TIDMACRL

RNS Number : 7367Y

Accrol Group Holdings PLC

18 January 2022

18 January 2022

Accrol Group Holdings plc

("Accrol, the "Group" or the "Company")

HALF YEAR RESULTS

Continued progress in a challenging environment

Accrol (AIM: ACRL), the UK's leading independent tissue

converter, announces its unaudited results for the six months ended

31 October 2021 ("H1 22" or the "Period").

Gareth Jenkins, Chief Executive Officer of Accrol, said:

"This has been one of the most challenging periods in the

industry that I have experienced in my 25-year career. Tissue

pricing has reached unprecedented levels, driven by escalating

energy costs (rising as much as 500% for certain suppliers) and

global sea freight charges, combined with increased UK transport

costs, resulting from HGV driver shortages.

"Despite the challenges, the Group is on track to recover the

cost increases that it has absorbed, as a result of these

challenging market dynamics, from its supportive retailer customer

base. Whilst the profitability of the Group will be impacted in the

short-term, due to the time-lag on price increase implementation

(averaging 2-3 months), we expect to exit the year in a strong

position both operationally and commercially.

"Improving market conditions during the period did, however,

result in month-on-month growth throughout H1 22, as shopping

behaviours started to normalise. Q2 revenues were 17% higher than

Q1 and market share was 15.3%, as we entered H2 22. We have also

seen pleasing progress at John Dale, our biodegradable wet wipe

business. The flushable range of products has been well received by

retailers and wet wipe sales were up 33% in the first six months of

ownership. In addition, our new direct to consumer markets,

supplied by our Oceans brand (revenues up c.140% in last six

months, compared to prior six months) and our recently launched

Amazon offering."

Key financials

H1 22 H1 21 Change

Revenue GBP73.7m GBP62.3m 18.3%

Gross margin 24.7% 23.7% 4.2%

Adjusted EBITDA(1) GBP5.0m GBP5.4m -6.7%

Adjusted profit before tax(2) GBP0.7m GBP2.6m (GBP1.9m)

Loss before tax (GBP3.5m) (GBP0.5m) (GBP3.0m)

Adjusted diluted earnings/(loss)

per share 0.2p 0.9p (0.7p)

Diluted (loss) per share (0.8p) (0.2p) (0.6p)

Adjusted net debt(3) GBP21.6m GBP18.1m 19.4%

(1) Adjusted EBITDA is defined as profit before finance costs,

tax, depreciation, amortisation, separately disclosed items

and share based payments

(2) Adjusted profit before tax is defined as loss before tax,

amortisation, separately disclosed items and share based

payments

(3) Adjusted net debt excludes operating type leases recognised

on balance sheet in accordance with IFRS 16

Highlights

-- Revenue growth of 18.3% to GBP73.7m, reflecting the successful scaling and diversification

of the business since the acquisitions of Leicester Tissue Company ("LTC") and John Dale ("JD")

-- Improving trend throughout the Period with Q2 revenues (GBP39.8m) 17% higher than Q1 (GBP33.9m)

-- Gross margins improved versus H1 21, despite raw material cost increases

-- Adjusted EBITDA of GBP5.0m achieved, despite increased operational costs caused by supply

chain issues

-- Significant price increases delivered in the Period with a supportive retail customer base

-- Strong performance from JD with a 33% increase in its biodegradable wet wipe sales in the

first six months of ownership

-- Strong market position maintained, despite a 1% reduction in market size and ongoing impacts

of the pandemic in Q1

-- LTC and JD acquisitions fully integrated and synergies being realised, as anticipated

-- Business continued to operate safely throughout the Period with zero lost time accidents

Current trading and outlook

-- Stronger volume momentum, as the Group entered H2 22

-- Operational improvements on track with the final automation

of the Leyland site to complete by the end of March 2022,

which, alongside the final machine installation, will complete

the major investment into the Group's Tissue business

-- Despite a slower than anticipated recovery from the discount

retailers, many discounters have announced accelerated

store openings over the next 12 months, from which the

Group is well positioned to benefit

-- Following another uplift in energy costs impacting all

parent reel suppliers, a further product price increase

is being implemented. A successful outcome to this process

is supported by Accrol's strong position in a tightening

market for finished tissue products and parent reels.

-- A full strategic review is being initiated to capitalise

on the evident strength of the business' market position,

its balance sheet, and its solvency, underpinned by significant

banking support, to ensure that shareholder value is optimised

-- Group on track to deliver revenue growth of 17% to c.GBP160m

and Adjusted EBITDA of c.GBP9.0m, despite an annualised

increase in costs of c.GBP50m

Dan Wright, Executive Chairman of Accrol, said:

"On 12 January, we issued a trading update as unavoidable

surcharges to parent reel prices, relating to exceptional energy

price increases, were levied on the Company, and this, together

with further inflationary pressure on input costs since the end of

H1 22, will impact growth in the current year.

