Ceridian HCM Holding Inc. (“Ceridian”) (NYSE:CDAY) (TSX:CDAY), a

global leader in human capital management (HCM) technology, today

announced its financial results for the first quarter ended

March 31, 2022.

"I am very pleased with our strong start to the year. In the

first quarter, Dayforce recurring revenue excluding float grew 31%

year-over-year. And, Adjusted EBITDA of $57.4 million exceeded the

high end of our guidance," said David Ossip, Chair and Co-CEO of

Ceridian.

“Our strong first quarter results highlight the value we’re able

to deliver to our customers as we help them adapt to the new world

of work,” said Leagh Turner, Co-CEO of Ceridian. “We continue to

see strong demand for Dayforce with more than 35% of new customers

purchasing the comprehensive suite.”

Financial Highlights for the First Quarter

20221

Revenue Highlights

- Total revenue, which includes revenue

from both Cloud and Bureau solutions, was $293.3 million for the

first quarter of 2022, an increase of 25.1% on a GAAP and a

constant currency basis. Excluding float revenue, total revenue was

$281.9 million for the first quarter of 2022, an increase of 26.0%

on a GAAP and a constant currency basis.

- Dayforce recurring revenue was $188.6

million for the first quarter of 2022, an increase of 29.8%, or

29.4% on a constant currency basis. Excluding float revenue,

Dayforce recurring revenue was $180.3 million for the first quarter

of 2022, an increase of 31.0%, or 30.6% on a constant currency

basis.

- Cloud revenue, which includes both

Dayforce and Powerpay revenue, was $252.0 million for the first

quarter of 2022, an increase of 24.3%, or 24.2% on a constant

currency basis. Excluding float revenue, Cloud revenue was $241.5

million for the first quarter of 2022, an increase of 25.1%, or

24.9% on a constant currency basis.

Other Financial Highlights

- Cloud recurring gross margin2 was

69.3% for the first quarter of 2022, compared to 72.2%. Excluding

the impact of share-based compensation and related employer taxes,

severance charges, and certain other non-recurring items, cloud

recurring gross margin was 75.5% for the first quarter of 2022,

compared to 73.3%.3

- Net loss was ($27.4) million for the

first quarter of 2022, compared to ($19.2) million. Adjusted net

income3 was $20.5 million for the first quarter of 2022, compared

to $15.7 million.

- Diluted net loss per share was $(0.18)

for the first quarter of 2022, compared to $(0.13). Adjusted

diluted net income per share3 was $0.13 for the first quarter of

2022, compared to $0.10. Diluted weighted average common shares

outstanding were 152.1 million and 148.7 million for the first

quarter of 2022 and 2021, respectively, on a GAAP basis, and 155.8

million and 155.1 million for the first quarter of 2022 and 2021,

respectively, on an Adjusted basis3.

- Adjusted EBITDA3 was $57.4 million for

the first quarter of 2022, compared to $44.5 million.

- Cash and equivalents were $354.8

million as of March 31, 2022, compared to $367.5 million as of

December 31, 2021.

- Total debt was $1,240.5 million as of

March 31, 2022, a decrease of $2.0 million, compared to

$1,242.5 million as of December 31, 2021.

Dayforce Live Customer Count

- 5,609 Dayforce customers4 were live on

the Dayforce platform as of March 31, 2022, an increase of

11%.

- Dayforce recurring revenue per

customer3,5 was $110,947 for the trailing twelve months ended

March 31, 2022, an increase of 10%.

1 The quarterly financial highlights are on a year-over-year

basis, unless otherwise stated. All financial results are reported

in U.S. dollars unless otherwise stated. 2 Cloud recurring gross

margin is defined as total Cloud recurring revenue less cost of

Cloud recurring revenue for the applicable solution as a percentage

of total Cloud recurring revenue, which is exclusive of any product

development and management or depreciation and amortization cost

allocations.3 This is a Non-GAAP financial measure. For Non-GAAP

financial measures with a directly comparable GAAP financial

measure, a reconciliation of U.S. generally accepted accounting

principles (“GAAP”) to non-GAAP financial measures has been

provided in this press release, included in the accompanying

tables. An explanation of these measures is also included below

under the heading “Use of Non-GAAP Financial Measures.”4 Excluding

the 2021 acquisitions of Ascender HCM Pty Limited ("Ascender") and

ATI ROW, LLC and ADAM HCM MEXICO, S. de R.L. de C.V. (collectively,

"ADAM HCM").5 Excluding float revenue, the impact of lower

employment levels in 2021 and 2020 due to the Coronavirus disease

2019 ("COVID-19") pandemic, Ascender and ADAM HCM revenue and on a

constant currency basis.

Business Outlook

Based on information available as of May 4, 2022, Ceridian is

issuing the following guidance for the second quarter and fiscal

year of 2022 as indicated below. Comparisons are on a

year-over-year basis, unless stated otherwise.

Second Quarter 2022 Guidance

- Dayforce recurring revenue, excluding

float revenue, of $182 million to $184 million, or an increase of

27% to 29% on a GAAP basis and 28% to 29% on a constant currency

basis.

- Cloud revenue of $258 million to $260

million, or an increase of 23% to 24% on a GAAP basis and 24% to

25% on a constant currency basis.

- Total revenue of $293 million to $296

million, or an increase of 17% to 18% on a GAAP basis and 18% to

19% on a constant currency basis.

- Float revenue of $13 million, an

increase of 25% on a GAAP and constant currency basis.

- Adjusted EBITDA of $45 million to $47

million.

Full Year 2022 Guidance

- Dayforce recurring revenue, excluding

float revenue of $751 million to $762 million, or an increase of

26% to 28% on both a GAAP basis and a constant currency basis.

- Cloud revenue of $1,067 million to

$1,083 million, or an increase of 22% to 24% on both a GAAP basis

and a constant currency basis compared to previously issued

guidance of $1,054 million to $1,075 million.

- Total revenue of $1,208 million to

$1,230 million, or an increase of 18% to 20% on a GAAP basis and

constant currency basis compared to previously issued guidance of

$1,192 million to $1,217 million.

- Float revenue of $52 million, an

increase of 27% on a GAAP and constant currency basis.

- Adjusted EBITDA of $190 million to $205

million compared to previously issued guidance of $180 million to

$195 million.

Supplemental Guidance Details

Ceridian's guidance continues to assume productivity gains

through further integration of the Excelity and Ascender

acquisitions and specifically a re-balancing of resources across

its global footprint.

