TIDMARG

RNS Number : 1897Y

Argos Resources Ltd

03 May 2023

This announcement contains inside information

ARGOS RESOURCES LIMITED

("Argos", the "Group" or "the Company")

Proposed Sale of North Falkland Basin Interests to JHI

Associates Inc

Proposed Cancellation of Admission to Trading on AIM

and

Notice of General Meeting

On 15(th) December 2022, Argos Resources Limited (AIM: ARG.L),

the Falkland Islands based exploration company focused on the North

Falkland Basin , announced that the Company and JHI Associates Inc.

("JHI"), a private company incorporated in Ontario, Canada, had

entered into an agreement pursuant to which it is proposed that JHI

will acquire Argos' PL001 Production Licence interests in the North

Falkland Basin (the "Disposal").

The Board is pleased to report that the Company has now entered

into the Licence Acquisition Agreement (LAA) pursuant to which the

Licence (and related assets) will be transferred from Argos

Exploration Limited (AEL), the Company's 100% owned subsidiary in

which the Licence is held, to the purchaser subject to, inter alia,

the approval of the Company's shareholders. As consideration for

the Licence, the Company is to be issued with 8,467,820 JHI Common

Shares credited as fully paid and GBP303,500 in cash (of which a

non-refundable payment of GBP151,750 has already been made).

As the Licence is the Company's principal asset, upon completion

of the Disposal the Company will be regarded as an AIM Rule 15 cash

shell, having ceased to own, control or conduct all or

substantially all, of its existing trading business, activities or

assets. The Disposal is therefore conditional on the consent of

Shareholders at a general meeting of the Company.

Assuming completion of the LAA, the Company's sole asset would

be its holding of JHI Common Shares. The Directors have concluded

that in this scenario it is in the best interests of the Company

and its Shareholders to seek Shareholder approval for cancellation

of the admission of the Ordinary Shares to trading on AIM.

Shareholder approval for the Disposal and Cancellation will be

sought at a general meeting of the Company to be held at The

Chamber of Commerce, West Hillside, Stanley, Falkland Islands at 5

pm (Falkland Islands time) on 26 May 2023.

In the event that Shareholder approval for the Disposal and

Cancellation are obtained, it is the intention of the Board that

the Company should then be wound up by way of a members voluntary

liquidation. The Company has agreed with certain creditors of the

Company to settle those liabilities in JHI Common Shares (up to

approximately 475,000 JHI Common Shares). Thereafter, approximately

8 million JHI Common Shares are expected to be available for

distribution to Shareholders pro rata to their holding in the

Company at that time.

A copy of the Circular containing more information regarding the

Disposal, Cancellation and Notice of General Meeting will be posted

to Shareholders on 4 May 2023 and will be available on the

Company's website www.argosresources.com shortly.

A summary of the key information contained in the Circular,

including a timetable of events, is set out below.

For further information:

Argos Resources Ltd (+500 22685)

www.argosresources.com

Ian Thomson, Chairman

John Hogan, Managing Director

Cenkos Securities plc, Nomad & Broker (+44 131 220 6939)

Derrick Lee

Neil McDonald

Proposed disposal of the Licence, cancellation of admission of

Ordinary Shares to trading on AIM, and Notice of General

Meeting

1. Introduction

On 15 December 2022 the Company announced that it had reached

preliminary agreement with JHI for JHI to acquire the Group's sole

principal asset - offshore production licence PL001 in the North

Falkland Basin and related data.

Today, we are pleased to report that the Company has now entered

into the Licence Acquisition Agreement (LAA) for the Buyer to

acquire the Licence (and related assets) from AEL for a

consideration of 8,467,820 JHI Common Shares to be issued to the

Company credited as fully paid and GBP303,500 in cash (of which a

non-refundable payment of GBP151,750 has already been made).

Completion of the LAA is scheduled to take place on or around 31

May 2023, with a long stop date of 28 June 2023, subject to:

-- Falkland Islands Government consent to the transfer of the Licence by AEL to the Buyer; and

-- Shareholder consent as referred to below.

