Voxtur Analytics Corp. (TSXV: VXTR; OTCQB: VXTRF) ("Voxtur" or the

"Company"), a North American technology company creating a more

transparent and accessible real estate lending ecosystem, is

pleased to announce its financial results for Q4 and FY 2022. The

Company's Audited Consolidated Financial Statements for the year

ended December 31, 2022, and the related Management's Discussion

and Analysis ("MD&A") are available at sedar.com.

“When factoring in the current market conditions and our

performance compared to our competitors, we are thrilled to

announce our impressive financial results for the fourth quarter

and full year 2022. It was a year of transformation for Voxtur,

driven by a strategic acquisition, the launch of innovative data

driven products, and expansion of our market presence," said Gary

Yeoman, CEO of Voxtur. "2022 was a year of unprecedented rate

increases that forced the Company to re-evaluate its strategy from

a financial and product perspective. This ultimately led to a

transformational acquisition, which significantly diversified our

product offerings within the mortgage market from the origination

market to the capital markets. This was a strategic move that not

only expanded our reach, but also allowed us to tap into new

revenue streams and enhance our competitiveness in the

industry.”

In addition to the above, the Company had many other milestones

within 2022 such as month over month growth in the Anow valuation

platform for either lenders or appraisal management companies to

manage their valuations, the Attorney Opinion Letter started

generating revenue with regulated banks and alternative lenders,

and the rolling out of data products with mortgage servicers and

large title agencies.

Also, the Company shifted its financial focus from pure revenue

growth to getting to operational profitability, which included

materially reducing headcount, streamlining processes, and

executing on cost efficiencies. As a result of these changes, the

Company has a diversified product portfolio and a clear strategic

direction that has an exciting future.

Financial Results for Q4 and FY 2022

- Q4 2022 Revenue decreased 6% over

Q4 2021 Revenue

- FY 2022 Revenue increased 57% over

FY 2021 Revenue

- Q4 2022 Gross Profit increased 25%

over Q4 2021

- FY 2022 Gross Profit increased 49%

over FY 2021

| |

|

Unaudited |

|

Audited |

| |

|

Three months ended December 31 |

|

Year ended December 31 |

|

(In thousands of Canadian dollars) |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

| Revenue |

|

$ |

36,432 |

|

$ |

38,775 |

|

$ |

150,878 |

|

$ |

95,992 |

|

Adjusted EBITDA, Unaudited1 |

|

|

(354 |

) |

|

28 |

|

|

(8,672 |

) |

|

610 |

Discussion with respect to the above-noted results can be found

in the Company’s MD&A.

1 - Adjusted EBITDA is an unaudited non-GAAP measure and does

not have any standardized meaning prescribed under IFRS and,

therefore, may not be comparable to similar measures employed by

other reporting issuers. Management believes Adjusted EBITDA

provides meaningful information with respect to the financial

performance and value of the Company, as items that may obscure the

underlying trends in the business performance are excluded.

Adjusted EBITDA is defined and calculated by the Company as

earnings (loss) before interest, taxes, depreciation/amortization

of property and equipment, intangible assets and right-of-use

assets, share-based compensation expense, foreign exchange gains

(losses) recorded through profit and loss, impairment losses and

other costs or income that are: (i) non-operating; (ii)

non-recurring; and/or (iii) are related to strategic initiatives.

The Company classifies income or costs as non-recurring if income

or costs similar in nature are not reasonably expected to occur

within the next two years nor have occurred during the prior two

years, and such costs are significant.

Shareholder Call

The Company will host a conference call at 9 a.m. Eastern time

on Wednesday, July 26th, 2023, following the release of ist Q1 2023

financial results to discuss details of the Company’s performance,

including a general company update, followed by a

question-and-answer period with analysts. Details to the above

referenced conference call will be provided later this week.