As expected, Ceridian incurred one-time severance and

restructuring costs in the first quarter of 2022 in conjunction

with the re-balancing of its workforce across its global footprint.

These costs amounted to $11 million in the first quarter of 2022

and were accounted for in cost of recurring revenue. Ceridian

continues to expect an additional $14 million of costs associated

with this re-balancing of the workforce. These remaining costs are

expected to be incurred primarily in the second and third quarters,

with the balance recognized in the fourth quarter of 2022.

Excluding these one-time costs, we expect cloud recurring gross

margin to continue to improve throughout 2022.

Ceridian's updated float guidance reflects the near-term rate

environment and the rolling maturity of our laddered core

portfolio.

Ceridian has not reconciled the Adjusted EBITDA range for the

full year or second quarter of 2022 to the directly comparable GAAP

financial measure because applicable information for the future

period, on which this reconciliation would be based, is not readily

available due to uncertainty regarding, and the potential

variability of, depreciation and amortization, share-based

compensation expense and related employer taxes, changes in foreign

currency exchange rates, and other items.

Foreign Exchange

The average U.S. dollar to Canadian dollar foreign exchange rate

was $1.27, with a daily range of $1.25 to $1.29 for the three

months ended March 31, 2022, compared to $1.27, with a daily

range of $1.24 to $1.29 for the three months ended March 31,

2021. As of March 31, 2022, the U.S. dollar to Canadian dollar

foreign exchange rate was $1.25. To present the performance of the

business excluding the effect of foreign currency rate

fluctuations, Ceridian presents revenue on a constant currency

basis, which it believes is useful to management and investors.

Revenue was calculated on a constant currency basis by applying the

average foreign exchange rate in effect during the comparable prior

period.

For the full year and second quarter of 2022, Ceridian's

guidance assumes an average U.S dollar to Canadian dollar foreign

exchange rate of $1.25, compared to an average rate of $1.25 for

the full year of 2022.

Conference Call Details

Ceridian will host a conference call to discuss the first

quarter of 2022 earnings at 5:00 p.m. Eastern Time on May 4, 2022.

A live Zoom Video Webinar of the event can be accessed at that

time, through a direct registration link at

https://ceridian.zoom.us/webinar/register/WN_13HXmXJ-RYy_tYlBkownIw.

Alternatively, the event can be accessed from the Events &

Presentations page on Ceridian’s Investor Relations website at

https://investors.ceridian.com. A replay and transcript will be

available after the conclusion of the live event on Ceridian’s

Investor Relations website.

About Ceridian HCM Holding Inc.

Ceridian. Makes Work Life Better™.

Ceridian is a global human capital management software company.

Dayforce, the flagship cloud HCM platform, provides human

resources, payroll, benefits, workforce management, and talent

management functionality. The Dayforce platform is used to optimize

management of the entire employee lifecycle, including attracting,

engaging, paying, deploying, and developing people. Ceridian has

solutions for organizations of all sizes.

Use of Non-GAAP Financial Measures

Ceridian uses certain non-GAAP financial measures in this

release including EBITDA, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted net income, Adjusted diluted net income per share, revenue

on a constant currency basis, and Dayforce recurring revenue per

customer. Ceridian believes that EBITDA, Adjusted EBITDA, Adjusted

EBITDA margin, and Adjusted net income, non-GAAP financial

measures, are useful to management and investors as supplemental

measures to evaluate its overall operating performance. Adjusted

EBITDA and Adjusted EBITDA margin are components of Ceridian’s

management incentive plan and are used by management to assess

performance and to compare its operating performance to its

competitors. Ceridian defines EBITDA as net income (loss) before

interest, taxes, depreciation, and amortization, and Adjusted

EBITDA as EBITDA, as adjusted to exclude foreign exchange gains

(losses), share-based compensation expense and related employer

taxes, severance charges, restructuring consulting fees, and other

non-recurring items. Adjusted EBITDA margin is determined by

calculating the percentage Adjusted EBITDA is of total revenue.

Adjusted net income is defined as net income (loss), as adjusted to

exclude foreign exchange gains (losses), share-based compensation

expense and related employer taxes, severance charges,

restructuring consulting fees, amortization of acquisition-related

intangible assets, and other non-recurring items, all of which are

adjusted for the effect of income taxes. Adjusted diluted net

income per share is calculated by dividing adjusted net income by

diluted weighted average common shares outstanding. When adjusted

diluted net income per share is positive, diluted weighted average

common shares outstanding incorporate the effect of dilutive equity

instruments. Ceridian believes that EBITDA, Adjusted EBITDA,

Adjusted EBITDA margin, and Adjusted net income are helpful in

highlighting management performance trends because EBITDA, Adjusted

EBITDA, Adjusted EBITDA margin, and Adjusted net income exclude the

results of decisions that are outside the normal course of its

business operations.

Ceridian’s presentation of EBITDA, Adjusted EBITDA, Adjusted

EBITDA margin, and Adjusted net income are intended as supplemental

measures of its performance that are not required by, or presented

in accordance with, GAAP. EBITDA, Adjusted EBITDA, Adjusted EBITDA

margin, and Adjusted net income should not be considered as

alternatives to net income, earnings per share, or any other

performance measures derived in accordance with GAAP, or as

measures of operating cash flows or liquidity. Ceridian’s

presentation of EBITDA, Adjusted EBITDA, Adjusted EBITDA margin,

and Adjusted net income should not be construed to imply that its

future results will be unaffected by similar items to those

eliminated in this presentation. EBITDA, Adjusted EBITDA, Adjusted

EBITDA margin, and Adjusted net income are included in this

discussion because they are key metrics used by management to

assess its operating performance.

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted

net income are not defined under GAAP, are not measures of net

income or any other performance measures derived in accordance with

GAAP, and are subject to important limitations. Ceridian’s use of

the terms EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and

Adjusted net income may not be comparable to similarly titled

measures of other companies in its industry and are not measures of

performance calculated in accordance with GAAP.

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted

net income have important limitations as analytical tools, and

should not be considered in isolation or as substitutes for

analysis of Ceridian’s results as reported under GAAP.

In evaluating EBITDA, Adjusted EBITDA, Adjusted EBITDA margin,

and Adjusted net income, users should be aware that in the future

Ceridian may incur expenses similar to those eliminated in this

presentation.

