Consolidated Uranium Inc. (“CUR”, the “Company”,

“Consolidated Uranium”) (TSXV: CUR) (OTCQX: CURUF) is

pleased to announce that it has entered into two purchase

agreements to acquire 100% of the Huemul-Agua Botada

Uranium-Vanadium-Copper Mine (“

Huemul”) and

surrounding prospective ground totalling ~27,350 hectares located

in the Malargüe department of southern Mendoza province, Argentina

(Figure 1) (collectively referred to as the

"Huemul

Project”). Huemul was Argentina´s first producing Uranium

mine and operated between 1955 and 1975, recording approximately

500,000 pounds of historical U3O8 production before it closed in

1976.1

Highlights

- Adds

Second Argentine Project in Mining Friendly Region – CUR

has been actively working in Argentina since the acquisition of the

Laguna Salada project in late 2021. Beyond the technical merits of

Huemul, its location in the mining friendly Malargüe department of

Mendoza province was an important consideration in making the

acquisition.

-

Leverages Existing In-Country Expertise – The CUR

team in Argentina boasts decades of experience operating in the

country exploring for and developing various commodities, including

uranium. The team conducted numerous technical due diligence site

visits and stands ready to move quickly to advance the project once

required approvals and permissions are granted.

-

Transaction Consolidates Large Land Package for the First

Time – The Huemul area, including the historic mine area,

was the subject of exploration by several different owners in the

past. This will be the first time the entire package has been held

in a single hand opening the potential for a more regional

exploration approach.

- High

Uranium, and Copper Grades Previously Recovered – The

Huemul mine historically recorded approximately 500,000 pounds of

U3O8, ~175,000 pounds of V2O5 and 5.2 million pounds of Cu

production from approximately 130,000 tonnes of ore averaging 0.21%

U3O8, 0.11% V2O5 and 2.00% Cu by flotation at a concentration

plant.

- Robust

Near Mine and Regional Exploration Potential – The

down-plunge and along-strike extensions of mineralization at the

Huemul mine and Aguas Botada zones are underexplored and merit

additional exploration work. In addition, the target geological

sequence is present and mineralized at surface over large areas

across the project. Gently dipping conglomerate units hosting the

mined ore at Huemul extend southwards from the historic mine

workings and are traceable over at least 15 kilometers. Within this

target stratigraphic package, strong Uranium-Vanadium-Copper

geochemical anomalies, with broad corresponding Uranium and Thorium

radiometric anomalies, have been defined by a previous exploration

company. These anomalies have never been drilled.

- Multiple

Critical Minerals Present – Uranium, copper and vanadium

are considered critical minerals by many countries based on their

importance for the transition towards more environmentally friendly

“green” energy.

-

Argentina Needs Uranium – With three reactors

currently generating approximately 7% of the country’s electricity,

a fourth under construction and a history of producing, converting

and enriching its own uranium, CUR believes exploring for

developing uranium mines in Argentina has strong merit and may

ultimately garner support by all levels of government.

Philip Williams, Chairman and CEO of CUR,

commented, “Argentina is often overlooked in the CUR portfolio but

is a country that presents significant opportunities. Few

jurisdictions that have such a strong commitment to nuclear power

also have the proven geological potential to provide domestically

sourced uranium. In this regard it is very similar to the dynamics

unfolding in the U.S. uranium industry, however, the level of

competition in Argentina is nearly non-existent, providing a

tremendous opportunity to CUR. The Huemul Project, with its history

of uranium mining and large, consolidated land package positions

CUR to be one of the leading Uranium explorer-developers in

Argentina's Neuquén basin, which could rival the large historic

Uranium producing basins located in the western U.S. and

Kazakhstan. Huemul was Argentina´s first producing Uranium mine and

we believe that its location in the emerging mining-friendly

department of Malargüe, as well as its vanadium and copper

potential, represents an exciting opportunity for the Company.”

*

Figure 1: Map showing location

of the Huemul Project in Argentina located in proximity to the

Comisión Nacional de Energía Atómica’s Sierra Pintada Uranium

Mine

Consolidation of the Huemul Project

Claim Package

The consolidated Huemul Project claim package

consists of three areas as shown in Figure 2:

- The Huemul Mine,

the Silvana Claim and Huemul Norte and Sur Claim applications - As

part of the Huemul Acquisition (as defined herein), the Company has

agreed to acquire the Huemul mine lease, the Silvana claim the

Huemul Norte and Huemul Sur claim applications totalling

approximately ~22,432 hectares.

- The NewEra

Claims - As part of the NewEra Acquisition (as defined herein), the

Company has agreed to acquire two claim applications covering

~2,352 hectares (the “NewEra Claim Applications”)

held by NewEra Metal Resources Ltd.

(“NewEra”).

- The Cerro Butalo Claims - Cerro Butalo, covering ~2,566

hectares, was previously staked by Energy Minerals/Maple and was

acquired by the Company in 2020 pursuant to an option agreement

with Green Shift Commodities Ltd. (previously U3O8 Corp.) (see CUR

press release December 14th, 2020).

