UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2020

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

File Number: 333-185083

HOME

BISTRO, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

27-1517938

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

15000

W. 6th Avenue, Suite 400

Golden,

CO 80401

|

|

(631)

964-1111

|

|

(Address

of principal executive offices, including zip code)

|

|

(Registrant’s

telephone number, including area code)

|

(Former

name, former address and formal fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act: None.

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

|

|

|

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☒ No ☐

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

Accelerated

filer

|

Non-accelerated

filer

|

Smaller

reporting company

|

Emerging

growth company

|

|

☐

|

☐

|

☒

|

☒

|

☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting

and non-voting common stock held by non-affiliates of the registrant as of June 30, 2020, the last business day of the registrant’s

last completed second quarter, based upon the closing price of the common stock of $0.08029 on such date, is $756,055.

As of March 15, 2021, there were 19,422,300 shares of registrant’s

common stock outstanding held by approximately 111 shareholders.

TABLE

OF CONTENTS

PART

I

CAUTIONARY

STATEMENT ON FORWARD-LOOKING INFORMATION

This Quarterly

Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements

discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may

include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,”

“should,” “would,” “may,” “seek,” “plan,” “might,” “will,”

“expect,” “predict,” “project,” “forecast,” “potential,” “continue”

negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various

underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown

risks, uncertainties and other factors that may cause our actual results, level of activity, performance, or achievement to be

materially different from the results of operations or plans expressed or implied by such forward-looking statements.

These

factors include, among others:

|

|

●

|

current

or future financial performance;

|

|

|

●

|

management’s

plans and objectives for future operations;

|

|

|

●

|

uncertainties

associated with product research and development

|

|

|

●

|

uncertainties

associated with dependence upon the actions of government regulatory agencies;

|

|

|

●

|

product

plans and performance;

|

|

|

●

|

management’s

assessment of market factors; and

|

|

|

●

|

statements regarding

our strategy and plans.

|

Actual

results could differ materially from the results described in the forward-looking statements due to the risks and uncertainties

set forth in this Report and those described from time to time in our future reports filed with the Securities and Exchange Commission

(the “SEC”).

We cannot predict all of the risks and uncertainties. Accordingly,

such information should not be regarded as representations that the results or conditions described in such statements or that

our objectives and plans will be achieved, and we do not assume any responsibility for the accuracy or completeness of any of these

forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information

concerning possible or assumed future results of our operations, including statements about business strategies; future cash flows;

financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future

operations, business plans and future financial results, and any other statements that are not historical facts. These forward-looking

statements represent our intentions, plans, expectations, assumptions, and beliefs about future events and are subject to risks,

uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially

from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions,

the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time

than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as

of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this

Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation

to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events,

conditions, circumstances, or assumptions underlying such statements, or otherwise.

ITEM

1. BUSINESS

Business

Overview

Home Bistro, Inc. (formerly known as Gratitude Health, Inc.)

(the “Company”) was incorporated in the State of Nevada on December 17, 2009. Effective March 23, 2018, the Company

changed its name to Gratitude Health, Inc. from Vapir Enterprises Inc. On September 14, 2020, the Company changed its name from

Gratitude Health, Inc. to Home Bistro, Inc. The Company is in the business of providing prepackaged and prepared meals to consumers

focused on offering a broad array of the highest quality meal planning, delivery, and preparation services. The Company’s

primary former operations were in the business of manufacturing, selling, and marketing functional RTD (Ready to Drink) beverages

sold under the Company’s trademark (the “RTD Business”). The RTD Business was disposed on September 25, 2020

as discussed below.

On

April 7, 2020, the Board of Directors of the Company approved the increase of authorized shares of common stock from 600,000,000

to 1,000,000,000.

Acquisition

of Home Bistro Holdings and Disposal of the Discontinued Operations of the RTD Business

Home

Bistro, Inc. was formed on April 9, 2013 as a Delaware corporation, under the name DineWise, LLC. On December 1, 2014, it underwent

a statutory conversion filed under Section 8-265 of the Delaware Code to converted from a limited liability company to a

corporation and changed its name to Home Bistro, Inc.

On September 22, 2020, Home Bistro, Inc. (presently known as

Home Bistro Holdings, Inc., a Nevada corporation) (“Home Bistro Holdings”) filed a Certificate of Conversion to a Non-Delaware

Entity Delaware Secretary State to file a statutory conversion under Section 266 of the Delaware General Corporation Law to

convert its state of domicile from Delaware to Nevada and simultaneously filed an Articles of Conversion Nevada Secretary of State

for the same and changed its name from Home Bistro, Inc. to Home Bistro Holdings, Inc., each effective as of September 30, 2020.

Home Bistro Holdings provides prepackaged

and prepared meals as a solution for time-constrained but discerning consumers focused on satisfying every member of the family

by offering a broad array of the highest quality meal delivery and preparation services. Products are gourmet meals delivered

fresh-frozen directly to the home.

Agreement

and Plan of Merger

On

April 20, 2020, the Company, Fresh Market Merger Sub, Inc., a Delaware corporation and a newly created wholly-owned subsidiary

of the Company, also referred to herein as Merger Sub, and Home Bistro, Inc., a privately-held Delaware corporation engaged in

the food preparation and home-delivery business (presently known as Home Bistro Holdings, Inc., a Nevada corporation), also referred

to herein also Home Bistro Holdings, entered into an Agreement and Plan of Merger, also referred to herein as the Merger Agreement,

pursuant to which, among other things, Merger Sub agreed to merge with and into Home Bistro Holdings, with Home Bistro Holdings

becoming a wholly-owned subsidiary of the Company and the surviving corporation in the merger, also referred to herein as the

Merger. Pursuant to the terms of the Merger Agreement, Home Bistro Holdings filed a Certificate of Merger with the Nevada Secretary

of State on April 20, 2020.

Prior to the effective time of the Merger,

the Company and certain of its existing securityholders entered into an Exchange Agreement providing for, among other things,

the exchange (the “Exchange”) of securities held by such securityholders for shares of common stock, as more fully

detailed therein. As a result of the Exchange, all of the Company’s issued and outstanding shares of Series A Preferred

Stock, Series C Preferred Stock and convertible notes were converted into an aggregate of 5,405,479 shares of common stock on

a fully diluted basis, consisting of 1,364,222 shares of common stock and warrants to purchase up to 4,041,258 shares of common

stock. The 250,000 shares of Series B Preferred Stock owned by a former officer were cancelled on April 9, 2020 pursuant to a

General Release Agreement and 250,000 shares of Series B Preferred Stock held by a related party remained issued and outstanding

as of the date of the Merger.

