HEXO Corp. (TSX: HEXO; NASDAQ: HEXO) ("

HEXO" or

the “

Company"), a leading producer of high-quality

cannabis products, is pleased to announce that the Company has

closed its previously announced transaction with Tilray Brands,

Inc. (“

Tilray Brands”) (Nasdaq | TSX: TLRY).

The transactions with Tilray Brands solidify the

strategic partnership between HEXO and Tilray Brands and provide

HEXO with a recapitalized balance sheet and the financial

flexibility necessary to accelerate its transformation into a cash

flow positive business within the next four quarters.

“This partnership with Tilray Brands is a

game-changer for HEXO,” said Charlie Bowman, CEO of HEXO Corp. “It

provides us with the opportunity to reset the organization onto a

path of profitable, sustainable growth and allows us to leverage

our leading market share into becoming the preferred cannabis

experience for consumers. We’re now able to proactively plan for

the second half of 2022 and beyond, focusing on meeting evolving

consumer demand and innovative product development.”

“Refinancing our balance sheet and funding

future growth has been a top priority,” said Julius Ivancsits, CFO

of HEXO Corp. “Finalizing this agreement accomplishes both

objectives, placing HEXO on solid financial footing and increasing

shareholder value.”

“This is a unique opportunity to realize our

vision of building Canada’s leading cannabis alliance,” noted Irwin

D. Simon, Chairman and CEO of Tilray Brands. “The partnership will

create substantial synergies and commercial benefits, as well as

allowing us to capitalize on our respective strengths in product

innovation, accelerating growth across global markets.”

Pursuant to a transaction agreement dated April

11, 2022 and amended pursuant to an amending agreement dated June

14, 2022 (together, as amended, the “Transaction

Agreement”) among HEXO, Tilray Brands and HT Investments

MA LLC (“HTI”), the terms of the outstanding

senior secured convertible note (the “Note”)

originally issued by HEXO to HTI were amended and restated (the

“Amended Note”) and the Note was immediately

thereafter assigned to Tilray Brands pursuant to the terms of an

amended and restated assignment and assumption agreement dated June

14, 2022 (together with the Transaction Agreement and the Amended

Note, the “Transaction”).

HEXO and Tilray Brands have also entered into

certain commercial agreements, providing the two companies with

cost saving synergies and production efficiencies (the

“Commercial Agreements”). The Commercial

Agreements are expected to create significant efficiencies, with a

target combined cost savings of up to US$80 million within two

years to be shared equally between the two companies.

Strategic Rationales for HEXO and Tilray

Brands Strategic AllianceIn furtherance of HEXO’s and

Tilray Brands’ respective independence, the strategic alliance with

Tilray Brands will provide several financial and strategic benefits

to HEXO, including the following:

-

Deleveraging: Tilray Brands purchased

the Amended Note at a lower price than the one at which HTI has

been redeeming the Amended Note over the past thirteen months.

- Operational

Flexibility: The Amended Note provides HEXO with immediate

operational flexibility by modifying the terms to be more

favourable to HEXO. This includes eliminating the monthly

redemption feature, amending the financial covenants and extending

the maturity by three additional years. These amendments limit

shareholder dilution moving forward and remove the going concern

risk that acted as an overhang on the business for the past several

quarters. The terms of the transaction unlock US$80 million of

previously restricted cash which, when combined with the Standby

Commitment, provides HEXO with significant liquidity to invest in

organic growth initiatives.

- Substantial

Synergies: The Commercial Agreements are expected to

deliver significant cost synergies and will target combined cost

savings of up to US$80 million within two years of the completion

of the Transaction. The two companies have identified and will

continue to work together to evaluate additional cost saving

synergies as well as other production efficiencies, including with

respect to cultivation and processing services, and certain

cannabis 2.0 products, including pre-rolls, beverages and edibles,

and shared services and procurement.

- Increases Product Breadth

and Commitment to Innovation: Leveraging both companies’

commitment to innovation, brand building and operational

efficiencies, HEXO and Tilray Brands will share expertise to

strengthen market positioning and capitalize on opportunities for

growth through a broadened product offering and new

innovation.

Transaction SummaryPursuant to

the terms of the Transaction Agreement, Tilray Brands acquired 100%

of the remaining outstanding principal balance of US$173.7 million

of the Amended Note. The purchase price paid by Tilray Brands to

HTI for the Amended Note was US$155 million, reflecting a 10.8%

discount on the outstanding principal amount. As consideration for

the Amended Note, HEXO issued 56,100,000 Common Shares and

11,674,266 rights exercisable for Common Shares to HTI,

representing (x) 12% of the outstanding principal of the Amended

Note at the closing, divided by (y) CAD$0.40. Pursuant to the

Transaction Agreement, Tilray Brands has nominated Denise

Faltischek and Roger Savell to HEXO’s board of directors. Tilray

Brands is also entitled to an observer on HEXO’s board of

directors.

The conversion price of the HEXO Note of

CAD$0.40 per share implies that, as of July 11, 2022, Tilray Brands

would have the right to convert into approximately 48% of the

outstanding common stock of HEXO (on a non-diluted basis).

HEXO did not receive any proceeds as a result of

Tilray Brands’ purchase of the Amended Note from HTI.

