TIDMAEO

RNS Number : 9886F

Aeorema Communications Plc

25 March 2022

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

Aeorema Communications plc / Index: AIM / Epic: AEO / Sector:

Media

25 March 2022

Aeorema Communications plc ('Aeorema' or 'the Company' or 'the

Group')

Interim Results

Aeorema Communications plc, the AIM-traded live events agency,

announces its unaudited results for the six months ended 31

December 2021.

Highlights

- Record revenue of GBP4,909,742 (H1 2020: GBP1,677,311)

- First profitable interim period for a number of years with

profit before taxation of GBP255,677 (H1 2020: loss GBP287,676)

- Benefitting significantly from a strong performance from US

office which continues to grow, deliver profits and has recently

onboarded 3 new clients.

- Virtual online conferences and events have experienced high

levels of demand, and the provision of consultancy services has

further enhanced performance for the period

- Maintained a robust cash position of GBP1,534,217 (31 December 2020: GBP1,342,548)

- Confident of continued delivery for remainder of financial year

Chairman's Statement

The six months ended 31 December 2021 has been a significant

period of growth for the Group and one which has seen us generate

record revenue and return to profitability, an endorsement of our

ability to meet our clients' continuously evolving needs. The pivot

to virtual and hybrid events over the last two years has been a

true success and the team has repeatedly risen to any challenge and

exceeded expectations with our results for the period a clear

demonstration of this.

During the period under review, we have received an

unprecedented demand for our bespoke services from a wide range of

blue-chip clients across a number of industries. Alongside our

existing offering, the strategic shift into providing consultancy

services to engage with clients at an advisory level on their

communication strategies has proved successful, utilising our

team's combined expertise in events and communications. This

division is seeing burgeoning demand and is performing well.

One of our biggest achievements has been opening our US office

in New York (opened in September 2020), which has seen significant

growth in the period; a strategic decision and demonstration of our

dedication to our US-based clients and potential international

clients. Our US office has seen strong performance and continues to

win new US-based clients to complement our existing client

portfolio. Indeed, the US business is confident of further strong

growth in the 18 months ahead and, with flights returning to

pre-pandemic levels, the UK team will be able to support more as

and when is needed.

The move to virtual events remains a popular choice for

companies, however live events are starting to return. Having

spoken with a number of clients, there is still an interest for

live events as there is no substitute for personal contact. There

is an expectation that popular events, in person, will go ahead

this year and this includes Cannes Lions which has been confirmed

to take place - an event which has traditionally been a success for

Aeorema. With live events on the rise, the team is focused and

prepared for when B2B events shift back to being predominantly

in-person.

Venue sourcing and luxury events division, Eventful, which was

acquired in March 2020 and was inevitably impacted by the

restrictions over the last 24 months, is well placed to return to

profitability over the next year. Despite the quiet period for the

company, it has maintained its relationships with existing clients

and has been introduced to new clients, whilst its cross-selling

opportunities continue to succeed. The upcoming year is due to see

Eventful make a strong comeback as the core business remains in

good shape and it has a healthy pipeline in place.

We ended the calendar year on a high note with a strong outlook

for the second half of the financial year having experienced the

best interim period on record with revenue of GBP4,909,742 and

profit before tax of GBP255,677. These results represent the first

profitable interim period in a number of years for the Company due

to the sustained high levels of demand for virtual events, coupled

with our consultancy services offering which further enhanced

performance.

Aeorema has shown that it can operate profitably across the

virtual, hybrid and live events space and that it is able to

successfully adapt to the ever-changing communication needs of

retained and potential clients. I am confident we will continue

this upward momentum for the remainder of 2022.

I would once again like to take the opportunity to thank our

dedicated team and shareholders for their ongoing support and I

look forward to what the next six months will bring for us.

M Hale

Chairman

25 March 2022

*S*

For further information visit www.aeorema.com or contact:

Aeorema Communications

Mike Hale plc +44 (0)20 7291 0444

John Depasquale /

Liz Kirchner (Corporate

Finance) Allenby Capital

Kelly Gardiner (Sales Limited (Nominated

and Corporate Broking) Adviser and Broker) +44 (0)20 3328 5656

Catherine Leftley/ St Brides Partners info@stbridespartners.co.uk

Selina Lovell Ltd (Financial PR)

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the period ended 31 December 2021

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2021 2020 2021

Notes GBP GBP GBP

Continuing Operations

Revenue 4,909,742 1,677,311 5,094,518

Cost of sales (3,734,995) (1,337,873) (3,912,376)

Gross profit 1,174,747 339,438 1,182,142

Other income 3,743 49,616 61,651

Administrative expenses (919,366) (666,985) (1,431,898)

Operating profit / (loss)

pre-exceptional items 259,124 (277,931) (188,105)

Exceptional items - - 50,000

Operating profit / (loss)

post exceptional items 259,124 (277,931) (138,105)

---------------- ---------------- ------------

Finance income 109 539 489

Finance costs (3,556) (10,284) (22,082)

Profit / (loss) before taxation 255,677 (287,676) (159,698)

Taxation 4 48,105 40,100 (5,228)