Ceridian presents revenue on a constant currency basis to assess

how its underlying businesses performed, excluding the effect of

foreign currency rate fluctuations, which it believes is useful to

management and investors. Revenue was calculated on a constant

currency basis by applying the average foreign exchange rate in

effect during the comparable prior period.

Ceridian's Dayforce recurring revenue per customer is an

indicator of the average size of our Dayforce recurring revenue

customers. To calculate Dayforce recurring revenue per customer,

Ceridian starts with Dayforce recurring revenue on a constant

currency basis by applying the same exchange rate to all comparable

periods for the trailing twelve months and excludes float revenue,

the impact of lower employment levels in 2021 and 2020 due to the

COVID-19 pandemic, and Ascender and ADAM HCM revenue. This amount

is divided by the number of live Dayforce customers at the end of

the trailing twelve month period, excluding Ascender and ADAM HCM.

Ceridian calculates and monitors Dayforce recurring revenue per

customer on a quarterly basis. Ceridian's Dayforce recurring

revenue per customer may fluctuate as a result of a number of

factors, including the number of live Dayforce customers and the

number of customers purchasing the full HCM suite. Ceridian has not

reconciled the Dayforce recurring revenue per customer because

there is no directly comparable GAAP financial measure.

Forward-Looking Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. All statements other than

statements of historical fact or relating to present facts or

current conditions included in this press release are

forward-looking statements. Forward-looking statements give

Ceridian’s current expectations and projections relating to its

financial condition, results of operations, plans, objectives,

future performance and business. Users can identify forward-looking

statements by the fact that they do not relate strictly to

historical or current facts. Forward-looking statements in this

press release include statements relating to the fiscal year of

2022, as well as those relating to future growth initiatives. These

statements may include words such as “anticipate,” “estimate,”

“expect,” “project,” “seek,” “plan,” “intend,” “believe,” “will,”

“may,” “could,” “continue,” “likely,” “should,” and other words and

terms of similar meaning in connection with any discussion of the

timing or nature of future operating or financial performance or

other events but not all forward-looking statements contain these

identifying words. The forward-looking statements contained in this

press release are based on assumptions that Ceridian has made in

light of its industry experience and its perceptions of historical

trends, current conditions, expected future developments and other

factors that it believes are appropriate under the circumstances.

As users consider this press release, it should be understood that

these statements are not guarantees of performance or results.

These assumptions and Ceridian’s future performance or results

involve risks and uncertainties (many of which are beyond its

control). In particular:

- its inability to manage its growth

effectively or execute on its growth strategy;

- its failure to provide new or enhanced

functionality and features;

- its inability to successfully compete

in the market in which we operate and expand its current offerings

into new markets or further penetrate existing markets due to

competition;

- its inability to offer and deliver

high-quality technical support, implementation and professional

services;

- system breaches, interruptions or

failures, including cyber-security breaches, identity theft, or

other disruptions that could compromise customer information or

sensitive company information;

- its failure to comply with applicable

privacy, security, data, and financial services laws, regulations

and standards, including its ongoing consent order with the Federal

Trade Commission regarding data protection;

- its failure to properly update its

solutions to enable its customers to comply with applicable

laws;

- its failure to manage its aging

technical operations infrastructure;

- its inability to maintain necessary

third-party relationships, and third party software licenses, and

identify errors in the software it licenses;

- its inability to attract and retain

senior management employees and highly skilled employees;

- the impact of its outstanding debt

obligations on its financial condition, results of operations, and

value of its common stock; or

- the duration and scope of the COVID-19

pandemic, including the uncertainty around the surge of different

variants and the actions that governmental authorities may take in

all the jurisdictions where we operate.

Additional factors or events that could cause Ceridian’s actual

performance to differ from these forward-looking statements may

emerge from time to time, and it is not possible for Ceridian to

predict all of them. Should one or more of these risks or

uncertainties materialize, or should any of Ceridian’s assumptions

prove incorrect, its actual financial condition, results of

operations, future performance and business may vary in material

respects from the performance projected in these forward-looking

statements. In addition to any factors and assumptions set forth

above in this press release, the material factors and assumptions

used to develop the forward-looking information include, but are

not limited to: the general economy remains stable; the competitive

environment in the HCM market remains stable; the demand

environment for HCM solutions remains stable; Ceridian’s

implementation capabilities and cycle times remain stable; foreign

exchange rates, both current and those used in developing

forward-looking statements, specifically USD to CAD, remain stable

at, or near, current rates; Ceridian will be able to maintain its

relationships with its employees, customers and partners; Ceridian

will continue to attract qualified personnel to support its

development requirements and the support of its new and existing

customers; and that the risk factors noted above, individually or

collectively, do not have a material impact on Ceridian. Any

forward-looking statement made by Ceridian in this press release

speaks only as of the date on which it is made. Ceridian undertakes

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

Ceridian HCM Holding Inc.