Commercial Agreements HEXO and

Tilray Brands have finalized and entered into various Commercial

Agreements on mutually agreeable terms, designed to strengthen each

entity’s independent position and covering the following key

areas:

- Co-Manufacturing. The parties have agreed to

complete certain production and processing as a third-party

manufacturer of products for the other. The Co-Manufacturing

Agreement initially contemplates the manufacturing of V-Cone

Pre-rolls in bulk format by Tilray Brands for HEXO, using

production equipment supplied by HEXO, and the manufacturing of

gummies and straight edge pre-rolls by HEXO for Tilray Brands.

- International

Sales. The parties have agreed to leverage Tilray Brands’

existing facility in Portugal and will negotiate a mutually

agreeable international supply agreement providing for the transfer

by HEXO to Tilray Brands of HEXO’s customers in the International

Markets, to the extent legally permitted, and in certain

circumstances, HEXO will source and purchase all of its cannabis

products for international markets, excluding Canada and the United

States, exclusively from Tilray Brands.

- Procurement and Cost

Savings. The parties have executed a Procurement and Cost

Savings Agreement, to identify and take advantage of cost savings

in their respective businesses. Under the agreement, the parties

will share certain services to achieve efficiencies and savings,

including administrative services, third-party commercial services,

procurement and internal distribution services. The agreement

creates an Efficiencies Committee, reflecting joint and equal

representation from both companies, to periodically identify

additional cost savings and shared cost opportunities that can be

realized in their respective operations. As part of these

initiatives, the parties have agreed to share in the resulting cost

savings realized from the Belleville facility, with HEXO paying

Tilray Brands a one-time US$10 million dollar fee for such shared

savings.

- Advisory Services and

Monthly Fee. Under an Advisory Services Agreement, Tilray

Brands will provide HEXO with certain advisory services on an “as

needed basis” in the areas of investor relations, internal audit,

Company marketing and market positioning. HEXO has agreed to pay

Tilray Brands a monthly fee of US$1.5 million for these advisory

services.

The performance of the Company’s previously

announced equity purchase agreement (the “Standby Commitment”) with

2692106 Ontario Inc. and KAOS Capital Ltd. remains subject to the

fulfilment of certain conditions, including receipt of exemptive

relief from securities regulators. The Company expects to receive

such exemptive relief in the coming weeks and expects the Standby

Commitment to be available to the Company upon receipt of same.

The foregoing is only a summary of the

Transaction Agreement, the Amended Note and the Commercial

Agreements described above, and investors should refer to the full

text of the Transaction Agreement, the form of Amended Note and

such Commercial Agreements under the Company’s profile on SEDAR at

www.sedar.com and its EDGAR profile at www.sec.gov.

Transaction AdvisorsLazard

served as financial advisor, and Norton Rose Fulbright Canada LLP

served as legal counsel, to HEXO.

Canaccord Genuity Corp. served as financial

advisor, and DLA Piper (Canada) LLP served as legal counsel, to

Tilray Brands.

Forward-Looking StatementsThis

press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities laws ("Forward-Looking Statements"),

including with respect to: the expected commercial, financial and

strategic benefits as a result of the alliance with Tilray Brands,

the strengthening of the balance sheet, the Company’s cash flow

projections, the expected efficiencies from the Commercial

Agreements, the funding schedule and the Company’s growth prospects

and strategy. Forward-Looking Statements are based on certain

expectations and assumptions and are subject to known and unknown

risks and uncertainties and other factors that could cause actual

events, results, performance and achievements to differ materially

from those anticipated in these Forward-Looking Statements.

Forward-Looking Statements should not be read as guarantees of

future performance or results. Readers are cautioned not to place

undue reliance on these Forward-Looking Statements, which speak

only as of the date of this press release. The Company disclaims

any intention or obligation, except to the extent required by law,

to update or revise any Forward-Looking Statements as a result of

new information or future events, or for any other reason.

This press release should be read in conjunction

with the management's discussion and analysis and unaudited

condensed consolidated interim financial statements and notes

thereto as at and for the three and nine months ended April 30,

2022. Additional information about HEXO is available on the

Company's profile on SEDAR at www.sedar.com and EDGAR at

www.sec.gov, including the Company's Annual Information Form for

the year ended July 31, 2021 dated October 29, 2021.

About HEXOHEXO is an

award-winning licensed producer of innovative products for the

global cannabis market. HEXO serves the Canadian recreational

market with a brand portfolio including HEXO, Redecan, UP Cannabis,

Original Stash, 48North, Trail Mix, Bake Sale and Latitude brands,

and the medical market in Canada and Israel. The Company also

serves the Colorado market through its Powered by HEXO® strategy

and Truss CBD USA, a joint venture with Molson-Coors. With the

completion of HEXO's acquisitions of Redecan and 48North, HEXO is a

leading cannabis products company in Canada by recreational market

share. For more information, please visit hexocorp.com.

For media or investor inquiries please

contact:

Christy Theriault, Kaiser & Partners

Communicationschristy.theriault@kaiserpartners.com416.993.9047

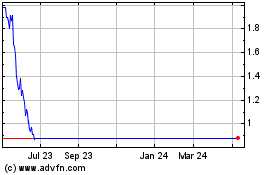

HEXO (TSX:HEXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

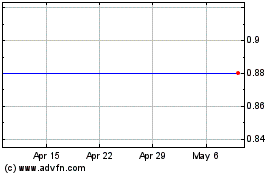

HEXO (TSX:HEXO)

Historical Stock Chart

From Dec 2023 to Dec 2024