After

the Exchange, a total of 1,899,094 shares of common stock, warrants to purchase 4,041,258 shares of common stock and 60,638 stock

options were deemed issued and outstanding.

At the effective time of the Merger, and

subject to the terms and conditions of the Merger Agreement, each outstanding share of common stock of Home Bistro Holdings was

converted into the right to receive approximately four hundred seventy-three (473) shares of common stock. Accordingly, the aggregate

shares of the Company’s common stock issued in the Merger to the former securityholders of Home Bistro Holdings is 24,031,453

shares of common stock on a fully diluted basis consisting of 17,105,139 shares of common stock and warrants to purchase up to

6,926,314 shares of common stock.

Subsequent to the Merger, the Company had

an aggregate of 30,031,501 shares of common stock issued and outstanding on a fully diluted basis consisting of 19,004,233 shares

of common stock, 60,638 stock options and warrants to purchase up to 10,967,572 shares of common stock.

On April 20, 2020, pursuant to the terms

of the Merger Agreement, Roy G. Warren, Jr., Mike Edwards, and Bruce Zanca resigned as directors of the Company and Roy G. Warren,

Jr. resigned as Chief Operating Officer of the Company. The resignations were not the result of any disagreement related to the

Company’s operations, policies, or practices. Furthermore, on April 20, 2020, Mr. Zalmi Duchman, the Chief Executive Officer

of Home Bistro Holdings, Michael Finkelstein and Michael Novielli were appointed as directors of the Company. In addition, Mr.

Duchman was appointed Chief Executive Officer.

In

connection with the Merger, certain Company stockholders entered into a Lock-Up and Leak-Out Agreement with the Company pursuant

to which, among other thing, such stockholders agreed to certain restrictions regarding the resale of common stock for a period

of two years from the date of the Merger Agreement, as more fully detailed therein.

Additionally,

on April 20, 2020, the Company and a stockholder entered into a Put Option Agreement, pursuant to which, among other things, the

Company agreed, at the election of the stockholder, to purchase certain shares of common stock from such stockholder no sooner

than two years from the date of the Put Option Agreement (the “Market Period”). Pursuant to the Put Option Agreement,

in the event that the stockholder does not generate $1.3 million dollars (the “Total Investment”) in gross proceeds

from the sale of its shares of common stock by the second anniversary of the Put Option Agreement, then the stockholder has the

right to cause the Company to purchase shares held by the stockholder at a price equal to the difference between the Total Investment

and the net proceeds actually realized by the stockholder from shares of common stock sold during the Market Period and the number

of shares of common stock held by the stockholder on the date the put right is exercised. The put right expires fourteen (14)

days from end of the Market Period. In connection with the Put Option Agreement, the Company recorded a common stock repurchase

obligation in the amount of $1.3 million.

Effective April 20, 2020, the Company

acquired all the issued and outstanding shares of Home Bistro Holdings pursuant to the Merger Agreement and Home Bistro Holdings

became a wholly owned subsidiary of the Company. As a result of the Merger, for financial statement reporting purposes, the Merger

between the Company and Home Bistro Holdings has been treated as a reverse acquisition and recapitalization with Home Bistro Holdings

deemed the accounting acquirer and the Company deemed the accounting acquiree in accordance with FASB Accounting Standards Codification

(“ASC”) Section 805-10-55. At the time of the Merger, both the Company and Home Bistro Holdings had their own separate

operating segments. Accordingly, the assets and liabilities and the historical operations that are reflected in the consolidated

financial statements after the Merger are those of Home Bistro Holdings and are recorded at the historical cost basis of Home

Bistro Holdings. The acquisition process utilizes the capital structure of the Company and the assets and liabilities of Home

Bistro Holdings which are recorded at historical cost. The results of operations of the Company are consolidated with results

of operations of Home Bistro Holdings starting on the date of the Merger Agreement. The equity of the consolidated entity is the

historical equity of Home Bistro Holdings retroactively restated to reflect the number of shares issued by the Company in the

reverse acquisition.

The Merger constituted a change of control

and the majority of the Board of Directors changed with the consummation of the Merger. The Company issued to the stockholders

of Home Bistro Holdings shares of common stock and stock warrants which represented approximately 80% of the combined company

on a fully converted basis after the closing of the Merger. As a result of the above transactions and the Company’s

intent to dispose of or divest the assets and liabilities associated with the RTD Business as discussed below, this transaction

was accounted for as a reverse recapitalization of Home Bistro Holdings where Home Bistro Holdings is considered the historical

registrant and the historical operations presented will be those of Home Bistro Holdings.

The

following assets and liabilities were assumed in the Merger:

|

Cash

|

|

$

|

4,917

|

|

|

Prepaid expense

|

|

|

9,776

|

|

|

Operating right-of-use asset

|

|

|

32,444

|

|

|

Total assets acquired

|

|

|

47,137

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

|

(209,417

|

)

|

|

Operating right-of-use liability

|

|

|

(32,444

|

)

|

|

Total liabilities assumed

|

|

$

|

(241,861

|

)

|

|

|

|

|

|

|

|

Net liability assumed

|

|

$

|

(194,724

|

)

|

Disposal

of Discontinued Operations of the RTD Business

On

September 25, 2020, pursuant to the Asset Purchase Agreement, among other things, the Company agreed to sell all of the Company’s

business, assets and properties used, or held or developed for use, in its functional RTD (Ready to Drink) beverage segment (the

“RTD Business”), and the Buyer agreed to assume certain debts, obligations and liabilities related to the RTD Business.

The Company assumed an accounts payable liability in the amount of $14,000 related to accounting expense of the RTD Business for

a period prior to the Merger. Pursuant to the Asset Purchase Agreement, the Buyer reimbursed the Company for t accounting expenses

in amount of $14,000 incurred prior to the Merger, of which $7,000 was payable in cash and the balance in form of a promissory

note dated September 25, 2020 in the amount of $7,000. The promissory note bears interest at a rate of 5% per annum, matures on

April 25, 2021 and is payable in monthly installments of $1,000 commencing on October 25, 2020 through April 25, 2021. The Company

received the $7,000 cash portion of the consideration subsequent to September 30, 2020 which has been included in the prepaid

and other current assets on the accompanying consolidated balance sheets as of September 30, 2020 (see Note 1). The $14,000 reimbursement

was recorded to additional paid in capital as reflected in the accompanying consolidated statements of changes in stockholders’

deficit.

