Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10/Amendment

2

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities

Exchange Act of 1934

ELINE ENTERTAINMENT

GROUP, INC.

(Exact name of registrant as specified in its

charter)

| Wyoming |

|

88-0429856 |

(State

of other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

7339 E. Williams Drive

Unit 26496

Scottsdale, AZ 85255

(Address of Principal

Executive Offices) (Zip Code)

602.793.8058

(Registrant’s

telephone number, including area code)

Correspondence:

Rhonda Keaveney

PO Box 26496

Scottsdale, AZ 85255

602.793.8058

Rhonda@scctransferllc.com

Securities to be

Registered Under Section 12(b) of the Act:

None

Securities to be

Registered Under Section 12(g) of the Act:

Common Stock, Par

Value $0.001

(Title of Class)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ELINE ENTERTAINMENT

GROUP, INC.

INDEX TO FORM 10

Cautionary Note Regarding

Forward-Looking Statements

This registration

statement on Form 10 contains “forward-looking statements” concerning our future results, future performance, intentions,

objectives, plans, and expectations, including, without limitation, statements regarding the plans and objectives of management for future

operations, any statements concerning our proposed services, any statements regarding future economic conditions or performance, and

any statements of assumptions underlying any of the foregoing. All forward-looking statements included in this document are made as of

the date hereof and are based on information available to us as of such date. We assume no obligation to update any forward-looking statements.

In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,”

“expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,”

“potential,” or “continue,” or the negative thereof or other comparable terminology. Although we believe that

the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations

or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or

assumed in the forward-looking statements. Future financial condition and results of operations, as well as any forward-looking statements

are subject to inherent risks and uncertainties, including those discussed under “Risk Factors” and elsewhere in this Form

10.

Introductory Comment

We are filing this General Form for Registration of Securities on Form

10 to register our common stock pursuant to Section 12(g) of the Exchange Act. Once this registration statement is deemed effective, we

will be subject to the requirements of Section 13(a) under the Exchange Act, which will require us to file annual reports on Form 10-K

(or any successor form), quarterly reports on Form 10-Q (or any successor form), and current reports on Form 8-K, and we will be required

to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g)

of the Exchange Act.

Throughout this Form 10, unless the context otherwise requires, the

terms “we,” “us,” “our,” the “Company,” “EEGI" and “our Company”

refer to Eline Entertainment Group, Inc., a Wyoming corporation. EEGI is a Blank Check Company under Rule 419 of the Securities Act of

1933.

The term ‘blank check company” means that we are a development

stage company and have no specific business plan or purpose or has indicated that is business plan is to engage in a merger or acquisition

with an unidentified company, or other entity or person. A blank check company:

(i) Is a development stage company that has no specific

business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company

or companies, or other entity or person; and

(ii) Is issuing “penny stock,” as defined in

Rule 3a51-1 under the Securities Exchange Act of 1934.

Our Company is currently listed on the Expert Market on the OTC Markets

platform. Our stock quote is not currently quoted on OTC Markets. The market for our stock is uncertain at this time. Quotations in Expert

Market securities are restricted from public viewing and only broker-dealers and professional or sophisticated investors are permitted

to view quotations in Expert Market securities. Our securities could be particularly illiquid due to being listed on this market and that

if we remain on the Expert Market it could impede a potential merger, acquisition, reverse merger or business combination pursuant to

which the company could become an operating company.

We have taken steps to be listed on a different tier of the OTC Markets.

The filing of this registration statement and continued compliance with financial reporting requirements will allow EEGI to be listed

as a Pink Current company on the OTC Markets platform. In addition, we are actively pursuing a viable merger candidate which will allow

us continued Pink Current status.

At this time, we have

not entered into any agreements with a merger candidate and have no viable potential business combination in place. The Company has not

engaged in any ongoing discussions or negotiations regarding a potential business combination.

(a) Business Development

Eline Entertainment Group, Inc. (OTC “EEGI”) was incorporated

under the laws of the State of Nevada on June 12, 1997, as Rapid Retrieval Systems, Inc. On April 25, 2001, the Company filed an amendment

to its Articles of Incorporation and changed its name to Eline Entertainment Group, Inc. In 2017, the Company converted out of the State

of Nevada and domiciled in the State of Wyoming.

Eline Entertainment Group, Inc., Inc. operated as food service business

specializing in sports and entertainment production and distribution.

Business operations for Eline Entertainment Group, Inc. were abandoned

by former management and a custodianship action, as described in the subsequent paragraph, was commenced in 2022.

On May 11, 2022, the First Judicial

District Court of Laramie, Wyoming granted the Application for Appointment of Custodian as a result of the absence of a functioning board

of directors and the revocation of the Company’s charter. The order appointed Rhonda Keaveney (the “Custodian”) custodian

with the right to appoint officers and directors, negotiate and compromise debt, execute contracts, issue stock, and authorize new classes

of stock.

The court awarded custodianship to the Custodian based on the absence

of a functioning board of directors, revocation of the company’s charter, and abandonment of the business. At this time, the

Custodian appointed Rhonda Keaveney as our sole individual serving as director, officer, and executive officer.

The Custodian attempted to contact the Company’s officers and

directors through letters, emails, and phone calls, with no success.

Small Cap Compliance, LLC (‘SCC”)

is a shareholder in the Company and Rhonda Keaveney is the sole member of SCC. Rhonda Keaveney applied to the Court for an Order

appointing her as the Custodian. This application was for the purpose of reinstating EEGI’s corporate charter to do business and

restoring value to the Company for the benefit of the stockholders.

The Custodian performed the following actions in its capacity as custodian:

| |

· |

Funded any expenses of the company including paying

off outstanding liabilities |

| |

· |

Brought the Company back into compliance with the Wyoming

Secretary of State, resident agent, transfer agent |

| |

· |

Appointed officers and directors, held a shareholders

meeting, and audited financial reports |

The Custodian paid the following expenses

on behalf of the company:

Wyoming Secretary of State for reinstatement of the Company, $188

Transfer agent, Signature Stock Transfer, Inc., $850

Amended and Restated Articles of Incorporation for the Company, $175

Audit expenses, $17,500

Upon appointment as the Custodian of EEGI and under its duties stipulated

by the Wyoming court, the Custodian took initiative to organize the business of the issuer. As Custodian, the duties were to conduct

daily business, hold shareholder meetings, appoint officers and directors, reinstate the company with the Wyoming Secretary of State.