Condensed Consolidated Balance

Sheets

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| (Dollars in millions,

except share data) |

|

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and equivalents |

|

$ |

354.8 |

|

|

$ |

367.5 |

|

|

Restricted cash |

|

|

1.9 |

|

|

|

1.9 |

|

|

Trade and other receivables, net |

|

|

144.5 |

|

|

|

146.3 |

|

|

Prepaid expenses and other current assets |

|

|

112.6 |

|

|

|

92.6 |

|

|

Total current assets before customer funds |

|

|

613.8 |

|

|

|

608.3 |

|

|

Customer funds |

|

|

7,364.2 |

|

|

|

3,535.8 |

|

|

Total current assets |

|

|

7,978.0 |

|

|

|

4,144.1 |

|

| Right of use lease asset |

|

|

28.7 |

|

|

|

29.4 |

|

| Property, plant, and equipment,

net |

|

|

134.3 |

|

|

|

128.2 |

|

| Goodwill |

|

|

2,336.8 |

|

|

|

2,323.6 |

|

| Other intangible assets, net |

|

|

330.1 |

|

|

|

332.5 |

|

| Other assets |

|

|

251.6 |

|

|

|

208.4 |

|

|

Total assets |

|

$ |

11,059.5 |

|

|

$ |

7,166.2 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

8.3 |

|

|

$ |

8.3 |

|

|

Current portion of long-term lease liabilities |

|

|

11.2 |

|

|

|

11.3 |

|

|

Accounts payable |

|

|

49.4 |

|

|

|

51.7 |

|

|

Deferred revenue |

|

|

48.1 |

|

|

|

48.7 |

|

|

Employee compensation and benefits |

|

|

69.7 |

|

|

|

77.3 |

|

|

Other accrued expenses |

|

|

23.7 |

|

|

|

24.7 |

|

|

Total current liabilities before customer funds obligations |

|

|

210.4 |

|

|

|

222.0 |

|

|

Customer funds obligations |

|

|

7,418.5 |

|

|

|

3,519.9 |

|

|

Total current liabilities |

|

|

7,628.9 |

|

|

|

3,741.9 |

|

| Long-term debt, less current

portion |

|

|

1,215.7 |

|

|

|

1,124.4 |

|

| Employee benefit plans |

|

|

20.2 |

|

|

|

20.7 |

|

| Long-term lease liabilities, less

current portion |

|

|

31.1 |

|

|

|

32.7 |

|

| Other liabilities |

|

|

22.8 |

|

|

|

19.0 |

|

|

Total liabilities |

|

|

8,918.7 |

|

|

|

4,938.7 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Common stock, $0.01 par, 500,000,000 shares authorized, 152,530,449

and 151,995,031 shares issued and outstanding,

respectively |

|

|

1.5 |

|

|

|

1.5 |

|

|

Additional paid in capital |

|

|

2,823.8 |

|

|

|

2,860.0 |

|

|

Accumulated deficit |

|

|

(326.6 |

) |

|

|

(309.2 |

) |

|

Accumulated other comprehensive loss |

|

|

(357.9 |

) |

|

|

(324.8 |

) |

|

Total stockholders’ equity |

|

|

2,140.8 |

|

|

|

2,227.5 |

|

|

Total liabilities and equity |

|

$ |

11,059.5 |

|

|

$ |

7,166.2 |

|

Ceridian HCM Holding Inc.

Condensed Consolidated Statements of

Operations

| |

|

Three Months Ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

| (Dollars in millions,

except share and per share data) |

|

(unaudited) |

|

| Revenue: |

|

|

|

|

|

|

|

Recurring |

|

$ |

247.9 |

|

|

$ |

196.0 |

|

|

Professional services and other |

|

|

45.4 |

|

|

|

38.5 |

|

|

Total revenue |

|

|

293.3 |

|

|

|

234.5 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

Recurring |

|

|

82.3 |

|

|

|

59.7 |

|

|

Professional services and other |

|

|

54.5 |

|

|

|

44.7 |

|

|

Product development and management |

|

|

40.4 |

|

|

|

25.8 |

|

|

Depreciation and amortization |

|

|

13.0 |

|

|

|

11.1 |

|

|

Total cost of revenue |

|

|

190.2 |

|

|

|

141.3 |

|

| Gross profit |

|

|

103.1 |

|

|

|

93.2 |

|

| Selling, general, and

administrative |

|

|

122.0 |

|

|

|

95.6 |

|

| Operating loss |

|

|

(18.9 |

) |

|

|

(2.4 |

) |

|

Interest expense, net |

|

|

5.8 |

|

|

|

5.6 |

|

|

Other (income) expense, net |

|

|

(0.3 |

) |

|

|

4.6 |

|

| Loss before income taxes |

|

|

(24.4 |

) |

|

|

(12.6 |

) |

| Income tax expense |

|

|

3.0 |

|

|

|

6.6 |

|

| Net loss |

|

$ |

(27.4 |

) |

|

$ |

(19.2 |

) |

| Net loss per share: |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.18 |

) |

|

$ |

(0.13 |

) |

|

Diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.13 |

) |

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

152,124,151 |

|

|

|

148,716,050 |

|

|

Diluted |

|

|

152,124,151 |

|

|

|

148,716,050 |

|

Ceridian HCM Holding Inc.

Condensed Consolidated Statements of Cash

Flows

| |

|

Three Months Ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(Dollars in millions, unaudited) |

|

| Net loss |

|

$ |

(27.4 |

) |

|

$ |

(19.2 |

) |

| Adjustments to reconcile net loss

to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

Deferred income tax benefit |

|

|

4.5 |

|

|

|

0.6 |

|

|

Depreciation and amortization |

|

|

20.9 |

|

|

|

15.0 |

|

|

Amortization of debt issuance costs and debt discount |

|

|

1.0 |

|

|

|

1.1 |

|

|

Provision for doubtful accounts |

|

|

0.9 |

|

|

|

0.4 |

|

|

Net periodic pension and postretirement cost |

|

|

1.2 |

|

|

|

2.2 |

|

|

Share-based compensation |

|

|

35.5 |

|

|

|

22.8 |

|

|

Change in fair value of contingent consideration |

|

|

0.8 |

|

|

|

— |

|

|

Other |

|

|

— |

|

|

|

1.1 |

|

|

Changes in operating assets and liabilities excluding effects of

acquisitions and divestitures: |

|

|

|

|

|

|

|

Trade and other receivables |

|

|

1.0 |

|

|

|

(8.1 |

) |

|

Prepaid expenses and other current assets |

|

|

(14.1 |

) |

|

|

(7.1 |

) |

|

Accounts payable and other accrued expenses |

|

|

(4.6 |

) |

|

|

(2.1 |

) |

|

Deferred revenue |

|

|

(1.1 |

) |

|

|

4.9 |

|

|

Employee compensation and benefits |

|

|

(8.2 |

) |

|

|

(24.7 |

) |

|

Accrued interest |

|

|

(0.4 |

) |

|

|

0.4 |

|

|

Accrued taxes |

|

|

(3.3 |

) |

|

|

8.6 |

|

|

Other assets and liabilities |

|

|

(1.2 |

) |

|

|

(0.4 |

) |

| Net cash provided by (used in)