ASC

205-20 “Discontinued Operations” establishes that the disposal or abandonment of a component of an entity or a group

of components of an entity should be reported in discontinued operations if the disposal represents a strategic shift that has

(or will have) a major effect on an entity’s operations and financial results. As a result, the component’s results

of operations have been classified as discontinued operations on a retrospective basis for all periods presented. The results

of operations of this component, for all periods, are separately reported as “discontinued operations” on the consolidated

statements of operations.

The

Asset Purchase Agreement, discussed above under Agreement and Plan of Merger, was intended to be part of the Merger and

in effect transferred the RTD Business and the related assets and liabilities to Gratitude Keto, whose CEO, Roy Warren Jr., formerly

served as the Company’s director and Chief Operating Officer and was considered a related party, in substance, in the accounting

of this transaction. Therefore, the disposal of net liabilities and the reimbursement discussed above in connection with the disposal

of the RTD Business was recorded to additional paid in capital as reflected in the accompanying consolidated statements of changes

in stockholders’ deficit.

The

following table set forth the selected financial data of the net liabilities recorded to additional paid in capital as of September

24, 2020.

|

|

|

September 24,

2020

|

|

|

Assets:

|

|

|

|

|

|

Other assets:

|

|

|

|

|

|

Operating lease right-of-use assets, net

|

|

$

|

2,417

|

|

|

Total assets

|

|

$

|

2,417

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

Accounts payable

|

|

$

|

112,212

|

|

|

Accrued expenses and other liabilities

|

|

|

5,009

|

|

|

Operating lease liabilities, current portion

|

|

|

2,417

|

|

|

Total current liabilities

|

|

|

119,638

|

|

|

Total liabilities

|

|

$

|

119,638

|

|

|

|

|

|

|

|

|

Net liabilities

|

|

$

|

117,221

|

|

|

Expense reimbursement by Buyer

|

|

|

14,000

|

|

|

Disposal of net liabilities to a related party

|

|

$

|

131,221

|

|

The

Products and Packaging:

The Company manufactures, packages, and

sells, direct-to-consumer, gourmet meals under the Home Bistro brand and markets restaurant quality meats and seafood under the

Prime Chop and Colorado Prime brands. The Company’s meals are freshly prepared, flash-frozen, to preserve freshness, and

packaged in its facility located in Miami, Florida. Home Bistro meals are ordered on-line and delivered to consumers in containers

designed to keep the products frozen during transport. Once delivered, the meals can be heated using a microware cooker or hot

water for consumption within minutes and with little to no preparation and minimal cleanup.

In addition to its diverse menu of gourmet meals, the Company

has also partnered with world-renowned chefs to offer a selection of each chef’s specialty cuisine (the “Celebrity

Chef Program”). The Company launched its Celebrity Chef Program with Iron Chef, Cat Cora to offer Chef Cora’s Mediterranean/Southern

inspired cooking. Home Bistro also partnered with “Hungry Fan” celebrity chef, Daina Falk to offer Ms. Falk’s

sports stadium tailgate inspired recipes. The Company plans to expand it celebrity chef program to include gourmet cuisine from

notable chefs around the world. In doing so, the Company intends to create a digital food court through which it will offer consumers

an internationally diversified selection of fully cooked gourmet meals.

Market

Information and the Value Chain and Routes to Market

The online food

delivery market is projected to reach $28.5 billion in the United States in 2021 and achieve a cumulative average growth rate of

4.3% through 2024, according to a recent report by market and consumer data company Statista.

Consumers are continually becoming time-starved and convenience-seeking,

while others have tired from the impact the pandemic has had on their access to restaurant quality food over the last year. As

a result, consumers have aggressively sought out alternatives to cooking at home or ordering take-out.

Meal-Kits

vs. Third-Party Delivery vs. Prepared Meals

Business models

for meal-kit providers, third-party delivery services and prepared “heat-to-eat” meal companies, differ vastly from

one another. Meal-kit companies provide customers pre-portioned, raw ingredients and recipes that require preparation, cooking,

and the ensuing clean-up, not to mention that the resulting meal is still subject to the preparer’s ability, or lack thereof,

to cook. On average, meals take anywhere from 30-60 minutes for preparation and cooking and another 15 minutes to clean up. In

addition, due to the short shelf life of raw materials provided in meal-kits, meal-kit providers experience higher operating and

supply chain costs compared to prepared meal providers. Home Bistro’s flash freezing process and packaging serves to extend

its product’s shelf life and promotes operational efficiencies.

Third-party online

delivery platforms such as Grubhub, Uber Eats and DoorDash offer access to restaurants’ menus via a single online portal.

Customers then order directly from the app and cooked meals are delivered typically within 60 minutes by the restaurant, third

party delivery service or the app platform itself. During the delivery, cooked meals lose heat, which can decrease the enjoyment

of the meal or require reheating.

The prepared, heat-to-eat providers in the meal delivery segment

(in which Home Bistro operates) ship fresh and fresh-frozen, fully cooked meals direct-to-consumer. On average, these meals require

heating for only three to five minutes using a microwave of sous vide machine. The experience is extremely convenient, requires

very little cleanup and delivers a gourmet meal prepared by a professional chef. Consumers can order one meal or several meals,

which can be stored and heated when desired.

Production

Until

mid-2020, the Company used third-party co-packers to cooks, packages, fulfill and ship its meals to its customers. In June, Home

Bistro entered into a lease for commercial kitchen facilities, hired and trained professional chefs and implemented its own fulfillment

operations. By managing its own food production and fulfillment, Home Bistro expects to be able to improve its competitive position,

while expanding its gross profit and operating margins. It will provide the Company with significantly greater flexibility to

create and introduce new menu items, including the expansion of its Celebrity Chef Program, and react to dynamics of a developing

marketplace.

Orders

for restaurant quality meats and seafood through the Company’s Prime Chop and Colorado Prime brands continue to be processed

through a third-party co-packer based in North Carolina who fulfills and ships customer orders.

Competition

In

the direct-to-consumer prepared meal home delivery market segment, our competition is extensive and includes larger more established

companies such as Jenny Craig, WW International and Nutrisystem which have significantly greater financial, technical, sales and

marketing resources than the Company, as well as numerous smaller independent providers. We believe, however, there is considerable

room for additional competitors offering modestly priced, high quality offerings, as the direct-to-consumer segment of the home

delivery market for food continues to expand. In addition, we believe the competition for consumers seeking ready-made gourmet

meals (such as Home Bistro) is less intensive than other niches such as weight loss, high protein, keto, or paleo.

