Goliath Resources Limited (TSX-V: GOT) (OTCQB: GOTRF)

(Frankfurt: B4IF) (the “Company” or “Goliath”) is pleased

to announce that it has signed a Memorandum of Understanding

(“

MOU”) with

BWCG Holding Ltd.

(Formerly Blackwolf Copper and Gold Inc.),

Blackwolf Copper

and Gold (TSXV: BWCG, OTC: BWCGF),

Coast

Copper Corp. (TSX-V: COCO),

Dolly Varden

Silver (TSXV: DV, OTC: DOLLF), and

New Moly

LLC (collectively, the “

Companies”) to

jointly study the viability of using New Moly’s Kitsault Project

(“

Kitsault” or the “

Project”) as

the potential site for a centralized polymetallic processing

facility that could accept mineralized material from the Companies’

respective deposits and/or new discoveries (“

Kitsault

Polymetallic Mill”), located nearby on tidewater in

northwestern, B.C. and/or southeastern, Alaska (See Figure 1.

below).

Prior to signing the initial MOU, Blackwolf

Copper and Gold undertook initial discussions with Nisga’a Lisims

Government regarding potential amendments to the Mines Act Permits

for Kitsault to support a polymetallic mill.

“Nisga’a Lisims Government has had initial

discussions with Blackwolf Copper and Gold on the concept of a hub

and spoke mill at the site of the Kitsault Project. We look

forward to further consultation on this and other natural resource

opportunities within the Nass Area which is subject to the Nisga’a

Final Agreement where we have constitutionally protected title and

rights” said Charles Morven, Secretary-Treasurer for Nisga’a Lisims

Government.

“We look forward to working with this

collaboration of Companies to study the potential synergies that

include reduced respective capital, processing costs as well as

reduce permitting timelines and risks by using a permitted site

located on tidewater,” said Roger Rosmus, Founder & CEO. “With

the Surebet’s Au-Ag-Cu-Pb-Zn discovery that has two barge access

points located on tidewater and marine bulk transport being

reasonably cost effective. We believe that the Kitsault site could

potentially be an excellent fit for Goliath to unlock additional

shareholder value.”

The proposed site at Kitsault previously hosted

a molybdenum mine. Within the past decade, Kitsault received

Canadian Federal and Provincial Permits and given the buoyant

molybdenum market, New Moly is now considering funding requirements

to restart a larger scale project. The Project is

located on the BC Hydro grid, has road access to the Nass Valley

and tidewater access. The Kitsault Polymetallic Mill concept may

assist to enhance and de-risk the potential restart of

Kitsault.

The Companies have engaged Fuse Advisors Inc.

(“Fuse Advisors”) to complete an initial assessment of the

technical viability of the Kitsault Polymetallic Mill concept and

will jointly share the costs of this study. By reviewing the

respective metallurgical test work completed at the various

deposits, Fuse will assess the potential for blending or batching

mineralized material, potential process flow-sheets, potential

throughputs from the various deposits and associated mill sizing

and timelines.

Figure 1. below - Location of Kitsault, Goliath

Resources, Dolly Varden, Blackwolf Copper and Gold and Coast Copper

projects.

Figure 1 is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b7dfc752-6873-40d7-b2d2-13f25cd9a080

NEW MOLY KITSAULT MINEThe

Kitsault Mine Project is one of the largest and highest-grade

primary molybdenum deposits in the world. The Project is owned by

Avanti Kitsault Mine Ltd. (“AKML”), in which New

Moly has a 100% interest. The Kitsault Mine is located in

northwestern British Columbia within the Regional District of

Kitimat-Stikine, approximately 140km northeast of Prince Rupert and

south of the terminus of Alice Arm, an inlet of the Pacific Ocean

(See Figure 2 below).

The Kitsault Mine is a brownfield site with

considerable past mining activity and basic infrastructure in

place. From as early as 1968, and intermittently until 1982, the

mine produced approximately 30 million pounds of molybdenum from

open-pit mining. Rehabilitation of the 1981 – 1982 mining program

was started under an approved reclamation program in the mid-1990s

and was completed in 2006.

AKML completed the purchase of an undivided, 100

percent (%) direct interest in the Kitsault Mine (molybdenum mine

and surrounding mineral tenures) from Aluminerie in October 2008.