The Custodian also had authority to enter into contracts and find a suitable merger candidate. Ms. Keaveney was compensated for her role

as custodian in the amount 1 share of Convertible Preferred D Series Stock and 10,000,000 shares of restricted common stock issued in

the name of Small Cap Compliance, LLC. The Custodian did not receive any additional compensation, in the form of cash or stock, for custodian

services. The custodianship was terminated. See Order Discharging and Dismissing the Receivership dated July 29, 2022 filed as Exhibit

10.1.

We are currently a shell company, as defined

in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2.

(b) Business of Issuer

Since May 2022, the Company’s operations consist of a search

for a merger, acquisition, reverse merger or a business transaction opportunity with an operating business or other financial transaction;

however, there can be no assurance that this plan will be successfully implemented. Until a transaction is effectuated, the Company does

not expect to have significant operations. At this time, the Company has no arrangements or understandings with respect to any potential

merger, acquisition, reverse merger or business combination candidate pursuant to which the Company may become an operating company.

Opportunities may come to the Company’s

attention from various sources, including our management, our stockholders, professional advisors, securities broker dealers, venture

capitalists and private equity funds, members of the financial community and others who may present unsolicited proposals. At this time,

the Company has no plans, understandings, agreements, or commitments with any individual or entity to act as a finder in regard to any

business opportunities. While it is not currently anticipated that the Company will engage unaffiliated professional firms specializing

in business acquisitions, reorganizations or other such transactions, such firms may be retained if such arrangements are deemed to be

in the best interest of the Company. Compensation to a finder or business acquisition firm may take various forms, including one-time

cash payments, payments involving issuance of securities (including those of the Company), or any combination of these or other compensation

arrangements. Consequently, the Company is currently unable to predict the cost of utilizing such services.

The Company has not restricted its search to any particular business,

industry, or geographical location. In evaluating a potential transaction, the Company analyzes all available factors and make a determination

based on a composite of available facts, without reliance on any single factor.

It is not possible at this time to predict the nature of a transaction

in which the Company may participate. Specific business opportunities would be reviewed as well as the respective needs and desires of

the Company and the legal structure or method deemed by management to be suitable would be selected. In implementing a structure for

a particular transaction, the Company may become a party to a merger, consolidation, reorganization, tender offer, joint venture, license,

purchase and sale of assets, or purchase and sale of stock, or other arrangement the exact nature of which cannot now be predicted. Additionally,

the Company may act directly or indirectly through an interest in a partnership, corporation or other form of organization. Implementing

such structure may require the merger, consolidation, or reorganization of the Company with other business organizations and there is

no assurance that the Company would be the surviving entity. In addition, our present management and stockholders may not have control

of a majority of the voting shares of the Company following reorganization or other financial transaction. As part of such a transaction,

some or all of the Company’s existing directors may resign and new directors may be appointed. The Company’s operations following

the consummation of a transaction will be dependent on the nature of the transaction. There may also be various risks inherent in the

transaction, the nature and magnitude of which cannot be predicted.

The Company may also be subject to increased

governmental regulation following a transaction; however, it is not possible at this time to predict the nature or magnitude of

such increased regulation, if any.

The Company expects to continue to incur

moderate losses each quarter until a transaction considered appropriate by management is effectuate.

At present financial revenue has not yet been realized. The Company

hopes to raise capital in order to fund the acquisitions.

All statements involving our business plan are forward looking statements

and have not been implemented as of this filing.

The

Company is moving in a new direction, statements made relating to our business plan are forward looking statements and we have no history

of performance. Current management does not have any experience in acquisition of companies but is actively looking for a suitable

person to incorporate into the management team.

The analysis will be undertaken by or under

the supervision of our management. As of the date of this filing, we have not entered into definitive agreements. In our continued efforts

to analyze potential business plan, we intend to consider the following factors:

| |

· |

Potential for growth, indicated by anticipated market

expansion or new technology; |

| |

· |

Competitive position as compared to other businesses

of similar size and experience within our contemplated segment as well as within the industry as a whole; |

| |

· |

Strength and diversity of management, and the accessibility

of required management expertise, personnel, services, professional assistance and other required items; |

| |

· |

Capital requirements and anticipated availability of

required funds, to be provided by the Company or from operations, through the sale of additional securities or convertible debt,

through joint ventures or similar arrangements or from other sources; |

| |

· |

The extent to which the business opportunity can be

advanced in our contemplated marketplace; and |

| |

· |

Other relevant factors |

In applying the foregoing criteria, management

will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available

data. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity

to be acquired. Additionally, we will be competing against other entities that may have greater financial, technical, and managerial

capabilities for identifying and completing our business plan.

We are unable to predict when we will, if

ever, identify and implement a business plan. We anticipate that proposed business plan would be made available to us through personal

contacts of our directors, officers and principal stockholders, professional advisors, broker-dealers, venture capitalists, members of

the financial community and others who may present unsolicited proposals. In certain cases, we may agree to pay a finder’s fee

or to otherwise compensate the persons who introduce the Company to business opportunities in which we participate.

We expect that our due diligence will encompass,

among other things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well

as a review of financial and other information, which is made available to the Company. This due diligence review will be conducted either

by our management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu of cash

payments for services or expenses related to any analysis.

We may incur time and costs required to select

and evaluate our business structure and complete our business plan, which cannot presently be determined with any degree of certainty.

Any costs incurred with respect to the indemnification and evaluation of a prospective business that is not ultimately completed may

result in a loss to the Company. These fees may include legal costs, accounting costs, finder’s fees, consultant’s fees and

other related expenses. We have no present arrangements for any of these types of fees.

We anticipate that the investigation of specific

business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments

will require substantial management time and attention and substantial cost for accountants, attorneys, consultants, and others. Costs

may be incurred in the investigation process, which may not be recoverable. Furthermore, even if an agreement is reached for the participation

in a specific business opportunity, the failure to consummate that transaction may result in a loss to the Company of the related costs

incurred.

As of the time of this filing, the Company

has not implemented a business combination. Our business plan is to merge with, or acquire, an operating entity that offers product or

service growth potential. We are actively looking for a suitable merger candidate and evaluating potential target companies that align

with our business plan. This will require review of financials, products and management of the merger candidate. We anticipate the review

process could take up to 30 days after a viable candidate is located.

