TIDMAQX

Aquis Exchange PLC

14 December 2020

14 December 2020

RNS Reach

Aquis Exchange PLC

("Aquis" or the "Company")

Aquis Stock Exchange rule changes and new market segments now in

effect

Aquis Exchange PLC (AQX.L), the exchange services group, is

pleased to announce that its proposed changes to the rules and

regulations of its subsidiary Aquis Stock Exchange (AQSE) Growth

Market are now in force.

The AQSE Growth Market will be divided into two segments

'Access' and 'Apex', with different levels of admission criteria,

in order to provide appropriate support across companies' growth

cycles. The Access market will focus on earlier stage growth

companies, while Apex is the intended market for larger, more

established businesses.

As of today:

-- New admissions to the Access market can now publish an

admission document specifically tailored to small cap

companies with proportionate disclosure requirements;

-- The Access market will accept SPACs with a minimum market

cap of GBP700,000;

-- New admissions to the Apex market will be required to

publish a growth prospectus, allowing private investor

participation in their IPOs; and

-- Companies on the Apex market will be protected from short

selling by third parties.

As announced on the 23 November, the market maker incentive

scheme, which has been designed to increase liquidity on the

exchange, will come into effect on the 4 January 2021.

The rule changes mark the end of the consultation launched on 1

May 2020, and have been developed to enhance Aquis Stock Exchange

and increase support from both retail and institutional investors

by applying core Aquis values, such as transparency and innovation

to the business, whilst ensuring a robust regulatory framework. The

complete rule books for each of the Access and Apex markets are

available on the website.

Some of the companies that are currently listed on the Apex

market include: private banking company Arbuthnot Banking, private

equity investment company EPE Special Opportunities, winery Chapel

Down, breweries Shepherd Neame and Daniel Thwaites, and private

healthcare provider Rutherford Health.

Following these rule changes Apex companies will need to

have:

-- A minimum market capitalisation of GBP10 million

-- At least 25% shares in public hands

-- At least 2 market makers

-- A minimum 2 years' trading history

-- Adopted a recognised governance code, such as the QCA

Code

Aquis Stock Exchange is one of only two existing options for

growing businesses looking to IPO in the UK. It brings positive

disruption and competition to the listed SME sector, alongside

using superior technology to deliver better results for all

participants.

Commenting on the changes coming into effect, Alasdair Haynes,

CEO of Aquis, said:

"I am delighted to see the new rules in place across Aquis Stock

Exchange today. I genuinely believe that whilst providing a strong

regulatory framework, they will make the market work better for all

those that use it and help to update the stock exchange for the

current day, fit to service the needs of modern businesses.

Private investors are rightly becoming ever more vocal in their

demand for better information and equal access. We support this,

and through requiring companies joining Apex to publish a growth

prospectus we are providing a way for them to be part of a

company's growth journey right from the point of floatation.

This is just one example of the work we have undertaken to

create a better, more supportive marketplace for all. We look

forward to welcoming many more great growth businesses to Aquis

Stock Exchange in due course."

Enquiries:

Aquis Exchange PLC Tel: +44 (0) 20 3597 6321

Alasdair Haynes, CEO

Jonathan Clelland, CFO and COO

Liberum Capital Limited (Nominated Adviser and Broker) Tel: +44 (0) 20 3100 2000

Clayton Bush

Chris Clarke

Edward Thomas

Kane Collings

Alma PR (Financial PR Adviser) Tel: +44 (0)20 3405 0209

Susie Hudson aquis@almapr.co.uk

Rebecca Sanders-Hewett

Caroline Forde

Notes to editors:

Aquis Exchange PLC is an exchange services group, which operates

pan-European cash equities trading businesses (Aquis Exchange),

growth and regulated primary markets (Aquis Stock Exchange/AQSE)

and develops/licenses exchange software to third parties (Aquis

Technologies).

Aquis Exchange is authorised and regulated by the UK Financial

Conduct Authority and France's Autorité des Marchés Financiers to

operate Multilateral Trading Facility businesses in the UK and in

EU27 respectively. Aquis operates a lit order book and does not

allow aggressive non-client proprietary trading, which has resulted

in lower toxicity and signalling risk on Aquis than other trading

venues in Europe. According to independent studies, trades on Aquis

are less likely to lead to price movement than on other lit

markets. Aquis uses a subscription pricing model which works by

charging users according to the message traffic they generate,

rather than a percentage of the value of each stock that they

trade.

Aquis Stock Exchange (AQSE) is a stock market providing primary

and secondary markets for equity and debt products. It is

authorised as a Recognised Investment Exchange, which allows it to

operate a regulated listings venue.

Aquis Technologies is the software and technology division of

Aquis Exchange PLC. It creates and licenses cutting-edge,

cost-effective matching engine and trade surveillance technology

for banks, brokers, investment firms and exchanges.

Aquis Exchange PLC (AQX.L) is listed on the Alternative

Investment Market of the LSE (AIM) market. For more information,

please go to www.aquis.eu

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRADZMMZVMNGGZM

(END) Dow Jones Newswires

December 14, 2020 02:00 ET (07:00 GMT)

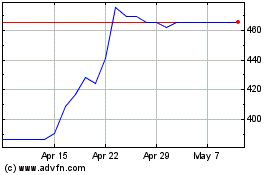

Aquis Exchange (LSE:AQX)

Historical Stock Chart

From Mar 2024 to Apr 2024

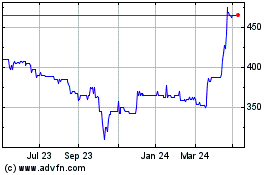

Aquis Exchange (LSE:AQX)

Historical Stock Chart

From Apr 2023 to Apr 2024