Borrowers Face New Fee to Cover Heightened Risks

August 12 2020 - 9:00PM

Dow Jones News

By Andrew Ackerman

Fannie Mae and Freddie Mac said they would impose a new fee to

insulate themselves from losses on refinanced mortgages they

guarantee, a sign of potential turbulence in the housing market and

a move likely to generate pushback from lenders.

The government-controlled companies, which back nearly half of

the $11 trillion U.S. mortgage market, said late Wednesday that

they would begin charging lenders the added fee next month. It will

apply to most loans they buy that borrowers have refinanced to lock

in a lower interest rate.

Some mortgage lenders have reported record earnings amid a

refinancing boom, and the fee could damp their future profits. It

is equal to 50 basis points, or half a percentage point, on each

loan Fannie and Freddie guarantees, or roughly $1,400 on the

average mortgage backed by the companies, according to industry

estimates.

Industry officials said the fee isn't correlated with the risk

of refinanced loans and would increase consumer costs at a time

when the Federal Reserve was acting aggressively to support lower

interest rates.

Bob Broeksmit, chief executive of the Mortgage Bankers

Association, said the move was inappropriate at a time when Fannie

and Freddie are reporting large profits -- a combined $4.33 billion

in the second quarter.

"For the GSEs to add a 50 basis-point surcharge on refinances

when the nation is struggling with the greatest economic downturn

since the Great Depression is outrageous," he said in an interview,

referring to Fannie and Freddie's status as government-sponsored

enterprises, or GSEs.

A representative for the Federal Housing Finance Agency, which

oversees Fannie and Freddie, said the companies requested the

"adverse market fee." It will apply to most refinanced mortgages

delivered to the firms beginning Sept. 1.

Fannie and Freddie buy mortgages from lenders, package them into

securities that are sold to investors and provide guarantees to

make the investors whole if the loan defaults. They don't lend to

homeowners.

The fees could help bolster the finances of Fannie and Freddie

as they prepare to raise capital and potentially exit from their

11-year tenure under government control.

Write to Andrew Ackerman at andrew.ackerman@wsj.com

(END) Dow Jones Newswires

August 12, 2020 21:45 ET (01:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

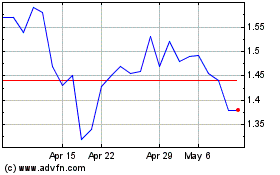

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Oct 2024 to Nov 2024

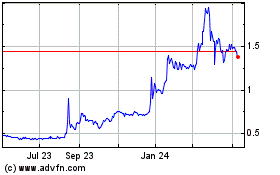

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Nov 2023 to Nov 2024