operating activities |

|

|

5.5 |

|

|

|

(4.5 |

) |

| Cash Flows from Investing

Activities |

|

|

|

|

|

|

| Purchase of customer funds

marketable securities |

|

|

(276.9 |

) |

|

|

(148.5 |

) |

| Proceeds from sale and maturity

of customer funds marketable securities |

|

|

112.1 |

|

|

|

97.4 |

|

| Expenditures for property, plant,

and equipment |

|

|

(2.1 |

) |

|

|

(3.4 |

) |

| Expenditures for software and

technology |

|

|

(17.8 |

) |

|

|

(11.9 |

) |

| Acquisition costs, net of cash

and restricted cash acquired |

|

|

— |

|

|

|

(338.3 |

) |

| Net cash used in investing

activities |

|

|

(184.7 |

) |

|

|

(404.7 |

) |

| Cash Flows from Financing

Activities |

|

|

|

|

|

|

| Increase in customer funds

obligations, net |

|

|

3,879.8 |

|

|

|

513.2 |

|

| Proceeds from issuance of common

stock under share-based compensation plans |

|

|

6.0 |

|

|

|

11.3 |

|

| Repayment of long-term debt

obligations |

|

|

(2.1 |

) |

|

|

(1.3 |

) |

| Proceeds from revolving credit

facility |

|

|

— |

|

|

|

295.0 |

|

| Repayment of revolving credit

facility |

|

|

— |

|

|

|

(295.0 |

) |

| Proceeds from issuance of

convertible senior notes, net of issuance costs |

|

|

— |

|

|

|

561.8 |

|

| Purchases of capped calls related

to convertible senior notes |

|

|

— |

|

|

|

(45.0 |

) |

| Net cash provided by financing

activities |

|

|

3,883.7 |

|

|

|

1,040.0 |

|

| Effect of exchange rate

changes on cash, restricted cash, and equivalents |

|

|

1.7 |

|

|

|

3.4 |

|

| Net increase in cash, restricted

cash, and equivalents |

|

|

3,706.2 |

|

|

|

634.2 |

|

| Cash, restricted cash, and

equivalents at beginning of period |

|

|

1,952.9 |

|

|

|

2,228.5 |

|

| Cash, restricted cash, and

equivalents at end of period |

|

$ |

5,659.1 |

|

|

$ |

2,862.7 |

|

| Reconciliation of cash,

restricted cash, and equivalents to the

condensed consolidated balance

sheets |

|

|

|

|

|

|

| Cash and equivalents |

|

$ |

354.8 |

|

|

$ |

339.6 |

|

| Restricted cash |

|

|

1.9 |

|

|

|

2.0 |

|

| Restricted cash and equivalents

included in customer funds |

|

|

5,302.4 |

|

|

|

2,521.1 |

|

| Total cash, restricted cash, and

equivalents |

|

$ |

5,659.1 |

|

|

$ |

2,862.7 |

|

Ceridian HCM Holding Inc.

Revenue Financial Measures

(Unaudited)

|

|

|

Three Months Ended March 31, |

|

|

Percentagechange

inrevenue

asreported |

|

|

Impact ofchanges

inforeigncurrency

(a) |

|

|

Percentagechange

inrevenue

onconstantcurrency basis

(a) |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 vs. 2021 |

|

|

|

|

|

2022 vs. 2021 |

|

|

|

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dayforce recurring, excluding float |

|

$ |

180.3 |

|

|

$ |

137.6 |

|

|

|

31.0 |

% |

|

|

0.4 |

% |

|

|

30.6 |

% |

|

Dayforce float |

|

|

8.3 |

|

|

|

7.7 |

|

|

|

7.8 |

% |

|

|

(— |

)% |

|

|

7.8 |

% |

|

Total Dayforce recurring |

|

|

188.6 |

|

|

|

145.3 |

|

|

|

29.8 |

% |

|

|

0.4 |

% |

|

|

29.4 |

% |

|

Powerpay recurring, excluding float |

|

|

19.4 |

|

|

|

18.4 |

|

|

|

5.4 |

% |

|

|

(0.6 |

)% |

|

|

6.0 |

% |

|

Powerpay float |

|

|

2.2 |

|

|

|

1.9 |

|

|

|

15.8 |

% |

|

|

(— |

)% |

|

|

15.8 |

% |

|

Total Powerpay recurring |

|

|

21.6 |

|

|

|

20.3 |

|

|

|

6.4 |

% |

|

|

(0.5 |

)% |

|

|

6.9 |

% |

|

Total Cloud recurring |

|

|

210.2 |

|

|

|

165.6 |

|

|

|

26.9 |

% |

|

|

0.3 |

% |

|

|

26.6 |

% |

|

Dayforce professional services and other |

|

|

41.6 |

|

|

|

36.8 |

|

|

|

13.0 |

% |

|

|

(0.6 |

)% |

|

|

13.6 |

% |

|

Powerpay professional services and other |

|

|

0.2 |

|

|

|

0.3 |

|

|

|

(33.3 |

)% |

|

|

(— |

)% |

|

|

(33.3 |

)% |

|

Total Cloud professional services

and other |

|

|

41.8 |

|

|

|

37.1 |

|

|

|

12.7 |

% |

|

|

(0.5 |

)% |

|

|

13.2 |

% |

|

Total Cloud revenue |

|

|

252.0 |

|

|

|

202.7 |

|

|

|

24.3 |

% |

|

|

0.1 |

% |

|

|

24.2 |

% |

|

Bureau recurring, excluding float |

|

|

36.8 |

|

|

|

29.3 |

|

|

|

25.6 |

% |

|

|

(1.0 |

)% |

|

|

26.6 |

% |

|

Bureau float |

|

|

0.9 |

|

|

|

1.1 |

|

|

|

(18.2 |

)% |

|

|

(— |

)% |

|

|

(18.2 |

)% |

|

Total Bureau recurring |

|

|

37.7 |

|

|

|

30.4 |

|

|

|

24.0 |

% |

|

|

(1.0 |

)% |

|

|

25.0 |

% |

|

Bureau professional services and other |

|

|

3.6 |

|

|

|

1.4 |

|

|

|

157.1 |

% |

|

|

(— |

)% |

|

|

157.1 |

% |

|

Total Bureau revenue |

|

|

41.3 |

|

|

|

31.8 |

|

|

|

29.9 |

% |

|

|

(0.9 |

)% |

|

|

30.8 |

% |

| Total revenue |

|

$ |

293.3 |

|

|

$ |

234.5 |

|

|

|

25.1 |

% |

|

|

(— |

)% |

|

|

25.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dayforce |

|

$ |

230.2 |

|

|

$ |

182.1 |

|

|

|

26.4 |

% |

|

|

0.2 |

% |

|

|

26.2 |

% |

|

Powerpay |

|

|

21.8 |

|

|

|

20.6 |

|

|

|

5.8 |

% |

|

|

(0.5 |

)% |

|

|

6.3 |

% |

| Total Cloud revenue |

|

$ |

252.0 |

|

|

$ |

202.7 |

|

|

|

24.3 |

% |

|

|

0.1 |

% |

|

|

24.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dayforce, excluding float |

