TIDMARS

RNS Number : 9518Y

Asiamet Resources Limited

10 May 2023

10 May 2023

Updated BKM Feasibility Study Delivers Excellent Economic

Outcomes

Asiamet Resources Limited (Asiamet or the Company) is pleased to

announce the results of the updated Feasibility Study (FS) for its

100% owned BKM Project located in Central Kalimantan,

Indonesia.

In line with significant changes in the macro-environment for

new projects, a very comprehensive update to the previously

announced 2019 FS for the BKM copper deposit has now been

completed. The updated 2023 study is based on open pit mining, and

heap leaching of crushed ore followed by solvent extraction and

electrowinning ('SX-EW') to produce LME Grade-A copper cathode (the

'Project') for sale into local and export markets.

Completion of the updated study enables the Company to

accelerate its engagement with key financial institutions,

commodity traders and equipment suppliers for a project finance

package to develop the BKM copper mine. The proposed development

timeline for the BKM Copper Project is well timed to take advantage

of the looming copper supply constraints predicted by leading

industry analysts. Development of this initial mine and associated

infrastructure is expected to unlock significant potential for

further mine developments based on deposits already identified

within the KSK Contract of Work.

A summary of the highlights of the Feasibility Study are

detailed below and the Executive Summary of the Feasibility Study

is available on the Company's website at

www.asiametresouces.com

Highlights - 2023 BKM FS Update:

-- Initial 9.2 year mine life producing up to 20ktpa of copper cathode per annum

-- Life of Mine ('LOM') Revenue of $1.4 billion and EBITDA of $655.3 million

-- Capital cost of $208.7 million (excluding growth and contingency $26.7 million)

-- Post Tax NPV(8) $162.8 million, IRR 21.0% (post tax, excluding closure costs)

-- Payback Period 3.4 years

-- C1 cash costs of $1.91/lb and AISC of $2.25/lb

-- Base case uses consensus long term copper price of $3.98/lb

-- Total Measured, Indicated and Inferred Resources unchanged at

69.6Mt @ 0.6% Cu for 451.9kt of contained copper.

-- Updated Ore Reserves of 40.8M tonnes @ 0.7% total Cu (272kt

contained total copper) and 0.5% soluble Cu (198kt contained

soluble copper).

-- Additional opportunities identified to further reduce capital

will be explored through the engineering design phase.

-- Strategic starter project - establishes infrastructure

springboard for delivering future phases of development from the

Beruang Kanan district and KSK Contract of Work.

-- (approval to use forest area) permit requirements well

advanced. All aspects of the project maintained in compliance with

regulatory requirements.

The majority of commodities analysts are predicting elevated

long term copper prices primarily driven by the inability of mine

supply to meet demand as the build out of renewable energy

infrastructure and transport systems accelerates to meet the 2050

net zero emissions targets committed to by many of the advanced

economies. Development of the BKM copper project is well timed to

capture this opportunity.

Table 1 compares 2023 BKM FS key economic metrics using a

US$3.98/lb long term copper price, the year to date (1 January 2023

to 28 April 2023) average of $4.06/lb, and a recent Goldman Sachs

long term copper price forecast of $10,000/t ($4.54/lb).

Table 1 BKM Copper Project Sensitivity to Copper Price

Copper Price US$/lb 3.98 4.06 4.54

-------- -------- -------- --------

Revenues US$M 1,396.6 1,415.0 1,580.5

-------- -------- -------- --------

EBITDA US$M 655.3 673.2 833.7

-------- -------- -------- --------

NPAT US$M 378.6 396.2 552.5

-------- -------- -------- --------

NPV(8) (post-tax, excl.

closure) US$M 162.8 171.2 260.9

-------- -------- -------- --------

IRR (post-tax, excl.

closure) % 21.0 21.3 27.3

-------- -------- -------- --------

Payback Period Yrs 3.4 3.4 2.8

-------- -------- -------- --------

1. Average YTD copper price 1 January 2023 to 28 April 2023

2. Goldman Sachs Copper Top Projects 2022, A Deficit on the Horizon

Next Steps

The release of this 2023 Feasibility Study is a significant

de-risking milestone for the Company. Along with the indicative

timeline (as per appendix) the following key milestones are

expected to be completed leading into the first phase

construction:

-- Completion and compilation of all Chapters of the 2023 BKM Project FS Update.

-- Formally appoint lead bank for the project financing.

-- Lead bank-appointed Independent Technical Expert ('ITE') will

complete a detailed review of the 2023 FS documentation. Likely to

be the same ITE that reviewed the 2019 FS on behalf of the Company

prior to commencing the update studies.

-- Close out outstanding work on capital and operating costs

savings opportunities as outlined in the Project Opportunities

section (as detailed in the Appendix).