About Voxtur

Voxtur is a transformational real estate

technology company that is redefining industry standards in a

dynamic lending environment. The Company offers targeted data

analytics to simplify tax solutions, property valuation and

settlement services throughout the lending lifecycle for investors,

lenders, government agencies and servicers. Voxtur's proprietary

data hub and workflow platforms more accurately and efficiently

value assets, originate and service loans, securitize portfolios

and evaluate tax assessments. The Company serves the property

lending and property tax sectors, both public and private, in the

United States and Canada. For more information, visit

www.voxtur.com.

Forward-Looking Information

This news release contains certain

forward-looking statements and forward-looking information

(collectively, “forward-looking information”) which reflect the

expectations of management regarding the Company’s future growth,

financial performance and objectives and the Company’s strategic

initiatives, plans, business prospects and opportunities. These

forward-looking statements reflect management’s current

expectations regarding future events and the Company’s financial

and operating performance and speak only as of the date of this

press release. By their very nature, forward-looking statements

require management to make assumptions and involve significant

risks and uncertainties, should not be read as guarantees of future

events, performance or results, and give rise to the possibility

that management’s predictions, forecasts, projections, expectations

or conclusions will not prove to be accurate, that the assumptions

may not be correct and that the Company’s future growth, financial

performance and objectives and the Company’s strategic initiatives,

plans, business prospects and opportunities, including the

duration, impact of and recovery from the COVID-19 pandemic, will

not occur or be achieved. Any information contained herein that is

not based on historical facts may be deemed to constitute

forward-looking information within the meaning of Canadian and

United States securities laws. Forward-looking information may be

based on expectations, estimates and projections as at the date of

this news release, and may be identified by the words “may”,

“would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”,

“believe”, “estimate”, “expect” or similar expressions.

Forward-looking information may include but is not limited to the

anticipated financial performance of the Company and other events

or conditions that may occur in the future. Investors are cautioned

that forward-looking information is not based on historical facts

but instead reflects estimates or projections concerning future

results or events based on the opinions, assumptions and estimates

of management considered reasonable at the date the information is

provided. Although the Company believes that the expectations

reflected in such forward-looking information are reasonable, such

information involves risks and uncertainties, and undue reliance

should not be placed on such information, as unknown or

unpredictable factors could have material adverse effects on future

results, performance, or achievements of the Company. Among the key

factors that could cause actual results to differ materially from

those projected in the forward-looking information include but are

not limited to: additional costs related to acquisitions,

integration of acquired businesses, and implementation of new

products; changing global financial conditions, especially in light

of the COVID-19 global pandemic; reliance on specific key employees

and customers to maintain business operations; competition within

the Company’s industry; a risk in technological failure, failure to

implement technological upgrades, or failure to implement new

technological products in accordance with expected timelines;

changing market conditions related to defaulted mortgage loans, and

the failure of clients to send foreclosure and bankruptcy referrals

in volumes similar to those prior to the COVID-19 global pandemic;

failure of governing agencies and regulatory bodies to approve the

use of products and services developed by the Company; the

Company’s dependence on maintaining intellectual property and

protecting newly developed intellectual property; operating losses

and negative cash flows; and currency fluctuations. Accordingly,

readers should not place undue reliance on forward-looking

information contained herein. Factors relating to the Company’s

financial guidance and targets disclosed in this press release

include, in addition to the factors set out above, the degree to

which actual future events accord with, or vary from, the

expectations of, and assumptions used by, Voxtur‘s management in

preparing the financial guidance and targets.

This forward-looking information is provided as

of the date of this news release and, accordingly, is subject to

change after such date. The Company does not assume any obligation

to update or revise this information to reflect new events or

circumstances except as required in accordance with applicable

laws.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Voxtur's common shares are traded on the TSX

Venture Exchange under the symbol VXTR and in the US on the OTCQB

under the symbol VXTRF.

Contact:

Jordan RossChief Investment OfficerTel: (416)

708-9764jordan@voxtur.com

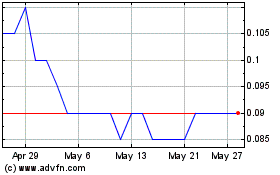

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Dec 2023 to Dec 2024