In

the direct-to-consumer, high quality meats and seafood market segment, our competition is extensive and includes larger more established

companies such as Omaha Steaks, Kansas City Steak Company and Snake River Farms which have significantly greater financial, technical,

sales and marketing resources than the Company, as well as Butcher Block, D’Artagnan and Crowd Cow. We believe, however,

there is considerable room for additional competitors offering modestly priced, high quality offerings, as the direct-to-consumer

segment of the home delivery market for food continues to expand.

Home Bistro’s online competition consists primarily of

national and local service providers, point-of-sale module vendors that serve some independent restaurants who have their own standalone

websites and the online interfaces of restaurants that also offer takeout. The Company also competes for diners with online competitors

on the basis of convenience, control, and customer care. For restaurants, Home Bistro competes with other online platforms based

on its ability to generate additional orders, manage challenges such as customization, change orders, menu updates and specials

and the ability to help them improve their operational efficiency.

Government

Regulation

We

are subject to labor and employment laws, import and trade restrictions laws, laws governing advertising, privacy and data security

laws, safety regulations and other laws, including consumer protection regulations that apply to retailers and/or the promotion

and sale of merchandise and the operation of stores and warehouse facilities. In the United States, we are subject to the regulatory

authority of, among other agencies, the Federal Trade Commission (“FTC”) and U.S. Food and Drug Administration (“FDA”).

We will employ a number of external resources to assist us in complying with our regulatory obligations. These external resources

will include outside technology providers and consultants. As we expand our business, we will be required to raise additional

capital to cover the expected increase in costs to hire and train additional internal and external resources to ensure we remain

in substantial compliance with our governmental obligations. We monitor changes in these laws and believe that we are in material

compliance with applicable laws.

Trademarks

We own trademarks on certain of our products,

including Trademark serial numbers 86636971 and 86636968.

Employees

As of December 31, 2020, Home Bistro had 5 full-time employees.

None of these employees are represented by collective bargaining agreements and the Company considers it relations with its employees

to be good.

ITEM

1A. RISK FACTORS

In

the execution of our business strategy, our operations and financial condition are subject to certain risks. A summary of certain

material risks is provided below, and you should take such risks into account in evaluating any investment decision involving

the Company. This section does not describe all risks applicable to us and is intended only as a summary of certain material factors

that could impact our operations in the industries in which we operate. Other sections of this report contain additional information

concerning these and other risks.

Risks

Relating to Our Business Generally

There

is substantial doubt about our ability to continue as a going concern.

We had had net losses $1,241,661 and $199,061

for the years ended December 31, 2020 and 2019, respectively. The net cash used in operations was approximately $273,817 and $30,244

for the years ended December 31, 2020 and 2019, respectively. Additionally, the Company had an accumulated deficit of approximately

$6,333,389 on December 31, 2020. These conditions, among others, raise substantial doubt about our ability to continue as a going

concern for a period of twelve months for the issuance date of this report.

Management cannot provide assurance that

we will ultimately achieve sufficient profitable operations or become cash flow positive or raise additional debt and/or equity

capital. Management believes that our capital resources are not currently adequate to continue operating and maintaining its business

strategy for a period of twelve months from the issuance date of this report. The Company may seek to raise capital through additional

debt and/or equity financings and generate sufficient revenues to fund its operations in the future.

The Report of our Independent Registered

Public Accountant firm issued in connection with our audited consolidated financial statement for the years ended December 31,

2020 and 2019 express substantial doubt about our ability to continue as a going concern.

Our

business strategy relating to the development and introduction of new products and services exposes us to risks such as limited

customer and/or market acceptance and additional expenditures that may not result in additional net revenue.

An

important component of our business strategy is to focus on new products and services that enable us to provide immediate value

to our customers. Customer and/or market acceptance of these new products and services cannot be predicted with certainty, and

if we fail to execute properly on this strategy or to adapt this strategy as market conditions evolve, our ability to grow revenue

and our results of operations may be adversely affected. If we fail to successfully implement our business strategy, our financial

performance and our growth could be materially and adversely affected.

If

we fail to successfully implement our business strategy, our financial performance and our growth could be materially and adversely

affected.

Our future financial performance and success are dependent in

large part upon our ability to implement our business strategy successfully. Implementation of our strategy will require effective

management of our operational, financial, and human resources and will place significant demands on those resources. See “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in this report for more information regarding our

business strategy. There are risks involved in pursuing our strategy, including the ability to hire or retain the personnel necessary

to manage our strategy effectively.

In

addition to the risks set forth above, implementation of our business strategy could be affected by a number of factors beyond

our control, such as increased competition, legal developments, government regulation, general economic conditions, increased

operating costs or expenses, and changes in industry trends. We may decide to alter or discontinue certain aspects of our business

strategy at any time. If we are not able to implement our business strategy successfully, our long-term growth and profitability

may be adversely affected. Even if we are able to implement some or all of the initiatives of our business strategy successfully,

our operating results may not improve to the extent we anticipate, or at all.

We

may fail to realize the anticipated benefits and cost savings of the acquisition of Home Bistro, which could adversely affect

the value of our common stock.

The

ultimate success of the acquisition of Home Bistro will depend, in part, on our ability to realize the anticipated benefits and

cost savings from combining the business of Home Bistro with our legacy business. Our ability to realize these anticipated benefits

and cost savings is subject to certain risks including:

|

|

●

|

our ability to successfully combine the business of Home Bistro with our legacy business, including with respect to the integration of our systems and technology;

|

|

|

●

|

whether

the combined businesses will perform as currently expected;

|

|

|

●

|

the

possibility that we paid more for Home Bistro than the value we will derive from the acquisition; and

|

|

|

●

|

the

assumption of known and unknown liabilities of Home Bistro.

|

If

we are not able to successfully combine the business of Home Bistro with our legacy business within the anticipated time frame,

or at all, the anticipated cost savings and other benefits of the acquisition may not be realized fully or at all or may take

longer to realize than expected, the combined businesses may not perform as expected, and the value of our common stock may be

adversely affected.

We

cannot provide assurances that Home Bistro’s business and our legacy business can be integrated successfully. It is possible

that the integration process could result in the loss of key employees, the disruption of our ongoing businesses or in unexpected

integration issues, higher than expected integration costs, and an overall integration process that takes longer than originally

anticipated. In addition, at times, the attention of certain members of our management and resources may be focused on completion

of the integration and diverted from day-to-day business operations, which may disrupt our ongoing business. We may experience

difficulties associated with the implementation and/or integration of new businesses, services (including outsourced services),

technologies, solutions, or products.

