TIDMANIC

RNS Number : 6797Y

Agronomics Limited

08 September 2022

8(th) September 2022

Agronomics Limited

("Agronomics" or the "Company")

Portfolio Company Bond Pet Foods Completes Series A Financing to

Scale Nutritionally Complete Meat Proteins

Agronomics (AIM:ANIC), the leading listed company focused on the

field of cellular agriculture, is pleased to announce that

portfolio company Bond Pet Foods, Inc ("Bond Pet Foods"), engaged

in the production of meat proteins through precision fermentation

for pet food applications, has completed its Series A financing

round, raising US$ 17.5 million.

Agronomics invested in Bond Pet Foods in September 2019, with a

US$ 15 0k investment in the form of a convertible promissory note

("CPN"). The CPN has now converted into 531,692 Series A Preferred

Shares, representing an equity ownership of 1.85%. Subject to

audit, Agronomics will now carry this position at a book value of

US$ 933k, representing an unrealised gain on cost of US$ 783k. This

provides a multiple on invested capital (MOIC) of 6.22 and an

internal rate of return (IRR) of 84% on the initial investment.

The full announcement is set out below without any material

changes:

Bond Pet Foods Closes $17.5MM in Series A Funding to Scale

Nutritionally Complete Meat Proteins Produced Through Precision

Fermentation

Company breaks ground on new 15,000 sq. ft. facility

BOULDER, Colo., September 8, 2022 -- Bond Pet Foods , the

Boulder-based company creating meat proteins through fermentation

for pet food applications, announced today that it has completed

its Series A fundraise totaling $17.5 million.

The oversubscribed round includes investment from global food

and agriculture pioneers ADM Ventures (Archer Daniels Midland

Company) and Cavallo Ventures (Wilbur Ellis); institutional funds

Genoa Ventures and Lever VC; food/tech and sustainability investors

Thia Ventures, iSelect Fund, Stage 1 Fund, Lifely VC and Satori

Capital, as well as music icons Sia Isabelle Furler and Joan

Jett.

The funding will be used to expand Bond's meat protein portfolio

and scale up production at a new 15,000 square foot facility in

central Boulder. The Series A will also allow Bond to more than

triple the size of its team, strengthening its science, technical

and regulatory competency.

"We're excited to be a part of this next chapter of Bond Pet

Foods' growth," said Jorge Martinez, President, Pet Solutions for

ADM. "Pet nutrition, with industry sales at $100 billion and

growing at 4.5% a year, is an important growth pillar for ADM. More

and more, consumers demand their pets eat the same sustainable,

responsibly - produced food that they themselves eat, and proteins

produced by precision fermentation are key to being part of the

future of the industry. We've expanded our capabilities in these

categories and are proud to be part of the Bond Pet Foods journey,

as they offer new opportunities to bring these growth trends

together."

Bond Pet Foods was founded in 2017 with a mission to create more

sustainable, responsible, and humane food by reimagining meat, the

mainstay of our pets' diets. Dogs and cats are voracious consumers

of animal proteins. However, studies show that the production of

meat and meat by-products for their consumption has an oversized

impact on the environment: if America's 163 million dogs and cats

were their own country, their consumption of meat products would

rank fifth in the world, and up to 30% of meat production's

negative effects (land, water, energy use) can be attributed to

satiating this demand.

Bond is solving for this by employing precision fermentation to

produce nutritionally complete, nature-identical chicken, beef,

fish and other meat proteins for pet food applications. Bond's

production process is safe and established, similar to that

routinely used to make common food ingredients such as lactic acid,

vitamin B12 and enzymes for cheese production- no animal farming

required.

"The company's recent achievements on strain development and

cost, as well as their expanding relationships with global

strategic partners, have validated Bond's technology platform and

their ability to usher in a new era of responsible protein for our

pets," said Jenny Rooke, Managing Director of Genoa Ventures.

"We're bullish about Bond's approach and their potential to change

the pet food supply chain for the better."

"We're thrilled to welcome this diverse, world-class coalition

of investors into the Bond family," added Rich Kelleman, CEO and

Co-Founder of Bond Pet Foods. "With their support we'll be able to

take our work to the next level, developing and scaling a variety

of meat proteins for our valued partners in the pet food

space."