Competition

Eline Entertainment Group, Inc. is in direct

competition with many other entities in its efforts to locate a suitable transaction. Included in the competition are business development

companies, special purpose acquisition companies (“SPACs”), venture capital firms, small business investment companies, venture

capital affiliates of industrial and financial companies, broker-dealers and investment bankers, management consultant firms and private

individual investors. Many of these entities possess greater financial resources and are able to assume greater risks than those which

Eline Entertainment Group, Inc. could consider. Many of these competing entities also possess significantly greater experience and contacts

than Eline Entertainment Group, Inc.’s management. Moreover, the Company also competes with numerous other companies similar to

it for such opportunities.

Effect of Existing or Probable Governmental

Regulations on the Business

Upon effectiveness of this Form 10, we will

be subject to the Exchange Act and the Sarbanes-Oxley Act of 2002. Under the Exchange Act, we will be required to file with the SEC annual

reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent

accounting oversight board to oversee the conduct of auditors of public companies and to strengthen auditor independence. It also (1)

requires steps be taken to enhance the direct responsibility of senior members of management for financial reporting and for the quality

of financial disclosures made by public companies; (2) establishes clear statutory rules to limit, and to expose to public view, possible

conflicts of interest affecting securities analysts; (3) creates guidelines for audit committee members’ appointment, and compensation

and oversight of the work of public companies’ auditors; (4) prohibits certain insider trading during pension fund blackout periods;

and (5) establishes a federal crime of securities fraud, among other provisions.

We will also be subject to Section 14(a)

of the Exchange Act, which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply

with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders

at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information

outlined in Schedules 14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least 10 days

prior to the date that definitive copies of this information are provided to our stockholders.

Employees

Rhonda Keaveney serves as Chief Executive Officer and Chief Financial

Officer. We have only one individual serving as director, officer, and executive officer. Ms. Keaveney is the sole member of the custodian,

Small Cap Compliance, LLC, the majority shareholder.

Because we have only one individual serving

as director, officer, and executive officer, management of the Company expects to use consultants, attorneys and accountants as necessary,

and it is not expected that Eline Entertainment Group, Inc. will have any full-time or other employees, except as may be the result of

completing a transaction.

Risks Relating to Our Business

Our

future business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following

risks. You could lose all or part of your investment due to any of these risks. You should invest in our common stock only if you can

afford to lose your entire investment.

Resale limitations of Rule 144(i) on your shares

According to the Rule 144(i), Rule 144 is not available for the resale

of securities initially issued by either a reporting or non-reporting shell company. Moreover, Rule 144(i)(1)(ii) states that Rule 144

is not available to securities initially issued by an issuer that has been “at any time previously” a reporting or non-reporting

shell company. Rule 144(i)(1)(ii) prohibits shareholders from utilizing Rule 144 to sell their shares in a company that at any time in

its existence was a shell company. However, according to Rule 144(i)(2), an issuer can “cure” its shell status.

To “cure” a company’s current or former shell company

status, the conditions of Rule 144(i)(2) must be satisfied regardless of the time that has elapsed since the public company ceased to

be a shell company and regardless of when the shares were issued. The availability of Rule 144 for resales of shares issued while the

company is a shell company or thereafter may be restricted even after the expiration of the one-year period since it filed its Form 10

information if the company is not current on all of its periodic reports required to be filed within the SEC during the 12 months before

the date of the shareholder’s sale. Thus, the company must file all 10-Qs and 10K for the preceding 12 months and since the filing

of the Form 10, or Rule 144 is not available for the resale of securities

We have extremely limited assets, have

incurred operating losses, and have no current source of revenue

We have had minimal assets. We do not expect

to generate revenues until we begin to implement a business plan. We can provide no assurance that we will produce any material revenues

for our stockholders, or that our contemplated business will operate on a profitable basis.

We will, likely, sustain operating expenses

without corresponding revenues, at least until the consummation of a business plan. This may result in our incurring a net operating

loss that will increase unless we consummate a business plan with a profitable business or internally develop our business. We cannot

assure you that we can identify a suitable business combination or successfully internally develop our business, or that any such business

will be profitable at the time of its acquisition by the Company or ever.

Our capital resources may not be sufficient

to meet our capital requirements, and in the absence of additional resources we may have to curtail or cease business operations

We have historically generated negative cash

flow and losses from operations and could experience negative cash flow and losses from operations in the future. Our independent auditors

have included an explanatory paragraph in their report on our financial statements for the fiscal years ended December 31, 2021, and

2020 expressing doubt regarding our ability to continue as a going concern. We currently only have a minimal amount of cash available,

which will not be sufficient to fund our anticipated future operating needs. The Company will need to raise substantial sums to implement

its business plan. There can be no assurance that the Company will be successful in raising funds. To the extent that the Company is

unable to raise funds, we will be required to reduce our planned operations or cease any operations.

We may encounter substantial competition

in our contemplated business and our failure to compete effectively may adversely affect our ability to generate revenue

We believe that existing and new competitors

will continue to improve in cost control and performance in whatever business we acquire. We may have global competitors and we will

be required to continue to invest in product development and productivity improvements to compete effectively in our markets. Our competitors

could develop a more efficient product or undertake more aggressive and costly marketing campaigns than ours, which may adversely affect

our marketing strategies and could have a material adverse effect on contemplated business, results of operations and financial condition.

Effect of Environmental Laws

We are not governed by environmental laws

at this time. However, our belief that that we will be compliance with all applicable environmental laws, in all material respects. We

do not expect future compliance with environmental laws to have a material adverse effect on our business.

We may not be able to obtain regulatory

approvals for our product

At this time the Company is not subject to any laws or regulations

relating to a business model. However, our future business may be subject to laws and regulations. The Company believes acquisition of

already established corporations will mitigate this risk.

We may face a number of risks associated

with implementing a business plan, including the possibility that we may incur substantial debt or convertible debt, which could adversely

affect our financial condition

We intend to use reasonable efforts to complete

a business plan. The risks commonly encountered in implementing a business plan is insufficient revenues to offset increased expenses

associated with finding a merger candidate. Failure to raise sufficient capital to carry out our business plan. Additionally, we have

no operations at this time so our expenses are likely to increase, and it is possible that we may incur substantial debt or convertible

debt in order to complete our business plan, which can adversely affect our financial condition. Incurring a substantial amount of debt

or convertible debt may require us to use a significant portion of our cash flow to pay principal and interest on the debt, which will

reduce the amount available to fund working capital, capital expenditures, and other general purposes. Our indebtedness may negatively

impact our ability to operate our business and limit our ability to borrow additional funds by increasing our borrowing costs, and impact

the terms, conditions, and restrictions contained in possible future debt agreements, including the addition of more restrictive covenants;

impact our flexibility in planning for and reacting to changes in our business as covenants and restrictions contained in possible future

debt arrangements may require that we meet certain financial tests and place restrictions on the incurrence of additional indebtedness

and place us at a disadvantage compared to similar companies in our industry that have less debt.

