Consolidated Uranium, Inc. (TSXV:CUR) (OTCQB: CURUF)

(“CUR”, “Consolidated Uranium”, the “Company”) is pleased

to announce the completion of a confirmation drill program and a

mineral resource estimate and supporting technical report prepared

in accordance with NI 43-101 at the Company’s 100%-owned Tony M

mine (the “Technical Report”). The Technical Report was prepared by

the independent consulting firm SLR International Corporation

(“SLR”) and has been filed under the Company’s profile on SEDAR.

Highlights

- The Mineral

Resource estimate is based upon a commodity price of US$65.00 per

pound of

U3O8,

and a cut-off grade of 0.14%

eU3O8

are reported as an:

- Indicated

Mineral Resource of 1,185,000 tons grading 0.28%

eU3O8

for 6.6 million pounds contained uranium; and

- Inferred

Mineral Resource of 404,000 tons grading 0.27%

eU3O8

for 2.2 million pounds contained uranium.

- The Mineral

Resource estimate for the Tony M Mine is consistent with the

historic Mineral Resource estimate previously reported by Energy

Fuels Inc. in 2012 when compared using a cut off grade of 0.10 %

U3O8

- Key

recommendations from the Technical Report include:

- Exploration

drilling and underground sampling to investigate the vanadium

potential of the deposit based on results from the confirmation

drill program which showed the

V2O5/U3O8

ratio ranges from an average of 1:1 to greater than 17:1 in

places.

- Completion

of a Preliminary Economic Assessment (“PEA”) to consider re-opening

the Tony M mine (including Mineral Resource update)

Table 1: Summary of Mineral Resources –

Effective Date September 9, 2022

|

Classification |

Tonnage(short tons) |

Grade(% eU3O8) |

Contained Metal(lbs. eU3O8) |

|

|

|

|

|

|

Indicated |

1,185,000 |

0.28 |

6,606,000 |

|

|

|

|

|

|

Inferred |

404,000 |

0.27 |

2,218,000 |

Notes:

- CIM (2014) definitions followed for all mineral resource

classifications.

- Mineral resources were estimated at a cut-off grade of 0.14%

eU3O8.

- Cut-off grade calculated using a US$65/pound uranium

price.

- Past Production (1979-2008) removed from the Mineral

Resource.

- Estimated mill recovery 96%

- Totals may not add due to rounding.

- Mineral Resources are 100 % attributable to Consolidated

Uranium Inc.

Mineral Resources are not Mineral Reserves, and

do not have demonstrated economic viability. While the estimate of

Mineral Resources for the Tony M Mine is based on the SLR Qualified

Person’s judgment that there are reasonable prospects for eventual

economic extraction, no assurance can be given that Mineral

Resources will eventually convert to Mineral Reserves. As of the

date hereof, there are no other known environmental, permitting,

legal, social, or other factors that would affect the development

of the Mineral Resources.

Table 2: Select assay results from the

8-hole confirmation drill program at the Tony M Mine

include:

|

Hole Number |

From Depth |

To Depth |

Thickness |

Grade |

|

(feet) |

(feet) |

(feet) |

(%

U3O8) |

|

CUR-TM-02 |

380 |

382 |

2 |

0.132 |

|

and |

387 |

389 |

2 |

0.120 |

|

CUR-TM-03 |

368 |

370 |

2 |

1.031 |

|

CUR-TM-04 |

417 |

418 |

1 |

0.100 |

|

CUR-TM-05 |

226 |

230 |

4 |

0.202 |

|

CUR-TM-09 |

292 |

297 |

5 |

0.195 |

|

Notes:*All grades reported above from ICP chemical assays from

American Assay Labs (independent of CUR) |

|

|

|

* Only radiometric data used for resource estimation |

|

|

Chairman and CEO Phil Williams stated “We are

very pleased with the results of the confirmation drill program and

mineral resource estimate for the Tony M Mine. We were attracted to

the project not only because it was a past producing mine with all

the infrastructure and permits in place for rapid and low-cost

restart when uranium market conditions warrant, but also because of

the robust nature of the deposit which is confirmed by this mineral

resource estimate. The indicated mineral resource grade of 0.28%

U3O8 ranks among the highest of all US uranium projects.

Additionally, we are encouraged by the previously untested vanadium

potential which was highlighted in our drilling. As the only

company with guaranteed access to the Energy Fuels White Mesa Mill,

which has a vanadium recovery circuit, if this potential bears out

it could improve the overall economics of the project. These

results confirm the Tony M Mine’s place in our portfolio as our

number one US asset and we look forward to an aggressive program at

the project next year, which we expect will advance us towards a

production decision.”