The JHI Common Shares to be issued to the Company would

represent some 9.68% of the enlarged issued capital of JHI as at

the date of the Circular and are expected to represent between

approximately 7.21% and 6.01% of JHI's enlarged share capital on a

fully diluted basis depending on the outcome of the Plan of

Arrangement JHI is currently undertaking.

JHI is a private limited company incorporated in Ontario,

Canada. JHI's principal asset is a 17.5% interest in the Canje

Block, offshore Guyana, which is operated by Esso Exploration &

Production Guyana Ltd (35%), a subsidiary of ExxonMobil Corp. JHI's

partners in the Canje Block are TotalEnergies E&P Guyana BV

(35%) and Mid-Atlantic Oil & Gas Inc (12.5%).

The Canje Block is a large and significant licence area adjacent

and immediately east of multiple ExxonMobil discoveries in the

Stabroek block. Covering approximately 4,800 square kilometres, the

Canje Block is located approximately 180 to 300 kilometres offshore

Guyana in water depths ranging from 1,700 to 3,000 metres. Over

7,000 square kilometres of 3D seismic data has been shot over the

Canje Block, from which over three dozen prospects have been mapped

in four proven plays in the Lower Tertiary and Upper Cretaceous

confined channels, Lower Cretaceous carbonate structures and, with

the recent drilling of Sapote-1 well and Stabroek discoveries

including Fangtooth SE-1, the block now offers the opportunity of

yet deeper prospectivity.

As of 31 December 2022, JHI's unaudited consolidated financial

statements indicated gross assets of approximately USD24,375,839,

of which approximately USD18,919,157 is cash or cash equivalents,

with no debt. The Company understands that JHI's sole purpose is

its participation in the Canje Block and that it has no other

significant assets or interests.

Further information on JHI can be found at

www.jhiassociates.com. ([1])

Since the Licence is the Company's principal asset, the Disposal

will result in a fundamental change in the business of the Company

for the purpose of Rule 15 of the AIM Rules and it is therefore

conditional upon the approval of Shareholders, amongst other

matters. Shareholder approval for the Disposal will be sought at a

general meeting of the Company to be held at The Chamber of

Commerce, West Hillside, Stanley, Falkland Islands at 5 pm

(Falkland Islands time) on 26 May 2023. The notice convening that

General Meeting is set out at the end of the Circular. The actions

that Shareholders should take to vote on the Disposal Resolution

and the recommendations of the Board are set out below.

Assuming completion of the LAA, the Company's sole asset would

be its holding of JHI Common Shares. The Directors have concluded

that in this scenario it is in the best interests of the Company

and its Shareholders to seek Shareholder approval for cancellation

of the admission of the Ordinary Shares to trading on AIM, for the

reasons set out in the Circular. In accordance with Rule 41 of the

AIM Rules, the Company has notified the London Stock Exchange of

the date of the proposed Cancellation which is expected to be on 6

June 2023.

Accordingly, the Company is also seeking Shareholders' approval

for the Cancellation which is conditional upon the consent of not

less than 75 per cent. of the votes cast by Shareholders (whether

present in person or by proxy) at the General Meeting. If the

Cancellation Resolution is passed at the General Meeting, and

assuming completion of the LAA on or around 31 May 2023, it is

anticipated that the Cancellation will become effective at 7 a.m.

on 6 June 2023.

If the Cancellation proceeds, Shareholders who wish to buy or

sell the Company's Ordinary Shares on AIM must do so prior to the

Cancellation date, which is expected to be 6 June 2023 (with the

last date for trading being 5 June 2023).

Assuming completion of the LAA and the Cancellation, the Board

has concluded that it would be in Shareholders best interests for

the Company to be wound up and for the JHI Common Shares to be

distributed proportionately to the Company's shareholders on the

register of members at the relevant time. Shareholders will be

written to separately on this in due course to provide further

details and to seek Shareholder approval at a further general

meeting of the Company for the Company to be wound up and a

liquidator appointed.