"To mitigate these further significant cost increases, the Group

is engaged with all its customers to achieve further substantial

price increases, over and above those secured in mid-2021. This is

an ongoing process but the initial response from all our customers

has been very supportive. These price increases will start to

impact from February onwards.

"Despite facing short-term price recovery challenges in H2 22,

the Group continues to strengthen its market position with the

operational foundations in place to enable future growth. The Board

is confident that the strong pricing actions taken in FY22, to

recover unprecedented cost increases, will ensure a strong recovery

of margins and profitability in FY23."

For further information, please contact:

Accrol Group Holdings plc

Dan Wright, Executive Chairman Via Belvedere Communications

Gareth Jenkins, Chief Executive Officer

Richard Newman, Chief Financial Officer

Zeus Capital Limited (Nominated Adviser

& Broker)

Dan Bate / Jordan Warburton Tel: +44 (0) 161 831 1512

Dominic King Tel: +44 (0) 203 829 5000

Liberum Capital Limited (Joint Broker) Tel: +44 (0) 20 3100 2222

Clayton Bush / Edward Thomas

Belvedere Communications Limited

Cat Valentine Tel: +44 (0) 7715 769 078

Keeley Clarke Tel: +44 (0) 7967 816 525

accrolpr@belvederepr.com

Overview of Accrol

Accrol Group Holdings plc is a leading tissue converter and

supplier of toilet tissues, kitchen rolls, facial tissues, and wet

wipes to many of the UK's leading discounters and grocery retailers

across the UK. Following the recent acquisitions of LTC in

Leicester and JD in Flint, North Wales, the Group now operates from

six manufacturing sites, including four in Lancashire, which

generate revenues totalling c.16% of the cGBP2.1bn UK retail tissue

market.

For more information, please visit www.accrol.co.uk .

OPERATIONAL REVIEW

Summary of progress

The Group's progress has continued strongly despite the ongoing

well-reported macro challenges. We have built a UK business with

scale, geographic footprint and innovation, which is able to

continue volume and market share growth. We are well positioned to

benefit from the significant growth expected across our sector with

many of the discount retailers having announced accelerated store

openings over the next 12 months.

Group revenues increased by 18.3% versus H1 21, reflecting the

successful scaling and diversification of the business since the

acquisitions of LTC and JD, with month-on-month growth throughout

the Period and into H2 22. Our market share reduced slightly in the

Period to 15.3% (FY 21: 15.9%), in a market that showed an overall

decline of 1%, reflecting a weaker performance in Q1. Revenues in

Q2 showed a strong recovery, as the impacts of the pandemic started

to fully unwind. Post Period end, our market share has continued to

grow month on month, as revenues continued to increase.

However, much of our hard work and achievement has been

overshadowed by the short-term impact of the significant increases

in raw material costs, UK supply chain costs, as well as global sea

freight charges, which are currently dominating the narrative.

I would like to take this opportunity to thank our employees

across the Group, who have been fantastic, working relentlessly to

meet the challenges presented. Our absence rate has been less than

3%, which is outstanding for our industry, and even more notable

considering the continued high levels of COVID-19 in the areas in

which we operate. I am particularly proud that our lost time

accident rate dropped to zero in the Period and it is thanks to our

team that our service record to our retailer base continues to be

strong, despite the challenging environment.

The challenges

Whilst the Group's supply chain has shown significant resilience

in H1 22, considerable raw material cost increases were absorbed

and shortages managed with the usual 3-month time lag between the

impact of the costs and being able to pass them on to customers. I

am pleased to report that cost increases passed on though price

increases to date amount to over GBP40 million on an annualised

basis.

To better understand what has been happening, it is worth

detailing the events and performance on a quarterly basis.

Q1 22

In Q1, tissue prices began to increase, with the usual 3-month

time horizon, and Accrol was engaging successfully with its

customer base to pass on these additional costs. Over the last 18

months, the Group has put in place indexation agreements with many

customers to enable it to better manage these fluctuations. To help

mitigate the supply chain challenges, the Group actively increased

its raw material and finished goods stock positions to ensure its

supply positions. Logistics bottlenecks in incoming parent reels

and UK transportation had significant impact in the quarter but the

Group's careful management of this ensured service levels to all

customers remained high, albeit with significant related on-costs

to the business.