Figure 1: Location Map: Tony M Mine, Utah

in proximity to the White Mesa Mill

Tony M Mine NI 43-101 Technical Report on

Mineral Resources

The completion of Mineral Resource estimate on

the Tony M Mine, located in eastern Garfield County, Utah USA, is

based upon historical exploration drilling data collected by

previous holders of the project, and confirmed by the results of a

combined rotary and core confirmation drilling program carried out

in May and June of 2022 by Consolidated Uranium. The estimated

Mineral Resources, which have been classified in accordance with

the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Definition Standards for Mineral Resources (CIM 2014) are based

upon data from 1,678 drill holes, totaling 947,610 feet of rotary

and core drilling carried out by previous owners of Tony M and the

Company. Uranium mineralization at the Tony M project is hosted in

the lowermost 35 feet to 62 feet favorable sandstone portion of the

Salt Wash Member, of the Jurassic age Morrison Formation, occurring

as a series of generally flat lying bodies within one of three

individual stratiform layers.

The Tony M Mineral Resource estimate was

prepared using a conventional block modeling methodology. A digital

geologic model of the lower Salt Wash was developed by SLR to

constrain the Mineral Resource estimate. The Mineral Resource

estimate used regularized block models, the inverse distance

squared (ID2) grade interpolation methodology, and length-weighted,

1.0-foot, uncapped composites to estimate the uranium (eU3O8) in a

three-search pass approach, using hard boundaries between subunits,

ellipsoidal search ranges, and search ellipse orientation informed

by geology. Average density values were assigned by lithological

unit.

A comparison of the historical Mineral Resource

estimate from June 27, 2012 (prepared for previous owner Energy

Fuels Inc.) with the 2022 Mineral Resource estimate using a cut-off

grade of 0.10% eU3O8 shows that Indicated Mineral Resources

estimate tonnage increased by 0.19 million short tons and the grade

decreased by 0.02% eU3O8, with a total increase of Indicated

Mineral Resources of 0.08 million pounds of eU3O8. The Inferred

Mineral Resource estimate tonnage decreased by 0.17 million short

tons and the grade increased by 0.05% eU3O8 with the difference in

Inferred Mineral Resources totaling 0.25 million pounds of eU3O8.

The small differences between the estimates are primarily

attributed to:

- A change in

Mineral Resource estimation methodology from Grade-Thickness (GT)

contouring to 3D block modelling.

- Block modelling tends to

overestimate tons while under estimating grade due to smoothing

during the grade estimation process, if not properly

controlled.

- Modifications to the 2012 0.01%

grade contour used to control horizontal extension of

mineralization to allow for more accurate prediction of grade

continuity during the block modelling process.

- Based on limited drilling

intercepts, portions of the ML (middle lower) mineralized zone were

downgraded from Inferred classification and removed from the

Mineral Resource Estimate.

- Increase in past

production depletion from 177,000 short tons to 258,000 short tons,

based on SLR’s 2022 reconciliation of past production records.

Table 3: Comparison of Historical 2012 vs

2022 Mineral Resource Estimate – Tony M Project

(Using 0.10% cut-off)

|

Classification |

Tonnage(Mst) |

Grade(%eU3O8) |

Contained Metal(Mlbs

eU3O8) |

|

June 27, 2012 Historical Estimate |

|

Indicated |

1.68 |

0.24 |

8.14 |

|

Inferred |

0.87 |

0.16 |

2.75 |

|

September 9, 2022 Estimate |

|

Indicated |

1.87 |

0.22 |

8.22 |

|

Inferred |

0.70 |

0.21 |

2.92 |

|

|

|

|

|

|

Difference |

|

Indicated |

0.19 |

-0.02 |

0.08 |

|

Inferred |

-0.17 |

0.05 |

0.17 |

|

% Difference |

|

Indicated |

11.2% |

-8.3% |

1.0% |

|

Inferred |

-19.2% |

29.7% |

6.1% |

Assay data from the CUR 2022 confirmation

drilling program also highlighted the presence of vanadium

mineralization. Results from the eight holes appear to indicate an

inverse relationship between the vanadium to the uranium oxide

grade, where the higher-grade vanadium is generally associated with

the lower grade uranium mineralization. SLR notes the 2022

V2O5/U3O8 ratio ranges from an average of 1:1 to greater than 17:1

in places and results are comparable with historic reported

ratios.

With the additional new 2022 vanadium assay data

collected by CUR, SLR revisited the vanadium potential using a

regression analysis curve at Tony M and found the 2022 V2O5/U3O8

ratio of approximately 3:1 is inline with historic reported ranges

and much higher than the previously accepted ratio of 1.66:1 for

the composite bulk samples collected over the period from October

1982 to January 1984. SLR opines the use of a vanadium regression

curve and equation is an appropriate way to estimate vanadium

resource potential in the future, however, the small sample size of

the 2022 drilling vanadium values prevents construction of a

reliable and accurate vanadium block model or Mineral Resource

estimate until more data is collected to improve confidence and

understanding of the vanadium distribution on the property.