Shareholders should be aware that following the Cancellation

there will be limited opportunities to trade in JHI Common Shares

as JHI is a private company whose shares are not listed on any

stock exchange. Furthermore, any transfer of JHI Common Shares will

be subject to the approval of the board of directors of JHI in

accordance with JHI's constitutional documents.

JHI's management has confirmed to the Board of ARL that it is

their intention to complete a liquidity event concerning JHI within

5 years of Completion, however there is no guarantee that a

liquidity event will take place within this period, or at all.

The purpose of the Circular is to provide Shareholders with the

background to, reasons for and details of the Disposal and

Cancellation and to explain why the Directors consider the Disposal

and Cancellation to be in the best interests of the Shareholders as

a whole.

2. Background to and reasons for Disposal

2.1 Background

The Company has had an interest in the Licence since 1997. In

2015 the Company assigned its interest in the Licence to Noble

Energy Falklands Limited and Edison International Spa

(Noble/Edison), for a participating interest in future income

streams from the Licence. Following a change in strategy by

Noble/Edison, Noble/Edison decided they wanted to exit their

investments in the Falkland Islands and assigned the Licence back

to AEL and the parties agreed to terminate the participation

agreement. The Company secured a 2-year extension to the Licence in

December 2022 (the Licence now continues until 31 December 2024).

However, during this extended period the Company is required to

carry out a work program for which it is not funded and there is no

certainty, in the Board's view, that capital to fund the work

program will be available to the Company. JHI has the cash reserves

to fund this work program and is enthusiastic as to the identified

prospects in the Licence area. It is the Board's view that

Shareholders' interests are best served by transferring the

Company's interest in the Licence to JHI in return for an equity

interest in JHI (and some cash) which would provide Shareholders

with an ongoing interest in the outcome of future work carried out

on the Licence, with upside potential through exposure to JHI's

interest in the Canje Block.

If the Resolutions are not passed, the Disposal will not

proceed. If the Board is unable to secure alternative funding to

cover the costs of the work program required under the Licence to

be completed by 31 December 2024 the Licence would be forfeited. In

light of this, if the Disposal was not to go ahead and alternative

funding could not be secured quickly, there is a risk that the

Board would feel obliged to wind up the Company.

2.2 Summary terms of the Disposal

Pursuant to the LAA, AEL will transfer its interest in the

Licence (and certain other assets) to the Buyer in return for a

cash payment of GBP305,500 (of which GBP151,750 has already been

paid as a non-refundable deposit) and the issue to ARL of 8,467,820

new common shares of no par value in the capital of JHI to be

issued credited as fully paid to ARL, subject to:

-- Falkland Islands Government consent to the transfer of the Licence to the Buyer; and

-- The Shareholders passing the Disposal Resolution at the General Meeting.

The JHI Common Shares to be issued to the Company would

represent some 9.68% of the enlarged issued capital of JHI as at

the date of the Circular. JHI are currently undertaking a Plan of

Arrangement , completion of which is subject to a Final Order of

the Ontario Superior Court of Justice. On (and subject to) receipt

of the Final Order the JHI Common Shares to be issued to the

Company are expected to represent up to approximately 7.21 % of the

enlarged issued capital of JHI. If the Plan of Arrangement was not

to complete, the JHI Common Shares to be issued to the Company

would still represent some 9.68% of JHI's enlarged issued capital

(or 6.01% of the enlarged capital on a fully diluted basis).

[2]

ARL is providing the Buyer with standard representations and

warranties, primarily relating to the Licence. Any warranty claims

by the Buyer may in ARL's option, be settled in JHI Common Shares

at a value of USD 0.71 per JHI Common Share.

JHI value the JHI Common Shares at USD 0.71 each, which equates

to USD 6,012,152 for all the JHI Common Shares to be issued to the

Company pursuant to the LAA (GBP0.582 per JHI Common Share and a

total of GBP4,928,271 using an exchange rate as of the 15 December

2022 (the date of the announcement of the proposed transaction) of

GBP1.00 : USD1.22). The value of the JHI Common Shares together

with the cash consideration equals approximately 2.23p per Ordinary

Share (a premium of approximately 27% to the closing share price of

the Ordinary Shares on 14 December 2022).