Q2 22

In Q2, the recovery of the cost increases incurred in Q1

progressed well across all retailers. Further increases of c.20% on

tissue prices were forecast across the industry, with additional

increases across all other raw materials including cartons,

corrugated, plastic wrap, paper wrap and core board. Many of these

cost increases were being driven by significant upward movements in

energy cost, impacting all aspects of the supply chain. The total

cost to the business of the first two tissue price increases was

c.GBP40 million on an annualised basis. Significant recovery of

these increased costs was achieved from retailers, with many price

increases being agreed that would positively impact in Q3 and fully

across Q4, given the usual 3-month time lag. Margins in H1 showed

an improvement on the same period in the prior financial year,

showing the robustness of the business model and the improved

relationships the business has with its customer base.

Q3 22

As the Group entered Q3, accelerating energy costs were

impacting the paper reel supply, which, over a short period of time

(c.5 months) saw energy costs for some suppliers increase by up to

500%, as hedging positions came to a close. Several suppliers in

different regions globally ceased trading. As a percentage of the

overall selling price of paper, energy costs currently comprise as

much as 50% (previously 10%), meaning that without significant

paper price increases the industry was unsustainable. As announced

in the Group's Trading Update on 12 January 2022, these sharp and

rapid (the average time horizon reduced significantly) price rises

in paper costs have materially impacted Accrol in the short term.

As with previous paper price increases, however, these are in the

process of being recovered from customers. A successful outcome to

this process is supported by Accrol's strong position in a

tightening market for finished tissue products and parent

reels.

The Board expects significant margin recovery by the end of Q4

22 and Accrol is expected to enter FY23 with good margins and an

operationally well-placed business to take advantage of the UK

market, which is forecast to grow significantly as the planned new

store openings across many discounters begin to take effect.

Commercial Development

We continue to make good progress to develop our product range

and add new sales channels. The Group has secured an extended sole

supply position with Morrisons for its paper category and increased

its own brands, Magnum and Oceans, into an initial 100 stores. The

Magnum brand is also in Poundland, Wilko, Iceland and other

independents and continues to grow strongly with a current Retail

Sales Value of c.GBP20 million pa.

We have secured our Softy facial tissue brand with Sainsburys,

from February 2022 and other Accrol branded ranges now being

supplied into Unitas, which represents 33,000 independent

retailers.

Oceans, which is the Group's plastic free brand sold direct to

consumers, continues to gain traction, growing 143% in the Period.

It is now available in a retail pack and on Amazon, where all of

Accrol's other branded products are also now available.

The development of wet wipes is making good progress. Further

accreditation has been achieved, including Fine to Flush and BRCGS

(UK Retailers Accreditation), which will help to drive growth

further across all retailers. In addition, the Group has secured

business with Ocado, across all biodegradable wet wipes, and we are

actively cross selling wipes into existing retailers offering a

'one stop shop' for paper products.

CURRENT TRADING AND OUTLOOK

Despite continued supply chain disruption, particularly at ports

around the world and specifically in the UK, the business continues

to manage customer supply well, having secured and maintained

additional stocks in paper and finished goods.

Whilst short-term profitability has been unavoidably impacted by

these significant prices increases, despite having recovered

c.GBP40 million from customer price increases to date, the Group is

confident in its ability to recover the further cost increases,

albeit with an approximately 3-month time lag.

As previously announced, FY22, revenue is now expected to grow

by 17% to c.GBP160m (FY21: GBP136.6m), generating adjusted

EBITDA(1) of c.GBP9.0m (FY21: GBP15.6m) with margin recovery

anticipated in FY23. The Group continues to operate well within its

existing banking covenants and has more than sufficient liquidity

to meet its existing and future needs.

Accrol continues to strengthen its market position with the

operational foundations in place to enable future growth. Volumes

are continuing to strengthen with overall Tissue sales from Q1 to

Q2 rising by 17% - Toilet Tissue up 16%, the newly improved kitchen

towel range up 18%, and facial tissue up 1%, with our newly

acquired JD business growing by 8% and our biodegradable wet wipes

sales up 33%. The Board is confident that the strong pricing

actions, taken to recover unprecedented cost increases, will ensure

a strong recovery of margins and profitability in FY23.

STRATEGIC REVIEW

Notwithstanding the resilient performance of the Group under

exceptional macro pressures, in light of the short-term but

inherent volatility of earnings experienced in the current year, as

announced in the Group's Trading Update on 12 January 2022, the

Board has concluded that it is appropriate for Accrol to conduct a

full strategic review of its business. Such review will be designed

to capitalise on the evident strength of the business' market

position, its balance sheet, and its solvency, underpinned by

significant banking support, to ensure that shareholder value is

optimised, and the Company will provide an update on progress in

due course.