-- Commence engineering design works.

-- Commence formal project financing including engaging parties

in relation to product offtake finance, equipment finance, and

export credit finance.

-- Commence early works at site.

Darryn McClelland, Asiamet's Chief Executive Officer

commented:

I am pleased to be able to release the details of the 2023 BKM

Copper Project FS update today, delivering what is a significant

milestone for the company. The time has come to deliver BKM to the

market, with a project that not only has strong operating and

financial fundamentals on current long-term copper pricing, but

offers significant upside considering forecast supply/demand

imbalance in the copper market looking 2-3 years into the future.

The work completed during the BKM copper project Feasibility Study

(BKM FS) update has given all those involved greater confidence in

the execution of this important project with risk areas

investigated, understood, and accounted for in the current project

design. Delivering a smaller footprint project with higher grade

has delivered a robust technical and financial outcome, reduced the

disturbance area, and contributed to a lower overall level of

environmental impact for the development.

Formally releasing the outcome of the FS update is a trigger to

progress several activities related to project finance. The Company

can now accelerate discussions with banks on debt financing and

commence the engagement with a bank-appointed ITE as soon as

practicable. In parallel with this the Company will engage with

various groups on opportunities for delivering the significant

equity funding component of the project financing including those

interested in securing the Grade-A copper cathode BKM will produce.

The Company is looking forward to discussing opportunities for

co-operation with parties who see the value of advancing BKM to

production and unlocking the much bigger opportunity to develop

multiple mines within the broader Beruang Kanan mineral district

and greater KSK Contract of Work.

To reiterate, we are very pleased to be able to share the

positive outcomes of the BKM FS update, however, this is just one

step on the exciting journey towards becoming Asia's newest copper

mine. Asiamet greatly appreciates the strong support received from

all its stakeholders to date. We are now focused on delivering the

project in a safe, environmentally conscious manner, and

effectively engaging with our local communities to ensure the

benefits of development are realised. I would like to thank all who

have contributed to the BKM FS Update and look forward to working

with them as we take the project into the next phase of

development.

Investor Call

A management presentation to discuss the results of the updated

Feasibility Study on the Investor Meet Company platform will take

place at 11am-12pm tomorrow (Thursday 11 May 2023). To register for

the presentation, investors can sign up to Investor Meet Company

and add to meet ASIAMET RESOURCES LIMITED via:

https://www.investormeetcompany.com/asiamet-resources-limited/register-investor

Investors who already follow ASIAMET RESOURCES LIMITED on the

Investor Meet Company platform will automatically be invited.

Qualified Person and Competent Person's Statement

The Ore Reserves referred to in this release have been completed

by Australian Mine Design and Development Pty Ltd ("AMDAD") and are

reported in accordance with the requirements of the JORC Code

(2012) (see RNS dated 10 May 2023).

The information in this release and the report to which this

statement is attached that relates to the estimation of Ore

Reserves is based on information compiled by Mr John Wyche, a

full-time employee of AMDAD, and who has acted as the Competent

Person on the Ore Reserve Estimation of the BKM Project. Mr Wyche

is a Member of The Australasian Institute of Mining and Metallurgy.

He has 35 years of relevant experience in operations and consulting

for open pit metalliferous mines, being sufficient experience that

is relevant to the style of mineralisation and type of deposit

under consideration and to the activity being undertaken to qualify

as a Competent Person as defined in the 2012 Edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. Mr Wyche consents to the inclusion in

the report and this release of the matters based on his information

in the form and context in which it appears. Mr Wyche confirms that

he is not aware of any new information or data that materially

affects the

information included in the relevant market announcements, and

that the form and context in which the information has been

presented has not been materially modified.

Data disclosed in this press release has been reviewed and

verified by Mr John Wyche, FAusIMM (Fellow of the Australian

Institute of Mining and Metallurgy) acting as a qualified appointed

adviser to Asiamet. Mr Wyche is a Competent Person within the

meaning of the JORC Code 2012 and a Qualified Person for the

purposes of the AIM Rules for Companies.

ON BEHALF OF THE BOARD OF DIRECTORS

Darryn McClelland, Chief Executive Officer

For further information, please contact:

-Ends-

Darryn McClelland

CEO, Asiamet Resources Limited

Email: darryn.mcclelland @ asiametresources .com

Tony Manini

Executive Chairman, Asiamet Resources Limited

Email: tony.manini@ asiametresources .com

FlowComms Limited

Sasha Sethi

Telephone: +44 (0) 7891 677 441

Email: Sasha@flowcomms.com

Asiamet Resources Nominated Adviser

RFC Ambrian Limited

Andrew Thomson / Stephen Allen

Telephone: +61 8 9480 2500

Email: Andrew.Thomson@rfcambrian.com /

Stephen.Allen@rfcambrian.com

Optiva Securities Limited

Christian Dennis

Telephone: +44 20 3137 1903

Email: Christian.Dennis@optivasecurities.com

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly undue reliance should not be put on

such statements due to the inherent uncertainty therein.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

