0001053369

true

FY

0001053369

2022-04-01

2023-03-31

0001053369

2022-09-30

0001053369

2023-06-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

Amendment

No. 1

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR

THE ANNUAL PERIOD ENDED MARCH 31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR

THE TRANSITION PERIOD FROM _______________ TO _______________

COMMISSION

FILE NUMBER: 001-15697

| ELITE

PHARMACEUTICALS, INC. |

| (Exact

Name of Registrant as Specified in Its Charter) |

| nevada |

|

22-3542636 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

165

LUDLOW AVENUE

NORTHVALE,

new jersey |

|

07647 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| (201)

750-2646 |

(Registrant’s

telephone number, including area code)

Securities

Registered pursuant to Section 12(g) of the Act: |

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

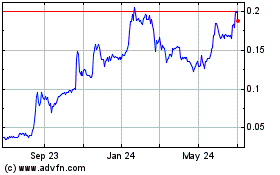

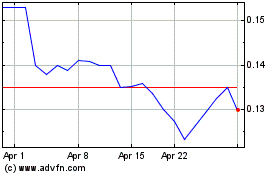

| Common

Stock, par value $0.001 per share |

|

ELTP |

|

OTCQB |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act

of 1934. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

aggregate market value of Common Stock held by non-affiliates at September 30, 2022, the last business day of the registrant’s

most recently completed second fiscal quarter was $40,556,603.

The

number of shares of the registrant’s Common Stock outstanding as of July 25, 2023 was 1,013,915,081.

| Auditor

Name |

|

Auditor

Location |

|

Auditor

Firm Id |

Buchbinder

Tunick & Company LLP |

|

Little

Falls, New Jersey 07424 |

|

6189 |

EXPLANATORY

NOTE

This

Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) is being filed to amend our Annual Report on Form 10-K for the annual

period ended March 31, 2023 (the “Original Filing”), filed with the U.S. Securities and Exchange Commission on June 29, 2023

(the “Original Filing Date”). The purpose of this Amendment No. 1 is to:

| |

● |

disclose

the information required by Item 11 of Part III of Form 10-K |

| |

|

|

| |

● |

delete

the reference on the cover of the Original Filing to the incorporation by reference of certain information from our proxy statement

into Part III of the Original Filing |

| |

|

|

| |

● |

file

new certifications of our principal executive officer and principal financial officer as exhibits to this Form 10/K-A under Item

15 of Part IV hereof pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, and to Section 302 of the Sarbanes-Oxley

Act of 2002. |

Except

as described above, no changes have been made to the Original Filing, and this Amendment No. 1 does not modify, amend or update in any

way any of the financial or other information contained in the Original Filing. This Amendment No. 1 does not reflect events that may

have occurred subsequent to the Original Filing Date.

ITEM

11. EXECUTIVE COMPENSATION

Role

of the Compensation Committee

The

Company formed the Compensation Committee in June 2007. Since the formation of the Compensation Committee all elements of the executives’

compensation are determined by the Compensation Committee, which currently is comprised of three independent non-employee directors,

and one director who is also the Company’s Chief Executive Officer. However, the Compensation Committee’s decisions concerning

the compensation of the Company’s Chief Executive Officer and equity awards are subject to ratification by the full Board of Directors.

The members of the Compensation Committee are Dr. Barry Dash (Chairman of the Compensation Committee), Jeffrey Whitnell, Davis Caskey

and Nasrat Hakim . The Compensation Committee operates pursuant to a charter. Under the Compensation Committee charter, the

Compensation Committee has authority to retain compensation consultants, outside counsel, and other advisors that the committee deems

appropriate, in its sole discretion, to assist it in discharging its duties, and to approve the terms of retention and fees to be paid

to such consultants. During the fiscal year ended March 31, 2023, the Compensation Committee did not engage any advisors.

Named

Executive Officers

The

named executive officers for the fiscal year ended March 31, 2023 were:

| |

● |

Nasrat

Hakim, Chief Executive Officer, and President for the full year; |

| |

● |

Robert

Chen, Chief Financial Officer, Secretary, and Treasurer of the Company from May 5, 2022 through February 25, 2023; |

| |

● |

Kirko

Kirkov, Chief Commercial Officer of the Company since September 6, 2022; and, |

| |

● |

Douglas

Plassche, Executive Vice President for the full year. |

These

individuals are referred to collectively as the “Named Executive Officers”.

Our

Executive Compensation Program

Overview

Our

approach to executive compensation, one of the most important and complex aspects of corporate governance, is influenced by our belief

in rewarding people for consistently strong execution and performance. We believe that the ability to attract and retain qualified executive

officers and other key employees is essential to our long-term success. Our plan to obtain and retain highly skilled employees is to

provide significant incentive compensation opportunities and market competitive salaries. We strive to link individual employee objectives

with overall company strategies and results, and to reward executive officers and significant employees for their individual contributions

to those strategies and results. Furthermore, we believe that equity ownership serves to align the interests of our executives with those

of our stockholders. As such, equity is a key component of our compensation program.

The

primary elements of our executive compensation program are base salary, incentive cash and stock bonus opportunities and equity incentives

typically in the form of stock option grants or stock awards. Although we provide other types of compensation, these three elements are

the principal means by which we provide the Named Executive Officers with compensation opportunities.

Elements

of our executive compensation program

Base

Salary

We

pay a base salary to certain of the Named Executive Officers, with such payments being made in either cash, Common Stock or a combination

of cash and Common Stock. In general, base salaries for the Named Executive Officers are determined by evaluating the responsibilities

of the executive’s position, the executive’s experience, and the competitive marketplace. Base salary adjustments are considered

and take into account changes in the executive’s responsibilities, the executive’s performance, and changes in the competitive

marketplace. We believe that the base salaries of the Named Executive Officers are appropriate within the context of the compensation

elements provided to the executives and because they are at a level which remains competitive in the marketplace.

In

the section below entitled “Agreements with Named Executive Officers”, we describe the breakdown between compensation

paid in cash and in equity for each Named Executive Officer during the fiscal year ended March 31, 2023.