We may face difficulties, costs, and delays in effectively implementing

and/or integrating acquired businesses, services (including outsourced services), technologies, solutions, or products into our

business. Implementing internally developed solutions and products, and/or integrating newly acquired businesses, services (including

outsourced services), and technologies could be time-consuming and may strain our resources. Consequently, we may not be successful

in implementing and/or integrating these new businesses, services, technologies, solutions, or products and may not achieve anticipated

revenue and cost benefits.

We

may experience difficulties associated with the implementation and/or integration of new businesses, services (including outsourced

services), technologies, solutions, or products.

We may face difficulties, costs, and delays in effectively implementing

and/or integrating acquired businesses, services (including outsourced services), technologies, solutions, or products into our

business. Implementing internally developed solutions and products, and/or integrating newly acquired businesses, services

(including outsourced services), and technologies could be time-consuming and may strain our resources. Consequently, we may not

be successful in implementing and/or integrating these new businesses, services, technologies, solutions, or products and may not

achieve anticipated revenue and cost benefits.

Changes

in macroeconomic conditions may adversely affect our business.

Economic

difficulties and other macroeconomic conditions could reduce the demand and/or the timing of purchases for certain of our services

from customers and potential customers. In addition, changes in economic conditions could create liquidity and credit constraints.

We cannot assure you that we would be able to secure additional financing if needed and, if such funds were available, that the

terms and conditions would be acceptable to us.

The

effects of the outbreak of the novel coronavirus (“COVID-19”) have negatively affected the global economy,

the United States economy, and the global financial markets, and may disrupt our operations and our clients’ and counterparties’

operations, which could have an adverse effect on our business, financial condition and results of operations.

The effects of the outbreak of the novel coronavirus have negatively

affected the global economy, the United States economy, and the global financial markets, and may disrupt our operations and our

clients’ and counterparties’ operations, which could have an adverse effect on our business, financial condition and

results of operations.

The

ongoing COVID-19 global and national health emergency has caused significant disruption in the international and United States

economies and financial markets. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. The spread

of COVID-19 has caused illness, quarantines, cancellation of events and travel, business and school shutdowns, reduction in business

activity and financial transactions, labor shortages, supply chain interruptions and overall economic and financial market instability.

The United States now has the world’s most reported COVID-19 cases, and all 50 states and the District of Columbia have

reported cases of individuals infected with COVID-19. All states have declared states of emergency. Similar impacts have been

experienced in every country in which we do business. Impacts to our business could be widespread and global, and material impacts

may be possible, including the following:

|

|

●

|

Our

employees contracting COVID-19;

|

|

|

●

|

Reductions

in our operating effectiveness as our employees work from home or disaster-recovery locations;

|

|

|

●

|

Unavailability

of key personnel necessary to conduct our business activities;

|

|

|

●

|

Unprecedented

volatility in global financial markets;

|

|

|

●

|

Reductions

in revenue across our operating businesses;

|

|

|

●

|

Closure

of our offices or the offices of our clients; and

|

Furthermore,

the Company has been following the recommendations of local health authorities to minimize exposure risk for its employees for

the past several weeks, including the temporary closures of its offices and having employees work remotely to the extent possible,

which has to an extent adversely affected their efficiency. In addition, the cancellation of in-person meetings and conferences

has had an adverse impact on the Company’s business and financial condition and has hampered the Company’s ability

to meet with customers to promote products, generate revenue and access usual sources of liquidity on reasonable terms, which

in turn has negatively impacted the Company’s cash flow and its ability to pay for certain professional services.

The

COVID-19 pandemic also has the potential to significantly impact our Home Bistro segment’s supply chain, food manufacturers,

distribution centers, or logistics and other service providers. Additionally, our service providers and their operations may be

disrupted, temporarily closed or experience worker or meat or other food shortages, which could result in additional disruptions

or delays in shipments of our Home Bistro segment’s products.

We

are still assessing our business operations and system supports and the impact COVID-19 may have on our results and financial

condition, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread

of COVID-19 or its consequences, including downturns in business sentiment generally or in our sectors in particular. To date,

the Company has been able to avoid layoffs and furloughs of employees.

As

the situation continues to evolve, the Company will continue to closely monitor market conditions and respond accordingly.

The

further spread of the COVID-19 outbreak may materially disrupt banking and other financial activity generally and in the areas

in which we operate. This would likely result in a decline in demand for our products and services, which would negatively impact

our liquidity position and our business strategies. Any one or more of these developments could have a material adverse effect

on our and our consolidated subsidiaries’ business, operations, consolidated financial condition, and consolidated results

of operations.

A

failure of our information technology or systems could adversely affect our business.

Our

ability to deliver our products and services depends on effectively using information technology. We rely upon our information

technology and systems, employees, and third parties for operating and monitoring all major aspects of our business. These technologies

and systems and, therefore, our operations could be damaged or interrupted by natural disasters, power loss, network failure,

improper operation by our employees, data privacy or security breaches, computer viruses, computer hacking, network penetration

or other illegal intrusions or other unexpected events. Any disruption in the operation of our information technology or systems,

regardless of the cause, could adversely impact our operations, which may adversely affect our financial condition, results of

operations and cash flows.

A

cybersecurity incident could result in the loss of confidential data, give rise to remediation and other expenses, expose us to

liability under consumer protection laws, common law theories or other laws, subject us to litigation and federal and state governmental

inquiries, damage our reputation, and otherwise be disruptive to our business.

The nature of our business involves the receipt, storage and

use of personal data about our customers, as well as employees. Additionally, we rely upon third parties that are not directly

under our control to store and use portions of that personal data as well. The secure maintenance of this and other confidential

information or other proprietary information is critical to our business operations. To protect our information systems from attack,

damage, and unauthorized use, we have implemented multiple layers of security, including technical safeguards, processes, and our

people. Our defenses are monitored and routinely tested internally and by external parties. Despite these efforts, threats from

malicious persons and groups, new vulnerabilities, technology failures, and advanced attacks against information systems create

risk of cybersecurity incidents. We cannot provide assurance that we or our third-party vendors or other service providers will

not be subject to cybersecurity incidents, which may result in unauthorized access by third parties, loss, misappropriation, disclosure

or corruption of customer, employee, or our information; or other data subject to privacy laws. Such cybersecurity incidents or

delays in responding to or remedying damage caused by such incidents may lead to a disruption in our systems or business, costs

to modify, enhance, or remediate our cybersecurity measures, liability under privacy, security and consumer protection laws or

litigation under these or other laws, including common law theories, and subject us to enforcement actions, fines, regulatory proceedings

or litigation against us, damage to our business reputation, a reduction in participation and sales of our products and services,

and legal obligations to notify customers or other affected individuals about an incident, which could cause us to incur substantial

costs and negative publicity, any of which could have a material adverse effect on our financial condition and results of operations

and harm our business reputation.