APPIX - BKM PROJECT FEASIBILITY STUDY DETAILS

The BKM Feasibility Study Life of Mine key metrics are included

in Table 2 below. The following economic assumptions were

utilised:

-- Long term copper price of $3.98/lb LME (London Metal Exchange);

-- Discount rate 8% (after tax, Real);

-- Indonesian corporate income tax ('CIT') rate of 22%[1]; and

-- Indonesian Government Royalty of 2% (of revenue).

Note : All references to ($) dollars in the tables below are US

Dollars. Tables with decimals may not add due to rounding.

Table 2: Summary LOM BKM Feasibility Study Metrics

Production Ore mined Mt 38.4

--------------------------------- ----------- --------

Waste mined Mt 52.5

--------------------------------- ----------------------------- --------

Strip ratio Waste:Ore 1.37:1

--------------------------------- ----------------------------- --------

Average soluble copper grade % 0.51

--------------------------------- ----------------------------- --------

Soluble copper recovery (from

Heap Leach) % 78.6

--------------------------------- ----------------------------- --------

Copper cathode produced Kt 156.3

--------------------------------- ----------------------------- --------

Initial project capital (ex.

Capital contingency) $M 208.7

--------------------------------- ----------- --------

Contingency $M 26.7

--------------------------------- ----------------------------- --------

Sustaining capital $M 35.4

--------------------------------- ----------------------------- --------

Closure and

Rehabilitation Closure costs $M 45.7

--------------------------------- ----------- --------

Economic Copper price $/lb 3.98

--------------------------------- ----------- --------

Assumptions Discount factor % (real) 8.00

--------------------------------- ----------- --------

Financials Revenue $M 1,396.6

--------------------------------- ----------- --------

Operating costs (ex. royalties) $M 657.3

--------------------------------- ----------------------------- --------

Other indirect costs (inc.

royalties) $M 38.3

--------------------------------- ----------------------------- --------

NPV(8) post-tax $M (real) 146.9

--------------------------------- ----------------------------- --------

NPV(8) post-tax, pre-closure $M (real) 162.8

--------------------------------- ----------------------------- --------

IRR post-tax % (real) 20.4

--------------------------------- ----------------------------- --------

IRR post-tax, pre-closure % (real) 21.0

--------------------------------- ----------------------------- --------

Payback period Years 3.4

--------------------------------- ----------------------------- --------

Initial mine life Years 9.2

--------------------------------- ----------------------------- --------

EBITDA $M 655.3

--------------------------------- ----------------------------- --------

NPAT $M 378.6

--------------------------------- ----------------------------- --------

C1 costs $/lb 1.91

--------------------------------- ----------------------------- --------

AISC $/lb 2.25

--------------------------------- ----------------------------- --------

The estimated initial construction capital costs are in

summarised in Table 3 below.

Table 3: Capital Costs

Mining Facilities 5.4

------

Crushing, Agglomeration and Stacking 19.0

------

Heap Leach 31.7

------

SX-EW (incl. Neutralisation) 27.1

------

Process Area Services and Utilities 17.6

------

On Site Infrastructure and Bulk Earthworks 30.9

------

Off Site Infrastructure 14.2

------

Sub-Total Direct Costs 145.9

------

Construction Indirect Costs 27.7

------

Spares and First Fills 6.9

------

EPCM & Owners Costs 28.1

------

Total Capital Estimate (excluding contingency) 208.7

------

Contingency 26.7

------

Total Capital Estimate 235.4

------

The capital cost estimate in Table 3 relates to the project

construction costs and excludes sustaining capital and mine closure

costs. These costs have been included as part of the financial

model and can be referred to in Table 4.

The total Life of Mine (LOM) operating costs for the Project as

adopted in the financial model are shown in Table 4.

Table 4 LOM Operating Costs

Mining 305.9 0.89

------ -----

Processing 234.3 0.68

------ -----

Transport, Logistics and Support

Services 117.1 0.34

------ -----

LOM C1 Cash Cost 657.3 1.91

------ -----

Other Indirect (incl. Royalties) 38.3 0.11

------ -----

Sustaining Capex 35.4 0.10

------ -----

Rehabilitation and Closure 45.7 0.13

------ -----

AISC 776.8 2.25

------ -----

Approximately 70% of the total operating costs are incurred in

the mining and processing activities. A mine operations life of 9.2

years and heap leach operations life of 10 years leads to no major

replacement or rebuilds being necessary on major equipment.