SLR has recommended the following work to

advance the Tony M Mine to the next stage:

- Carry out

exploration drilling and vanadium sampling: drill approximately 75

holes to better define the distribution of vanadium mineralization,

to increase U3O8 resources, and increase Inferred Mineral Resource

to the Indicated classification.

- Access the

underground workings at the mine for the purpose of mapping and

sampling for vanadium.

- Prepare a PEA

for the project, incorporating the results of the proposed uranium

and vanadium surface drilling programs, and the results derived

from the underground sampling program for vanadium.

Figure 2: Tony M Mine 2022 Drilling and

Resource Outline

2022 Confirmation Drilling Program at the

Tony M Mine Project

The surface rotary and core drilling program

(previously announced in the Company’s February 17, 2022 press

release) was designed to confirm the results of previous drilling

carried out by Plateau Resources, who were the original discoverers

and developers of the Tony M Mine.

The 2022 CUR drilling program was designed to

confirm the stratigraphic position of uranium mineralization, the

relative thicknesses of mineralized intervals, and the range of

uranium grades that were encountered in the historical drill holes.

The drill program was comprised of eight combined conventional

rotary and core holes with vertical orientation, totaling 2,894

feet. Core samples from the CUR drilling were assayed for uranium

and vanadium, although a very limited amount of historical data

exists for vanadium. The program successfully verified the historic

drill results as accurate and true for resource estimation.

CUR’s eight holes were drilled with a tri-cone

rotary method (“conventional open-hole”) to the top of the lower

rim of the Salt Wash sandstone unit, approximately 400 feet from

surface. The rotary drill cuttings were collected at 5-foot

intervals and the lithologies were recorded by CUR personnel. When

the core point was reached (the top of the target horizon) a

traditional 3-inch core barrel was placed on the drill string to

core the entire Lower Rim of the Salt Wash sandstone. The zones

that were cored in 20-foot-long intervals and were measured and

marked by CUR personnel and logged for lithology, geotechnical

properties, and mineralization. The core boxes were stored in a

locked warehouse on the Tony M property.

Table 4:

%U3O8

and

%V2O5

Results of the 2022 CUR Confirmation Drilling:

|

Hole Number |

From Depth |

To Depth |

Thickness |

Grade |

Grade |

|

(feet) |

(feet) |

(feet) |

(%

U3O8) |

(%

V2O5) |

|

CUR-TM-01 |

378 |

384 |

6 |

0.003 |

0.027 |

|

CUR-TM-02 |

375 |

378 |

3 |

0.003 |

0.277 |

|

and |

380 |

382 |

2 |

0.132 |

0.135 |

|

and |

387 |

389 |

2 |

0.120 |

0.002 |

|

CUR-TM-03 |

361 |

364 |

3 |

0.003 |

0.149 |

|

and |

368 |

370 |

2 |

1.031 |

0.986 |

|

CUR-TM-04 |

417 |

418 |

1 |

0.100 |

0.124 |

|

CUR-TM-05 |

226 |

230 |

4 |

0.202 |

0.048 |

|

or |

225 |

227 |

2 |

0.157 |

0.174 |

|

CUR-TM-06 |

211 |

214 |

3 |

0.024 |

0.005 |

|

and |

217 |

218 |

1 |

0.015 |

0.023 |

|

CUR-TM-07 |

365 |

368 |

3 |

0.001 |

0.068 |

|

and |

376 |

379 |

3 |

0.030 |

0.004 |

|

CUR-TM-09 |

283 |

284 |

1 |

0.006 |

0.104 |

|

and |

292 |

297 |

5 |

0.195 |

0.128 |

|

or |

290 |

296 |

6 |

0.169 |

0.141 |

|

*All grades reported above from ICP chemical assay from American

Assay Labs |

|

|

|

|

*Individual intervals chosen to maximize the U3O8 or V2O5 assay

intercepts |

|

|

* Only radiometric data used for resource estimation |

|

Continuous geophysical logging of all of the CUR

drill holes was carried out by Century Wireline Services of Tulsa,

Oklahoma, and included natural gamma-ray, conductivity, and

resistivity data from the boreholes. Core samples were bagged and

shipped to American Assay Laboratories, in Sparks, Nevada for

chemical determinations of U3O8 and V2O5 grades. American Assay is

an independent mineral industry analytical laboratory that holds an

ISO/IEC 17025 accreditation.