Bonuses

Named

Executive Officers may earn discretionary bonuses, which are awarded by the Compensation Committee in its discretion after the end of

a fiscal year based on its assessment of factors including Company and individual performance. Pursuant to his employment agreement,

Mr. Hakim was eligible to earn an annual cash bonus, paid in accordance with the Company’s payroll practices for the fiscal year

ended March 31, 2023 of up to 100% of his base salary ($500,000 for fiscal 2023), which he earned in full. In addition, as described

in the section below entitled “Agreements with Named Executive Officers,” Mr. Plassche received a cash bonus of $120,000

during the fiscal year ended March 31, 2023, with such bonus paid pursuant to the Company’s employment contract with Mr. Plassche

as further detailed below. Mr. Chen, resigned on February 25, 2023 and did not receive a bonus during the fiscal year ended

March 31, 2023. Mr. Kirkov earned a cash bonus of $43,750 during the fiscal year ended March 31, 2023.

Equity

As

noted above, certain components of our Named Executive Officers’ fiscal year 2023 base salary and bonuses were payable in shares

of Common Stock. In addition, Mr. Plassche is entitled to an annual grant of shares of Common Stock, as described in the section entitled

“Agreements with Named Executive Officers” below. From time to time, we also grant stock options to our Named Executive Officers

which generally vest over time, obtainment of a corporate goal or a combination of the two. During the fiscal year ended March 31, 2023,

Mr. Kirkov received options to purchase 3,000,000 shares of Common Stock at a price of $0.035 per share. Mr. Plassche received options

to purchase 7,500,000 shares of Common Stock at a price of $0.030 per share. Mr. Chen received options to purchase 900,000 shares of

Common Stock at a price $0.040 per share. All options granted include vesting periods consisting of one-third of total options granted

vesting on each of the first, second and third anniversaries of the grant date, with current employment being a requisite for all vesting.

Options granted expire the earlier of ten years from the grant date or 90 days subsequent to the employee’s last date of employment.

Retirement

Benefits

We

maintain a tax-qualified retirement plan under Section 401(k) of the Code. The plan allows employees to defer compensation on a pre-tax

basis subject to certain limits; however, Elite does not provide a matching contribution to its participants.

Perquisites

Mr.

Hakim receives a monthly car allowance of up to $1,500 pursuant to the terms of his employment agreement. Mr. Plassche receives a monthly

car allowance of up to $500. Mr. Hakim is also entitled to a monthly housing allowance up to $5,000. The value of the perquisites we

provide are taxable to the Named Executive Officers and the incremental cost to us of providing these perquisites are reflected in the

Summary Compensation Table. The Board of Directors believes that the perquisites provided are reasonable and appropriate. The Company

generally covers life insurance premiums for its employee population, including its Named Executive Officers. For more information on

perquisites provided to the Named Executive Officers, please see the “All Other Compensation” column of the Summary

Compensation Table.

Agreements

with Named Executive Officers

Nasrat

Hakim

Pursuant

to his August 2013 employment agreement, as amended on January 12, 2016 (the “Hakim Employment Agreement”), Mr. Hakim receives

an annual salary of $500,000 per year paid via issuance of shares of the Company’s Common Stock pursuant to the Company’s

current procedures for paying Company executives in Common Stock. Mr. Hakim is also entitled to an annual bonus equal to up to 100% of

his annual salary, payable in accordance with the Company’s payroll practices. The Board may also award discretionary bonuses in

its sole discretion. Mr. Hakim is entitled to employee benefits (e.g., health, vacation, employee benefit plans and programs) consistent

with other Company employees of his seniority, a car allowance of $1,500 and housing allowance of $5,000 per month, respectively. The

Hakim Employment Agreement contains confidentiality, non-competition and other standard restrictive covenants.

Mr.

Hakim’s employment is terminable by the Company for cause (as defined in the Hakim Employment Agreement). The Hakim Employment

Agreement also may be terminated by the Company upon at least 30 days written notice due to disability (as defined in the Hakim Employment

Agreement) or without cause. Mr. Hakim can terminate the Hakim Employment Agreement by resigning, provided he gives notice at least 60

days prior to the effective resignation date.

If

Mr. Hakim is terminated for cause or he resigns, he only is entitled to accrued and unpaid annual salary, accrued vacation time and any

reasonable and necessary business expenses, all through the date of termination and payable in stock (“Basic Termination Benefits”).

If Mr. Hakim is terminated because of disability or death, in addition to Basic Termination Benefits, he is entitled to a pro rata annual

bonus through the date of termination (payable in Stock), payable in a lump sum. In addition, in the event of the termination of Mr.

Hakim’s employment due to his disability, he will be entitled to a lump sum payment within 60 days of the termination date equal

to one year of his base salary (payable in Stock), subject to his execution of a release. If the Company terminates Mr. Hakim without

cause, in addition to Basic Termination Benefits, Mr. Hakim is entitled to his pro rata annual bonus through the date of termination

and an amount equal to two years’ annual salary (all payable in Stock in a lump sum within 60 days of the termination date), and

12 months of continued health insurance continuation under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”),

at active employee rates, subject to his execution of a release and his continued compliance with applicable restrictive covenants.

Upon

a termination of employment in connection with a Change of Control (as defined below), in addition to Basic Termination Benefits, Mr.

Hakim is entitled to a pro rata annual bonus and payment in an amount equal to two year’s base annual salary in effect upon the

Date of Termination, less applicable deductions, and withholdings, payable in Stock in a lump sum within 60 days, and two years of health

care continuation benefits. In addition, all outstanding unvested equity held by Mr. Hakim will then vest.

Under

the Hakim Employment Agreement:

“Cause”

means (1) Mr. Hakim’s failure or refusal to perform the services required under the agreement, (2) the material breach by Mr. Hakim

of any of the terms of the agreement, or (3) Mr. Hakim’s conviction of a crime that results in imprisonment or involves embezzlement,

dishonest or activities injurious to the Company or its reputation.