The Directors have reviewed the basis of the valuation being

applied to the JHI Common Shares for the purposes of this

transaction and consider it to be appropriate.

The Licence is subject to an annual licence fee payable to the

Falkland Islands Government of USD 78,300. AEL earns no income from

the Licence and is currently loss making.

The effect of the Disposal on the Company will be that it

becomes a dormant investment company (its sole asset being the JHI

Common Shares) and it is the intention of the Board that the

Company should then delist and be wound up by way of a members

voluntary liquidation. The Company has agreed with certain

creditors of the Company to settle those liabilities in JHI Common

Shares (up to approximately 475,000 JHI Common Shares). Thereafter,

approximately 8 million JHI Common Shares are expected to be

available for distribution to Shareholders pro rata to their

holding in the Company at that time.

2.3 Use of Proceeds

The net cash proceeds of the Disposal will be placed on deposit

and used by the Company in payment of expenses until it is

liquidated as intended (see below).

3. AIM Rule 15

In accordance with AIM Rule 15, the Disposal constitutes a

fundamental change of business of the Company. Accordingly, as set

out in AIM Rule 15, the Disposal is conditional on the consent of

shareholders at a general meeting of the Company.

Further, on Completion, the Company would cease to own, control

or conduct all, or substantially all, of its existing trading

business, activities or assets. Following Completion therefore, the

Company will become an AIM Rule 15 cash shell and as such will be

required to make an acquisition or acquisitions which constitutes a

reverse takeover under AIM Rule 14 (including seeking re-admission

as an investing company (as defined under the AIM Rules)) on or

before the date falling six months from Completion or be re-

admitted to trading on AIM as an investing company under the AIM

Rules (which requires the raising of at least GBP6 million) failing

which, the Ordinary Shares would then be suspended from trading on

AIM pursuant to AIM Rule 40. Admission to trading on AIM would be

cancelled six months from the date of suspension should the reason

for the suspension not have been rectified.

As there is no intention by the Directors to make an acquisition

or acquisitions which constitute a reverse takeover under AIM Rule

14 (including seeking re-admission as an investing company (as

defined under the AIM Rules)) on or before the date falling six

months from Completion of the Disposal or be re-admitted to trading

on AIM as an investing company under the AIM Rules (which requires

the raising of at least GBP6 million), the Directors are seeking

Shareholder approval for Cancellation, as detailed below.

4. Background to and reasons for the Cancellation

4.1 Background

The Directors have conducted a review of the benefits and

drawbacks to the Company and its Shareholders of continuing to

maintain the Company's admission to trading on AIM following

completion of the Disposal. The Directors have concluded that in

the event that the Disposal proceeds, Cancellation is in the best

interests of the Company and its Shareholders as a whole. In

reaching that conclusion, the Directors have considered the

following key factors, amongst others:

-- the significant time and cost of identifying a suitable

acquisition or acquisitions which constitute(s) a reverse takeover

under AIM Rule 14 and the appetite of the existing management to do

so;

-- the recurring costs per annum of around GBP350,000 (in

respect of, amongst other things, management time and the legal and

regulatory costs) associated with maintaining the Company's

admission to trading on AIM which, in the Directors' opinion, are

disproportionate to the benefits to the Company of remaining

admitted to trading on AIM;

-- admission of the Ordinary Shares to trading on AIM does not

necessarily offer investors the opportunity to trade in meaningful

volumes per se or with frequency within an active market. With low

trading volumes and liquidity, the Company's share price can move

up or down significantly following trades of small volumes of

Ordinary Shares; and

-- the limited ability of the Company to access capital on AIM.

