Consolidated Uranium Inc. (“CUR”, the “Company”,

“Consolidated Uranium”) (TSXV: CUR) (OTCQX: CURUF) is

pleased to announce the commencement of comprehensive work programs

at CUR’s 100%-owned Tony M Mine (“Tony M”) in southeastern Utah.

Tony M is one of three past producing uranium mines in Utah owned

by CUR, and is a large-scale, fully developed and permitted

underground mine that produced nearly one million pounds of U3O8

during two different periods of operation from 1979-1984 and from

2007-2008. The work programs being initiated follow key

recommendations highlighted by SLR International Corporation

(“SLR”) in a technical report entitled “Technical Report on the

Tony M Project, Utah, USA” dated effective September 9, 2022 (the

“Technical Report”).

Highlights of the Work

Programs

- Defining

the Vanadium Potential of the Tony M Deposit – CUR has

commenced an up to 59-hole infill drill program from surface

totalling ~38,000 feet along with an underground sampling program

designed to collect detailed information on the distribution and

grades of vanadium mineralization from both the drill program and

underground sampling programs with the ultimate aim of calculating

a vanadium mineral resource. Historically, there has been very

little investigation of the vanadium potential at Tony M. CUR’s

confirmation drill program in 2022 showed V2O5/U3O8 ratio ranges

from an average of 1:1 to greater than 17:1 in places (see press

release dated December 13, 2022). The 2023 program is based on the

recommendations highlighted in the Technical Report.

-

Delineation Drilling to Upgrade Inferred Resources

– The drilling may also have the added benefit of potentially

allowing for an upgrade of a portion of the currently estimated

“Inferred” mineral resources to the “indicated” category.The

Mineral Resource estimate for Tony M as of September 9, 2022, as

reported in the Technical Report, is based upon a commodity price

of US$65.00 per pound of U3O8, and a cut-off grade of 0.14% eU3O8

includes:

- Indicated

Mineral Resource of 1,185,000 tons grading 0.28% eU3O8 for 6.6

million pounds contained uranium; and

- Inferred Mineral

Resource of 404,000 tons grading 0.27% eU3O8 for 2.2 million pounds

contained uranium.

- See Table 1

below for further details.

-

Reopening of the Underground for Sampling and Mine

Preparation – Once the Tony M portal has been opened, an

extensive sampling program is expected to be undertaken for both

uranium and vanadium. Consultants have been retained to oversee the

design and implementation of the ventilation plan and assess ground

conditions. This program is a key step toward the ultimate restart

of the mine.

- Next

Step, Completion of a Preliminary Economic Assessment – A

further key recommendation of the Technical Report was the

completion of a Preliminary Economic Assessment for Tony M. Results

from both the surface and underground programs, including an

updated Mineral Resource estimate, are expected to form the basis

for this assessment which could be completed prior to the end of

the year.

To view a summary of today’s news delivered by

Marty Tunney, President and COO of CUR, and Tyler Johnson, US

Exploration Manager, click here.

Chairman and CEO Phil Williams stated, “With

uranium market fundamentals showing significant strength and the

unquestionable need and political support for domestic U.S. uranium

production, we believe advancing the Tony M project toward a near

term production decision is the correct course of action. The

programs announced today will not only provide detailed information

to guide ultimate mining of the Tony M resource, by potentially

upgrading mineral resources into the indicated category and

allowing us to evaluate the conditions of the extensive underground

workings, but, if successful, could add meaningful value to the

deposit through the possible addition of vanadium resources not

previously evaluated. CUR remains one of the few junior uranium

companies actively advancing its projects through drilling and

pre-development activities. We believe this not only sets us apart

from our peers but positions us as a potential first mover back

into production providing investors with strong leverage to

increasing uranium prices.”

Tony M 2023 Work Program

The 2023 drilling program will include up to 59

vertical drill holes, totaling approximately 38,000 feet across the

Tony M deposit (Figure 1).