Our future success is highly dependent

on the ability of management to locate and attract suitable business opportunities and our stockholders will not know what business we

will enter into until we consummate a transaction with the approval of our then existing directors and officers

At this time, we have no operations and future

implementation of a business plan is highly speculative, there is a consequent risk of loss of an investment in the Company. The success

of our plan of operations will depend to a great extent on the operations, financial condition and management of future business and

internal development. While management intends to seek businesses opportunities with entities having established operating histories,

we cannot provide any assurance that we will be successful in locating opportunities meeting that criterion. In the event we complete

a business plan, the success of our operations will be dependent upon management, its financial position and numerous other factors beyond

our control. We have only one individual serving as director, officer, and executive officer.

There can be no assurance that we will

successfully consummate a business plan or internally develop a successful business

We are a blank check company and can give

no assurance that we will successfully identify and evaluate suitable business opportunities or that we will successfully implement our

business plan. We cannot guarantee that we will be able to negotiate contracts on favorable terms. No assurances can be given that we

will successfully identify and evaluate suitable business opportunities, that we will conclude a business plan or that we will be able

to develop a successful business. Our management and affiliates will play an integral role in establishing the terms for any future business.

We will incur increased costs as a

result of becoming a reporting company, and given our limited capital resources, such additional costs may have an adverse impact on

our profitability.

Following the effectiveness of this Form

10, we will be an SEC reporting company. The Company currently has no business and no revenue. However, the rules and regulations under

the Exchange Act require a public company to provide periodic reports with interactive data files which will require the Company to engage

legal, accounting and auditing services, and XBRL and EDGAR service providers. The engagement of such services can be costly, and the

Company is likely to incur losses, which may adversely affect the Company’s ability to continue as a going concern. In addition,

the Sarbanes-Oxley Act of 2002, as well as a variety of related rules implemented by the SEC, have required changes in corporate governance

practices and generally increased the disclosure requirements of public companies. For example, as a result of becoming a reporting company,

we will be required to file periodic and current reports and other information with the SEC and we must adopt policies regarding disclosure

controls and procedures and regularly evaluate those controls and process.

The additional costs we will incur in connection

with becoming a reporting company will serve to further stretch our limited capital resources. The expenses incurred for filing periodic

reports and implementing disclosure controls and procedures may be as high as $70,000 USD annually. In other words, due to our limited

resources, we may have to allocate resources away from other productive uses in order to pay any expenses we incur in order to comply

with our obligations as an SEC reporting company. Further, there is no guarantee that we will have sufficient resources to meet our reporting

and filing obligations with the SEC as they come due.

The time and cost of preparing a private

company to become a public reporting company may preclude us from entering into an acquisition or merger with the most attractive private

companies and others

From time to time the Company may come across

target merger companies. These companies may fail to comply with SEC reporting requirements may delay or preclude acquisitions. Sections

13 and 15(d) of the Exchange Act require reporting companies to provide certain information about significant acquisitions, including

certified financial statements for the company acquired, covering one or two years, depending on the relative size of the acquisition.

The time and additional costs that may be incurred by some target entities to prepare these statements may significantly delay or essentially

preclude consummation of an acquisition. Otherwise, suitable acquisition prospects that do not have or are unable to obtain the required

audited statements may be inappropriate for acquisition so long as the reporting requirements of the Exchange Act are applicable.

A Business may result in a change of

control and a change of management.

In conjunction with completion of a business

acquisition, it is anticipated that we may issue an amount of our authorized but unissued common or preferred stock which represents

the majority of the voting power and equity of our capital stock, which would result in stockholders of a target company obtaining a

controlling interest in us. As a condition of the business combination agreement, our current stockholders may agree to sell or transfer

all or a portion of our common stock as to provide the target company with all or majority control. The resulting change in control may

result in removal of our present officers and directors and a corresponding reduction in or elimination of their participation in any

future affairs.

We depend on our officers and the loss of their services would

have an adverse effect on our business

We have only one individual serving as director, officer, and executive

officer of the Company that she is critical to our chances for business success. We are dependent on her services to operate our business

and the loss of this person would have an adverse impact on our future operations until such time she could be replaced, if she could

be replaced. We do not have employment contracts or employment agreements with our sole officer and director, and we do not carry key

man life insurance on her life.

Because we are significantly smaller than many of our competitors,

we may lack the resources needed to capture market share

We are at a disadvantage as a blank check company, we do not have

an established business. Many of our competitors have an already established their business, more established market presence, and substantially

greater financial, marketing, and other resources than do we. New competitors may emerge and may develop new or innovative products that

compete with our anticipated future production. No assurance can be given that we will be able to compete successfully within the international

education industry.

Our ability to use our net operating loss carry-forwards and

certain other tax attributes may be limited

We have incurred losses during our history. To the extent that we

continue to generate taxable losses, unused losses will carry forward to offset future taxable income, if any, until such unused losses

expire. Under Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, if a corporation undergoes an “ownership change,”

generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability

to use its pre-change net operating loss carry-forwards, or NOLs, and other pre-change tax attributes (such as research tax credits)

to offset its post-change income may be limited. We may experience ownership changes in the future because of subsequent shifts in our

stock ownership. As a result, if we earn net taxable income, our ability to use our pre-change net operating loss carryforwards to offset

U.S. federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us. In

addition, at the state level, there may be periods during which the use of NOLs is suspended or otherwise limited, which could accelerate

or permanently increase state taxes owed.

Our ability to hire and retain key

personnel will be an important factor in the success of our business and a failure to hire and retain key personnel may result in our

inability to manage and implement our business plan

Our management has extensive experience when acting in the officer

and director capacity, however we have only one individual serving as director, officer, and executive officer, and will need to hire

additional personnel. We may not be able to attract and retain the necessary qualified personnel. If we are unable to retain or to

hire qualified personnel as required, we may not be able to adequately manage and implement our business plan.

Legal disputes could have an impact on our Company

We plan to engage in business matters that are common to the business

world that can result in disputations of a legal nature. In the event the Company is ever sued or finds it necessary to bring suit

against others, there is the potential that the results of any such litigation could have an adverse impact on the Company.