|

$ |

221.9 |

|

|

$ |

174.4 |

|

|

|

27.2 |

% |

|

|

0.2 |

% |

|

|

27.0 |

% |

|

Powerpay, excluding float |

|

|

19.6 |

|

|

|

18.7 |

|

|

|

4.8 |

% |

|

|

(0.5 |

)% |

|

|

5.3 |

% |

|

Cloud float |

|

|

10.5 |

|

|

|

9.6 |

|

|

|

9.4 |

% |

|

|

(— |

)% |

|

|

9.4 |

% |

| Total Cloud revenue |

|

$ |

252.0 |

|

|

$ |

202.7 |

|

|

|

24.3 |

% |

|

|

0.1 |

% |

|

|

24.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cloud recurring, excluding float |

|

$ |

199.7 |

|

|

$ |

156.0 |

|

|

|

28.0 |

% |

|

|

0.3 |

% |

|

|

27.7 |

% |

|

Bureau recurring, excluding float |

|

|

36.8 |

|

|

|

29.3 |

|

|

|

25.6 |

% |

|

|

(1.0 |

)% |

|

|

26.6 |

% |

| Total recurring, excluding

float |

|

|

236.5 |

|

|

|

185.3 |

|

|

|

27.6 |

% |

|

|

0.1 |

% |

|

|

27.5 |

% |

| Total revenue, excluding

float |

|

$ |

281.9 |

|

|

$ |

223.8 |

|

|

|

26.0 |

% |

|

|

(— |

)% |

|

|

26.0 |

% |

|

(a) |

We have calculated revenue on a constant currency basis by applying

the average foreign exchange rate in effect during the comparable

prior period. |

Ceridian HCM Holding Inc.

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Unaudited)

The following tables present a reconciliation of the reported

results to the non-GAAP financial measures EBITDA, Adjusted EBITDA,

Adjusted EBITDA margin, and Adjusted net loss for all periods

presented:

| |

|

Three Months Ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(Dollars in millions) |

|

|

Net loss |

|

$ |

(27.4 |

) |

|

$ |

(19.2 |

) |

|

Interest expense, net |

|

|

5.8 |

|

|

|

5.6 |

|

|

Income tax expense |

|

|

3.0 |

|

|

|

6.6 |

|

|

Depreciation and amortization |

|

|

20.9 |

|

|

|

15.0 |

|

|

EBITDA (a) |

|

|

2.3 |

|

|

|

8.0 |

|

|

Foreign exchange (gain) loss |

|

|

(0.8 |

) |

|

|

1.9 |

|

|

Share-based compensation (b) |

|

|

35.5 |

|

|

|

23.0 |

|

|

Severance charges (c) |

|

|

17.3 |

|

|

|

2.1 |

|

|

Restructuring consulting fees (d) |

|

|

1.9 |

|

|

|

7.8 |

|

|

Other non-recurring items (e) |

|

|

1.2 |

|

|

|

1.7 |

|

|

Adjusted EBITDA |

|

$ |

57.4 |

|

|

$ |

44.5 |

|

|

Net profit margin (f) |

|

|

(9.3 |

)% |

|

|

(8.2 |

)% |

|

Adjusted EBITDA margin |

|

|

19.6 |

% |

|

|

19.0 |

% |

|

(a) |

We define EBITDA as net income or loss before interest, taxes, and

depreciation and amortization. |

|

(b) |

Represents share-based compensation expense and related employer

taxes. |

|

(c) |

Represents costs for severance compensation paid to employees whose

positions have been eliminated or who have been terminated not for

cause. |

|

(d) |

Represents consulting fees and expenses incurred during the periods

presented in connection with any acquisition, investment,

disposition, recapitalization, equity offering, issuance or

repayment of debt, issuance of equity interests, or

refinancing. |

|

(e) |

Represents (1) the impact of the fair value adjustment for the

DataFuzion HCM, Inc. ("DataFuzion") contingent consideration in

2022, (2) the difference between the historical five-year average

pension expense and the current period actuarially determined

pension expense associated with the planned termination of the

frozen U.S. pension plan and related changes in investment strategy

associated with protecting the now fully funded status in 2022 and

2021, (3) charges of $0.3 million during the three months ended

March 31, 2021 related to the abandonment of certain leased

facilities. |

|

(f) |

Net profit margin is determined by calculating the percentage that

net income (loss) is of total revenue. |

| |

|

Three Months Ended March 31, 2022 |

|

| |

|

As reported |

|

|

Share-basedcompensation |

|

|

Severancecharges |

|

|

Other (a) |

|

|

Adjusted (b) |

|

| |

|

(Dollars in millions) |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cloud |