Under AKML, permits have been well advanced with key provincial and

federal permits in place for development of an estimated mine life

of 15 years with an ore production rate of 16.2 Mt/year. Kitsault’s

development would include construction of a process plant, upgrade

of the existing powerline, expansion of the existing open pit,

construction of a low-grade ore stockpile, waste rock management

facility, and a tailings management facility with associated water

management ponds. In 2014, AKML entered into a Cooperation and

Benefits Agreement (“CBA”) and an Environmental Agreement with the

Nisga’a Nation. This agreement recognizes and formalizes the

working relationships between the Nisga’a Nation and AKML and is a

vital step in the development of Kitsault Mine.

New Moly also owns 80% of the Mt. Hope

molybdenum project in Nevada, one of the largest permitted primary

molybdenum projects in the world with more than a billion pounds of

molybdenum and a proposed mine life of more than 40 years.

Figure 2.

Figure 2 is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/fe8b2de2-cefb-469c-be56-5161df3ac95b

NIBLACKBlackwolf Copper and

Gold’s Niblack Project hosts multiple Cu-Au-Zn-Ag deposits and

prospects, located next to tidewater on Prince of Wales Island in

southeast Alaska. Current Mineral Resources1 include

5,851,000 tonnes averaging 0.94% Cu, 1.83 g/t Au, 1.73% Zn and 29.0

g/t Ag in the Indicated Category and 214,000 tonnes averaging 0.93%

Cu, 1.52 g/t Au, 1.38% Zn and 18.0 g/t Ag in the additional

Inferred Category. Primarily hosted in the Lookout Zone, the

Mineral Resources have excellent metallurgical recoveries within a

wide mineralized zone, up to 120 meters in true width and is

accessed with a production-size underground ramp.

Mineralization is wide open for expansion in most areas, and

numerous prospects have only received limited drill testing.

- Refer to the NI43-101 compliant Mineral Resource Estimation –

Niblack Polymetallic Sulphide Project Updated see News Release

Dated February 16, 2023, by Dr. Gilles Arsenault, P.Geo,of

Arsenault Consulting Services, a Qualified Person Independent of

the Company. The Resource uses a US$100 cut-off Net

Smelter Return (NSR) and uses long-term metal forecasts: gold

US$1,650/oz, silver US$20.00/oz, copper US$3.50/lb, and zinc

US$1.10/lb; Recoveries (used for all NSR calculations) to Cu

concentrate of 94.3% Cu, 72% Au, 90.2% Zn and 76% Ag. Detailed

engineering studies will determine the best cutoff.

COAST COPPERCoast Copper’s

exploration focus is the optioned Empire Mine property, located on

northern Vancouver Island, British Columbia, which covers three

historical open pit mines and two past-producing underground mines

that yielded iron, copper, gold and silver. Coast Copper’s other

properties include its 100% owned Knob Hill NW Property located on

northern Vancouver Island, its Home Brew and Shovelnose South

Properties in central B.C., and its Scottie West Property located

in the “Golden Triangle” of northern B.C.

DOLLY VARDEN/HOMESTAKE

RIDGEThe contiguous Dolly Varden and

Homestake Ridge projects, owned 100% by Dolly Varden Silver, make

up a 163 sq. km. land package that is accessible to tidewater at

the end of Alice Arm, just across the inlet from the Kitsault site,

via a 28km historic mine road. Mineralization in the area

consists of silver and gold systems in several areas, often with

significant zinc and copper values. The Dolly Varden

and Torbrit deposits have seen combined historic production of

approximately 20 million oz Ag and have demonstrated good

metallurgical recoveries. The property remains prospective for the

discovery of additional deposits along a 15 kilometer trend of

favorable host rocks and alteration.

GOLIATH RESOURCES/SUREBET

ZONEGoliath controls 100% of the Golddigger property that

covers an area of 59,089 hectares, located on tidewater northwest

of the Kitsault site and west of Dolly Varden Silver’s Kitsault

Valley Project. The Company has discovered a new, high-grade

polymetallic gold-silver shear zone, the “Surebet Zone” on the

property that has been confirmed over a 1.6 square kilometer area

averaging 6.31 g/t AuEq (4.45 g/t Au & 110 g/t Ag) over 6.88

meters* wide. Mineralization within the Surebet Zone consists

of structurally controlled massive, semi-massive, and disseminated

sulphides containing Galena, Sphalerite, Pyrrhotite and Pyrite.

These lenses occur within broad alteration halos of silica flooded

sediments which also contain polymetallic mineralization up to 43.5

meters wide. The initial metallurgy shows exceptional results of

92.2% Gold recovery using traditional gravity and flotation

processes; inclusive of 48.8% free gold from simple gravity at a

327 micron crush.