Gareth Jenkins

Chief Executive Officer

FINANCIAL REVIEW

Revenue

Revenue for the Period to 31 October was GBP73.7m (H1 21:

GBP62.3m), an increase of GBP11.4m (18.3%) compared to H1 21,

reflecting the increased scale and diversification of the Group

following the acquisition of LTC in November 2020 and JD in April

2021. Month on month revenues increased steadily during the Period

as volumes strengthened and price increases started to impact.

Gross profit

In line with the wider market, pressures on the Group's raw

material supply chains increased during the Period and, whilst they

have shown significant resilience and supply shortages,

considerable cost increases had to be absorbed in the short

term.

Gross profit as a percentage of revenue at 24.6% (H1 21: 23.7%)

was lower than FY21 exit rates, as higher input costs were only

partially mitigated by pricing increases in the Period, given the

lag in timing of implementation with retail customers.

Adjusted EBITDA

Adjusted EBITDA(1) declined slightly to GBP5.0m (H1 21:

GBP5.4m), reflecting an increase in operating costs driven by

distribution pressures, notably the availability of HGV drivers,

and the increased scale of the operational cost base following the

acquisitions of LTC and JD.

Separately disclosed items

Separately disclosed items totalled GBP0.7m (H1 21: GBP0.6m) of

which GBP0.4m related to incremental costs of supply chain

disruption, particularly at ports and in securing additional

vehicles to ensure continuity of service to our customers. Other

items largely related to operational restructuring measures and

specific COVID-19 related costs within the manufacturing

environment.

Depreciation and amortisation

The total charge for the Period was GBP6.1m (H1 21: GBP3.2m) of

which GBP2.7m (H1 21: GBP1.2m) related to the amortisation of

intangible assets. This increase reflects the Group's acquisitions

of LTC and JD.

Share-based payments

The total charge for the Period under IFRS 2 "Share-based

payments" was GBP0.6m (H1 21: GBP1.3m). This charge related to the

awards made under the 2021 Long Term Incentive Plan, that was

approved on 5 March 2021.

Operating profit and earnings per share

Net finance costs were GBP1.1m (H1 21: GBP0.8m), resulting in a

loss before taxation of GBP3.5m (H1 21: GBP0.5m). Basic losses per

share were 0.8 pence (H1 21: 0.2 pence). Adjusted diluted earnings

per share were 0.2 pence (H1 21: 0.9 pence)

Dividends

A payment of GBP1.6m (equating to 0.5 pence per share) was made

on 30 September 2021, in respect of the final dividend for the year

ended 30 April 2021. No interim dividend will be paid and the

payment of a final dividend for FY22 will be considered by the

Board as part of the Company's strategic review.

Cashflow

The Group's adjusted net debt was GBP21.6m (H1 21: 18.1m). The

net cash flow from operating activities was GBP0.9m (H1 21:

GBP8.7m) with the reduction reflecting a working capital outflow of

GBP3.4m (H1 21: GBP4.0m inflow). This outflow reflected a reduction

in trade payables over the Period, as payments were made for

incremental raw materials stocks that were purchased at the end of

FY21 in order to reduce supply chain risks.

Capital expenditure in the Period was GBP3.4 m (H1 21: GBP6.4m)

including GBP1.2m (H1 21: GBP1.1m) in respect intangible assets

that include IT infrastructure and product development costs. Lease

payments of GBP3.4m (H1 21: GBP2.2m) include leases capitalised in

accordance with IFRS 16. The increase arises as results of the

acquisitions of LTC and JD.

Balance Sheet

The Group's balance sheet reflects the acquisitions of LTC and

JD with net assets increasing to GBP82.7m (H1 21: GBP46.0m). The

increase in intangible assets represent mostly goodwill and

customer relationships arising upon acquisition.

Investment

The final automation of the Leyland site is due to be completed

by the end of March 22, notably on time and to budget. Alongside a

final machine installation, this will complete all major

investments into the Tissue businesses with only c.GBP3m investment

required in existing machinery per year going forward for general

maintenance capital. This will result in the Group having four

state-of-the-art fully automated factories in Blackburn (x2),

Leyland and Leicester operating at significantly lower cost

levels.

The Group has continued to develop its mill plans but, in light

of the current spike in energy costs and building material cost

inflation, investment in a mill will form a part of the strategic

review announced in the Trading Update on 12 January 2022.