“Change

of Control” means generally (1) an acquisition or merger resulting in the holders of the Company’s voting stock immediately

prior to the transaction holding less than fifty (50%) percent of the combined voting power after the transaction; (2) the sale of all

or substantially all of the assets or capital stock of the Company; or (3) the securities of the Company representing greater than fifty

(50%) percent of the combined voting power of the Company’s then outstanding voting securities are acquired in a single transaction

or series of related transactions.

“Disability”

means that Mr. Hakim is prevented by illness, accident or other disability (mental or physical) from performing the essential functions

of his position for one or more periods cumulatively totaling 3 months during any consecutive 12 month period.

Kirko

Kirkov

On

September 5, 2022, the Company entered into an employment agreement with Mr. Kirko Kirkov (“the Kirkov Employment Agreement”).

Pursuant to the terms of the Kirkov Employment Agreement, Mr. Kirkov serves as an at-will employee in the position of its Chief Commercial

Officer. The Kirkov Employment Agreement includes an initial annual base salary of $150,000, payable in accordance with the Company’s

payroll practices. After one year of employment, Mr. Kirkov’s annual base salary shall be adjusted to $275,000 contingent upon

achieving corporate goals including maintaining current revenues and profits and transitioning the Amphetamine IR and ER business.

For

the first year of employment, Mr. Kirkov shall be entitled to an annual bonus equal to 50% of Kirkov’s annual salary (“Annual

Bonus”) based on attaining agreed specific, measurable, achievable, relevant and time-based (“SMART”) objectives

set by the CEO and Mr. Kirkov. For the second year and as long as Mr. Kirkov is employed by Company, Mr. Kirkov is entitled to a bonus

equal to 50% of Mr. Kirkov’s annual salary distributed based on the following criteria:

| |

a. |

Guaranteed

Bonus. Mr. Kirkov shall be entitled to twenty percent (20%) bonus payable in cash upon achieving personal KPI’s assigned

by Mr. Kirkov and the CEO; and, |

| |

b. |

Corporate

Performance Bonuses. Mr. Kirkov shall be entitled to thirty percent (30%) bonus payable in cash upon Company achieving its goals. |

Pursuant

to the Kirkov Employment Agreement, the Board of Directors of the Company granted to Mr. Kirkov options to purchase 3,000,000 shares

of Common Stock at a price of $0.035 per share, with such price being equal to the closing price of the Company’s stock as traded

on the OTCQB market (ELTP). The options granted include vesting periods consisting of one-third of total options granted vesting on each

of the first, second and third anniversaries of the grant date, with current employment being a requisite for all vesting. Options granted

expire the earlier of ten years from the grant date or 90 days subsequent to the employee’s last date of employment.

Mr.

Kirkov was entitled generally to the same employee benefits offered to other employees of the Company, subject to applicable eligibility

requirements.

Douglas

Plassche

On

July 20, 2013, the Company entered into an employment agreement with Mr. Douglas Plassche (the “Plassche Employment Agreement”).

Pursuant to the Plassche Employment Agreement, Mr. Plassche serves as an at-will employee, in the position of Vice President of Operations,

commencing on August 12, 2013. The Plassche Employment Agreement includes an initial base salary of $205,000 being paid in accordance

with the Company’s payroll practices and an additional $25,000 being paid by the issuance of shares of Common Stock. The Common

Stock component of Mr. Plassche’s compensation is to be computed on an annual basis, with the number of shares issued being equal

to the quotient of the annual amount due, divided by the average daily closing price of the Company’s Common Stock for the calendar

year just ended.

Mr.

Plassche is also eligible for an annual bonus in cash and/or equity-based awards, with such annual bonus being awarded based upon the

achievement of agreed milestones and at the discretion of the Company and its Chief Executive Officer. In addition, pursuant to the Plassche

Employment Agreement, Mr. Plassche was initially granted options to purchase 3,000,000 shares of Common Stock, at a price of $ 0.07 per

share, (the closing price of the Common Stock on the date of the Plassche Employment Agreement). The options were issued pursuant to

the 2004 Employee Stock Option Plan and vested over a period of three years with the vesting period commencing one year from the date

of issuance and expire ten years from the date of issuance.

Mr.

Plassche is entitled to a monthly automobile allowance of $500.

Mr.

Plassche’s employment is terminable by either party. If the Company terminates Mr. Plassche without cause, Mr. Plassche is entitled

to an amount equal to six months of base annual salary in effect upon the date of termination.

Throughout

his tenure, Mr. Plassche’s compensation was increased from time to time by the Board.

On

March 1, 2022, Mr. Plassche’s compensation was adjusted to include an annual salary of $300,000 payable in accordance with the

Company’s payroll practices.

On

June 21, 2019, Mr. Plassche entered into a first retention agreement with the Company (the “2019 Plassche Retention Agreement”)

as an incentive for his continued employment and cooperation which provided a retention bonus of $253,552, subject to his continued employment

through June 30, 2021. This amount was earned and paid during the fiscal years ended March 31, 2022 and March 31, 2021.

On

February 18, 2022, Mr. Plassche entered into a second retention agreement with the Company (the “2022 Plassche Retention Agreement”),

as an incentive for his continued employment and cooperation during a transitional period for the Company. Pursuant to the 2022 Plassche

Retention Agreement, Mr. Plassche is entitled to a $150,000 retention payment on each of October 31, 2022 and June 30, 2023, subject

in each case to his continued employment through such date. The retention payments have been made to Mr. Plassche in accordance with

2022 Plassche Retention Agreement, with the final payment being made subsequent to fiscal year ended March 31, 2023.

Robert

Chen

On

May 5, 2022, the Company appointed Robert Chen to serve as the Company’s Chief Financial Officer, effective May 16, 2022. In connection

with this appointment, Mr. Chen and the Company entered into a letter agreement (the “Chen Employment Agreement”).

Pursuant

to the terms of the Chen Employment Agreement, commencing on May 16, 2022, Mr. Chen became an at-will employee of the Registrant as its

Chief Financial Officer, receiving an annual base salary of $250,000, payable in accordance with the Registrant’s payroll practices.

