Crown Point Announces Strategic Acquisition of Exploitation Concessions in Santa Cruz, Argentina

February 09 2024 - 10:49AM

Crown Point Energy Inc. (TSX-V: CWV) (“

Crown

Point” or the “

Company”) is pleased to

announce that its wholly-owned subsidiary, Crown Point Energia

S.A., has entered into an asset sale and purchase agreement (the

“

Acquisition Agreement”), dated as of February 1,

2024, with PAN AMERICAN ENERGY S.L., SUCURSAL ARGENTINA (the

“

Seller”), an arm's length party, to acquire all

of Seller’s right, title and interest in the Piedra Clavada and

Koluel Kaike hydrocarbons exploitation concessions.

Acquired Assets

The Company will acquire from the Seller a 100%

operating interest in Piedra Clavada and Koluel Kaike blocks

located in the Santa Cruz Province, on the southern flank of Golfo

San Jorge basin, approximately 200 km southwest of Comodoro

Rivadavia (the “Santa Cruz

Concessions”).

This acquisition represents an excellent

opportunity for the Company to acquire a 100% operated interest in

already producing oil assets in Argentina and with an average daily

production level of 3,500 bbl/d during the three month period ended

December 31, 2023.

The Santa Cruz Concessions, comprising a total

of 71,593 acres, will include Company owned extensive

infrastructure in place capable of handling larger than current

production volumes.

The purchase price payable by Crown Point to the

Seller is US$12,000,000 cash base consideration, subject to

customary closing adjustments, plus certain contingent in-kind

consideration that is payable throughout a fifteen-year period

following the closing date.

With respect to the in-kind consideration, Crown

Point will deliver to the Seller a monthly quantity of oil produced

from the Santa Cruz Concessions that may range from zero up to 600

bbl/d, subject to the oil market price so determined for each

month.

Crown Point intends to fund the base cash

portion of the purchase price using its existing cash resources,

operating cash flows, and by completing a debt and/or equity

financing prior to closing of the acquisition.

Acquisition Agreement

Completion of the acquisition is subject to,

among other things, the receipt of all necessary regulatory and

Provincial approvals, including the approval of the TSX Venture

Exchange ("TSXV"), and other customary closing

conditions. Completion of the acquisition is not subject to

approval by the Company's shareholders. The acquisition is expected

to close in April 2024. The effective date of the

acquisition is January 1, 2024.

On February 1, 2024, the common shares of the

Company (the "Common Shares") were halted pending

review of the Acquisition Agreement pursuant to TSXV Policy 5.3 –

Acquisitions and Dispositions of Non-Cash Assets ("Policy

5.3") as the matters contemplated by the Acquisition

Agreement are considered to be a "Fundamental Acquisition" under

Policy 5.3. Trading of the Common Shares will remain halted pending

receipt by the TSXV of acceptable documentation pursuant to Policy

5.3.

For inquiries please contact:

| Gabriel

Obrador |

Marisa

Tormakh |

| President & CEO |

Vice-President, Finance & CFO |

| Ph: (403) 232-1150 |

Ph: (403) 232-1150 |

| Crown Point Energy Inc. |

Crown Point Energy Inc. |

| gobrador@crownpointenergy.com |

mtormakh@crownpointenergy.com |

| |

|

About Crown Point

Crown Point is an international oil and gas

exploration and development company incorporated in Alberta,

Canada, trading on the TSX Venture Exchange and operating in

Argentina. Crown Point's exploration and development activities are

focused in three producing basins in Argentina, the Austral basin

in the province of Tierra del Fuego, and the Neuquén and Cuyano

basins in the province of Mendoza. Crown Point has a strategy that

focuses on establishing a portfolio of producing properties, plus

production enhancement and exploration opportunities to provide a

basis for future growth.

Advisories

Forward-Looking Statements.