Richard Newman

Chief Financial Officer

HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Interim Income Statement

For six months ended 31 October 2021

Unaudited Unaudited Audited

Six months Six months Year

ended 31 ended 31 ended 30

October October April

2021 2020 2021

Continuing operations Note GBP'000 GBP'000 GBP'000

Revenue 4 73,709 62,306 136,594

Cost of sales (55,526) (47,532) (98,710)

---------------------------------- ----- ----------- ----------- ----------

Gross profit 18,183 14,774 37,884

Administration costs (14,480) (10,221) (27,072)

Distribution costs (6,083) (4,262) (11,424)

Group operating (loss)/profit (2,380) 291 (612)

Finance costs 7 (1,198) (918) (2,196)

---------------------------------- ----- ----------- ----------- ----------

Finance income 7 111 124 242

---------------------------------- ----- ----------- ----------- ----------

Loss before taxation (3,467) (503) (2,566)

Tax credit/(charge) 8 795 94 (74)

---------------------------------- ----- ----------- ----------- ----------

Loss for the period attributable

to equity shareholders (2,672) (409) (2,640)

---------------------------------- ----- ----------- ----------- ----------

Loss per share (pence)

Basic 6 (0.8) (0.2) (1.1)

Diluted 6 (0.8) (0.2) (1.1)

---------------------------------- ----- ----------- ----------- ----------

Group Operating (loss)/profit (2,380) 291 (612)

Adjusted for:

Depreciation & Amortisation 6,072 3,176 8,306

Share based payments 638 1,250 3,245

Separately disclosed items 5 675 649 4,705

Adjusted EBITDA 5,005 5,366 15,644

---------------------------------- ----- ----------- ----------- ----------

Consolidated Interim Statement of Comprehensive Income

For six months ended 31 October 2021

Unaudited Unaudited Audited

Six months Six months

ended ended 31 Year

31 October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

Loss for the period attributable

to equity shareholders (2,672) (409) (2,640)

Total comprehensive expense attributable

to equity shareholders (2,672) (409) (2,640)

------------------------------------------ ------------ ----------- ------------

Consolidated Interim Balance Sheet

As at 31 October 2021

Unaudited Unaudited Audited

31 October 31 October 30 April

2021 2020 2021

Note GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and

equipment 65,207 43,131 63,341

Intangible assets 60,408 26,754 61,763

Lease receivables 4,680 5,368 5,027

Deferred tax asset - 895 -

------------------------------- ----- ----------- ----------- ----------

Total non-current assets 130,295 76,148 130,131

------------------------------- ----- ----------- ----------- ----------

Current assets

Inventories 20,787 12,830 23,185

Trade and other receivables 24,487 17,550 26,480

Lease receivables 689 662 675

Derivative financial

instruments - 203 -

Cash and cash equivalents 3,074 5,791 7,604

------------------------------- ----- ----------- ----------- ----------

Total current assets 49,037 37,036 57,944

------------------------------- ----- ----------- ----------- ----------

Total assets 179,332 113,184 188,075

------------------------------- ----- ----------- ----------- ----------

Current liabilities

Borrowings 9 (17,488) (14,102) (12,349)

Trade and other payables (39,593) (28,531) (47,031)

Derivative financial

instruments (2) - (120)

Income taxes - - (300)

Provisions 10 (7,327) (368) (7,321)

Total current liabilities (64,410) (43,001) (67,121)

------------------------------- ----- ----------- ----------- ----------

Total assets less current

liabilities 114,922 70,183 120,954

------------------------------- ----- ----------- ----------- ----------

Non-current liabilities

Borrowings 9 (29,310) (24,024) (30,851)

Deferred tax liabilities (2,886) - (3,666)

Provisions 10 - (186) -

Total non-current liabilities (32,196) (24,210) (34,517)

------------------------------- ----- ----------- ----------- ----------

Total liabilities (96,606) (67,211) (101,638)

------------------------------- ----- ----------- ----------- ----------

Net assets 82,726 45,973 86,437

------------------------------- ----- ----------- ----------- ----------

Capital and reserves

Share capital 319 195 311

Share premium 108,782 68,015 108,782

Capital redemption reserve 27 27 27

Retained earnings (26,402) (22,264) (22,683)

Total equity shareholders' funds 82,726 45,973 86,437

-------------------------------------- ----------- ----------- ----------

Consolidated Interim Statement of Changes in Equity

For six months ended 31 October 2021

Capital Retained

Share Share redemption earnings/

capital premium reserve (deficit) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 April 2021

(audited) 311 108,782 27 (22,683) 86,437

Comprehensive income

Loss for the period - - - (2,672) (2,672)

Total comprehensive expense - - - (2,672) (2,672)

-------------------------------- ---------- ---------- ------------ ----------- --------

Transactions with owners

recognised directly in

equity

---------- ---------- ------------ -----------

Proceeds from shares

issued 8 - - - 8

Share-based payment (inc.

tax) - - - (1,047) (1,047)

Total transactions recognised

directly in equity 8 - - (1,047) (1,039)

-------------------------------- ---------- ---------- ------------ ----------- --------

Balance at 31 October

2021 (unaudited) 319 108,782 27 (26,402) 82,726

-------------------------------- ---------- ---------- ------------ ----------- --------