Our Company is currently listed on the Expert Market on the

OTC Markets platform

Although we are listed on the OTC Markets platform, our stock quote

is not currently quoted on OTC Markets. The market for our stock is uncertain at this time. Quotations in Expert Market securities are

restricted from public viewing and only broker-dealers and professional or sophisticated investors are permitted to view quotations in

Expert Market securities. Our securities could be particularly illiquid due to being listed on this market and that if we remain on the

Expert Market it could impede a potential merger, acquisition, reverse merger or business combination pursuant to which the company could

become an operating company.

Our common stock is not currently quoted on the OTC MARKETS.

An investment in our common stock is risky and there can be no assurance that the price for our stock will not decrease substantially

in the future

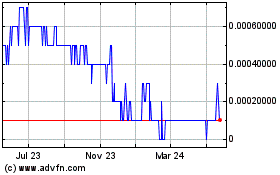

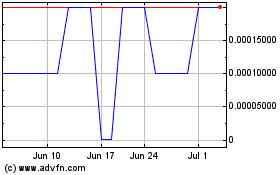

Our common stock is not quoted on an exchange. The market for our

stock has been volatile and has been characterized by large swings in the trading price that do not appear to be directly related to

our business or financial condition. As a result, an investment in our common stock is risky and there can be no assurance that the price

for our stock will not decrease substantially in the future.

Our stock trades below $5.00 per share and is subject to special

sales practice requirements that could have an adverse impact on any trading market that may develop for our stock

If our stock trades below $5.00 per share and is subject to special

sales practice requirements applicable to "penny stocks" which are imposed on broker-dealers who sell low-priced securities

of this type. These rules may be anticipated to affect the ability of broker-dealers to sell our stock, which may in turn be anticipated

to have an adverse impact on the market price for our stock if and when an active trading market should develop.

Our officers, directors and principal stockholders own a large

percentage of our stock and other stockholders have little or no ability to elect directors or influence corporate matters

As of June 30, 2022, we have only one individual serving as director,

officer, executive officer, and principal stockholder were deemed to be the beneficial owners of approximately .07% of our issued and

outstanding shares of common stock and 100% of our issued and outstanding Preferred D Stock.

Our sole officer and director holds 100% of the Convertible Series

D Preferred Stock. Each share of Convertible Series D Preferred Stock is convertible into 1,000 shares of common stock. In addition,

the Convertible Series D Preferred Stock has voting privileges equal to 20 times the sum of (i) the total number of shares of Common

Stock which are issued and outstanding at the time of voting, and (ii) the total number of shares of any class of Preferred stock which

are issued and outstanding at the time of voting , and (iii) divided by the total number of Series D Stock which are outstanding at the

time of voting. None of these shares have not been converted as of this writing.

As a result, the holder of the Convertible Series D Preferred Stock,

via voting rights, can determine the outcome of any actions taken by us that require stockholder approval. For example, they will be

able to elect all our directors, control the policies and practices of the Company and control the outcome of any proposed business combination.

Offering securities pursuant to a registration statement under

the Rule 419 of the Securities Act of 1933

In the event that we offer securities pursuant to a registration statement

under the Securities Act, such offering will be subject to the provisions of Rule 419 of the Securities Act of 1933. Rule 419 applies

to blank check companies and requires that the net offering proceeds, and all securities to be issued (and those sold by a selling shareholder

upon their sale) be promptly deposited by the company into an escrow or trust account pending the execution of an agreement for an acquisition

or merger.

In addition, the registrant is required to file a post-effective amendment

to the registration statement containing the same information as found in a Form 10 registration statement, upon the execution of an

agreement for such acquisition or merger. The rule provides procedures for the release of the offering funds in conjunction with the

post effective acquisition or merger. The obligation to file post-effective amendments are in addition to the obligation to file Forms

8-K to report both the entry into a material non-ordinary course agreement and the completion of the transaction.

Under Rule 419, the funds and securities will be released by the to

the company and to investors, respectively, only after the company has met the following three conditions: first, the company must execute

an agreement for an acquisition; second, the Company must successfully complete a reconfirmation offering which is reconfirmed by sufficient

investors so that the remaining funds are adequate to allow the acquisition to be consummated; and third, the acquisition meeting the

above criteria must be consummated.

If a consummated acquisition meeting the requirements of this section

has not occurred by a date 18 months after the effective date of the initial registration statement, funds held in the escrow or trust

account shall be returned by first class mail or equally prompt means to the purchaser within five business days following that date.

As of this draft, we plan to issue preferred shares in an acquisition

or merger and plan to rely on an exemption from Rule 419. Section 4(a)(2) of the Securities Act of 1933 exempts from registration "transactions

by an issuer not involving any public offering." It is section 4(a)(2) that permits an issuer to sell securities in a "private

placement" without registration under the Act of ’33.

As a blank check company, our shareholders may face significant

restrictions on the resale of our Common Stock due to state "blue sky" laws and due to the applicability of Rule 419 adopted

by the Securities and Exchange Commission.

The resale of Common Stock must meet the blue-sky resale requirements

in the states in which the proposed purchasers reside. If we are unable to qualify the Common Stock and there is no exemption from qualification

in certain states, the holders of the Common Stock or the purchasers of the Common Stock may be unable to sell them.

There are state regulations that may adversely affect the transferability

of our Common Stock. We have not registered our Common Stock for resale under the securities or blue-sky laws of any state. We may seek

qualification or advise our shareholders of the availability of an exemption. But we are under no obligation to register or qualify our

Common Stock in any state or to advise the shareholders of any exemptions.

Current shareholders, and persons who desire to purchase the Common

Stock in any trading market that may develop in the future, should be aware that there might be significant state restrictions upon the

ability of new investors to purchase the Common Stock.

Blue sky laws, regulations, orders, or interpretations place limitations

on offerings or sales of securities by blank check companies. These limitations typically provide, in the form of one or more of the

following limitations, that such securities are:

(a) Not

eligible for sale under exemption provisions permitting sales without registration to accredited investors or qualified purchasers;

(b) Not

eligible for the transaction exemption from registration for non-issuer transactions by a registered broker-dealer;

(c) Not

eligible for registration under the simplified small corporate offering registration form available in many states;

(d) Not

eligible for the "solicitations of interest" exception to securities registration requirements available in many states;

(e) Not

permitted to be registered or exempted from registration, and thus not permitted to be sold in the state under any circumstances.

If the company engages in an offering of our

securities, any resales of our securities will require registration in an offering subject to Rule 419. The Securities and Exchange Commission

has adopted Rule 419 which defines a blank-check company as (i) a development stage company, that is (ii) offering penny stock, as defined

by Rule 3a51-1, and (iii) that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger

or acquisition with an unidentified company or companies. Certain jurisdictions may have definitions that are more restrictive than Rule

419. Provisions of Rule 419 apply to every registration statement filed under the Securities Act of 1933, as amended, relating to an

offering by a blank-check company.