Profit / (loss) for the period

from continuing operations 303,782 (247,576) (164,926)

Other comprehensive income

Items that may be reclassified

to profit or loss

Exchange differences on translation

of foreign entities 11,552 (7,479) (11,044)

Other comprehensive income

for the period 11,552 (7,479) (11,044)

Total comprehensive income

for the period 315,334 (255,055) (175,970)

================ ================ ============

Basic and diluted earnings

per share from continuing

operations

Basic (pence) 5 3.28840 (2.67997) (1.78529)

Diluted (pence) 5 2.72255 (2.67997) (1.78529)

================ ================ ============

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the period ended 31 December 2021

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2021 2020 2021

restated

GBP GBP GBP

Non-current assets

Intangible assets 570,182 572,682 571,431

Property, plant and equipment 121,138 76,832 103,477

Right-to-use assets - 333,983 18,995

Deferred taxation 182,179 47,710 -

873,499 1,031,207 693,903

Current assets

Trade and other receivables 2,337,399 1,007,548 1,429,064

Cash and cash equivalents 1,534,217 1,342,548 1,101,713

Current tax receivable 36,942 - 10,758

---------------- ---------------- ----------

3,908,558 2,350,096 2,541,535

Total assets 4,782,057 3,381,303 3,235,438

Current liabilities

Trade and other payables 2,514,347 1,338,500 1,417,467

Lease liabilities - 87,219 25,912

Bank loans 83,334 13,889 54,089

Current tax payable 136,132 3,711 -

Provisions 25,020 - 25,020

---------------- ---------------- ----------

2,758,833 1,443,319 1,522,488

Non-current liabilities

Lease liabilities - 256,538 -

Bank loans 152,778 236,112 195,911

Provisions - 25,020 -

Deferred taxation - - 2,059

---------------- ---------------- ----------

152,778 517,670 197,970

Total liabilities 2,911,611 1,960,989 1,720,458

Net assets 1,870,446 1,420,314 1,514,980

================ ================ ==========

Equity attributable to equity

holder:

Share capital 1,154,750 1,154,750 1,154,750

Share premium 9,876 9,876 9,876

Merger reserve 16,650 16,650 16,650

Other reserve 152,193 96,480 112,061

Capital contribution reserve 257,812 257,812 257,812

Retained earnings 279,165 (115,254) (36,169)

Total equity 1,870,446 1,420,314 1,514,980

================ ================ ==========

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 31 December 2021

Share capital Share Merger Other Capital Retained Total

premium reserve reserve contribution earnings equity

reserve

restated restated

GBP GBP GBP GBP GBP GBP GBP

At 1 July 2020 1,154,750 9,876 16,650 81,358 257,812 139,801 1,660,247

Comprehensive

income for the

period - - - - - (255,055) (255,055)

Share-based

payments - - - 15,122 - - 15,122

At 31 December

2020 1,154,750 9,876 16,650 96,480 257,812 (115,254) 1,420,314

At 1 January

2021 1,154,750 9,876 16,650 96,480 257,812 (115,254) 1,420,314

Comprehensive

income for the

period - - - - - 79,085 79,085

Share-based

payments - - - 15,581 - - 15,581

At 30 June 2021 1,154,750 9,876 16,650 112,061 257,812 (36,169) 1,514,980

At 1 July 2021 1,154,750 9,876 16,650 112,061 257,812 (36,169) 1,514,980

Comprehensive

income for the

period - - - - - 315,334 315,334

Share-based

payments - - - 40,132 - - 40,132

At 31 December

2021 1,154,750 9,876 16,650 152,193 257,812 279,165 1,870,446

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 31 December 2021

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2021 2020 2021

GBP GBP GBP

Cash flow from operating activities

(Loss) / profit before taxation 255,677 (287,676) (159,698)

Adjustments for:

Depreciation of property, plant

and equipment 24,586 18,209 40,885

Depreciation of right-of-use assets 18,995 45,546 91,092

Amortisation of intangible fixed

assets 1,250 1,250 2,500

Loss on disposal of fixed assets 2,096 769 769

Share-based payment 40,132 15,122 30,703

Interest on lease liabilities - 8,996 16,932

Finance income (109) (539) (489)

Exchange rate differences on translation 11,552 (7,479) (11,044)

Revaluation of right-to-use asset - - (5,311)

---------------- ---------------- ----------

Operating cash flow before movement

in working capital 354,179 (205,802) 6,339

Increase/(decrease) in trade and

other payables 1,096,880 112,278 191,244

(Increase)/decrease in trade and

other receivables (908,336) (410,049) (831,592)

Cash (used in) / generated from

operating activities 542,723 (503,573) (634,009)

Taxation paid (26,185) (64,779) (74,805)

Cash flow from investing activities

Finance income 109 539 489

Purchase of property, plant and

equipment (44,343) (9,856) (59,179)

Disposal of property, plant and - - -

equipment

Repayment of leasing liabilities (25,912) (51,000) (102,000)

Net cash used in investing activities (70,146) (60,317) (160,690)

Cash flow from financing activities

Bank loans - 250,000 250,000

Repayment of bank loans (13,888) - -

---------------- ---------------- ----------

Net cash used in financing activities (13,888) 250,000 250,000

Net increase / (decrease) in cash

and cash equivalents 432,504 (378,669) (619,504)

---------------- ---------------- ----------

Cash and cash equivalents at beginning

of period 1,101,713 1,721,217 1,721,217

Cash and cash equivalents at end

of period 1,534,217 1,342,548 1,101,713

================ ================ ==========

AEOREMA COMMUNICATIONS PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 31 December 2021

1. General information

Aeorema Communications plc is a public limited company

incorporated within the United Kingdom. The company is domiciled in

the United Kingdom and its principal place of business is 23-31

Great Titchfield Street, London, W1W 7PA. The Company's ordinary

shares are traded on the AIM market of the London Stock

Exchange.