QUALIFIED PERSONS:Andrew

Hamilton, P.Geo., a Qualified Person and Rein Turna P. Geo a

Qualified Person as defined by National Instrument 43-101 has

reviewed and approved, the technical information in this

release.

For more information please

contact: Goliath Resources LimitedMr. Roger

Rosmus Founder and CEOTel:

+1-416-488-2887roger@goliathresources.comwww.goliathresourcesltd.com

*Goliath widths are reported in drill core

lengths and the true widths are approximately 80-90% and AuEq metal

values are calculated using: Au 1644.08 USD/oz, Ag 19.23 USD/oz, Cu

3.47 USD/lbs, Pb 1870.50 USD/ton and Zn 2882.50 USD/ton on October

28, 2022. There is potential for economic recovery of gold, silver,

copper, lead, and zinc from these occurrences based on other mining

and exploration projects in the same Golden Triangle Mining Camp

where Goliath’s project is located such as the Homestake Ridge Gold

Project (Auryn Resources Technical Report), Updated Mineral

Resource Estimate and Preliminary Economic Assessment on the

Homestake Ridge Gold Project, prepared by Minefill Services Inc.

(Bothell, Washington), dated May 29, 2020. Here, AuEq values were

calculated using 3-year running averages for metal price, and

included provisions for metallurgical recoveries, treatment

charges, refining costs, and transportation. Recoveries for Gold

were 85.5%, Silver at 74.6%, Copper at 74.6% and Lead at 45.3%. It

will be assumed that Zinc can be recovered with the Copper at the

same recovery rate of 74.6%. The quoted reference of metallurgical

recoveries is not from Goliath’s Golddigger Project, Surebet Zone

mineralization, and there is no guarantee that such recoveries will

ever be achieved, unless detailed metallurgical work such as in a

Feasibility Study can be eventually completed on the Golddigger

Project. Table 2 above has all the drill hole collar

information.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange), nor the OTCQB Venture Market

accepts responsibility for the adequacy or accuracy of this

release.

Certain statements contained in this press

release constitute forward-looking information. These statements

relate to future events or future performance. The use of any of

the words "could", "intend", "expect", "believe", "will",

"projected", "estimated" and similar expressions and statements

relating to matters that are not historical facts are intended to

identify forward-looking information and are based on Goliath’s

current belief or assumptions as to the outcome and timing of such

future events. Actual future results may differ materially. In

particular, this release contains forward-looking information

relating to, among other things, the ability of Company to complete

the financings and its ability to build value for its shareholders

as it develops its mining properties. Various assumptions or

factors are typically applied in drawing conclusions or making the

forecasts or projections set out in forward-looking information.

Those assumptions and factors are based on information currently

available to Goliath. Although such statements are based on

management's reasonable assumptions, there can be no assurance that

the proposed transactions will occur, or that if the proposed

transactions do occur, will be completed on the terms described

above.

The forward-looking information contained in

this release is made as of the date hereof and Goliath is not

obligated to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws. Because of the

risks, uncertainties and assumptions contained herein, investors

should not place undue reliance on forward-looking information. The

foregoing statements expressly qualify any forward-looking

information contained herein.

This announcement does not constitute an offer,

invitation, or recommendation to subscribe for or purchase any

securities and neither this announcement nor anything contained in

it shall form the basis of any contract or commitment. In

particular, this announcement does not constitute an offer to sell,

or a solicitation of an offer to buy, securities in the United

States, or in any other jurisdiction in which such an offer would

be illegal.

The securities referred to herein have not been

and will not be will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to or for the account or benefit of a U.S. person

(as defined in Regulation S under the U.S. Securities Act) unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

NOT FOR DISSEMINATION IN THE UNITED

STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES AND DOES NOT

CONSTITUTE AN OFFER OF THE SECURITIES DESCRIBED

HEREIN.

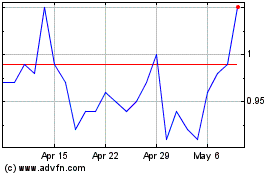

Dolly Varden Silver (TSXV:DV)

Historical Stock Chart

From Jun 2024 to Jul 2024

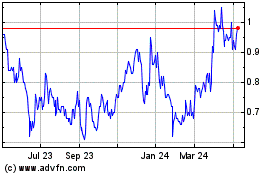

Dolly Varden Silver (TSXV:DV)

Historical Stock Chart

From Jul 2023 to Jul 2024