Certain information regarding Crown Point set forth in this

document, including all details regarding the proposed acquisition

of the Seller's right, title and interest in the Piedra Clavada and

Koluel Kaike exploitation Concessions; the opportunities the

acquisition presents; the benefits that we anticipate deriving from

the acquisition; the in-kind consideration and the volumes of oil

to be delivered to the Seller at different average oil prices and

in different years; our beliefs regarding how we will fund the

purchase price for the acquisition and our ability to fund the

purchase price for the acquisition; including our ability to obtain

the requisite debt and/or equity financing; and the anticipated

timing for closing the acquisition. The forward-looking information

is based on certain key expectations and assumptions made by Crown

Point, including expectations and assumptions concerning: the

timing of receipt of the necessary regulatory; stock exchange and

other approvals and the satisfaction of and time necessary to

satisfy the conditions to the closing of the acquisition;

prevailing commodity prices and exchange rates; applicable royalty

rates and tax laws; future well production rates and reserve

volumes; the timing of receipt of regulatory approvals; the

performance of existing wells; the success obtained in drilling new

wells; the sufficiency of budgeted capital expenditures in carrying

out planned activities; and the availability and cost of labour and

services. In addition, there are no assurances the acquisition will

be completed on the terms disclosed herein or at all. Although

Crown Point believes that the expectations and assumptions on which

such forward-looking information is based are reasonable, undue

reliance should not be placed on the forward-looking information

because Crown Point can give no assurances that they will prove to

be correct. Since forward-looking information addresses future

events and conditions, by its very nature it involves inherent

risks and uncertainties. Actual results could differ materially

from those currently anticipated due to a number of factors and

risks. These risks include, without limitation: risks associated

with oil and gas exploration, development, exploitation,

production, marketing and transportation; loss of markets;

volatility of commodity prices; environmental risks; inability to

obtain drilling rigs or other services; capital expenditure costs,

including drilling, completion and facility costs; unexpected

decline rates in wells; wells not performing as expected; delays

resulting from labour unrest; delays resulting from our inability

to obtain required regulatory approvals and ability to access

sufficient capital from internal and external sources; the impact

of general economic conditions in Canada, Argentina, the United

States and overseas; industry conditions; changes in laws and

regulations (including the adoption of new environmental laws and

regulations) and changes in how they are interpreted and enforced;

increased competition; the lack of availability of qualified

personnel or management; fluctuations in foreign exchange or

interest rates; and stock market volatility and market valuations

of companies with respect to announced transactions and the final

valuations thereof. There are also risks inherent in the nature of

the proposed acquisition, including failure to realize anticipated

opportunities and benefits; risks regarding the integration of

assets into Crown Point; incorrect assessment by Crown Point of the

value of the assets; failure to obtain the required regulatory and

other third party approvals; failure to obtain the debt and/or

other financing required to fund the purchase price for the

acquisition; and the possibility that the asset sale and purchase

agreement will be terminated. Readers are cautioned that the

foregoing list of factors is not exhaustive.

Crown Point's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward looking statements will transpire or occur, or if any of

them do so, what benefits that the Company will derive therefrom.

Additional information on these and other factors that could affect

Crown Point's operations and financial results are included in

reports on file with Canadian securities regulatory authorities and

may be accessed through the SEDAR website (www.sedar.com) or Crown

Point's website (www.crownpointenergy.com). The forward-looking

statements contained in this document are made as at the date of

this news release and Crown Point does not undertake any obligation

to update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

laws.

Oil and Gas Matters. "bbl/d"

means barrel per day.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

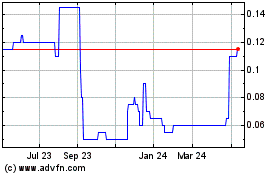

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Dec 2024 to Jan 2025

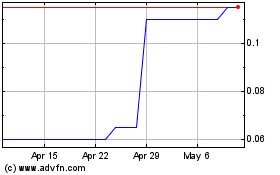

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Jan 2024 to Jan 2025