Figure 2: Map showing the

various claims and claim applications comprising the Huemul Project

in Argentina

Terms of the Huemul

Acquisition

Pursuant to an agreement between CUR´s

wholly-owned subsidiary, 2847312 Ontario Inc. (“Ontario

Inc.”), and the vendor of Huemul (the “Huemul

Vendor”) dated June 13, 2023 (the “Huemul

Agreement”), Ontario Inc. has agreed to acquire (the

“Huemul Acquisition”) a 100% interest in ~22,432

hectares within the Huemul Project Area held by the Huemul Vendor

(the “Huemul Claims”) for consideration comprised

of:

- US$200,000 in

cash;

- 500,000 common

shares of CUR (“Common Shares”); and

- A 2% NSR royalty

payable by the Company to the Huemul Vendor on certain portions of

the Huemul Project (the “Huemul Royalty”). CUR

will have the right to repurchase 1% of the Huemul Royalty by

paying the amount of US$2,000,000.

Terms of the Purchase

Agreement with NewEra

Pursuant to an agreement between Ontario Inc.

dated June 13, 2023 (the “NewEra Agreement”),

Ontario Inc. has a right to acquire (the “NewEra

Acquisition” and together with the Huemul Acquisition, the

“Acquisitions”) 100% interest of the NewEra Claim

Applications for consideration comprised of:

- US$120,000 in

cash;

- 119,372 Common

Shares; and

- A 1% NSR royalty

payable by the Company to NewEra on the claims covered by the

NewEra Claim Applications.

The Common Shares issuable pursuant to the

Huemul Agreement and the NewEra Agreement are subject to approval

of the TSXV and will be subject to a hold period expiring four

months and one day from the date of issuance. There are no

finders’ fees payable in connection with the acquisitions and the

Huemul Vendor and NewEra are arms-length parties with respect to

the Company.

The Huemul Uranium-Vanadium-Copper

Project

The Huemul Project is an early-stage exploration

project located in the southern part of Mendoza

Province, Argentina. Huemul consists of ~27,350 hectares of

exploration claims centred around CNEA´s (Comisión Nacional de

Energía Atómica) historic Huemul-Agua Botada mine, Argentina´s

first producing Uranium mine (Figure 3). The Argentinian government

discovered the Huemul-Agua Botada Zone in 1952 and exploited the

deposit between 1955 and 1975. Historically, ore was treated in a

concentration plant at the nearby town of Malargüe.

Figure 3: Photos showing the

historic Huemul mine and nearby processing plant

Uranium-Vanadium-Copper mineralization at Huemul

comprises a number of stacked, metres-thick stratabound lenses

hosted by an approximately 50-metre-thick packet of conglomerates

and arenites, sandwiched by redbeds and intruded by andesite sills

(Figure 4). These sedimentary rocks are part of the fill sequence

of the Cretaceous Neuquén Basin. Host rocks to the mineralization

are highly bituminous and mineralized zones are likely to have been

failed petroleum-gas traps.

Approximately 130,000 tonnes were historically

mined from the Huemul Mine averaging 0.21% U3O8, 2.0% Cu and 0.11%

V2o5, while the production from the adjacent Agua Botada deposit

averaged approximately 0.13% U3O8 and 0.10% Cu. The hypogene

ore-related minerals at Huemul-Agua Botada include pitchblende,

pyrite, marcasite, chalcopirite, bornite, sphalerite and galena,

and in the overlying supergene zone uranophane, carnotite,

torbenite, malachite, azurite, neoticite and roscolite.

Figure 4: Geological map and

section through the historic Huemul mine operation

In 2005, Energy Minerals (local subsidiary of

Calypso Uranium Corp.) conducted radiometric surveys, ground

truthing and geochemical sampling over the Huemul district around

the historic Huemul-Agua Botada mines; however, no drilling was

ever conducted. Results of these historical studies are shown in

Figures 5 to 7.

Figure 5: Map showing historic

Uranium-channel radiometrics and prospects within the Huemul

Project area

Figure 6: Map showing historic

Uranium and Vanadium rock geochemistry anomalies, Huemul

Project

Figure 7: Map showing historic

Copper and Silver rock geochemistry anomalies, Huemul Project

Several kilometers to the east and southeast of

the historic mines, Calypso Uranium defined a number of new

prospects characterized by strong radiometric and geochemical

anomalism plus favourable geology:

- Black Zone /

Larga Vega

- Rosa /

Uryco

- Cerro Mirano,

Tres Diques

CUR´s more recent analysis suggests that these

prospects all have both strong geochemical and radiometric

similarities with Huemul, plus the size potential to warrant

immediate follow up. These prospects only require interpretive

geological mapping and radiometric ground traversing before

proceeding to preliminary drill testing.

