Altius Commits to $21 Million Investment in ARR

December 01 2022 - 5:29PM

Altius Minerals Corporation (TSX: ALS; OTCQX:

ATUSF) (“Altius” or the “Corporation”) is pleased to

announce that it has committed to purchase 2,298,700 common

shares in the Altius Renewable Royalties Corp. (“ARR”) financing

announced today.

ARR also announced that its 50% held Great Bay

Renewables II (“Great Bay”) joint venture has completed a US$46

million royalty investment in support of Longroad Energy’s

(“Longroad”) acquisition of the 70 MWac Titan Solar project in

California.

With this participation Altius will maintain its

59% ownership in ARR. The financing, and Altius’s participation, is

subject to customary closing conditions and associated regulatory

filings, and is expected to close on or about December 8, 2022. For

more information on this financing, see ARR’s news release

here.

John Baker, Executive Chairman of Altius

commented “In a short timeframe, ARR’s Great Bay joint venture has

deployed almost US$300 million into the rapidly expanding US

renewable energy sector. The joint venture recently reached the

milestone of becoming cash flow positive and has created a strong

embedded revenue growth profile. The pace of adoption of its

royalty financing model continues to exceed our expectations as

evidenced both by its current portfolio now consisting of 32

projects representing over 6500 MW of wind and solar generation and

also the top-tier nature of its royalty counter-parties. We are

pleased to take this opportunity to allocate further capital

towards ARR as it continues to successfully execute its growth

strategies.”

About Altius

Altius’s strategy is to create per share growth

through a diversified portfolio of royalty assets that relate to

long-life, high margin operations. This strategy further provides

shareholders with exposures that are well aligned with

sustainability-related global growth trends including the

electricity generation transition from fossil fuel to renewables,

transportation electrification, reduced emissions from steelmaking

and increasing agricultural yield requirements. These macro-trends

each hold the potential to cause increased demand for many of

Altius’s commodity exposures including copper, renewable based

electricity, several key battery metals (lithium, nickel and

cobalt), clean iron ore, and potash. In addition, Altius runs a

successful Project Generation business that originates mineral

projects for sale to developers in exchange for equity positions

and royalties. Altius has 47,616,297 common shares issued and

outstanding that are listed on Canada’s Toronto Stock Exchange. It

is included in each of the S&P/TSX Small Cap, the S&P/TSX

Global Mining, and the S&P/TSX Canadian Dividend Aristocrats

indices.

About ARR

ARR is a renewable energy royalty company whose

business is to provide long-term, royalty-level investment capital

to renewable power developers, operators, and originators. ARR

currently has 32 renewable energy royalties representing 735 MW of

renewable power on operating projects and an additional

approximately 6 GW on projects in the development phase, across

several regional power pools in the U.S. The Corporation also

expects future royalties from Great Bay’s investments in Bluestar

Energy Capital and Hodson Energy. The Corporation combines industry

expertise with innovative, partner-focused solutions to further the

growth of the renewable energy sector as it fulfills its critical

role in enabling the global energy transition.

Forward-looking

information

This news release contains forward‐looking

information. The statements are based on reasonable assumptions and

expectations of management and Altius provides no assurance that

actual events will meet management's expectations. In certain

cases, forward‐looking information may be identified by such terms

as "anticipates", "believes", "could", "estimates", "expects",

"may", "shall", "will", or "would". Although Altius believes the

expectations expressed in such forward‐looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. Readers should not place undue

reliance on forward-looking information. Altius does not undertake

to update any forward-looking information contained herein except

in accordance with securities regulation.

For further information, please

contact:

|

Flora WoodVP, Investor Relations &

Sustainability Email:

Fwood@altiusminerals.comTel: 1.877.576.2209

Direct: 1.416.346.9020 |

Ben LewisChief Financial

OfficerEmail:

Blewis@altiusminerals.comTel: 1.877.576.2209 |

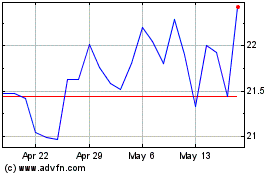

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Oct 2024 to Nov 2024

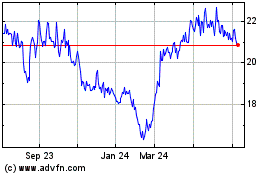

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Nov 2023 to Nov 2024