In addition, Mr. Chen was granted options to purchase 900,000 shares of Common Stock at a price of $0.0375 per share. The options granted

include vesting periods consisting of one-third of total options granted vesting on each of the first, second and third anniversaries

of the grant date, with current employment being a requisite for all vesting. Options granted expire the earlier of ten years from the

grant date or 90 days subsequent to the employees last date of employment.

Mr.

Chen’s resigned his position with the Company as of February 25, 2023. All stock options issued to Mr. Chen, expired prior to their

vesting.

Potential

Payments Upon Termination or Change of Control

Messrs.

Hakim and Plassche are entitled to certain benefits upon a termination event (and in the case of Mr. Hakim, in connection with a change

of control), as described in the section entitled “Agreements with Named Executive Officers” above. We do not presently provide

the Named Executive Officers with any plan or arrangement, other than those that may be contained in the employment contracts disclosed

above, in connection with any termination, including, without limitation, through retirement, resignation, severance, or constructive

termination (including a change in responsibilities) of such Named Executive Officer’s employment with the Company.

As

part of the Company’s efforts to ensure the retention and continuity of key employees, officers, and directors in the event of

a change of control of the ownership of the Company, unless otherwise stated in applicable employment contracts, key executives would

receive an amount not to exceed twelve months of such executive’s salary, and certain Directors and managers would receive an amount

equal to six months of such Director’s or manager’s fees or salaries, as applicable. In addition, any outstanding and unvested

options would immediately vest, in the event of a change of control.

Summary

Compensation Table

| Name and Principal Position | |

Fiscal Year | | |

Salary

($) | | |

Bonus

($) | | |

Option Awards ($) 15 | | |

All Other Compensation

($) | | |

Total

($) | |

| Nasrat Hakim, President, Chief Executive Officer and Chairman of the Board of Directors | |

| | |

| 2023 | | |

| 500,0001 | | |

| 499,9922 | | |

| — | | |

| 78,0003 | | |

| 1,077,992 | |

| | |

| 2022 | | |

| 500,0001 | | |

| 500,0002 | | |

| — | | |

| 78,0003 | | |

| 1,078,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Douglas Plassche, Executive Vice President | |

| | |

| 2023 | | |

| 302,5604 | | |

| 232,0005 | | |

| 187,0556 | | |

| 6,0007 | | |

| 727,615 | |

| | |

| 2022 | | |

| 261,6444 | | |

| 393,9025 | | |

| — | | |

| 6,0007 | | |

| 661,546 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Robert Chen, Chief Financial Officer8 | |

| | |

| 2023 | | |

| 197,9179 | | |

| — | | |

| 27,79910 | | |

| — | | |

| 225,716 | |

| | |

| 2022 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Kirko Kirkov, Chief Commercial Officer11 | |

| | |

| 2023 | | |

| 86,36412 | | |

| 43,75013 | | |

| 86,79914 | | |

| — | | |

| 216,913 | |

| | |

| 2022 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| 1 |

Represents

salary earned by Mr. Hakim pursuant to the Hakim Employment Agreement for the fiscal years ended March 31, 2023 and 2022, with such

amounts to be paid via the issuance of Common Stock in lieu of cash. No shares have been issued in payment of salaries earned during

the fiscal years ended March 31, 2023 and 2022. In aggregate a total of $3,125,000 in salaries are accrued due and owing to Mr. Hakim

for salaries earned during the fiscal years ended March 31, 2023, 2022 and the sixty month period ended March 31, 2021, with the

issuance date of such shares being undetermined. |

| |

|

| 2 |

Represents

bonus earned by Mr. Hakim for the fiscal years ended March 31, 2023 and 2022, respectively, and paid in accordance with the Company’s

payroll practices. |

| |

|

| 3 |

Represents

annual auto and housing allowances of $18,000 and $60,000, respectively. |

| |

|

| 4 |

Represents

salaries earned by Mr. Plassche pursuant to the Plassche Employment Agreement and paid in accordance with the Company’s payroll

practices. |

| |

|

| 5 |

Fiscal

year 2023 amount represents cash bonuses earned pursuant to the Plassche Employment Agreement and the 2022 Plassche Retention Agreement.

Fiscal year 2022 amount represents cash bonuses totaling $375,152 earned pursuant to Plassche Employment Agreement and the 2019 Plassche

Retention Agreement and $18,750 of salaries earned during the fiscal year ended March 31, 2022, which Mr. Plassche elected to receive

in cash instead of via the issuance of Common Stock |

| |

|

| 6 |

Represents

options to purchase 7,500,000 shares of Common Stock at a price of $0.03 per share and valued via application of the Black Scholes

options pricing model. |

| |

|

| 7 |

Represents

annual auto allowances. |

| |

|

| 8 |

Mr.

Chen served as the Company’s Chief Financial Officer from his appointment on May 5, 2022 through his resignation on February

25, 2023. |

| |

|

| 9 |

Represents

salaries earned by Mr. Chen pursuant to the Chen Employment Agreement and paid in accordance with the Company’s payroll practices. |

| 10 |

Represents

options to purchase 900,000 shares of Common Stock at a price of $0.0375 per share and valued via application of the Black Scholes

options pricing model. These options expired without vesting as a result of Mr. Chen’s resignation from the Company on February

25, 2023. |

| |

|

| 11 |

Mr.

