 million euros, compared with 30.4 million euros

a year ago.

Business development of the divisions

Sartorius Stedim Biotech

In 2008, the Biotechnology Division performed well in an

exceptionally adverse market environment. In North America the

division, just like its competitors, had to grapple with the

temporary downturn in demand from a few key accounts as a result of

their scale-backs in production and reductions in inventory. This

resulted in a drop-off in orders from pharmaceutical suppliers,

especially in the first half, whereas during the fourth quarter the

North American market environment began showing signs of recovery.

On the whole, the division�s sales revenue of 366.0 million euros

in constant currencies was approximately at the year-earlier level

(+0.2%; current exchange rates: -2.6%).

In Europe, the Biotechnology Division�s growth was largely

fueled by business with disposable products for biopharmaceutical

applications. For instance, innovative single-use bioreactors were

much in demand. In Asia, Sartorius Stedim Biotech reported flat

sales growth on the whole.

In the course of 2008, the division received orders worth 367.1

million euros, up 3.0% on a currency-adjusted basis (current

exchange rates: 0.0%). While positive growth impulses came from

Europe and Asia, order intake in North America slid due to the

market situation there, but then showed an upward trend in the

fourth quarter.

The Biotechnology Division achieved operating earnings (EBITA)

of 39.7 million euros in fiscal 2008 (2007: 49.7 million euros).

Business with single-use products contributed by far the largest

share of earnings. Reported at an EBITA margin of 10.9%, the

profitability of Sartorius Stedim Biotech continued to remain very

solid (2007: 13.2%). This decrease in margin from a year ago

essentially resulted from the sales decline in North America and

the negative exchange rate impact.

Sartorius Mechatronics

For the first three quarters of 2008, Sartorius Mechatronics

reported encouraging gains of more than 5% on a currency-adjusted

basis in both order intake and in sales revenue, and thus remained

initially unaffected by the emerging economic crisis. In November

and December 2008, however, the division received significantly

fewer orders for laboratory instruments and industrial weighing and

control equipment as a consequence of the global economic downturn,

which was reflected by a drop in revenue in some of its segments at

year-end. By contrast, the division�s service business showed

overall positive development throughout the entire fiscal year. At

242.7 million euros, full-year order intake for 2008 was down 0.5%

on a currency-adjusted basis from the year-earlier figure (current

exchange rates: -2.8%). Sales revenue rose 1.8% (currency-adjusted)

and stood at 245.6 million euros (current exchange rates:

-0.5%).

When viewed regionally, the cyclical downturn hit North America

first so sales with mechatronics products fell in that region, also

on a full-year basis. For Europe, by contrast, the division posted

slight gains and for Asia, significant increases, as the first

three quarters were on track.

The division�s operating earnings (EBITA) fell from 21.3 million

euros to 17.1 million euros; at year-end, the corresponding EBITA

margin was at 7.0% compared with 8.6% a year earlier. This decline

was due to the sharp economic downturn and the negative exchange

rate impact as well as the higher expenses budgeted for research

and development.

Key balance sheet ratios and financials at a solid

level

Key ratios and financials for the Group were at a good level:

the consolidated equity ratio was 38.5% (Dec. 31, 2007: 42.6%) and

the ratio of net debt to EBITDA was 2.7. The financing package

concluded in September 2008 and totaling an aggregate of 400

million euros has placed the company�s financing on a broad-based,

long-term footing.

Research and development strengthened

In fiscal 2008, Sartorius further intensified its R&D

activities and increased its spending on R&D by 10.0% to 43.9

million euros (2007: 39.9 million euros). The rise in R&D costs

can be attributed essentially to the build-up of scientific staff.

The ratio of R&D costs to sales revenue rose accordingly and

was at 7.2%, up from 6.4% a year ago.

Number of employees increased

As of December 31, 2008, the Sartorius Group employed 4,660

people, 142 persons or 3.1% more than in the previous year. In

Europe, the number of employees rose 5.4% to 3,151 persons. Of this

total, 2,339 worked in Germany overall and 1,829 at the company�s

headquarters in Goettingen, Germany. In

Asia�|�Pacific, the workforce increased 8.7% to 898

people, whereas in North America, the number dropped 11.8% to 540

employees.