Sustaining capex needs for the project are dominated by required

increases in ARD water management capacity in the mine and

processing. The other primary requirement for sustaining capital

relates to the planned installation of inter-lift liners within the

heap leach facility.

The majority of the mining works, namely site preparation, blast

hole drilling and load and haul requirements will be performed by a

primary mining contractor. Some smaller pieces of the mining scope

will be completed by support contractors. The mining LOM cost is

forecast to be $3.37 per tonne of material mined inclusive of mine

geology (including dedicated grade control) and ancillary mining

activities.

The LOM processing costs equate to $6.10 per tonne ore stacked,

with the key component being electricity consumption. Power is

proposed to be sourced from the development of a new, dedicated

biomass power station located within 135km of the site with a

dedicated transmission line connecting the power station and BKM.

The biomass power station will be built and operated by a

third-party supplier. The current cost model adopted for the

project delivers an average unit cost of 11.4c per kilowatt hour

over the life of the heap leach facility.

Support Service costs include transport and logistics

(contracted), site camp services (contracted), Supply Chain

Management, Information Technology, Environmental, Sustainability

and Governance and overhead administration activities. The LOM unit

cost of these activities in the financial model is $3.05 per tonne

ore processed or $0.34 per pound copper produced.

The charts below show the Life of Mine (LOM) production (Figure

1) and cash flows after tax (Figure 3). Ore mined is slightly lower

in years 1-3 as higher grades of soluble copper are mined first

(Figure 2), delivering strong early-stage cash flows to the

project. The LOM strip ratio is low at 1.37:1, adding to the high

margin and highly profitable project.

Figure 1 LOM Mining Production

Figure 2 LOM Ore Stacked and Soluble Copper Grade

pper Cathode Production

Figure 4 LOM Project Cash Flows - US$M(1)

1. Yr1 Figure 4 represents first year of expenditure on the

project, Yr4 represents Yr1 of production as shown in the

production figures.

Strong free cash flow generation is expected from the project

with the LOM net operating cash flows of $695.1 million. This

strong cash flow generation underpinned by a long-term copper price

of $3.98/lb results in a 3.4 year payback period for the

Project.

As part of the Feasibility Study, a sensitivity analysis was

conducted to determine the effect of key variables on the base case

NPV(8) of $162.8 million (post tax and excluding closure costs).

The results of this analysis are shown in Figure 5 and Table 5.

Figure 5 Project Sensitivities - US$M Base NPV(8) (Post-tax,

Real)

Table 5 provides a sensitivity of +/- 2% for the Company's 8%

weighted average cost of capital (WACC).

Table 5 Weighted Average Cost of Capital Sensitivity

NPV Post-tax 189.8 146.9 111.1

------ ------ ------

NPV Post-tax (pre-closure) 210.7 162.8 123.3

------ ------ ------

Project Opportunities[2]

Several opportunities to further de-risk the project will be

addressed prior to, and during, the detailed engineering design

phase. Promising outcomes from this work will be used as the basis

for detailed engineering design. These include:

-- Relocation of the Heap Leach Facility - an expected 25% to

30% reduction in earthworks volume associated with Heap Leach Pad

construction. A more straightforward location to build with an

expected reduction in costs, material movement and an overall

reduction in construction time.

-- Open Pit Mine Design and Schedule - iterative design review

of the open pit slopes based on outcomes of the geotechnical and

hydrogeological study completed as part of FS update. Opportunity

to review pit slope parameters in certain areas of the open pit

that could lead to reduced waste mining.

-- Engineering services review - review options to execute

additional engineering services in Indonesia and China through

partnerships established during development of the FS update. This

is part of the Company's overall lower-cost sourcing

initiative.

-- Contracting Strategy - full review of contracting strategy

for execution of the project and the transition from construction

to operations.

-- Acid Mine Drainage Water Treatment - review wider range of

options for treatment of mine impacted water with a specific focus

on the opportunity to increase recovery of copper.

[1] Tax holiday (subject to successful application of

regulation, PMK-130 (130/PMK.010/2020)) of a 100% Corporate Income

Tax reduction for 7 years followed by a further 2 years at a 50%

reduction.

[2] Asiamet cautions the Project Opportunities described above

are preliminary in nature and have only been subjected to

high-level preliminary assessment. It is uncertain if further

evaluation and or exploration work will result in the

implementation of any of the potential opportunities or whether any

additional economic benefit will be realised.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGPUPGAUPWUBU

(END) Dow Jones Newswires

May 10, 2023 05:30 ET (09:30 GMT)

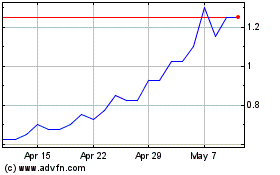

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Apr 2024 to May 2024

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From May 2023 to May 2024