Should we conduct an offering of our securities,

before we complete a business combination with an operating company, the Company would be considered a blank check company within the

meaning of Rule 419 and any sales or resales of the stock issued in the offering would require a registration under the Securities Act

of 1933, as amended, in an offering subject to Rule 419, unless there exists a transaction or security exemption for such sale under

the Securities Act of 1933, as amended. Any resales of our Common Stock would require registration under the Securities Act of

1933, as amended, in an offering subject to Rule 419.

Any transactions in our Common Stock by our sole officer, director,

executive officer and majority shareholder will require compliance with the registration requirements under the Securities Act of 1933,

as amended.

As of this draft, we plan to issue preferred shares in an acquisition

or merger and plan to rely on an exemption from Rule 419. Section 4(a)(2) of the Securities Act of 1933 exempts from registration "transactions

by an issuer not involving any public offering." It is section 4(a)(2) that permits an issuer to sell securities in a "private

placement" without registration under the Act of ’33.

Risks Related to Our Shareholders and

Shares of Common Stock

There is presently no public market

for our securities

Our common stock is not currently trading

on any market, and a robust and active trading market may never develop. Because of our current status as a “shell company,”

Rule 144 is not currently available. Future sales of our common stock by existing stockholders pursuant to an effective registration

statement or upon the availability of Rule 144 could adversely affect the market price of our common stock. A shareholder who decides

to sell some, or all, of their shares in a private transaction may be unable to locate persons who are willing to purchase the shares,

given the restrictions. Also, because of the various risk factors described above, the price of the publicly traded common stock may

be highly volatile and not provide the true market price of our common stock.

Our stock is not traded, so you may

be unable to sell your shares at or near the quoted bid prices if you need to sell a significant number of your shares

Even if our stock becomes trading, it is

likely that our common stock will be thinly traded, meaning that the number of persons interested in purchasing our common shares at

or near bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors,

including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors

and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons,

they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of

our shares until such time as we became more seasoned and viable. Consequently, there may be periods of several days or more when trading

activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity

that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader

or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

Due to these conditions, we can give you no assurance that you will be able to sell your shares at or near bid prices or at all if you

need money or otherwise desire to liquidate your shares.

Our common stock is be considered a

“penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell

A common stock is a “penny stock”

if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded

on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even if so, has a price less

than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than

$5 million.

The principal result or effect of being designated

a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny

stock” regulations set forth in Rules 15g-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires

broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain

a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock

for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor

for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain

from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably

determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient

knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor

with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a

signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation,

investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for

holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

We may issue more shares in an acquisition

or merger, which will result in substantial dilution

Our Articles of Incorporation, as amended, authorize the Company to

issue an aggregate of 20,005,000,000 shares of common stock of which 8,264,529,727 shares are currently outstanding and 10,000,000 shares

of Preferred Stock are authorized, of which 1 share of Convertible Series D Preferred Stock are outstanding. Any acquisition or merger

effected by the Company may result in the issuance of additional securities without stockholder approval and may result in substantial

dilution in the percentage of our common stock held by our then existing stockholders. Moreover, shares of our common stock issued in

any such merger or acquisition transaction may be valued on an arbitrary or non-arm’s-length basis by our management, resulting

in an additional reduction in the percentage of common stock held by our then existing stockholders. In an acquisition type transaction,

our Board of Directors has the power to issue any, or all, of such authorized but unissued shares without stockholder approval. To the

extent that additional shares of common stock are issued in connection with a business combination or otherwise, dilution to the interests

of our stockholders will occur and the rights of the holders of common stock might be materially adversely affected.

Obtaining additional capital though

the sale of common stock will result in dilution of stockholder interests

We may raise additional funds in the future

by issuing additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants

or preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further dilution

of the equity ownership of existing holders of our common stock. Additionally, the existing conversion rights may hinder future equity

offerings, and the exercise of those conversion rights may have an adverse effect on the value of our stock. If any such conversion rights

are exercised at a price below the then current market price of our shares, then the market price of our stock could decrease upon the

sale of such additional securities. Further, if any such conversion rights are exercised at a price below the price at which any stockholder

purchased shares, then that particular stockholder will experience dilution in his or her investment.

Our director has the authority to authorize the issuance

of preferred stock and we have only one individual serving as director, officer, and executive officer.

Our Articles of Incorporation, as amended,

authorize the Company to issue an aggregate of 10,000,000 shares of Preferred Stock. Our sole director, without further action by

our stockholders, has the authority to issue shares to be determined by our board of directors of Preferred Stock with the relative rights,

conversion rights, voting rights, preferences, special rights, and qualifications as determined by the board without approval by

the shareholders. Any issuance of Preferred Stock could adversely affect the rights of holders of common stock. Additionally, any future

issuance of preferred stock may have the effect of delaying, deferring, or preventing a change in control of the Company without further

action by the shareholders and may adversely affect the voting and other rights of the holders of common stock. Our Board is comprised

of one director and does not intend to seek shareholder approval prior to any issuance of currently authorized stock, unless otherwise

required by law or stock exchange rules.

We have never paid dividends on our

common stock, nor are we likely to pay dividends in the foreseeable future. Therefore, you may not derive any income solely from ownership

of our stock

We have never declared or paid dividends

on our common stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available

for payment of dividends will be re-invested into the Company to further our business strategy. This means that your potential for economic

gain from ownership of our stock depends on appreciation of our stock price and will only be realized by a sale of the stock at a price

higher than your purchase price.