At the Black Zone-Vega Larga Prospect, a

semi-coherent Uranium channel airborne radiometric anomaly

approximately 4.0 x 1.0 kilometers in size was delimited, elongated

in an ENE-WSW direction. The radiometric anomaly is centred on an

erosional window of bleached conglomerates and sandstones

sandwiched between redbed facies. Strongly radiogenic

Uranium-Copper mineralisation is hosted by southwesterly-dipping

Upper Cretaceous conglomerates of the Cretaceous Diamante Fm. A

strong Uranium-Copper rock geochemistry anomaly of a similar size

to the airborne radiometric anomaly reported Uranium values up to

8,738 ppm and Copper values in excess of 10,000 ppm (1%) in

historic sampling. Follow up ground radiometry by Calypso Uranium

allowed interpretation of laterally extensive, stratabound,

potentially mineralized conglomerate units.

Preliminary surface observations by CUR in the

Black Zone-Larga Vega prospect areas has confirmed the presence of

Uranium and Copper sulfates/hydroxides in certain conglomerate beds

and in steep fractures striking NE-SW and NW-SE. In addition, high

scintillometer counts (1,700-50,000+ cps) have been confirmed in

the field, particularly within silica-clay alteration zones within

some conglomerate horizons. Verification of the historic

geochemical assays reported has not yet been undertaken.

The historic results gathered by Calypso Uranium

and CUR field verification indicate that the Huemul Project has

potential to host extensive, and as yet undiscovered, zones of

shallow conglomerate-hosted Uranium, Vanadium and Copper

mineralization of a similar style to that historically exploited at

the Huemul-Aguas Botadas mine.

Following the receipt of environmental and

exploration permits, CUR's 2023 exploration program at Huemul is

expected to focus on more precisely defining the extent of

radiometric and geochemical anomalies, through a program of

detailed geological mapping, ground scintillometer traversing and

systematic rock geochemical sampling. Potentially mineralized

targets will later be tested through shallow diamond drilling.

Notes

- Guillermo Rojas,

1999. Distrito Uranìfero Pampa Amarilla, Mendoza. En Recursos

Minerales de la Republica Argentina. Pag.1135-1140

Qualified Person

The scientific and technical information

contained in this news release was reviewed and approved by Peter

Mullens (FAusIMM), Consolidated Uranium’s VP, Business Development,

who is a “Qualified Person” (as defined in NI 43-101).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQX:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development.

The Company is currently advancing its portfolio

of permitted, past-producing conventional uranium and vanadium

mines in Utah and Colorado, with a toll milling arrangement in

place with Energy Fuels Inc., a leading U.S.-based uranium mining

company. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.

For More Information, Please

Contact:

Philip WilliamsChairman and

CEOpwilliams@consolidateduranium.com

Toll-Free: 1-833-572-2333Twitter:

@ConsolidatedUr www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including, but not limited to, completion of

the Acquisitions, the approval of the TSXV and the Company’s

ongoing business plan, sampling, exploration and work programs.

Generally, but not always, forward-looking information and

statements can be identified by the use of words such as “plans”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates”, or “believes” or the

negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connotation thereof. Such forward-looking

information and statements are based on numerous assumptions,

including that general business and economic conditions will not

change in a material adverse manner, that financing will be

available if and when needed and on reasonable terms, and that

third party contractors, equipment and supplies and governmental

and other approvals required to conduct the Company’s planned

exploration activities will be available on reasonable terms and in

a timely manner. Although the assumptions made by the Company in

providing forward-looking information or making forward-looking

statements are considered reasonable by management at the time,

there can be no assurance that such assumptions will prove to be

accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves or resources, reliance on key

management and other personnel, potential downturns in economic

conditions, actual results of exploration activities being

different than anticipated, changes in exploration programs based

upon results, and risks generally associated with the mineral

exploration industry, environmental risks, changes in laws and

regulations, community relations and delays in obtaining

governmental or other approvals and the risk factors with respect

to Consolidated Uranium set out in CUR’s annual information form in

respect of the year ended December 31, 2022 filed with the Canadian

securities regulators and available under CUR’s profile on SEDAR at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

Photos accompanying this announcement are available

athttps://www.globenewswire.com/NewsRoom/AttachmentNg/716e92d2-baac-4fe8-a50f-4956418b6704

https://www.globenewswire.com/NewsRoom/AttachmentNg/11010024-922b-42fd-9623-094a3a3de8ac

https://www.globenewswire.com/NewsRoom/AttachmentNg/83b2dc26-0361-433f-8a74-7311a468dcd0

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d73640f-8255-42bc-ab43-57095f5cf57a

https://www.globenewswire.com/NewsRoom/AttachmentNg/2acf4e88-464c-4c58-838e-61d97a245c5b

https://www.globenewswire.com/NewsRoom/AttachmentNg/14715c7a-9ea8-4df3-ac49-50e3361e2882

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c5c6af6-e23d-4c66-8519-2061ab50151e

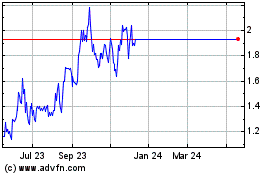

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024