Prior to this Series A round, Bond raised $2.5MM from investors

including Lever VC, Agronomics, KBW Ventures, Plug and Play

Ventures and Trellis Road, bringing its total funding to-date to

$20MM. In November of last year Bond also announced an

industry-first partnership with Hill's Pet Nutrition, to develop a

craft meat protein for its product portfolio.

ABOUT BOND PET FOODS

Bond Pet Foods is a Boulder, Colorado-based company using

biotechnology to create meat proteins that are nutritionally

comparable to their conventional counterparts but without all the

bad stuff- so people, pets, farm animals and the planet all win.

Using some of the same processes that are employed in craft

brewing, Bond produces high-quality animal proteins through

fermentation, harvests them to better meet the nutritional

requirements of companion animals, and supplies the ingredients to

manufacturers for pet food, treat and supplement applications.

For more information on Bond's technology and team visit

bondpets.com or follow @bondpetfoods on Instagram , Linkedin and

Twitter.

MEDIA CONTACT

Heather Krug

Corporate Communications

press@bondpets.com

About Agronomics

Agronomics is a leading listed alternative proteins company with

a focus on cellular agriculture and cultivated meat. The Company

has established a portfolio of 24 companies at the Pre-Seed to

Series C stage in this rapidly advancing sector. It seeks to secure

minority stakes in companies owning technologies with defensible

intellectual property that offer new ways of producing food and

materials with a focus on products historically derived from

animals. These technologies are driving a major disruption in

agriculture, offering solutions to improve sustainability, as well

as addressing human health, animal welfare and environmental

damage. This disruption will decouple supply chains from the

environment and animals, as well as being fundamental to feeding

the world's expanding population. A full list of Agronomics'

portfolio companies is available at https://agronomics.im/ .

About Cellular Agriculture

Cellular Agriculture is the production of agriculture products

directly from cells, as opposed to raising an animal for slaughter,

or growing crops. This encompasses cell culture to produce

cultivated meat and materials, and fermentation processes that

harness a combination of molecular biology, synthetic biology,

tissue engineering and biotechnology to massively simplify

production methods in a sustainable manner.

Over the coming decades, the source of the world's food supply

traditionally derived from conventional agriculture is going to

change dramatically. We have already witnessed the first wave of

this shift with the consumer adoption of plant-based alternative

proteins but today, we are on the cusp of an even bigger wave of

change. This is being facilitated by advances in cellular

agriculture. This change is necessary, given scientists claims that

if we maintain existing animal protein consumption patterns, then

we will not meet the Paris Agreement's goal of limiting warming to

1.5

AT Kearney, a global consultancy firm, projects that cultivated

meat's market share will reach 35% by 2040. This combined with the

Good Food Institute's estimate that a US $1.8 trillion investment

will be required in order to produce just 10% of the world's

protein using this technology, means that we are on the cusp of a

multi-decade flow of capital to build out manufacturing facilities.

Funding in the field of cellular agriculture is accelerating,

however still less than US$ 4 billion has been invested worldwide

since the industry's inception in 2016.

For further information please contact:

Agronomics Beaumont Canaccord Cenkos Peterhouse TB Cardew

Limited Cornish Genuity Securities Capital

Limited Limited Plc Limited

The Company Nomad Joint Broker Joint Broker Joint Broker Public Relations

========== ============= =============== =============== ========================

Richard Reed Roland Andrew Giles Balleny Lucy Williams Ed Orlebar

Denham Eke Cornish Potts Max Gould Charles Alistair Walker

James Harry Rees Michael Goodfellow

Biddle Alex Aylen Johnson

(Head of

Equities)

========== ============= =============== =============== ========================

+44 (0) 20 7930

0777

+44 (0) 1624 +44 (0) +44 (0) +44 (0) +44 (0) +44 (0) 7738

639396 207 628 207 523 207 397 207 469 724 630

info@agronomics.im 3396 8000 8900 0936 agronomics@tbcardew.com

========== ============= =============== =============== ========================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUUABUPPGQM

(END) Dow Jones Newswires

September 08, 2022 02:00 ET (06:00 GMT)

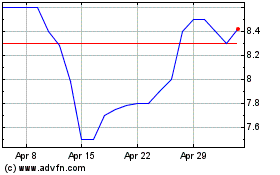

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024