|

$ |

64.6 |

|

|

$ |

3.5 |

|

|

$ |

9.6 |

|

|

$ |

— |

|

|

$ |

51.5 |

|

|

Bureau |

|

|

17.7 |

|

|

|

0.4 |

|

|

|

1.5 |

|

|

|

— |

|

|

|

15.8 |

|

|

Total recurring |

|

|

82.3 |

|

|

|

3.9 |

|

|

|

11.1 |

|

|

|

— |

|

|

|

67.3 |

|

|

Professional services and other |

|

|

54.5 |

|

|

|

2.9 |

|

|

|

0.2 |

|

|

|

— |

|

|

|

51.4 |

|

|

Product development and management |

|

|

40.4 |

|

|

|

5.8 |

|

|

|

3.3 |

|

|

|

— |

|

|

|

31.3 |

|

|

Depreciation and amortization |

|

|

13.0 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13.0 |

|

|

Total cost of revenue |

|

|

190.2 |

|

|

|

12.6 |

|

|

|

14.6 |

|

|

|

— |

|

|

|

163.0 |

|

| Sales and marketing |

|

|

58.4 |

|

|

|

5.2 |

|

|

|

2.1 |

|

|

|

— |

|

|

|

51.1 |

|

| General and administrative |

|

|

63.6 |

|

|

|

17.7 |

|

|

|

0.6 |

|

|

|

10.5 |

|

|

|

34.8 |

|

| Operating (loss) profit |

|

|

(18.9 |

) |

|

|

35.5 |

|

|

|

17.3 |

|

|

|

10.5 |

|

|

|

44.4 |

|

| Other (income) expense, net |

|

|

(0.3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.4 |

) |

|

|

0.1 |

|

| Depreciation and

amortization |

|

|

20.9 |

|

|

|

— |

|

|

|

— |

|

|

|

(7.8 |

) |

|

|

13.1 |

|

| EBITDA |

|

$ |

2.3 |

|

|

$ |

35.5 |

|

|

$ |

17.3 |

|

|

$ |

2.3 |

|

|

$ |

57.4 |

|

| Interest expense, net |

|

|

5.8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5.8 |

|

| Income tax expense (c) |

|

|

3.0 |

|

|

|

— |

|

|

|

— |

|

|

|

(15.0 |

) |

|

|

18.0 |

|

| Depreciation and

amortization |

|

|

20.9 |

|

|

|

— |

|

|

|

— |

|

|

|

7.8 |

|

|

|

13.1 |

|

| Net (loss) income |

|

$ |

(27.4 |

) |

|

$ |

35.5 |

|

|

$ |

17.3 |

|

|

$ |

(4.9 |

) |

|

$ |

20.5 |

|

| Net (loss) income per share -

basic (d) |

|

$ |

(0.18 |

) |

|

$ |

0.23 |

|

|

$ |

0.11 |

|

|

$ |

(0.03 |

) |

|

$ |

0.13 |

|

| Net (loss) income per share -

diluted (d) |

|

$ |

(0.18 |

) |

|

$ |

0.23 |

|

|

$ |

0.11 |

|

|

$ |

(0.03 |

) |

|

$ |

0.13 |

|

|

(a) |

Other includes amortization of acquisition-related intangible

assets, restructuring consulting fees, foreign exchange gain, the

impact of the fair value adjustment for the DataFuzion contingent

consideration, and the difference between the historical five-year

average pension expense and the current period actuarially

determined pension expense associated with the planned termination

of the frozen U.S. pension plan and related changes in investment

strategy associated with protecting the now fully funded

status. |

|

(b) |

The Adjusted amount is a non-GAAP financial measure. |

|

(c) |

Income tax effects have been calculated based on the statutory tax

rates in effect in the U.S. and foreign jurisdictions during the

period. |

|

(d) |

GAAP and Adjusted basic and diluted net (loss) income per share are

calculated based upon 152,124,151 and 155,766,268 weighted-average

shares of common stock, respectively. |

| |

|

Three Months Ended March 31, 2021 |

|

| |

|

As reported |

|

|

Share-basedcompensation |

|

|

Severancecharges |

|

|

Other (a) |

|

|

Adjusted (b) |

|

| |

|

(Dollars in millions) |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cloud |

|

$ |

46.1 |

|

|

$ |

1.9 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

44.2 |

|

|

Bureau |

|

|

13.6 |

|

|

|

0.4 |

|

|

|

0.7 |

|

|

|

— |

|

|

|

12.5 |

|

|

Total recurring |

|

|

59.7 |

|

|

|

2.3 |

|

|

|

0.7 |

|

|

|

— |

|

|

|

56.7 |

|

|

Professional services and other |

|

|

44.7 |

|

|

|

1.9 |

|

|

|

— |

|

|

|

— |

|

|

|

42.8 |

|

|

Product development and management |

|

|

25.8 |

|

|

|

3.1 |

|

|

|

0.2 |

|

|

|

— |

|

|

|

22.5 |

|

|

Depreciation and amortization |

|

|

11.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11.1 |

|

|

Total cost of revenue |

|

|

141.3 |

|

|

|

7.3 |

|

|

|

0.9 |

|

|

|

— |

|

|

|

133.1 |

|

| Sales and marketing |

|

|

46.1 |

|

|

|

2.8 |

|

|

|

0.8 |

|

|

|

— |

|

|

|

42.5 |

|

| General and administrative |

|

|

49.5 |

|

|

|

12.9 |

|

|

|

0.4 |

|

|

|

10.3 |

|

|

|

25.9 |

|

| Operating (loss) profit |

|

|

(2.4 |

) |

|

|

23.0 |

|

|

|

2.1 |

|

|

|

10.3 |

|

|

|

33.0 |

|

| Other expense, net |

|

|

4.6 |

|

|

|

— |

|

|

|

— |

|

|

|

3.3 |

|

|

|

1.3 |

|

| Depreciation and

amortization |

|

|

15.0 |

|

|

|

— |

|

|

|

— |

|

|

|

(2.2 |

) |

|

|

12.8 |

|

| EBITDA |

|

$ |

8.0 |

|

|

$ |

23.0 |

|

|

$ |

2.1 |

|

|

$ |

11.4 |

|

|

$ |

44.5 |

|

| Interest expense, net |

|

|

5.6 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5.6 |

|

| Income tax expense (c) |

|

|

6.6 |

|

|

|

— |

|

|

|

— |

|

|

|

(3.8 |

) |

|

|

10.4 |

|

| Depreciation and

amortization |

|

|

15.0 |

|

|

|

— |

|

|

|

— |

|

|

|

2.2 |

|

|

|

12.8 |

|

| Net (loss) income |

|

$ |

(19.2 |

) |

|

$ |

23.0 |

|

|

$ |

2.1 |

|

|

$ |

9.8 |

|

|

$ |

15.7 |

|

| Net (loss) income per share -

basic (d) |

|

$ |

(0.13 |

) |

|

$ |

0.15 |

|

|

$ |

0.01 |

|

|

$ |

0.07 |

|

|

$ |

0.11 |

|

| Net (loss) income per share -

diluted (d) |

|

$ |

(0.13 |

) |

|

$ |

0.15 |

|

|

$ |

0.01 |

|

|

$ |

0.06 |

|

|

$ |

0.10 |

|

|

(a) |

Other includes amortization of acquisition-related intangible

assets, foreign exchange loss, restructuring consulting fees, the

difference between the historical five-year average run rate and

the current period actuarially determined pension expense resulting

from the changes in investment strategy associated with protecting

the now fully funded status of our largest U.S pension plan, and

charges related to the abandonment of certain leased

facilities. |

|

(b) |

The Adjusted amount is a non-GAAP financial measure. |

|

(c) |

Income tax effects have been calculated based on the statutory tax

rates in effect in the U.S. and foreign jurisdictions during the

period. |

|

(d) |

GAAP basic and diluted net loss per share are calculated based upon

148,716,050 weighted-average shares of common stock, and Adjusted

basic and diluted net income per share are calculated based upon

148,716,050 and 155,130,391 weighted-average shares of common

stock, respectively. |

Ceridian is providing the supplemental tables below to

illustrate the impacts of the adjustment for amortization of

acquisition-related intangible assets for the set forth historical

periods indicated. All figures below are non-GAAP financial

measures, and readers should refer to the “Use of Non-GAAP

Financial Measures” section above for further information.