Consolidated Interim Cash Flow Statement

For six months ended 31 October 2021

Unaudited Unaudited Audited

Six months Six months Year

ended 31 ended 31 ended

October October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating (loss)/profit (2,380) 291 (612)

Adjustment for:

Depreciation 3,401 1,940 4,786

Amortisation of intangible

assets 2,671 1,236 3,520

Share based payments 638 1,250 3,245

----------------------------------------- ------------ ------------ ----------

Operating cash flows before movements

in working capital 4,330 4,717 10,939

Decrease/(increase) in inventories 2,398 (3,457) (8,553)

Decrease in trade and other

receivables 1,994 3,130 604

(Decrease)/increase in trade

and other payables (7,688) 4,467 14,800

Increase/(decrease) in provisions 6 13 (418)

(Increase)/decrease in derivatives (118) (175) 148

----------------------------------------- ------------ ------------ ----------

Cash generated from operations 922 8,695 17,520

Tax received 15 40 40

----------------------------------------- ------------ ------------ ----------

Net cash flows from operating

activities 937 8,735 17,560

----------------------------------------- ------------ ------------ ----------

Cash flows from investing

activities

Purchase of property, plant

and equipment (2,300) (5,331) (9,112)

Purchase of intangible assets (1,222) (1,114) (1,702)

Acquisition of subsidiaries

net of cash acquired - - (32,235)

Receipt of capital element

of leases 334 321 650

Lease interest received 111 124 242

Net cash flows used in investing

activities (3,077) (6,000) (42,157)

----------------------------------------- ------------ ------------ ----------

Cash flows from financing

activities

Proceeds of issue of ordinary

shares 8 - 42,610

Cost of raising equity - - (1,727)

Amounts received from factors 76,284 69,995 151,645

Amounts paid to factors (74,391) (75,221) (161,489)

New finance leases 1,940 131 1,694

Repayment of capital element

of leases (3,404) (2,241) (5,764)

Advance/(repayment) of bank

loans - 3,266 (997)

Transaction costs of bank

facility - (306) (413)

Dividends paid (1,594) - -

Interest paid (1,233) (715) (1,505)

----------------------------------------- ------------ ------------ ----------

Net cash flows used in financing

activities (2,390) (5,091) 24,054

---------------------------------------- ------------ ------------ ----------

Net decrease in cash and

cash equivalents (4,530) (2,356) (543)

Cash and cash equivalents at

beginning of the period 7,604 8,147 8,147

---------------------------------------- ------------ ------------ ----------

Cash and cash equivalents

at period end 3,074 5,791 7,604

----------------------------------------- ------------ ------------ ----------

The notes below form part of these condensed interim financial

statements.

Notes to the Interim Financial Statements

For six months ended 31 October 2021

1. General Information

Accrol Group Holdings plc (the "Company") and its subsidiaries

(together "the Group") is incorporated in the United Kingdom with

company number 09019496.

The registered address of the Company is the Delta Building,

Roman Road, Blackburn, United Kingdom, BB1 2LD.

The Company's shares are quoted on the Alternative Investment

Market.

The principal activity of the Company and its subsidiaries

(together the 'Group') is soft paper tissue conversion.

The condensed consolidated interim financial information was

approved and authorised for issue by a duly appointed and

authorised committee of the Board of Directors on 18 January

2022.

This condensed interim financial information has not been

audited or reviewed by the Company's auditor.

Forward looking statements

Certain statements in this results announcement are forward

looking. The terms "expect", "anticipate", "should be", "will be"

and similar expressions identify forward-looking statements.

Although the Board of Directors believes that the expectations

reflected in these forward-looking statements are reasonable, such

statements are subject to a number of risks and uncertainties and

events could differ materially from these expressed or implied by

these forward-looking statements.

2. Basis of preparation

This condensed consolidated interim financial information for

the six months ended 31 October 2021 should be read in conjunction

with the Group's Annual Report and Accounts for the year ended 30

April 2021, prepared and approved by the Directors in accordance

with International Financial Reporting Standards as adopted by the

EU ('Adopted IFRSs'), IFRIC Interpretations and the Companies Act

2006.

The interim financial statements included in this report are not

audited and do not constitute statutory accounts within the meaning

of the Companies Act 2006. The Annual Report and accounts for the

year ended 30 April 2021 have been filed with Companies House. The

Group's auditor, BDO LLP have reported on those accounts and their

report was unqualified.

The interim financial statements have been prepared on a going

concern basis and on the historical cost convention modified for

the revaluation of certain financial instruments.

In assessing the Group's ability to continue as a going concern,

the Board has reviewed the Group's cash flow and profit forecasts.