These condensed consolidated interim financial statements for

the period ended 31 December 2021 (including comparatives for the

periods ended 31 December 2020 and 30 June 2021) were approved by

the board of directors on 25 March 2022.

The financial information set out in this interim report does

not constitute statutory accounts for the purposes of section 434

of the Companies Act (2006). The Group's statutory financial

statements for the year ended 30 June 2021, prepared under

International Financial Reporting Standards (IFRS), have been filed

with the Registrar of Companies. The auditor's report for those

financial statements was unqualified and did not contain a

statement under section 498 (2) or section 498 (3) of the Companies

Act (2006).

The interim financial statements have been prepared using the

accounting policies set out in the Group's 2021 statutory accounts

and have not been audited.

Copies of the annual statutory financial statements and the

interim report can be found on our website at www.aeorema.com or

can be requested from the Company Secretary at the Company's

registered office: 64 New Cavendish Street, London, W1G 8TB.

2. Basis of preparation

These condensed consolidated interim financial statements for

the period ended 31 December 2021 have been prepared in accordance

with IAS 34, 'Interim Financial Reporting' as adopted by the

European Union. The interim condensed consolidated financial

statements should be read in conjunction with the annual financial

statements for the year ended 30 June 2021, which have been

prepared in accordance with IFRS as adopted by the European

Union

3. Revenue and segmental results

The Company uses several factors in identifying and analysing

reportable segments, including the basis of organisation such as

differences in products and geographical areas. The Board of

Directors, being the chief operating decision makers, has

determined that for the period ended 31 December 2021 there is only

one reportable operating segment.

4. Income tax charge

Income period tax is accrued based on the estimated average

annual effective income tax rate of 19 per cent (2020: 19 per

cent).

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Diluted earnings per share are calculated by dividing the profit

attributable to ordinary owners of the parent by the weighted

average number of ordinary shares outstanding during the year plus

the weighted average number of ordinary shares that would have been

issued on the conversion of all dilutive potential ordinary shares

into ordinary shares.

The following reflects the income and share data used and

dilutive earnings per share computations:

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 31 December to 31 December 30 June

2021 2020 2021

Profit / (loss) for the GBP303,782 GBP(247,576) GBP(164,926)

year attributable to owners

of the Company

Number of shares

Basic weighted average number

of shares 9,238,000 9,238,000 9,238,000

Effect of dilutive share

options 1,920,000 1,020,000 1,920,000

Diluted weighted average

number of shares 11,158,000 10,258,000 11,158,000

6. Dividends

During the interim period no dividend (2020: nil) was declared

to holders of the Company's ordinary shares in respect of the full

year ended 30 June 2021.

Related party transactions

The Group has a related party relationship with its subsidiaries

and its directors. Transactions between Group companies, which are

related parties, have been eliminated on consolidation and are

therefore not included in these consolidated interim financial

statements.

Unaudited Unaudited

6 months 6 months

to 31 December to 31 December

2021 2020

GBP GBP

Subsidiaries

Amounts owed by/(to) subsidiaries 397,759 504,694

---------------- ----------------

Amounts owed by/(to) subsidiaries 397,759 504,694

Harris & Trotter LLP is a firm in which S Haffner is a

member. The following was charged to the Group in respect of

professional services.

Unaudited Unaudited

6 Months 6 Months

to 31 December to 31 December

2021 2020

Harris & Trotter LLP GBP GBP

Aeorema Communications plc 7,500 7,500

Aeorema Limited 5,750 10,450

---------------- ----------------

13,250 17,950

Fees charged to Aeorema Communications plc include GBP7,500

(2020: GBP7,500) for the services of S Haffner as a non-executive

director of that company.

The compensation of key management (including directors) of the

Group is as follows:

Unaudited Unaudited

6 Months 6 Months

to 31 December to 31 December

2021 2020

GBP GBP

Short-term employee benefits 162,933 140,500

Post-employment benefits 7,496 2,992

170,429 143,492

During the previous period S Quah received an interest-free loan

of GBP10,000. At 31 December 2021 GBP10,000 (2020: GBP10,000) was

outstanding.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKPBBKBKKANB

(END) Dow Jones Newswires

March 25, 2022 03:00 ET (07:00 GMT)

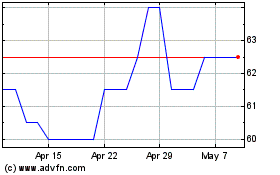

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024