Kirkov was appointed as the Company’s Chief Commercial Officer on September 6, 2022. |

| |

|

| 12 |

Represents

salaries earned by Mr. Kirkov pursuant to the Kirkov Employment Agreement and paid in accordance with the Company’s payroll

practices. |

| |

|

| 13 |

Represents

cash bonuses earned and accrued during the fiscal year ended March 31, 2023, pursuant to the Kirkov Employment Agreement, with such

accrued cash bonus being paid during June 2023. |

| |

|

| 14 |

Represents

options to purchase 3,000,000 shares of Common Stock at a price of $0.035 per share and valued via application of the Black Scholes

options pricing model. |

| |

|

| 15 |

The

amounts in these columns reflect the grant date fair value of stock option awards computed in accordance with FASB ASC Topic 718,

excluding the effect of estimated forfeitures. See Note 13 to the Consolidated Financial Statements contained in the Company’s

report on Form 10-K for the fiscal year ended March 31, 2023 for the assumptions used in the valuations that appear in this column. |

Outstanding

Equity Awards as of March 31, 2023

| Name | |

Number of securities underlying unexercised options Exercisable (#) | | |

Number of securities underlying unexercised options Unexercisable (#) | | |

Options Exercise Price ($) | | |

Option Expiration Date |

| Douglas Plassche | |

| 3,000,000 | | |

| — | | |

$ | 0.070 | | |

7/23/2023 |

| Douglas Plassche | |

| — | | |

| 7,500,0001 | | |

$ | 0.030 | | |

1/3/2033 |

| Kirko Kirkov | |

| — | | |

| 3,000,0002 | | |

$ | 0.035 | | |

9/5/2032 |

| Robert Chen | |

| — | | |

| — | | |

| | | |

|

| Nasrat Hakim | |

| — | | |

| — | | |

| | | |

|

| 1 |

Options

vest in equal annual increments of 2,500,000 shares on January 3, 2024, January 3, 2025 and January 3, 2026. |

| |

|

| 2 |

Options

vest in equal annual increments of 1,000,000 shares on September 5, 2023, September 5, 2024 and September 5, 2025 |

Director

Compensation

The

following table sets forth information concerning director compensation for the year ended March 31, 2023:

| Name | |

Fees Earned or Paid In Cash 1 ($) | | |

Stock Awards1 ($) | | |

Total ($) | |

| Barry Dash | |

| 10,0002 | | |

| 20,0003 | | |

| 30,000 | |

| Jeffrey Whitnell | |

| 10,0002 | | |

| 20,0003 | | |

| 30,000 | |

| Davis Caskey | |

| 10,0002 | | |

| 20,0003 | | |

| 30,000 | |

| 1 |

Please

refer to the section below titled “Director Fee Compensation” for details on the Company’s director fee compensation

policy. No directors held unexercised or unvested stock or option awards as of March 31, 2023. |

| |

|

| 2 |

Amounts

represent Director fees earned during the fiscal year ended March 31, 2023 which are to be paid in cash. These fees were accrued as of

March 31, 2023 and will be paid during the fiscal year ended March 31, 2024. |

| |

|

| 3 |

Amounts

represents Director fees earned during the fiscal year ended March 31, 2023 which are paid via the issuance of 584,562 Common Shares

issued to each of Dr. Dash, Mr. Whitnell and Mr. Caskey. The shares will be issued during the fiscal year ended March 31, 2024. Please

see Note 13 to the Consolidated Financial Statements contained in the Company’s report on Form 10-K for the fiscal year ended

March 31, 2023 for a discussion of the valuation of Common Shares issued in payment of Director fees. |

Director

Fee Compensation

The

Company’s policy regarding director fees is as follows: (i) Directors who are employees or consultants of the Company (and/or any

of its subsidiaries) receive no additional remuneration for serving as directors or members of committees of the Board; (ii) all Directors

are entitled to reimbursement for out-of-pocket expenses incurred by them in connection with their attendance at the Board or committee

meetings; (iii) Directors who are not employees or consultants of the Company (and/or any of its subsidiaries) receive a $30,000 annual

retainer fee, with $20,000 of this amount being paid via the issuance of Common Stock, and the remaining $10,000 being paid in cash;

(iv) Directors do not receive any additional compensation for attendance at or chairing of any meetings.

Director

Equity Compensation

As

described above, members of the Board of Directors are paid a portion of their annual retainer fees via the issuance of shares of Common

Stock of the Company. The number of shares to be issued to each Director and the Chairman is equal to the quotient of the quarterly amount

due to each Director, divided by the average daily closing price of the Company’s stock for the quarter just ended.

Other

The

Company’s Articles of Incorporation, as amended, provide for the indemnification of each of the Company’s directors to the

fullest extent permitted under Nevada General Corporation Law.

PART

IV

ITEM

15. EXHIBITS, FINANCIAL STATEMENTS AND SCHEDULES

| Exhibit

No. |

|

Description |

| 3.1(a) |

|

Articles

of Incorporation of Elite-Nevada, incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K filed with the SEC on

January 9, 2012. |

| 3.1(b) |

|

Certificate

of Designations of the Series G Convertible Preferred Stock as filed with the Secretary of State of the State of Nevada on April

18, 2013, incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K, dated April 18, 2013 and filed with the SEC

on April 22, 2013. |

| 3.1(c) |

|

Certificate

of Designation of the Series H Junior Participating Preferred Stock, incorporated by reference to Exhibit 2 (contained in Exhibit

1) to the Registration Statement on Form 8-A filed with the SEC on November 15, 2013. |

| 3.1(d) |

|

Certificate of Designations of the Series I Convertible Preferred Stock as filed with the Secretary of State of the State of Nevada on February 6, 2014, incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K, dated February 6, 2014 and filed with the SEC on February 7, 2014. |

| 3.1(e) |

|

Certificate

of Designations of the Series J Convertible Preferred Stock as filed with the Secretary of State of the State of Nevada on May 3,

2017, incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K, dated April 28, 2017 and filed with the SEC on

April 28, 2017. |

| 3.1(f) |

|

Certificate

of Amendment to Articles of Incorporation, incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K, dated June

29, 2020 and filed with the SEC on June 29, 2020. |

| 3.2(a) |

|

Amended

and Restated By-Laws of the Company, incorporated by reference to Exhibit 3.2 to the Current Report on Form 8-K dated April 23, 2020

and filed with the SEC on April 23, 2020. |

| 4.1 |

|

Form

of specimen certificate for Series G Convertible Preferred Stock of the Company, incorporated by reference to Exhibit 4.2 to the

Current Report on Form 8-K, dated April 18, 2013 and filed with the SEC on April 22, 2013. |

| 4.2 |

|

Form

of specimen certificate for Series I Convertible Preferred Stock of the Company, incorporated by reference to Exhibit 4.2 to the