The impact of potential risks and related sensitivities to the

forecasts were considered, whilst assessing the available

mitigating actions.

The Group's performance is dependent on a number of market and

macroeconomic factors particularly the sensitivity to the price of

parent reels and the sterling/USD exchange rate which are

inherently difficult to predict. The Group continues to monitor the

impact of the COVID-19 pandemic on performance along with the

ongoing disruption of the supply chain, particularly at ports,

exacerbated by the national shortage of haulage drivers.

The Board has formed a judgement that there is reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

the going concern basis has been adopted in preparing the interim

financial statements.

3. Accounting Policies

The accounting policies applied in preparing the unaudited

interim financial statements are consistent with those used in

preparing the statutory financial statements for the year ended 30

April 2021 as set out in the Group's Annual Report and

Accounts.

4. Revenue

The Group has one type of revenue and class of business.

The analysis of geographical area of destination of the Group's

revenue is set out below:

Unaudited Unaudited Audited

Six months Six months

ended 31 ended 31 Year

October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

United Kingdom 71,855 57,874 127,107

Europe 1,854 4,432 9,487

---------------- ----------- ----------- ------------

Total 73,709 62,306 136,594

---------------- ----------- ----------- ------------

5. Separately disclosed items

Unaudited Unaudited Audited

Six months Six months

ended 31 ended 31 Year

October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

Acquisition professional fees - - 2,150

Acquisition integration costs - - 724

--------------------------------- ----------- ----------- ------------

Acquisition related items - - 2,874

--------------------------------- ----------- ----------- ------------

Operational restructure 145 327 ,1,034

COVID-19 costs 43 245 670

Set up & exit costs relating to

Skelmersdale warehouse 5 6 12

FCA investigation legal costs - - 22

Supply chain disruption 430 - -

Other 52 71 93

--------------------------------- ----------- ----------- ------------

Other items 675 649 1,831

---------------------------------

Total 675 649 4,705

--------------------------------- ----------- ----------- ------------

Operational restructure costs - GBP145,000 (31 October 2020:

GBP327,000)

Salary and settlement costs due to the reorganising and

restructuring of its operations to improve the long-term

profitability and efficiencies .

COVID-19 - GBP43,000 (31 October 2020: GBP245,000)

The Group incurred incremental costs principally relating to

overtime and temporary labour, to cover employees who were in

isolation during this period. There were additional costs for COVID

safety representatives and also PPE/cleaning costs.

Supply chain disruption - GBP430,000 (31 October 2020:

GBPnil)

The Group has incurred additional costs due to ongoing

disruption of the supply chain, particularly at ports, exacerbated

by the national shortage of haulage drivers.

6. Loss per share

The basic loss per share is calculated by dividing the loss

attributable to ordinary equity holders of the parent by the

weighted average number of ordinary shares outstanding during the

period.

Diluted loss per share is calculated by dividing the loss above

by the weighted average number of shares in issue during the year,

adjusted for potentially dilutive shares.

Unaudited Unaudited Audited

Six months Six months

ended 31 ended 31 Year

October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

Loss for the period attributable

to equity shareholders (2,672) (409) (2,640)

Number Number Number

'000 '000 '000

Issued ordinary shares at beginning

of period 311,355 195,247 195,247

Effect of shares issued in the

period 4,088 - 51,214

----------- ----------- ------------

Basic weighted average number of

shares at end of period 315,443 195,247 246,461

Effect of conversion of Accrol

Group Holdings plc share options - - -

Diluted weighted average number

of shares at end of period 315,443 195,247 246,461

Basic loss per share (pence) (0.8) (0.2) (1.1)

Diluted loss per share (pence) (0.8) (0.2) (1.1)

For the periods above, no adjustment has been made to the

weighted average number of shares for the purpose of the diluted

loss per share calculation as the effect would be

anti-dilutive.

7. Finance costs

Unaudited Unaudited Audited

Six months Six months

ended 31 ended 31 Year

October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

Bank loans and overdrafts 375 402 661

Finance lease interest 521 313 844

Amortisation of finance fees 106 196 438

Unwind of discount on provisions 196 7 253

Total finance costs 1,198 918 2,196

---------------------------------- ----------- ----------- ------------

Lease interest income 111 124 242

Total finance income 111 124 242

----------------------- ---- ---- ---------

Net finance costs 1,087 794 1,954

-------------------- ------ ---- -----------

8. Taxation

The taxation credit recognised is based on management's best

estimate of the weighted average annual tax rate expected for the

full financial year.

The tax credit for the period has been calculated at an

effective rate of 22.9% (half year ended 31 October 2020: 18.6%;

year ended 30 April 2021: 19%).