4.2 Cancellation process

Under the AIM Rules it is a requirement that, unless the London

Stock Exchange otherwise agrees, the Cancellation must be

conditional upon the consent of not less than 75 per cent. of votes

cast by the Shareholders at a general meeting. Accordingly, the

Company is proposing the Cancellation Resolution at the General

Meeting. In addition, the Company is required to give a notice

period of not less than 20 Business Days from the date on which

notice of the intended Cancellation is notified via a Regulatory

Information Service and is given to the London Stock Exchange.

Accordingly, on 3 May 2023, the Company notified the London Stock

Exchange of the Company's intention, subject to the Cancellation

Resolution being passed at the General Meeting, to cancel the

admission of the Ordinary Shares to trading on AIM with effect from

7 a.m. on 6 June 2023.

4.3 Principal effects of the Cancellation

The Board considers the principal effects of the Cancellation

will be:

-- there will no longer be a public market mechanism for

Shareholders to trade in the Ordinary Shares and no price will be

publicly quoted for the Ordinary Shares;

-- the Ordinary Shares will remain freely transferable subject

to there being a willing buyer;

-- it is possible that, following publication of the Circular,

the liquidity and marketability of the Ordinary Shares may be

reduced and the value of the Shares may be adversely affected,

although, as previously stated, the Directors believe that the

liquidity of the Ordinary Shares on AIM is at present very

limited;

-- in the absence of a formal market for the Ordinary Shares

following Cancellation, it may be difficult for Shareholders to

determine the market value of their investment in the Company at

any given time;

-- whilst the Company's CREST facility will remain in place

following the Cancellation, the Company's CREST facility may be

cancelled in the future and, although the Ordinary Shares will

remain transferable, they may cease to be transferable through

CREST. In the event the Ordinary Shares are no longer transferable

in CREST, Shareholders who hold Ordinary Shares in CREST at such

time will receive share certificates;

-- the AIM Rules will no longer apply to the Company and,

accordingly, Shareholders will no longer be afforded the

protections given by the AIM Rules. In particular, the Company will

not be bound to:

- make any public announcements of material events, or to announce interim or final results;

- comply with any of the corporate governance practices applicable to AIM companies;

- comply with the requirement to obtain Shareholder approval for

certain corporate actions, where applicable, including substantial

transactions, related party transactions, reverse takeovers and

fundamental changes in the Company's business; or

- comply with AIM Rule 26, obliging the Company to publish

prescribed information on its website;

-- the Company will cease to retain a nominated adviser and a broker;

-- as an unlisted and non-traded company, the Company will be

subject to less stringent accounting disclosure requirements;

-- the Company would no longer be subject to UK MAR regulating

inside information and other matters;

-- the Company will no longer publicly disclose any change in

major shareholdings in the Company under DTR;

-- as from the date of the Cancellation, stamp duty will be due

on transfers of shares and agreements to transfer shares unless a

relevant exemption or relief applies to a particular transfer as a

result of prevailing Shareholder circumstances;

-- some Shareholders might not be able to hold shares in a

private Canadian company and accordingly may wish to sell their

Ordinary Shares before the Cancellation; and

-- the Cancellation might have personal taxation consequences

for Shareholders. Shareholders who are in any doubt about their tax

position should consult their own professional independent adviser

immediately.

In the event that the Cancellation proceeds, it is expected that

the non-executive directors will resign as directors of the Company

shortly after the date on which the Cancellation becomes effective.

Following this, Ian Thomson (executive chairman), John Hogan

(managing director), and Andrew Irvine (finance director) intend to

remain as directors of the Company for the purposes of placing the

Company into members voluntary liquidations, further details on

which are set out in the Circular.

The considerations set out above are not exhaustive, and

Shareholders should seek their own independent advice when

assessing the likely impact of the Cancellation on them.

The Company will continue to communicate information about the

Company (including annual accounts) to its Shareholders, as

required by the Companies Act.