Current Report on Form 8-K, dated February 6, 2014 and filed with the SEC on February 7, 2014. |

| 4.3 |

|

Rights

Agreement, dated as of November 15, 2013, between the Company and American Stock Transfer & Trust Company, LLC., incorporated

by reference to Exhibit 1 to the Registration Statement on Form 8-A filed with the SEC on November 15, 2013. |

| 4.4 |

|

Form

of Series H Preferred Stock Certificate, incorporated by reference to Exhibit 1 to the Registration Statement on Form 8-A filed with

the SEC on November 15, 2013. |

| 4.5 |

|

Warrant

to purchase shares of Common Stock issued to Nasrat Hakim dated April 28, 2017 incorporated by reference to Exhibit 4.1 to the Current

Report on Form 8-K, dated April 28, 2017, and filed with the SEC on April 28, 2017. |

| 4.6 |

|

Description

of Common Stock, incorporated by reference to Exhibit 4.6 to the Annual Report on Form 10-K, filed with the SEC on June 29, 2020 |

| 10.1 |

|

Elite

Pharmaceuticals, Inc. 2014 Equity Incentive Plan, incorporated by reference to Appendix B to the Company’s Definitive Proxy

Statement for its Annual Meeting of Shareholders, filed with the SEC on April 3, 2014. |

| 10.2 |

|

Form

of Confidentiality Agreement (corporate), incorporated by reference to Exhibit 10.7 to the Form SB-2. |

| 10.3 |

|

Form

of Confidentiality Agreement (employee), incorporated by reference to Exhibit 10.8 to the Form SB-2. |

| 10.4 |

|

Loan

Agreement, dated as of August 15, 2005, between New Jersey Economic Development Authority (“NJEDA”) and the Company,

incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, dated August 31, 2005 and filed with the SEC on September

6, 2005. |

| 10.5 |

|

Series

A Note in the aggregate principal amount of $3,660,000.00 payable to the order of the NJEDA, incorporated by reference to Exhibit

10.2 to the Current Report on Form 8-K, dated August 31, 2005 and filed with the SEC on September 6, 2005. |

| 10.19 |

|

August

1, 2013 Secured Convertible Note from the Company to Mikah Pharma LLC., incorporated by reference to Exhibit 10.2 to the Current

Report on Form 8-K, dated August 1, 2013 and filed with the SEC on August 5, 2013. |

| 10.20 |

|

August 1, 2013 Security Agreement from the Company to Mikah Pharma LLC., incorporated by reference to Exhibit 10.3 to the Current Report on Form 8-K, dated August 1, 2013 and filed with the SEC on August 5, 2013. |

| 10.21 |

|

October

15, 2013 Hakim Credit Line Agreement, incorporated by reference to Exhibit 10.16 to the Quarterly Report on Form 10-Q for the period

ended September 30, 2013. |

| 10.22 |

|

October

2, 2013 Manufacturing and Licensing Agreement with Epic Pharma LLC, incorporated by reference to Exhibit 10.17 to the Amended Quarterly

Report on Form 10-Q/A for the period ended September 30, 2013 and filed with the SEC on April 25, 2014. Confidential Treatment granted

with respect to portions of the Agreement. |

| 10.23 |

|

February

7, 2014 Amendment to Secured Convertible Note from the Company to Mikah, incorporated by reference to Exhibit 10.1 to the Current

Report on Form 8-K, dated February 7, 2014 and filed with the SEC on February 7, 2014. |

| 10.24 |

|

Employment

Agreement with Dr. G. Kenneth Smith, dated October 20, 2014, incorporated by reference to Exhibit 10.82 to the Quarterly Report on

Form 10-Q for the period ended September 30, 2014 and filed with the SEC on November 14, 2014. |

| 10.25 |

|

January

28, 2015 First Amendment to the Loan Agreement between Nasrat Hakim and Elite Pharmaceuticals dated October 15, 2013, incorporated

by reference to Exhibit 10.83 to the Quarterly Report on Form 10-Q for the period ended December 31, 2014 and filed with the SEC

on February 17, 2015. |

| 10.26 |

|

January

28, 2015 Termination of Development and License Agreement for Mikah-001 between Elite Pharmaceuticals, Inc. and Mikah Pharma LLC

and Transfer of Payment, incorporated by reference to Exhibit 10.84 to the Quarterly Report on Form 10-Q for the period ended December

31, 2014 and filed with the SEC on February 17, 2015. |

| 10.27 |

|

June 4, 2015 License Agreement with Epic Pharma LLC, incorporated by reference to Exhibit 10.85 to Amendment No. 1 to the Annual Report on Form 10-K for the fiscal year ended March 31, 2015 and filed with the SEC on July 11, 2016. (Confidential Treatment granted with respect to portions of the Agreement). |

| 10.28 |

|

Amendment

No. 1 to Hakim Employment Agreement, incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC

on January 29, 2016. |

| 10.29 |

|

August

24, 2016 Master Development and License Agreement between Elite and SunGen Pharma LLC. incorporated by reference to Exhibit 10.44

to the Quarterly Report on Form 10-Q for the period ended September 30, 2016 and filed with the SEC on November 9, 2016. (Confidential

Treatment granted with respect to portions of the Agreement). |

| 10.30 |

|

Purchase

Agreement between the Company and Lincoln Park Capital LLC dated May 1, 2017, incorporated by reference to Exhibit 10.1 to the Current

Report on Form 8-K, dated May 2, 2017 and filed with the SEC on May 2, 2017. |

| 10.31 |

|

Registration

Rights Agreement between the Company and Lincoln Park Capital LLC dated May 1, 2017, incorporated by reference to Exhibit 10.2 to

the Current Report on Form 8-K, dated May 2, 2017 and filed with the SEC on May 2, 2017. |

| 10.32 |

|

April

28, 2017 Exchange Agreement between the Company and Nasrat Hakim, incorporated by reference to Exhibit 10.1 to the Current Report

on Form 8-K, dated April 28, 2017 and filed with the SEC on April 28. 2017. |

| 10.33 |

|

May

2017 Trimipramine Acquisition Agreement from Mikah Pharma, incorporated by reference to Exhibit 10.50 to the Annual Report on Form