Figure 1: Map of Tony M Mine outlining

underground workings and planned drill locations for 2023

work

The 2023 drilling program aims to collect assay

data for vanadium which, along with similar vanadium assay data

derived from the Company’s 2022 drilling program and a planned

underground sampling program, is expected to provide a more

thorough understanding of the distribution of vanadium in the Tony

M deposit, provide an assessment of the relationship between the

distribution of uranium and vanadium and provide the basis for

development of a model of the vanadium mineralization at Tony M

(Figure 1).

Prior owners of Tony M did not assay for

vanadium and, other than information on the occurrences of vanadium

mineralization carried out by the US Geological Survey in 19901,

there has been very little study of V2O5 in Tony M until

Consolidated Uranium’s 2022 confirmation drilling program. The

design of the 2023 drilling program was carried out by CUR’s

technical consultants and in within the context of recommendations

made by SLR and Mark Mathisen, the Qualified Person who prepared

the Technical Report on Tony M. Mr. Mathisen and the team from SLR

had identified what may be an inverse relationship between the

uranium and vanadium grades at Tony M, as such much of the work

will be focused on lower grade uranium targets.

In addition to drilling, the Company is working

towards re-opening of Tony M for an underground sampling program.

The Company has contracted RME Consulting, a leading international

technical underground mining ventilation and refrigeration design

firm, to oversee the design and implementation of the ventilation

plan and Call & Nicholas, Inc. an international mining

consulting firm that specializes in geological engineering,

geotechnical engineering, and hydrogeology to review the ground

conditions. This will allow the Company to more easily access

mineralization for sampling and observe mineralization in

place.

Figure 2: Picture of drill rig being set

up at the Tony M Mine for the 2023 program

Drilling will be carried out by an independent

drilling contractor, and all of the drill holes will utilize the

conventional “open hole” rotary drill method. The entire interval

of the Salt Wash Sandstone member will be cored, and core samples

will be submitted to American Assay Laboratories of Sparks, Nevada

for assaying of uranium and vanadium. All of the drill holes will

be logged (probed) with a surface recording geophysical logging

instrument that will collect natural gamma-ray, self-potential and

resistivity data. The geophysical instrumentation will be

calibrated at the US Department of Energy’s “test pits” in Grand

Junction, Colorado prior to the commencement of the drilling

program, and again at the conclusion of drilling. Selected drill

holes will also be logged by an independent geophysical contractor

as a further check of the accuracy of logging results. Core samples

will be scanned with a hand-held scintillometer to measure

radioactivity in the core and will be scanned with a portable X-ray

fluorescence analyzer to determine zones of vanadium mineralization

prior to collecting samples to be assayed. All sample submissions

will include certified reference materials (“standards”) and barren

samples (“blanks”) for quality control and quality assurance, as

checks on the assaying program.

About Tony M Mine

Tony M is located in eastern Garfield County,

southeastern Utah, approximately 66 air miles (107 kilometers) west

northwest of the town of Blanding and 215 miles (347 kilometers)

south-southeast of Salt Lake City. The project is the site of the

Tony M underground uranium mine that was developed by Plateau

Resources, a subsidiary of Consumer’ Power Company, in the mid-

1970s.

Uranium and vanadium mineralization at the Tony

M mine is hosted in sandstone units of the Salt Wash Member of the

Jurassic age Morrison Formation, one of the principal hosts for

uranium deposits in the Colorado Plateau region of Utah and

Colorado.

Tony M has been estimated to contain the

following mineral resources:

Table 1: Summary of Mineral Resources –

Effective Date September 9, 2022

|

Classification |

Tons(short tons) |

Grade(% eU3O8) |

Contained Metal(lbs. eU3O8) |

|

|

|

|

|

|

Indicated |

1,185,000 |

0.28 |

6,606,000 |

|

|

|

|

|

|

Inferred |

404,000 |

0.27 |

2,218,000 |

Notes:

- Technical Report on the Tony M

Project, Utah, USA Report for NI 43-101, prepared for Consolidated

Uranium, Inc. by SLR International Corporation; Mark B. Mathisen,

Qualified Person, Effective Date September 9, 2022.