4.4 Transactions in the Ordinary Shares prior to and post the proposed Cancellation

If Shareholders wish to buy or sell Ordinary Shares on AIM they

must do so prior to the Company's Ordinary Shares being cancelled,

with the expected last day of dealing in Ordinary Shares on AIM

expected to be 5 June 2023. As noted above, in the event that

Shareholders approve the Cancellation, it is anticipated that

Cancellation will become effective on 6 June 2023.

As soon as possible following the Cancellation, it is the

Board's intention to proceed with the members voluntary liquidation

process described in the Circular.

It is not the Board's intention to implement a matched bargain

facility and there will be no formal market for Shareholders to

effect transactions in the Ordinary Shares following

Cancellation.

5. Members Voluntary Liquidation

Assuming the Resolutions are passed, Completion takes place, and

the Cancellation occurs, the Directors believe that it will be in

Shareholders' best interests for the Company to be placed into

members voluntary liquidation (MVL) and the surplus assets of the

Company (after satisfying the Company's liabilities) be distributed

to Shareholders. The Board intends to settle certain of the

Company's liabilities of up to approximately GBP276,000 in JHI

Common Shares. This will require approximately 475,000 JHI Common

Shares, leaving a balance of approximately 8 million JHI Common

Shares remaining for distribution to holders of Ordinary Shares.

The cash portion of the consideration payable by JHI for the

Licence is expected to cover the Company's remaining

liabilities.

The appointment of a liquidator and the Company entering into a

MVL process is dependent on Shareholder consent in a subsequent

general meeting of the Company, which it is proposed is held

following the Cancellation.

It is also the Company's intention to liquidate its subsidiary

AEL.

6. Non-United Kingdom Shareholders

The distribution of the Circular in certain jurisdictions may be

restricted by law. Persons into whose possession the Circular comes

should inform themselves about and observe any such

restrictions.

Shareholders who are not resident in the United Kingdom should

note that they should satisfy themselves that they have fully

observed any applicable legal requirements under the laws of their

relevant jurisdiction in relation to the Disposal and

Cancellation.

7. General Meeting

The Disposal is conditional upon, amongst other things,

Shareholder approval being obtained at the General Meeting. The

Cancellation is conditional upon Shareholder approval being

obtained at the General Meeting. At the end of the Circular is a

notice convening the General Meeting to be held at The Chamber of

Commerce, West Hillside, Stanley, Falkland Islands, at 5 p.m.

(Falkland Islands time) on 26 May 2023, at which the Resolutions

will be proposed.

8. Recommendation

The Directors consider the Disposal and the Cancellation to be

in the best interests of the Company and the Shareholders as a

whole. Accordingly, the Board unanimously recommends that you vote

in favour of the Resolutions, as the Directors intend to do in

respect of their beneficial holdings, which represent in aggregate

approximately 18.95 per cent. of the issued share capital of the

Company.

EXPECTED TIMETABLE OF EVENTS

Notice provided to the London Stock Exchange of 3 May 2023

the proposed Cancellation

Publication and posting of the Circular 4 May 2023

Latest time and date for completion of receipt 5 p.m. on 23 May

of Forms of Instruction 2023

Latest time and date for completion of receipt 9 p.m. on 24 May

of Forms of Proxy 2023

General Meeting 5 p.m. on 26 May

2023 (Falkland

Islands time)

Expected Completion of the Disposal 31 May 2023

Expected last day of dealings in Ordinary Shares 5 June 2023

on AIM

Expected date of Cancellation (1) 7 a.m. on 6 June

2023

Notes

All references to time in the Circular are to London time unless

specifically stated otherwise .

Each of the times and dates in the above timetable is subject to

change. If any of the above times and/or dates change, the revised

times and dates will be notified to Shareholders by an announcement

through a Regulatory Information Service.