10-K, for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. |

| 10.34 |

|

May

2017 Secured Promissory Note from the Company to Mikah Pharma, incorporated by reference to Exhibit 10.51 to the Annual Report on

Form 10-K, for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. |

| 10.35 |

|

May

2017 Security Agreement between the Company to Mikah Pharma, incorporated by reference to Exhibit 10.52 to the Annual Report on Form

10-K, for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. |

| 10.36 |

|

May 2017 Assignment of Supply and Distribution Agreement between Dr. Reddy’s Laboratories and Mikah Pharma, incorporated by reference to Exhibit 10.53 to the Annual Report on Form 10-K, for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. |

| 10.37 |

|

May

2017 Assignment of Manufacturing and Supply Agreement between Epic and Mikah Pharma, incorporated by reference to Exhibit 10.54 to

the Annual Report on Form 10-K, for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. |

| 10.38 |

|

Supply and Distribution Agreement between Dr. Reddy’s Laboratories and Mikah Pharma, incorporated by reference to Exhibit 10.55 to the Annual Report on Form 10-K, for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. (Confidential Treatment granted with respect to portions of the Agreement). |

| 10.39 |

|

Manufacturing

and Supply Agreement between Epic and Mikah Pharma, incorporated by reference to Exhibit 10.56 to the Annual Report on Form 10-K,

for the period ended March 31, 2017 and filed with the SEC on June 14, 2017. (Confidential Treatment granted with respect to portions

of the Agreement). |

| 10.40 |

|

Master

Development and License Agreement For Products Between Elite Pharmaceuticals, Inc. And SunGen dated July 6, 2017, incorporated by

reference to Exhibit 10.57 to the Quarterly Report on Form 10-Q for the period ended June 30, 2017 and filed with the SEC on August

9, 2017. (Confidential Treatment granted with respect to portions of the Agreement). |

| 10.41 |

|

First

Amendment to Master Development And License Agreement For Products Between Elite Pharmaceuticals, Inc. and SunGen Pharma, LLC, incorporated

by reference to Exhibit 10.59 to the Quarterly Report on Form 10-Q for the period ended June 30, 2017 and filed with the SEC on August

9, 2017. (Confidential Treatment granted with respect to portions of the Agreement). |

| 10.42 |

|

Second

Amendment to Master Development And License Agreement For Products Between Elite Pharmaceuticals, Inc. and SunGen Pharma, LLC, incorporated

by reference to Exhibit 10.58 to the Quarterly Report on Form 10-Q for the period ended June 30, 2017 and filed with the SEC on August

9, 2017. (Confidential Treatment granted with respect to portions of the Agreement). |

| 10.43 |

|

May

22, 2018 License, Manufacturing and Supply Agreement with Glenmark Pharmaceuticals Inc. USA, incorporated by reference to Exhibit

10.60 to the Annual Report on Form 10-K for the fiscal year ended March 31, 2018 and filed with the SEC on June 14, 2018. (Confidential

treatment granted with respect to portions of the Agreement). |

| 10.44 |

|

August 1, 2018 Amendment to the Glenmark Pharmaceuticals Inc. USA License, Supply and Distribution Agreement, incorporated by reference to Exhibit 10.44 to the Quarterly Report on Form 10-Q, for the period ended December 31, 2019 and filed with the SEC on February 10, 2020. (Portions of this Agreement have been redacted in compliance with Regulation S-K Item 601(b)(10)).of this Agreement have been redacted in compliance with Regulation S-K Item 601(b)(10)). |

| 10.45 |

|

Development Agreement effective December 3, 2018 by and between Mikah Pharma LLC and Elite Laboratories, Inc., incorporated by reference to Exhibit 10.51 to the Annual Report on Form 10-K for the period ended March 31, 2019 and filed with the SEC on June 21, 2019 (portions of this Agreement have been redacted in compliance with Regulation S-K Item 601(b)(10)). |

| 10.46 |

|

Asset Purchase Agreement dated November 13, 2019 by and between the Company and Nostrum Laboratories Inc., incorporated by reference to Exhibit 10.49 to the Quarterly Report on Form 10-Q, for the period ended December 31, 2019 and filed with the SEC on February 10, 2020. |

| 10.47 |

|

January 2, 2020 Amendment to the Glenmark Pharmaceuticals Inc. USA License, Supply and Distribution Agreement, incorporated by reference to Exhibit 10.50 to the Quarterly Report on Form 10-Q, for the period ended December 31, 2019 and filed with the SEC on February 10, 2020. (Portions of this Agreement have been redacted in compliance with Regulation S-K Item 601(b)(10)). |

| 10.48 |

|

Asset Purchase Agreement executed January 16, 2020 by and between the Company and Nostrum Laboratories Inc., incorporated by reference to Exhibit 10.49 to the Quarterly Report on Form 10-Q, for the period ended December 31, 2019 and filed with the SEC on February 10, 2020. |

| 10.49 |

|

Employment Agreement with Douglas Plassche, incorporated by reference to Exhibit 10.52 to the Annual Report on Form 10-K, filed with the SEC on June 14, 2021. |

| 10.50 |

|

Master Development and License Agreement for Products Between Elite Pharmaceuticals, Inc. and Mikah Pharma LLC, effective as of June 10, 2021.(Portions of this Agreement have been redacted in compliance with Regulation S-K Item 601(b)(10), incorporated by reference to the 10-Q for the period ended June 30, 2021 and filed with the SEC on August 16, 2021. |

| 10.51 |

|

License and Distribution Agreement by and between Elite Pharmaceuticals, Inc. and Dexcel Ltd. (Or Akiva, Israel), dated December 6, 2021, incorporated by reference to Exhibit 10.57 to the Annual Report on Form 10-K for the period ended March 31, 2022, filed with the SEC on June 29, 2022. |