| Item 2. |

Financial Information |

Management’s Discussion and Analysis

or Plan of Operation

Upon effectiveness of this Registration Statement,

we will file with the SEC annual and quarterly information and other reports that are specified in the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and SEC regulations. Thus, we will need to ensure that we will have the ability to prepare,

on a timely basis, financial statements that comply with SEC reporting requirements following the effectiveness of this registration

statement. We will also become subject to other reporting and corporate governance requirements, including the listing standards of any

securities exchange upon which we may list our Common Stock, and the provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”), and the regulations promulgated hereunder, which impose significant compliance obligations upon us. As a public company,

we will be required, among other things, to:

| |

· |

Prepare and distribute reports and other stockholder

communications in compliance with our obligations under the federal securities laws and the applicable national securities exchange

listing rules; |

| |

· |

Define and expand the roles and the duties of our Board

of Directors and its committees; |

| |

· |

Institute more comprehensive compliance, investor relations

and internal audit functions; |

| |

· |

Involve and retain outside legal counsel and accountants

in connection with the activities listed above. |

Management for each year commencing with

the year ending December 31, 2021 must assess the adequacy of our internal control over financial reporting. Our internal control over

financial reporting will be required to meet the standards required by Section 404 of the Sarbanes-Oxley Act. We will incur additional

costs in order to improve our internal control over financial reporting and comply with Section 404, including increased auditing and

legal fees and costs associated with hiring additional accounting and administrative staff. Ultimately, our efforts may not be adequate

to comply with the requirements of Section 404. If we are unable to implement and maintain adequate internal control over financial reporting

or otherwise to comply with Section 404, we may be unable to report financial information on a timely basis, may suffer adverse regulatory

consequences, may have violations of the applicable national securities exchange listing rules, and may breach covenants under our credit

facilities.

The significant obligations related to being

a public company will continue to require a significant commitment of additional resources and management oversight that will increase

our costs and might place a strain on our systems and resources. As a result, our management’s attention might be diverted from

other business concerns. In addition, we might not be successful in implementing and maintaining controls and procedures that comply

with these requirements. If we fail to maintain an effective internal control environment or to comply with the numerous legal and regulatory

requirements imposed on public companies, we could make material errors in, and be required to restate, our financial statements. Any

such restatement could result in a loss of public confidence in the reliability of our financial statements and sanctions imposed on

us by the SEC.

Eline Entertainment Group, Inc. is a blank

check company and has no operations. Our business plan includes acquisitions of operating companies. In summary, EEGI is

focused on raising capital for its business plan. As of this filing, we have not raised any capital and our business is not yet operational.

Results of Operations for Eline Entertainment

Group, Inc. — Comparison of the Years ended December 31, 2021 and 2020

Revenue

We had no revenues from operations during

either 2021 or 2020.

General and Administrative Expense

General and Administrative Expenses were

$0 for the year ended December 31, 2021 compared to Nil for the year ended December 31, 2020, an increase of $0.

Stock compensation expense

During the year ended December 31, 2021,

we incurred $0 on non-cash stock compensation expense from the issuance of common stock for payment of debt on behalf of the company.

There was no stock issued for services or debt payment in the prior year.

Net Loss

We had a net loss of $0 for the year ended

December 31, 2021, compared to Nil for the year ended December 31, 2020.

Liquidity and Capital Resources

As of December 31, 2021, we had $0 of cash,

no liabilities, and an accumulated deficit of $15,071,976. We used zero of cash in operations for the year ended December 31, 20201and

received net proceeds from financing of $0.

The financial statements accompanying this

Report have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments

in the normal course of our business. As reflected in the accompanying financial statements, we have not yet generated any revenue, had

a net loss of $0 and have an accumulated stockholders’ deficit of $0 as of December 31, 2021. These factors raise substantial doubt

about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability to raise additional

funds and implement our business plan. The financial statements do not include any adjustments that might be necessary if we are unable

to continue as a going concern.

In the next 12 months our expenses could

be as high at $70,000. Expenses include preparing and distributing reports and other stockholder communications in compliance with our

obligations under the federal securities laws and the applicable national securities exchange listing rules. In addition, we will incur

costs associated with retaining outside counsel, accountants, and transfer agent fees. As we have not yet identified a merger candidate

and have not generated revenue, there is an ongoing concern that EEGI will have the ability to fund these expenses without the assistance

of outside funding.

We may raise additional funds in the future

by issuing additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants

or preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further dilution

of the equity ownership of existing holders of our common stock.

Results of Operations for Eline Entertainment

Group, Inc. — Comparison of the Six Months ended June 30, 2021 and 2020 (unaudited)

Revenue

We had no revenues from operations during

either 2020 or 2021.

General and Administrative Expense

General and Administrative Expenses were

$18,713 for the six months ended June 30, 2022 compared to Nil for the year ended December 31, 2021, an increase of $0.

Stock compensation expense

During the six months ended June 30, 2022,

we incurred $100on non-cash stock compensation expense from the issuance of common stock for services. There was no stock issued for

services in the prior year.

Net Loss

We had a net loss of $18,713 for the six

months ended June 30, 2022, compared to Nil for the year ended December 31, 2021.

Liquidity and Capital Resources

As of June 30, 2022, we had $0 of cash, no

liabilities and an accumulated deficit of $15,090,689. We used zero of cash in operations for the six months ended June 30, 2022 and

received net proceeds from financing of $0.

The financial statements accompanying this

Report have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments

in the normal course of our business. As reflected in the accompanying financial statements, we have not yet generated any revenue, had

a net loss of $18,713 and have an accumulated stockholders’ deficit of $15,090,689 as of June 30, 2022. These factors raise substantial

doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability to raise

additional funds and implement our business plan. The financial statements do not include any adjustments that might be necessary if

we are unable to continue as a going concern.

We do not own any property and do not pay

for office space.

| Item 4. |

Security Ownership of

Certain Beneficial Owners and Management |

(a) Security ownership of certain beneficial

owners.

The following table sets forth, as of September 30, 2022, the number

of shares of common stock owned of record and beneficially by our executive officer, director and persons who beneficially own more than

5% of the outstanding shares of our common stock.

| Name and Address of Beneficial Owner |

|

Amount and

Nature of

Beneficial Ownership |

|

Percentage

of Class |

|

| |

|

|

|

|

|

| Small Cap Compliance, LLC* |

|

1 Preferred D Shares** |

|

100% |

|

| Control Person/Rhonda

Keaveney |

|

20,000,000 Restricted Common Shares |

|

.002% |

|

| PO Box 26496 |

|

|

|

|

|

| Scottsdale, AZ 85255 |

|

|

|

|

|

| |

|

|

|

|

|

| Christopher Davies |

|

600,000,000 Restricted Common Shares |

|

.07% |

|

| 5514 NW Terrance |

|

|

|

|

|

| Coconut Creek, Fl 33073 |

|

|

|

|

|

| |

|

|

|

|

|

| Security

Ownership of Management as a Group |

|

Amount and

Nature of

Beneficial Ownership |

|

Percentage

of Class |

|

| |

|

|

|

|

|

| Rhonda Keaveney, CEO,

Secretary, Treasurer, Director* |

|

1 Preferred D Shares** |

|

100% |

|

| |

|

20,000,000 Restricted Common Shares |

|

.002% |

|

| |

|

|

|

|

|

*Rhonda Keaveney, is the sole owner of Small Cap Compliance, LLC

and only officer and director of EEGI

**if at

least one share of Series D Stock is issued and outstanding, then the total aggregate issued shares of Series D Stock at any given time,

regardless of their number, shall have voting rights equal to 20 times the sum of (i) the total number of shares of Common Stock which

are issued and outstanding at the time of voting, and (ii) the total number of shares of any class of Preferred stock which are issued

and outstanding at the time of voting, and (iii) divided by the total number of Series D Stock which are outstanding at the time of voting.