As

a result, cybersecurity and the continued development and enhancement of our controls, processes and practices remain a priority

for us. We may be required to expend significant additional resources in our efforts to modify or enhance our protective measures

against evolving threats or to investigate and remediate any cybersecurity vulnerabilities.

Our business is subject to changing privacy and security laws,

rules, and regulations, including the Payment Card Industry Data Security Standards, the Telephone Consumer Protection Act and

other state privacy regulations, which impact our operating costs and for which failure to adhere could negatively impact our business.

Our business is subject to various privacy and data security

laws, regulations, and codes of conduct that apply to our various business units (e.g., Payment Card Industry Data Security Standards

and Telephone Consumer Protection Act (“TCPA”)). These laws and regulations may be inconsistent across jurisdictions

and are subject to evolving and differing (sometimes conflicting) interpretations. While we are using internal and external resources

to monitor compliance with and to continue to modify our data processing practices and policies in order to comply with evolving

privacy laws, relevant regulatory authorities could determine that our data handling practices fail to address all the requirements

of certain new laws, which could subject us to penalties and/or litigation. Government regulators, privacy advocates and class

action attorneys are increasingly scrutinizing how companies collect, process, use, store, share and transmit personal data. This

increased scrutiny may result in new interpretations of existing laws as well as new laws, regulations, and industry standards

concerning privacy, data protection, and information security proposed and enacted in various jurisdictions, thereby further impacting

our business. For example, the California Consumer Privacy Act of 2018 (“CCPA”), went into effect on January 1, 2020,

and it applies broadly to information that identifies or is associated with any California household or individual, and compliance

with the new law requires that we implement several operational changes, including processes to respond to individuals’ data

access and deletion requests. Failure to comply with the CCPA may result in attorney general enforcement action and damage to our

reputation. The CCPA also provides for civil penalties for violations, as well as a private right of action for data breaches that

may increase data breach litigation. We may also be exposed to litigation, regulatory fines, penalties or other sanctions if the

personal, confidential or proprietary information of our customers is mishandled or misused by any of our suppliers, counterparties

or other third parties, or if such third parties do not have appropriate controls in place to protect such personal, confidential

or proprietary information. Additionally, the Federal Trade Commission (“FTC”) and many state attorneys general are

interpreting federal and state consumer protection laws to impose standards for the collection, use, dissemination, and security

of data. The obligations imposed by the CCPA and other similar laws that may be enacted at the federal and state level may require

us to modify our business practices and policies and to incur substantial expenditures in order to comply.

We

depend on our management team.

The Company’s future success primarily depends on the

efforts of the existing management team, particularly, Zalmi Duchman, our Chief Executive Officer. Loss of the services of Mr.

Duchman could materially and adversely affect the Company’s business prospects. We do not carry “key-man” life

insurance on the lives of any of our employees or advisors. As sufficient funds become available, the Company intends to hire additional

qualified personnel. Significant competition exists for such personnel and, accordingly, our compensation costs may increase significantly.

The Company believes it will be able to recruit and retain personnel with the skills required for present needs and future growth

but cannot assure it will be successful in those efforts.

In order to be successful, we must attract, engage, retain,

and integrate key employees and have adequate succession plans in place, and failure to do so could have an adverse effect on our

ability to manage our business.

Our success depends, in large part, on our ability to attract,

engage, retain, and integrate qualified executives and other key employees throughout all areas of our business. Identifying, developing

internally, or hiring externally, training and retaining highly skilled managerial and other personnel are critical to our future,

and competition for experienced employees can be intense. Failure to successfully hire executives and key employees or the loss

of any executives and key employees could have a significant impact on our operations. The loss of services of any key personnel,

the inability to retain and attract qualified personnel in the future, or delays in hiring may harm our business and results of

operations. Further, changes in our management team may be disruptive to our business, and any failure to successfully integrate

key newly hired employees could adversely affect our business and results of operations.

We

face competition for staffing, which may increase our labor costs and reduce profitability.

We

compete with other food and beverage services providers in recruiting qualified management, including executives with the required

skills and experience to operate and grow our business, and staff personnel for the day-to-day operations of our business. These

challenges may require us to enhance wages and benefits to recruit and retain qualified management and other professionals. Difficulties

in attracting and retaining qualified management and other professionals, or in controlling labor costs, could have a material

adverse effect on our profitability.

We

are or may become a party to litigation that could potentially force us to pay significant damages and/or harm our reputation.

We

could be subject to certain legal proceedings, which potentially involve large claims and significant defense costs (see “Legal

Proceedings”). These legal proceedings and any other claims that we may face in the future, whether with or without merit,

could result in costly litigation, and divert the time, attention, and resources of our management. The coverage limits of our

insurance policies may not be adequate to cover all such claims and some claims may not be covered by insurance. Additionally,

insurance coverage with respect to some claims against us or our directors and officers may not be available on terms that would

be favorable to us, or the cost of such coverage could increase in the future. Further, although we believe that we have conducted

our operations in compliance with applicable statutory and contractual requirements and that we have meritorious defenses to outstanding

claims, it is possible that resolution of these legal matters could have a material adverse effect on our results of operations.

In addition, legal expenses associated with the defense of these matters may be material to our results of operations in a particular

financial reporting period.

Third

parties may infringe on our brands, trademarks, and other intellectual property rights, which may have an adverse impact on our

business.

We currently rely on a combination of trademark and other intellectual

property laws and confidentiality procedures to establish and protect our proprietary rights, including our brands. If we fail

to successfully enforce our intellectual property rights, the value of our brands, services and products could be diminished and

our business may suffer. Our precautions may not prevent misappropriation of our intellectual property. Any legal action that we

may bring to protect our brands and other intellectual property could be unsuccessful and expensive and could divert management’s

attention from other business concerns. In addition, legal standards relating to the validity, enforceability, and scope of protection

of intellectual property, especially in Internet-related businesses, are uncertain and evolving. We cannot assure you that these

evolving legal standards will sufficiently protect our intellectual property rights in the future.

We

may be subject to intellectual property rights claims.

Third parties may make claims against us alleging infringement

of their intellectual property rights. Any intellectual property claims, regardless of merit, could be time-consuming and expensive

to litigate or settle and could significantly divert management’s attention from other business concerns. In addition, if

we were unable to successfully defend against such claims, we may have to pay damages, stop selling the service or product or stop

using the software, technology or content found to be in violation of a third party’s rights, seek a license for the infringing

service, product, software, technology, or content or develop alternative non-infringing services, products, software, technology

or content. If we cannot license on reasonable terms, develop alternatives, or stop using the service, product, software, technology

or content for any infringing aspects of our business, we may be forced to limit our service and product offerings. Any of these

results could reduce our revenue and our ability to compete effectively, increase our costs or harm our business.

Damage

to our reputation could harm our business, including our competitive position and business prospects.

Our ability to attract and retain customers

and employees is impacted by our reputation. Harm to our reputation can arise from various sources, including employee misconduct,

cyber security breaches, unethical behavior, litigation, or regulatory outcomes, which could, among other consequences, increase

the size and number of litigations claims and damages asserted or subject us to enforcement actions, fines and penalties and cause

us to incur related costs and expenses.

We

rely on third parties to provide us with adequate food supply, freight and fulfillment and Internet and networking services, the

loss or disruption of any of which could cause our revenue, earnings, or reputation to suffer.

We rely on third-party manufacturers to supply all of the food

and other products we sell as well as packaging materials. If we are unable to obtain sufficient quantity, quality and variety

of food, other products, and packaging materials in a timely and low-cost manner from our manufacturers, we will be unable to fulfill

our customers’ orders in a timely manner, which may cause us to lose revenue and market share or incur higher costs, as well

as damage the value of our brands.

Currently,

all of our Home Bistro order fulfillment is handled by one third-party provider. Also, almost all of our direct-to-consumer Home

Bistro customer orders are shipped by one third-party provider and almost all of our orders for Home Bistro retail programs are

shipped by another third-party provider. Should these providers be unable to service our needs for even a short duration, our

revenue and business could be adversely affected. Additionally, the cost and time associated with replacing these providers on

short notice would add to our costs. Any replacement fulfillment provider would also require startup time, which could cause us

to lose sales and market share.

Our

business also depends on a number of third parties for Internet access and networking, and we have limited control over these

third parties. Should our network connections go down, our ability to fulfill orders would be delayed. Further, if our websites

or call center become unavailable for a noticeable period of time due to Internet or communication failures, our business could

be adversely affected, including harm to our brands and loss of sales.

Therefore,

we are dependent on these third parties. The services we require from these parties may be disrupted by a number of factors, including

the following:

|

|

●

|

financial

condition or results of operations;

|

|

|

●

|

internal

inefficiencies;

|

|

|

●

|

natural

or man-made disasters; and

|

|

|

●

|

with

respect to our food suppliers, shortages of ingredients or United States Department of Agriculture (“USDA”) or United

States Food and Drug Administration (“FDA”) compliance issues.

|

Further,

if a regional or global health epidemic or pandemic occurs, such as COVID-19, depending upon its location, duration and severity,

our business could be severely affected. A regional or global health epidemic or pandemic might also adversely affect our business

by disrupting the operations of our call center, creating negative popular sentiment among consumers of delivered food, or by

disrupting or delaying our third-party providers’ ability to, among other things (i) supply the products that we sell, as

well as packaging materials, (ii) fulfill segment customer orders and (iii) provide internet and networking services.

Our

industries are highly competitive. If any of our competitors or a new entrant into the market with significant resources has products

similar to ours, our business could be significantly affected.

Competition

is intense in the meal delivery services industry and the beverage industry and we must remain competitive in the areas of program

efficacy, price, taste, customer service and brand recognition. Some of our competitors are significantly larger than we are and

have substantially greater resources. Our business could be adversely affected if someone with significant resources decided to

imitate our services or products. Any increased competition from new entrants into our segments’ industry or any increased

success by existing competition could result in reductions in our sales or prices, or both, which could have an adverse effect

on our business and results of operations.

If

we do not continue to receive referrals from existing Home Bistro segment customers, our Home Bistro segment’s customer

acquisition cost may increase.

We

rely on word-of-mouth advertising for a portion of our new Home Bistro segment customers. If our brands suffer or the number of

customers acquired through referrals drops due to other circumstances, our costs associated with acquiring new Home Bistro segment

customers and generating revenue will increase, which will, in turn, have an adverse effect on our profitability.

Changes

in customer preferences could negatively impact our operating results.

Our Home Bistro segment programs feature gourmet online meal

delivery service selections, which we believe offer convenience and value to our customers. Our continued success depends,

to a large degree, upon the continued popularity of our Home Bistro segment programs versus various other food services. Changes

in customer tastes and preferences away from our ready-to-go food, and any failure to provide innovative responses to these changes,

may have a materially adverse impact on our business, financial condition, operating results, and cash flows.

Our

success is also dependent on our food innovation including maintaining a robust array of food items and improving the quality

of existing items. If we do not continually expand our food items or provide customers with items that are desirable in taste

and quality, our business could be adversely impacted.

The

industry in which our Home Bistro segment operates is subject to governmental regulation that could increase in severity and hurt

results of operations.

The industry in which our Home Bistro segment operates is subject

to federal, state, and other governmental regulation. Certain federal and state agencies, such as the FTC, regulate and enforce

such laws relating to advertising, disclosures to customers, privacy, customer pricing and billing arrangements and other customer

protection matters. A determination by a federal or state agency, or a court, that any of our practices do not meet existing or

new laws or regulations could result in liability, adverse publicity, and restrictions on our business operations.

Other

aspects of the industry in which our Home Bistro segment operates are also subject to government regulation. For example, the

manufacturing, labeling and distribution of food products are subject to strict USDA and FDA requirements and food manufacturers

are subject to rigorous inspection and other requirements of the USDA and FDA, and companies operating in foreign markets must

comply with those countries’ requirements for proper labeling, controls on hygiene, food preparation and other matters.

Additionally, remedies available in any potential administrative or regulatory actions may include product recalls and requiring

us to refund amounts paid by all affected customers or pay other damages, which could be substantial.

Laws and regulations directly applicable

to communications, operations, or commerce over the Internet such as those governing intellectual property, privacy, libel and

taxation, are becoming more prevalent and some remain unsettled. If we are required to comply with new laws or regulations or

new interpretations of existing laws or regulations, or if we are unable to comply with these laws, regulations or interpretations,

our business could be adversely affected.

Future

laws or regulations, including laws or regulations affecting our marketing and advertising practices, relations with customers,

employees, service providers, or our services and products, may have an adverse impact on us.

The

sale of ingested products involves product liability and other risks.