| 10.52 |

|

February 18, 2022 Retention Agreement with Douglas Plassche, incorporated by reference to Exhibit 10.58 to the Annual Report on Form 10-K for the period ended March 31, 2022, filed with the SEC on June 29, 2022. |

| 10.53 |

|

Agreement for Sale and Purchase of Real Estate, dated April 8, 2022, by and between Clyde Wesp and Margaret Wesp as trustees of the Wesp Family Joint Living Trust UTD November 19, 2015 and the Company, incorporated by reference to Exhibit 10.2 to the Quarterly Report on Form 10-Q, for the period ended June 30, 2022 and filed with the SEC on August 15, 2022. |

| 10.54 |

|

Loan and Security Agreement, dated April 1, 2022, by and among East West Bank, Elite Pharmaceuticals, Inc. and Elite Laboratories, Inc., incorporated by reference to Exhibit 10.3 to the Quarterly Report on Form 10-Q, for the period ended June 30, 2022 and filed with the SEC on August 15, 2022. |

| 10.55 |

|

Employment Agreement, dated September 5, 2022, between Elite Pharmaceuticals, Inc. and Kirko Kirkov, incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC on September 7, 2022. |

| 21 |

|

Subsidiaries

of the Company, incorporated by reference to Exhibit 21 to the Annual Report on Form 10-K, for the period ended March 31, 2019 and

filed with the SEC on June 21, 2019. |

| 23.1 |

|

Consent of Buchbinder Tunick & Company LLP, Independent Registered Public Accounting Firm* |

| 31.1 |

|

Certification of Chief Executive Officer pursuant to Exchange Act Rule 13a-14(a) and Rule 15d-14(a)** |

| 32.1 |

|

Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.*** |

| |

|

|

| 101.INS* |

|

Inline

XBRL Instance Document |

| |

|

|

| 101.SCH* |

|

Inline

XBRL Taxonomy Schema Document |

| |

|

|

| 101.CAL* |

|

Inline

XBRL Taxonomy Extension Calculation Linkbase Document |

| |

|

|

| 101.DEF* |

|

Inline

XBRL Taxonomy Extension Definition Linkbase Document |

| |

|

|

| 101.LAB* |

|

Inline

XBRL Taxonomy Extension Label Linkbase Document |

| |

|

|

| 101.PRE* |

|

Inline

XBRL Taxonomy Extension Presentation Linkbase Document |

| |

|

|

| 104** |

|

Cover Page Interactive Data File (embedded within the

Inline XBRL document) |

*

Previously filed.

** Filed herewith.

*** Previously Furnished.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| |

ELITE PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/ Nasrat

Hakim |

| |

|

Nasrat Hakim |

| |

|

Chief Executive Officer |

| |

|

|

| |

Dated: July 31, 2023 |

Exhibit

31.1

CERTIFICATION

BY PRINCIPAL EXECUTIVE OFFICER, PRINCIPAL FINANCIAL OFFICER AND PRINCIPAL ACCOUNTING OFFICER

I,

Nasrat Hakim, certify that:

| |

1. |

I have reviewed this Annual

Report on Form 10-K for the year ended March 31, 2023 of Elite Pharmaceuticals, Inc. (the “Registrant”) |

| |

|

|

| |

2. |

Based on my knowledge,

this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this

report; |

| |

|

|

| |

3. |

Based on my knowledge,

the financial statements, and other financial information included in this report, fairly present in all material respects the financial

condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this report; |

| |

|

|

| |

4. |

I am responsible for establishing

and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control

over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the Registrant and have: |

| |

a. |

Designed such disclosure

controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material

information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities,

particularly during the period in which this report is being prepared; |

| |

|

|

| |

b. |

Designed such internal

control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision,

to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c. |

Evaluated the effectiveness

of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness

of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d. |

Disclosed in this report

any change in the Registrant’s internal control over financial reporting that occurred during the Registrant’s most recent

fiscal quarter (the Registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is

reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

| |

5. |

I have disclosed, based

on our most recent evaluation of internal control over financial reporting, to the Registrant’s auditors and the audit committee

of the Registrant’s board of directors (or persons performing the equivalent functions): |

| |

a. |

All significant deficiencies

and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely

affect the Registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b. |

Any fraud, whether or not

material, that involves management or other employees who have a significant role in the Registrant’s internal control over

financial reporting. |

| Date: July

31, 2023 |

/s/

Nasrat Hakim |

| |

Nasrat

Hakim

Chief

Executive Officer, President and Chairman of the Board of Directors

(Principal

Executive Officer, Principal Financial Officer and Principal Accounting Officer) |

v3.23.2

Cover - USD ($)

|

12 Months Ended |

|

|

Mar. 31, 2023 |

Jun. 20, 2023 |

Sep. 30, 2022 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

This

Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) is being filed to amend our Annual Report on Form 10-K for the annual

period ended March 31, 2023 (the “Original Filing”), filed with the U.S. Securities and Exchange Commission on June 29, 2023

(the “Original Filing Date”)

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Mar. 31, 2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Current Fiscal Year End Date |

--03-31

|

|

|

| Entity File Number |

001-15697

|

|

|

| Entity Registrant Name |

ELITE

PHARMACEUTICALS, INC.

|

|

|

| Entity Central Index Key |

0001053369

|

|

|

| Entity Tax Identification Number |

22-3542636

|

|

|

| Entity Incorporation, State or Country Code |

NV

|

|

|

| Entity Address, Address Line One |

165

LUDLOW AVENUE

|

|

|

| Entity Address, City or Town |

NORTHVALE

|

|

|

| Entity Address, State or Province |

NJ

|

|

|

| Entity Address, Postal Zip Code |

07647

|

|

|

| City Area Code |

(201)

750-2646

|

|

|

| Local Phone Number |

750-2646

|

|

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

|

|

| Trading Symbol |

ELTP

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 40,556,603

|

| Entity Common Stock, Shares Outstanding |

|

1,013,915,081

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Auditor Name |

Buchbinder

Tunick & Company LLP

|

|

|

| Auditor Location |

Little

Falls, New Jersey 07424

|

|

|

| Auditor Firm ID |

6189

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |