Johnson Controls Profit Jumps

July 21 2016 - 11:50AM

Dow Jones News

Johnson Controls Inc. said profit jumped sharply in its latest

quarter, topping expectations, and the company moved up the date to

close its merger with Tyco International PLC.

Johnson Controls also narrowed its full-year earnings guidance,

saying it now expects earnings of $3.95 to $3.98 a share instead of

its previous estimate of $3.85 to $4.00 a share. That previous

estimate was boosted in April from an estimated range of $3.70 to

$3.90.

The company also forecast $1.17 to $1.20 of earnings per share

for the current quarter, while analysts polled by Thomson Reuters

expect $1.15 to $1.23.

The company said it is speeding up its merger with Tyco, now

expected to close on September 2. The close was previously planned

for September 30.

Johnson Controls agreed to a $14 billion merger with Tyco in

January. Under the agreement's terms. Johnson Controls shareholders

will own a slight majority at 56% of the combined company.

The new headquarters will be in Cork, Ireland, effectively

completing a so-called inversion for Johnson Controls, a tactic

used by some to take advantage of lower corporate tax rate in other

countries. The combined company would be a giant provider of

commercial-building systems.

Johnson Controls also moved its fourth-quarter dividend up to

make it payable on August 19 to those who own the stock on August

5.

For the quarter ended June 30, the company posted a profit of

$383 million, or 59 cents a share, up from $178 million, or 27

cents a share, a year earlier. Adjusted earnings were $1.07 a

share, compared with 91 cents last year.

Revenue was $9.5 billion, down 1% from a year ago.

Analysts had expected $1.03 in per-share earnings on $9.62

billion in revenue.

During the third quarter, Johnson incurred costs related to the

spinoff of its auto-parts business, Aident, its merger with Tyco

and the integration of a joint venture with Hitachi Ltd. totaling

$167 million. It also booked $102 million in restructuring charges

and $85 million in tax-related charges tied to the Aident

spinoff.

Building efficiency sales rose 33% to $3.64 billion compared

with last year, helped by a 5% increase in orders during the

quarter. The segment's income grew to $397 million compared with

$272 million a year ago.

Sales in the power solutions segment rose 3% to $1.52 billion

compared with last year, boosted by higher volumes in all regions.

Power solutions income was $262 million, compared with $234 million

last year.

Automotive experience revenue fell 19% to $4.36 billion. The

company blamed the decline on deconsolidation of the impact of its

interiors joint venture and foreign- exchange rates. The segments

income rose 1% to $344 million from $342 million a year ago.

Johnson Control shares rose 3.9% to $46.05 in midday

trading.

(END) Dow Jones Newswires

July 21, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

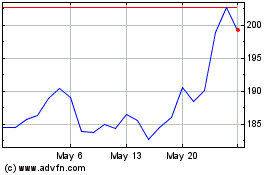

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

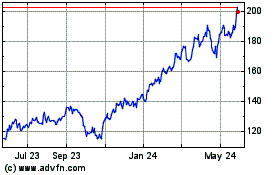

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Jan 2024 to Jan 2025