Like other distributors of products that

are ingested, we face an inherent risk of exposure to product liability claims if the use of our products results in illness or

injury. The foods that we resell in the U.S. are subject to laws and regulations, including those administered by the USDA and

FDA that establish manufacturing practices and quality standards for food products. Product liability claims could have a material

adverse effect on our business as existing insurance coverage may not be adequate. The successful assertion or settlement of an

uninsured claim, a significant number of insured claims or a claim exceeding the limits of our insurance coverage would harm us

by adding costs to the business and by diverting the attention of senior management from the operation of our business. We may

also be subject to claims that our Home Bistro segment products contain contaminants, are improperly labeled, include inadequate

instructions as to use or inadequate warnings covering interactions with other substances. Product liability litigation, even

if not meritorious, is very expensive and could also entail adverse publicity for us and adversely affect our results of operations.

In addition, the products we distribute, or certain components of those products, may be subject to product recalls or other deficiencies.

Any negative publicity associated with these actions would adversely affect our brands and may result in decreased product sales

and, as a result, lower revenue, and profits.

Risks

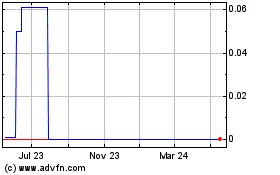

Related to an Investment in Our Common Stock

There

is currently a limited public market for our common stock, a trading market for our common stock may never develop, and our common

stock prices may be volatile and could decline substantially.

Although

our common stock is quoted on OTC Markets, OTCQB tier of OTC Markets Group Inc., an over-the-counter quotation

system, under the symbol “GRTD,” there has been no material public market for our common stock. In these marketplaces,

our stockholders may find it difficult to obtain accurate quotations as to the market value of their shares of our common stock

and may find few buyers to purchase their stock and few market makers to support its price. As a result of these and other factors,

investors may be unable to resell shares of our common stock at or above the price for which they purchased them, at or near quoted

bid prices, or at all. Further, an inactive market may also impair our ability to raise capital by selling additional equity in

the future and may impair our ability to enter into strategic partnerships or acquire companies or products by using shares of

our common stock as consideration.

Moreover,

there can be no assurance that any stockholders will sell any or all of their shares of common stock and there may initially

be a lack of supply of, or demand for, our common stock. In the case of a lack of supply for our common stock, the trading price

of our common stock may rise to an unsustainable level, particularly in instances where institutional investors may be discouraged

from purchasing our common stock because they are unable to purchase a block of shares in the open market due to a potential unwillingness

of our stockholders to sell the amount of shares at the price offered by such investors and the greater influence individual investors

have in setting the trading price. In the case of a lack of demand for our common stock, the trading price of our common stock

could decline significantly and rapidly at any time.

We

intend to list shares of our common stock on a national securities exchange in the future, but we do not now, and may not in the

future, meet the initial listing standards of any national securities exchange, which is often a more widely traded and liquid

market. Some, but not all, of the factors which may delay or prevent the listing of our common stock on a more widely-traded and

liquid market include the following: our stockholders’ equity may be insufficient; the market value of our outstanding securities

may be too low; our net income from operations may be too low; our common stock may not be sufficiently widely held; we may not

be able to secure market makers for our common stock; and we may fail to meet the rules and requirements mandated by the several

exchanges and markets to have our common stock listed. Should we fail to satisfy the initial listing standards of the national

exchanges, or our common stock is otherwise rejected for listing, and remains listed on the OTC Markets or is suspended

from the OTC Markets, the trading price of our common stock could suffer and the trading market for our common stock

may be less liquid and our common stock price may be subject to increased volatility.

Therefore,

an active, liquid, and orderly trading market for our common stock may not initially develop or be sustained, which could significantly

depress the public price of our common stock and/or result in significant volatility, which could affect your ability to sell

your common stock. Even if an active trading market develops for our common stock, the market price of our common stock may be

highly volatile and subject to wide fluctuations. Our financial performance, government regulatory action, tax laws, interest

rates and market conditions in general could have a significant impact on the future market price of our common stock.

Our

CEO has significant voting power and may take actions that may not be in the best interests of our other stockholders.

Stockholders

have limited ability to exercise control over the Company’s daily business affairs and implement changes in its policies

because management beneficially owns a majority of the current shares of Common Stock. As of April 20, 2020, the Company’s

Chief Executive Officer, Mr. Zalmi Duchman beneficially owns 50.7% of the Common Stock. As directors and officers of the Company,

the Company’s management team has a fiduciary duty to the Company and must act in good faith in the manner it reasonably

believes to be in the best interest of the members. As stockholders, the management team is entitled to vote its shares in its

own interest, which may not always be in the best interest of the stockholders.

We

are not subject to the rules of a national securities exchange requiring the adoption of certain corporate governance measures

and, as a result, our stockholders do not have the same protections.

We

are quoted on the OTCQB marketplace and are not subject to the rules of a national securities exchange, such as the New York Stock

Exchange or the Nasdaq Stock Market. National securities exchanges generally require more rigorous measures

relating to corporate governance designed to enhance the integrity of corporate management. The requirements of the OTCQB afford

our stockholders fewer corporate governance protections than those of a national securities exchange. Until we comply with

such greater corporate governance measures, regardless of whether such compliance is required, our stockholders will

have fewer protections such as those related to director independence, stockholder approval rights and governance measures

designed to provide board oversight of management.

We

do not have a class of our securities registered under Section 12 of the Exchange Act. Until we do, or we become subject to Section

15(d) of the Exchange Act, we will be a “voluntary filer.”

We

are not currently required under Section 13 or Section 15(d) of the Exchange Act to file periodic reports with the SEC. We have

in the past voluntarily elected to file some or all of these reports to ensure that sufficient information about us and our operations

is publicly available to our stockholders and potential investors. Until we become subject to the reporting requirements under

the Exchange Act, we are a “voluntary filer”, and we are currently considered a non-reporting issuer under the Exchange

Act. We will not be required to file reports under Section 13(a) or 15(d) of the Exchange Act until the earlier to occur of: (i)

our registration of a class of securities under Section 12 of the Exchange Act, which would be required if we list a class of

securities on a national securities exchange or if we meet the size requirements set forth in Section 12(g) of the Exchange Act,

or which we may voluntarily elect to undertake at an earlier date; or (ii) the effectiveness of a registration statement under

the Securities Act relating to our common stock. Until we become subject to the reporting requirements under either Section 13(a)

or 15(d) of the Exchange Act, we are not subject to the SEC’s proxy rules, and large holders of our capital stock will not

be subject to beneficial ownership reporting requirements under Sections 13 or 16 of the Exchange Act and their related rules.

As a result, our stockholders and potential investors may not have available to them as much or as robust information as they

may have if and when we become subject to those requirements. In addition, if we do not register under Section 12 of the Exchange

Act, and remain a “voluntary filer”, we could cease filing annual, quarterly, or current reports under the Exchange

Act.