Dividend proposal

At the Annual Shareholders� Meeting on April 23, 2009, the

Supervisory Board and the Executive Board will submit a proposal

for payment of dividends of 0.42 euro per preference share and 0.40

per ordinary share (previous year: 0.68 euro and 0.66 euro,

respectively). At nearly the same dividend payout ratio as the

previous year's, the total profit distributed would decrease from

11.4 million euros a year earlier to 7.0 million euros, if this

proposal is approved.

Outlook

Given the high uncertainty surrounding global economic

development, Sartorius still does not think it possible to issue a

reliable forecast about how its business will evolve in 2009.

As experience has shown, the growth potential for the

Mechatronics Division, which predominantly manufactures capital

goods, is significantly affected by the economic climate. Because

sales revenue for this division has been declining since the end of

2008, Sartorius has implemented extensive programs designed to

swiftly cut costs and strengthen cash flow. These programs entail a

temporary reduction in workhours and salaries for some 950

employees of the Mechatronics Division and administrative staff at

the Goettingen and Hamburg, Germany, sites. As company management

expects its Mechatronics Division to face very difficult market

conditions throughout 2009, it anticipates that sales revenue and

earnings in this division will decline in the current fiscal year.

By contrast, the Biotechnology Division as a supplier to the

pharmaceutical industry is usually less affected by general

cyclical trends as the company has experienced so far. For this

reason, company management plans for growth in sales revenue and

earnings for this division.

In both divisions, Sartorius will focus in the current year on

launching a number of important product innovations. For instance,

the Mechatronics Division will be unveiling its new Cubis series of

premium user-configurable lab balances, which set new benchmarks in

laboratory weighing technology. The Biotechnology Division will

expand its offer particularly in integrated single-use systems and

introduce new process-scale single-use mixing systems and

bioreactors as well as a number of new types of membrane filter on

the market, among other products.

Current image files:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius AG:

http://www.sartorius-stedim.com/media/content/press/support/Dr_Kreuzburg.jpg

Sartorius Stedim Biotech: (STR)

http://www.sartorius.com/media/content/press/support/Biotech_AR_2008.jpg

Sartorius Mechatronics: (CUBIS)

http://www.sartorius.com/media/content/press/support/Mechatronics_AR_2008.jpg

Upcoming Financial Dates:

April 23, 2009 Annual Shareholders� Meeting in Goettingen,

Germany

April 2009 Publication of first-quarter figures (Jan. � March

2009)

This is a translation of the original German-language press

release. Sartorius shall not assume any liability for the

correctness of this translation. The original German press release

is the legally binding version. Furthermore, Sartorius reserves the

right not to be responsible for the topicality, correctness,

completeness or quality of the information provided. Liability

claims regarding damage caused by the use of any information

provided, including any kind of information which is incomplete or

incorrect, will therefore be rejected.

A Profile of Sartorius

The Sartorius Group is a leading international laboratory and

process technology provider covering the segments of biotechnology

and mechatronics. In 2008, the technology group earned sales

revenue of 611.6 million euros. Founded in 1870, the

Goettingen-based company currently employs approximately 4,600

persons. The major areas of activity in its biotechnology segment

focus on filtration, fluid management, fermentation, purification

and laboratory applications. In the mechatronics segment, the

company primarily manufactures equipment and systems featuring

weighing, measurement and automation technology for laboratory and

industrial applications. Key Sartorius customers are from the

pharmaceutical, chemical and food and beverage industries and from

numerous research and educational institutes of the public sector.

Sartorius has its own production facilities in Europe, Asia and

America as well as sales subsidiaries and local commercial agencies

in more than 110 countries.

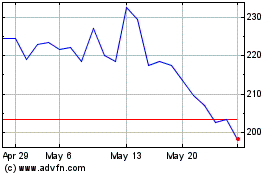

Sartorius (TG:SRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

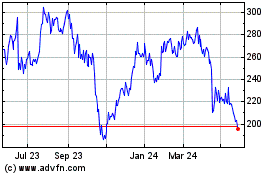

Sartorius (TG:SRT)

Historical Stock Chart

From Jul 2023 to Jul 2024