TIDMAAU

RNS Number : 1864S

Ariana Resources PLC

15 March 2021

15 March 2021

AIM: AAU

2021 JV PRODUCTION GUIDANCE

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

exploration and development company operating in Europe, is pleased

to announce the production guidance for 2021 for its joint venture

Kiziltepe Mine ("Kiziltepe" or "the Project"). Kiziltepe is 23.5%

owned by Ariana through its shareholding in Zenit Madencilik San.

ve Tic. A.S.

Highlights:

-- Gold production guidance for 2021 from Kiziltepe is expected

to be c. 19,000 ounces of gold*, c. 90% above feasibility plan for

this approximate stage of mine life.

-- Average monthly production is expected at approximately

27,000 tonnes of ore, peaking during Q2 2021; a stockpile of over

240,000 tonnes, representing well over a year of current production

capacity, has already been built up on site.

-- Ore throughput to the mill during 2021 is expected to be c.

325,000 tonnes, once operating capacity is increased as planned,

which represents a 115% increase over the feasibility plan.

-- Average grade of gold to be mined during the year is expected

to be c. 2.1 g/t Au and gold recovery is expected to exceed

90%.

-- Open-pit mining will continue largely at the Arzu North pit

during 2021, with some mining being undertaken concurrently at the

Derya pit.

-- Plant expansion to an operating capacity of up to 500,000

tonnes of ore per annum is well underway and scheduled for

completion in early Q3 2021; new mill has recently been installed

(Figures 1, 2 & 3).

-- Expansion plan being funded through a capital loan of US$6.6

million (inclusive of interest) to Zenit through Turkiye Garanti

Bankasi A.S., of which 25% has already been repaid, with nine equal

quarterly payments remaining.

Dr. Kerim Sener, Managing Director, commented:

"This year's production guidance from the joint venture follows

on from the completion of our arrangements with Ozaltin Holding

A.S. and Proccea Construction Co. With the enhanced JV now formally

underway, we are pleased to report on JV plans to increase the

operational capacity at Kiziltepe. This will see a marked positive

impact on production output and will continue to ensure the lowest

possible unit costs. During Q1 2021, mining has largely focused on

the Arzu North open-pit, within which significant additional gold

mineralisation has been encountered outside of the original mine

reserve. This bodes well for JV production plans and may have a

positive impact on the mining schedule, which is nominally

targeting circa 19,000 oz gold in 2021.

"By early 2020, the entire JV capital development loan of US$33

million was repaid to Turkiye Finans Katilim Bankasi A.S. The JV is

currently paying down its remaining working capital loan from the

same bank and this is about 70% complete, with US$3.1 million

requiring repayment from April to October 2021. A new loan facility

of US$6.6 million (inclusive of interest) with Turkiye Garanti

Bankasi A.S., providing the capital required for the plant

expansion, is already one quarter repaid.

"The continued positive economic environment for gold and silver

underpins the performance of the Kiziltepe mine, with both

commodities continuing to trade at near 5-year highs. With the

growing concerns over unsustainable levels of debt within major

economies, gold and silver are expected to continue to hold their

time-honoured position in the minds of investors. While the price

of oil has risen somewhat since late last year, the Turkish Lira

has continued its decline in value relative to the US dollar which

will again be reflected in lower dollar-based unit costs.

"Meanwhile, precautions are continuing to be undertaken at the

mine site against COVID-19. While issues associated with the

pandemic have not impacted gold production directly, some supply

issues have been encountered, specifically in the context of the

plant expansion programme. Despite this, the plant expansion is

still expected to be concluded by early Q3 2021 and factored into

the JV production guidance accordingly.