The Century Wireline geophysical probing

equipment was calibrated at the US Department of Energy geophysical

facility (the Grand Junction “test pits”) prior to the commencement

of drilling and at the conclusion of the program, and a comparison

of the results of the calibration runs showed no changes in

gamma-ray responses.

The Company’s QA/QC (quality control/quality

assurance) program for the core samples submitted to American Assay

was consistent with industry standards and best practices and

included the insertion of certified reference materials at three

different grade levels (“standards”) obtained from OREAS North

America, unmineralized standards (“blanks”), and duplicate samples

from the core. Collectively, these QA/QC samples comprised

approximately 18 percent of all of the samples (not including the

internal control samples that the laboratory used) analyzed by

American Assay.

SLR notes that the gamma logging estimates of

equivalent uranium grade (%eU3O8) for the Tony M Project are

slightly conservative and underestimate the average U3O8 grade by

up to 3%, with some portions of the Tony M deposit underestimated

by as much as 6%. The relative difference between chemical and

probe assays is not considered material, no correction

(disequilibrium ratio of 1:1) to the radiometric data is required,

and the data is suitable for resource estimation

Qualified Person

The scientific and technical information

contained in this news release regarding the mineral resource

estimate was reviewed and approved by Mark Mathisen, who is a

“Qualified Person” (as defined in National Instrument 43-101 -

Standards of Disclosure for Mineral Projects).

All other scientific and technical information

contained in this news release was reviewed and approved by Dean T.

Wilton: PG, CPG, MAIG, who is a “Qualified Person” (as defined in

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects).

Technical Report

A Technical Report prepared in accordance with

NI 43-101 for Tony M has been filed under the Company’s profile on

SEDAR at www.sedar.com. Readers are encouraged to read the

Technical Report in its entirety, including all qualifications,

assumptions and exclusions that relate to the Mineral Resource. The

Technical Report is intended to be read as a whole, and sections

should not be read or relied upon out of context.

Private Placement of Virginia Energy

Resources

The Company is also pleased to announce that on

December 6, 2022 it completed its investment (the “Private

Placement”) in Virginia Energy Resources Inc.

(“Virginia Energy”) in connection with the

proposed acquisition by the Company of all of the outstanding

shares Virginia Energy (the “Virginia Shares”)

pursuant to a statutory plan of arrangement, as previously

announced on November 15, 2022. Pursuant to the Private Placement,

the Company purchased, on a non-brokered private placement basis,

2,000,000 Virginia Shares at a price of $0.50 per Virginia Share,

for aggregate consideration of $1,000,000. The Private Placement

remains subject to the final approval of the TSX Venture

Exchange.

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development. Most recently, the

Company completed a transformational strategic acquisition and

alliance with Energy Fuels Inc., a leading U.S.-based uranium

mining company, and acquired a portfolio of permitted,

past-producing conventional uranium and vanadium mines in Utah and

Colorado. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.

For More Information, Please

Contact:

Philip WilliamsChairman

& CEOpwilliams@consolidateduranium.com

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including, but not limited to, the Company’s

ongoing business plan, exploration and work programs, mineral

resource estimates, the interpretation of frilling results, future

work recommendations and the expectations with respect to advancing

the project. Generally, but not always, forward-looking information

and statements can be identified by the use of words such as

“plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connotation thereof. Such forward-looking

information and statements are based on numerous assumptions,

including that general business and economic conditions will not

change in a material adverse manner, that financing will be

available if and when needed and on reasonable terms, and that

third party contractors, equipment and supplies and governmental

and other approvals required to conduct the Company’s planned

exploration activities will be available on reasonable terms and in

a timely manner. Although the assumptions made by the Company in

providing forward-looking information or making forward-looking

statements are considered reasonable by management at the time,

there can be no assurance that such assumptions will prove to be

accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves, reliance on key management

and other personnel, potential downturns in economic conditions,

actual results of exploration activities being different than

anticipated, changes in exploration programs based upon results,

and risks generally associated with the mineral exploration

industry, environmental risks, changes in laws and regulations,

community relations and delays in obtaining governmental or other

approvals and the risk factors with respect to Consolidated Uranium

set out in CUR’s annual information form in respect of the year

ended December 31, 2020 filed with the Canadian securities

regulators and available under CUR’s profile on SEDAR at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

Graphics accompanying this announcement are available

athttps://www.globenewswire.com/NewsRoom/AttachmentNg/4bfee485-65ff-4c53-928e-eb70f2fe9d42

https://www.globenewswire.com/NewsRoom/AttachmentNg/ef739655-84df-400e-a5ef-3c430fbadd58

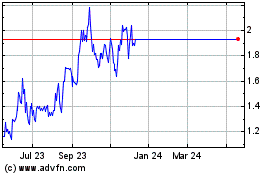

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024