- CIM (2014) definitions were

followed for all Mineral Resource categories.

- Uranium Mineral Resources are

estimated at a cut-off grade of 0.14% U3O8.

- The cut-off grade is calculated

using a metal price of $65/lb U3O8.

- No minimum mining width was used in

determining Mineral Resources.

- Mineral Resources are based on a

tonnage factory of 15 ft3/ton (Bulk density 0.0667 ton/ft3 or 2.14

t/m3).

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability.

- Past production (1979-2008) has

been removed from the Mineral Resource.

- Totals may not add due to

rounding.

- Mineral Resources are 100%

attributable to CUR and are in situ.

______________________

1 “Genesis of the Tabular-Type Vanadium-Uranium

Deposits of the Henry Basin, Utah”; H. Roy Nathrop, Martin B.

Goldhaber, Gene Whitney, Gary P. Landis, and Robert O. Rye;

Economic Geology, Volume 85, No. 2, pages 215 – 269.

Qualified Person

The scientific and technical information

contained in this news release was reviewed and approved by Dean T.

Wilton: PG, CPG, MAIG, a consultant of CUR who is a “Qualified

Person” (as defined in National Instrument 43-101 - Standards of

Disclosure for Mineral Projects).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQX:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development.

The Company is currently advancing its portfolio

of permitted, past-producing conventional uranium and vanadium

mines in Utah and Colorado, with a toll milling arrangement in

place with Energy Fuels Inc., a leading U.S.-based uranium mining

company. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.

For More Information, Please

Contact:

Philip Williams

Chairman and

CEOpwilliams@consolidateduranium.com

Toll-Free: 1-833-572-2333Twitter:

@ConsolidatedUr www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including, but not limited to, details of the

2023 drill program and potential results and benefits thereof;

details of the potential underground sampling program and potential

benefits thereof; expectations regarding the preparation of a

potential vanadium mineral resource estimate; expectations

regarding the potential upgrade of existing mineral resources from

“inferred” to “indicated”; expectations regarding the restart of

Tony M; expectations regarding the preparation and timing of a

Preliminary Economic Assessment; the Company’s ongoing business

plan, sampling, exploration and work programs. Generally, but not

always, forward-looking information and statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or the negative connotation

thereof or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved” or the negative

connotation thereof. Such forward-looking information and

statements are based on numerous assumptions, including that

general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms, and that third party

contractors, equipment and supplies and governmental and other

approvals required to conduct the Company’s planned exploration

activities will be available on reasonable terms and in a timely

manner. Although the assumptions made by the Company in providing

forward-looking information or making forward-looking statements

are considered reasonable by management at the time, there can be

no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves, mineral resources are not

mineral reserves and do not have demonstrated economic viability;

reliance on key management and other personnel, potential downturns

in economic conditions, actual results of exploration activities

being different than anticipated, changes in exploration programs

based upon results, and risks generally associated with the mineral

exploration industry, environmental risks, changes in laws and

regulations, community relations and delays in obtaining

governmental or other approvals and the risk factors with respect

to Consolidated Uranium set out in CUR’s annual information form in

respect of the year ended December 31, 2022 filed with the Canadian

securities regulators and available under CUR’s profile on SEDAR at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/c95473ba-37a0-4b69-95b8-d9e1981b2a3d

https://www.globenewswire.com/NewsRoom/AttachmentNg/6f872210-92fd-4da4-be45-62d16d964f71

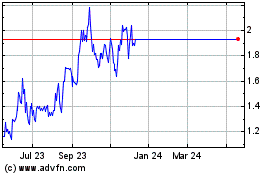

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024