Japan Display Seeks Financial Support From INCJ

August 09 2016 - 5:50AM

Dow Jones News

TOKYO—A top maker of displays for Apple Inc. smartphones has

asked a Japanese government-backed fund for hundreds of millions of

dollars in aid, the latest sign of stress among Apple

suppliers.

Japan Display Inc. said Tuesday it lost about $115 million in

the April-June quarter and turned to its top shareholder, the

government-backed Innovation Network Corp. of Japan, for

support.

Sluggish demand from Apple and the strong yen have battered

Japan Display and Sharp Corp., another Japanese display maker,

which has agreed to be taken over by Taiwan's Foxconn Technology

Group.

"Our largest shareholder, INCJ, told us that they will continue

to provide full-fledged support," said Japan Display's chief

executive, Mitsuru Homma. "My hope is the support would come in a

way that doesn't affect other existing shareholders," Mr. Homma

said, indicating he doesn't want to issue new shares to the fund,

which already owns 35.6% of Japan Display.

Another Japan Display official said the company expected to get

tens of billions of yen, or hundreds of millions of dollars, in

loans and loan guarantees from the fund. An INCJ spokesman said

that nothing specific has been decided, but that the fund has

expressed its support for Japan Display.

Japanese companies in the electronic-devices area have leaned

heavily on Apple for business in the past few years, prospering

when the iPhone was on the upswing and taking a hit when sales

slackened.

What amounts to a nagging cold for Apple, which still earned

$7.8 billion in the most recent quarter, can quickly turn

life-threatening for its suppliers. Japan Display's revenue in the

most recent quarter was down 29% compared with the year-earlier

period. Analysts say there might not be room left for Japan Display

in an industry with tough competitors from China and South

Korea.

"If the government believes this industry is still important for

Japan, the fund or the Ministry of Economy, Trade and Industry

would need to take aggressive turnaround measures," said SMBC Nikko

Securities analyst Ryosuke Katsura.

Japan Display was created by the government-backed fund in 2012

by merging display operations from Sony Corp., Hitachi Ltd. and

Toshiba Corp. It had an initial public offering in 2014, but the

shares are now trading at less than one-fifth of the offering

price.

Sales of the iPhone have been slowing because of advances by

Android phones from Samsung Electronics Co. and cut-price Chinese

makers. More than half of Japan Display's revenue comes from Apple,

according to a company stock-exchange filing. Despite sales efforts

in China, Japan Display's largest Chinese client, Huawei

Technologies Co., accounted for only 12% of sales in the year ended

March 2016.

Mr. Homma, the Japan Display CEO, said he expected orders from

Apple to pick up starting this month, and he said the company was

looking for other business in products such as virtual-reality

headsets and in-car displays.

Even if orders pick up in the short term, Japan Display risks

getting stuck with dated technology. The company has focused mainly

on developing traditional liquid-crystal displays, but smartphone

makers are eyeing organic light-emitting diode, or OLED,

technology. Industry executives say they expect Apple to introduce

the new technology on some iPhones as soon as next year, a

projection Apple has declined to discuss.

Japan Display is trying to catch up and says it hopes to start

mass-producing OLED displays next year. But Amir Anvarzadeh, head

of Japan equities at brokerage BGC Partners, said the company's

limited arsenal for investment would have trouble catching up with

bullish development plans by South Korean and Chinese makers, both

backed by strong support from their governments.

OLED panels in theory are more flexible and offer improved

energy efficiency. But some executives say the technology has yet

to fulfill its promise and LCD panels display colors more

vividly.

Executives at both Japan Display and Sharp have sent conflicting

messages, sometimes saying they plan big investments in OLED while

maintaining at other times that LCD is superior and capable of

further improvement.

Atsuko Fukase contributed to this article.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

August 09, 2016 06:35 ET (10:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

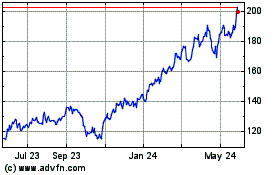

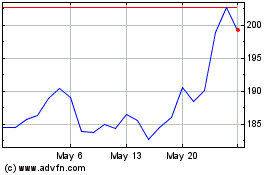

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Jan 2024 to Jan 2025