**As long as Small Cap Compliance owns at least one share of Preferred

D shares, it will have the majority of the voting power of the company stock outstanding.

| Item 5. |

Directors and Executive

Officers |

A. Identification of Directors and Executive Officers.

Our Officers and directors and additional information concerning them

are as follows:

| Name |

|

Age |

|

|

Position |

| Rhonda Keaveney* |

|

|

54 |

|

|

CEO, President,

Secretary, Treasurer, Director |

| |

|

|

|

|

|

|

* Ms. Keaveney is only individual serving

as director, officer, and executive officer.

Officer Bios

Rhonda Keaveney, J.D., Chief Executive Officer (age 55)

Rhonda L. Keaveney is the Founder and Managing Member of Small Cap

Compliance, LLC, a securities compliance firm specializing in micro-cap public companies. Ms. Keaveney founded Small Cap Compliance,

LLC in 2014 and has been her principal employment since inception. Her experience includes securities compliance, reverse mergers, custodian

shells, OTC Markets filings and company reorg.

Ms. Keaveney has been appointed custodian of several public entities

in her position with Small Cap Compliance. Her duties as custodian require Ms. Keaveney to rehabilitate a microcap company that is disrepair.

These duties include state filings to reinstate the company, bringing the company current with their transfer agent, holding shareholder

meetings, appointing officer and directors, negotiating company debt, general day to day management and compliance.

Ms. Keaveney’s experience with custodian entities is a great

fit for the position of sole officer, director, and executive officer of Eline Entertainment Group, Inc. She has extensive knowledge

of microcap companies that require regulatory compliance. Ms. Keaveney has experience in drafting registration statements (S-1 and Form

10) and regulatory compliance (Edgar filings, OTC Markets filings, FINRA corporate actions, internal company controls, daily management

of public companies).

Ms. Keaveney has worked in the public company industry for over 20

years and has extensive experience in rehabilitating administratively abandoned public companies and mergers and acquisitions.

Ms Keaveney started in the industry as stockbroker in 1993, Series

7 and 63 licensed. After working for several boutique brokerage firms, she moved into the role of compliance officer in 1996, holding

a Series 24 license and managed brokers for mutual fund and annuity companies.

After her role as compliance officer, Ms. Keaveney held the position

of COO for an OTCBB company, MotorSports Emporium, Inc., from 2005 through 2008. She managed the financial accounting department and

maintained SEC compliance for the company. Since then, she has acted as Interim CEO for several OTC Pinks companies and assisted in reorganization

of these entities.

After law school Ms. Keaveney also holds a Juris Doctor degree and

worked as an independent contractor for the State of Arizona in 2013. She was assigned to state appointed attorneys and assisted in preparation

and trying of cases.

Rhonda Keaveney has been appointed as custodian to many companies

in the states of Nevada, Wyoming, Colorado and Florida. As custodian, Ms. Keaveney, through her company, Small Cap Compliance, LLC has

rehabilitated many companies, including EEGI. The only potential conflict in working with, and acting as officer and director, of multiple

companies is the amount of time Ms. Keaveney has to spend on the daily operations of each company. The companies have no operations and

Ms. Keaveney reinstates each company with its state of domicile, files Form 10s or OTC Markets financial statements, pays certain outstanding

company bills and searches for a suitable merger candidate or business combination for each company.

At this time Ms. Keaveney is CEO, Director, Secretary and Treasurer

of the following custodian companies. Ms. Keaveney was appointed as custodian through her company Small Cap Compliance, LLC.

Eline Entertainment Group, Inc.

Reynaldo’s Mexican Food Company, Inc.

Vestiage, Inc.

Ms. Keaveney is currently searching for suitable merger candidates

for each business, and there are potential conflicts when managing 3 public companies:

| · | Finding

a suitable merger candidate |

| · | Continuing

to fund multiple companies |

| · | Time

management for multiple companies |

| · | Maintaining

regulatory compliance for multiple companies |

| · | Small

Cap Compliance, LLC is majority shareholder for each company |

Ms. Keaveney is the sole director of EEGI. Ms. Keaveney has experience

in servicing as director of several public companies, as listed below. In her role as director for each of these companies, Ms. Keaveney

was responsible for implementing and assessing the company’s operating plan. This entailed the following:

| · | financial

literacy in assisting auditors and accountants in preparing financials (filing financial

reports with OTC Markets and Form 10s) |

| · | extensive

knowledge of compliance regulation in administration of daily management matters for public

companies (drafting board minutes, negotiating with creditors, compliance with transfer agent

regulation, regulatory compliance) |

| · | corporate

governance experience that supports transparency and protection of shareholder interests

(holding shareholder meetings, posting financial reports and disclosure statements, filing

Form 10s and working with outside counsel to maintain compliance) |

| · | knowledge

and experience of the specific state statutes that govern board governance for each company

that Ms. Keaveney is director (each state has its own statutes that require public companies

comply with state of incorporation rules) |

| · | experience

in drafting board of director documents and compliance with the differing state statutes

|

| · | hiring

outside contractors to maintain compliance and transparency (attorneys, auditors, accountants) |

Small Cap Compliance, LLC/Ms. Keaveney are

no longer associated with the companies listed below. The custodianships have been terminated for all companies.

CUSTODIAN

COMPANIES

| COURT |

COMPANY

NAME |

DATE

OF CUSTODIAN APPT. |

DATE

OF CUSTODIAN DISCHARGE |

TICKER |

| |

|

|

|

|

| 9th

Judicial Circuit Court, Orange County, Florida |

Vestiage,

Inc. |

5/26/2022 |

8/30/2022 |

VEST |

| 9th

Judicial Circuit Court, Orange County, Florida |

NuOncology

Labs, Inc. |

10/1/2021 |

12/9/2021 |

NLAB |

| 2nd

Judicial District Court, Denver County, Colorado |

Consolidated

Capital of North America Inc. |

1/28/2021 |

04/19/2021 |