(1) The Cancellation is conditional upon the LAA completing in

accordance with its terms and requires the approval of not less

than 75 per cent. of the votes cast (in person or by proxy) by

Shareholders at the General Meeting

DEFINITIONS

The following definitions apply throughout the Circular, unless

the context otherwise requires:

"AEL" Argos Exploration Limited, a wholly owned subsidiary of

the Company;

"AIM" the AIM market, being a market of that name and operated

by the London Stock Exchange;

"AIM Rules" the AIM Rules for Companies (as amended from time to

time);

"ARL" or "Company" Argos Resources Limited;

"Board" or "Directors" the board of directors of the Company;

"Business Day" a day (excluding Saturday, Sunday and public

holidays in England and Wales) on which banks are generally open

for business in London for the transaction of normal banking

business;

"Buyer" JHI Falkland, Inc., a private limited company

incorporated in Ontario, Canada having its registered office at 130

Adelaide Street West, Toronto, Ontario M5H 3P5, Canada;

"Cancellation" the proposed cancellation of admission of the

Ordinary Shares to trading on AIM subject to the passing of the

Cancellation Resolution and in accordance with Rule 41 of the AIM

Rules;

"Cancellation Resolution" Resolution 2 to be proposed to

Shareholders at the General Meeting to approve the

Cancellation;

"Canje Block" the petroleum licence area offshore Guyana in

which JHI has a 17.5% interest;

"Cenkos" Cenkos Securities plc, the Company's nominated advisor

and broker;

"Circular" the circular published by the Company containing

details of the Disposal and Cancellation;

"Companies Act " the Companies Act 1948 of the United Kingdom as

it applies to the Falkland Islands:

"Completion" completion of the Disposal in accordance with the

LAA, expected to occur on or about 31 May 2023;

"CREST" the computerised settlement system (as defined in the

CREST Regulations) operated by Euroclear UK & International

Limited which facilitates the transfer of title to share in

uncertificated form;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 20013755);

"Disposal" the proposed sale of the Licence (and related assets)

to the Buyer pursuant to the LAA;

"Disposal Resolution" Resolution 1 to be proposed to

Shareholders at the General Meeting to approve the Disposal;

"DTR" the disclosure guidance and transparency rules made by the

FCA pursuant to section 73A of the Financial Services and Markets

Act 2000;

"FCA" the UK Financial Conduct Authority;

"Final Order" the final order of the Ontario Superior Court of

Justice (Commercial List) approving the Plan of Arrangement under

section 182(5) of the OBCA ;

"Form of Instruction" voting form to be used by Depository

Interest holders to submit votes via the custodian;

"Form of Proxy" voting form to be used by Shareholders to submit

votes;

"General Meeting" the general meeting of the Company to be held

at The Chamber of Commerce, West Hillside, Stanley, Falkland

Islands, at 5 p.m. on 26 May 2023 (Falkland Islands time);

"Group" the Company and its wholly owned subsidiary, AEL;

"JHI" JHI Associates, Inc., a private limited company

incorporated in Ontario, Canada having its registered office at 130

Adelaide Street West, Toronto, Ontario M5H 3P5, Canada;

"JHI Common Shares" common shares of no par value in the capital

of JHI to be issued to the Company as part consideration for the

Licence and related assets in accordance with the terms of the

LAA;

"LAA" the licence acquisition agreement dated 2 May 2023 between

ARL, AEL, JHI and the Buyer relating to the sale and transfer of

the Licence (and related assets) by AEL to the Buyer;

"Licence" offshore petroleum production licence PL001 in the

North Falkland Basin granted by the Falkland Islands Government and

currently held by AEL;

"Notice" the notice set out at the end of the Circular convening

the General Meeting;

"OBCA" the Business Corporations Act (Ontario);

"Ordinary Shares" ordinary shares of 2 pence each in the capital

of the Company;

" Plan of Arrangement " the arrangement being undertaken by JHI

pursuant to section 182 of the OBCA ;

"Resolutions" the resolutions to approve the Disposal and the

Cancellation to be proposed at the General Meeting;

"Shareholders" holders of Ordinary Shares;

"UK MAR" the UK version of the Market Abuse Regulations (EU) (No

596/2014) which is part of the UK law by virtue of the European

Union (Withdrawal) Act 2018 as amended by the Market Abuse

(Amendment) (EU Exit) Regulations 2019;

"USD" the lawful currency of the United States of America;

and

"GBP" the lawful currency of the United Kingdom.