"With the wider JV now in place, we intend to advance our

collective interests in Turkey, continue with exploration and

development on behalf of the JV, progress with Ariana's earn-in and

the exploration programmes planned in Cyprus, as well as pursuing

separate opportunities elsewhere in Eastern Europe. As such, 2021

is set to be an exciting year for the Company and we look forward

to updating the market on these activities in due course."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

* Silver production guidance is not provided, as silver is

treated as a by-product credit. All figures are stated gross to the

Project unless otherwise stated.

http://www.rns-pdf.londonstockexchange.com/rns/1864S_1-2021-3-14.pdf

Figure 1: Processing plant expansion programme fully underway at

Kiziltepe, with new semi-autogenous grind (SAG) mill about to be

lifted by the crane into position, within the new mill building. In

the foreground, additional pre-leach tanks are being

constructed.

http://www.rns-pdf.londonstockexchange.com/rns/1864S_1-2021-3-14.pdf

Figure 2: Installation of the new SAG mill at Kiziltepe, located

in its final position, within the new mill building.

http://www.rns-pdf.londonstockexchange.com/rns/1864S_1-2021-3-14.pdf

Figure 3: Summary schematic of the Kiziltepe processing plant,

showing the areas which have seen additions or substantial

modifications (outlined in red). A notable modification involves

the partial by-pass of the crushing units, specifically the cone

crushers, to allow the SAG mill to operate ahead of input into the

existing ball-mill. An additional liquid oxygen tank is being

installed in tandem with the two additional pre-leach tanks.

Summary of Project

The Kiziltepe gold-silver mine is expected to deliver an average

of approximately 20,000 oz gold equivalent per annum over eight

years of initial mine life, for a total of up to 160,000 oz gold

equivalent based on current resources. The operating company, Zenit

Madencilik San. ve Tic. A.S., is a JV between Ariana (23.5%),

Proccea (23.5%) and Ozaltin (53%). Management control of the JV

lies with Proccea. Commercial production was initiated at Kiziltepe

during July 2017 and has continued without interruption to the

present, with production consistently being delivered above

plan.

The latest resource estimate for Kiziltepe was based on recent

drilling and geological interpretation in April 2020. Detailed

technical and economic assessments are underway on several

satellite vein systems which are not currently in the mining plan,

in anticipation of these being developed in future years. The

Kiziltepe operation is currently targeting a minimum ten-year mine

life (to 2026), which will require the addition of a further 40,000

oz gold equivalent in reserves outside of the four main pits (Arzu

South, Arzu North, Banu and Derya) that are currently scheduled to

be mined. The joint venture is confident that this can be achieved

assuming the conversion of existing resources to reserves.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

John Prior / Hugh Rich / Atholl

Tweedie

Yellow Jersey PR Limited Tel: +44 (0) 7951 402 336

Dom Barretto / Joe Burgess / Henry arianaresources@yellowjerseypr.com

Wilkinson

Editors' Note:

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at July 2020). The

joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 227,000 ounces gold and 0.7 million ounces silver (as at April

2020). The mine has been in profitable production since 2017 and is

expected to produce at a rate of c.20,000 ounces of gold per annum

to at least the mid-2020s. A Net Smelter Return ("NSR") royalty of

2.5% on production is being paid to Franco-Nevada Corporation.

The Tavsan Gold Project is located in western Turkey and

contains a JORC Measured, Indicated and Inferred Resource of

253,000 ounces gold and 3.7 million ounces silver (as at June

2020). The project is being progressed through permitting and an

Environmental Impact Assessment, with the intention of developing

the site to become the second joint venture gold mining operation.

A NSR royalty of up to 2% on future production is payable to

Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Goldfield, which contains the "Hot Gold

Corridor" comprising several significant gold-copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana is also earning-in to 50% of UK-registered Venus Minerals

Ltd ("Venus") and has to date earned into an entitlement to 16%.

Venus is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Inferred Resource of

9.5Mt @ 0.65% copper (excluding additional gold, silver and

zinc).

Panmure Gordon (UK) Limited is broker to the Company and

Beaumont Cornish Limited is the Company's Nominated Adviser and

Broker.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com .

Glossary of Technical Terms:

"Au" chemical symbol for gold;

"g/t" grams per tonne;

"JORC" the Joint Ore Reserves Committee;

"oz" Troy ounces;

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZGMFGDMGMZZ

(END) Dow Jones Newswires

March 15, 2021 03:00 ET (07:00 GMT)

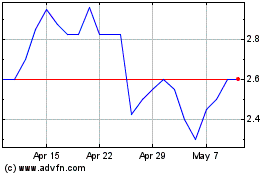

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

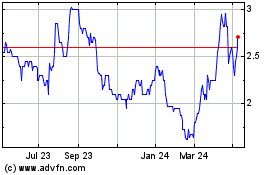

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024