Ceridian’s amortization of acquisition-related intangible assets is

included within General and administrative expense; therefore, this

adjustment impacts only the line items presented below.

| |

|

Three Months Ended |

|

|

|

|

| |

|

March 31, 2021 |

|

|

June 30, 2021 |

|

|

September 30, 2021 |

|

|

December 31, 2021 |

|

|

Twelve Months Ended December 31, 2021 |

|

| |

|

(Dollars in millions, except share and per share

data) |

|

| Adjusted, as

previously reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

28.1 |

|

|

$ |

37.6 |

|

|

$ |

34.2 |

|

|

$ |

36.1 |

|

|

$ |

136.0 |

|

|

Operating profit |

|

$ |

30.8 |

|

|

$ |

18.2 |

|

|

$ |

18.9 |

|

|

$ |

18.8 |

|

|

$ |

86.7 |

|

|

Net income |

|

$ |

13.5 |

|

|

$ |

9.1 |

|

|

$ |

8.5 |

|

|

$ |

9.3 |

|

|

$ |

40.4 |

|

|

Net income per share- basic |

|

$ |

0.09 |

|

|

$ |

0.06 |

|

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

$ |

0.27 |

|

|

Net income per share- diluted |

|

$ |

0.09 |

|

|

$ |

0.06 |

|

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

$ |

0.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition-related intangible

amortization expense |

|

$ |

2.2 |

|

|

$ |

9.8 |

|

|

$ |

7.3 |

|

|

$ |

4.6 |

|

|

$ |

23.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted,

revised: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

25.9 |

|

|

$ |

27.8 |

|

|

$ |

26.9 |

|

|

$ |

31.5 |

|

|

$ |

112.1 |

|

|

Operating profit |

|

$ |

33.0 |

|

|

$ |

28.0 |

|

|

$ |

26.2 |

|

|

$ |

23.4 |

|

|

$ |

110.6 |

|

|

Net income |

|

$ |

15.7 |

|

|

$ |

18.9 |

|

|

$ |

15.8 |

|

|

$ |

13.9 |

|

|

$ |

64.3 |

|

|

Net income per share- basic |

|

$ |

0.11 |

|

|

$ |

0.13 |

|

|

$ |

0.11 |

|

|

$ |

0.09 |

|

|

$ |

0.43 |

|

|

Net income per share- diluted |

|

$ |

0.10 |

|

|

$ |

0.12 |

|

|

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-averages shares

outstanding - basic |

|

|

148,716,050 |

|

|

|

149,293,833 |

|

|

|

150,450,595 |

|

|

|

151,465,292 |

|

|

|

150,402,321 |

|

| Weighted-averages shares

outstanding - diluted |

|

|

155,130,391 |

|

|

|

155,360,486 |

|

|

|

156,861,973 |

|

|

|

157,799,902 |

|

|

|

156,842,934 |

|

| |

|

Three Months Ended |

|

|

|

|

| |

|

March 31, 2020 |

|

|

June 30, 2020 |

|

|

September 30, 2020 |

|

|

December 31, 2020 |

|

|

Twelve Months Ended December 31, 2020 |

|

| |

|

(Dollars in millions, except share and per share

data) |

|

| Adjusted, as

previously reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

22.7 |

|

|

$ |

22.9 |

|

|

$ |

25.7 |

|

|

$ |

27.6 |

|

|

$ |

98.9 |

|

|

Operating profit |

|

$ |

44.2 |

|

|

$ |

26.2 |

|

|

$ |

21.2 |

|

|

$ |

19.3 |

|

|

$ |

110.9 |

|

|

Net income |

|

$ |

22.0 |

|

|

$ |

19.4 |

|

|

$ |

17.7 |

|

|

$ |

14.0 |

|

|

$ |

73.1 |

|

|

Net income per share- basic |

|

$ |

0.15 |

|

|

$ |

0.13 |

|

|

$ |

0.12 |

|

|

$ |

0.09 |

|

|

$ |

0.50 |

|

|

Net income per share- diluted |

|

$ |

0.15 |

|

|

$ |

0.13 |

|

|

$ |

0.12 |

|

|

$ |

0.09 |

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition-related intangible

amortization expense |

|

$ |

0.4 |

|

|

$ |

0.4 |

|

|

$ |

0.8 |

|

|

$ |

2.2 |

|

|

$ |

3.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted,

revised: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

22.3 |

|

|

$ |

22.5 |

|

|

$ |

24.9 |

|

|

$ |

25.4 |

|

|

$ |

95.1 |

|

|

Operating profit |

|

$ |

44.6 |

|

|

$ |

26.6 |

|

|

$ |

22.0 |

|

|

$ |

21.5 |

|

|

$ |

114.7 |

|

|

Net income |

|

$ |

22.4 |

|

|

$ |

19.8 |

|

|

$ |

18.5 |

|

|

$ |

16.2 |

|

|

$ |

76.9 |

|

|

Net income per share- basic |

|

$ |

0.15 |

|

|

$ |

0.14 |

|

|

$ |

0.13 |

|

|

$ |

0.11 |

|

|

$ |

0.52 |

|

|

Net income per share- diluted |

|

$ |

0.15 |

|

|

$ |

0.13 |

|

|

$ |

0.12 |

|

|

$ |

0.10 |

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-averages shares

outstanding - basic |

|

|

144,645,325 |

|

|

|

145,593,019 |

|

|

|

147,141,403 |

|

|

|

148,086,778 |

|

|

|

146,774,471 |

|

| Weighted-averages shares

outstanding - diluted |

|

|

151,178,498 |

|

|

|

151,444,901 |

|

|

|

153,509,899 |

|

|

|

155,358,595 |

|

|

|

153,403,306 |

|

Source: Ceridian HCM Holding Inc.

For further information, please contact:

Investor Relations1-844-829-9499investors@ceridian.com

Public Relations1-647-417-2117teri.murphy@ceridian.com

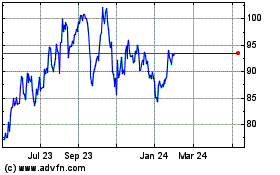

Ceridian HCM (TSX:CDAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ceridian HCM (TSX:CDAY)

Historical Stock Chart

From Dec 2023 to Dec 2024