Asian Shares Lower as Investors Await U.S. Jobs Data

October 01 2015 - 9:20PM

Dow Jones News

Japanese and Australian shares drifted lower early Friday, as

investors look to a coming jobs report in the U.S. for clues about

when the Federal Reserve will raise interest rates.

Japan's Nikkei 225 is 0.4% lower at 17655.18 and Australia's

S&P/ASX 200 is down 0.2% at 5099.80, following a mixed

performance overnight in U.S. markets.

The losses indicate continued caution among investors in markets

more broadly, after slowing growth in China and market volatility

shook stocks globally and made the three months to the end of

September the worst quarter for many markets in years.

In Japan, SoftBank Group Corp. fell 0.8% and Hitachi Ltd. was 2%

lower. Among Australian stocks, Rio Tinto Ltd. is 1.9% lower.

In currency markets, the Japanese yen was little changed against

the U.S. dollar, trading at ¥ 119.86 to the dollar compared with ¥

119.92 at the close of U.S. markets. The Australian dollar weakened

0.2% from its previous close, while Malaysia's ringgit lost

0.5%.

With uncertainty about the health of the global economy, many

investors are watching closely for improvement in economic

indicators, particularly from the U.S., which is expected to

announce monthly jobs data late Friday. A brighter jobs picture

could offer Fed officials reason to raise short-term interest rates

later this year.

In Asia, better-than-expected Chinese manufacturing data on

Thursday offered some relief from the string of disappointing

readings in recent weeks. In Australia, retail sales data for

August is expected mid-morning local time; most economists surveyed

by The Wall Street Journal expect an improvement on July's

data.

But analysts remain cautious about looking too much into any

short-term positive data. "Our global economists believe that

near-term global recession risks are higher than usual, with a 25%

chance of a recession-like slump this year," Bank of America

Merrill Lynch said in a note.

In commodity markets, Brent crude prices rose 0.9% early Friday,

to US$48.10 a barrel.

Chinese markets remain closed Friday for a national holiday

celebration. Indian markets are also closed.

Write to Jake Maxwell Watts at jake.watts@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 01, 2015 22:05 ET (02:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

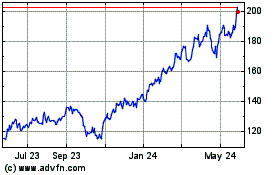

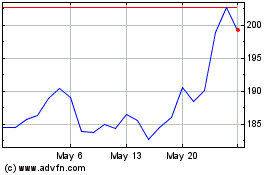

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Jan 2024 to Jan 2025