9. Borrowings

Unaudited Unaudited Audited

31 October 31 October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

Current

Bank facility 1,854 2,949 1,821

Factoring facility 5,869 6,591 3,975

Leases 9,765 4,562 6,553

------------------------------------- --------------- ----------- ------------

Total current 17,488 14,102 12,349

------------------------------------- --------------- ----------- ------------

Non-current

Bank facility 9,880 11,810 9,807

Leases 19,430 12,214 21,044

------------------------------------- --------------- ----------- ------------

Total non-current 29,310 24,024 30,851

------------------------------------- --------------- ----------- ------------

Total current & non-current 46,798 38,126 43,200

------------------------------------- --------------- ----------- ------------

31 October 31 October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

Total borrowings (excluding finance

fees) 47,064 38,633 43,572

Less: lease receivables (5,369) (6,030) (5,702)

Less: cash and cash equivalents (3,074) (5,791) (7,604)

Net debt 38,621 26,812 30,266

------------------------------------- --------------- ----------- ------------

Less: leases recognised on adoption

of IFRS16 (17,008) (8,709) (15,628)

Adjusted net debt (excl leases recognised

on adoption of IFRS16) 21,613 18,103 14,638

------------------------------------------- --------- -------- ------------

10. Provisions

Unaudited Unaudited Audited

31 October 31 October 30 April

2021 2020 2021 Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Onerous contracts 172 554 358 172 -

Contingent consideration 6,800 - 6,608 6,800 -

Other 355 - 355 355 -

Total provisions 7,327 554 7,321 7,327 -

-------------------------- ----------- ----------- ----------- ----------- ------------

The onerous contract provision of GBP172,000 relates to a

logistics agreement resulting from the decision to exit from the

Skelmersdale facility.

Other provisions of GBP355,000 arose on the Group's acquisition

of Leicester Tissue Company and John Dale, relating to dilapidation

and other compliance provisions.

The contingent consideration relates to the acquisition of

Leicester Tissue Company.

11. Dividends

On 30 September 2021, the Company paid a final dividend of 0.5p

per share for the year ended 30 April 2021, totalling

GBP1,594,000.

12. Non-GAAP measures

Adjusted profit before tax

Unaudited Unaudited Audited

Six months Six months

ended 31 ended 31 Year

October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

Reported (loss) before tax (3,467) (503) (2,566)

Adjustment for:

Amortisation 2,671 1,236 3,520

Separately disclosed items 675 649 4,705

Share based payment 638 1,250 3,245

Discount unwind on contingent consideration 192 - 239

--------------------------------------------- ----------- ----------- ------------

Adjusted profit before tax 709 2,632 9,143

--------------------------------------------- ----------- ----------- ------------

Adjusted earnings per share

The adjusted earnings per share is calculated by dividing the

adjusted earnings attributable to ordinary equity holder of the

parent by the weighted average number of ordinary shares

outstanding during the year. The following reflects the income and

share data used in the adjusted earnings per share calculation.

Unaudited Unaudited Audited

Six months Six months

ended 31 ended 31 Year

October October ended 30

2021 2020 April 2021

GBP'000 GBP'000 GBP'000

Earnings attributable to shareholders (2,672) (409) (2,640)

Adjustment for:

Amortisation 2,671 1,236 3,520

Separately disclosed items 675 649 4,705

Share based payment 638 1,250 3,245

Discount unwind on contingent consideration 192 - 239

Tax effect of adjustments above (961) (596) (2,225)

--------------------------------------------- ----------- ----------- ------------

Adjusted earnings attributable

to shareholders 543 2,130 6,844

--------------------------------------------- ----------- ----------- ------------

Number Number Number

GBP'000 GBP'000 GBP'000

Basic weighted average number of

shares 315,443 195,247 246,461

Dilutive share options 3,152 30,463 10,675

Diluted weighted average number

of shares 318,595 225,710 257,136

pence pence pence

Adjusted earnings per share 0.2 1.1 2.7

Diluted adjusted earnings per share 0.2 0.9 2.6

For the periods above, no adjustment has been made to the

weighted average number of shares for the purpose of the diluted

earnings per share calculation as the effect would be

anti-dilutive.

13. Events after the balance sheet date

There are no subsequent events after the reporting date which

require disclosure other than those already announced in the

trading update of 12(th) January 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KDLFFLFLBBBZ

(END) Dow Jones Newswires

January 18, 2022 02:00 ET (07:00 GMT)

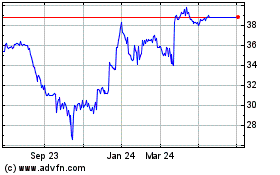

Accrol (LSE:ACRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accrol (LSE:ACRL)

Historical Stock Chart

From Apr 2023 to Apr 2024