Notes to Editors

Argos Resources is an oil and gas exploration company listed on

AIM and based in the Falkland Islands. The Company's principal

asset is a 100 per cent interest in Production Licence PL001

covering an area of approximately 1,126 square kilometres in the

North Falkland Basin.

A 3D seismic survey has been acquired over the entire licence

area. The quality of the seismic data acquired is excellent and has

led to the identification of 52 prospects and 40 leads within the

licence area. An independent Competent Person's Report attributes

to these prospects a total unrisked potential of 3.1 billion

barrels of prospective recoverable resource in the most likely case

and up to 10.4 billion barrels in the upside case.

The licence area is immediately adjacent to the giant Sea Lion

oil discovery which contains over 500 million barrels of

recoverable resource. A decision to proceed with the development of

the Sea Lion field is awaited.

The licence is held under the name of Argos Exploration Ltd,

which is a wholly owned subsidiary of the Company.

The Company has a strong and experienced management team with

extensive experience in both the oil and gas industry and the

Falkland Islands.

This statement has been approved by John Hogan, Managing

Director of Argos Resources, and a qualified geologist with over 40

years of experience in the petroleum industry.

Information on JHI

JHI is a private company incorporated in Ontario and

headquartered in Toronto, Canada. JHI owns a 17.5 per cent.

interest in the Canje block, offshore Guyana, operated by Esso

Exploration & Production Guyana Ltd. (35 per cent.), a

subsidiary of ExxonMobil Corp. The other partners in the block are

TotalEnergies E&P Guyana BV (35 per cent.) and Mid-Atlantic Oil

& Gas Inc. (12.5 per cent.). The Canje block covers

approximately 4,800 square kilometres and is located approximately

180 to 300 kilometres offshore Guyana in water depths ranging from

1,700 to 3,000 metres.

The Canje block is a large and significant licence adjacent and

immediately east of multiple ExxonMobil discoveries in the Stabroek

block. 6,100 square kilometres of 3D seismic data has been shot

over the Canje block, from which over three dozen prospects have

been mapped in four proven plays in the Lower Tertiary and Upper

Cretaceous confined channels, Lower Cretaceous carbonate structures

and, with the recent drilling of Sapote-1 well and Stabroek

discoveries, the block now offers the opportunity of yet deeper

prospectivity.

As of 31 December 2021, JHI's audited financial statements

indicate total gross assets of approximately US$30.7 million, of

which approximately US$27 million in cash and investments, and

total liabilities of approximately US$500,000.

[1] Whilst the Company has no reason to doubt the veracity of

this information (as at the date of this Circular), it is provided

by JHI and has not been independently verified. No representation,

warranty, assurance or undertaking is made, and no responsibility

or liability is or will be accepted, by the Company (or by its

officers, employees or agents) in relation to the adequacy,

accuracy, completeness or fairness of the information and/or

opinions available at www.jhiassociates.com.

[2] The Company has not had sight of JHI's register of

shareholders or the Plan of Arrangement, which may in any event be

subject to amendment or modification in the Final Order, and the

figures in this paragraph are based on the warranties given by JHI

in the LAA as well as the Board's understanding of the Plan of

Arrangement .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISUPUUPAUPWPUP

(END) Dow Jones Newswires

May 03, 2023 02:00 ET (06:00 GMT)

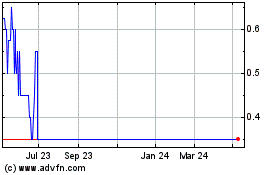

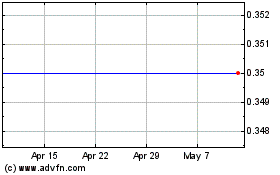

Argos Resources (LSE:ARG)

Historical Stock Chart

From Apr 2024 to May 2024

Argos Resources (LSE:ARG)

Historical Stock Chart

From May 2023 to May 2024